Understanding the influences contributing to price variations in the cryptocurrency market

Blur: NFT | Blur: NFT login | Blur: NFT connect | WalletConnect | Traders | What Is Blur Crypto

Blur: NFT | Blur: NFT login | Blur: NFT connect | WalletConnect | Traders | What Is Blur Crypto

The cryptocurrency market has experienced immense growth and volatility in recent years, attracting investors and traders from all over the world. However, this rapid growth has also led to price distortion, where the market value of cryptocurrencies does not accurately reflect their intrinsic value. Understanding the factors behind this distortion is crucial for investors and analysts to make informed decisions.

One of the main factors contributing to price distortion in the cryptocurrency market is market manipulation. With the lack of regulations and oversight, some individuals and organizations are able to manipulate prices to their advantage. This can be done through techniques such as pump and dump schemes, where prices are artificially inflated and then rapidly sold off, resulting in significant losses for unsuspecting investors.

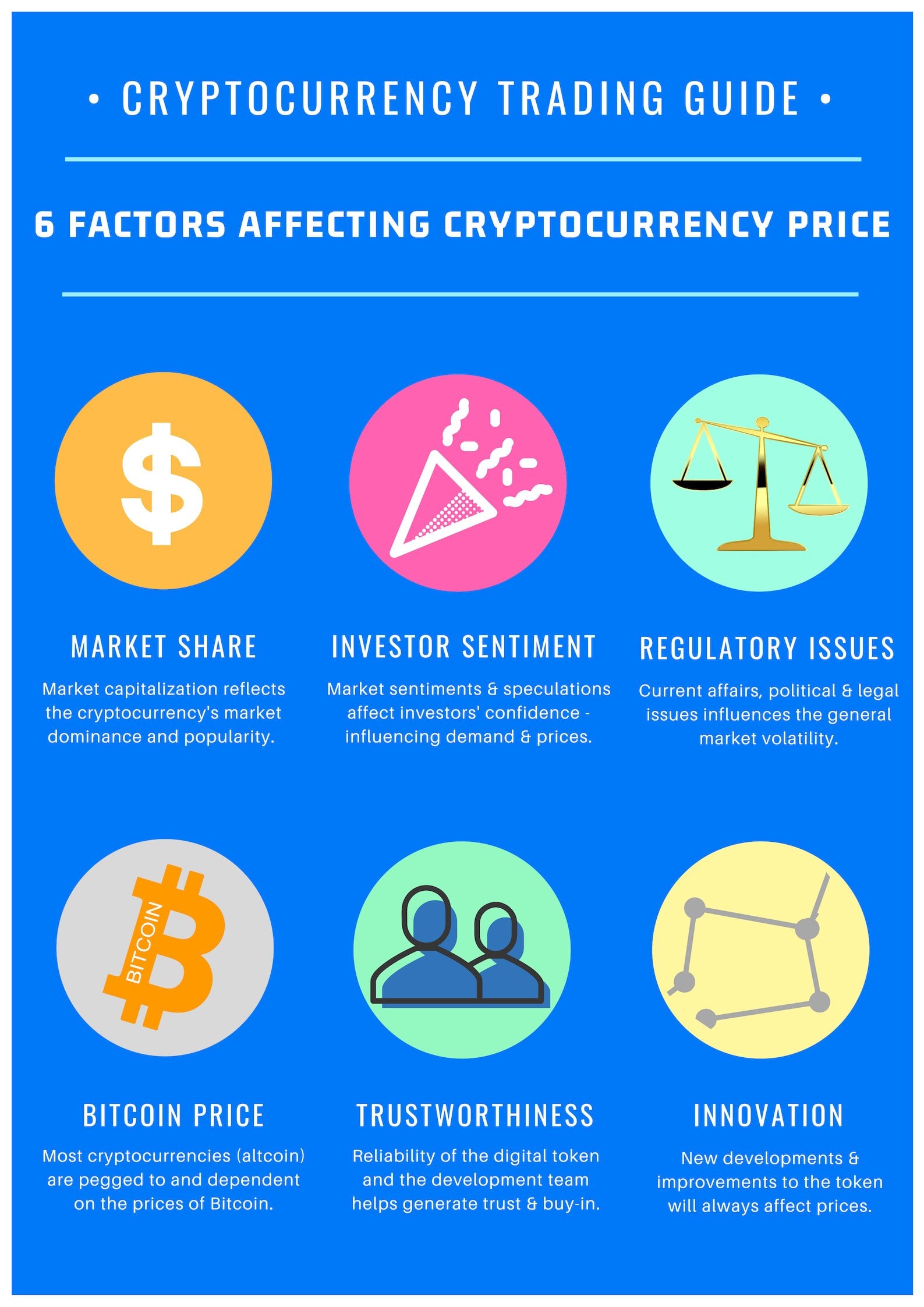

Another factor is the influence of speculative investment. Cryptocurrencies are highly speculative assets, meaning their value is largely driven by investor sentiment and expectations of future growth. This speculative behavior can lead to price bubbles, where prices are driven far above their intrinsic value. When these bubbles burst, prices can plummet, causing significant losses for investors.

Additionally, the lack of transparency and information asymmetry in the cryptocurrency market exacerbate price distortion. Traditional financial markets have extensive reporting and disclosure requirements, ensuring that investors have access to accurate and timely information. In the cryptocurrency market, however, there is often limited information available, making it difficult for investors to make well-informed decisions. This information asymmetry can lead to mispricing and price distortion.

In conclusion, price distortion in the cryptocurrency market is a complex issue, influenced by factors such as market manipulation, speculative investment, and information asymmetry. As the cryptocurrency market continues to evolve, it is important for regulators and market participants to address these issues in order to improve market efficiency and protect investors.

Examining the Causes of Price Distortion in Cryptocurrency Markets

Price distortion in cryptocurrency markets has been a persistent issue that has attracted significant attention from investors, regulators, and researchers alike. The highly volatile nature of cryptocurrencies, combined with the absence of a centralized governing authority, creates an environment prone to price manipulation and distortion. In this article, we will explore some of the key factors that contribute to the price distortion in cryptocurrency markets.

Lack of regulation and oversight

One of the primary causes of price distortion in the cryptocurrency market is the lack of regulation and oversight. Unlike traditional financial markets, cryptocurrencies operate in a decentralized manner and are not subject to the same level of scrutiny and regulation. This allows malicious actors to manipulate prices through various means, such as wash trading, pump and dump schemes, and spoofing.

Without proper regulation and oversight, these manipulative practices can distort the true value of cryptocurrencies, leading to price volatility and unpredictability. Investors can be easily misled by artificial price movements, resulting in significant financial losses.

Limited liquidity

Another factor contributing to price distortion in cryptocurrency markets is the limited liquidity. Liquidity refers to the ease with which an asset can be bought or sold without significantly affecting its price. In illiquid markets, even a small buy or sell order can have a substantial impact on the price due to the lack of sufficient buyers or sellers.

Cryptocurrency markets, especially those with lower trading volumes, often suffer from limited liquidity. This makes them susceptible to price manipulation by individuals or groups with large amounts of capital. By executing large trades, these actors can artificially inflate or deflate prices, creating an illusion of market demand or supply.

Information asymmetry

Information asymmetry is another factor that can contribute to price distortion in the cryptocurrency market. In traditional financial markets, regulators require companies to disclose relevant information to all investors to ensure a fair and transparent trading environment. However, in the cryptocurrency market, there is often a lack of standardized disclosure requirements.

This information asymmetry gives certain market participants an unfair advantage, allowing them to exploit the lack of information. By selectively disclosing or withholding crucial information, such as partnership announcements or regulatory developments, these participants can influence market sentiment and manipulate prices for their own benefit.

Lack of regulation and oversight

Allows for price manipulation through wash trading, pump and dump schemes, and spoofing

Limited liquidity

Susceptible to price manipulation due to the small number of buyers and sellers

Information asymmetry

Gives certain participants an unfair advantage in manipulating prices through selective disclosure

In conclusion, price distortion in cryptocurrency markets can be attributed to various factors, including the lack of regulation and oversight, limited liquidity, and information asymmetry. Addressing these issues is crucial to create a more transparent and efficient market environment, which can help mitigate the risks associated with cryptocurrency investments.

The Rise of Cryptocurrency

Cryptocurrency has emerged as a revolutionary digital asset that has gained significant attention and popularity in recent years. It is a form of decentralized digital currency that utilizes cryptography for secure financial transactions, control the creation of additional units, and verify the transfer of assets. The rise of cryptocurrency has completely transformed the traditional financial landscape, offering numerous benefits and opportunities for individuals and businesses.

One of the key factors driving the popularity of cryptocurrency is its potential for decentralization and autonomy. Unlike traditional centralized financial systems, cryptocurrencies are not regulated or controlled by any central authority such as a government or financial institution. This enables users to have full control over their assets and transactions, reducing the need for intermediaries and eliminating associated fees and restrictions.

The emergence of blockchain technology has played a crucial role in the rise of cryptocurrency. Blockchain is a distributed ledger that records the transactions across multiple computers, providing transparency, security, and immutability. By utilizing blockchain technology, cryptocurrencies ensure that all transactions are verifiable and traceable, enhancing trust and eliminating the risk of fraud or manipulation.

Furthermore, cryptocurrency offers a new level of financial inclusivity, particularly for the unbanked populations across the world. Traditional banking systems often have strict requirements and high fees, excluding a significant portion of the global population from accessing financial services. Cryptocurrencies enable individuals to participate in the global financial system without relying on traditional banking infrastructure, opening up new economic opportunities and empowering individuals.

Additionally, the rise of cryptocurrency has given birth to a wide range of innovative applications and platforms. From decentralized finance (DeFi) protocols to non-fungible tokens (NFTs), the cryptocurrency ecosystem has witnessed remarkable growth and diversification. These advancements have not only created new investment opportunities but have also revolutionized various industries such as art, gaming, and real estate.

As the cryptocurrency market continues to evolve, it is important for individuals and businesses to stay informed and educated about the risks and opportunities associated with this digital asset. Proper understanding, reliable research, and cautious decision-making are essential to navigate the volatile nature of the cryptocurrency market.

In conclusion, the rise of cryptocurrency has brought about significant changes in the financial landscape, offering decentralization, security, inclusivity, and innovation. However, with great opportunities come great risks, and individuals must approach the cryptocurrency market with caution and knowledge to make informed decisions.

To explore the world of cryptocurrency further, check out the Blur NFT Marketplace, a platform that provides a unique space for buying, selling, and trading digital collectibles and artworks on the blockchain.

The Role of Speculation

Speculation plays a significant role in the price distortion observed in the cryptocurrency market. In simple terms, speculation refers to the act of buying and selling assets in the hope of making a profit from future changes in their prices.

Cryptocurrencies, being highly volatile and unpredictable, attract a significant amount of speculative activity. Many investors and traders are attracted to the potential gains that can be made by correctly predicting the market movements of cryptocurrencies.

Speculators in the cryptocurrency market often rely on technical analysis, which involves studying historical price data and identifying patterns that can help predict future price movements. They also use various indicators and tools to make informed decisions about when to enter or exit a trade.

Speculation can lead to price distortions in the cryptocurrency market because it amplifies price movements in both directions. When speculators anticipate a rise in the price, they tend to buy cryptocurrencies, increasing the demand and driving the price up even further. This is known as a bullish trend.

Conversely, when speculators predict a decline in the price, they may sell their holdings, leading to an increase in supply and driving the price down. This is known as a bearish trend. These price movements driven by speculation can be exaggerated and create price bubbles or crashes in the market.

It's important to note that speculation is not inherently bad for the cryptocurrency market. It can provide liquidity and market efficiency, allowing for price discovery. However, excessive speculation can lead to market manipulation, as some individuals or groups with significant resources can manipulate prices for their own benefit.

Regulatory measures and increased transparency are often implemented to mitigate the negative effects of speculation and ensure a fair and orderly market. These measures can include regulatory oversight, surveillance, and the adoption of best practices by market participants.

Speculation in the cryptocurrency market involves buying and selling assets in the hope of making a profit from future price changes.

Speculation can lead to price distortions and exaggerated price movements in both bullish and bearish trends.

Excessive speculation can result in market manipulation and the creation of price bubbles or crashes.

Regulatory measures and increased transparency are important in mitigating the negative effects of speculation.

Supply and Demand Factors

The cryptocurrency market is influenced by a variety of factors, including supply and demand dynamics. These factors play a crucial role in determining the price of cryptocurrencies.

Supply is a key factor that affects the price of cryptocurrencies. The total supply of a cryptocurrency determines its availability in the market. When the supply is limited, and there is high demand, the price tends to increase. On the other hand, when the supply is abundant, and there is less demand, the price may decrease.

Demand is another significant factor that impacts cryptocurrency prices. Demand can be influenced by various factors such as market sentiment, news, and developments within the cryptocurrency industry. For example, positive news about a particular cryptocurrency, such as a partnership announcement or a technological breakthrough, can lead to an increase in demand and ultimately drive up its price.

In addition to these basic supply and demand dynamics, there are other factors that can distort prices in the cryptocurrency market. These include market manipulation, regulatory changes, and speculative trading. Market manipulation can occur when individuals or entities attempt to artificially influence prices for their own gain.

Regulatory changes can also have a significant impact on cryptocurrency prices. Governments and regulatory bodies around the world have the power to introduce new policies or regulations that can affect the legality and usage of cryptocurrencies. Such changes can create uncertainty in the market, leading to price volatility.

Speculative trading is another factor that can contribute to price distortion. Some investors may trade cryptocurrencies purely based on speculation, without considering the underlying value or utility of the cryptocurrency. This can lead to price bubbles and significant price fluctuations.

In conclusion, supply and demand dynamics, along with other factors such as market manipulation, regulatory changes, and speculative trading, can contribute to price distortion in the cryptocurrency market. Understanding these factors is essential for investors and traders to make informed decisions and navigate the volatile cryptocurrency market.

For more information on the cryptocurrency market and how to get started, visit WIE MAN SICH BEI BLUR.IO ANMELDET.

Market Manipulation

Market manipulation refers to the deliberate and unethical practices carried out by individuals or groups to influence the price of a cryptocurrency in the market. This can be done through various strategies, such as:

Pump and dump: This strategy involves artificially inflating the price of a cryptocurrency by spreading positive news and hype around it. Once the price reaches a certain point, the manipulators sell their holdings, causing the price to crash, leaving other investors with substantial losses.

Wash trading: In this technique, manipulators create artificial trading activity by buying and selling the same cryptocurrency simultaneously. This creates an illusion of demand and trading volume, tricking other investors into thinking that the cryptocurrency is popular and liquid.

Spoofing: Spoofing involves placing large buy or sell orders with no intention of executing them. This is done to create false market impressions and manipulate other investors into making certain decisions based on the perceived supply and demand dynamics.

Front running: In front running, manipulators exploit their access to non-public information to execute trades ahead of other investors. This allows them to profit from the price movements resulting from their own trades, at the expense of other market participants.

Insider trading: This illegal practice involves trading on material non-public information about a cryptocurrency. Insiders, such as employees or executives of a cryptocurrency project, may manipulate the market for personal gain or to benefit the project.

Market manipulation can have significant consequences, such as distorting the true value of cryptocurrencies, creating false market expectations, and eroding investor confidence. Regulators and market participants must remain vigilant to detect and prevent such manipulative practices in order to maintain the integrity and fairness of the cryptocurrency market.

Regulatory Uncertainty

One of the key factors contributing to price distortion in the cryptocurrency market is regulatory uncertainty. As the cryptocurrency market is relatively new and still evolving, governments and regulatory bodies around the world have struggled to establish clear and consistent rules and regulations for this emerging asset class.

Lack of Legal Framework:

One reason for regulatory uncertainty is the lack of a comprehensive legal framework for cryptocurrencies. While some countries have taken proactive steps to regulate cryptocurrencies, many others have yet to define their stance or implement any specific regulations. This lack of legal clarity creates uncertainty for both market participants and investors, leading to price volatility and distortion.

Inconsistent Regulatory Approaches:

Even in countries where cryptocurrency regulations exist, there is often inconsistency in regulatory approaches. Different regulatory bodies may have different interpretations and enforcement actions when it comes to cryptocurrencies, resulting in a fragmented regulatory landscape. This lack of consistency further adds to the uncertainty and price distortion in the market.

Impact on Investor Confidence:

The regulatory uncertainty surrounding cryptocurrencies has a significant impact on investor confidence. Investors are hesitant to enter the market and commit substantial amounts of capital when there is ambiguity about the rules and regulations that will govern their investments. This lack of confidence leads to reduced trading volumes and liquidity, contributing to price distortions.

Regulatory Developments and Their Effects

Recent regulatory developments, such as the tightening of regulations in some jurisdictions and the introduction of new regulations in others, have had a profound impact on the cryptocurrency market. These developments have resulted in increased uncertainty and amplified price distortions.

Market Manipulation:

Regulatory uncertainty provides fertile ground for market manipulation. Bad actors can exploit gaps in regulatory oversight and engage in practices such as pump and dump schemes or insider trading, leading to significant price distortions. Without clear regulations and strong enforcement mechanisms, it becomes difficult to prevent and detect such manipulative activities.

Investor Protection:

Regulatory uncertainty not only affects market participants but also puts investors at risk. Without proper regulations in place, investors are more vulnerable to scams, frauds, and Ponzi schemes in the cryptocurrency market. Instances of hacking and theft are also more prevalent in the absence of robust regulatory frameworks, which further erodes investor confidence and distorts prices.

Overall, regulatory uncertainty plays a crucial role in price distortion in the cryptocurrency market. To reduce price distortions and foster market stability, it is important for governments and regulatory bodies to work towards establishing clear and consistent regulations that provide investor protection and address market manipulation risks.

Technology and Infrastructure Limitations

While the cryptocurrency market has grown rapidly over the past decade, it still faces significant limitations in terms of technology and infrastructure. These limitations can contribute to price distortion and market inefficiencies.

Lack of Scalability

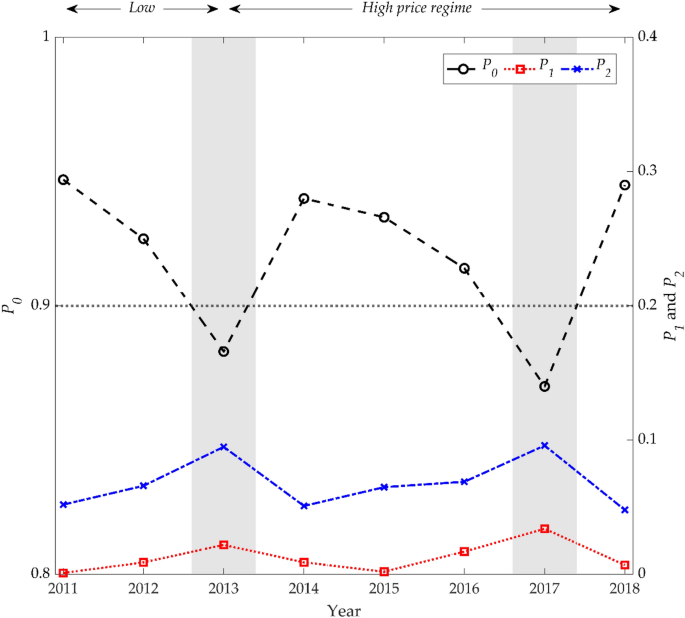

One of the main challenges facing the cryptocurrency market is scalability. Many popular cryptocurrencies, such as Bitcoin and Ethereum, have limited transaction processing capabilities. This means that as the number of users and transactions increase, the network can become congested, leading to slower confirmation times and higher transaction fees. These scalability issues can create price distortions, as market participants may be willing to pay higher prices to ensure their transactions are processed quickly.

Limited Market Access

Another factor contributing to price distortion is the limited market access for cryptocurrency trading. While cryptocurrency exchanges have become more widespread and accessible, there are still barriers to entry for many individuals and institutions. Some countries have strict regulations or bans on cryptocurrency trading, making it difficult for residents in those regions to access the market. Additionally, there are challenges with onboarding traditional financial institutions onto the cryptocurrency ecosystem, which can limit liquidity and create price discrepancies between different markets.

Data Quality and Transparency

The lack of reliable data and transparency in the cryptocurrency market can also contribute to price distortions. Unlike traditional financial markets, where regulators monitor and enforce reporting standards, the cryptocurrency market is relatively unregulated. This can make it challenging for investors to obtain accurate and timely information about trading volumes, market depth, and other relevant factors. The lack of transparency can allow for market manipulation and the spread of false information, leading to price distortions.

Overall, the technology and infrastructure limitations present in the cryptocurrency market contribute to price distortion and market inefficiencies.

Scalability issues can result in slower transaction times and higher fees, leading to price distortions.

Limited market access and regulatory barriers can create discrepancies in prices between different markets.

The lack of reliable data and transparency allows for market manipulation and false information, further exacerbating price distortions.

Trading Volume and Liquidity

One of the main factors that can lead to price distortion in the cryptocurrency market is the trading volume and liquidity of a particular cryptocurrency. Trading volume refers to the number of shares or coins traded within a given period of time. Liquidity, on the other hand, refers to how easily a cryptocurrency can be bought or sold without causing significant changes in its price.

A cryptocurrency with a high trading volume and liquidity is considered to be more stable and less prone to price manipulation. This is because there is a larger pool of buyers and sellers, which helps to create a more efficient market. On the other hand, a cryptocurrency with low trading volume and liquidity is more vulnerable to price manipulation as it is easier for a single trader or group of traders to influence the price.

There are several factors that can affect the trading volume and liquidity of a cryptocurrency. These include:

Market demand: The level of demand for a particular cryptocurrency can greatly affect its trading volume and liquidity. If there is high demand for a cryptocurrency, more people will be buying and selling it, leading to higher trading volume and liquidity. Conversely, if there is low demand, the trading volume and liquidity will be lower.

Listings on exchanges: The availability of a cryptocurrency on major exchanges can also impact its trading volume and liquidity. Cryptocurrencies that are listed on multiple exchanges are more likely to have higher trading volume and liquidity compared to those that are only listed on a few exchanges.

Market sentiment: The overall sentiment of the cryptocurrency market can also affect trading volume and liquidity. In times of positive market sentiment, more people are likely to buy and sell cryptocurrencies, leading to higher trading volume and liquidity. On the other hand, in times of negative market sentiment, trading volume and liquidity may decrease as people become more cautious.

Regulatory environment: The regulatory environment surrounding cryptocurrencies can have a significant impact on trading volume and liquidity. Cryptocurrencies that are subject to strict regulations may have lower trading volume and liquidity as investors may be hesitant to trade them due to compliance issues.

In conclusion, trading volume and liquidity play a crucial role in the price distortion of cryptocurrencies. It is important for investors to consider these factors when making trading decisions. To explore more about the cryptocurrency market and enhance your trading experience, you can visit Blur: NFT connect.

Psychological Factors

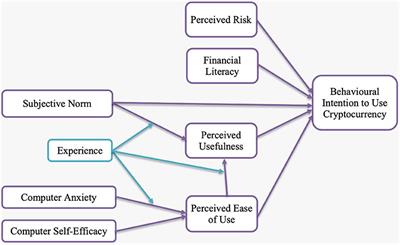

Psychological factors play a significant role in the price distortion of cryptocurrencies. The inherent nature of human psychology often leads to emotional decision-making, which can greatly impact the supply and demand dynamics in the market.

Fear and Greed

Two prominent psychological factors that influence cryptocurrency prices are fear and greed. When prices are soaring, investors often experience a fear of missing out (FOMO), leading them to buy into the market and drive prices even higher. This behavior can create a speculative bubble, causing prices to become artificially inflated.

On the other hand, fear can lead to panic selling during market downturns. When investors see prices dropping, they may succumb to panic and sell their assets at significantly lower prices, exacerbating the downward spiral. This fear-driven behavior can cause prices to deviate from their intrinsic value.

Herd Mentality

Another psychological factor is the herd mentality, where individuals tend to follow the actions and decisions of the majority. In the cryptocurrency market, this can result in a bandwagon effect, where investors flock to buy or sell based on the actions of others, rather than conducting their own independent analysis.

During periods of bullish sentiment, the fear of being left behind can lead to a rush of buyers driving up prices. Conversely, during bearish sentiment, the fear of further losses can cause a mass exodus of sellers, intensifying the downward pressure on prices. This herd mentality contributes to price distortion as it amplifies the effects of market sentiment on cryptocurrency prices.

Fear and Greed

Creates speculative bubbles and panic selling

Herd Mentality

Amplifies market sentiment effects on prices

News and Media Influence

The cryptocurrency market is highly susceptible to news and media influence. This market is driven by investor sentiment and perception, and news plays a significant role in shaping these factors.

1. Breaking News: News about government regulations, technological advancements, security breaches, or prominent figures entering the cryptocurrency market can have a significant impact on prices. Breaking news that indicates positive developments often leads to an increase in demand and price surge, while negative news can trigger panic selling and price drops.

2. Media Coverage: Mainstream media outlets often shape public opinion and provide insights into the cryptocurrency market. News reports, interviews, and analysis segments can influence investor sentiment. Positive coverage from reputable media sources can boost investor confidence in cryptocurrencies, while negative coverage can create doubt and skepticism.

3. Opinions from Experts: Experts' opinions and predictions on the future of cryptocurrencies can greatly impact market sentiment. When influential figures express positive views on cryptocurrencies, it can lead to increased investment and price appreciation. Conversely, negative opinions from experts can cause market instability and price declines.

4. Social Media: Social media platforms like Twitter, Reddit, and Telegram have become influential channels in the crypto community. Influencers, industry leaders, and community members share their thoughts, analyses, and trading strategies on these platforms. The sentiments expressed in these discussions can have a substantial impact on cryptocurrency prices.

5. Pump and Dump Schemes: Unscrupulous individuals or groups can manipulate cryptocurrency prices through pump and dump schemes. They use social media platforms and online forums to artificially inflate prices by spreading positive news and creating hype. Once the prices have risen substantially, they sell their holdings, causing a price collapse and leaving other investors at a loss.

Addressing the Influence

1. Verify Information: It is crucial to verify the accuracy and reliability of news before making investment decisions. Relying solely on social media or unverified sources can lead to poor decision-making. Cross-referencing information from multiple sources can provide a more comprehensive understanding of the situation.

2. Consider Long-term Fundamentals: While short-term price movements may be influenced by news, it is important to consider the long-term fundamentals of the cryptocurrency market. Analyze the technology, adoption rate, development team, and overall market trends to make informed investment decisions.

3. Diversification: Diversifying your cryptocurrency portfolio can help mitigate the impact of short-term price fluctuations caused by news. By spreading your investments across different cryptocurrencies, you can reduce the risk of being solely affected by a single news event.

4. Emphasize Independent Research: Rather than relying solely on news and media coverage, conduct independent research to gain a deeper understanding of the cryptocurrency market. This can help you make rational decisions based on your own findings and analysis.

Stay updated with reliable news sources and platforms.

Engage in discussions and forums to gain insights from the crypto community.

Follow reputable experts and influencers for their perspectives.

Stay cautious of potential pump and dump schemes and avoid falling victim to fraudulent activities.

Integration with Traditional Markets

The cryptocurrency market has experienced increasing integration with traditional financial markets in recent years, leading to both positive and negative effects on price distortion. This integration has been driven by various factors, including the growing acceptance of cryptocurrencies by mainstream financial institutions and the development of cryptocurrency derivatives.

On one hand, the integration with traditional markets has brought more liquidity and institutional investment to the cryptocurrency market. This has had a positive impact on price stability and reduced the level of price distortion. Traditional financial institutions, such as banks and hedge funds, have started offering cryptocurrency investment products, allowing their clients to invest in cryptocurrencies without directly owning the underlying assets. This has attracted more institutional investors to the market, bringing in larger volumes of capital and increasing market efficiency.

On the other hand, the integration with traditional markets has also introduced new sources of price distortion. Cryptocurrency derivatives, such as futures contracts and options, have become popular instruments in the market. These instruments allow traders to speculate on the future price movements of cryptocurrencies, without actually owning them. While these derivatives provide liquidity and price discovery, they can also lead to price manipulation and market manipulation. Traders with large positions in derivatives can influence the price of the underlying assets, causing price distortions.

In addition to derivatives, the integration with traditional markets has also led to the emergence of cryptocurrency exchange-traded funds (ETFs), which enable investors to gain exposure to a diversified portfolio of cryptocurrencies. While ETFs can enhance price discovery and reduce price distortion, they can also introduce new risks to the market. For example, if there is a sudden surge in demand for a particular cryptocurrency held by an ETF, it can lead to price distortions in both the ETF and the underlying assets.

In conclusion, the integration with traditional financial markets has had both positive and negative effects on price distortion in the cryptocurrency market. While it has brought more liquidity and institutional investment, it has also introduced new sources of price distortion through derivatives and ETFs. It is important for regulators and market participants to monitor and address these issues to ensure a fair and efficient market.

Geopolitical Events and Economic Crises

Geopolitical events and economic crises have a significant impact on the cryptocurrency market, often leading to price distortions. These events and crises can create uncertainty and fear among investors, causing them to sell off their cryptocurrencies and seek safe-haven assets. As a result, the demand for cryptocurrencies decreases, leading to a drop in prices.

One example of a geopolitical event that has affected the cryptocurrency market is the trade war between the United States and China. The escalating tensions between these two economic powerhouses have led to increased volatility in the cryptocurrency market. Investors are unsure about the impact of the trade war on the global economy and are therefore more cautious with their investments. This caution often leads to a decrease in demand for cryptocurrencies and a subsequent decrease in prices.

Economic crises, such as recessions or financial market crashes, also have a significant impact on the cryptocurrency market. During these crises, investors often seek alternative investments to protect their wealth. Cryptocurrencies, with their decentralized nature and potential for high returns, can be seen as an attractive option. This increased demand for cryptocurrencies during economic crises can cause a surge in prices.

However, economic crises can also have a negative impact on the cryptocurrency market. For example, during the 2008 financial crisis, many investors faced liquidity problems and had to sell off their assets, including cryptocurrencies. This forced selling of cryptocurrencies led to a decrease in prices, as the market was flooded with supply.

In conclusion, geopolitical events and economic crises can both positively and negatively impact the cryptocurrency market. They create uncertainty among investors, leading to fluctuations in demand and subsequently, price distortions. It is important for investors to stay informed about these events and crises and understand their potential impact on the cryptocurrency market.

Competition among Cryptocurrencies

Competition plays a significant role in shaping the cryptocurrency market and can be considered one of the factors behind price distortion. With thousands of cryptocurrencies available today, each with its unique features and use cases, the market is highly competitive.

When new cryptocurrencies enter the market, they often try to differentiate themselves by offering improvements or innovations compared to existing coins. This competition can lead to price distortions as investors and traders evaluate the potential of these new coins.

Additionally, the presence of multiple cryptocurrencies targeting similar use cases can create competition among them. For example, there are numerous cryptocurrencies focusing on decentralized finance (DeFi), each aiming to offer a more efficient or secure solution compared to others. This competition can result in price distortions as investors navigate among different options.

The competition among cryptocurrencies is further fueled by the trading and investment strategies of individuals and institutions. Traders and investors constantly seek opportunities to maximize their returns, often resulting in a frenzied behavior in the market. This behavior can lead to rapid price fluctuations and price distortions.

Moreover, the emergence of new technologies and advancements in the cryptocurrency space can also contribute to price distortions. Technological breakthroughs, such as the introduction of smart contracts or the scalability solutions for blockchain networks, can lead to a surge in demand for specific cryptocurrencies, causing their prices to deviate from their fundamental values.

In conclusion, competition among cryptocurrencies is a significant factor that can contribute to price distortions in the market. As different coins compete for attention and investors seek to maximize their returns, the prices of cryptocurrencies can deviate from their intrinsic values. Understanding the dynamics of this competition is essential for analyzing and predicting price movements in the cryptocurrency market.

What factors contribute to price distortion in the cryptocurrency market?

Price distortion in the cryptocurrency market can be attributed to several factors. One of the main factors is the lack of regulation and oversight, which allows for manipulative practices such as wash trading and spoofing. Additionally, the relatively small market size and low liquidity of some cryptocurrencies can make them susceptible to price manipulation by large holders. Lastly, the high volatility and speculative nature of the market also contribute to price distortion, as market participants can engage in irrational buying and selling behavior.

How does the lack of regulation affect the cryptocurrency market?

The lack of regulation in the cryptocurrency market allows for manipulative practices that can distort prices. Without proper oversight, entities can engage in activities like wash trading, where they buy and sell assets to create a false impression of trading volume, artificially inflating prices. This can mislead other investors and participants. Additionally, the lack of regulation makes it difficult to prevent market manipulation and protect against fraudulent activities, leading to higher risks for investors.

Why do small cryptocurrencies have a higher chance of price distortion?

Small cryptocurrencies, with relatively low market capitalization and liquidity, are more susceptible to price distortion due to several reasons. The smaller market size makes it easier for large holders to manipulate prices by buying or selling significant amounts of the cryptocurrency. Additionally, the low liquidity means that even small trades can have a significant impact on the price. This makes it more challenging to determine the true value of these cryptocurrencies, as their prices can be easily influenced by a few big players in the market.

How does the volatility of the cryptocurrency market contribute to price distortion?

The high volatility of the cryptocurrency market can contribute to price distortion in several ways. Firstly, the volatile nature of cryptocurrencies leads to rapid price fluctuations, which can make it challenging to establish the true value of a cryptocurrency. This volatility also creates opportunities for traders to engage in speculative behavior, buying and selling assets based on short-term market movements rather than underlying fundamentals. This speculative activity can further distort prices and create price bubbles. Moreover, the fear of missing out on potential gains can also lead to irrational buying behavior and subsequent price distortion.

What can be done to reduce price distortion in the cryptocurrency market?

Reducing price distortion in the cryptocurrency market requires a combination of regulatory measures and market transparency. Implementing stricter regulations and oversight can help prevent manipulative practices such as wash trading and increase investor protection. Additionally, enhancing market transparency by requiring accurate and timely reporting of trading volumes and enforcing stricter listing standards can also contribute to reducing price distortion. Improving liquidity in smaller cryptocurrencies and promoting education about the risks and characteristics of the market can also help reduce price distortions caused by irrational behavior.

What are the main factors that cause price distortion in the cryptocurrency market?

There are several main factors that can cause price distortion in the cryptocurrency market. One factor is the lack of regulations and oversight, which allows for market manipulation and price manipulation. Another factor is the high volatility of cryptocurrencies, which can lead to sudden price swings. Additionally, the presence of scams and fraudulent activities in the market can also contribute to price distortion.

How does the lack of regulations contribute to price distortion in the cryptocurrency market?

The lack of regulations in the cryptocurrency market creates an environment where manipulation is possible. Without proper oversight, individuals or organizations can engage in activities such as pump and dump schemes, where they artificially inflate the price of a cryptocurrency before selling it off at a profit. These manipulative practices can distort the true value of cryptocurrencies and lead to price distortion.

What role does market psychology play in price distortion in the cryptocurrency market?

Market psychology plays a significant role in price distortion in the cryptocurrency market. The fear of missing out (FOMO) and the fear of losing out (FOLO) can drive investors to buy or sell cryptocurrencies at inflated or deflated prices. For example, during a bull run, the excitement and FOMO can lead to an increase in buying pressure, causing prices to skyrocket. Conversely, during a bear market, FOLO and panic selling can lead to a sharp decline in prices.

How do scams and fraudulent activities contribute to price distortion in the cryptocurrency market?

Scams and fraudulent activities can contribute to price distortion in the cryptocurrency market by creating false market demand or supply. For example, a fraudulent project may create fake news or exaggerate its capabilities, leading to an artificial increase in price. Additionally, pump and dump schemes, where organized groups artificially inflate the price of a cryptocurrency before selling it off, can also distort the market and deceive investors.

Blur: NFT | Blur: NFT login | Blur: NFT connect | WalletConnect | Traders | What Is Blur Crypto

2022-2024 @ Exploring the factors behind price distortion in the cryptocurrency market