A comprehensive analysis of blur coingecko in comparison to traditional financial institutions

Blur: NFT | Blur: NFT login | Blur: NFT connect | WalletConnect | Traders | What Is Blur Crypto

Blur: NFT | Blur: NFT login | Blur: NFT connect | WalletConnect | Traders | What Is Blur Crypto

As the world of finance continues to evolve, new players have emerged to challenge the dominance of traditional financial institutions. One such player is Blur Coingecko, a revolutionary platform that aims to bridge the gap between traditional banking and the world of cryptocurrency. In this article, we will compare Blur Coingecko with traditional financial institutions, exploring the strengths and weaknesses of each.

Blur Coingecko, with its decentralized nature, offers a unique advantage over traditional financial institutions. By utilizing blockchain technology, Blur Coingecko eliminates the need for intermediaries, lowering transaction costs and increasing efficiency. This decentralized approach also enhances security, as transactions are recorded on an immutable ledger that is virtually impossible to tamper with. These features make Blur Coingecko an attractive option for those who value transparency and security in their financial transactions.

On the other hand, traditional financial institutions have their own set of strengths. With their long-established reputation and extensive experience in the industry, these institutions have developed robust systems for managing and safeguarding funds. They offer a wide range of financial services, such as lending, investment advice, and insurance, which cater to the diverse needs of individuals and businesses. Additionally, traditional financial institutions are subject to strict regulatory oversight, ensuring that they adhere to industry standards and protect the interests of their customers.

In conclusion, both Blur Coingecko and traditional financial institutions have their own unique advantages and disadvantages. While Blur Coingecko offers enhanced transparency, security, and efficiency through its decentralized approach, traditional financial institutions bring reputation, experience, and a wide range of financial services to the table. As the financial landscape continues to evolve, it is crucial for individuals and businesses to carefully consider their needs and preferences when deciding which platform to entrust their financial transactions with.

Comparing Blur Coingecko with Traditional Financial Institutions

When it comes to financial institutions, there are two main options that individuals can choose from: traditional banks and blur coingecko. While traditional banks have been the go-to option for many years, blur coingecko is a relatively new player in the market. In this article, we will compare the two and analyze their strengths and weaknesses.

The Role of Trust

One of the key factors that differentiates blur coingecko from traditional financial institutions is the issue of trust. Traditional banks have established a reputation and a history that instills trust in their customers. They are highly regulated and have to follow strict guidelines to ensure the safety and security of funds. Customers often prefer this level of trust when it comes to their finances.

On the other hand, blur coingecko operates in the decentralized world of cryptocurrencies. While it offers transparency and security through blockchain technology, it lacks the established reputation and history of traditional banks. Trust in blur coingecko is mainly built through user reviews, ratings, and the overall performance of the platform.

Accessibility and Convenience

Another important aspect to consider is accessibility and convenience. Traditional banks have physical branches where customers can visit and interact with staff. They offer a wide range of services, such as loans, credit cards, and insurance, making them a one-stop-shop for all financial needs.

On the other hand, blur coingecko operates entirely online and offers a platform for users to trade and invest in cryptocurrencies. This online presence makes it highly accessible to users all around the world. However, the range of services offered by blur coingecko is limited compared to traditional banks.

Conclusion

In conclusion, the choice between blur coingecko and traditional financial institutions depends on individual preferences and needs. Traditional banks offer trust and a wide range of services, while blur coingecko provides accessibility and transparency. As the world of finance continues to evolve, it will be interesting to see how blur coingecko and traditional banks adapt and compete in the market.

In-Depth Analysis of Different Aspects

When comparing Blur Coingecko with traditional financial institutions, it is important to consider various aspects that highlight the advantages and functionalities of Blur.io. This decentralized NFT marketplace offers a unique and innovative approach to digital assets, providing users with new opportunities for investment and digital creativity.

1. Transparency and Accessibility

One of the key advantages of Blur.io is its transparency. Unlike traditional financial institutions that are often opaque and difficult to understand, Blur.io provides a transparent and accessible platform. Users can easily access and explore the marketplace, gaining insights into the latest trends and opportunities in the NFT space. This transparency fosters trust and confidence among users, enabling them to make informed decisions.

2. Efficient and Secure Transactions

Blur.io leverages blockchain technology to enable efficient and secure transactions. Traditional financial institutions often involve intermediaries and lengthy processes, leading to delays and higher costs. However, Blur.io eliminates the need for intermediaries, allowing users to directly transact with one another. This not only reduces transaction costs but also ensures the security and immutability of digital assets.

Moreover, Blur.io's smart contract functionality adds an additional layer of security to transactions. With smart contracts, the terms and conditions of a transaction are automatically executed, minimizing the risk of fraud or manipulation.

3. Empowering Digital Creativity

Blur.io is not just a marketplace for buying and selling NFTs; it also serves as a platform for digital creativity. Artists and creators can showcase their work, gain recognition, and monetize their digital assets. This empowers artists to have full control over their intellectual property and opens up new avenues for artistic expression.

By leveraging the decentralized nature of blockchain technology, Blur.io empowers artists and creators with direct access to a global audience without the need for intermediaries. This democratizes the art world, allowing anyone with talent and creativity to participate and thrive.

Overall, Blur.io offers a unique and innovative alternative to traditional financial institutions. Its transparency, efficiency, security, and empowerment of digital creativity make it a promising platform for investors, artists, and creators. To explore the functionalities and advantages of Blur.io further, visit the official website: Blur.io の機能と利点を探る.

Understanding the Role of Technology

Technology plays a crucial role in the comparison between Blur Coingecko and traditional financial institutions. It has transformed the way people access and manage their financial resources, making transactions faster, more convenient, and secure.

Enhanced Accessibility

One of the major advantages of technology is its ability to make financial services accessible to a wider audience. With traditional financial institutions, individuals often face barriers such as physical distance or high transaction fees. However, Blur Coingecko, with its online platform, eliminates these obstacles and allows anyone with internet access to participate in the financial market. This inclusivity has empowered individuals globally to take control of their finances and explore investment opportunities.

Efficiency and Speed

Another significant aspect of technology is its ability to streamline processes and enhance efficiency. Traditional financial institutions often involve lengthy paperwork, manual verification, and delays in transactions. In contrast, Blur Coingecko leverages technology to automate and expedite these processes, resulting in faster transactions and reduced administrative burden. The use of blockchain technology also ensures transparent and secure transactions, eliminating the need for intermediaries and reducing the risk of fraud.

Enhanced Accessibility

Restricted by physical distance, high fees

Accessible globally with internet connectivity

Efficiency and Speed

Lengthy paperwork, manual processes, delays

Automated processes, faster transactions

Transparency and Security

Risk of fraud, dependence on intermediaries

Blockchain technology ensures transparency and security

Overall, technology has revolutionized the financial industry, enabling individuals to access financial services conveniently and efficiently. Blur Coingecko, with its innovative approach, leverages technology to offer a user-friendly platform that is accessible to a global audience, allowing individuals to take control of their finances and explore investment opportunities in a secure and transparent manner.

Exploring the Financial Services Offered

Blur Coingecko offers a wide range of financial services that are designed to cater to the needs of its users. These services are not only convenient, but they also provide enhanced access to the world of cryptocurrencies and traditional financial instruments. Here are some of the key financial services offered by Blur Coingecko:

1. Digital Wallet: Blur Coingecko provides a secure and user-friendly digital wallet where users can store their cryptocurrencies. This wallet allows users to easily manage their assets, make transactions, and monitor their portfolio.

2. Exchange Platform: The platform also acts as an exchange where users can buy and sell cryptocurrencies using various payment methods. This provides users with the flexibility to trade their digital assets and take advantage of market opportunities.

3. Tokenized Assets: Blur Coingecko allows users to invest in tokenized assets such as stocks, commodities, and real estate. This opens up new investment opportunities for users and helps diversify their portfolios.

4. Staking and DeFi Services: Users can also participate in staking and decentralized finance (DeFi) services offered by Blur Coingecko. These services allow users to earn passive income by locking up their cryptocurrencies or participating in liquidity pools.

5. Loans and Borrowing: Blur Coingecko offers lending and borrowing services where users can borrow cryptocurrencies or lend their digital assets to earn interest. This provides users with additional financial opportunities and helps them manage their liquidity needs.

6. Portfolio Analytics: The platform also offers comprehensive portfolio analytics tools that help users track their investments, analyze their performance, and make informed decisions. This empowers users to optimize their portfolios and maximize their returns.

7. Education and Research: Blur Coingecko provides educational resources and research materials to help users understand the world of cryptocurrencies and traditional financial instruments better. This empowers users with the knowledge they need to make informed investment decisions.

Overall, Blur Coingecko offers a comprehensive suite of financial services that combine the best of both worlds: the convenience and flexibility of cryptocurrencies with the stability and sophistication of traditional financial institutions.

Evaluating the Level of Transparency

When comparing Blur Coingecko with traditional financial institutions, one important factor to consider is the level of transparency. Transparency is crucial for investors and users as it provides visibility into the inner workings of a platform or institution.

Traditional financial institutions often lack transparency, with complex structures and hidden fees. It can be difficult for investors to fully understand where their money is going and how it is being used. This lack of transparency can lead to mistrust and uncertainty among investors.

On the other hand, Blur Coingecko is built on the principles of transparency. The platform provides real-time data on all transactions, allowing users to track and verify the movement of their assets. Additionally, the platform publishes regular audits and reports, providing further transparency into its operations.

By providing this level of transparency, Blur Coingecko instills confidence in its users, making it an attractive option for investors looking for transparency in their financial transactions.

In conclusion, when evaluating the level of transparency, Blur Coingecko stands out as a transparent platform compared to traditional financial institutions. Its commitment to providing real-time data and regular audits contributes to a higher level of trust and confidence among its users.

Analyzing the Security Measures

When it comes to comparing Blur Coingecko with traditional financial institutions, one important aspect to consider is the security measures in place.

Blur Coingecko:

Blur Coingecko takes security very seriously and implements various measures to protect user funds and information. One of the main security features is the use of advanced encryption algorithms to secure transactions and user data. This ensures that sensitive information is encrypted and cannot be accessed by unauthorized individuals.

Additionally, Blur Coingecko utilizes multi-factor authentication, which adds an extra layer of security to user accounts. This requires users to provide multiple pieces of information to verify their identity, making it much more difficult for hackers to gain unauthorized access.

Traditional financial institutions:

Traditional financial institutions also have security measures in place to protect user information and funds. These include things like firewalls, secure servers, and encryption. However, unlike Blur Coingecko, traditional financial institutions may also have physical security measures, such as security guards and surveillance cameras, in place to protect their offices and data centers.

Furthermore, traditional financial institutions often have strict regulations and compliance requirements that they must adhere to. These regulations are designed to protect users and ensure the security of the financial system as a whole.

In conclusion, both Blur Coingecko and traditional financial institutions prioritize security and have measures in place to protect user funds and information. However, Blur Coingecko's use of advanced encryption algorithms and multi-factor authentication may give it an edge in terms of digital security.

Considering the Accessibility Factor

When it comes to comparing Blur Coingecko with traditional financial institutions, one important aspect to consider is accessibility. Traditional financial institutions often have strict requirements and limitations, making it difficult for many individuals to access their services. This can include high minimum deposit requirements, account fees, and geographical constraints.

In contrast, Blur Coingecko offers a more inclusive and accessible platform for users. The Blur NFT marketplace provides an opportunity for artists and creators to connect with a global audience and monetize their work in a decentralized manner. With just an internet connection and a computer or smartphone, anyone can participate in the Blur.io ecosystem and explore the features and benefits it has to offer.

The accessibility of Blur.io is further enhanced by its user-friendly interface and intuitive design. Users can easily navigate the platform, browse through different NFT collections, and engage in transactions seamlessly. Whether you are an experienced cryptocurrency user or new to the world of blockchain, Blur.io provides a welcoming and user-centric environment for all.

With Blur Coingecko's focus on accessibility and inclusivity, it is paving the way for a more democratized financial landscape. By eliminating many of the traditional barriers to entry, more individuals can participate in the emerging digital economy and unlock new opportunities for financial growth and success.

To learn more about the functionalities and advantages of Blur.io, you can visit their official website: Blur.io の機能と利点を探る. Explore the platform, discover unique NFTs, and experience the future of decentralized finance firsthand.

Assessing the Cost and Fees Involved

When it comes to comparing Blur Coingecko with traditional financial institutions, it is important to thoroughly assess the cost and fees involved in both options. Here is a detailed analysis of the expenses you might encounter:

1. Transaction Fees: Blur Coingecko typically charges lower transaction fees compared to traditional financial institutions. While banks and other financial institutions may impose high fees for transferring money or processing transactions, Blur Coingecko offers a more cost-effective solution.

2. Account Maintenance Fees: Traditional financial institutions often require customers to pay monthly or annual account maintenance fees. These fees can add up over time and impact your overall returns. In contrast, Blur Coingecko generally does not charge any account maintenance fees, allowing you to save money and maximize your profits.

3. Foreign Exchange Fees: If you frequently engage in international transactions, traditional financial institutions may charge significant fees for converting currencies. However, Blur Coingecko offers a more competitive exchange rate and lower fees for cross-border transactions, making it a more attractive option for international users.

4. Withdrawal Fees: Some traditional financial institutions impose fees for withdrawing money from ATMs or transferring funds to external accounts. Blur Coingecko, on the other hand, typically does not charge withdrawal fees, providing more flexibility and convenience for users.

5. Trading Fees: If you are involved in trading cryptocurrencies, traditional financial institutions often charge hefty brokerage fees. Blur Coingecko, as a decentralized platform, may have lower trading fees or even no fees at all, enabling you to save money and engage in more cost-efficient trading activities.

By carefully evaluating the cost and fees involved, it becomes evident that Blur Coingecko offers substantial advantages over traditional financial institutions. Its cost-effective nature and user-friendly approach make it an appealing option for individuals seeking greater financial flexibility and reduced expenses.

Examining the Regulation and Compliance

When comparing Blur Coingecko with traditional financial institutions, one important aspect to consider is the regulation and compliance framework that governs their operations. Traditional financial institutions are subject to a wide range of regulatory requirements imposed by governmental agencies.

This level of regulation aims to ensure transparency, protect consumers, and maintain the stability of the financial system. Banks, for example, are required to comply with anti-money laundering (AML) and know your customer (KYC) regulations, among others.

However, the decentralized nature of Blur Coingecko and its blockchain infrastructure present unique challenges for regulation and compliance efforts. As a platform that enables NFT trading and cryptocurrency transactions, Blur Coingecko has its own set of rules and policies to maintain security and prevent illegal activities.

In addition to its internal policies, Blur Coingecko also collaborates with regulatory bodies to adhere to the relevant regulations and ensure a safe trading environment. This collaboration helps to address concerns regarding money laundering, fraud, and other criminal activities that could potentially occur in the crypto space.

For a more detailed understanding of Blur Coingecko's regulatory framework and compliance efforts, you can visit the official website: Blur.io の機能と利点を探る. Here, you will find information on the platform's policies, security measures, and its commitment to regulatory compliance.

By examining the regulation and compliance aspect, we can gain a deeper insight into how Blur Coingecko operates within the regulatory landscape, ensuring the safety and integrity of its users and the broader financial ecosystem.

Measuring the Speed and Efficiency of Transactions

One of the key factors in comparing blur coingecko with traditional financial institutions is the speed and efficiency of transactions. The traditional financial system often involves a lengthy process that requires multiple intermediaries, such as banks and clearinghouses, to verify and settle transactions. This can result in delays and increased costs.

On the other hand, blur coingecko, being built on blockchain technology, offers a faster and more efficient way to conduct transactions. Blockchain allows for peer-to-peer transactions without the need for intermediaries. Transactions are verified and recorded on a decentralized ledger, providing transparency and security.

Additionally, blur coingecko utilizes smart contracts, which are self-executing contracts with predefined rules and conditions. This eliminates the need for manual verification and reduces the chances of errors or fraud. Smart contracts also enable automatic settlement, further enhancing the efficiency of transactions.

Transaction Speed

When it comes to transaction speed, blur coingecko has a clear advantage over traditional financial institutions. Traditional systems often require several days for international transactions, while blur coingecko can process transactions within minutes or even seconds. This is particularly beneficial for cross-border transactions, enabling businesses to operate more efficiently on a global scale.

Speed is crucial, especially in time-sensitive processes such as stock trading or remittances. With blur coingecko, these transactions can be executed quickly, reducing the risk of price fluctuations or delays in funds transfers.

Cost Efficiency

Another aspect to consider is the cost efficiency of transactions. Traditional financial institutions often charge high fees for services like wire transfers, currency conversions, and international transactions. These fees can significantly eat into the funds being transferred.

Blur coingecko, on the other hand, offers lower transaction fees compared to traditional systems. The decentralized nature of blockchain technology eliminates the need for intermediaries, reducing costs associated with their services. Additionally, smart contracts automate processes, further reducing overhead costs.

Overall, the speed and efficiency of transactions in blur coingecko make it a more desirable option compared to traditional financial institutions. The ability to conduct transactions quickly and at lower costs is a significant advantage in today's fast-paced, global economy.

Comparing the Customer Support Services

When it comes to customer support services, there are significant differences between Blur Coingecko and traditional financial institutions.

1. Responsiveness

Blur Coingecko's customer support is known for its quick response time. They have a dedicated team that is available 24/7 to address customer inquiries and resolve any issues or concerns they might have. The platform values its users and strives to provide timely assistance.

On the other hand, traditional financial institutions often have limited customer support availability, typically during business hours. This can result in delays in resolving customer issues, causing frustration and inconvenience for the customers.

2. Accessibility

Blur Coingecko offers multiple channels for customer support. Users can reach out to them via email, live chat, or even through their social media platforms. This allows users to choose the most convenient method for them to communicate their concerns.

Traditional financial institutions also have customer support hotlines and email support. However, they may not have the same level of accessibility and responsiveness as Blur Coingecko, making it more difficult for customers to get the help they need in a timely manner.

3. Expertise

Blur Coingecko's customer support team consists of individuals with in-depth knowledge of cryptocurrencies and blockchain technology. Their expertise allows them to provide accurate information and guidance to users, especially regarding the platform's specific features and functionalities.

In contrast, traditional financial institutions may not have the same level of expertise when it comes to cryptocurrencies. Their customer support might be more focused on general financial services and may have limitations in terms of providing detailed information about cryptocurrencies and their specific issues or concerns.

In conclusion, Blur Coingecko's customer support services tend to excel in terms of responsiveness, accessibility, and expertise compared to traditional financial institutions. These differences can significantly impact the user experience and satisfaction, making Blur Coingecko a more attractive option for users seeking reliable customer support in the world of cryptocurrencies.

Looking at the Risk and Reward Potential

When comparing Blur Coingecko with traditional financial institutions, it is important to consider the risk and reward potential. Both options come with their own set of risks and rewards, and understanding them is crucial for making informed decisions.

One of the main risks associated with Blur Coingecko is the volatility of the cryptocurrency market. Cryptocurrencies can experience significant price fluctuations in a short period of time, which can either result in substantial gains or losses. This high volatility is not typically observed in traditional financial markets, where the value of assets tends to be more stable.

On the other hand, Blur Coingecko offers the potential for high rewards. The cryptocurrency market has been known for its ability to generate substantial returns for investors. Those who have invested in cryptocurrencies early on have seen their investments grow exponentially. This level of return is often not possible with traditional financial instruments.

In contrast, traditional financial institutions come with their own set of risks and rewards. While the risk of volatility is lower, there are other risks to consider, such as inflation and economic downturns. Additionally, the potential rewards from investing in traditional financial instruments may be more modest compared to the potential rewards of the cryptocurrency market.

It is important to note that both Blur Coingecko and traditional financial institutions have their own risk management strategies in place. Blur Coingecko employs various security measures to protect its users' funds, such as encryption technology and multi-signature wallets. Traditional financial institutions, on the other hand, are regulated by governing bodies and are required to follow certain standards and protocols to ensure the safety of investors' funds.

In conclusion, when comparing Blur Coingecko with traditional financial institutions, it is important to carefully evaluate the risk and reward potential of each option. While Blur Coingecko may offer high returns, it also comes with higher volatility. Traditional financial institutions may provide more stability but may offer lower rewards. Ultimately, the decision should be based on an individual's risk tolerance, investment goals, and understanding of the market.

Considering the Future Prospects and Trends

As we delve deeper into the comparison between Blur Coingecko and traditional financial institutions, it is essential to consider the future prospects and emerging trends in the financial industry.

1. Decentralization and Empowerment

One notable trend that is expected to shape the future of finance is the rise of decentralization and empowerment. Blur Coingecko, being a decentralized platform, offers users the ability to transact and manage their finances without the need for intermediaries. This eliminates the reliance on traditional financial institutions and empowers individuals to have control over their own financial assets.

With the growing adoption of cryptocurrencies and blockchain technology, decentralized finance (DeFi) is gaining traction. DeFi projects, like Blur Coingecko, are enabling users to participate in lending, borrowing, and trading activities on a peer-to-peer basis, further disrupting traditional financial institutions.

2. Transparency and Security

Another significant trend that is likely to shape the future of the financial industry is the emphasis on transparency and security. Traditional financial institutions have often faced criticism for their lack of transparency and accountability. In contrast, Blur Coingecko, as a blockchain-based platform, offers users complete transparency through its immutable and publicly verifiable ledger.

Furthermore, the innovative use of cryptographic protocols in blockchain technology provides enhanced security for financial transactions. By leveraging advanced encryption methods, Blur Coingecko ensures that user data and assets are protected from potential cyber threats and fraud.

3. Digitization and Interoperability

The increased digitization of financial services is another crucial trend that will shape the future of finance. Traditional financial institutions are gradually embracing digital technologies to improve their operations and provide seamless customer experiences.

Blur Coingecko, being a digital platform, is at the forefront of this trend. It enables users to participate in the financial ecosystem from anywhere in the world, eliminating geographic limitations. Moreover, blockchain technology facilitates interoperability between different financial systems, allowing for seamless transfer of assets and information.

In conclusion, as we compare Blur Coingecko with traditional financial institutions, it becomes evident that the future prospects and trends in the financial industry are leaning towards decentralization, transparency, security, and digitization. As more individuals and businesses embrace these concepts, the potential for innovation and disruption in the financial sector is immense.

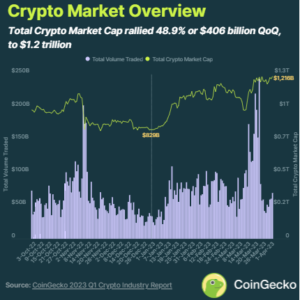

Understanding the Market Impact

When comparing Blur Coingecko with traditional financial institutions, it is important to consider the market impact of both options.

Blur Coingecko, as a decentralized cryptocurrency platform, operates in a largely unregulated market. This means that the market impact of Blur Coingecko can be highly volatile and unpredictable. The value of cryptocurrencies can fluctuate wildly in short periods, leading to potential gains or losses for investors. Additionally, the lack of regulation can make the market vulnerable to scams and fraud.

On the other hand, traditional financial institutions operate within a regulated framework, where market impact is typically more stable and predictable. The value of traditional financial instruments, such as stocks and bonds, tends to fluctuate in response to economic factors and market trends, but within a relatively controlled range. This stability can provide investors with a safer and more predictable investment environment.

However, it is also important to consider the limitations of traditional financial institutions. These institutions are often subject to regulatory restrictions and bureaucratic processes that can slow down transactions and limit accessibility. They also have higher fees and often require a minimum investment, making them less accessible to smaller investors.

In contrast, Blur Coingecko offers users greater accessibility and lower transaction costs. Decentralized platforms like Blur Coingecko can provide individuals with the opportunity to participate in the market without the need for intermediary institutions. This can be particularly beneficial for individuals in countries with limited access to traditional financial services.

Overall, when considering the market impact, it is clear that Blur Coingecko and traditional financial institutions offer different advantages and disadvantages. Traditional financial institutions provide stability and regulatory oversight, while Blur Coingecko offers accessibility and cost efficiency. The choice between the two will depend on individual risk tolerance, investment goals, and level of comfort with decentralized platforms.

What is Coingecko?

Coingecko is a cryptocurrency data platform that provides information about various cryptocurrencies, including their prices, market capitalization, trading volume, and other relevant data.

How does Coingecko compare to traditional financial institutions?

Coingecko differs from traditional financial institutions in that it primarily focuses on providing cryptocurrency-related information and does not offer traditional financial services such as banking or investing. However, Coingecko can be used as a tool to compare and analyze cryptocurrencies in a similar way to how traditional financial institutions analyze traditional assets.

What are the advantages of using Coingecko compared to traditional financial institutions?

One advantage of using Coingecko is that it provides real-time data and market information about cryptocurrencies, which can be useful for traders and investors who want to stay up-to-date with the cryptocurrency market. Additionally, Coingecko offers a wide range of metrics and analysis tools specifically tailored for cryptocurrencies, which may not be available from traditional financial institutions.

Are there any disadvantages of relying on Coingecko instead of traditional financial institutions?

One potential disadvantage of relying on Coingecko is that it may not provide the same level of regulatory oversight and consumer protection as traditional financial institutions. Additionally, as Coingecko primarily focuses on cryptocurrencies, it may not provide the same breadth of financial services and products that traditional financial institutions offer.

Can Coingecko be used as a substitute for traditional financial institutions?

Coingecko can be used as a tool to supplement traditional financial institutions, especially for individuals who are specifically interested in cryptocurrencies. However, it may not be a suitable substitute for traditional financial institutions, especially for individuals who require a broader range of financial services or who need the oversight and protection provided by regulatory authorities.

What is Coingecko?

Coingecko is an online platform that provides information about cryptocurrencies and their market prices. It allows users to track the current prices, trading volumes, and other relevant data of cryptocurrencies.

How does Coingecko compare to traditional financial institutions?

Coingecko differs from traditional financial institutions in several ways. Firstly, it focuses specifically on cryptocurrencies, while traditional financial institutions deal with various types of assets. Secondly, Coingecko operates entirely online and does not have physical branches like traditional banks. Lastly, Coingecko provides real-time data and updates about cryptocurrencies, which traditional financial institutions might not have.

What advantages does Coingecko have over traditional financial institutions?

Coingecko offers several advantages over traditional financial institutions. Firstly, it provides real-time data and updates about cryptocurrencies, allowing users to make informed investment decisions. Secondly, Coingecko operates 24/7, meaning users can access information and trading opportunities at any time. Lastly, Coingecko does not require users to go through the lengthy process of opening a traditional bank account and can be accessed by anyone with an internet connection.

Can Coingecko be trusted as a reliable source of information?

Yes, Coingecko can generally be trusted as a reliable source of information. It aggregates data from various exchanges and provides comprehensive information about cryptocurrencies. However, it is important to note that the cryptocurrency market is highly volatile and unpredictable, so it is always recommended to do thorough research and consider multiple sources of information before making any investment decisions.

Are there any risks associated with using Coingecko compared to traditional financial institutions?

While Coingecko itself is a reputable platform, there are risks associated with investing in cryptocurrencies. The cryptocurrency market is highly volatile and can experience significant price fluctuations within short periods of time. Additionally, cryptocurrencies are not regulated by central authorities, which means there is a higher risk of fraud and security breaches. It is important to carefully consider these risks before investing through Coingecko or any other platform.

Blur: NFT | Blur: NFT login | Blur: NFT connect | WalletConnect | Traders | What Is Blur Crypto

2022-2024 @ Comparing blur coingecko with traditional financial institutions an in depth analysis