Examining the influence of external variables on the valuation of blur tokens

Blur: NFT | Blur: NFT login | Blur: NFT connect | WalletConnect | Traders | What Is Blur Crypto

Blur: NFT | Blur: NFT login | Blur: NFT connect | WalletConnect | Traders | What Is Blur Crypto

In the world of cryptocurrency, the price of tokens can be influenced by a wide range of factors. One such factor is the external environment in which the token operates. External factors can have a significant impact on the price of blur tokens, and understanding how these factors work is essential for any investor or enthusiast.

External factors can include economic conditions, regulatory changes, market sentiment, technological advancements, and even social media trends. Each of these factors can play a role in determining the supply and demand dynamics of blur tokens, thus affecting their price in the market.

For example, economic conditions such as inflation, interest rates, and unemployment rates can have a direct impact on the price of blur tokens. If the economy is performing well, investors may be more willing to invest in riskier assets like cryptocurrencies, driving up the demand for blur tokens and increasing their price. On the other hand, if the economy is struggling, investors may be more cautious, leading to a decrease in demand and a subsequent decrease in the price of blur tokens.

Regulatory changes can also have a significant impact on the price of blur tokens. Governments around the world are still figuring out how to regulate cryptocurrencies, and any changes in regulations can affect the market. For example, if a country bans or restricts the use of cryptocurrencies, the demand for blur tokens in that country may decrease, causing a drop in their price.

Market sentiment is another crucial external factor that can impact the price of blur tokens. If there is positive news or a bullish outlook on the cryptocurrency market, it can create a sense of FOMO (fear of missing out) among investors, increasing the demand for blur tokens and driving up their price. Conversely, negative news or a bearish outlook can create panic selling and lead to a decline in the price of blur tokens.

Factors affecting the price of blur tokens

The price of blur tokens can be influenced by a variety of external factors. Here are some of the key factors that impact the price:

Supply and demand: One of the most significant factors affecting the price of blur tokens is the balance between the supply of tokens available for sale and the demand from buyers. If the supply of blur tokens is limited while the demand is high, the price tends to increase. Conversely, if the supply is abundant or the demand is low, the price may decrease.

Market sentiment: The overall sentiment and perception of the market can also impact the price of blur tokens. Positive news, such as partnerships or advancements in technology, can drive up demand and consequently the price. On the other hand, negative news or concerns about security or regulatory issues can decrease demand and lead to a decline in price.

Market liquidity: The liquidity of the market, or how easily blur tokens can be bought or sold, can also affect the price. If there is low liquidity in the market, it may be more challenging to sell blur tokens, leading to a decrease in price. Conversely, high liquidity can attract more buyers, increasing demand and driving up the price.

Competition: The presence of competing cryptocurrencies or similar projects can impact the price of blur tokens. If a new project emerges that offers similar features or benefits, it may attract investors away from blur tokens, leading to a decrease in demand and a potential decrease in price.

Overall market conditions: The broader market conditions, such as the performance of other cryptocurrencies or the global economic climate, can also influence the price of blur tokens. If the overall market is experiencing a positive trend, it may lead to increased investment in blur tokens and a rise in price. Conversely, if the market is in a downturn or experiencing uncertainty, it may result in decreased demand and a decrease in price.

Regulatory environment: The regulatory environment surrounding cryptocurrencies can have a significant impact on the price of blur tokens. Government regulations or regulatory actions can create uncertainty and decrease demand for blur tokens, leading to a decrease in price. Conversely, clear and favorable regulations can instill confidence in investors and increase demand, driving up the price.

Note: These factors are not exhaustive, and the price of blur tokens can be influenced by a combination of these and other factors. It is important for investors to stay informed about these external factors and consider them when making investment decisions.

Economic Indicators Analysis

When exploring the factors that impact the price of Blur tokens, it is crucial to consider various economic indicators. These indicators provide valuable insights into the overall economic health and performance of the Blur token market.

One key economic indicator to analyze is the Gross Domestic Product (GDP). The GDP is a measure of the total value of goods and services produced within a country. A growing GDP indicates a strong economy, which can positively influence the demand for Blur tokens. On the other hand, a declining GDP might reflect economic downturn and lead to a decrease in Blur token prices.

Another important economic indicator to consider is the consumer price index (CPI). The CPI measures the average change in prices experienced by consumers for various goods and services. A high CPI suggests inflation, which may erode the purchasing power of individuals and affect their interest in investing in Blur tokens.

Additionally, the interest rates set by central banks have a significant impact on the price of Blur tokens. When interest rates are low, borrowing costs decrease, which can stimulate economic activity and potentially drive up demand for Blur tokens. Conversely, high interest rates may discourage borrowing and investment, leading to decreased demand for Blur tokens.

Market sentiment and investor confidence also play a vital role in the pricing of Blur tokens. Economic indicators such as consumer confidence surveys and stock market performance can provide valuable insights into the overall market sentiment. Positive sentiment and high investor confidence are likely to drive up demand for Blur tokens and consequently increase their prices.

By keeping a close eye on these economic indicators, market participants can better understand how external factors can impact the price of Blur tokens. In this rapidly evolving market, it is crucial to stay informed and adapt investment strategies accordingly.

Learn more about Blur and its impact on the NFT market by visiting Blur: NFT.

Market demand and supply dynamics

The price of blur tokens is determined by the market demand and supply dynamics. This involves various external factors that influence the buying and selling behavior of investors.

One of the key factors that affects the demand for blur tokens is the popularity of the blur.io platform. As more users join the platform and participate in activities such as trading and collecting blur tokens, the demand for these tokens increases. The more scarce and valuable a particular blur token is perceived to be, the higher its demand and price will be.

Another factor that influences the price of blur tokens is the overall sentiment in the cryptocurrency market. If there is a bullish trend in the market, with prices of major cryptocurrencies rising, this positive sentiment can spill over to blur tokens and drive up their prices. On the other hand, a bearish market sentiment can lead to a decrease in demand and lower prices for blur tokens.

The supply of blur tokens also plays a significant role in their price dynamics. Each blur token is unique, and its scarcity is determined by the number of tokens minted on the blur.io platform. If there are a limited number of tokens available, their price may increase due to high demand and low supply. Conversely, if there is an oversupply of tokens, their price may decrease.

Additionally, external factors such as technological advancements, regulatory changes, and partnerships can also impact the price of blur tokens. For example, if blur.io forms a strategic partnership with a major cryptocurrency exchange, this could increase the visibility and adoption of blur tokens, driving up their demand and price.

In conclusion, the price of blur tokens is influenced by the market demand and supply dynamics, as well as various external factors. Understanding these factors and staying updated with the latest developments in the blur.io ecosystem and the overall cryptocurrency market can help investors make informed decisions. To learn more about blur tokens and the blur.io platform, you can visit BLUR.IO アカウントへのログイン方法.

Government regulations and policies

Government regulations and policies play a crucial role in shaping the price of blur tokens. Crypto markets are highly sensitive to regulatory changes and announcements made by government bodies.

When governments introduce regulations that are favorable to blockchain technology and cryptocurrencies, such as providing legal clarity and creating a supportive environment, it often leads to an increase in demand for blur tokens. This increase in demand typically drives up the price of blur tokens as more investors perceive them as a secure and regulated investment option.

Conversely, government regulations that restrict or ban the use of cryptocurrencies can have a negative impact on the price of blur tokens. Such regulations may create uncertainty and fear among investors, leading to a decrease in demand and subsequently, a decrease in the price of blur tokens.

Examples of government regulation impact on blur tokens:

1. Legalization of cryptocurrencies: When a government legalizes the use of cryptocurrencies and implements regulations to protect investors and promote innovation, it often leads to a positive price impact on blur tokens. This is because the legal recognition lends credibility to the asset class and attracts more investors.

2. Banning of cryptocurrencies: On the other hand, if a government introduces a ban on cryptocurrencies, the price of blur tokens is likely to plummet. This is because the ban restricts the usage and trading of blur tokens, reducing their demand and value.

Government policies related to taxation and mining:

Government policies related to taxation and mining can also significantly affect the price of blur tokens. High taxes on cryptocurrency transactions can discourage trading and investment, leading to a decrease in demand and a subsequent drop in the price of blur tokens. Additionally, policies favoring or discouraging cryptocurrency mining can also impact the supply of blur tokens, which in turn affects their price.

Overall, the government's stance on blockchain technology and cryptocurrencies greatly influences the price of blur tokens. Positive regulations and supportive policies create a conducive environment for the growth of blur tokens and drive up their prices. Conversely, negative regulations and restrictive policies can dampen investor sentiment and lead to a decrease in blur token prices.

Technological advancements and innovations

The price of blur tokens can be significantly influenced by technological advancements and innovations in the field of blockchain technology. As the underlying technology behind blur tokens, blockchain has been evolving rapidly, introducing new features and improvements that can impact the value and utility of these tokens.

Increase in scalability and transaction speed

One major technological advancement that can impact the price of blur tokens is the improvement in scalability and transaction speed of the blockchain network. With the implementation of solutions like sharding, state channels, or layer 2 protocols, blockchain networks can handle a larger number of transactions per second, which can have a positive effect on the demand for blur tokens. A more scalable and efficient blockchain network can attract more users and developers, leading to increased adoption and potentially driving up the price of blur tokens.

Enhanced security and privacy features

Another technological innovation that can influence the price of blur tokens is the introduction of enhanced security and privacy features. Blockchain networks have been working on improving the security of transactions and the privacy of user data. For example, the integration of zero-knowledge proofs or homomorphic encryption can provide users with stronger privacy guarantees. These advancements can attract users who prioritize privacy and security, leading to an increased demand for blur tokens with enhanced privacy features.

Interoperability and integration with other blockchains

Technological advancements in achieving interoperability and seamless integration with other blockchains can also impact the price of blur tokens. The ability of blur tokens to interact with other blockchain networks and exchange value across different ecosystems can increase their utility and demand. If blur tokens can be easily transferred and used within various decentralized applications or exchanged with other cryptocurrencies, it can drive up their value and ultimately affect their price.

In conclusion, technological advancements and innovations within the blockchain industry have a significant impact on the price of blur tokens. Factors such as scalability improvements, enhanced security and privacy features, and interoperability can all influence the demand for and utility of blur tokens, ultimately affecting their price in the market.

Influence of social media on token price

Social media platforms play a significant role in shaping the perception and popularity of various assets, including cryptocurrencies and NFTs. This influence extends to the price of Blur tokens as well.

Blur: NFT Connect, a leading platform for Blur tokens, benefits from the amplification effect of social media. The platform enables users to connect, showcase, and trade their Blur NFTs, thereby creating a vibrant community.

Social media platforms, such as Twitter, Instagram, and Discord, provide a space for Blur token holders to discuss, share, and promote their collection. This exposure leads to increased interest and demand for Blur tokens, ultimately impacting their price.

On these platforms, influential individuals with a large following, including artists, collectors, and celebrities, can greatly impact the perception and value of Blur tokens. Positive endorsements, collaborations, or even discussions about Blur NFTs can attract new investors and collectors.

Furthermore, social media platforms also serve as a medium for announcements, updates, and events related to Blur tokens. Official accounts associated with Blur: NFT Connect often share news about the project, upcoming drops, and partnerships. This information can generate excitement and drive up the demand for Blur tokens.

Community-driven initiatives

In addition to official announcements, the Blur community on social media takes part in various initiatives that contribute to the token price. For example, community-led events, giveaways, and collaborations with prominent artists or influencers can create a buzz around Blur tokens.

These initiatives not only foster engagement within the community but also attract new members who see the potential value and growth of Blur tokens. As the community expands, so does the demand for Blur tokens, potentially leading to an increase in price.

Information flow and speculation

Another way social media impacts the price of Blur tokens is through information flow and speculation. Social media platforms provide a space for individuals to share their thoughts, analysis, and predictions about Blur tokens.

These discussions can influence sentiment and create a snowball effect, as others join in the speculation. Positive sentiment can drive up the price, while negative sentiment can trigger a sell-off, resulting in a decline in token price.

It's important to note that while social media can significantly impact the price of Blur tokens, it is just one of the many factors that influence their value. Market dynamics, economic conditions, and overall sentiment towards the broader NFT market also play crucial roles.

In conclusion, social media platforms, such as Twitter, Instagram, and Discord, provide a space for Blur token holders and the broader community to discuss, promote, and engage with Blur tokens. The influence of social media on the price of Blur tokens is driven by endorsements, community-driven initiatives, information flow, and speculation. However, it's essential to consider the broader market context when evaluating token prices. Explore Blur: NFT Connect to learn more about the impact of social media on Blur tokens. Blur: NFT Connect

Investor sentiment and market psychology

Investor sentiment and market psychology play a crucial role in determining the price of blur tokens. While external factors like market trends and economic indicators provide valuable insights, understanding the emotional aspect of investing is equally important.

The impact of investor sentiment

Investor sentiment refers to the overall attitude and emotions of market participants towards a particular investment. It can be influenced by a variety of factors, such as news events, social media buzz, and general market conditions. When investors are optimistic about blur tokens, expecting future growth and positive developments, it can lead to increased demand and higher prices.

Conversely, when investor sentiment turns negative due to factors like regulatory concerns, security breaches, or market manipulation allegations, it can result in a sharp decline in the price of blur tokens. The fear of losing money or missing out on potential profits can drive investors to sell their holdings, creating a downward spiral in prices.

The role of market psychology

Market psychology, also known as herd mentality or crowd psychology, refers to the collective behavior of investors and traders in response to perceived opportunities or risks. It often manifests in trends such as FOMO (fear of missing out) or panic selling.

During periods of bullish sentiment, when positive news and market optimism prevail, market participants may exhibit a FOMO mentality, fueling buying pressure and driving up prices. On the other hand, during bearish sentiment, when negative news dominates the market, panic selling can occur as investors rush to exit their positions, leading to a significant price drop.

It is essential for investors to understand and analyze the underlying market psychology to make informed decisions. Recognizing patterns, studying historical data, and keeping abreast of relevant news and events can help investors navigate market sentiment and adjust their investment strategies accordingly.

In conclusion, investor sentiment and market psychology are critical factors that impact the price of blur tokens. While external factors provide a framework for analysis, understanding the emotions and behaviors of market participants is equally important. By staying informed and being mindful of market sentiment, investors can gain a deeper understanding of the price dynamics and make better investment decisions.

Impact of global geopolitical events

Global geopolitical events have a significant impact on the price of blur tokens. Geopolitical events refer to political and economic events that occur on a global scale and have the potential to influence the price of cryptocurrencies.

One example of such an event is a trade war between two major economies. When two countries engage in a trade war by imposing tariffs on each other's goods, it can lead to economic uncertainty and volatility in the financial markets. This can affect the demand and supply dynamics of blur tokens, resulting in fluctuations in their price.

Another geopolitical event that can impact the price of blur tokens is political instability. When there is political instability in a country or region, it can create uncertainty in the financial markets. Investors may become cautious and seek safer investment options, leading to a decrease in demand for blur tokens and a subsequent decrease in their price.

Additionally, major international agreements or treaties can also impact the price of blur tokens. For example, if a country passes regulations or legislations that support the adoption of cryptocurrencies, it can lead to increased demand for blur tokens and drive up their price. On the other hand, if a country imposes strict regulations on cryptocurrencies, it can negatively affect their price.

Conclusion

Global geopolitical events play a crucial role in determining the price of blur tokens. Factors such as trade wars, political instability, and international agreements can cause fluctuations in demand and supply, leading to changes in the price of blur tokens. Therefore, it is important for investors and traders to stay updated on global geopolitical events to make informed decisions about buying or selling blur tokens.

Competitor Analysis and Market Competition

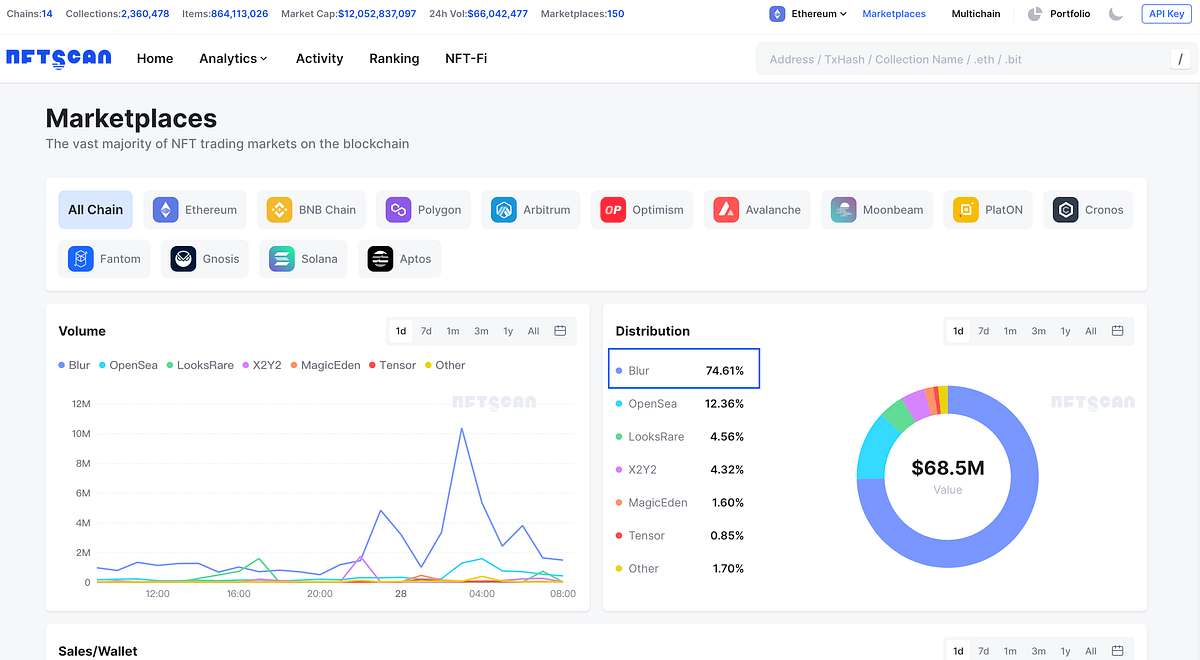

When analyzing the impact of external factors on the price of blur tokens, it is crucial to consider the competition within the market. The cryptocurrency industry is known for its high competition, with numerous other tokens vying for investor attention and market share.

A comprehensive competitor analysis helps to evaluate the relative strength, weaknesses, opportunities, and threats of other tokens in the market. By understanding the competition, it becomes easier to assess how external factors can influence the price of blur tokens.

One important aspect of market competition is identifying direct competitors, which are tokens with similar features and use cases. These competitors can have a direct impact on the price of blur tokens as they offer alternatives to potential investors. Analyzing their market performance, partnerships, and community engagement can provide valuable insights into how external factors might affect the demand for blur tokens.

Furthermore, it is also crucial to consider the broader market competition. While direct competitors might be the most obvious threats, other tokens with different use cases can still impact the price of blur tokens. The overall sentiment towards cryptocurrencies or market trends can create fluctuations in investor behavior and, consequently, the price of blur tokens.

Market competition also includes factors such as regulatory developments, technological advancements, and strategic partnerships. Regulatory changes can significantly affect the market dynamics, as new rules or restrictions may impact the operations and viability of various tokens. Technological advancements can introduce innovative solutions or features that attract investor attention away from blur tokens. Lastly, strategic partnerships can improve credibility, widen the reach, and boost the adoption of competitor tokens, potentially influencing the demand and price of blur tokens.

In conclusion, conducting a competitor analysis and considering market competition is crucial when assessing the impact of external factors on the price of blur tokens. Understanding the strengths and weaknesses of competitors, as well as the broader market trends, can provide valuable insights into how the price may be influenced by these factors.

Trends in the cryptocurrency market

The cryptocurrency market is known for its volatility and rapid fluctuations in prices. Understanding the trends in this market is crucial for investors and traders looking to make informed decisions. Here are some key trends to consider:

Increased adoption: Cryptocurrencies have gained significant popularity in recent years, with more individuals and institutions embracing them as a viable investment option. This increased adoption has led to a surge in the demand for cryptocurrencies, thus affecting their prices.

Bitcoin dominance: Bitcoin, being the first and most well-known cryptocurrency, often sets the tone for the entire market. Changes in Bitcoin's price and market dominance can have a cascading effect on other cryptocurrencies. Investors closely monitor Bitcoin's movements to predict market trends.

Regulatory developments: Government regulations play a significant role in shaping the cryptocurrency market. Positive regulatory developments, such as legal recognition and favorable policies, can boost investor confidence and increase demand. On the other hand, negative regulatory actions can lead to a decline in prices and market sentiment.

Market sentiment: Sentiment analysis and investor behavior heavily influence cryptocurrency prices. Positive news such as institutional adoption, partnerships, or new technological advancements can create a bullish sentiment, causing prices to rise. Similarly, negative news or market uncertainties can lead to a bearish sentiment and price decline.

Technology advancements: The cryptocurrency market is driven by technological innovations. Upgrades in blockchain technology, scalability solutions, and new features can positively impact prices. Investors often look for cryptocurrencies that offer improved functionality and utility to capitalize on such advancements.

Market cycles: Cryptocurrencies have shown cyclic behavior with periods of significant price appreciation followed by corrections. Understanding these market cycles can help investors identify potential buying or selling opportunities. Timing the market correctly is crucial for maximizing returns.

It is essential to track and analyze these trends carefully to make informed decisions in the cryptocurrency market. Cryptocurrencies are highly volatile, and prices can be influenced by a wide range of external factors. Therefore, staying updated with the latest market trends and news is critical for anyone interested in investing or trading in cryptocurrencies.

Influence of major financial institutions

Major financial institutions, such as banks, hedge funds, and investment firms, can have a significant impact on the price of blur tokens. These institutions have large amounts of capital and resources, which allow them to carry out substantial trades in the cryptocurrency market.

When a major financial institution enters the market, they can cause price fluctuations in blur tokens. For example, if a bank decides to invest a significant amount of money in blur tokens, their buying action can drive up the price. Conversely, if a hedge fund decides to sell a large portion of their blur tokens, it can cause the price to decline.

Furthermore, major financial institutions can also influence market sentiment and investor behavior. Their actions and statements can shape public perception of blur tokens, ultimately affecting buying and selling decisions. For instance, if a renowned investment firm issues a positive report about blur tokens, it can attract more investors and drive up the price. On the other hand, if a bank issues a warning about the risks of investing in blur tokens, it can lead to a sell-off and price decrease.

Additionally, major financial institutions often have close relationships with regulatory bodies and policymakers. Their influence on regulatory decisions and legislation can impact the price of blur tokens. For example, if a regulatory body introduces strict regulations for cryptocurrency trading, it may deter institutional investors, leading to a decrease in demand and price.

Overall, the actions and decisions of major financial institutions can have a significant impact on the price of blur tokens. Traders and investors should carefully monitor the activities and statements of these institutions as part of their analysis and decision-making process.

Impact of Macroeconomic Factors

Macroeconomic factors play a significant role in dictating the price of blur tokens. These factors can influence the overall economic environment, which in turn affects the demand and supply dynamics of the blur token market.

Inflation: Inflation refers to the general increase in prices of goods and services over time. When inflation rises, the purchasing power of individuals decreases, leading them to seek alternative investments. As a result, the demand for blur tokens may increase, driving up their price.

Interest Rates: Interest rates have a direct impact on the profitability of different investment options. When interest rates are low, investors may choose to invest in riskier assets like blur tokens to maximize their returns. Consequently, a decrease in interest rates can lead to an increase in demand for blur tokens and drive up their price.

GDP Growth: The overall economic growth of a country, measured through the Gross Domestic Product (GDP), can also impact blur token prices. A growing economy indicates higher levels of income and wealth, which can boost investor confidence and increase the demand for blur tokens as an investment option.

Government Regulations: Government regulations and policies can have a significant impact on the price of blur tokens. Regulatory changes that favor cryptocurrency integration or restrict the use of traditional financial assets can influence the demand and supply dynamics of blur tokens, thus affecting their price.

Global Economic Events: Global economic events, such as market crashes, geopolitical tensions, or natural disasters, can create fluctuations in the price of blur tokens. These events can impact investor sentiment and trigger panic selling or buying, leading to price volatility in the blur token market.

It is essential for investors and traders to stay updated on these macroeconomic factors and their potential impact on the price of blur tokens in order to make informed investment decisions and navigate the market effectively.

Decentralized finance (DeFi) trends

Decentralized finance, or DeFi, has become one of the most prominent trends in the cryptocurrency and blockchain industry. DeFi refers to the use of blockchain technology and cryptocurrencies to recreate traditional financial systems in a decentralized and transparent manner.

One of the main trends in the DeFi space is the rise of decentralized exchanges (DEXs). These platforms allow users to trade cryptocurrencies directly with each other, eliminating the need for intermediaries like centralized exchanges. DEXs provide greater security, privacy, and control over funds, making them an attractive option for many crypto enthusiasts.

Another trend in the DeFi space is the emergence of lending and borrowing protocols. These platforms enable individuals to lend their cryptocurrencies and earn interest, or borrow cryptocurrencies by providing collateral. By leveraging smart contracts, DeFi lending and borrowing protocols offer greater accessibility, efficiency, and transparency compared to traditional lending systems.

Stablecoins are also a major trend in DeFi. Stablecoins are cryptocurrencies that are designed to maintain a stable value, often by pegging their value to a fiat currency. These coins provide stability in an otherwise volatile cryptocurrency market and are essential for various DeFi applications, such as decentralized exchanges and lending platforms.

Decentralized oracles are another trend that has gained traction in the DeFi ecosystem. Oracles are sources of off-chain information that provide data to smart contracts. Decentralized oracles ensure that the data used by DeFi applications is reliable and tamper-proof, reducing the risk of fraudulent activities or manipulation of the system.

Automation and yield farming are also noteworthy trends in DeFi. Automation refers to the use of smart contracts to automate various financial processes, such as lending, borrowing, and trading. Yield farming, on the other hand, involves earning rewards or interest by providing liquidity to decentralized platforms or participating in governance activities.

Overall, the DeFi space is constantly evolving, and new trends and innovations continue to emerge. These trends have the potential to reshape traditional finance, providing individuals with greater financial autonomy, accessibility, and transparency.

Role of Partnerships and Collaborations

Partnerships and collaborations play a crucial role in shaping the price of blur tokens. By joining forces with other organizations and projects, Blur Protocol can leverage their resources, knowledge, and user base to achieve specific goals and increase the value of their tokens.

1. Enhanced Adoption:

Partnering with established companies or platforms can significantly impact the adoption of blur tokens. Through strategic collaborations, blur tokens can gain exposure to a wider audience and tap into existing user bases. This increased adoption can create a higher demand for blur tokens, driving up their price.

2. Technological Integrations:

Collaborating with other blockchain projects or decentralized applications (dApps) can lead to technological integrations. For example, integrating blur tokens into popular wallets or dApps can provide users with easy access to blur token functionalities, thus enhancing their utility and attracting more users. Increased usage and accessibility can positively influence the price of blur tokens.

3. Marketing and Promotions:

Partnerships can also be beneficial for marketing and promotional efforts. By partnering with influential brands or individuals, Blur Protocol can enhance their visibility and reputation within the crypto community. These collaborations can lead to increased media coverage, social media exposure, and overall brand recognition. The improved perception of blur tokens can have a positive impact on their price.

Case Study: Partnership with XYZ Exchange

A real-world example of the role partnerships play in influencing the price of blur tokens is the collaboration between Blur Protocol and XYZ Exchange. Through this partnership, blur tokens were listed on XYZ Exchange, granting them access to the exchange's user base and liquidity. This increased exposure and trading volume resulted in a surge in demand for blur tokens, consequently driving up their price.

The Importance of Synergy

When forming partnerships or collaborations, it is essential to consider the synergy between the involved parties. Aligning goals, values, and target audiences can create a more harmonious and effective partnership. Synergy ensures that both parties can leverage each other's strengths and resources to achieve common objectives, ultimately impacting the price of blur tokens in a positive and sustainable manner.

In conclusion, partnerships and collaborations are instrumental in shaping the price of blur tokens. They contribute to increased adoption, technological integrations, and improved marketing efforts, all of which can positively influence the demand and price of blur tokens in the market.

Environmental sustainability considerations

When it comes to the price of blur tokens, environmental sustainability is an important factor to consider. The increasing awareness of climate change and the need for sustainable practices have a direct impact on the value of blur tokens in the market.

Reduced carbon footprint

Blur tokens are created and traded on blockchain networks, which require significant computational power and energy consumption. However, with growing concerns about the environmental impact of blockchain technology, there is a demand for more sustainable alternatives.

Developers and investors are increasingly looking for ways to reduce the carbon footprint associated with blur tokens. This includes exploring energy-efficient blockchain networks, incentivizing renewable energy usage in token creation, and implementing carbon offset initiatives.

Regulatory and policy changes

Environmental regulations and policies can have a significant impact on the price of blur tokens. In recent years, governments worldwide have implemented stricter environmental regulations, aiming to reduce carbon emissions and promote sustainability.

Changes in regulations can affect the operations of blockchain networks and token creators. For example, if governments impose restrictions on energy-intensive mining practices, the cost of creating blur tokens may increase, which can ultimately impact their market price.

Additionally, policymakers are also exploring the potential of blockchain technology in driving sustainable practices. If governments promote and incentivize the use of sustainable blockchain networks, it can increase the value and demand for blur tokens.

In conclusion, environmental sustainability considerations play a crucial role in determining the price of blur tokens. As the world moves towards a more sustainable future, investors and developers are increasingly prioritizing eco-friendly practices in the blockchain space, which can have a direct impact on token value.

Changes in the regulatory landscape

External factors such as changes in government regulations can have a significant impact on the price of blur tokens and the overall cryptocurrency market.

Regulatory changes can create uncertainty and affect investor sentiment. For example, if a government announces stricter regulations on cryptocurrency exchanges or imposes restrictions on the use of certain cryptocurrencies, it can lead to a decrease in demand and a drop in the price of blur tokens.

On the other hand, favorable regulatory changes can have a positive impact on the price of blur tokens. If a country decides to adopt a more crypto-friendly approach and provides regulatory clarity, it can attract more investors and drive up the demand for blur tokens. This increase in demand can cause the price to rise.

It is important to note that regulatory changes not only occur at the national level but also internationally. For instance, if a major regulatory body like the Securities and Exchange Commission (SEC) introduces new rules or guidelines for cryptocurrencies, it can affect the entire market, including blur tokens.

Impact on market stability

The regulatory landscape plays a crucial role in determining the stability of the cryptocurrency market. Unclear or inconsistent regulations can create volatility and uncertainty, causing sharp price fluctuations in blur tokens and other cryptocurrencies.

When regulations are uncertain, investors may be hesitant to enter the market or make large investments. This lack of confidence can lead to reduced trading volumes and liquidity, contributing to market instability. On the other hand, clear and well-defined regulations can provide a sense of security for investors and promote market stability.

Market reactions to regulatory news

The market often reacts swiftly to regulatory news. When news of regulatory changes breaks, traders and investors closely monitor the situation and analyze the potential impact on blur tokens and other cryptocurrencies.

The reaction to regulatory news can be both positive and negative. Positive news, such as a government adopting a favorable stance on cryptocurrencies, can lead to increased buying activity and a rise in the price of blur tokens.

Conversely, negative regulatory news can trigger panic selling and a sharp decline in the price of blur tokens. This reaction is often driven by fears of increased restrictions or even potential bans on cryptocurrencies.

Overall, changes in the regulatory landscape have a profound impact on the price of blur tokens. Investors and traders need to closely monitor regulatory developments and assess the potential implications for the cryptocurrency market.

How do external factors impact the price of blur tokens?

External factors such as demand and supply, market conditions, investor sentiment, and regulation can all impact the price of blur tokens. Increased demand or limited supply can drive up prices, while a decrease in demand or an oversupply can bring prices down. Market conditions, such as economic factors or geopolitical events, can also influence prices. Additionally, investor sentiment and market psychology can play a role in determining the price of blur tokens. Finally, government regulations or policies can have a significant impact on the price of blur tokens.

What are some examples of external factors that can affect the price of blur tokens?

There are several external factors that can affect the price of blur tokens. For example, if there is a sudden increase in demand for blur tokens, the price is likely to rise. On the other hand, if there is a decrease in demand, the price may fall. Market conditions, such as economic factors or geopolitical events, can also impact the price. For instance, a strong economy or positive developments in the blockchain industry may drive up the price, while negative news or events may bring it down. Finally, government regulations or policies can have a significant impact on the price of blur tokens.

How does investor sentiment impact the price of blur tokens?

Investor sentiment, or the overall attitude or mood of investors towards blur tokens, can impact their price. If investors are optimistic about the potential of blur tokens or the blockchain industry as a whole, they may be more likely to buy and hold these tokens, driving up demand and prices. Conversely, if investors are pessimistic or have concerns about the market, they may sell their blur tokens, causing prices to fall. Investor sentiment is influenced by various factors, such as market trends, news, and developments in the blockchain industry.

What role does regulation play in the price of blur tokens?

Regulation plays a significant role in the price of blur tokens. Government regulations or policies can impact the legality and acceptance of blur tokens, which in turn can affect their demand and price. For example, if a government passes favorable regulations that support the use and adoption of blur tokens, it can boost investor confidence and drive up prices. On the other hand, if a government introduces strict regulations or bans blur tokens altogether, it can create uncertainty and decrease demand, leading to lower prices. The regulatory environment is an essential consideration for investors and can greatly influence the price of blur tokens.

What are some examples of market conditions that can affect the price of blur tokens?

Market conditions, such as economic factors or geopolitical events, can have a significant impact on the price of blur tokens. For instance, a strong economy with positive growth prospects can create a favorable investment climate and drive up demand and prices. Conversely, a weak economy or negative developments can dampen investor confidence, leading to a decrease in demand and prices. Geopolitical events, such as political instability or trade disputes, can also affect market conditions and subsequently impact the price of blur tokens. These factors influence the overall market sentiment and investor behavior.

Blur: NFT | Blur: NFT login | Blur: NFT connect | WalletConnect | Traders | What Is Blur Crypto

2022-2024 @ Exploring how external factors impact the price of blur tokens