Understanding the reasons behind the constantly changing patterns of blur token value

Blur: NFT | Blur: NFT login | Blur: NFT connect | WalletConnect | Traders | What Is Blur Crypto

Blur: NFT | Blur: NFT login | Blur: NFT connect | WalletConnect | Traders | What Is Blur Crypto

The world of cryptocurrency is never short of surprises, and one token that has been making waves recently is Blur. With its skyrocketing price and unpredictable performance, Blur tokens have attracted the attention of both seasoned investors and curious onlookers. But what exactly is causing these dramatic fluctuations in Blur token price? In this article, we will delve into the factors that contribute to the volatility of Blur tokens.

One of the main factors behind the fluctuating trends of Blur token price is market sentiment. Cryptocurrency markets are heavily influenced by the emotions and behaviors of traders. When positive news or rumors circulate about Blur tokens, it can create a buying frenzy, pushing the price up. On the other hand, negative news or market uncertainties can cause panic selling and a sharp decline in price. Traders constantly analyze the market sentiment and react accordingly, which leads to the rollercoaster-like nature of Blur token price.

In addition to market sentiment, another factor that affects the price of Blur tokens is supply and demand dynamics. Blur tokens are typically created through a process called mining, where powerful computers solve complex mathematical problems to verify transactions on the blockchain. The supply of Blur tokens is limited, and as more people become interested in owning them, the demand increases. This increased demand can drive up the price of Blur tokens. Conversely, if the demand for Blur tokens diminishes, the price can plunge.

Furthermore, external factors beyond the scope of the cryptocurrency market can also impact the price of Blur tokens. Global economic events, government regulations, and even natural disasters can have a ripple effect on the cryptocurrency market as a whole, including Blur tokens. Traders must constantly monitor and assess these external factors to anticipate potential price fluctuations and adapt their strategies accordingly.

In conclusion, the fluctuating trends of Blur token price can be attributed to a combination of market sentiment, supply and demand dynamics, and external factors. Understanding and analyzing these factors can be a valuable tool for investors looking to navigate the volatile world of cryptocurrency. Whether Blur tokens continue their upward trajectory or experience a sharp decline, one thing is certain – the cryptocurrency market will continue to surprise us.

Understanding the Influence of External Factors

The fluctuating trends of Blur token price can be attributed to a variety of external factors that impact the value of the token. These factors include but are not limited to:

Market Demand and Supply

Blur token price is heavily influenced by market demand and supply dynamics. If there is a high demand for Blur tokens and a limited supply, the price is likely to increase. Conversely, if there is low demand and a large supply, the price may decrease. Market demand can be influenced by factors such as the popularity of Blur raders, the level of interest in the NFT space, and the overall economic environment.

Blur raders' Adoption and Expansion

The success and adoption of Blur raders can have a significant impact on the value of Blur tokens. If Blur raders gain a large and active user base, it can drive demand for Blur tokens, leading to an increase in price. Additionally, if Blur raders expand their features, partnerships, or collaborations with other projects in the NFT ecosystem, it can further enhance the value of Blur tokens.

Crypto Market Volatility

As with many other cryptocurrencies, Blur token price can be influenced by overall crypto market volatility. If there are significant fluctuations or negative sentiment in the broader crypto market, it can impact the price of Blur tokens as well. Crypto market trends, investor sentiment, and regulatory developments can all play a role in shaping the value of Blur tokens.

Technological Advancements

Technological advancements and updates to the Blur platform can also impact the token price. If there are improvements to the platform's functionality, user experience, or security measures, it can enhance the overall value proposition of owning Blur tokens. Conversely, if there are issues or vulnerabilities with the technology, it can erode confidence and lead to a decrease in price.

Understanding these external factors and monitoring their influence is crucial for investors and participants in the Blur ecosystem. By keeping a close eye on market trends, the success of Blur raders, crypto market dynamics, and technological advancements, individuals can make more informed decisions regarding their participation in the Blur token market. To stay updated with the latest Blur raders, visit Blur raders.

The Impact of Market Demand

Market demand plays a crucial role in determining the fluctuating trends of Blur Token price. The popularity and desirability of Blur Token among investors greatly influence its demand in the market.

When there is high demand for Blur Token, the price tends to increase as more investors are willing to buy it. This increased demand can be driven by various factors such as positive market sentiment, technological advancements, or the introduction of new features and functionalities to the Blur Token ecosystem.

In contrast, when the market demand for Blur Token decreases, the price may decline. This can happen when there is negative market sentiment, regulatory uncertainties, or a lack of interest from investors. Additionally, market demand can be influenced by external factors such as economic conditions, global events, or the performance of other cryptocurrencies.

To better understand the impact of market demand on Blur Token price, it is important to analyze and monitor key indicators such as trading volume, investor sentiment, and market trends. These indicators can provide valuable insights into the current level of demand and help anticipate potential price movements.

Positive market sentiment

Increase

Technological advancements

Increase

Introduction of new features

Increase

Negative market sentiment

Decrease

Regulatory uncertainties

Decrease

Lack of interest from investors

Decrease

Economic conditions

Variable

Global events

Variable

Performance of other cryptocurrencies

Variable

Understanding and predicting market demand is crucial for investors, as it can help them make informed decisions about buying, selling, or holding Blur Tokens. By monitoring market demand indicators and staying updated with relevant news and events, investors can adapt their strategies accordingly and potentially benefit from price fluctuations.

Government Policies and Regulations

The blur token market is heavily influenced by government policies and regulations. The introduction of strict regulations can have a significant impact on the price and demand for blur token.

Government regulations can restrict or control the usage of blur tokens, which can directly affect their value and availability. For example, if a government bans or limits the use of blur tokens in certain industries or sectors, the demand for blur tokens in those areas will decrease, leading to a potential drop in prices.

Furthermore, governments can also impose taxes or fees on transactions involving blur tokens, which can affect their attractiveness as an investment option. Higher taxes or fees can discourage investors from buying blur tokens, reducing demand and potentially causing a decline in prices.

On the other hand, governments can also introduce favorable policies that promote the use of blur tokens or blockchain technology. These policies can create a positive environment for blur token adoption and increase demand, leading to an increase in prices. For instance, if a government incentivizes businesses to accept blur tokens as a form of payment, it can drive up demand and boost prices.

It is important for investors and market participants to closely monitor government policies and regulations related to blur tokens, as they can significantly impact the market dynamics and price fluctuations.

Technological Advancements and Innovations

In recent years, technological advancements and innovations have played a significant role in shaping the trends and fluctuations in the blur token price. As the Blur Token ecosystem continues to grow and evolve, innovative technologies have emerged, impacting the value and demand for blur tokens.

One notable technological advancement that has influenced blur token prices is the integration of blockchain technology. Blur.io, a prominent platform in the blur token ecosystem, utilizes blockchain technology to provide a secure and transparent environment for artists and collectors.

The implementation of blockchain technology has several advantages for blur token holders. Firstly, it ensures the immutability of transactions, making it nearly impossible to tamper with ownership records or manipulate prices. This transparency and trust in the blockchain technology enhance investor confidence in blur tokens, leading to increased demand and potentially driving up prices.

Additionally, blockchain technology enables decentralized marketplaces and eliminates the need for intermediaries. Blur.io acts as a decentralized marketplace, connecting artists directly with collectors, thereby reducing transaction fees and allowing for faster and more efficient transactions.

Furthermore, technological innovations such as non-fungible tokens (NFTs) have also impacted blur token prices. Blur.io leverages NFTs to represent unique digital assets, allowing artists to create and sell one-of-a-kind digital artworks. The scarcity and uniqueness associated with NFTs contribute to the value and demand for blur tokens.

Overall, technological advancements and innovations have revolutionized the blur token ecosystem. Platforms like Blur.io, which integrate blockchain technology and leverage NFTs, provide artists and collectors with unique opportunities and advantages. These technological advancements ultimately contribute to the fluctuating trends of blur token prices, making it an exciting and dynamic market to explore.

To explore the features and benefits of Blur.io, you can Se connecter à Blur.io: Explorer les caractéristiques et les avantages de Blur.io.

Exploring the Role of Investor Sentiment

Investor sentiment plays a significant role in the fluctuating trends of the blur token price. The emotions and perceptions of investors can heavily influence market dynamics and price movements. Understanding and analyzing investor sentiment can provide valuable insights into the underlying factors affecting the blur token market.

There are several factors that contribute to investor sentiment:

1. Market News and Rumors

News and rumors circulating in the market can greatly impact investor sentiment. Positive news, such as new partnerships or upcoming product releases, can generate optimism and drive up demand for blur tokens. On the other hand, negative news, such as security breaches or regulatory concerns, can create fear and uncertainty, leading to a decrease in investor confidence.

2. Social Media and Online Communities

Social media platforms and online communities have become breeding grounds for investor sentiment. Discussions, opinions, and recommendations shared on platforms like Twitter or Reddit can shape the perception of the blur token among investors. Positive sentiment expressed by influential individuals or communities can generate a bandwagon effect, while negative sentiment can lead to selling pressure.

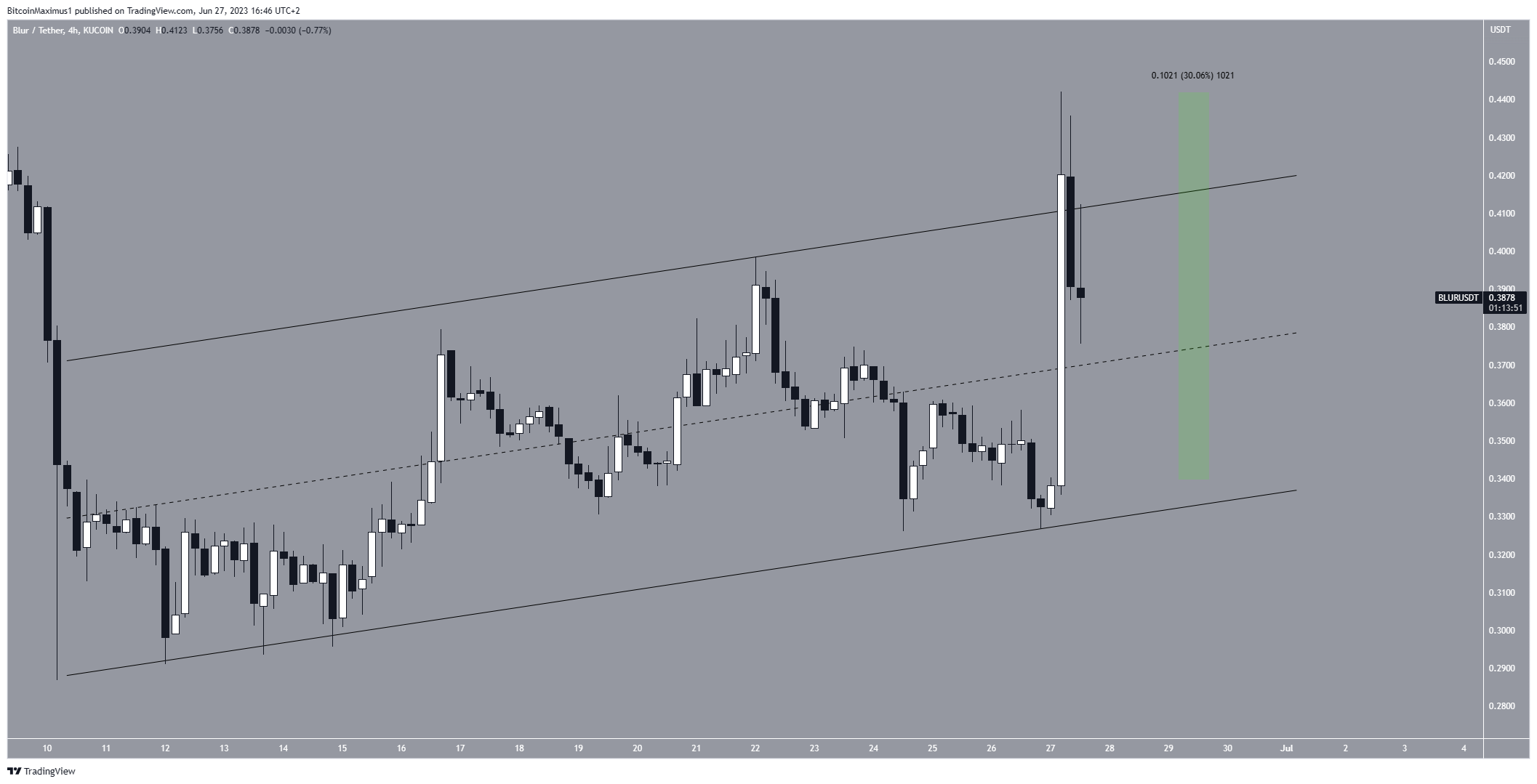

3. Technical Analysis and Market Trends

Investors often rely on technical analysis and market trends to assess the sentiment surrounding blur tokens. Chart patterns, moving averages, and other technical indicators are used to identify potential buying or selling opportunities and predict price movements. If a significant number of investors detect a bullish or bearish trend, it can amplify investor sentiment and influence market behavior.

It's important to note that investor sentiment is subjective and can vary among individuals. Some investors may have a long-term positive outlook on the blur token, while others may be more risk-averse and cautious. Additionally, market sentiment can change rapidly in response to new information or events, making it a challenging factor to predict.

By monitoring and understanding investor sentiment, market participants can gain insights into potential price movements, identify market trends, and adjust their investment strategies accordingly. However, it's crucial to combine sentiment analysis with other fundamental and technical analysis tools to make well-informed investment decisions.

Emotional Decision-making and Fear of Missing Out

Emotions play a significant role in decision-making, especially when it comes to financial investments. The world of cryptocurrencies is no exception, and the blur token price is susceptible to the influence of emotional decision-making.

Fear of Missing Out (FOMO)

Fear of Missing Out, or FOMO, is a strong emotional driver that can lead individuals to make impulsive investment decisions. When people see others profiting or making significant gains from an investment, they can feel a sense of urgency and fear of missing out on those potential gains.

This fear can lead to hasty and irrational investment choices, such as buying blur tokens at an inflated price without considering the underlying factors or long-term prospects. FOMO can cause a surge in demand, resulting in a temporary increase in the blur token price.

Market Speculation

Emotional decision-making often goes hand in hand with market speculation. Speculators may drive up the blur token price based on rumors or unfounded expectations, leading to sudden surges or drops in value.

Speculation can be fueled by social media hype, influencer endorsements, or news that may or may not be accurate. These speculative behaviors can create short-term fluctuations in the blur token price, causing uncertainty in the market and adding to the volatility.

Impacts on Long-term Stability

The impact of emotional decision-making and FOMO on the fluctuating trends of blur token price can have both short-term and long-term consequences. In the short term, emotional decision-making can cause price spikes followed by sudden drops, leading to increased market volatility.

However, in the long term, emotional decision-making can hinder the development of a stable and sustainable market for blur tokens. Investors who make decisions based solely on emotions or FOMO may neglect to consider the fundamental factors driving the token's value, such as the project's technology, team, or market potential.

Conclusion

Emotional decision-making, driven by FOMO and market speculation, can have a significant impact on the fluctuating trends of blur token price. It is important for investors to take a rational and informed approach, considering both short-term trends and long-term prospects when making investment decisions.

By understanding the influence of emotions on investment choices, individuals can mitigate the risks associated with FOMO and contribute to the development of a more stable and sustainable cryptocurrency market.

Market Speculation and Rumors

One factor that can greatly impact the fluctuating trends of the blur token price is market speculation and rumors. The cryptocurrency market is highly volatile and is often influenced by the sentiments and actions of traders and investors.

Speculation in the market involves making predictions about the future price movements of a particular cryptocurrency based on various factors such as news, events, and market trends. Traders may engage in speculation by buying or selling blur tokens based on their expectations of future price changes. For example, if there are rumors of a potential partnership or a major development in the project, traders may start buying blur tokens in anticipation of a price increase.

Rumors also play a significant role in shaping the market sentiment and influencing price movements. In the crypto community, rumors can spread quickly through social media platforms, forums, and news outlets. Traders can easily be swayed by these rumors and may make impulsive buying or selling decisions based on unverified information.

The Impact of Market Speculation and Rumors on Blur Token

Market speculation and rumors can create both positive and negative effects on the price of blur token. Positive rumors, such as partnerships with established companies or upcoming product releases, can drive up demand for blur tokens and result in a price increase.

On the other hand, negative rumors, such as regulatory concerns or security breaches, can lead to panic selling and a decline in the price of blur token. Traders may fear the potential risks associated with the rumors and decide to sell their holdings, causing a downward pressure on the price.

It is important for investors to differentiate between genuine news and rumors in order to make informed decisions. Conducting thorough research, analyzing market trends, and following reliable sources of information can help investors avoid succumbing to market speculation and rumors.

In summary, market speculation and rumors can have a significant impact on the fluctuating trends of blur token price. Traders and investors should be cautious and discerning when considering rumors and should rely on verified information and analysis to make informed decisions.

Psychological Factors Influencing Buying Behavior

When it comes to the fluctuating trends of blur token price, several psychological factors play a role in influencing buying behavior. Understanding these factors is crucial for investors and traders as it can help them make informed decisions.

1. Fear of Missing Out (FOMO)

Fear of Missing Out (FOMO) is a psychological phenomenon in which individuals have a strong desire to participate in something for the fear of missing out on potential opportunities or rewards. In the context of blur token price, FOMO can drive individuals to buy the tokens at higher prices, hoping to capitalize on future price increases.

2. Risk Appetite

Risk appetite is the willingness of individuals to take risks in their investment decisions. Some investors prefer low-risk options, while others are more comfortable with high-risk investments. The fluctuating trends of blur token prices can attract individuals with a higher risk appetite who perceive the potential for significant returns.

3. Social Proof

Social proof refers to the tendency of individuals to rely on the actions and opinions of others when making decisions. If influential figures or well-known investors are seen buying blur tokens, it can create a sense of social proof and attract others to follow suit.

4. Anchoring Bias

Anchoring bias is the tendency to rely too heavily on the first piece of information encountered when making decisions. If individuals are exposed to high token prices early on, it may act as an anchor, causing them to perceive subsequent prices as relatively lower, leading to higher buying behavior.

5. Market Sentiment

Market sentiment refers to the overall attitude and feeling of investors towards the market. Positive market sentiment can create a buying frenzy, leading to increased demand for blur tokens and driving up their prices. Conversely, negative market sentiment can result in a sell-off and price decline.

It is important to note that these psychological factors are not the only determinants of buying behavior, and other external factors such as market conditions, news events, and economic indicators also play a significant role.

To explore the features and advantages of Blur.io, you can Se connecter à Blur.io : Explorer les caractéristiques et les avantages de Blur.io. This platform provides insights into the blur token market and can further assist in understanding the factors behind its fluctuating trends.

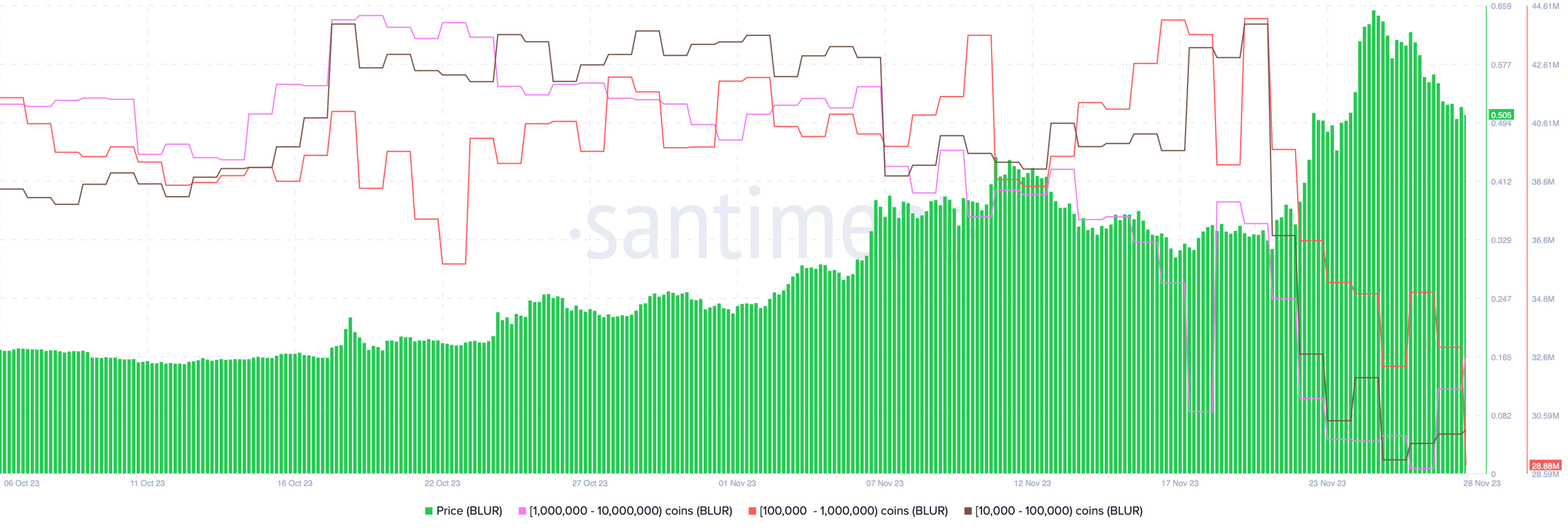

Analyzing the Supply and Demand Dynamics

Understanding the supply and demand dynamics is crucial when it comes to unraveling the factors behind the fluctuating trends of Blur Token price. The price of any cryptocurrency, including Blur Token, is influenced by the interaction between the supply of tokens available in the market and the demand for those tokens.

Supply Dynamics

The supply of Blur Tokens is determined by various factors, including the initial token distribution, token emission schedule, and token burning mechanisms. The initial supply of Blur Tokens is usually determined during the token sale or initial coin offering (ICO) phase, where a specific number of tokens are distributed to investors and contributors.

Additionally, the emission schedule plays a crucial role in determining the future supply of Blur Tokens. Some cryptocurrencies have a fixed supply, where no additional tokens can ever be created. Others employ a token emission schedule, where new tokens are gradually released into circulation over time.

Token burning mechanisms, on the other hand, reduce the supply of tokens in circulation. This is typically done by permanently removing tokens from the total supply, often as part of a buyback or redistribution program. Token burning can help create scarcity and potentially increase the value of the remaining tokens.

Demand Dynamics

The demand for Blur Tokens can be influenced by various factors, including market sentiment, technological developments, partnerships, regulatory changes, and investor speculation. Positive news and developments surrounding Blur Token and the broader cryptocurrency market can create increased demand as investors seek to capitalize on potential price appreciation.

On the other hand, negative news or regulatory changes can dampen investor sentiment and decrease demand. Additionally, the perceived value and utility of Blur Tokens play a significant role in determining the demand for them. If users see tangible benefits and use cases for Blur Tokens, they are more likely to demand and hold onto them.

Investor speculation also plays a role in driving demand. Cryptocurrency markets are highly speculative, and investors often buy tokens with the anticipation of selling them at a higher price in the future. Investor sentiment and market trends can influence the demand for Blur Tokens and contribute to the fluctuating price trends.

By carefully analyzing the supply and demand dynamics of Blur Tokens, we can gain a deeper understanding of the factors influencing the fluctuating trends in price. This analysis can help investors make more informed decisions and potentially predict future price movements.

Token Distribution and Circulation

Understanding the distribution and circulation of Blur tokens is crucial in unraveling the factors behind the fluctuating trends of Blur token price. The distribution of tokens refers to how the initial supply of tokens was allocated among different entities.

In the case of Blur token, a certain percentage of the total supply was allocated to private investors, while another percentage was set aside for the project team and advisors. Additionally, a portion of the tokens may have been reserved for marketing and promotion purposes.

After the initial distribution, tokens begin to circulate within the Blur ecosystem. This circulation is driven by various factors such as buying and selling activities on different cryptocurrency exchanges where Blur is listed. The token circulation can also be influenced by factors like staking rewards, token burning events, or airdrops that incentivize users to hold and transact with Blur tokens.

It's important to note that the token circulation can impact the overall supply and demand dynamics, which can directly affect the token price. For example, if there is a high demand for Blur tokens and a limited supply available on exchanges, the price is likely to increase. Conversely, if there is a surplus of tokens being sold on exchanges, the price may decrease.

Monitoring the token distribution and circulation can provide insights into the market sentiment and the overall health of the Blur ecosystem. By analyzing the patterns of token movement and understanding the factors that drive token circulation, investors and traders can make more informed decisions and potentially navigate the volatility of Blur token price.

Economic Factors Affecting Supply and Demand

The fluctuating trends of blur token price can be attributed to various economic factors that impact supply and demand in the market. These factors can include:

1. Market Demand: The level of demand for blur tokens plays a crucial role in determining their price. If the demand for blur tokens increases, more people are willing to buy them, driving the price up. On the other hand, if the demand decreases, the price will likely decline.

2. Market Supply: The supply of blur tokens refers to the number of tokens available in the market. If there is a limited supply of blur tokens, their price may increase due to scarcity. Conversely, if there is an oversupply of tokens, the price may decrease as sellers compete to attract buyers.

3. Economic Conditions: General economic conditions, such as inflation, recession, or economic growth, can also influence the price of blur tokens. During periods of economic stability and growth, people may have more disposable income to invest in cryptocurrencies, which can drive up demand and consequently the price of blur tokens. Conversely, during economic downturns, people may be more cautious with their investments, leading to decreased demand and lower token prices.

4. Regulatory Environment: Government regulations and policies towards cryptocurrencies can greatly impact the price of blur tokens. Favorable regulations that support the use and adoption of cryptocurrencies can increase demand and drive up prices. Conversely, strict regulations or negative government sentiment can dampen demand and lead to lower token prices.

5. Investor Sentiment: Investor sentiment and market psychology can play a significant role in determining the price of blur tokens. Positive sentiment and optimism about the future potential of blur tokens can drive up demand and prices. Conversely, negative sentiment or fear of a market correction can lead to decreased demand and lower prices.

6. Technological Advancements: Advancements in blockchain technology or improvements in the functionality and security of blur tokens can also impact their price. If the technology behind blur tokens evolves and offers new and improved features, it can generate increased demand and higher prices as investors perceive greater value in holding these tokens.

It's important to note that these factors are not exhaustive and market trends are often influenced by a combination of several factors simultaneously.

Inventory Management and Scalability

One crucial factor that can influence the fluctuating trends of blur token price is inventory management. Proper inventory management is essential for ensuring a constant supply of blur tokens in the market. When the supply of blur tokens is limited, their price tends to increase due to high demand and scarcity. Conversely, when the supply of blur tokens is excessive, their price can decrease as the market becomes saturated.

To maintain an optimal balance between supply and demand, the issuers of blur tokens must carefully manage their inventory levels. This involves monitoring the market demand, analyzing trends, and adjusting the production of blur tokens accordingly. By understanding the fluctuating trends and implementing effective inventory management strategies, issuers can better adapt to the changing dynamics of the market and stabilize the price of blur tokens.

Another important aspect of managing the price fluctuations of blur tokens lies in scalability. Scalability refers to the ability of the blur token ecosystem to handle increased demand without sacrificing performance or increasing transaction costs. As the popularity and usage of blur tokens grow, it is crucial for the underlying infrastructure to be able to scale accordingly.

Scalable Infrastructure

Developing a scalable infrastructure involves incorporating technologies and systems that can handle increased transaction volumes and maintain fast processing times. This may include utilizing scalable blockchain platforms, implementing efficient smart contracts, and optimizing network architecture.

User Adoption and Liquidity

In addition to infrastructure scalability, user adoption and liquidity play a vital role in stabilizing the price of blur tokens. Increasing user adoption can help establish a more robust and active market for blur tokens, while higher liquidity levels can facilitate smoother transactions and reduce volatility.

Overall, by addressing both inventory management and scalability, issuers of blur tokens can navigate the fluctuating market trends more effectively and work towards stabilizing the price of blur tokens. This creates a more attractive and reliable asset for investors and traders alike.

Examining the Role of Competitor Actions

In order to understand the fluctuating trends of blur token price, it is important to examine the role played by competitor actions. The cryptocurrency market is highly volatile and affected by a multitude of factors, including the actions taken by other players in the market.

Competitors in the cryptocurrency world play a crucial role in shaping the market trends. When a competitor launches a new token or implements a groundbreaking technology, it can have a significant impact on the blur token's price. If the competitor's offering is seen as superior or more innovative, it may lead to a decrease in demand for blur token, and subsequently, a drop in its price.

Furthermore, competitor actions can also affect investor sentiment. If a competitor attracts a large number of investors or receives positive media coverage, it can create a sense of FOMO (fear of missing out) among potential blur token investors. This can result in increased demand for the competitor's token and a decrease in demand for blur token, leading to a price drop.

However, competitor actions are not always negative for blur token. In some cases, news or developments related to competitors can have a positive impact on blur token's price. For example, if a competitor encounters regulatory issues or faces a security breach, it may create a sense of uncertainty and distrust among investors. This can lead to a shift in demand towards more established and secure tokens such as blur token, resulting in an increase in its price.

Overall, the role of competitor actions cannot be ignored when analyzing the fluctuating trends of blur token price. It is essential to keep a close eye on the activities and developments in the market, as competitor actions can have a direct impact on the success and value of blur token.

Price Manipulation Strategies by Competitors

As the popularity of the blur token increases, it is not uncommon for competitors to use price manipulation strategies in order to gain an advantage in the market. These strategies can have a significant impact on the fluctuating trends of the blur token price. Some of the most common price manipulation strategies used by competitors include:

False Rumors: Competitors may spread false rumors about the future prospects of the blur token in order to create fear and uncertainty among investors. By creating a negative sentiment, they can drive down the price of the token.

Whale Manipulation: Competitors with large holdings of the blur token can manipulate the price by making large buy or sell orders. By creating artificial demand or supply, they can influence the price in their favor.

Wash Trading: Competitors may engage in wash trading, which involves creating fake buy and sell orders to create an illusion of high trading volume. This can make the blur token appear more attractive to potential investors, leading to an increase in price.

Front Running: Competitors may engage in front running, which involves placing their own orders ahead of large orders by other investors. By doing so, they can take advantage of the price movement caused by the large order and profit from it.

Pump and Dump: Competitors may organize coordinated buying and selling activities to artificially inflate the price of the blur token. Once the price reaches a certain level, they sell off their holdings, causing a sudden drop in price and leaving other investors with losses.

It is important for investors to be aware of these price manipulation strategies and to conduct thorough research before making investment decisions. By understanding the factors behind the fluctuating trends of the blur token price, investors can make informed decisions and mitigate the risks associated with price manipulation.

Market Positioning and Advertising Campaigns

Market positioning plays a crucial role in determining the success of any product or service. In the case of Blur Token, the team behind the project has focused on positioning their token as a unique and innovative solution in the cryptocurrency space.

One of the key factors contributing to the fluctuating trends of Blur Token price is the effectiveness of its advertising campaigns. The team has been proactive in promoting the token through various marketing channels, including social media, online forums, and targeted advertisements.

By carefully crafting their advertising campaigns, the team has managed to create brand awareness and generate buzz around Blur Token. This has attracted the attention of potential investors and traders, causing fluctuations in the token's price.

Furthermore, market positioning also involves differentiating Blur Token from its competitors. The team has highlighted the token's unique features and use cases, emphasizing its utility and potential for future growth. This strategic positioning has helped to create a niche market for Blur Token, attracting a specific group of investors and traders.

In addition, the team has leveraged partnerships and collaborations with other projects and influencers in the cryptocurrency industry to further enhance the market positioning of Blur Token. These collaborations have allowed the team to tap into new markets and expand the reach of their advertising campaigns.

Overall, market positioning and well-executed advertising campaigns have played a significant role in shaping the fluctuating trends of Blur Token price. By effectively positioning the token and generating buzz around it, the team has successfully attracted the attention of investors and traders, causing fluctuations in the token's price.

What is the blur token price?

The blur token price refers to the price of the Blur cryptocurrency token in a specific market. It fluctuates based on supply and demand dynamics, investor sentiment, and other economic factors.

Why has the blur token price been fluctuating so much recently?

The fluctuation in the blur token price can be attributed to several factors. Some possible reasons include market speculation, changes in regulations affecting the cryptocurrency market, announcements or updates from the Blur project team, and overall fluctuations in the cryptocurrency market.

What are some factors that influence the blur token price?

Several factors can influence the blur token price. These include the overall market sentiment towards cryptocurrencies, the demand for the Blur token, the supply of the token in circulation, news or updates related to the Blur project, regulatory developments, and macroeconomic factors such as interest rates and inflation.

Is it possible to predict the future trends of the blur token price?

Predicting the future trends of the blur token price is challenging and highly speculative. The cryptocurrency market is known for its volatility, and prices can be influenced by a wide range of factors. While technical analysis and market trends can provide some insights, making accurate predictions is difficult.

How can investors protect themselves from the volatility of the blur token price?

Investors can take several measures to protect themselves from the volatility of the blur token price. These include diversifying their investment portfolio, setting stop-loss orders to limit potential losses, staying informed about the latest developments in the Blur project, and avoiding making impulsive investment decisions based on short-term price movements.

Blur: NFT | Blur: NFT login | Blur: NFT connect | WalletConnect | Traders | What Is Blur Crypto

2022-2024 @ Unraveling the factors behind the fluctuating trends of blur token price