Exploring how manipulation affects the obscuration of cryptocurrency prices

Blur: NFT | Blur: NFT login | Blur: NFT connect | WalletConnect | Traders | What Is Blur Crypto

Blur: NFT | Blur: NFT login | Blur: NFT connect | WalletConnect | Traders | What Is Blur Crypto

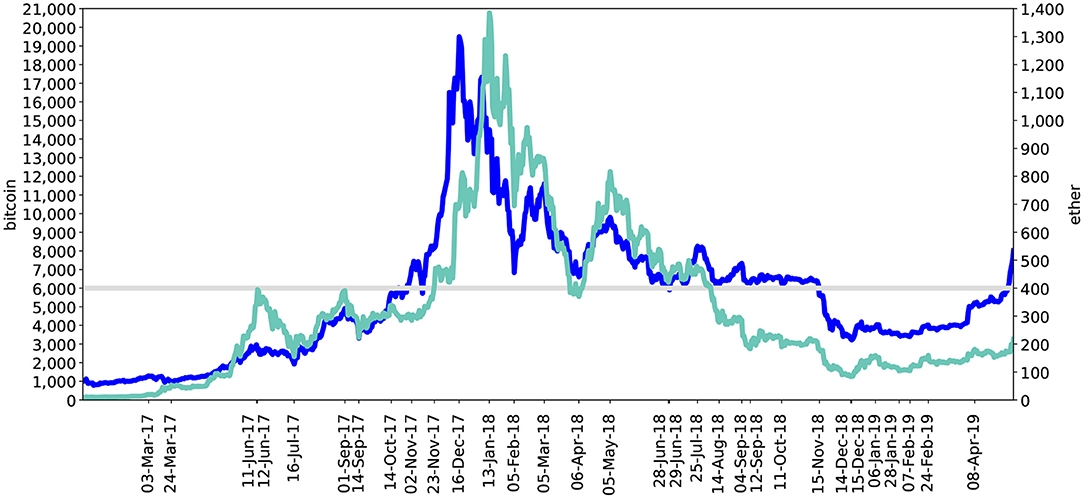

In recent years, cryptocurrencies have gained significant attention as a new form of digital currency. Bitcoin, Ethereum, and other cryptocurrencies have seen unprecedented growth, leading many investors to jump on the bandwagon. However, amidst this excitement, concerns about market manipulation and the accuracy of cryptocurrency prices have emerged.

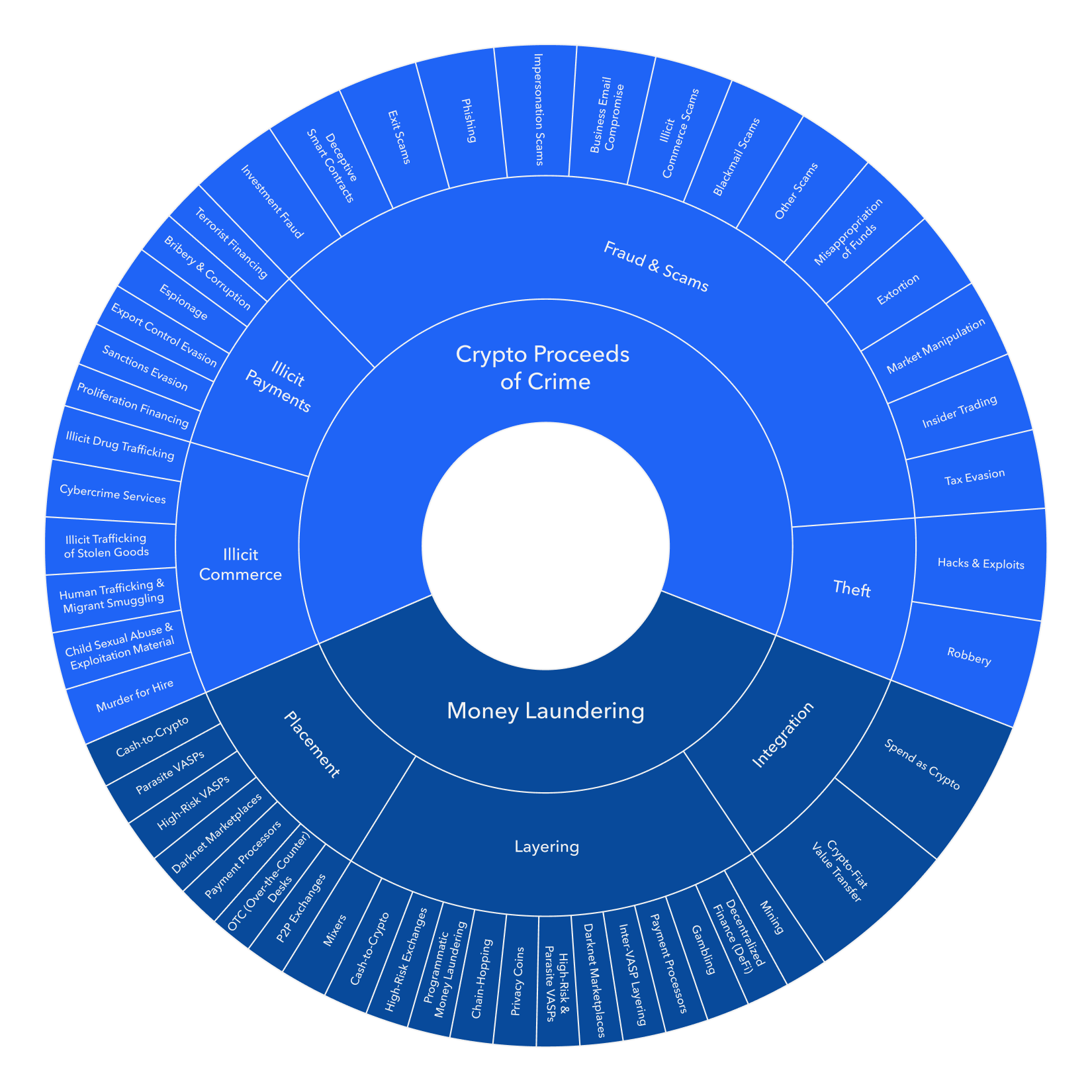

Manipulation, defined as intentional interference with market dynamics to benefit certain participants, can have a profound impact on cryptocurrency prices. By artificially inflating or deflating prices, manipulators can mislead investors and distort market perceptions. This can result in significant financial losses for unsuspecting participants and undermine the credibility of the entire cryptocurrency ecosystem.

There are several ways in which manipulation can obscure cryptocurrency prices. One common method is "pump and dump" schemes, where manipulators artificially inflate the price of a cryptocurrency by spreading positive news or creating a sense of urgency among investors. Once the price reaches a peak, these manipulators sell off their holdings, causing the price to plummet and leaving novice investors with substantial losses.

Moreover, the lack of regulation and oversight in the cryptocurrency market makes it an attractive target for manipulators. The decentralized nature of cryptocurrencies and the absence of a central authority overseeing transactions create opportunities for fraudulent activities. Market manipulation can be carried out through various strategies, including wash trading, spoofing, and front-running, making it difficult for regulators to detect and prevent these manipulative practices.

Examining the influence of manipulation on obscuring cryptocurrency prices is crucial to understanding the risks associated with investing in cryptocurrencies. By shedding light on the tactics employed by manipulators and their impact on market dynamics, policymakers, investors, and regulators can work towards creating a more transparent and secure cryptocurrency market.

Examining the Influence of Manipulation on Obscuring Cryptocurrency Prices

In the world of cryptocurrency, market manipulation has become a prevalent concern. The volatile nature of digital currencies makes them susceptible to various forms of manipulation, which can lead to unclear and unreliable price information. This article aims to explore the impact of manipulation on obscuring cryptocurrency prices.

Understanding Market Manipulation

Market manipulation refers to the deliberate act of influencing the market to create false or misleading price movements. This can be done through various techniques, such as pump and dump schemes, spoofing, and wash trading. Manipulators often use these tactics to artificially inflate or deflate the price of a cryptocurrency, luring unsuspecting traders into making uninformed decisions.

The Effect on Price Transparency

Manipulation can significantly affect the transparency of cryptocurrency prices. When prices are manipulated, it becomes challenging for traders and investors to assess the true value of a digital asset. This lack of transparency leads to an increased risk of losses and hinders the overall growth and adoption of cryptocurrencies.

Furthermore, manipulation can create a false sense of market trends. Traders may rely on manipulated price movements to make investment decisions, resulting in distorted market analysis and inaccurate predictions.

The Need for Countermeasures

Addressing manipulation in the cryptocurrency market is crucial for upholding the integrity of the industry. Regulatory bodies and exchanges have taken steps to combat manipulation, including implementing stricter trading rules and monitoring suspicious activities.

Additionally, increased awareness and education about market manipulation can help traders identify and avoid potential manipulative practices. By promoting transparency and accountability, the industry can work towards minimizing the impact of manipulation on cryptocurrency prices.

Resource:

The Rise of Cryptocurrencies in the Financial Market

Cryptocurrencies have emerged as a disruptive force in the financial market, revolutionizing the way individuals and institutions transact and store value. With the introduction of Bitcoin in 2009, these digital currencies gained traction, and their popularity has only continued to grow ever since.

One of the key attractions of cryptocurrencies is their decentralized nature, as they operate on a technology called blockchain. This enables transactions to be recorded and verified by a network of computers, eliminating the need for an intermediary such as a bank. The decentralized nature of cryptocurrencies also makes them resistant to censorship and control by governments or financial institutions.

The rise in popularity of cryptocurrencies can partially be attributed to their potential as an investment. Bitcoin, for example, has experienced significant price volatility over the years, attracting both speculators and long-term investors. Additionally, the limited supply of certain cryptocurrencies, such as Bitcoin, contributes to their value appreciation over time.

Cryptocurrencies also offer advantages in terms of speed and cost of transactions. Traditional financial systems often involve lengthy processes and high fees, especially for cross-border transactions. In contrast, cryptocurrencies enable fast and low-cost transactions, making them particularly attractive for individuals and businesses operating globally.

Furthermore, cryptocurrencies have gained attention due to their potential as a tool for financial inclusion. In many parts of the world, traditional banking services are inaccessible to a significant proportion of the population. Cryptocurrencies offer an alternative, allowing individuals to access financial services and participate in the global economy, even without access to a traditional bank account.

However, the rise of cryptocurrencies also presents challenges and risks. The lack of regulation and oversight in the cryptocurrency market has made it vulnerable to manipulation, fraud, and security breaches. Moreover, the volatile nature of cryptocurrency prices has raised concerns about their stability and their suitability as a medium of exchange or store of value.

In conclusion, cryptocurrencies have emerged as a disruptive force in the financial market, offering decentralized transactions, investment opportunities, fast and low-cost transactions, and potential financial inclusion. However, the risks and challenges associated with cryptocurrencies also need to be addressed for their adoption to become widespread and sustainable in the long term.

The Role of Market Manipulation in Cryptocurrency Prices

Market manipulation plays a significant role in shaping the prices of cryptocurrencies. This phenomenon occurs when individuals or groups intentionally create artificial demand or supply to influence the price of a cryptocurrency. Manipulation can occur through various techniques, such as spoofing, pump and dump schemes, and wash trading.

One key way manipulation obscures cryptocurrency prices is through spoofing. Spoofing involves placing large buy or sell orders that are not executed with the intention of misleading other traders and creating a false impression of market interest. These spoof orders can create a sense of artificial liquidity in the market, which can impact the perceived value and volatility of a cryptocurrency.

Another manipulative technique is pump and dump schemes. In these schemes, manipulators artificially inflate the price of a cryptocurrency by creating hype and spreading positive news or rumors. Once the price has increased, they dump their holdings, causing a rapid decline in price and leaving other investors with significant losses. This manipulation tactic can create an illusion of value and attract unsuspecting investors.

Wash trading is yet another method used to manipulate cryptocurrency prices. It involves a trader simultaneously buying and selling the same cryptocurrency to create the impression of increased trading volume. This increased volume can attract other investors who may think that the cryptocurrency is experiencing high demand. In reality, wash trading skews the true supply and demand dynamics, leading to distorted price movements.

Market manipulation in cryptocurrencies is a significant concern as it can lead to financial losses for investors and undermine trust in the market. It is important for regulators and exchanges to implement measures to detect and prevent manipulation, such as increased transparency, strict enforcement of trading regulations, and surveillance systems.

As the cryptocurrency market continues to grow, it is crucial for investors to stay vigilant and informed about the risks associated with market manipulation. Learning to identify and understand these manipulation techniques can help investors make more informed decisions and protect themselves from potential losses.

For more information on cryptocurrency trading and market dynamics, you can visit WIE MAN SICH BEI BLUR.IO ANMELDET. This platform provides valuable resources and insights for cryptocurrency enthusiasts.

Understanding Different Manipulation Techniques

Manipulation techniques are commonly used to obscure cryptocurrency prices and create a false perception of value. Understanding these techniques is important for investors and traders to make informed decisions in the volatile cryptocurrency market.

1. Wash Trading

Wash trading is a manipulative technique where a trader simultaneously buys and sells the same asset to create artificial trading activity. This gives the illusion of high demand and liquidity, which can attract other traders and drive up prices. By repeatedly conducting wash trades, manipulators can distort the market and manipulate prices.

2. Spoofing

Spoofing involves placing large, fake orders to create the illusion of market demand or supply. For example, a manipulator might place a significant buy order for a cryptocurrency, only to cancel it once the price starts to rise. This can trick other market participants into thinking that there is strong demand and cause them to buy at inflated prices. Once the manipulator sells their holdings at the artificially high price, they cancel the remaining buy orders, leading to a sharp price drop.

To further complicate matters, manipulators may use sophisticated algorithms to automatically place and cancel these fake orders, making it difficult for other traders to detect their intent.

3. Pump and Dump

Pump and dump schemes involve artificially inflating the price of a cryptocurrency through false or misleading statements and then selling off the inflated holdings at a profit. Manipulators may use social media and other communication channels to spread hype and positive sentiment about the cryptocurrency, attracting unsuspecting investors who buy in at the inflated prices. Once the price reaches a peak, the manipulators sell off their holdings, leading to a significant price decline and causing losses for those who bought in at the high prices.

Pump and dump schemes are considered illegal in many jurisdictions and can result in severe penalties.

It's important for market participants to be aware of these manipulation techniques and exercise caution when trading cryptocurrencies. By staying informed and conducting thorough research, traders can better protect themselves against manipulative practices.

Wash Trading

A manipulative technique where a trader simultaneously buys and sells the same asset to create artificial trading activity.

Spoofing

Placing large, fake orders to create the illusion of market demand or supply.

Pump and Dump

Artificially inflating the price of a cryptocurrency through false or misleading statements and then selling off the inflated holdings at a profit.

The Impact of Insider Trading on Cryptocurrency Prices

Insider trading is a form of unethical behavior that has a significant impact on the prices of cryptocurrencies. It occurs when individuals who have privileged information about a cryptocurrency trade that information to gain a personal advantage in the market.

One of the main reasons why insider trading has such a profound impact on cryptocurrency prices is because of the decentralized nature of cryptocurrencies. Since cryptocurrencies operate outside of traditional financial systems, they are more susceptible to manipulation by insiders.

When insiders trade based on privileged information, it distorts the market, leading to artificial price movements. These price movements can be significant, especially in the case of smaller cryptocurrencies that have lower liquidity. Insider trading can create a false sense of demand or supply, leading to price volatility and market uncertainty.

Another consequence of insider trading in the cryptocurrency market is the erosion of trust among investors. When insiders exploit their insider knowledge for personal gain, it undermines the integrity of the market and reduces the confidence of investors. This can result in a decrease in trading volume and a decline in the overall value of cryptocurrencies.

Efforts are being made to combat insider trading in the cryptocurrency market. Regulatory bodies and exchanges are implementing stricter policies and surveillance systems to detect and prevent insider trading activities. However, due to the complex and decentralized nature of cryptocurrency transactions, it remains a challenging task.

Ultimately, the impact of insider trading on cryptocurrency prices cannot be ignored. It distorts the market, creates volatility, and erodes investor trust. It is crucial for the cryptocurrency industry to continue striving for transparency and accountability to mitigate the negative effects of insider trading on prices.

The Role of Pump and Dump Schemes in Obscuring Cryptocurrency Prices

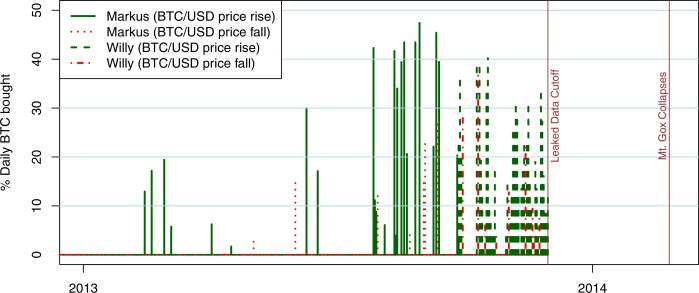

Cryptocurrency markets have been plagued by pump and dump schemes, which are orchestrated efforts to artificially inflate or deflate the prices of specific cryptocurrencies. These schemes are carried out by groups of manipulative individuals who aim to take advantage of unsuspecting investors.

The basic idea behind a pump and dump scheme is to create a false sense of scarcity or demand for a particular cryptocurrency. The manipulators buy up a large amount of the cryptocurrency at a low price, and then spread rumors and false information to create hype and attract other investors.

Once the price of the cryptocurrency has been artificially inflated, the manipulators sell their holdings at a profit, causing the price to plummet. This leaves other investors holding worthless coins and suffering significant financial losses.

One of the key ways in which pump and dump schemes obscure cryptocurrency prices is through the creation of artificial trading volume. Manipulators use various techniques to generate large trading volumes, such as wash trading, spoofing, and front running.

Wash trading involves an individual or group trading with themselves in order to create a false impression of high trading activity. This can make it difficult for legitimate investors to determine the true value of a cryptocurrency.

Spoofing involves placing large buy or sell orders with the intention of canceling them before they are executed. This creates an illusion of market demand or supply and can lead to price manipulation.

Front running occurs when a manipulator trades on insider information before a large order is executed, causing the price to move in their favor. This can distort market prices and make it difficult for other investors to make informed decisions.

By engaging in these manipulative practices, pump and dump schemes not only distort cryptocurrency prices, but also erode trust in the overall market. It is important for investors to be aware of these schemes and exercise caution when trading cryptocurrencies.

The Influence of Spoofing on Cryptocurrency Prices

In recent years, the rise of cryptocurrencies has attracted considerable attention from investors and speculators around the world. As the value of cryptocurrencies fluctuates rapidly, many researchers have focused on understanding the factors that influence their prices.

One such factor that has emerged as a significant concern is spoofing. Spoofing refers to the practice of creating false orders or other market activity to deceive traders and manipulate prices. It involves placing large buy or sell orders with no intention of executing them, thus creating a false impression of supply or demand in the market.

How does spoofing work?

Spoofing typically involves a trader placing a large order on one side of the market, creating an illusion of market strength or weakness. Once other traders observe the order and respond by adjusting their positions, the spoofer cancels the initial order, leaving the market to reverse in the opposite direction. This manipulation can lead to sharp price movements and unsuspecting traders suffering losses.

Spoofing is facilitated by the use of algorithms and automated trading systems, which can place and cancel orders at high speeds. This makes it difficult for market participants to detect and respond to spoofing in real-time, further exacerbating its impact on cryptocurrency prices.

The impact on cryptocurrency prices

The influence of spoofing on cryptocurrency prices cannot be understated. This deceptive practice creates artificial market imbalances that can lead to price distortions and increased volatility. The manipulation of prices can mislead traders and investors, making it difficult for them to make informed decisions based on actual market conditions.

Furthermore, spoofing can erode trust in the cryptocurrency market as a whole. If the market is perceived as being manipulated, investors may become wary and choose to stay away or reduce their investments. This loss of confidence can result in decreased liquidity and decreased overall market efficiency.

In conclusion, spoofing has a significant impact on cryptocurrency prices. It distorts market dynamics, increases volatility, and undermines investor confidence. Regulators and market participants need to remain vigilant and implement measures to detect and prevent spoofing in order to maintain the integrity of the cryptocurrency market.

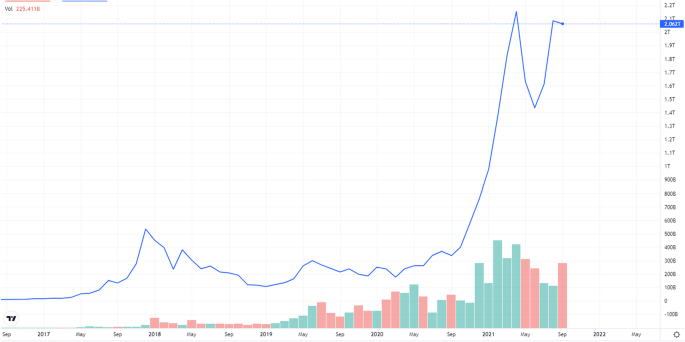

The Role of Wash Trading in Hiding the True Value of Cryptocurrencies

In the world of cryptocurrencies, the price of a coin can fluctuate wildly, often driven by market manipulation techniques. One such technique is wash trading, which plays a significant role in obscuring the true value of cryptocurrencies. Wash trading involves buying and selling a cryptocurrency simultaneously by the same person or entity, creating the appearance of increased trading volume and activity.

What is Wash Trading?

Wash trading is a deceptive practice where a trader creates artificial activity in the market by executing buy and sell orders for the same cryptocurrency. These orders can be placed through multiple accounts or coordinated with other traders, giving the illusion of high trading volume and generating false market signals. The purpose of wash trading is to manipulate market sentiment and artificially inflate the price of a cryptocurrency.

Wash trading is typically conducted using automated trading bots or algorithms, making it difficult to detect. It is particularly prevalent in less-regulated cryptocurrency exchanges where there is a lack of oversight and transparency. These exchanges often have lower liquidity, making them more susceptible to manipulation.

Impact on Price Discovery

The presence of wash trading distorts the true supply and demand dynamics of a cryptocurrency market, leading to inaccurate price discovery. With increased trading activity and apparent liquidity, unsuspecting traders may perceive a cryptocurrency as more valuable than it actually is. This can create a false sense of market strength and attract further investment, causing the price to artificially rise.

Conversely, wash trading can also be used to drive down the price of a cryptocurrency. By executing large-scale sell orders, wash traders can create panic among other traders, leading to a mass sell-off and a rapid decrease in price. This allows them to accumulate more coins at a lower price, increasing their holdings and potential profits once the price rebounds.

Detection and Prevention

Wash trading is a challenging practice to detect and prevent, but there are several strategies that can be employed. Increased regulatory oversight and stricter reporting requirements for cryptocurrency exchanges can help reduce the prevalence of wash trading. Implementing surveillance technologies and algorithms that can identify patterns indicative of wash trading can also aid in detection.

Enhancing transparency: Exchanges can improve transparency by providing detailed trading data to the public, including information on individual trades and order books.

Collaborating with regulators: Cryptocurrency exchanges should work closely with regulators to establish and enforce strict anti-manipulation policies.

Analyzing trading patterns: Advanced data analytics can be used to identify abnormal trading patterns indicative of wash trading.

Implementing penalties: Exchanges should impose severe penalties, such as fines or delisting, for individuals or entities found engaging in wash trading.

In conclusion, wash trading plays a significant role in obscuring the true value of cryptocurrencies. It distorts price discovery, manipulates market sentiment, and creates false impressions of liquidity. Detecting and preventing wash trading requires a collaborative effort between cryptocurrency exchanges, regulators, and advanced surveillance technologies.

Examining the Effect of Price Manipulation on Crypto Trading Platforms

Price manipulation can have a significant impact on cryptocurrency trading platforms. In the world of cryptocurrencies, where prices are highly volatile and subject to speculative trading, manipulation tactics can distort market conditions and deceive traders. This article aims to delve into the effects of price manipulation on crypto trading platforms and shed light on its implications.

Understanding Price Manipulation

Price manipulation refers to the deliberate and strategic actions taken by individuals or groups to influence the price of a cryptocurrency. These manipulative practices can include pump and dump schemes, spoofing, wash trading, and insider trading.

Distorted Market Conditions

Liquidity Concerns: Price manipulation can create artificial liquidity in the market, leading to misleading trading volume and depth. Traders may find it challenging to accurately assess the demand and supply dynamics in such conditions.

False Signals: Manipulation tactics can generate false technical indicators, making it difficult for traders to rely on traditional analysis tools. This can result in erroneous trading decisions and increased financial risks.

Impact on Traders

Loss of Trust: Price manipulation can erode trust in the crypto market, as traders may feel deceived and exploited by manipulative practices. This loss of trust can discourage participation in the market and hinder its growth.

Financial Losses: Traders who fall victim to price manipulation can suffer significant financial losses. Manipulators often aim to take advantage of unsuspecting traders by artificially inflating or deflating prices, leading to unfavorable trading outcomes.

Regulatory Challenges

Price manipulation presents unique challenges for regulators in the crypto space. The decentralized nature and anonymous transactions associated with cryptocurrencies make it challenging to identify and prosecute manipulative actions effectively. Regulators need to collaborate with industry stakeholders, implement transparent trading practices, and establish robust surveillance systems to combat price manipulation.

In conclusion, price manipulation can have far-reaching effects on crypto trading platforms. It creates distorted market conditions, negatively impacts traders, and poses regulatory challenges. A comprehensive understanding of price manipulation and proactive measures to detect and prevent such practices are crucial for ensuring fair and transparent trading in the cryptocurrency market.

Identifying Manipulated Cryptocurrencies in the Market

With the increasing popularity of cryptocurrencies, markets have seen an influx of various digital assets. However, the rise of manipulation tactics aimed at obscuring cryptocurrency prices has become a concerning issue.

Identifying manipulated cryptocurrencies in the market is crucial for investors and traders to make informed decisions. By recognizing and avoiding these manipulated assets, market participants can protect themselves from potential financial losses.

Signs of Manipulation

There are several signs that can indicate the presence of manipulation in the cryptocurrency market:

Unusual price movements: Manipulated cryptocurrencies often exhibit sudden and significant price swings that cannot be explained by market fundamentals.

Abnormal trading volumes: A sudden surge or decline in trading volumes, especially in illiquid markets, can be an indication of manipulation.

Wash trading: This tactic involves creating fake buy and sell orders to give the illusion of high trading activity. It can artificially inflate trading volumes and create a false sense of market demand.

Pump and dump schemes: These schemes involve artificially pumping up the price of a cryptocurrency through coordinated buying, followed by a sudden sell-off to profit at the expense of other market participants.

Suspicious trading patterns: Manipulated cryptocurrencies may exhibit repetitive and unnatural trading patterns that deviate from normal market behavior.

By carefully monitoring these signs and conducting thorough research, market participants can identify potential instances of manipulation and take appropriate actions to mitigate risks.

The Role of Data Analysis

Data analysis plays a crucial role in identifying manipulated cryptocurrencies. Utilizing advanced statistical methods and machine learning algorithms, patterns and anomalies in price movements and trading volumes can be detected.

By analyzing historical data, market participants can identify abnormal behaviors and distinguish manipulated assets from genuine ones. Data-driven techniques can uncover hidden connections and correlations that are not readily apparent on the surface.

Furthermore, the use of external data sources, such as social media sentiment analysis, can provide additional insights into the market sentiment and help in identifying potential manipulations.

WIE MAN SICH BEI BLUR.IO ANMELDET

Overall, identifying manipulated cryptocurrencies in the market requires a combination of market awareness, careful observation of key indicators, and rigorous data analysis. By staying vigilant and employing these tools and techniques, investors and traders can navigate the complex cryptocurrency market with greater confidence and make more informed decisions.

Analyzing the Consequences of Manipulated Cryptocurrency Prices for Investors

As the cryptocurrency market continues to grow and mature, the issue of price manipulation has become a significant concern for investors. Manipulation refers to the intentional act of artificially influencing the price of a cryptocurrency in order to create a false impression or to gain an unfair advantage.

There are several consequences that manipulated cryptocurrency prices can have on investors:

Loss of faith in the market: When investors discover that the prices of certain cryptocurrencies have been manipulated, it can erode their trust in the market. This loss of faith can lead to increased volatility and a decrease in overall market value.

Difficulty in making informed investment decisions: If cryptocurrency prices are manipulated, it becomes much more challenging for investors to make informed decisions. The price data they rely on may not accurately reflect the true value of a cryptocurrency, leading to potentially poor investment choices.

Inaccurate price signals: Manipulated prices can give false signals to investors, leading them to believe that a cryptocurrency is performing better or worse than it actually is. This can create an inflated or deflated perception of value, causing investors to act based on inaccurate information.

Increased risk of market manipulation: When manipulation goes unchecked, it creates an environment in which further manipulation can occur. This increased risk of market manipulation can deter institutional investors and hinder the overall growth and legitimacy of the cryptocurrency market.

Overall, the consequences of manipulated cryptocurrency prices for investors are significant. They can lead to a loss of trust in the market, make it difficult to make informed investment decisions, create inaccurate price signals, and increase the risk of further manipulation. To protect investors and ensure the long-term success of the cryptocurrency market, it is crucial to detect and mitigate manipulation as effectively as possible.

Regulatory Efforts to Combat Manipulation in the Cryptocurrency Market

In recent years, there has been an increased interest in cryptocurrencies, with Bitcoin being the most well-known and widely used. With the growing popularity of cryptocurrencies, there has also been an increase in concerns about market manipulation and the potential for fraudulent activities.

Risks of Manipulation

The decentralized nature of cryptocurrencies, lack of regulation, and the existence of unregulated exchanges make them susceptible to manipulation. Market manipulation can take various forms, including pumping and dumping, spoofing, and wash trading. These practices can distort prices, mislead investors, and undermine the integrity of the market.

Manipulation in the cryptocurrency market not only affects individual investors but also the overall market stability. It can lead to excessive volatility, unjustifiably inflated prices, and increased risks for all participants.

Regulatory Efforts

To address the concerns surrounding manipulation in the cryptocurrency market, regulatory authorities in different jurisdictions have taken various measures:

United States

The U.S. Securities and Exchange Commission (SEC) has been actively involved in regulating cryptocurrencies. It has enforced securities laws and cracked down on fraudulent activities, including manipulation. It has also provided guidance on the application of existing laws to the cryptocurrency market.

Japan

In Japan, the Financial Services Agency (FSA) has implemented regulations to combat manipulation in the cryptocurrency market. It has imposed licensing requirements on exchanges, introduced know-your-customer (KYC) and anti-money laundering (AML) measures, and established guidelines for token issuance.

European Union

The European Union (EU) has taken a comprehensive approach to regulate cryptocurrencies and address the risks of manipulation. It has proposed regulations to increase transparency, prevent money laundering, and enhance investor protection. The EU also plans to establish a regulatory framework for cryptocurrencies.

Other countries, such as South Korea, Singapore, and Switzerland, have also introduced regulatory measures to combat manipulation in the cryptocurrency market.

Additionally, international organizations, such as the Financial Action Task Force (FATF), have issued guidelines and recommendations to combat money laundering and terrorist financing in the cryptocurrency sector.

While regulatory efforts are crucial in combating manipulation in the cryptocurrency market, it is a complex challenge that requires ongoing monitoring and adaptation to evolving market dynamics.

Investors and market participants should remain vigilant, conduct thorough research, and be aware of the risks associated with cryptocurrencies.

Steps to Protect Yourself from Manipulated Cryptocurrency Prices

As the cryptocurrency market continues to grow, so does the potential for price manipulation. Manipulators can influence the price of a cryptocurrency by engaging in activities like wash trading, pump and dump schemes, and spreading false information. To protect yourself from manipulated cryptocurrency prices, consider taking the following steps:

1. Conduct thorough research

Before investing in any cryptocurrency, it is crucial to conduct thorough research. Look for projects with solid foundations, experienced teams, and a clear roadmap. Scrutinize the technology behind the cryptocurrency and assess its potential for long-term success. By conducting due diligence, you can minimize the risk of falling prey to manipulated prices.

2. Diversify your portfolio

Investing in a diverse range of cryptocurrencies can reduce the impact of price manipulation on your portfolio. By spreading your investments across different projects, you decrease the influence of any single manipulated price. This strategy can help you maintain a more stable and balanced portfolio in the face of market manipulation.

3. Stay updated with reputable sources

Stay informed about the latest news and developments in the cryptocurrency market. However, it is essential to rely on reputable and trustworthy sources for information. Be cautious of relying solely on social media platforms or anonymous online forums, as they can be sources of misleading or manipulated information. Utilize established cryptocurrency news websites and reputable trading platforms for accurate and reliable information.

4. Use technical analysis

Technical analysis involves studying chart patterns, indicators, and historical price data to make informed decisions. By learning how to read and interpret technical charts, you can identify potential manipulation and make more strategic trading decisions. Technical analysis provides a toolset to help you assess the overall market sentiment and distinguish between natural market movements and manipulated price actions.

5. Be aware of market indicators

Keep an eye on market indicators that signal potential manipulation. Unusually high trading volumes, sudden price spikes or drops, and suspicious trading patterns can be indicators of market manipulation. By actively monitoring and recognizing these indicators, you can make informed decisions and react accordingly to protect yourself from manipulated cryptocurrency prices.

While it is impossible to completely eliminate the risk of encountering manipulated cryptocurrency prices, applying these steps can significantly reduce the impact and protect you as an investor. Stay vigilant, do your due diligence, and remain proactive in protecting your investments.

What is the purpose of the study?

The purpose of the study is to examine the influence of manipulation on obscuring cryptocurrency prices.

How was the influence of manipulation on cryptocurrency prices examined?

The influence of manipulation on cryptocurrency prices was examined through a thorough analysis of market data and trading patterns.

What are some of the findings of the study?

Some of the findings of the study include evidence of manipulation techniques being used to obscure cryptocurrency prices and create artificial trading patterns.

Why is it important to study the influence of manipulation on cryptocurrency prices?

Studying the influence of manipulation on cryptocurrency prices is important because it helps to understand the factors that can distort market behavior and impact the overall stability and trustworthiness of the cryptocurrency market.

What are the potential implications of manipulation on cryptocurrency prices?

The potential implications of manipulation on cryptocurrency prices include increased volatility, reduced market transparency, and potential financial risks for investors.

How does manipulation affect cryptocurrency prices?

Manipulation can have a significant impact on cryptocurrency prices. By artificially inflating or deflating the price, manipulators can create a false perception of market demand or supply, leading to price manipulation. This can cause rapid price movements and volatility, making it difficult for traders and investors to make informed decisions.

Who is responsible for manipulating cryptocurrency prices?

The responsibility for manipulating cryptocurrency prices can lie with various actors in the market. It could be individual traders, groups of traders, or even large institutions. These manipulators often have significant resources and market influence, allowing them to execute their strategies and influence prices.

What are some common manipulation techniques used to obscure cryptocurrency prices?

There are several common manipulation techniques used to obscure cryptocurrency prices. One technique is called "pump and dump," where manipulators artificially inflate the price of a cryptocurrency and then sell it at a profit, leaving other investors with losses. Another technique is "spoofing," where manipulators place fake buy or sell orders to create the illusion of market demand or supply. These techniques, along with others, can distort market prices and mislead traders and investors.

Blur: NFT | Blur: NFT login | Blur: NFT connect | WalletConnect | Traders | What Is Blur Crypto

2022-2024 @ Examining the influence of manipulation on obscuring cryptocurrency prices