Analyzing the Increasing Popularity of Bitcoin NFT Marketplaces

Blur: NFT | Blur: NFT login | Blur: NFT connect | WalletConnect | Traders | What Is Blur Crypto

Blur: NFT | Blur: NFT login | Blur: NFT connect | WalletConnect | Traders | What Is Blur Crypto

The emergence of non-fungible tokens (NFTs) has taken the cryptocurrency world by storm, and Bitcoin is no exception. Bitcoin, which has long been hailed as the king of digital currencies, is now stepping into the world of NFT marketplaces. This intersection between Bitcoin and NFTs has led to an explosion of interest and investment, with enthusiasts and collectors flocking to these platforms to explore and engage with this new paradigm in digital ownership.

Unlike traditional cryptocurrencies, which are fungible and can be exchanged on a like-for-like basis, NFTs represent unique assets that are indivisible and irreplaceable. These digital assets can range from artwork and music to virtual real estate and collectibles. The concept of owning a one-of-a-kind digital item has captured the imagination of many, and Bitcoin's entry into the NFT marketplace has only intensified this frenzy.

Bitcoin's foray into the world of NFT marketplaces has been met with both excitement and skepticism. Proponents argue that Bitcoin's integration with NFTs will bring increased liquidity and stability to the burgeoning market, attracting mainstream adoption and investment. Critics, on the other hand, raise concerns about the environmental impact of Bitcoin and its compatibility with the underlying technology of NFTs.

Despite the polarizing opinions, one thing is clear: the popularity of Bitcoin NFT marketplaces is surging. Established platforms such as Rarible and OpenSea now offer Bitcoin as a payment option alongside Ethereum, the dominant cryptocurrency in the NFT space. This convergence of two major players in the crypto world opens up new possibilities and opportunities for both collectors and artists, as well as investors looking to diversify their portfolios.

As the Bitcoin NFT marketplace continues to evolve, experts are closely analyzing the impact of this new trend. Will Bitcoin's presence disrupt the existing ecosystem, or will it simply add fuel to the fire of NFT mania? Only time will tell, but one thing is certain: the world of digital art and collectibles will never be the same again.

Uncovering the Rise of Bitcoin NFT Marketplaces

The surge in popularity of Bitcoin non-fungible tokens (NFTs) has led to the rapid rise of specialized marketplaces dedicated to trading and collecting these digital assets. These platforms offer a unique opportunity for artists, collectors, and investors to participate in the growing NFT market.

One notable Bitcoin NFT marketplace gaining traction is Blur: NFT login. This platform provides a user-friendly interface and a wide variety of digital artwork available for purchase or sale.

Unique Features of Bitcoin NFT Marketplaces

Bitcoin NFT marketplaces, such as Blur, bring several unique features to the table:

Ownership Verification: With NFTs built on the Bitcoin blockchain, buyers can verify the authenticity and ownership of the digital assets.

Artistic Freedom: Artists can create and sell their digital artwork directly on the platform, bypassing traditional art galleries and intermediaries.

Easy Trading: Bitcoin NFT marketplaces facilitate easy buying and selling of NFTs, providing a seamless experience for collectors and investors.

Global Access: These platforms enable artists and collectors from around the world to connect and interact, expanding the reach of digital art.

The Growing Popularity of Bitcoin NFTs

The growing popularity of Bitcoin NFTs can be attributed to several factors:

Scarcity and Exclusivity: NFTs allow for the creation of unique digital assets that cannot be replicated or replaced.

Investment Potential: As the demand for Bitcoin NFTs increases, their value may appreciate, making them attractive investment opportunities.

Creative Expression: Bitcoin NFTs provide artists with a new medium for showcasing their creativity and reaching a global audience.

Technological Advancements: The blockchain technology behind Bitcoin NFTs ensures transparency, security, and immutability, enhancing trust among buyers and sellers.

In conclusion, the rise of Bitcoin NFT marketplaces, such as Blur, highlights the increasing interest in digital art and the potential for blockchain-based assets to reshape the art world. These platforms offer unique features and opportunities for artists, collectors, and investors, contributing to the overall growth and popularity of Bitcoin NFTs.

Understanding the Surging Popularity of Bitcoin NFTs

In recent years, Bitcoin non-fungible tokens (NFTs) have gained significant popularity in the cryptocurrency world. These unique digital assets have captivated the attention of art enthusiasts, collectors, and investors, driving the emergence of various bitcoin NFT marketplaces.

Bitcoin NFTs are distinct from traditional cryptocurrencies like Bitcoin in their individualized nature. While Bitcoin represents a fungible form of digital currency, NFTs are one-of-a-kind tokens that exist on the blockchain. This uniqueness gives NFTs value and makes them highly desirable among collectors.

One reason behind the surging popularity of Bitcoin NFTs is the rise of digital art as a legitimate art form. Artists can now tokenize their digital creations as NFTs, providing them with proof of ownership and the ability to sell their artwork directly to buyers, without the need for intermediaries. Moreover, NFTs enable artists to gain royalties from subsequent sales of their work, ensuring ongoing income even after the initial sale.

Another factor contributing to the popularity of Bitcoin NFTs is the sense of community and social interaction they provide. NFT marketplaces allow users to buy, sell, and trade unique digital assets, fostering a vibrant ecosystem of collectors and enthusiasts. This sense of community often leads to increased demand, as buyers seek to own rare and valuable NFTs that hold cultural and artistic significance.

Furthermore, the scarcity aspect of NFTs plays a crucial role in their popularity. Unlike traditional artwork or collectibles, NFTs are often limited in supply, making them more exclusive and desirable. This scarcity factor drives up prices and creates a sense of urgency among collectors who want to acquire these unique digital assets before they are no longer available.

Lastly, the rise of Bitcoin NFTs can also be attributed to the increased accessibility of blockchain technology. With the advancement of user-friendly platforms and wallets, individuals can now easily participate in NFT markets and explore the world of digital art and collectibles. This accessibility has opened up new opportunities for creators and collectors worldwide, fueling the demand for Bitcoin NFTs.

Emergence of digital art

Artists tokenizing their works

Social interaction/community

Buyers, sellers, and collectors

Scarcity

Limited supply of NFTs

Accessibility

User-friendly platforms and wallets

Exploring the Unique Features of Bitcoin NFT Marketplaces

Bitcoin NFT marketplaces have gained significant popularity in recent years, allowing users to buy, sell, and trade unique digital assets known as non-fungible tokens (NFTs). These marketplaces have introduced several unique features that set them apart from traditional cryptocurrency exchanges. Let's take a closer look at some of these distinctive features:

Ownership Verification

Bitcoin NFT marketplaces utilize blockchain technology to provide transparent and immutable proof of ownership. Each NFT is associated with a unique token identifier, which is recorded on the Bitcoin blockchain. This allows buyers to confidently verify the authenticity and ownership of the digital asset they are purchasing.

Scarcity and Rarity

NFTs are designed to be indivisible and unique, making them scarce and rare. Bitcoin NFT marketplaces create a sense of exclusivity by limiting the number of available NFTs for each digital asset. This scarcity factor increases the perceived value of the NFTs and creates a thriving secondary market for trading and collecting.

Interoperability

Bitcoin NFT marketplaces often support the interoperability of NFTs, allowing users to seamlessly transfer their digital assets between different platforms and ecosystems. This feature enables artists and creators to reach a broader audience and increases the liquidity of NFTs in the market.

Smart Contract Functionality

Smart contract functionality is a crucial aspect of Bitcoin NFT marketplaces. Smart contracts automate the execution of NFT transactions, ensuring that the terms and conditions of the sale are met before the transfer of ownership occurs. This feature provides security and eliminates the need for intermediaries in the buying and selling process.

Creative Possibilities

Bitcoin NFT marketplaces have opened up a world of creative possibilities for artists and creators. They can now tokenize various forms of digital art, including images, videos, music, and more. These marketplaces have sparked a digital art revolution, where artists can monetize their work directly and engage with a global community of collectors and enthusiasts.

In conclusion, Bitcoin NFT marketplaces offer a range of unique features that have contributed to their surging popularity. These features, such as ownership verification, scarcity, interoperability, smart contract functionality, and creative possibilities, have created an exciting and thriving ecosystem for buying, selling, and trading NFTs. As the market continues to evolve, we can expect even more innovative features and advancements to further enhance the Bitcoin NFT marketplace experience.

Analyzing the Growing Demand for Bitcoin NFTs

Bitcoin NFTs, or Non-Fungible Tokens, have been experiencing a surge in popularity in recent years. These unique digital assets, built on the blockchain technology of Bitcoin, have captured the attention of collectors, investors, and artists alike. This article will analyze the factors driving the growing demand for Bitcoin NFTs.

One key factor contributing to the popularity of Bitcoin NFTs is their ability to establish verifiable ownership and provenance. Unlike physical artwork or collectibles, which can be easily replicated or counterfeited, Bitcoin NFTs are uniquely identifiable and cannot be duplicated. This gives collectors and investors confidence in the authenticity and scarcity of the digital assets they are acquiring.

Additionally, Bitcoin NFTs provide a new way for artists to monetize their creations and reach a global audience. Through the use of NFT marketplaces, artists can sell their digital art directly to collectors, eliminating the need for intermediaries such as galleries or auction houses. This direct connection between artists and collectors has democratized the art market and opened up new opportunities for creators.

The blockchain technology underlying Bitcoin NFTs also ensures greater transparency and security in transactions. Each transaction is recorded on a decentralized ledger, making it easily traceable and verifiable. This level of transparency helps to build trust between buyers and sellers, further driving the demand for Bitcoin NFTs.

Furthermore, the potential for investment returns has attracted many individuals to the Bitcoin NFT market. Some rare and highly sought-after NFTs have sold for significant amounts, generating substantial profits for early adopters. This has created a speculative aspect to the market, with investors looking to capitalize on the potential value appreciation of Bitcoin NFTs.

Lastly, the buzz surrounding Bitcoin NFTs and the media attention they have garnered have also contributed to their growing demand. Celebrities, athletes, and influencers have jumped on the NFT bandwagon, creating their own digital collectibles or endorsing existing ones. This mainstream attention has helped to bring Bitcoin NFTs to a wider audience and increase their appeal.

In conclusion, the growing demand for Bitcoin NFTs can be attributed to their ability to establish ownership, provide new opportunities for artists, offer transparency and security, attract investors, and benefit from mainstream attention. As the market continues to evolve and more individuals become aware of the potential of Bitcoin NFTs, their popularity is expected to further increase.

The Expanding Range of Bitcoin NFT Use Cases

NFTs (Non-Fungible Tokens) have gained significant popularity in the world of Bitcoin as of late. While they were initially seen as a unique way to own digital art and collectibles, their use cases have expanded far beyond that. In this article, we will explore some of the innovative ways in which Bitcoin NFTs are being used today.

1. Gaming: One of the most exciting use cases for Bitcoin NFTs is in the gaming industry. NFTs can be used to create unique in-game items and assets that players can buy, sell, and trade on the blockchain. This has the potential to revolutionize the gaming experience by giving players true ownership of their digital assets.

2. Virtual Real Estate: Bitcoin NFTs are also being used to buy and sell virtual real estate. Virtual worlds like Decentraland allow users to purchase plots of land using Bitcoin NFTs, giving them full ownership and control over their virtual property. This opens up a whole new realm of possibilities for virtual economies and online communities.

3. Music and Entertainment: Musicians and artists are increasingly using Bitcoin NFTs to sell their music, merchandise, and other digital content directly to their fans. This allows them to bypass traditional intermediaries and have more control over their creative work. Fans can purchase exclusive NFTs that give them access to unique experiences and behind-the-scenes content.

4. Intellectual Property: Bitcoin NFTs can also be used to tokenize intellectual property such as patents, trademarks, and copyrights. This provides a way to prove ownership and authenticity of these assets, making it easier to license and monetize intellectual property in a transparent and secure manner.

5. Charity and Crowdfunding: Bitcoin NFTs have also found a place in the world of charity and crowdfunding. Artists and creators can auction off their NFTs to raise funds for charitable causes, and individuals can purchase these NFTs as a way to support their favorite charities. This creates a new avenue for fundraising and brings more visibility to important causes.

In conclusion, the range of use cases for Bitcoin NFTs is constantly expanding. From gaming and virtual real estate to music and intellectual property, NFTs are revolutionizing how we own, trade, and interact with digital assets. As this technology continues to evolve, there is no doubt that we will see even more innovative applications of Bitcoin NFTs in the near future.

Debunking Common Misconceptions About Bitcoin NFTs

Bitcoin NFTs have become increasingly popular in recent years, with artists, collectors, and investors alike flocking to Bitcoin NFT marketplaces like Blur: NFT login. However, there are still some common misconceptions about Bitcoin NFTs that need to be debunked. Let's take a closer look at a few of these misconceptions and separate fact from fiction.

Misconception 1: Bitcoin NFTs Are Just Another Form of Bitcoin

One common misconception is that Bitcoin NFTs are simply another form of Bitcoin, but this is not the case. While both Bitcoin and Bitcoin NFTs are built on blockchain technology, they serve different purposes. Bitcoin is a digital currency used for transactions, while Bitcoin NFTs represent unique digital assets such as artwork, collectibles, or virtual real estate.

Misconception 2: Bitcoin NFTs Have No Intrinsic Value

Another misconception is that Bitcoin NFTs have no intrinsic value. Critics argue that since Bitcoin NFTs can be easily duplicated and shared, they are essentially worthless. However, the value of Bitcoin NFTs comes from their scarcity and uniqueness. Each Bitcoin NFT is created with a unique identifier, making it one-of-a-kind and impossible to reproduce.

Furthermore, the ownership and provenance of Bitcoin NFTs are recorded on the blockchain, providing a transparent and immutable ledger of ownership. This adds value to Bitcoin NFTs, as it allows artists and creators to authenticate their work and ensures that collectors have genuine, original pieces.

Misconception 3: Bitcoin NFTs Harm the Environment

There is a belief that Bitcoin NFTs contribute to the environmental issues associated with Bitcoin mining. While it is true that Bitcoin mining consumes a significant amount of energy, not all Bitcoin NFTs are created on the Bitcoin network. Many NFT marketplaces, including Blur: NFT login, are built on other blockchain networks that are more energy-efficient and have lower carbon footprints.

For example, Blur: NFT login utilizes a proof-of-stake (PoS) consensus algorithm, which consumes considerably less energy compared to the proof-of-work (PoW) algorithm used by Bitcoin.

Furthermore, steps are being taken to develop and implement more sustainable blockchain solutions that minimize the environmental impact of Bitcoin NFTs.

Overall, Bitcoin NFTs offer a unique and exciting way to own and trade digital assets. By debunking these common misconceptions, we can better understand the true value and potential of Bitcoin NFTs in the evolving digital art and collectibles market.

The Role of Blockchain Technology in Bitcoin NFT Marketplaces

The surge in popularity of Bitcoin NFT marketplaces has been largely driven by the use of Blockchain technology. Blockchain provides a decentralized and transparent system for creating, buying, and selling NFTs, which has revolutionized the art market.

One of the key advantages of using blockchain technology in Bitcoin NFT marketplaces is the ability to establish provenance and authenticity. Each transaction and ownership change is recorded on the blockchain, ensuring that the history of a specific NFT can be traced back to its creation. This eliminates the risk of fraud and ensures that collectors can confidently invest in digital art.

Additionally, blockchain technology provides a secure and efficient platform for conducting transactions. The use of smart contracts allows for automatic execution of agreements, ensuring that both buyers and sellers are protected. This eliminates the need for intermediaries, reducing costs and increasing accessibility for artists and collectors.

Increased Transparency and Accountability

Another important role of blockchain technology in Bitcoin NFT marketplaces is the increased transparency and accountability it provides. The public nature of the blockchain ensures that all transactions are visible to anyone, creating a level playing field for all participants. This transparency helps to prevent manipulation and unethical practices, fostering trust among users.

Expanding Market Opportunities

Furthermore, blockchain technology has opened up new market opportunities for artists and collectors. The use of decentralized marketplaces allows artists to directly reach a global audience, without the need for traditional gatekeepers. This has democratized the art market and provided artists with more control over their own work. Similarly, collectors now have access to a wide range of digital art from artists around the world, expanding their options and fostering a more diverse and inclusive art community.

In conclusion, blockchain technology plays a crucial role in the success of Bitcoin NFT marketplaces. It provides a secure and transparent system for creating, buying, and selling NFTs, ensuring provenance, authenticity, and accountability. Additionally, it expands market opportunities for artists and collectors, fostering a more inclusive and diverse art community. With the increasing popularity of Bitcoin NFT marketplaces, the role of blockchain technology is poised to grow even further in the future.

Navigating the Legal and Regulatory Landscape of Bitcoin NFTs

The exploding popularity of Bitcoin Non-Fungible Tokens (NFTs) has caught the attention of individuals, artists, and collectors alike. However, as with any emerging industry, there are legal and regulatory considerations that need to be addressed and understood.

Intellectual Property Rights:

One of the main legal concerns associated with Bitcoin NFTs is the issue of intellectual property rights. Artists who create and sell NFTs need to ensure that they have the necessary rights to the content they are minting as NFTs. Additionally, buyers should be cautious and verify that the NFTs they are purchasing do not infringe upon any existing copyrights or trademarks.

Tax Implications:

Another critical aspect to consider when navigating the Bitcoin NFT market is the tax implications. Given that buying and selling NFTs can result in substantial profits, it is crucial to understand the tax regulations in your jurisdiction. Depending on the country, the sale of NFTs may be subject to capital gains tax or other related taxes.

Consumer Protection:

Consumer protection is another area that requires careful attention in the Bitcoin NFT market. Due to the decentralized nature of blockchain technology, it can be challenging to resolve disputes or protect buyers from fraudulent activity. It is crucial for marketplaces and individuals to implement robust security measures, conduct due diligence, and provide transparent information to protect consumers' interests.

AML and KYC Compliance:

Given the potential for money laundering and illicit activities, Bitcoin NFT marketplaces need to comply with Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations. Implementing robust identity verification processes and transaction monitoring systems can help prevent illegal activities and promote transparency within the market.

Regulatory Oversight:

As the popularity of Bitcoin NFTs continues to grow, regulatory bodies around the world are starting to pay attention. It is essential for market participants to stay informed about any new legislation or regulatory guidelines that may impact the industry. Adhering to applicable regulations can help foster trust and legitimacy for both marketplaces and participants.

Conclusion:

The surging popularity of Bitcoin NFTs opens up exciting opportunities for artists, collectors, and investors. However, it is crucial to navigate the legal and regulatory landscape to ensure compliance and protect the interests of all parties involved. By addressing intellectual property rights, tax implications, consumer protection, AML and KYC compliance, and regulatory oversight, the Bitcoin NFT market can continue to thrive in a responsible and sustainable manner.

Examining the Potential Risks and Benefits of Investing in Bitcoin NFTs

As the popularity of Bitcoin NFT marketplaces continues to surge, many investors are considering the potential risks and benefits of investing in these unique digital assets. Here, we will take a closer look at some of the key factors to consider before jumping into the Bitcoin NFT market.

Potential Risks

Market Volatility: Like any investment, the value of Bitcoin NFTs can be highly volatile. Prices can experience rapid fluctuations, which could result in significant gains or losses for investors.

Regulatory Uncertainty: The regulatory environment surrounding Bitcoin NFTs is still evolving. Government agencies around the world are grappling with how to classify and regulate these digital assets, which could pose risks to investors.

Counterfeit NFTs: There is a risk of counterfeit NFTs in the market. Due diligence is essential to ensure the authenticity and provenance of the NFT before making an investment.

Limited Liquidity: Bitcoin NFTs may not have as much liquidity as other traditional investments. Selling an NFT may take time and finding a buyer at the desired price may be challenging, particularly for less popular or newly issued NFTs.

Potential Benefits

Profit Potential: Investing in Bitcoin NFTs can offer significant profit potential. The unique nature of NFTs and the growing demand for digital artwork and collectibles can lead to substantial returns on investment.

Digital Ownership: NFTs provide a novel way to prove ownership of a digital item. By investing in Bitcoin NFTs, individuals can secure ownership of unique digital assets and be part of an emerging digital economy.

Opportunity for Creators: Bitcoin NFTs provide creators with an opportunity to monetize their digital creations directly, without the need for intermediaries. This can offer artists, musicians, and other content creators new revenue streams and greater control over their work.

Diversification: Bitcoin NFTs can provide diversification in an investment portfolio. By including NFTs alongside traditional assets, investors can potentially reduce risk and potentially benefit from the unique characteristics of the NFT market.

While investing in Bitcoin NFTs can be risky and speculative, it can also offer exciting opportunities for those willing to navigate the market. It is crucial for investors to carefully consider these potential risks and benefits and do thorough research before making any investment decisions.

Spotlight on Successful Bitcoin NFT Artists and Collectors

In the world of Bitcoin NFTs, there are a number of artists and collectors who have achieved significant success and recognition. These individuals have not only made a name for themselves in the industry but have also contributed to the overall growth and popularity of Bitcoin NFT marketplaces. Let's take a closer look at some of these influential figures:

1. Beeple

Beeple, also known as Mike Winkelmann, is a digital artist who has gained widespread recognition for his innovative and visually stunning NFT artworks. In March 2021, he made headlines when his artwork "Everydays: The First 5000 Days" sold for a staggering $69 million at a Christie's auction, making it one of the most expensive NFT sales to date. Beeple's success has inspired countless artists to explore the world of Bitcoin NFTs.

2. Pak

Pak is an anonymous digital artist who has gained a cult-like following in the Bitcoin NFT community. Their unique and intricate artworks have captivated collectors and investors alike. In 2020, Pak's artwork "The Switch" sold for $1.4 million, solidifying their status as one of the top Bitcoin NFT artists. Their thought-provoking creations continue to push the boundaries of what is possible in the digital art world.

Beeple

"Everydays: The First 5000 Days"

$69 million

Pak

"The Switch"

$1.4 million

These are just two examples of the many talented artists and collectors who have contributed to the surging popularity of Bitcoin NFT marketplaces. Their success serves as a testament to the vast potential and opportunities that exist within the Bitcoin NFT ecosystem. As the industry continues to evolve, it will be fascinating to see the emergence of new artists and collectors who will shape the future of this exciting and rapidly expanding space.

The Future of Bitcoin NFT Marketplaces and Their Impact on the Art World

Introduction

The emergence of Bitcoin NFT marketplaces has brought about a significant shift in the way art is created, sold, and collected. As these marketplaces continue to gain popularity, it is crucial to examine their future and the potential impact they may have on the art world as a whole.

Expanding the Reach of Artists

Bitcoin NFT marketplaces have created new opportunities for artists to showcase and sell their work without the need for traditional art galleries or intermediaries. This direct-to-consumer approach allows artists to retain more control over their artwork and potentially reach a global audience. As these marketplaces continue to grow, we can expect to see more artists leveraging this technology to gain exposure and establish their presence in the art world.

Ownership and Authenticity

One of the key factors that make Bitcoin NFT marketplaces attractive to collectors is the ability to prove ownership and establish the authenticity of digital assets. Blockchain technology provides a transparent and immutable record of ownership, ensuring that each NFT is unique and cannot be replicated or counterfeited. This innovation has the potential to revolutionize the art world by eliminating many of the challenges surrounding provenance and authentication.

New Avenues for Collaboration

Bitcoin NFT marketplaces also open up new avenues for collaboration between artists, collectors, and even brands. Through the use of smart contracts, artists can create limited editions or series of their artwork, allowing them to work with multiple collectors simultaneously. This collaborative approach encourages artists to experiment with different styles and mediums, ultimately driving innovation within the art world.

Challenges and Considerations

While the future of Bitcoin NFT marketplaces looks promising, it is essential to consider the challenges that may arise. One major concern is the environmental impact of blockchain technology, particularly the energy consumption associated with Bitcoin mining. Additionally, as the market becomes more saturated with NFTs, ensuring the quality and value of digital artwork may become a challenge.

Conclusion

The rise of Bitcoin NFT marketplaces has the potential to reshape the art world by empowering artists, establishing ownership and authenticity, and fostering collaboration. However, it is crucial to address the challenges and consider the sustainability of this technology. As these marketplaces continue to evolve, they offer an exciting and transformative future for artists, collectors, and the art community as a whole.

Tips for Choosing the Right Bitcoin NFT Marketplace for Your Needs

As the popularity of Bitcoin NFTs continues to surge, it can be overwhelming to choose the right marketplace for your needs. Here are some helpful tips to consider:

1. Reputation and Trustworthiness

Before diving into the world of Bitcoin NFT marketplaces, it's important to research and ensure the reputation and trustworthiness of the platform. Look for reviews, user feedback, and any history of security breaches or scams. A reputable marketplace will prioritize the safety and security of its users.

2. Platform Fees

Each Bitcoin NFT marketplace will have its own fee structure. It's crucial to understand the platform fees associated with listing, buying, and selling NFTs. Compare the fees between different marketplaces and consider how they may impact your overall profits.

3. User Interface and Experience

Choosing a Bitcoin NFT marketplace with a user-friendly interface and seamless experience is essential. Look for a platform that makes it easy to navigate, view, and manage your NFTs. A well-designed marketplace will enhance your overall experience and make it easier to connect with potential buyers or sellers.

4. Supported Cryptocurrencies

Consider the cryptocurrency options supported by the marketplace. While Bitcoin is the most popular, some marketplaces may also support other cryptocurrencies like Ethereum or Binance Coin. Make sure the marketplace aligns with your preferred cryptocurrency for trading NFTs.

5. Community and Engagement

The community and engagement within a Bitcoin NFT marketplace can play a significant role in its success. Look for a platform that fosters a vibrant community, with active discussions, events, and unique opportunities for creators and collectors. Engaging with like-minded individuals can enhance your experience and help you discover new NFTs.

6. Availability of Artists and Collectors

Consider the availability of artists and collectors within the marketplace. Choose a platform that attracts a diverse range of talented artists and passionate collectors. This will allow for more variety in the NFTs available and increase your chances of finding the perfect piece or connecting with potential buyers.

7. Additional Features and Services

Take into account any additional features or services offered by the marketplace. Some platforms may provide advanced tracking and analytics tools, support for auctions, or integration with other popular NFT platforms. These extra features can enhance your experience and provide valuable insights for making informed trading decisions.

Reputation and Trustworthiness

✓

✓

✓

Platform Fees

$

$$

$$

User Interface and Experience

✓

✓

✓

Supported Cryptocurrencies

BTC, ETH

BTC, ETH, BNB

BTC

Community and Engagement

✓

✓

✓

Availability of Artists and Collectors

✓

✓

✓

Additional Features and Services

✓

✓

✓

Overall, selecting the right Bitcoin NFT marketplace requires careful consideration of various factors. By taking into account reputation, fees, user experience, supported cryptocurrencies, community engagement, available artists and collectors, and additional features, you can make an informed decision that aligns with your goals and preferences.

What are NFTs?

NFTs, or non-fungible tokens, are unique digital assets that are stored on blockchain technology. They can represent ownership or proof of authenticity for various types of digital content, including art, music, videos, and more.

Why has the popularity of Bitcoin NFT marketplaces surged?

The popularity of Bitcoin NFT marketplaces has surged for several reasons. Firstly, the rise of cryptocurrencies has created a demand for digital assets that can be bought and sold using Bitcoin. Additionally, the unique nature of NFTs and the ability to prove ownership and authenticity has attracted collectors and investors to these marketplaces.

How do Bitcoin NFT marketplaces work?

Bitcoin NFT marketplaces work by allowing users to buy, sell, and trade NFTs using Bitcoin as the primary form of currency. Users can browse listings, make offers, and complete transactions all within the marketplace platform. The ownership and authenticity of the NFTs are verified and recorded on the blockchain, ensuring transparency and security.

What are the benefits of using Bitcoin NFT marketplaces?

Using Bitcoin NFT marketplaces offers several benefits. Firstly, it provides a decentralized platform for buying and selling digital assets, removing the need for intermediaries such as galleries or auction houses. Additionally, using Bitcoin as the primary currency allows for faster and more secure transactions. Finally, the ability to prove ownership and authenticity using blockchain technology adds value and trust to the NFTs being bought and sold.

Are there any risks associated with Bitcoin NFT marketplaces?

Yes, there are some risks associated with Bitcoin NFT marketplaces. One of the main risks is the volatility of the cryptocurrency market. The value of Bitcoin can fluctuate greatly, which means that the price of NFTs bought or sold using Bitcoin can also vary significantly. Additionally, there have been instances of scams and fraudulent activities within the NFT market, so users should always exercise caution and do their due diligence before making any transactions.

What are NFT marketplaces?

NFT marketplaces are online platforms where users can buy, sell, and trade non-fungible tokens (NFTs). These marketplaces provide a space for artists, creators, and collectors to showcase and monetize their digital assets.

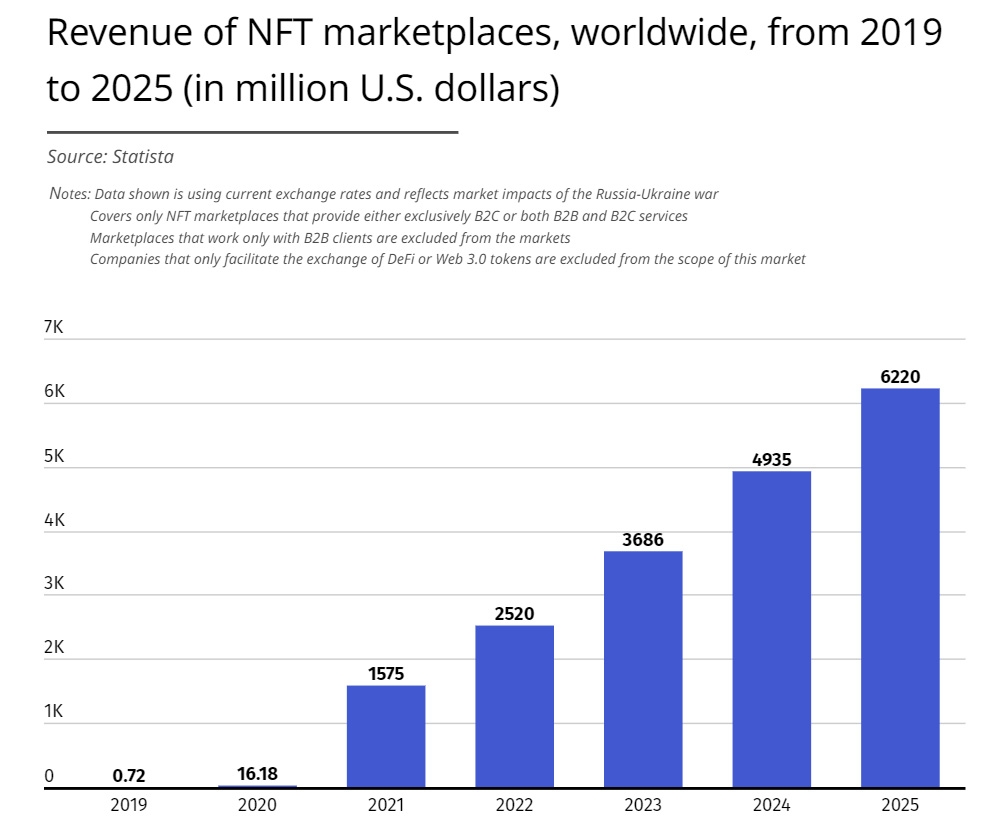

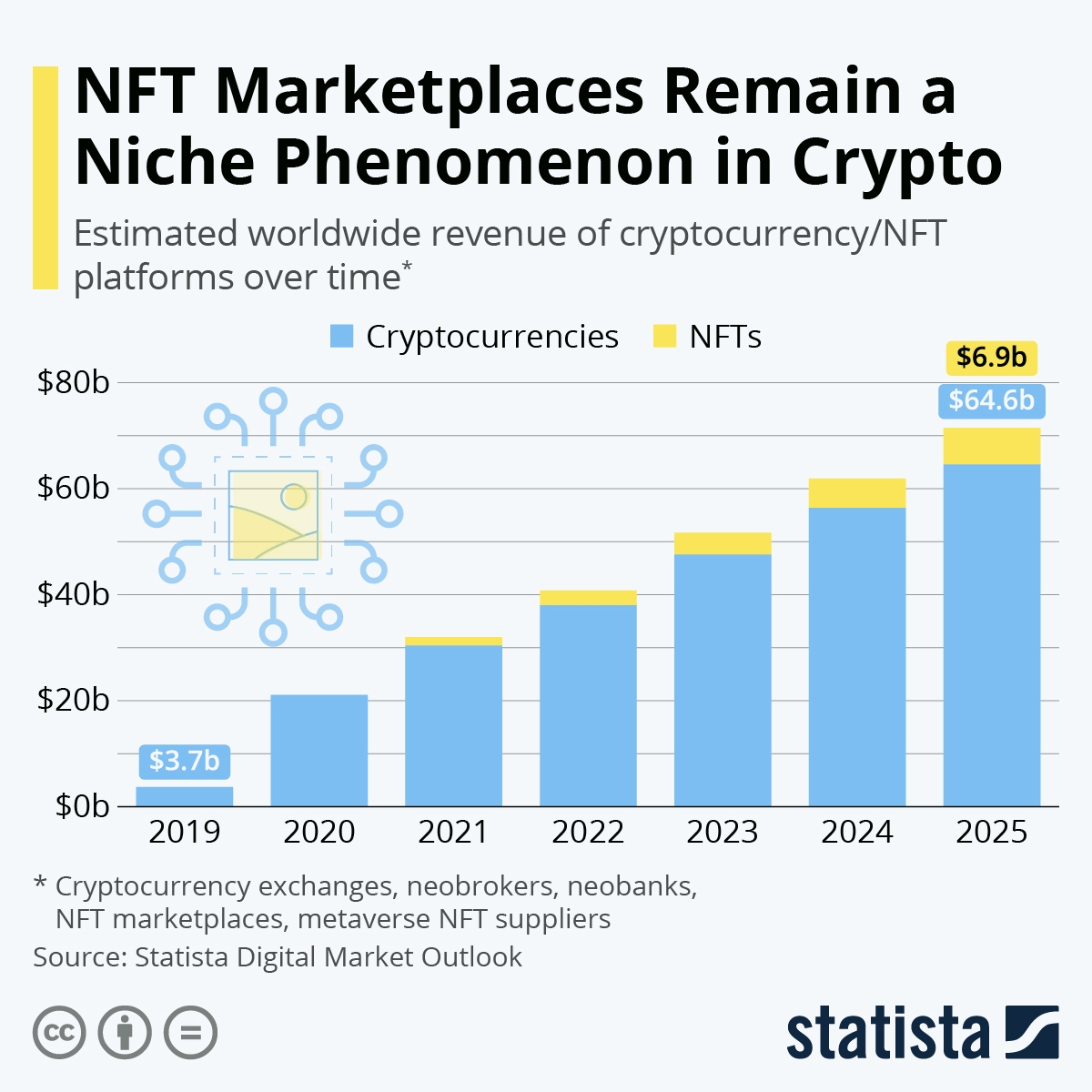

Why are NFT marketplaces gaining popularity?

NFT marketplaces are gaining popularity due to several reasons. Firstly, they provide a unique opportunity for artists and creators to monetize their digital artworks and creations. Additionally, NFTs offer the potential for ownership and authenticity verification of digital assets, which was not possible before. The growing interest in cryptocurrency and blockchain technology has also contributed to the surge in popularity of NFT marketplaces.

What are some popular NFT marketplaces?

There are several popular NFT marketplaces in the crypto space. Some of the well-known ones include OpenSea, Rarible, SuperRare, NBA Top Shot, and Foundation. These platforms offer a wide range of NFTs, including digital art, collectibles, virtual real estate, and more.

What are the risks associated with NFT marketplaces?

While NFT marketplaces offer exciting opportunities, there are also some risks involved. One of the main concerns is the potential for fraud and scams, as the NFT market is still relatively new and unregulated. There is also the risk of price volatility, as the value of NFTs can fluctuate greatly. Additionally, there are environmental concerns due to the large carbon footprint associated with blockchain and cryptocurrency transactions.

Blur: NFT | Blur: NFT login | Blur: NFT connect | WalletConnect | Traders | What Is Blur Crypto

2022-2024 @ Bitcoin nft marketplaces analyzing the surging popularity