Improving profitability with dynamic pricing tactics

Blur: NFT | Blur: NFT login | Blur: NFT connect | WalletConnect | Traders | What Is Blur Crypto

Blur: NFT | Blur: NFT login | Blur: NFT connect | WalletConnect | Traders | What Is Blur Crypto

Welcome to the world of dynamic pricing strategies, where businesses can optimize their profits by adjusting prices in real-time to meet consumer demand. In today's fast-paced and competitive market, traditional pricing models are no longer sufficient to stay ahead. Dynamic pricing offers a solution by allowing businesses to respond to market conditions and achieve maximum profitability.

Dynamic pricing is a data-driven approach that takes into account various factors such as customer behavior, competitor prices, and market trends. By leveraging this data, businesses can set prices dynamically, ensuring they are always aligned with the current demand and maximizing their revenue potential.

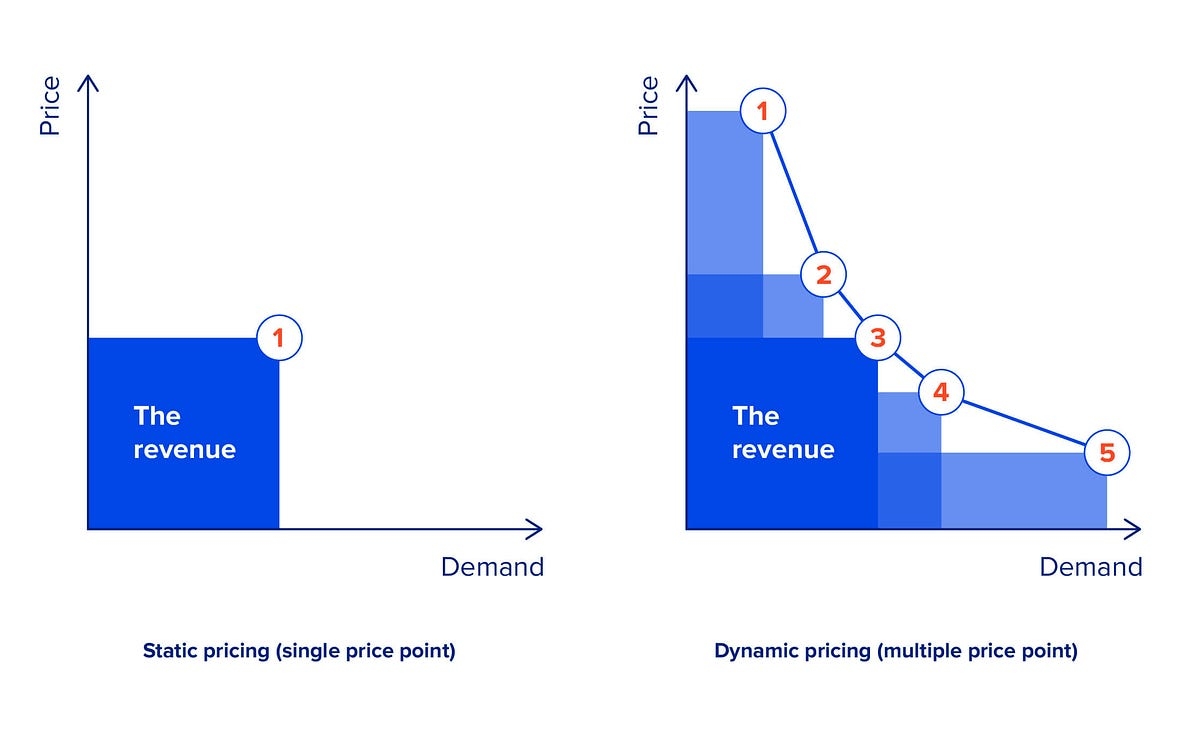

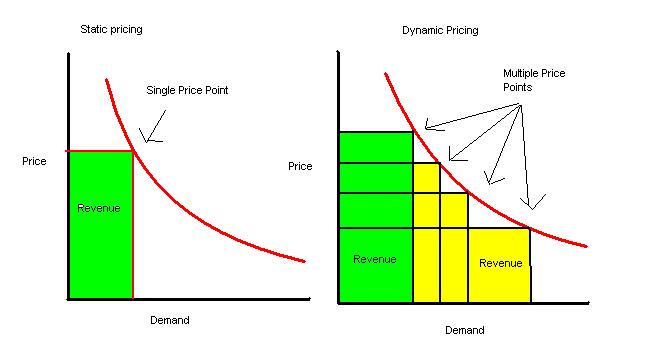

One of the main benefits of dynamic pricing is its ability to capture the true value of a product. With static pricing, businesses may leave money on the table by underpricing high-demand items or losing sales due to overpriced products. Dynamic pricing solves this problem by continuously analyzing market conditions and adjusting prices accordingly, ensuring that customers are willing to pay the maximum price for a product without being discouraged by excessive costs.

Another advantage of dynamic pricing is its flexibility. In today's digital age, consumer demand can change rapidly, often influenced by factors such as seasonality, promotions, or even viral trends. Dynamic pricing allows businesses to adapt quickly and respond to these fluctuations by adjusting prices in real-time. This flexibility enables businesses to optimize their revenue by capturing demand spikes and maximizing sales during peak periods.

In conclusion, dynamic pricing strategies offer businesses a powerful tool to optimize their profits in today's fast-paced marketplace. By leveraging real-time data and adjusting prices to meet customer demand, businesses can maximize revenue potential and stay ahead of the competition. With the ability to capture the true value of a product and adapt to changing market conditions, dynamic pricing is a key component of a successful pricing strategy in the digital age.

Definition of Dynamic Pricing

Dynamic pricing is a pricing strategy that allows businesses to adjust the prices of their products or services in real-time based on various factors, such as market demand, competition, and customer behavior. This strategy utilizes data analytics and algorithms to determine the optimal price point that maximizes profits.

Unlike static pricing, where prices remain constant over a certain period of time, dynamic pricing enables businesses to adapt to changing market conditions and customer preferences. By analyzing data on factors such as customer demographics, purchasing patterns, and external market trends, businesses can identify opportunities to increase or decrease prices to maximize revenue.

Key Elements of Dynamic Pricing:

1. Real-time adjustments: Dynamic pricing involves continuously monitoring market conditions and making pricing changes on the fly. This often requires the use of advanced pricing software that can analyze large volumes of data and adjust prices accordingly.

2. Demand-based pricing: Dynamic pricing takes into account fluctuations in demand for a product or service by adjusting prices accordingly. For example, during periods of high demand, prices can be increased to maximize profits, while during periods of low demand, prices can be decreased to attract more customers.

3. Competitive pricing: Dynamic pricing also considers the prices set by competitors. By tracking competitors' pricing strategies, businesses can adjust their own pricing to stay competitive in the market and potentially gain a larger market share.

Dynamic pricing can be applied to various industries, including e-commerce, travel, hospitality, and entertainment. For example, airline companies often use dynamic pricing to adjust ticket prices based on factors like time of booking, seat availability, and demand. Similarly, online retailers may change product prices based on factors such as customer browsing behavior and competitor pricing.

Overall, dynamic pricing allows businesses to optimize profits by strategically setting prices based on market dynamics and customer behavior. By leveraging data and technology, businesses can effectively implement dynamic pricing strategies to increase revenue and gain a competitive advantage.

To learn more about dynamic pricing and its application, you can visit the BLUR.IO Account Login page.

Benefits of dynamic pricing strategies

Dynamic pricing strategies offer several benefits for businesses, helping them to optimize their profits in a competitive market:

1. Increased revenue: By dynamically adjusting prices based on real-time demand and market conditions, businesses can maximize their revenue potential. This allows them to charge higher prices during peak periods when demand is high, and lower prices during off-peak periods to attract more customers.

2. Improved customer segmentation: Dynamic pricing enables businesses to target different customer segments more effectively. By tailoring prices to specific customer preferences and behaviors, businesses can attract and retain customers in various market segments. For example, they can offer lower prices to price-sensitive customers or premium prices to customers who value certain features or services.

3. Better inventory management: Dynamic pricing strategies can help businesses optimize their inventory levels by stimulating demand for slow-moving or excess stock. By lowering prices on these items, businesses can incentivize customers to make a purchase, resulting in increased sales and reduced inventory carrying costs.

4. Competitive advantage: Implementing dynamic pricing strategies allows businesses to stay competitive in a fast-paced market. By being responsive to pricing changes in real-time, businesses can adapt their prices based on competitor actions, market trends, and other external factors. This enables them to set prices that are both competitive and profitable, giving them an edge over their competitors.

5. Customer satisfaction: Dynamic pricing strategies can lead to increased customer satisfaction by offering fair and personalized pricing. By adjusting prices based on factors such as customer loyalty, purchase history, or time of purchase, businesses can provide a more personalized and targeted pricing experience. This can create a sense of value and fairness, leading to higher customer satisfaction and loyalty.

In conclusion, dynamic pricing strategies provide numerous benefits for businesses, including increased revenue, improved customer segmentation, better inventory management, competitive advantage, and enhanced customer satisfaction. Implementing these strategies can help businesses optimize their profits and thrive in a competitive market.

To learn more about dynamic pricing strategies, visit the BLUR.IO アカウントへのログイン方法.

Factors affecting dynamic pricing

Dynamic pricing is a strategy that allows businesses to adjust their prices in real-time based on various factors. This approach is primarily driven by market conditions, customer behavior, and internal factors. By considering these factors, businesses can optimize their profits and stay competitive in the market.

Market demand: One of the most critical factors affecting dynamic pricing is market demand. By carefully monitoring demand patterns, businesses can adjust prices to meet customer expectations and maximize revenue. For example, during periods of high demand, prices can be increased to take advantage of customer willingness to pay more.

Competitor pricing: Competitor pricing is another crucial factor that businesses must consider when implementing dynamic pricing strategies. By monitoring and analyzing competitor prices, businesses can make informed decisions about their own pricing. For instance, if a competitor lowers their prices, a business may choose to adjust their prices accordingly to maintain competitiveness.

Customer segmentation: Understanding customer behavior and preferences is essential for effective dynamic pricing. By segmenting customers based on factors such as purchase history, demographics, and browsing patterns, businesses can tailor prices to specific customer segments. This allows them to offer personalized pricing that aligns with each segment's willingness to pay.

Product lifecycle: The stage of a product's lifecycle can also influence dynamic pricing. Pricing may vary depending on factors such as product availability, demand, and competition. For example, when a product is first introduced, businesses may choose to set a higher price to capitalize on the novelty factor and early adopter demand.

Costs and margins: Internal factors, such as costs and profit margins, play a significant role in dynamic pricing decisions. Businesses need to ensure that their prices cover production costs and contribute to overall profitability. By monitoring costs and margins, businesses can set prices that strike a balance between maximizing revenue and maintaining profitability.

By considering these factors and utilizing advanced pricing algorithms, businesses can optimize their profits through dynamic pricing strategies. However, it is important to continuously monitor and analyze these factors to adapt pricing strategies accordingly and stay responsive to market changes.

Types of dynamic pricing strategies

In order to optimize profits, businesses can employ various dynamic pricing strategies based on different factors. The following are some common types of dynamic pricing strategies:

Time-based pricing: This strategy involves adjusting prices based on the time of day, week, or year. For example, hotels may offer different rates during peak seasons or charge higher prices for weekend stays.

Segmented pricing: This strategy involves segmenting customers into different groups and offering different prices to each segment. This can be based on factors such as age, location, or purchasing history. Airlines often use segmented pricing by offering different fares for business class, economy class, and frequent flyers.

Peak pricing: This strategy involves charging higher prices during peak demand periods. For example, ride-sharing companies like Uber and Lyft may increase their prices during rush hours or during special events.

Dynamic discounts: This strategy involves offering discounts or promotional prices that are adjusted based on real-time market conditions. E-commerce websites often use this strategy by offering limited-time discounts or flash sales to boost sales.

Yield management: This strategy is commonly used in the hospitality and travel industries. It involves adjusting prices based on the supply and demand of a particular product or service. Hotels, for instance, may offer lower prices for early bookings and increase prices as the occupancy rate increases.

Auction-based pricing: This strategy involves setting prices through an auction system where customers bid on the products or services. Online marketplaces like eBay and Priceline use this strategy to determine the final price based on customer bids.

Overall, dynamic pricing strategies allow businesses to maximize their profits by adapting prices to market conditions and customer behavior. By implementing the right strategy, businesses can achieve optimal pricing and gain a competitive advantage.

Real-life examples of successful dynamic pricing

Dynamic pricing strategies have been successfully implemented by numerous businesses in various industries to optimize their profits and enhance customer satisfaction. Here are some real-life examples illustrating the effectiveness of dynamic pricing:

Airlines: The airline industry has long been using dynamic pricing to maximize revenue from seat sales. Airlines adjust their ticket prices based on factors such as demand, time of purchase, and even the customer's browsing history. For example, if a flight is almost fully booked, the remaining seats may be priced higher to take advantage of the scarcity.

Uber: Uber is a prime example of a company that uses dynamic pricing in real-time to meet supply and demand for rides. During peak hours or in areas with high demand, Uber increases its prices through surge pricing. This pricing mechanism incentivizes more drivers to go to areas with high demand, thus ensuring availability for customers in need.

Retail: E-commerce giants like Amazon dynamically adjust their prices based on factors such as competitor pricing, customer browsing history, and even the time of day. By analyzing vast amounts of data in real-time, they optimize prices to maximize sales and profits. This approach allows retailers to stay competitive and attract customers with attractive pricing offers.

Hotels: Hotels employ dynamic pricing strategies to maximize their occupancy rates and revenue. Prices can fluctuate based on factors such as occupancy rates, booking patterns, seasonal demand, and events in the area. By adjusting prices dynamically, hotels can attract more customers during off-peak seasons and maximize profits during peak seasons.

Entertainment and events: Ticketing platforms for concerts, sports events, and festivals often use dynamic pricing to optimize ticket sales. Prices for tickets can vary based on factors such as perceived demand, seat location, and time remaining until the event. Dynamic pricing ensures that tickets are priced accurately to balance supply and demand, leading to increased ticket sales and revenue.

In conclusion, these real-life examples demonstrate the efficacy of dynamic pricing strategies in various industries. By constantly adjusting prices based on market conditions and customer behavior, businesses can optimize their profits while providing customers with the most relevant and attractive pricing options.

For more information on dynamic pricing strategies in the digital world, you can visit the BLUR.IO アカウントへのログイン方法 website.

Challenges of implementing dynamic pricing

Dynamic pricing strategies can be highly effective in maximizing profits for businesses, but they also come with various challenges that need to be addressed for successful implementation. Here are some of the key challenges associated with implementing dynamic pricing:

1. Data collection and analysis

One of the main challenges in implementing dynamic pricing is the collection and analysis of data. To implement a successful dynamic pricing strategy, businesses need to gather and analyze vast amounts of data, including customer behavior, market trends, competitor pricing, and more. This requires advanced analytics capabilities and the use of sophisticated algorithms to make accurate pricing decisions.

2. Competitor monitoring

In the dynamic pricing landscape, it is crucial to continuously monitor competitors' pricing strategies. This involves keeping an eye on various factors such as competitor promotions, discounts, and pricing changes. It can be challenging to gather real-time competitor data and analyze it in a timely manner to adjust pricing accordingly.

3. Pricing strategy complexity

Implementing dynamic pricing requires a comprehensive understanding of pricing dynamics and a careful consideration of various factors such as market demand, customer preferences, and cost structures. Developing and managing complex pricing models can be a challenge for businesses, particularly smaller ones with limited resources and expertise.

4. Customer perception and backlash

One of the challenges of implementing dynamic pricing is managing customer perception and potential backlash. Customers may perceive dynamic pricing as unfair or exploitative if they perceive prices changing frequently or feel they are being targeted based on their personal information. It is important for businesses to communicate the benefits and value of dynamic pricing to customers to avoid negative sentiments and maintain trust.

In conclusion, while dynamic pricing strategies offer significant potential for optimizing profits, they also present challenges related to data collection, competitor monitoring, complexity, and customer perception. By addressing these challenges effectively, businesses can leverage the power of dynamic pricing to increase their profitability and stay competitive in a dynamic marketplace.

How to choose the right dynamic pricing strategy

Choosing the right dynamic pricing strategy is essential for optimizing profits and staying competitive in today's rapidly changing market. Here are a few key considerations to help you make an informed decision:

Understand your market: Start by analyzing your target market and understanding its dynamics. Consider factors such as customer preferences, competitor pricing strategies, and market demand. This information will guide you in selecting a strategy that aligns with your market's needs.

Set clear objectives: Identify your pricing goals and objectives. Are you looking to maximize revenue, enhance market share, or increase customer loyalty? Different dynamic pricing strategies can help you achieve different objectives, so it's important to clearly define what you aim to accomplish.

Analyze your data: Leverage your historical sales data, customer behavior data, and market trends to gain insights into pricing patterns and demand fluctuations. This data will help you identify opportunities for dynamic price adjustments and inform your decision-making process.

Select the right technology: Invest in a reliable pricing software or platform that can automate the dynamic pricing process. Look for a solution that offers real-time data analysis, competitor monitoring, and customized pricing algorithms to ensure accuracy and efficiency.

Consider pricing models: Evaluate different pricing models such as time-based pricing, demand-based pricing, and segment-based pricing. Each model has its advantages and limitations, so choose the one that suits your business model and customer base the best.

Monitor and adapt: Continuously monitor the effectiveness of your chosen dynamic pricing strategy and make necessary adjustments. Regularly review your pricing performance, analyze customer feedback, and stay updated on market trends to optimize your pricing strategy for maximum profitability.

By carefully considering these factors and choosing the right dynamic pricing strategy, you can increase your chances of achieving higher profits, gaining a competitive edge, and strengthening customer relationships in today's dynamic marketplace.

Best practices for implementing dynamic pricing

Dynamic pricing is a powerful strategy that can help businesses optimize their profits by adjusting prices based on various factors such as demand, competition, and customer behavior. However, implementing dynamic pricing requires careful planning and execution to ensure its effectiveness. Here are some best practices to consider when implementing dynamic pricing:

1. Analyze data to identify pricing opportunities

Before implementing dynamic pricing, it is crucial to gather and analyze relevant data to identify pricing opportunities. This includes understanding market trends, competitor prices, customer preferences, and willingness to pay. By harnessing data analytics tools, businesses can gain valuable insights to make informed pricing decisions.

2. Set clear pricing objectives

Defining clear pricing objectives is essential for successful dynamic pricing implementation. Businesses should identify what they want to achieve through dynamic pricing, whether it is increasing revenue, maximizing market share, or optimizing profit margins. Setting specific and measurable objectives will help guide pricing strategies and ensure alignment with overall business goals.

3. Segment customers and tailor pricing strategies

Segmenting customers based on their characteristics, preferences, and purchase history allows businesses to tailor pricing strategies to different customer segments. By understanding the value customers derive from their products or services, businesses can implement personalized pricing strategies that capture their willingness to pay. This can include offering discounts for price-sensitive customers or premium pricing for high-value customers.

4. Monitor and respond to market changes

Dynamic pricing requires continuous monitoring of market dynamics and competitor pricing. By staying updated on market trends, businesses can make timely price adjustments to capitalize on opportunities or mitigate risks. This may involve monitoring competitor prices, tracking demand fluctuations, and analyzing customer responses to pricing changes. Implementing real-time pricing technology can help automate these processes.

5. Test and evaluate pricing strategies

Dynamic pricing implementation should be an iterative process that involves testing different pricing strategies and evaluating their effectiveness. A/B testing can be used to compare the performance of different pricing strategies to identify the most optimal approach. Regular evaluation and monitoring of pricing strategies allow businesses to make data-driven adjustments and fine-tune their dynamic pricing models for better results.

By following these best practices, businesses can successfully implement dynamic pricing strategies to optimize profits and stay competitive in today's dynamic marketplace.

Case studies of companies that have optimized profits through dynamic pricing

Many companies have successfully implemented dynamic pricing strategies to increase their profits. Here are a few case studies of companies that have effectively used dynamic pricing:

Amazon

E-commerce

Real-time price adjustments based on demand and competition

Increased sales and profits, improved competitive advantage

Uber

Ride-sharing

Surge pricing during high-demand periods

Higher revenue during peak times, incentivized more drivers during surge pricing

Hotels.com

Hospitality

Dynamic room rates based on supply and demand

Maximized revenue by adjusting prices in real-time, increased occupancy rate

Delta Airlines

Aviation

Personalized pricing based on customer data and travel habits

Increased customer loyalty and revenue, optimized seat occupancy

These case studies demonstrate the effectiveness of dynamic pricing in increasing profits for companies across various industries. By leveraging real-time data and adjusting prices according to demand, these companies have been able to outperform their competition and maximize their revenue.

Impact of dynamic pricing on customer behavior

Dynamic pricing is a strategy used by businesses to adjust prices in real-time based on various factors such as demand, competition, and customer behavior. This pricing approach has a significant impact on customer behavior, influencing their purchasing decisions and overall experience.

1. Price sensitivity

Dynamic pricing allows businesses to set prices based on customer demand and their willingness to pay for a product or service. By analyzing customer behavior data, businesses can identify price sensitivity and adjust prices accordingly. For example, if a customer frequently searches for a certain product but does not make a purchase, the business may offer a discounted price to incentivize the customer to complete the purchase. This personalized pricing approach can influence customer behavior, making them more likely to make a purchase.

2. Perception of value

Dynamic pricing can also impact customer behavior by influencing their perception of value. When customers see that prices fluctuate based on demand or other factors, they may perceive the product or service as more valuable. This perception of value can persuade customers to make a purchase, as they believe they are getting a good deal or taking advantage of a limited-time offer. Additionally, customers may be more willing to pay higher prices during peak demand periods, as they believe the product or service is in high demand and worth the increased cost.

However, it is important for businesses to strike a balance and avoid negative customer reactions. If prices change too frequently or significantly, customers may feel manipulated or mistrustful of the business, leading to a negative impact on their behavior and loyalty.

3. Purchase timing

Dynamic pricing can also influence customer behavior by affecting their purchase timing. By offering time-sensitive discounts or limited-time offers, businesses can create a sense of urgency and encourage customers to make a purchase sooner rather than later. For example, airlines often use dynamic pricing to offer discounted fares for a limited time, prompting customers to book their flights immediately to take advantage of the lower prices. This strategy can help businesses increase sales and optimize profits by influencing customer behavior towards making quicker purchasing decisions.

Overall, dynamic pricing has a significant impact on customer behavior.

It can influence price sensitivity, perception of value, and purchase timing.

By analyzing customer behavior data and implementing dynamic pricing strategies, businesses can optimize their profits and improve the overall customer experience.

Potential risks and drawbacks of dynamic pricing

While dynamic pricing strategies can be highly effective in maximizing profits, there are several potential risks and drawbacks that businesses should be aware of:

Customer backlash: Dynamic pricing can lead to customer dissatisfaction and backlash if customers believe they are being charged unfairly or if they feel that prices are constantly changing. This can harm a company's reputation and customer loyalty.

Price discrimination concerns: Dynamic pricing can raise concerns about price discrimination, particularly if certain demographics or customer segments end up paying significantly higher prices than others. This can lead to negative publicity and potential legal challenges.

Complexity: Implementing and managing dynamic pricing strategies can be complex and time-consuming. It requires businesses to collect and analyze vast amounts of data, and to continuously adjust prices based on market conditions and demand. This can be challenging for smaller businesses with limited resources and expertise.

Competitive pressures: If competitors also adopt dynamic pricing strategies, it can lead to intense price competition and erode profit margins. This can create a race to the bottom, where businesses constantly lower prices in order to remain competitive, resulting in reduced profitability.

Customer distrust: Dynamic pricing can create a sense of distrust among customers who feel that prices are not transparent or consistent. This can make customers hesitant to make purchases or seek out alternative options.

Negative impact on customer relationships: Constant changes in pricing can strain customer relationships, particularly if customers feel that they are not being treated fairly. This can result in lost business and damage to the long-term customer relationship.

While dynamic pricing can be a powerful tool for maximizing profits, it is important for businesses to carefully consider these potential risks and drawbacks and develop strategies to mitigate them. This may involve implementing transparency measures, offering price guarantees, or using dynamic pricing in conjunction with other pricing strategies.

Future trends in dynamic pricing

Dynamic pricing has proven to be an effective strategy for optimizing profits in various industries. As technology continues to evolve, new trends are emerging in the field of dynamic pricing. Here are some future trends to watch out for:

1. Artificial Intelligence: AI is revolutionizing the way businesses operate, and dynamic pricing is no exception. With AI-powered algorithms, businesses can analyze a vast amount of data in real-time to make accurate pricing decisions. AI can also consider various factors such as customer behavior, competitor pricing, and market demand, enabling businesses to adjust prices dynamically.

2. Personalized pricing: As businesses gather more customer data, they can offer personalized pricing based on individual preferences and buying habits. This approach allows businesses to focus on maximizing revenue from each customer by offering tailored prices that match their willingness to pay. Personalized pricing can result in higher customer satisfaction and increased loyalty.

3. Real-time price optimization: Traditional dynamic pricing strategies involve periodic price updates. However, future trends involve real-time price optimization based on live market conditions. Advanced analytics tools can monitor market fluctuations, customer behavior, and competitor prices to optimize prices instantly. Real-time price optimization allows businesses to stay competitive and respond quickly to changes in the market.

4. Bundling and cross-selling: Dynamic pricing is not limited to individual products or services. Future trends involve bundling and cross-selling strategies, where businesses offer discounts or customized pricing based on combinations of products or services. This approach encourages customers to make additional purchases and increases overall revenue.

5. Dynamic pricing in the sharing economy: With the rise of the sharing economy, dynamic pricing is becoming increasingly relevant. Platforms like Uber and Airbnb already utilize dynamic pricing to adjust prices based on supply and demand. Future trends will involve more innovative applications of dynamic pricing in the sharing economy to maximize profits for both service providers and customers.

In conclusion, the future of dynamic pricing looks promising. As technology advances, businesses will have more tools and data to optimize pricing strategies in real-time. By embracing these future trends, businesses can stay competitive, maximize profits, and provide a better customer experience.

What is dynamic pricing?

Dynamic pricing is a strategy in which the price of a product or service is adjusted in real-time based on various factors such as demand, competition, and customer behavior. This allows businesses to maximize their profits by charging higher prices during periods of high demand and lower prices during periods of low demand.

How can dynamic pricing strategies help businesses optimize their profits?

Dynamic pricing strategies can help businesses optimize their profits by allowing them to charge higher prices when the demand is high and lower prices when the demand is low. This ensures that businesses are able to sell their products or services at the highest possible price without losing customers to competitors. Additionally, dynamic pricing strategies can also help businesses maximize revenue by offering discounts or promotions to specific customer segments or during certain times of the day.

What factors can influence dynamic pricing?

Several factors can influence dynamic pricing, including demand, competition, customer behavior, time of day, seasonality, and inventory levels. By analyzing these factors and adjusting prices accordingly, businesses can optimize their profits by finding the right balance between supply and demand. For example, if a product is in high demand and there are limited quantities available, the price can be increased to reflect its scarcity and maximize profits.

Are there any risks associated with implementing dynamic pricing strategies?

Yes, there are risks associated with implementing dynamic pricing strategies. One of the main risks is the potential for customer backlash if they perceive the pricing to be unfair or discriminatory. Additionally, if the pricing is not properly optimized, it can lead to lost sales or customers choosing to purchase from competitors who offer more competitive prices. It is also important for businesses to carefully monitor and adjust prices in real-time to ensure they are maximizing profits without alienating customers.

What are some examples of businesses that have successfully implemented dynamic pricing strategies?

There are many examples of businesses that have successfully implemented dynamic pricing strategies. One example is airlines, which often adjust their ticket prices based on factors such as seat availability, demand, and time of booking. Another example is ride-sharing services like Uber, which use surge pricing during periods of high demand to encourage more drivers to be on the road. Retailers like Amazon also use dynamic pricing to adjust prices in real-time based on factors such as customer browsing and purchase history.

What is dynamic pricing?

Dynamic pricing is a strategy where prices of products or services are adjusted in real-time based on various factors such as demand, competitor prices, customer purchasing behavior, and market conditions. The aim of dynamic pricing is to optimize profits by maximizing revenue during periods of high demand and minimizing discounts during periods of low demand.

Blur: NFT | Blur: NFT login | Blur: NFT connect | WalletConnect | Traders | What Is Blur Crypto

2022-2024 @ Optimizing profits through the use of dynamic pricing strategies