The Influence of Crypto NFTs on the Concept of Value in Bill Theory's Perspective and its Exploration

Blur: NFT | Blur: NFT login | Blur: NFT connect | WalletConnect | Traders | What Is Blur Crypto

Blur: NFT | Blur: NFT login | Blur: NFT connect | WalletConnect | Traders | What Is Blur Crypto

In recent years, the world of digital art and collectibles has been revolutionized by the emergence of crypto NFTs (Non-Fungible Tokens). These unique tokens have brought about a paradigm shift in how we perceive and assign value to creative works and virtual assets. One particular vision that has been influential in understanding the implications of crypto NFTs is Bill Theory's.

Bill Theory, a renowned economist and futurist, posits that the advent of crypto NFTs challenges traditional notions of value by introducing new dimensions of uniqueness, scarcity, and digital ownership. Unlike traditional cryptocurrencies like Bitcoin or Ethereum, which are fungible and interchangeable, crypto NFTs represent one-of-a-kind assets that cannot be replicated or substituted. This inherent scarcity and uniqueness have sparked a new wave of excitement and speculation in the digital art and collectibles market.

Furthermore, crypto NFTs have opened up possibilities for creators to monetize their work in unprecedented ways. Through blockchain technology, artists can now authenticate, tokenize, and sell their digital creations directly to collectors, bypassing traditional intermediaries. This direct creator-to-collector relationship has the potential to redefine the dynamics of the art market, allowing artists to retain more control over their work and earn royalties on future resales.

However, the rise of crypto NFTs has also raised questions about the subjective nature of value. In the traditional art market, value is often determined by factors such as artistic merit, historical significance, and cultural impact. But as these dimensions of value are abstract and ever-evolving, the emergence of crypto NFTs adds another layer of complexity. Value in the crypto NFT space is driven not only by artistic quality but also by factors such as rarity, reputation of the creator, and the overall demand within the market.

In conclusion, the impact of crypto NFTs on the definition of value in Bill Theory's vision is profound. These unique tokens challenge traditional notions of value by introducing new dimensions of uniqueness, scarcity, and digital ownership. They offer creators new opportunities to monetize their work and have the potential to redefine the dynamics of the art market. However, the subjective nature of value in the crypto NFT space adds complexity to the equation. As the world continues to explore and adapt to this digital revolution, it becomes crucial to critically analyze and understand the implications of crypto NFTs on the definition of value.

Exploring the Impact of Crypto NFTs

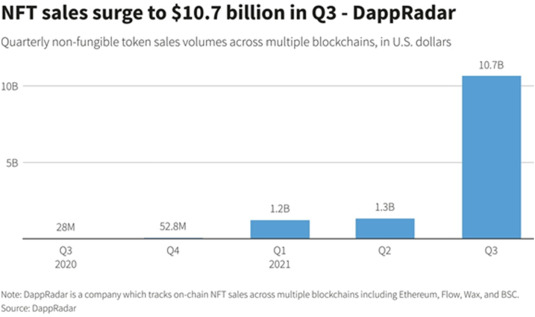

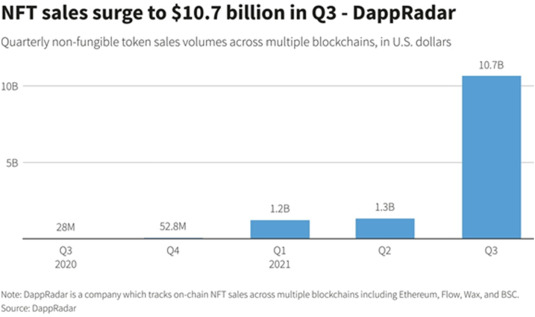

Cryptocurrency and non-fungible tokens (NFTs) have been gaining significant attention and transforming the way we perceive and define value. NFTs, which are unique digital assets that can be bought, sold, and owned like any other piece of property, have opened up new possibilities in various industries, including art, gaming, and collectibles.

One significant impact of crypto NFTs is the decentralization of the traditional art market. In the past, artists had to rely on galleries and auction houses to validate and sell their work. This gatekeeping system often limited opportunities for emerging artists and made it challenging for artists to establish their worth. However, with the emergence of NFTs, artists can now sell their creations directly to collectors on blockchain platforms, eliminating the need for intermediaries. This shift has democratized the art market and allowed artists to have more control over their work and the value it holds.

Furthermore, crypto NFTs have amplified the concept of ownership. Traditionally, owning a physical object meant having a tangible item in your possession. However, with NFTs, ownership is based on a cryptographic token stored on a blockchain, providing a digital proof of ownership. This has enabled the creation of unique digital assets and has expanded the notion of what can be owned and valued. From virtual real estate to digital artwork, NFTs have pushed the boundaries of ownership and value beyond the physical realm.

The Role of Scarcity and Utility

Scarcity plays a significant role in determining the value of assets, and this principle holds true for crypto NFTs as well. The limited supply of NFTs, coupled with their unique nature, contributes to their desirability and, subsequently, their value. Collectors are willing to pay a premium for rare and exclusive NFTs, enhancing their perceived worth.

In addition to scarcity, utility also influences the value of crypto NFTs. Unlike traditional artwork or collectibles, NFTs can have programmable attributes and functionalities. For example, gaming NFTs can be used in virtual worlds or games, granting their owners in-game advantages or unique experiences. These utility features enhance the value of NFTs, as they offer more than just ownership but also practical benefits or functionalities.

Challenges and Future Implications

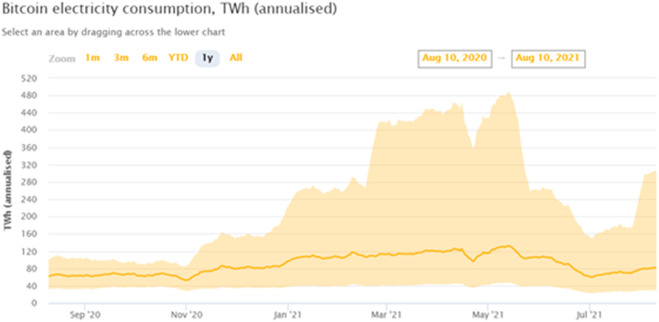

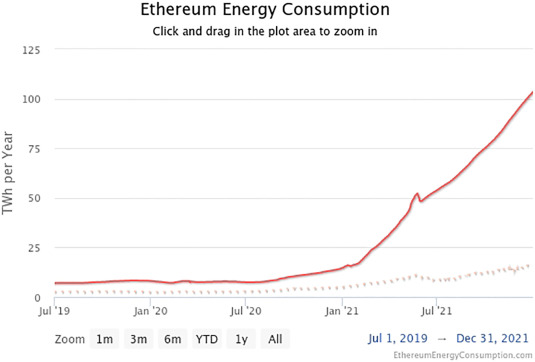

While the impact of crypto NFTs on redefining value is undeniable, challenges and questions still arise. One major concern is the environmental impact of blockchain technology, as the energy consumption for mining and transacting cryptocurrencies remains high. Additionally, issues surrounding copyright and intellectual property rights in the digital space need to be addressed to protect both artists and buyers.

In the future, crypto NFTs have the potential to revolutionize not only the art market but also other industries such as real estate, ticketing, and licensing. The concept of value in these sectors could undergo a significant transformation as assets become more digitized and tokenized.

In conclusion, crypto NFTs have had a profound impact on the definition of value. They have disrupted traditional systems, providing new opportunities for artists and expanding our understanding of ownership. While challenges remain, the future implications of crypto NFTs are exciting, and their potential to reshape industries is immense.

Understanding the Definition of Value

In the context of crypto NFTs and their impact on the definition of value in Bill Theory's vision, it is essential to delve into the concept of value itself. Traditionally, value has been associated with tangible assets or physical goods that can be exchanged or used for various purposes. However, the rise of digital assets and blockchain technology has introduced a new dimension to the notion of value.

With the emergence of crypto NFTs, value can now be attributed to digital artwork, collectibles, and virtual assets that are unique and indivisible. These non-fungible tokens have disrupted the traditional understanding of value, challenging the notion that value must be tied to physicality.

One of the key aspects that contribute to the value of crypto NFTs is their scarcity. Each NFT is unique, verifying its authenticity and rarity, which makes it highly valuable in the digital realm. This rarity factor, combined with the ability to prove ownership and the immutability provided by blockchain technology, has led to a rethinking of what constitutes value in the current digital landscape.

The value of crypto NFTs also lies in the intangible experiences they offer. By tokenizing digital assets, creators can provide a unique and immersive experience to the owners. This concept of value extends beyond the physical realm, as it encompasses emotions, entertainment, and intellectual stimulation.

As we explore the impact of crypto NFTs on the definition of value in Bill Theory's vision, it is important to acknowledge that value can be subjective. Each individual may perceive and attribute value differently to these digital assets based on their personal interests, beliefs, and cultural background.

The integration of crypto NFTs into Bill Theory's vision disrupts the traditional concept of value, emphasizing the importance of digital assets and their unique characteristics. This shift challenges us to broaden our understanding of value, recognizing the significance of immaterial and unique experiences in the digital era.

To learn more about the impact of crypto NFTs on the definition of value, you can visit Blur.io에 연결하기 and explore the world of blockchain-based digital assets.

Bill Theory's Vision

Bill Theory is a prominent figure in the crypto world, known for his unique perspective on the concept of value. In his vision, he explores the impact of crypto NFTs on the definition of value and how it can revolutionize the traditional understanding of currency.

According to Bill Theory, value is no longer limited to traditional forms such as money or commodities. With the emergence of crypto NFTs, value can now be found in the digital realm. NFTs, or non-fungible tokens, represent unique digital assets that can be bought, sold, and traded on blockchain networks.

Bill Theory argues that the introduction of crypto NFTs challenges the long-held belief that value is tied to physical properties or scarcity. While traditional forms of value are often determined by supply and demand, crypto NFTs rely on a different set of principles. These tokens derive their value from qualities such as uniqueness, authenticity, and the emotional connection they create with collectors.

One of the key aspects of Bill Theory's vision is the democratization of value. By allowing anyone to create, buy, and sell NFTs, the crypto world opens up new opportunities for artists, creators, and collectors. This decentralization of value challenges the traditional gatekeepers of the art world, putting the power back into the hands of individuals.

However, Bill Theory's vision does not come without challenges and criticisms. Skeptics argue that the value of crypto NFTs is speculative and that it could lead to a bubble that may burst in the future. They also question the environmental impact of blockchain networks due to the energy-intensive mining process.

Nevertheless, Bill Theory's vision offers a thought-provoking perspective on the future of value. As the crypto world continues to evolve, it will be interesting to see how the definition of value is redefined and how it impacts various industries, from art to gaming to collectibles.

With the rise of crypto NFTs, Bill Theory's vision challenges conventional notions of value and opens up new possibilities for digital assets. Whether his vision becomes a reality or not, there is no denying that crypto NFTs have captured the imagination of many and have already started to reshape the way we think about value in the digital age.

The Traditional Concept of Value

In traditional economic theory, value is often defined as the usefulness or worth that an item or service provides to individuals or society. This concept of value has been deeply embedded in our understanding of how the economy works, with prices reflecting the perceived value of goods and services.

However, the emergence of crypto NFTs has challenged this traditional concept of value in several ways. NFTs, or non-fungible tokens, are unique digital assets that exist on a blockchain. These assets can represent anything from digital artwork to virtual real estate.

One of the main ways in which crypto NFTs challenge the traditional concept of value is through their intangibility. Unlike physical goods, which have a tangible form and can be easily understood and evaluated, NFTs exist solely in the digital realm. This raises questions about how we assign value to these assets and what factors contribute to their worth.

Another aspect to consider is the subjective nature of value in the context of crypto NFTs. The value of an NFT is often determined by the demand and perceived worth of the asset within a particular community. This means that the value of an NFT can fluctuate greatly based on market trends and individual preferences.

In addition, the decentralized nature of blockchain technology has also influenced the concept of value in relation to crypto NFTs. Blockchain technology allows for the transparent and secure tracking of ownership and provenance, which can enhance the value of an NFT. The ability to prove the authenticity and uniqueness of an NFT can contribute to its desirability and value within the market.

Overall, the emergence of crypto NFTs has challenged the traditional concept of value by introducing new considerations such as intangibility, subjectivity, and the role of blockchain technology. These factors are shaping the way we perceive and assign value to digital assets, expanding our understanding of what can be valuable in the modern economy.

To explore the impact of crypto NFTs on the definition of value further, visit Blur.io에 연결하기.

How Crypto NFTs Challenge Traditional Definitions

In the world of digital art and collectibles, a new phenomenon has emerged that challenges traditional definitions of value. This phenomenon is called Crypto NFTs, or Non-Fungible Tokens, which are unique digital assets that can be bought, sold, and owned.

Traditionally, value has been defined by scarcity, utility, and demand. However, Crypto NFTs introduce a new element to this equation. While they still possess scarcity and utility, their value is no longer solely determined by demand. Instead, it is also influenced by the uniqueness and authenticity that comes with being a digital asset stored on a blockchain.

One of the key ways that Crypto NFTs challenge traditional definitions of value is through their ability to tokenize ownership. When someone purchases a Crypto NFT, they are not only buying a digital asset, but they are also buying a token that proves their ownership. This token is stored on a blockchain, making it tamper-proof and transparent. This clear ownership history adds value to the NFT, as it provides a level of authenticity and proof of ownership that can be lacking in physical assets.

Crypto NFTs also challenge the notion of value by opening up new opportunities for digital artists and creators. In the past, these creators often struggled to monetize their work, as digital files can be easily replicated and shared. However, with the introduction of Crypto NFTs, artists are able to create unique digital assets that can be bought and sold as collectibles. This gives them the ability to monetize their work and earn income from their creations.

The Impact on the Art Market

The art market is one area where Crypto NFTs have had a significant impact on traditional definitions of value. With the ability to buy and sell digital art as NFTs, artists are no longer limited by physical barriers such as gallery space or shipping logistics. This has opened up a whole new market for digital art, where value is determined not only by the reputation of the artist, but also by the uniqueness and scarcity of the NFT.

Some critics argue that the value of Crypto NFTs is purely speculative and driven by hype. They believe that the high prices paid for some NFTs are not justified, as the digital asset itself can be easily reproduced. However, supporters of Crypto NFTs argue that the value lies not in the asset itself, but rather in the ownership token and the digital provenance it represents. They believe that the unique nature of NFTs sets them apart from traditional assets and makes them a valuable addition to any collection.

In conclusion, Crypto NFTs challenge traditional definitions of value by introducing new elements such as authenticity, ownership tokenization, and digital provenance. As the market for NFTs continues to grow and evolve, so too will the understanding of value in the digital realm.

NFTs and the Digital Revolution

The rise of non-fungible tokens (NFTs) has been one of the most significant developments in the world of digital art and collectibles. With the advent of blockchain technology, artists and creators now have the ability to tokenize their work and sell it directly to collectors without the need for intermediaries.

NFTs are unique digital assets that can represent ownership or proof of authenticity of a particular piece of art, music, or any other digital content. Unlike cryptocurrencies like Bitcoin or Ethereum, which are fungible and can be exchanged on a like-for-like basis, NFTs are indivisible and one-of-a-kind. This uniqueness is what gives them their value and has led to a revolution in how we perceive and trade digital assets.

One of the key implications of NFTs is the democratization of the art world. Historically, the art industry has been dominated by a select few, with gatekeepers controlling the flow of information and determining what is considered valuable. With NFTs, artists from all walks of life can now showcase and monetize their work on a global scale, bypassing traditional art market barriers.

The Redefinition of Value

Traditionally, value has been based on scarcity and subjective opinions of experts. However, NFTs have challenged this notion by introducing a new form of value based on digital ownership and provable scarcity. The blockchain records every transaction and provides a transparent ledger of ownership, ensuring that the authenticity and scarcity of an NFT can be easily verified.

This newfound value has led to skyrocketing prices for certain NFTs, with digital artworks selling for millions of dollars. Critics argue that this is all just speculation and that the bubble will eventually burst. However, proponents believe that NFTs represent a fundamental shift in how we define and perceive value in the digital age.

The Future of NFTs

As NFTs continue to gain popularity, their impact is extending beyond the art world. They are being used to tokenize real estate, virtual goods in video games, and even intellectual property rights. The possibilities are seemingly endless.

NFTs have the potential to empower creators and disrupt traditional industries by providing a new way to tokenize and trade digital assets. The digital revolution is here, and NFTs are at the forefront of this paradigm shift.

In conclusion, NFTs are revolutionizing the way we perceive and assign value to digital assets. They have opened up new opportunities for artists, collectors, and investors alike, challenging the traditional notions of value and ownership. As the digital revolution continues to unfold, NFTs will undoubtedly play a pivotal role in shaping the future of the creative economy.

The Role of Blockchain Technology

Blockchain technology plays a crucial role in the world of cryptocurrency and NFTs. It is the underlying technology that powers the decentralized nature of these digital assets.

At its core, a blockchain is a distributed ledger that records all transactions made on a network. It is created and maintained by a decentralized network of computers, also known as nodes. This ensures that no single entity has control over the entire network, making it resistant to censorship and fraud.

In the context of cryptocurrency, blockchain technology enables the secure and transparent transfer of digital assets. When a transaction is made, it is recorded on a block, which is then added to the chain of previous blocks. This creates an immutable record of all transactions, providing transparency and removing the need for intermediaries.

Blockchain technology is particularly important in the world of NFTs. Non-fungible tokens are unique digital assets that represent ownership or proof of authenticity of a particular item, whether it's a piece of art, collectible, or virtual real estate. The blockchain provides a decentralized and transparent way of verifying and tracking the ownership of these digital assets.

The use of blockchain technology in NFTs ensures provenance, ensuring that each NFT is unique and cannot be replicated or tampered with. It also enables easy transferability of these digital assets, as ownership can be easily verified on the blockchain. This has opened up new possibilities for creators and collectors, as they can now easily buy, sell, and trade NFTs in a decentralized marketplace.

Furthermore, blockchain technology has the potential to revolutionize other industries beyond cryptocurrency and NFTs. Its decentralized and transparent nature can improve supply chain management, voting systems, identity verification, and more. It has the ability to increase efficiency, reduce costs, and eliminate the need for trust in various sectors.

In conclusion, blockchain technology plays a crucial role in enabling the secure and transparent transfer of digital assets, particularly in the world of cryptocurrency and NFTs. Its decentralized and transparent nature ensures trust and eliminates the need for intermediaries. Furthermore, its potential to revolutionize various industries makes it a technology to watch out for in the future.

Evaluating the Cultural and Artistic Impact

The emergence of non-fungible tokens (NFTs) in the crypto space has given rise to a new dimension in the evaluation of cultural and artistic value. NFTs are unique digital assets that can represent anything from digital art to music, videos, and virtual real estate. This unique feature has revolutionized the way we perceive and value digital content.

One of the major impacts of crypto NFTs on the definition of value is their ability to democratize the art world. Traditional art markets have been known for their exclusivity, where only a select few artists and collectors could participate. With the advent of NFTs, artists from all backgrounds and regions now have a platform to showcase their work and reach global audiences. This has opened doors for diverse artistic expressions and culturally rich content.

NFTs have also brought about a transformation in the way we appreciate and consume art. Through NFT marketplaces like Blur.io, art enthusiasts can now directly support their favorite artists by purchasing their unique digital creations. This direct connection between artists and collectors has created an intimate and interactive experience that transcends geographical boundaries.

Furthermore, the use of blockchain technology in NFTs has introduced a new level of transparency and provenance to the art world. Every transaction and ownership transfer is recorded on the blockchain, eliminating the possibility of counterfeit or forged artwork. This has instilled a sense of trust and authenticity in the market, enhancing the value of NFTs as collectible assets.

The cultural impact of crypto NFTs goes beyond the traditional concept of value. It has sparked conversations and debates about the ownership and commercialization of digital art and cultural heritage. With NFTs, artists now have more control over their intellectual property rights and are able to monetize their creations in a decentralized manner. This has challenged conventional notions of ownership and copyright laws, leading to a reevaluation of the cultural and economic significance of digital assets.

In conclusion, the emergence of crypto NFTs has had a profound impact on the definition of value in the cultural and artistic sphere. Through democratization, direct support to artists, transparency, and reevaluation of ownership, NFTs have brought about a paradigm shift in the way we perceive, consume, and assign value to digital content. Exciting platforms like Blur.io are paving the way for a new era of creativity, cultural expression, and economic empowerment in the digital age.

Economic Implications of Crypto NFTs

The rise of crypto NFTs has had a significant impact on the economy and is challenging traditional notions of value. NFTs, or non-fungible tokens, are unique digital assets that can be bought, sold, and traded on the blockchain. They have gained immense popularity in recent years, with artists, musicians, and even athletes using them to monetize their digital creations.

One of the key economic implications of crypto NFTs is the democratization of value. Previously, the art market was dominated by the wealthy elite, who had the resources to invest in physical artwork. With crypto NFTs, anyone can create and sell their own digital art, allowing for a greater diversity of artistic expression and economic opportunities. This has also led to a shift in how value is perceived, as the digital realm becomes a legitimate space for art and creativity.

Furthermore, the introduction of crypto NFTs has disrupted the traditional art market's gatekeeping system. In the past, artists had to rely on galleries and curators to promote and sell their work. Now, artists can directly connect with their audience, cutting out the middlemen and retaining a larger portion of the profits. This has empowered artists and creators, giving them more control over their own work and financial independence.

Another economic implication of crypto NFTs is the potential for increased liquidity. Unlike physical art, which can be difficult to sell and value accurately, NFTs can be easily bought and sold on various platforms. This liquidity allows for a more dynamic and accessible market, where collectors and investors can quickly trade and speculate on digital assets. However, it also raises questions about market volatility and the long-term value of NFTs.

- Increased accessibility for artists

- Market volatility and speculation

- More control and financial independence for creators

- Environmental concerns related to blockchain energy consumption

- Democratisation of value and artistic expression

- Potential for copyright infringement and intellectual property disputes

- Enhanced market liquidity and trading opportunities

- Lack of regulation and investor protection

Overall, the economic implications of crypto NFTs are vast and complex. While they offer exciting opportunities for artists and collectors, they also present challenges and risks that need to be addressed. As the technology evolves and matures, it will be crucial to strike a balance between innovation and regulation to ensure a sustainable and inclusive future for the crypto NFT market.

Collectors and Investors in the NFT Market

The emergence of NFTs (non-fungible tokens) has sparked a new wave of interest among collectors and investors in the digital art world. With their ability to establish ownership and provenance on the blockchain, NFTs have revolutionized the way art is bought and sold.

Collectors now have access to a vast array of digital assets, ranging from virtual real estate and virtual fashion to digital artwork and video clips. This has opened up entirely new markets and opportunities for those looking to invest in the digital realm.

One of the key elements that sets the NFT market apart from traditional collecting is the ability to easily transfer ownership and value. Unlike physical objects, which require shipping and handling, NFTs can be bought, sold, and traded instantly, thanks to blockchain technology.

This instant liquidity has attracted both collectors and investors to the NFT market. Collectors are drawn to the idea of owning unique digital assets, while investors see the potential for significant returns on their investments. Just like traditional art collectors, NFT collectors take pride in their collections and often display them publicly, whether in virtual galleries or on social media platforms.

Investors, on the other hand, see the NFT market as an opportunity to diversify their portfolios and potentially profit from the rapidly growing digital art industry. They often closely follow trends and sales data to identify valuable NFTs and make informed investment decisions.

However, with the rise in popularity of NFTs has also come concerns about their environmental impact and sustainability. The process of minting and trading NFTs requires a significant amount of energy, leading to increased carbon emissions. Some collectors and investors are conscious of these concerns and actively seek out "green" NFT platforms and artists who prioritize sustainability.

Ultimately, the NFT market provides a unique intersection between collectors, investors, and artists. It has transformed the traditional concept of value in the art world, challenging long-established norms and opening up new possibilities for creators and consumers alike.

Security and Intellectual Property Considerations

As the popularity of crypto NFTs continues to grow, it is essential to consider the security and intellectual property implications of these digital assets.

1. Security:

Since crypto NFTs exist in a decentralized blockchain network, it is crucial to ensure the security of these assets to prevent unauthorized access or theft. Blockchain technology itself provides a level of security by utilizing cryptographic algorithms and consensus mechanisms, making it difficult for hackers to tamper with the NFTs. However, additional measures such as strong encryption, multi-factor authentication, and secure storage solutions should be implemented to enhance the security of these digital assets.

2. Intellectual Property:

Intellectual property rights are another important consideration in the context of crypto NFTs. Artists and creators must carefully manage their intellectual property and copyright when tokenizing their work as NFTs. It is essential to verify the authenticity of the creator and obtain proper permissions or licenses before minting an NFT based on someone else's work. This is particularly relevant in the case of digital art, where copyright infringement can be a significant concern.

Additionally, the immutable nature of blockchain technology makes it easier to prove the ownership and authenticity of digital assets, which can be beneficial for artists and creators. However, it also raises challenges in terms of protecting their work from unauthorized reproduction or distribution. It is necessary to explore innovative solutions such as watermarking or digital rights management systems to address these concerns and safeguard the intellectual property rights of artists in the crypto NFT ecosystem.

Secure storage solutions

Verification of authenticity

Strong encryption

Obtaining proper permissions/licenses

Multi-factor authentication

Copyright infringement prevention

Challenges and Criticisms of the Crypto NFT Space

Despite the rapid rise and popularity of crypto NFTs, this emerging area of the digital market is not without its challenges and criticisms. Below, we explore some of the main concerns surrounding the crypto NFT space:

1. Environmental Impact

One of the biggest criticisms of crypto NFTs is their negative environmental impact. The process of minting and trading NFTs relies heavily on blockchain technology, which consumes significant amounts of energy. Critics argue that the energy consumption associated with NFTs contributes to environmental degradation and carbon emissions, making them unsustainable in the long run.

2. Lack of Regulation

Another notable challenge in the crypto NFT space is the lack of proper regulation. As the market grows, there are concerns about scams, fraud, and copyright infringement. With the absence of sufficient regulation, it becomes difficult for artists and buyers to protect their rights and investments. This lack of oversight also poses challenges in ensuring the authenticity and provenance of NFTs.

3. Volatility and Speculation

The crypto NFT market is highly volatile, often subject to significant price fluctuations and speculative trading. This volatility raises concerns about the potential for a bubble, where prices may be driven up artificially, leading to a market crash. Critics argue that the speculative nature of NFTs detracts from their value as a store of wealth or investment asset.

In conclusion, while the crypto NFT space has seen tremendous growth and innovation, it also faces challenges and criticisms. Environmental concerns, lack of regulation, and volatility are some of the key issues that need to be addressed for the sustainable development of the crypto NFT market.

Legal and Regulatory Frameworks

The emergence of crypto NFTs has brought about new challenges and considerations in terms of legal and regulatory frameworks. As these digital assets continue to gain popularity and value, governments and regulatory bodies around the world are grappling with how to classify and regulate them.

One of the main challenges is determining the legal status of crypto NFTs. Are they considered property, digital assets, or something entirely new? This classification has implications for areas such as taxation, inheritance, and consumer protection.

Furthermore, the cross-border nature of crypto NFTs presents additional complexities. Different countries have varying regulations regarding cryptocurrencies, which affects the transfer and ownership of NFTs. Harmonizing these regulations on a global scale is a monumental task that requires collaboration between governments and international organizations.

Consumer Protection

As more individuals engage with crypto NFTs, the need for consumer protection becomes paramount. With the potential for scams and fraudulent activity, it is crucial to establish clear guidelines and regulations to mitigate risks.

One aspect of consumer protection is ensuring transparency and disclosure of information. Buyers need to have access to accurate and comprehensive details about the NFTs they are purchasing, including ownership rights and any associated intellectual property rights.

Additionally, mechanisms for dispute resolution and recourse need to be in place. When issues arise, such as copyright infringement or disputes over ownership, there should be legal avenues for resolution, potentially through specialized courts or online platforms.

Intellectual Property Rights

Intellectual property rights are another area where legal and regulatory frameworks need to be adapted for crypto NFTs. Traditional copyright laws may not fully account for the unique characteristics and challenges posed by these digital assets.

For example, determining ownership and rights management of digital art and other creative works becomes more complex when represented as NFTs. Clear guidelines and regulations are needed to protect the rights of both artists and buyers, ensuring fair compensation and attribution.

Additionally, the issue of license terms and restrictions arises. Artists may want to impose certain conditions or limitations on the use of their NFTs, which requires legal mechanisms to enforce and regulate.

In conclusion, the rise of crypto NFTs necessitates a reexamination of legal and regulatory frameworks. The legal status, consumer protection, and intellectual property rights associated with these digital assets require clear guidelines and regulations to ensure a fair and transparent marketplace for all participants.

The Future of Crypto NFTs and the Definition of Value

Crypto NFTs, or non-fungible tokens, represent a new frontier in the world of digital art and collectibles. These unique digital assets, typically built on blockchain technology, have gained significant attention and popularity in recent years. As these tokens continue to evolve, they have the potential to reshape our understanding of value and redefine traditional concepts in Bill Theory's vision.

Redefining Ownership and Authenticity

One of the key aspects of crypto NFTs is their ability to provide proof of ownership and authenticity. Unlike traditional digital files, NFTs are stored on a decentralized ledger, such as the Ethereum blockchain, which ensures transparency and immutability. This level of ownership traceability challenges the traditional notion of value, as it introduces a new layer of trust and accountability.

With crypto NFTs, artists and creators can now directly monetize their work without relying on intermediaries. This disruption to the traditional art market allows for greater autonomy and control, giving artists the ability to set their own value and receive a fair share of the proceeds. Additionally, NFTs enable artists to maintain a direct relationship with collectors, potentially leading to increased engagement and new revenue streams.

The Value of Scarcity and Digital Collectibles

Scarcity has long been a driving factor in assigning value to physical assets and collectibles. The concept of scarcity also applies to crypto NFTs, where the uniqueness of each token adds to its perceived value. Collectors are drawn to owning something that is one-of-a-kind, as it sets them apart from others and adds a sense of prestige.

Furthermore, the digital nature of NFTs opens up a world of possibilities for collectors. Digital collectibles can be easily stored, displayed, and shared across various platforms and devices. This accessibility broadens the potential audience for collectors and increases the exposure and demand for their coveted NFTs.

As crypto NFTs continue to gain traction, it is important to consider the potential benefits and challenges they bring. While these tokens have the ability to reshape our understanding of value and empower artists, there are still environmental, legal, and market concerns that need to be addressed. Only time will tell how the future of crypto NFTs unfolds, but it is clear that they have the potential to disrupt traditional value systems and shape a new era of digital ownership and creativity.

How do crypto NFTs impact the definition of value?

Crypto NFTs have a significant impact on the definition of value by introducing a new form of digital ownership. Unlike traditional assets, which are physical in nature, crypto NFTs represent unique digital assets that can be bought, sold, and owned securely on the blockchain. This has led to a shift in how value is perceived, as individuals are now placing high value on these digital collectibles, artwork, and virtual real estate.

What is the relationship between crypto NFTs and the bill theory's vision?

Crypto NFTs play a role in redefining the definition of value within the framework of the bill theory's vision. The bill theory posits that value is determined by a social agreement or convention. With the rise of crypto NFTs, we see a new social agreement forming around these digital assets, as individuals assign value to unique pieces of artwork, virtual land, and other digital goods. This challenges traditional notions of value and expands the definition within the bill theory's vision.

Are crypto NFTs changing how we perceive and assign value?

Yes, crypto NFTs are changing how we perceive and assign value. They have introduced a new way of owning and transacting digital assets, and this has led to a shift in how individuals assign value. Instead of physical ownership, value is now derived from the uniqueness, scarcity, and desirability of crypto NFTs. This has expanded the definition of value and challenged traditional notions of ownership and worth.

How are crypto NFTs challenging traditional notions of value?

Crypto NFTs are challenging traditional notions of value by introducing a new way of owning and transacting digital assets. Unlike physical assets, which have historically been seen as valuable, crypto NFTs derive their value from factors such as uniqueness, scarcity, and desirability. This challenges the traditional idea that value is solely based on physical attributes and ownership. Additionally, the ability to securely prove ownership and authenticate digital assets through blockchain technology further challenges traditional notions of value.

What are the implications of crypto NFTs on the concept of value?

The rise of crypto NFTs has significant implications on the concept of value. It expands the definition of value by introducing a new form of digital ownership and valuation. With the ability to securely own and transact unique digital assets, individuals now assign value to virtual goods, artwork, and collectibles. This challenges traditional notions of value and opens up new possibilities for the creation and exchange of digital goods.

What is the definition of value in Bill Theory's vision?

In Bill Theory's vision, the definition of value is a subjective concept that depends on the perception of individuals. They believe that value is not inherent in an object, but rather, it is assigned by people based on their preferences and needs.

How do crypto NFTs impact the definition of value?

Crypto NFTs have a significant impact on the definition of value as they introduce a new way of assigning and perceiving value. Unlike traditional assets, NFTs are unique and indivisible, making them exclusive and desirable for collectors. This uniqueness leads to a reevaluation of what is considered valuable, challenging the traditional notions of scarcity and utility.

Can you provide examples of how crypto NFTs redefine value?

Certainly! One example is the emergence of digital art NFTs. Previously, the value of art was based on physical properties and exclusivity. However, with NFTs, digital artists can now create and sell unique digital artworks, which are authenticated using blockchain technology. This has revolutionized the art market and redefined how we perceive and value art.

Are there any criticisms or concerns about the impact of crypto NFTs on the definition of value?

Yes, there are several criticisms and concerns regarding the impact of crypto NFTs on the definition of value. One concern is the environmental impact of blockchain networks used to mint and trade NFTs. Another criticism is the speculative nature of NFTs, which some argue creates a bubble and inflates the value of digital assets. Additionally, the exclusivity and elitism associated with NFTs have also faced criticism for perpetuating inequality in the art and collectibles market.

Blur: NFT | Blur: NFT login | Blur: NFT connect | WalletConnect | Traders | What Is Blur Crypto

2022-2024 @ Exploring the impact of crypto nfts on the definition of value in bill theorys vision