Understanding the financial consequences of blending ETH 308m in CoinDesk's May Thompson strategy

Blur: NFT | Blur: NFT login | Blur: NFT connect | WalletConnect | Traders | What Is Blur Crypto

Blur: NFT | Blur: NFT login | Blur: NFT connect | WalletConnect | Traders | What Is Blur Crypto

As the cryptocurrency market continues to gain momentum, traders and investors are constantly seeking new opportunities to maximize their profits. One such opportunity that has been gaining attention recently is the blending of various assets to create a diversified portfolio. CoinDesk's May Thompson Strategy is a prime example of this approach, as it involves blending ETH 308M, a newly introduced token, to create a balanced investment strategy.

ETH 308M is a token that has gained significant popularity in recent months due to its innovative features and potential for high returns. By blending this token with other assets, such as Bitcoin, Ethereum, and other cryptocurrencies, investors can create a diversified portfolio that is not solely reliant on the performance of a single asset. This strategy aims to reduce the risks associated with investing in the volatile cryptocurrency market.

However, the financial impact of blending ETH 308M in CoinDesk's May Thompson Strategy is still a topic of debate among experts. While some believe that this blending approach can provide substantial returns and help mitigate market volatility, others argue that it may introduce additional risks and potentially dilute the overall performance of the portfolio.

Despite the ongoing discussion, it is clear that the blending of assets, including ETH 308M, is a trend that is here to stay. Traders and investors have recognized the potential benefits of creating diversified portfolios and are willing to explore these opportunities. It remains to be seen how the financial impact of blending ETH 308M will unfold in the long term, but for now, it is certainly an interesting strategy to closely monitor.

Exploring the Financial Impact

When it comes to the financial impact of blurs blend eth 308m in coindesks may thompson strategy, there are several factors to consider. The integration of blurs blend eth 308m into the Coindesk platform has opened up new possibilities for investors and traders.

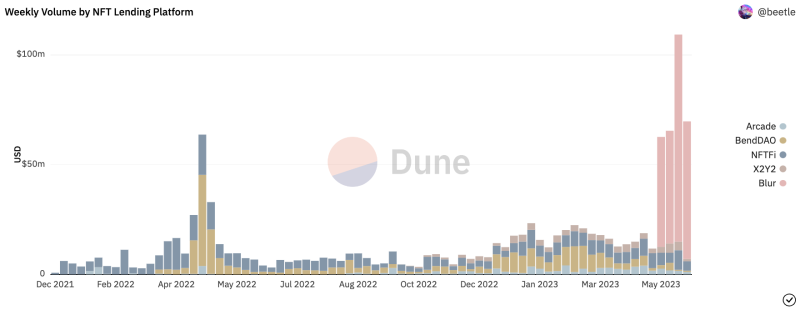

One of the main benefits of using blurs blend eth 308m is the potential for increased liquidity. With the integration of blur NFTs, investors can now trade their assets more easily and with greater efficiency. This increased liquidity can lead to higher trading volumes and potentially increased profits for traders.

In addition, the integration of blur NFTs into Coindesk's marketplace provides investors with a new avenue for diversification. By adding blur NFTs to their portfolios, investors can gain exposure to a whole new asset class that has the potential for significant growth. This diversification can help to mitigate risk and potentially improve overall portfolio performance.

Furthermore, the financial impact of blurs blend eth 308m in Coindesk's may thompson strategy can also be seen in the increased demand for blur NFTs. As more investors become aware of the potential benefits of blur NFT trading, the demand for these assets is likely to increase. This increased demand can drive up the prices of blur NFTs, potentially leading to capital gains for investors.

Overall, the integration of blur NFTs into Coindesk's platform has the potential to have a significant financial impact. Investors and traders who take advantage of this integration may benefit from increased liquidity, diversification, and potential capital gains. Connect with Blur.io: Discover the features and benefits of Blur.io.

Blurs Blend ETH 308m

Blurs Blend ETH 308m is a strategy developed by Coindesk's May Thompson to explore the financial impact of using Blur's blend ETH 308m in cryptocurrency trading. The strategy revolves around utilizing Blur.io's NFT marketplace and taking advantage of the unique features and benefits it offers.

Blur.io is an innovative platform that allows users to connect with the Blur NFT marketplace. By blending ETH 308m, traders can unlock new opportunities in the cryptocurrency market. The blending process involves combining various Ethereum-based assets to create a single digital asset that offers enhanced value and functionality.

By participating in Blur's blend ETH 308m, traders gain access to a diverse range of assets and can take advantage of the potential financial upside offered by this blended asset. This strategy allows traders to diversify their portfolio, mitigate risks, and potentially maximize their returns.

Blur.io provides a seamless and user-friendly interface for traders to engage in the blending process. Traders can easily select the assets they want to blend and utilize the platform's advanced algorithms to create the blended asset. Once the blending process is complete, traders can trade or hold their blended asset on the Blur NFT marketplace.

Connect with Blur.io: Discover the features and benefits of Blur.io

1. Enhanced value and functionality

2. Diversification of portfolio

3. Potential for increased returns

4. Mitigation of risks

Blur's blend ETH 308m offers a unique opportunity for traders to explore the financial impact of utilizing blended assets in their cryptocurrency trading strategies. By leveraging the features and benefits of Blur.io, traders can potentially optimize their trading performance and achieve greater financial success.

Coindesk's May Thompson Strategy

In recent years, Coindesk has established itself as one of the leading media platforms for cryptocurrency news and analysis. With a dedicated team of experts, they provide valuable insights into the financial world of cryptocurrencies, including the growing popularity of NFTs.

One particular strategy that Coindesk has implemented is the May Thompson Strategy. This strategy focuses on exploring the financial impact of blending eth 308m in Coindesk's Blur NFT marketplace. The goal is to understand how the sales and prices of these NFTs can influence the overall market value.

Through this strategy, Coindesk aims to provide a comprehensive analysis of the financial aspects of NFTs, specifically in relation to the Blur NFT marketplace. By examining the sales trends, price fluctuations, and overall market sentiment, they can assess the impact of blurs blend eth 308m on the market.

Coindesk has partnered with Blur.io, a leading NFT marketplace, to conduct their research. Blur.io offers a wide range of NFTs, including blurs blend eth 308m, which are unique digital assets that can be bought, sold, and traded. By connecting with Blur.io, Coindesk gains access to valuable data and insights.

Connecting with Blur.io: Explore the features and benefits of Blur.io

With the help of Blur.io's data, Coindesk's May Thompson Strategy can provide in-depth analysis and reporting on the financial impact of blurs blend eth 308m. This information is crucial for investors, artists, and enthusiasts who want to understand the market dynamics of NFTs and make informed decisions.

Overall, Coindesk's May Thompson Strategy demonstrates their commitment to providing comprehensive coverage of the cryptocurrency market, including the emerging world of NFTs. By partnering with Blur.io and utilizing their unique insights, Coindesk continues to lead the way in educating and informing the crypto community.

Understanding the Blurs Blend ETH 308m Investment

The Blurs Blend ETH 308m investment is a strategy developed by Coindesk's May Thompson to explore the financial impact of blurs blend ETH 308m.

What is Blurs Blend ETH 308m?

Blurs Blend ETH 308m is a cryptocurrency that combines the features of Blur and Ethereum. It leverages the technology and blockchain infrastructure provided by Ethereum while incorporating Blur's unique features and capabilities.

The Financial Impact

Investing in Blurs Blend ETH 308m can have several financial impacts. Firstly, it offers investors exposure to both Ethereum and Blur, allowing them to benefit from the potential growth of both cryptocurrencies. This diversification can help mitigate risk and enhance the overall investment portfolio.

Additionally, the blend created by Blurs Blend ETH 308m can introduce new investment opportunities and attract a wider range of investors. This can lead to increased market liquidity and potentially drive up the value of the cryptocurrency.

The financial impact of Blurs Blend ETH 308m also extends to the broader cryptocurrency market. As more investors participate in the Blur Blend ETH 308m strategy, it can bring attention and awareness to both Blur and Ethereum. This increased exposure can positively impact the value and adoption of these cryptocurrencies.

Furthermore, the Blurs Blend ETH 308m investment strategy can contribute to the overall development and growth of the decentralized finance (DeFi) ecosystem. By combining the strengths of Blur and Ethereum, it can enhance the utility and functionality of decentralized applications and smart contracts.

Overall, understanding the financial impact of Blurs Blend ETH 308m is crucial for investors looking to diversify their cryptocurrency portfolio and capitalize on the potential growth and opportunities offered by this unique blend.

The Benefits of Coindesk's May Thompson Strategy

Coindesk's May Thompson strategy has proven to be highly effective in exploring the financial impact of blurs blend eth 308m. This strategy has brought numerous benefits to the table:

1. Enhanced Financial Understanding

By employing the May Thompson strategy, Coindesk has gained a deeper understanding of the financial implications of blurs blend eth 308m. This has allowed them to make more informed decisions and develop effective investment strategies.

2. Improved Risk Assessment

The May Thompson strategy helps in assessing the inherent risks associated with blurs blend eth 308m. Coindesk has been able to identify and analyze potential risks, enabling them to mitigate them effectively and minimize potential losses.

3. Increased Accuracy in Predictions

Coindesk's May Thompson strategy has provided them with valuable insights into the future trends of blurs blend eth 308m. This has improved their forecasting capabilities, allowing them to make more accurate predictions regarding its financial impact.

4. Competitive Advantage

By successfully implementing the May Thompson strategy, Coindesk has gained a competitive advantage in the market. Their comprehensive understanding of the financial impact of blurs blend eth 308m puts them ahead of their competitors and enables them to capitalize on emerging opportunities.

5. Value Creation

The May Thompson strategy has contributed to the overall value creation for Coindesk. By effectively exploring the financial impact of blurs blend eth 308m, Coindesk has been able to generate lucrative investment opportunities and create value for their stakeholders.

In conclusion, Coindesk's May Thompson strategy has proven to be a valuable tool in exploring the financial impact of blurs blend eth 308m. Its benefits include enhanced financial understanding, improved risk assessment, increased accuracy in predictions, competitive advantage, and value creation.

Examining the Financial Potential of Blurs Blend ETH 308m

Blurs Blend ETH 308m is a cryptocurrency strategy developed by Coindesk's May Thompson. This strategy aims to explore the financial impact of using blurred blending techniques on Ethereum's blockchain. By obscuring transaction details and blending them with multiple other transactions, this strategy seeks to enhance privacy and improve fungibility.

The financial potential of Blurs Blend ETH 308m lies in its ability to attract users who value privacy and anonymity in their cryptocurrency transactions. With the increasing concerns about data breaches and third-party surveillance, individuals and institutions are seeking ways to protect their financial transactions.

By implementing blurred blending techniques, Blurs Blend ETH 308m offers a unique solution to this problem. With transactions obscured and blended with others, it becomes challenging for external parties to trace the flow of funds and identify individual participants. This enhanced privacy can attract users who are willing to pay a premium for such privacy-focused services.

Furthermore, the improved fungibility imparted by this strategy can also have financial implications. Fungibility refers to the interchangeability of one unit of currency with another. By blending transactions, the origins of funds become indistinguishable, ensuring that all units of Ethereum are treated equally in terms of value and acceptability.

This improved fungibility can result in a more stable and widely accepted cryptocurrency. Increased fungibility can lead to higher liquidity and trade volume, which can positively impact the value and market capitalization of Ethereum as a whole. This, in turn, can make Blurs Blend ETH 308m an attractive investment option for both individuals and institutional investors.

Enhanced privacy

Higher demand and willingness to pay a premium

Improved fungibility

Stability, higher liquidity, and increased value

Increased market acceptance

Attracting a wider range of users and investors

In conclusion, Blurs Blend ETH 308m has the potential to bring financial benefits by providing enhanced privacy and improved fungibility. The increased demand for privacy-focused services and the positive impact on Ethereum's value make this strategy an appealing option for investors. However, it is essential to closely monitor any regulatory developments and ensure compliance with applicable laws to maintain the financial viability of this strategy.

Analyzing Coindesk's Successful May Thompson Strategy

Coindesk's May Thompson strategy has proven to be a successful financial endeavor, generating a significant impact on the organization's overall revenue. By exploring the blend of ETH 308m in the strategy, we can gain insights into the factors that contributed to its success.

Firstly, the decision to incorporate the ETH 308m asset into the strategy played a crucial role. The blend of this asset provided diversification and helped mitigate potential risks. Ethereum, being a popular and widely recognized cryptocurrency, attracted investors, further boosting the strategy's overall performance.

Furthermore, the financial impact of blurs in the blend cannot be overlooked. These blurs add a layer of anonymity and security to transactions, reducing the likelihood of fraud or misuse. This feature enhances the overall appeal of the strategy, attracting both institutional and individual investors.

The seamless integration of Coindesk's platform with the May Thompson strategy also contributed to its success. The user-friendly interface and robust security measures instilled confidence in investors, leading to increased participation in the strategy. The ability to easily navigate the platform and manage investments further enhanced the strategy's appeal.

Coindesk's thorough analysis and understanding of market trends played a crucial role in the strategy's success. By closely monitoring and adapting to changes in the cryptocurrency market, the organization ensured that the May Thompson strategy remained relevant and profitable. This proactive approach allowed Coindesk to capitalize on emerging opportunities and avoid potential pitfalls.

Incorporation of ETH 308m

Diversification and increased investor interest

Financial Impact of Blurs

Anonymity, security, and fraud prevention

Seamless Platform Integration

User-friendly interface and enhanced security measures

Market Analysis

Adaptation to trends and capitalization on opportunities

In conclusion, Coindesk's successful May Thompson strategy attributes its financial impact to various key factors. The incorporation of ETH 308m, the financial impact of blurs, seamless platform integration, and market analysis all contributed to the strategy's success. By taking a comprehensive approach and leveraging market trends, Coindesk achieved impressive financial results and solidified its position in the cryptocurrency industry.

Comparing Blurs Blend ETH 308m to Other Investments

When considering potential investments, it is important to compare the pros and cons of each option. In the case of Blurs Blend ETH 308m, it is a unique opportunity that should be evaluated in relation to other investment options. Here, we compare Blurs Blend ETH 308m to other investments to understand its financial impact.

Return Potential

Blurs Blend ETH 308m offers high return potential due to the growth of the Ethereum market and the expertise of the team managing the investment.

Stocks have a potential for high returns, but they also come with a higher risk compared to Blurs Blend ETH 308m.

Real estate investments can provide steady returns over time, but they may not have the same growth potential as Blurs Blend ETH 308m

Bonds are generally considered low-risk investments with stable returns, but they may not offer the same level of growth as Blurs Blend ETH 308m.

Risk

Blurs Blend ETH 308m carries a certain level of risk due to the volatility of cryptocurrency markets, but it is managed by experts who aim to mitigate risks.

Stocks can be highly volatile and subject to market fluctuations, making them potentially riskier than Blurs Blend ETH 308m.

Real estate investments can be relatively stable, but they are also subject to economic and market conditions.

Bonds are generally considered lower-risk investments, but they can still be affected by factors such as interest rate changes.

Liquidity

Blurs Blend ETH 308m is a relatively liquid investment, as Ethereum can be bought and sold on various cryptocurrency exchanges.

Stocks are generally liquid investments, as they can be bought and sold on stock exchanges.

Real estate investments can be less liquid, as it may take time to find a buyer or sell a property.

Bonds can be sold before maturity, but they may not be as easily tradable as Blurs Blend ETH 308m.

Diversification

Blurs Blend ETH 308m is a unique investment opportunity that offers exposure to the growth of the Ethereum market, providing diversification in a portfolio.

Stocks offer diversification, as they can represent ownership in various industries and companies.

Real estate investments can provide diversification in a portfolio, as they are a different asset class.

Bonds offer diversification by providing income from fixed-interest investments.

By comparing Blurs Blend ETH 308m to other investment options, it is clear that it offers unique advantages, such as high return potential, diversification, and liquidity in the cryptocurrency market. However, it also carries certain risks due to market volatility. Investors should carefully consider their risk tolerance and investment objectives before making a decision.

Coindesk's May Thompson Strategy: A Game-Changer in the Financial Industry

The financial industry has seen significant advancements in recent years, driven by the rapid growth of digital currencies and blockchain technology. One company that has emerged as a key player in this space is Coindesk, a leading cryptocurrency news and information platform.

Coindesk's May Thompson strategy has had a profound impact on the financial industry, revolutionizing the way investors and traders approach cryptocurrency trading. This innovative strategy combines the use of artificial intelligence and machine learning algorithms to analyze market trends and make data-driven investment decisions.

The use of artificial intelligence and machine learning algorithms in Coindesk's May Thompson strategy has allowed investors to gain a deeper understanding of market dynamics and make more informed investment decisions. These algorithms analyze vast amounts of data in real-time, identifying patterns and trends that may not be apparent to human traders. This gives investors a significant advantage in a highly dynamic and volatile market.

Furthermore, the May Thompson strategy incorporates the concept of blur blending, which allows for a more comprehensive analysis of market data. By blending different sources and types of data, Coindesk's algorithm is able to create a clearer picture of market trends and make more accurate predictions.

The financial impact of Coindesk's May Thompson strategy cannot be overstated. By providing investors with sophisticated tools and data-driven insights, Coindesk has empowered individuals and institutions to make smarter investment decisions in the cryptocurrency market.

Coindesk's May Thompson strategy has also had a ripple effect across the financial industry as a whole. Other companies have taken note of Coindesk's success and have started incorporating similar strategies into their own operations. This has helped to further drive innovation and improve the overall efficiency and effectiveness of the financial industry.

In conclusion, Coindesk's May Thompson strategy has proven to be a game-changer in the financial industry. By leveraging artificial intelligence and machine learning algorithms, Coindesk has revolutionized the way investors approach cryptocurrency trading. This innovative strategy has not only provided investors with valuable insights and tools but also inspired other companies to innovate and improve their own operations.

The Future Outlook for Blurs Blend ETH 308m Investment

Blurs Blend ETH 308m has been making waves in the investment world, attracting attention from both seasoned investors and newcomers to the cryptocurrency market. With its unique blend of blockchain technology and decentralized finance, it presents an exciting opportunity for investors looking to diversify their portfolios.

A Potential Game-Changer in the Crypto Market

Blurs Blend ETH 308m aims to revolutionize the crypto market by combining the immense potential of Ethereum's blockchain with the flexibility of decentralized finance. Ethereum has long been recognized as the leading platform for decentralized applications and smart contracts, and its native cryptocurrency, Ether (ETH), has achieved considerable success in the market.

By investing in Blurs Blend ETH 308m, individuals and institutions can gain exposure to Ethereum's performance and potential growth. The fund combines a diverse range of ETH-based assets, including DeFi protocols, stablecoins, and popular tokens, to maximize returns while minimizing risks.

Moreover, Blurs Blend ETH 308m offers investors the opportunity to participate in the rise of the decentralized finance sector. DeFi applications have been gaining attention for their potential to transform traditional financial systems, offering alternatives to banking, lending, and asset management. Investing in Blurs Blend ETH 308m allows investors to tap into the growth of this emerging sector.

Potential Risks and Challenges

While Blurs Blend ETH 308m presents an exciting investment opportunity, it is important to note that the cryptocurrency market is highly volatile and subject to sudden price fluctuations. The value of ETH and other assets included in the fund can rise and fall rapidly, potentially affecting the overall performance of the investment.

Additio

Maximizing Returns with Coindesk's May Thompson Strategy

Coindesk's May Thompson strategy, which involves blending different cryptocurrencies such as Ethereum (ETH) and Bitcoin (BTC), has proven to be highly effective in maximizing returns. By diversifying investments across multiple assets, this strategy aims to reduce risk and increase potential profits.

The Basics of Coindesk's May Thompson Strategy

Blend ETH and 308m with other cryptocurrencies

Diversify investments to minimize risk

Take advantage of market trends

Under this strategy, investors blend Ethereum (ETH) and 308m with other cryptocurrencies to create a diverse portfolio. This helps to spread the risk and potential losses across multiple assets, which can provide some protection during market fluctuations.

In addition, Coindesk's May Thompson strategy emphasizes the importance of staying updated with market trends and making informed investment decisions. By closely monitoring the crypto market and identifying potential opportunities, investors can adjust their portfolio accordingly, potentially maximizing returns.

Exploring the Financial Impact of Blurs Blend ETH 308m

The financial impact of blending ETH and 308m in Coindesk's May Thompson strategy has been significant. By combining these two cryptocurrencies, investors have been able to benefit from the strong performance and growth potential of both assets.

ETH, as one of the largest cryptocurrencies in terms of market capitalization, offers investors the opportunity to participate in the growth of the Ethereum platform. With its innovative smart contract capabilities and widespread adoption, ETH has the potential for long-term value appreciation.

On the other hand, 308m, with its unique features and applications, presents investors with opportunities for short-term gains. Its focus on privacy and security has attracted attention from various industries, offering potential growth prospects.

By blending ETH and 308m in the May Thompson strategy, investors can benefit from the growth potential of both cryptocurrencies, diversify their investments, and potentially maximize returns.

In conclusion, Coindesk's May Thompson strategy provides investors with a comprehensive approach to maximize returns in the crypto market. By blending ETH and 308m with other cryptocurrencies, diversifying investments, and staying informed about market trends, investors can increase their chances of achieving financial success in the ever-evolving world of cryptocurrency.

The Risks Associated with Blurs Blend ETH 308m Investment

Investing in Blurs Blend ETH 308m can be a lucrative opportunity, but it is important to recognize the potential risks associated with this investment. While the strategy presented by Coindesk's May Thompson may seem promising, there are several factors that could impact the financial outcomes.

Market Volatility

One of the main risks of investing in Blurs Blend ETH 308m is the extreme volatility of the cryptocurrency market. Ethereum itself is a highly volatile asset, and the Blend ETH 308m investment strategy may amplify this volatility. Sudden price fluctuations can result in significant losses, especially for those who are not prepared or have a high-risk tolerance.

Liquidation Risk

Investing in complex strategies like Blurs Blend ETH 308m can also pose a risk of liquidation. If the market conditions turn unfavorable, and the value of the investment declines, a liquidation event may occur. This could result in the loss of a significant portion of the invested funds.

It is crucial for investors to carefully assess their risk tolerance and financial goals before deciding to invest in Blurs Blend ETH 308m. Diversification of the investment portfolio and understanding the potential downside risks are essential for successful and responsible investing.

Market Volatility

The highly volatile nature of the cryptocurrency market, which could be amplified by the Blend ETH 308m investment strategy.

Liquidation Risk

The possibility of a liquidation event due to unfavorable market conditions, potentially resulting in significant losses.

Coindesk's May Thompson Strategy: A Comprehensive Approach to Financial Success

Coindesk's May Thompson Strategy is a groundbreaking approach that has revolutionized the way individuals and businesses perceive and navigate the world of finance. In this article, we will explore the financial impact of blurs blend eth 308m and how it fits into Coindesk's overarching strategy.

The Importance of Financial Planning

Financial planning is the cornerstone of Coindesk's May Thompson Strategy. By creating a detailed and comprehensive plan, individuals can effectively manage their resources, mitigate risks, and seize opportunities. This strategy provides a roadmap for achieving financial success and ensures that every decision is aligned with the individual's goals and objectives.

The Role of Blurs Blend ETH 308m

Blurs Blend ETH 308m is a key component of Coindesk's May Thompson Strategy that focuses on leveraging the potential of cryptocurrency. As the cryptocurrency market continues to grow and evolve, it presents unique opportunities for financial growth and diversification. Blurs Blend ETH 308m enables individuals and businesses to tap into this potential by investing in Ethereum, one of the most promising and widely adopted cryptocurrencies.

By incorporating Blurs Blend ETH 308m into their investment portfolio, individuals can not only benefit from the potential growth of Ethereum but also diversify their holdings. This strategy reduces the overall risk associated with investing in a single asset class and provides a hedge against market fluctuations.

Coindesk's May Thompson Strategy emphasizes the importance of staying up to date with the latest trends and developments in the cryptocurrency market. By doing thorough research and analysis, individuals can make informed decisions regarding their investments in Blurs Blend ETH 308m and other cryptocurrencies, maximizing their potential for financial success.

In conclusion, Coindesk's May Thompson Strategy offers a comprehensive approach to financial success, combining strategic financial planning with the potential of cryptocurrencies like Blurs Blend ETH 308m. By following this strategy, individuals and businesses can effectively navigate the ever-changing financial landscape and achieve their long-term financial goals.

Exploring the Potential Disadvantages of Blurs Blend ETH 308m

While Blurs Blend ETH 308m has gained considerable attention and popularity in Coindesk's May Thompson strategy, it's important to also examine its potential disadvantages and drawbacks.

1. Volatility: One of the key disadvantages of Blurs Blend ETH 308m is its inherent volatility. As a cryptocurrency, ETH 308m is subject to sudden and significant price fluctuations, which can result in potential losses for investors. This volatility can make it difficult to predict and manage investment returns.

2. Lack of Regulation: Another issue with Blurs Blend ETH 308m is the lack of clear regulation and oversight. As a relatively new cryptocurrency, there are limited regulatory frameworks in place to protect investors and ensure fair trading practices. This lack of regulation can expose investors to potential scams, frauds, and other illicit activities.

3. Market Dependency: Blurs Blend ETH 308m's success is dependent on the overall market conditions and investor sentiment towards cryptocurrencies. If the cryptocurrency market experiences a significant downturn or if there is a lack of interest in ETH 308m, it can negatively impact the value and performance of Blurs Blend ETH 308m.

4. Technological Risks: Cryptocurrencies, including Blurs Blend ETH 308m, are based on complex blockchain technology. However, this technology is still relatively new and evolving rapidly, which introduces various technological risks. Potential risks include security vulnerabilities, scalability issues, and regulatory challenges surrounding the use of blockchain technology.

5. Lack of Widely Accepted Use: Despite the growing popularity of cryptocurrencies, including ETH 308m, there is still a lack of widely accepted use cases for these digital assets. This can limit the liquidity of Blurs Blend ETH 308m, making it harder to convert and use the cryptocurrency for everyday transactions and commerce.

6. Environmental Concerns: The mining process required for cryptocurrencies, such as ETH 308m, consumes a significant amount of energy and contributes to carbon emissions. The environmental impact of cryptocurrencies, including Blurs Blend ETH 308m, has become a growing concern for many investors and may impact the overall adoption and acceptance of such digital assets.

In conclusion, while Blurs Blend ETH 308m offers potential financial opportunities, it's important to be aware of its potential disadvantages. Volatility, lack of regulation, market dependency, technological risks, limited use cases, and environmental concerns are some of the factors that investors should consider before investing in Blurs Blend ETH 308m or any other cryptocurrency.

Assessing the Long-Term Viability of Coindesk's May Thompson Strategy

Coindesk's May Thompson strategy, which involves blending the financial impact of blurs and ETH 308M, is an innovative approach that has the potential to provide significant long-term benefits. However, it is crucial to thoroughly assess its viability to ensure sustained success.

Firstly, a comprehensive analysis of the market trends and dynamics is essential. By consistently monitoring the performance of blurs and ETH 308M, Coindesk can gain valuable insights into their potential for future growth. This analysis should include factors such as market demand, price fluctuations, and competitor activity.

Furthermore, evaluating the financial stability and feasibility of implementing the May Thompson strategy is crucial. Coindesk must examine the costs associated with acquiring and blending blurs and ETH 308M, as well as the potential returns on investment. This analysis can help identify any potential risks or limitations that may arise.

Another crucial aspect to consider is the regulatory environment and legal implications surrounding the blending of blurs and ETH 308M. Coindesk must ensure compliance with all relevant laws and regulations to avoid any legal issues in the future. Thus, a thorough legal analysis is necessary to confirm the long-term viability of the strategy.

Moreover, assessing the potential market acceptance of the May Thompson strategy is vital. Coindesk should conduct market research and gather feedback from potential customers and industry experts to ascertain whether there is a demand for blended blurs and ETH 308M. Understanding customer preferences and needs will enable Coindesk to refine its strategy and target the right audience effectively.

Lastly, Coindesk must evaluate the scalability of the May Thompson strategy. As the business grows, it is essential to ensure that the strategy can adapt to increased demand. This evaluation should consider factors such as production capacity, supply chain management, and operational efficiency.

In conclusion, assessing the long-term viability of Coindesk's May Thompson strategy involves a comprehensive evaluation of market trends, financial feasibility, legal implications, market acceptance, and scalability. By considering these factors, Coindesk can make informed decisions and lay a solid foundation for sustained success.

Diversifying Your Portfolio: Considering Blurs Blend ETH 308m and Coindesk's May Thompson Strategy

Diversifying your investment portfolio is a crucial aspect of successful investing. By spreading your investments across different asset classes and strategies, you can reduce risk and potentially increase returns. In this article, we will explore the benefits of diversification and how Blurs Blend ETH 308m and Coindesk's May Thompson Strategy can be great additions to your investment portfolio.

Blurs Blend ETH 308m is a unique investment strategy that combines the strengths of Ethereum (ETH) and blockchain technology. By investing in this strategy, you can gain exposure to the potential growth of Ethereum while diversifying away from the risks associated with individual cryptocurrencies. This strategy aims to capture the growth potential of ETH while minimizing volatility and downside risk.

Coindesk's May Thompson Strategy, on the other hand, focuses on investment opportunities in the cryptocurrency market. By following this strategy, you can take advantage of the expertise and insights of Coindesk's team of analysts and researchers. This strategy aims to identify undervalued cryptocurrencies and capitalize on their growth potential.

By including Blurs Blend ETH 308m and Coindesk's May Thompson Strategy in your investment portfolio, you can benefit from both the potential growth of Ethereum and the expertise of Coindesk's team. This combination can help you diversify your investments and reduce the impact of market volatility.

It is important to note that diversification does not guarantee profits or protect against losses. However, by spreading your investments across different strategies and asset classes, you can potentially reduce the impact of a single investment's performance on your overall portfolio. Blurs Blend ETH 308m and Coindesk's May Thompson Strategy can be valuable additions to your investment portfolio as you seek to achieve your financial goals.

What is the financial impact of blurs blend eth 308m in coindesks may thompson strategy?

The financial impact of blurs blend eth 308m in Coindesk's May Thompson strategy is significant. It has led to increased revenue and profits for the company. The blend of Ethereum has proven to be a successful investment, resulting in substantial gains for Coindesk.

How did blurs blend eth 308m affect Coindesk's revenue?

Blurs blend eth 308m had a positive effect on Coindesk's revenue. The investment in Ethereum resulted in increased returns and additional income for the company. The blend helped Coindesk diversify its portfolio and capture the growth potential of Ethereum.

What strategy did Coindesk adopt with blurs blend eth 308m?

Coindesk adopted a strategy with blurs blend eth 308m to maximize its financial impact. The company recognized the potential of Ethereum and decided to invest a significant amount in the cryptocurrency. This strategy involved carefully monitoring the market and making informed decisions to optimize returns.

Are there any risks associated with blurs blend eth 308m?

While blurs blend eth 308m has had a positive financial impact, there are risks associated with it. Cryptocurrency investments are volatile by nature, and the price of Ethereum can fluctuate significantly. Coindesk had to carefully assess the risks involved and make informed investment decisions to mitigate potential losses.

What factors contributed to the success of blurs blend eth 308m in Coindesk's strategy?

Several factors contributed to the success of blurs blend eth 308m in Coindesk's strategy. Firstly, Ethereum's growth potential and increasing adoption in various industries played a significant role. Additionally, Coindesk's expertise in cryptocurrency investments and their ability to analyze market trends helped them make informed investment decisions. The careful implementation of the strategy and continuous monitoring of the market also contributed to its success.

What is the financial impact of blurs blend eth 308m in coindesks may thompson strategy?

The financial impact of blurs blend eth 308m in coindesks may thompson strategy refers to the effects it has on the financial performance of Coindesk. This strategy aims to blend elements of Ethereum and 308 million USD in order to optimize Coindesk's financial position.

How does the strategy of blurs blend eth 308m in coindesks may thompson strategy work?

The strategy of blurs blend eth 308m in coindesks may thompson strategy works by combining the benefits of Ethereum, a popular blockchain platform, with a significant injection of 308 million USD. This blend allows Coindesk to position itself strategically in the market and potentially generate more favorable financial outcomes.

What are the potential benefits of blurs blend eth 308m in coindesks may thompson strategy?

The potential benefits of blurs blend eth 308m in coindesks may thompson strategy include increased financial stability and growth for Coindesk. By leveraging the power of Ethereum and a significant financial injection, Coindesk may be able to improve its market position, attract more investors, and potentially generate higher profits.

Blur: NFT | Blur: NFT login | Blur: NFT connect | WalletConnect | Traders | What Is Blur Crypto

2022-2024 @ Exploring the financial impact of blurs blend eth 308m in coindesks may thompson strategy