uncovering the hidden value behind cryptocurrency price fluctuations

Blur: NFT | Blur: NFT login | Blur: NFT connect | WalletConnect | Traders | What Is Blur Crypto

Blur: NFT | Blur: NFT login | Blur: NFT connect | WalletConnect | Traders | What Is Blur Crypto

In the world of finance, cryptocurrencies have emerged as a groundbreaking innovation, revolutionizing how we perceive and interact with money. However, the value of these digital assets can often appear elusive, with prices fluctuating rapidly and seemingly without rhyme or reason. This article aims to delve deeper into the hidden worth behind cryptocurrency prices, uncovering the obscurity that surrounds their valuation.

At first glance, the volatility of cryptocurrency prices may seem daunting and unpredictable. One day, a coin may be worth a fortune, only to plummet in value the next. Yet, beneath this seemingly chaotic market lies a fascinating realm of intricate factors that contribute to the rise and fall of prices.

Supply and demand play a pivotal role in shaping cryptocurrency prices. With limited supply, the demand for a particular coin can skyrocket, driving up its value. Conversely, if the demand wanes or the supply increases, prices can quickly stagnate or even plummet. Thus, understanding the dynamics of supply and demand is crucial to decipher the hidden worth of cryptocurrencies.

Market sentiment also exerts a significant influence on cryptocurrency prices. Just as in traditional finance, fear and greed can dictate market behavior, causing prices to soar or crash. News, regulations, and public opinion can swiftly trigger shifts in sentiment, leading to rapid fluctuations in prices that are sometimes difficult to comprehend.

The Obscurity in Cryptocurrency Prices: An Exploration of Hidden Worth

In the world of cryptocurrency, understanding the intricate details of price fluctuations can be a daunting task. The seemingly random nature of price movements often leaves investors puzzled, searching for hidden patterns and potential worth.

One platform that aims to uncover the obscurity in cryptocurrency prices is Blur Crypto. With its innovative technology and in-depth analytics, Blur Crypto provides users with valuable insights into the true worth of various cryptocurrencies.

By analyzing market trends, Blur Crypto helps users make informed decisions about buying and selling digital assets. Its comprehensive data analysis includes factors such as trading volume, historical price data, and market sentiment, allowing users to potentially uncover hidden opportunities for profit.

Through its user-friendly interface and user-centric approach, Blur Crypto empowers investors to navigate the complexities of the cryptocurrency market with confidence. Whether you are a seasoned trader or a newcomer to the world of cryptocurrencies, Blur Crypto provides the tools and resources necessary to understand the intricacies of price movements.

- Access to real-time market data

- Advanced analytics and charting tools

- Historical price analysis for informed decision-making

- User-friendly interface for easy navigation

- Market sentiment analysis for better market understanding

With Blur Crypto, investors no longer have to rely solely on guesswork or speculation when it comes to cryptocurrency prices. The platform's comprehensive insights and tools allow them to delve into the hidden worth of digital assets and make informed investment decisions.

So, if you're ready to uncover the obscurity in cryptocurrency prices, visit Blur Crypto today and start exploring the hidden worth waiting to be discovered.

The Intricacies of Cryptocurrency Pricing

Cryptocurrency pricing is a complex and ever-changing subject that requires a deep understanding of the market dynamics and factors that influence price movements. In this article, we will delve into the intricacies of cryptocurrency pricing and explore the various factors that contribute to the volatility and unpredictability of this emerging asset class.

One of the key factors that affect cryptocurrency pricing is market demand. Just like any other asset, the price of a cryptocurrency is determined by the forces of supply and demand. When demand for a particular cryptocurrency increases, its price tends to rise, and vice versa. However, unlike traditional assets such as stocks or bonds, cryptocurrencies are not tied to any underlying company or government, making their pricing even more complex.

Another factor that influences cryptocurrency pricing is market sentiment. Cryptocurrencies are highly speculative assets that are often driven by hype and market sentiment. Positive news and announcements about a particular cryptocurrency can create a sense of optimism and drive up its price, while negative news can lead to a decline in price. As a result, investors and traders have to closely monitor the news and sentiment surrounding various cryptocurrencies to make informed decisions.

Furthermore, the scarcity of cryptocurrencies plays a vital role in their pricing. Many cryptocurrencies have a limited supply, which creates a sense of scarcity and drives up their value. This scarcity is often achieved through mechanisms such as mining rewards, where the supply of new coins is gradually reduced over time. As a result, investors and traders perceive these limited supply cryptocurrencies as more valuable and are willing to pay a higher price for them.

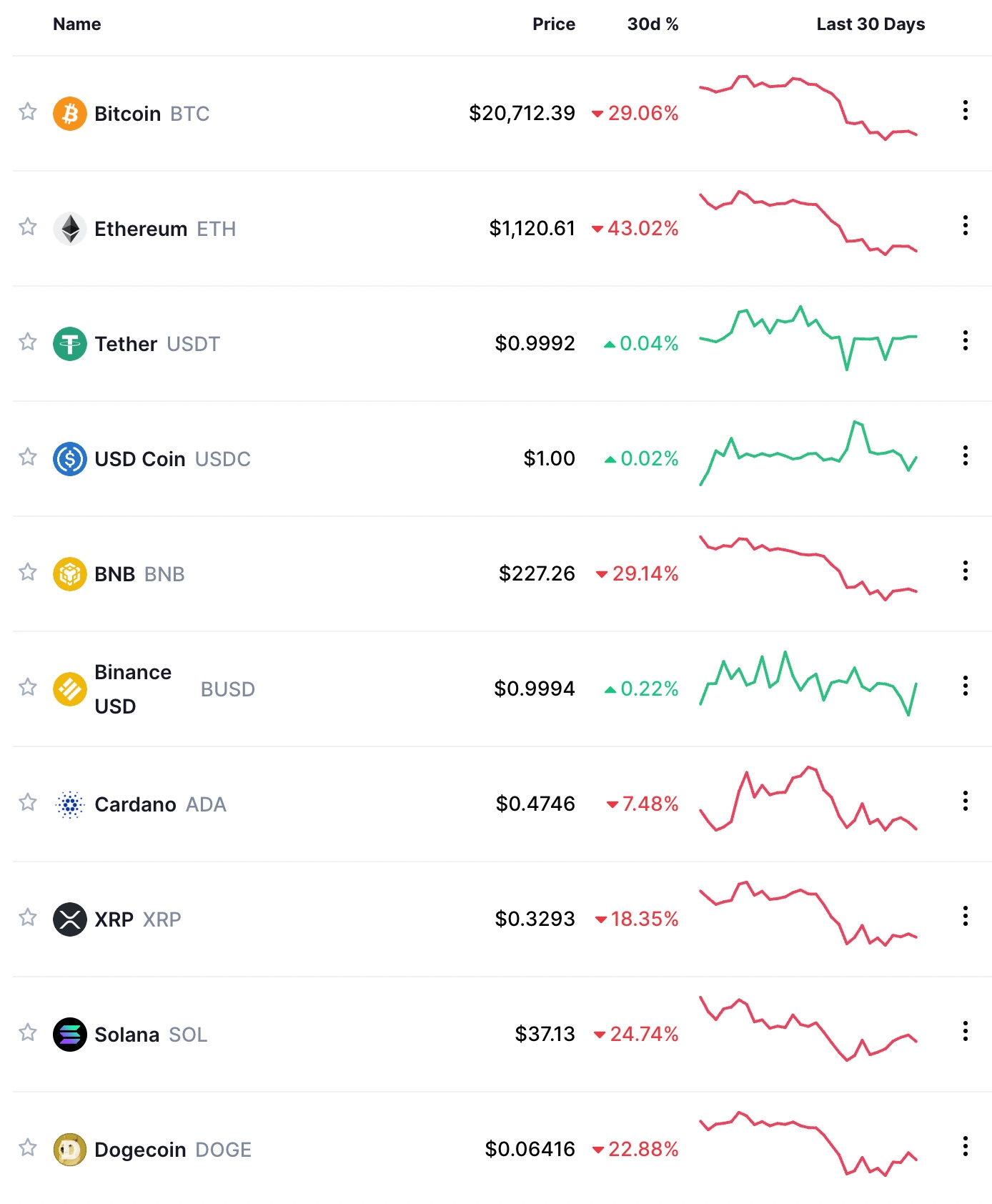

Additionally, the overall market conditions and the performance of other cryptocurrencies can also impact the pricing of a particular cryptocurrency. Cryptocurrencies are often traded in pairs, such as Bitcoin and Ethereum. If the price of Bitcoin, for example, experiences a significant increase, it can create a positive sentiment in the market and lead to a surge in the prices of other cryptocurrencies as well. However, if the overall market sentiment is negative, it can have a cascading effect and cause the prices of multiple cryptocurrencies to decline.

In conclusion, the pricing of cryptocurrencies is a multi-faceted and intricate process that involves various factors such as supply and demand dynamics, market sentiment, scarcity, and overall market conditions. Understanding these intricacies is essential for investors and traders looking to navigate the volatile world of cryptocurrencies and make informed decisions about their investments. To explore more about the cryptocurrency market, you can visit What Is Blur Crypto.

Unveiling the Mysterious Factors Influencing Cryptocurrency Prices

Cryptocurrency prices are notorious for their volatility and unpredictable nature. While some may attribute these price fluctuations to market sentiment or technical factors, there are several hidden and mysterious factors that can significantly impact cryptocurrency prices. Understanding these factors can provide valuable insights for investors and traders in this rapidly evolving market.

One of the key influences on cryptocurrency prices is regulatory developments. The decisions and actions taken by governments and regulatory bodies can have a significant impact on the value of cryptocurrencies. For example, the introduction of new regulations or bans on cryptocurrencies can cause prices to plummet, while the adoption of crypto-friendly policies can lead to a surge in demand and prices. Keeping a close eye on regulatory news and developments can help investors anticipate and react to these price movements.

Another mysterious factor that affects cryptocurrency prices is investor sentiment. Cryptocurrencies are often driven by hype and speculation, and investor sentiment can play a crucial role in determining their prices. Positive sentiment, fueled by news of mainstream adoption or technological advancements, can result in a surge in prices as more investors pile in. Conversely, negative sentiment, triggered by security breaches or regulatory concerns, can lead to significant price drops as investors panic-sell.

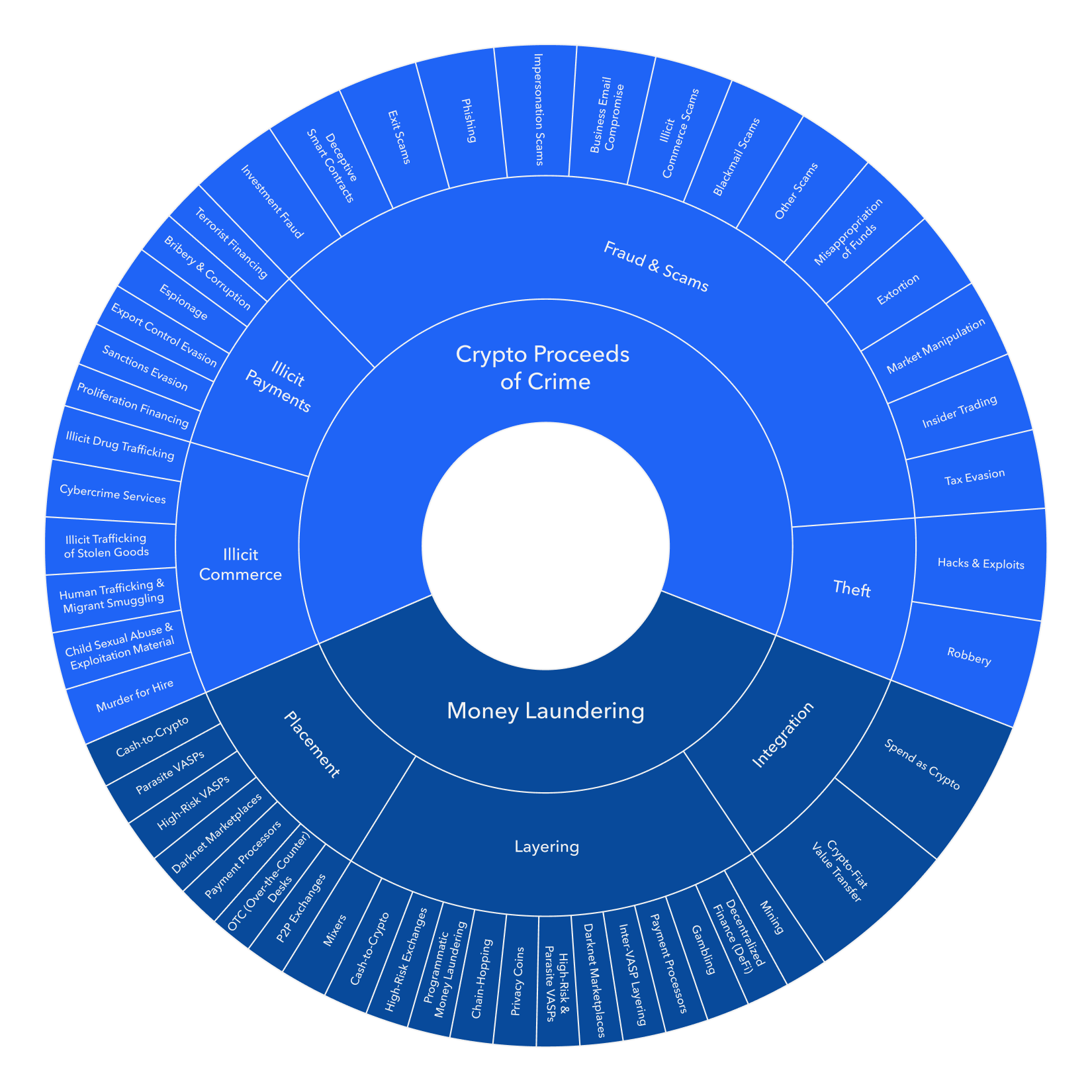

Market manipulation is yet another hidden factor that can influence cryptocurrency prices. Due to the lack of regulation and oversight in the cryptocurrency market, it is vulnerable to manipulation by large traders or "whales". These whales can carry out actions like pump-and-dump schemes, where they artificially inflate the price of a cryptocurrency before selling off their holdings, causing prices to crash. Fast-paced algorithmic trading and coordinated efforts among market participants can also contribute to price manipulation.

The overall market sentiment and trends in the broader financial markets can also impact cryptocurrency prices. During times of economic uncertainty or financial crises, investors may flock to alternative assets like cryptocurrencies as a safe haven. This increased demand can drive up prices, even in the face of negative news or developments specific to the cryptocurrency market. Similarly, positive trends in global markets can lead to increased investor confidence and a rise in cryptocurrency prices.

Lastly, media coverage plays a significant role in shaping cryptocurrency prices. Positive or negative coverage by influential media outlets can greatly impact investor sentiment and, consequently, prices. For example, favorable coverage of blockchain technology or endorsements by high-profile individuals can create positive sentiment and drive up prices. On the other hand, negative coverage highlighting security concerns or fraudulent activities can result in a sharp decline in prices.

In conclusion, while the cryptocurrency market remains highly volatile and unpredictable, there are several hidden factors that consistently impact cryptocurrency prices. These factors include regulatory developments, investor sentiment, market manipulation, overall market trends, and media coverage. By closely monitoring and understanding these factors, investors and traders can gain a better understanding of the forces driving cryptocurrency prices and make more informed decisions in this rapidly evolving market.

The Role of Supply and Demand in Cryptocurrency Valuation

When it comes to determining the value of a cryptocurrency, the forces of supply and demand play a crucial role. Supply refers to the total number of coins or tokens available in circulation, while demand represents the desire and willingness of individuals to buy those cryptocurrencies.

The relationship between supply and demand directly impacts the price of a cryptocurrency. If the demand for a particular cryptocurrency is high and the supply is limited, the price tends to increase. Conversely, if the supply exceeds the demand, the price may decrease.

One of the key factors driving the demand for cryptocurrencies is their utility and perceived value. Many cryptocurrencies offer unique features and use cases that make them attractive to investors. For example, a cryptocurrency with advanced privacy features may be in high demand in a market where privacy is of utmost importance.

Additionally, the speculative nature of cryptocurrency markets can also influence demand. Some individuals may buy cryptocurrencies with the hope of selling them at a higher price in the future, leading to increased demand and potentially driving up the price.

On the supply side, the total number of coins or tokens available is an important factor. Cryptocurrencies with a limited supply, such as Bitcoin, often experience higher demand due to their scarcity. This limited supply can create a sense of urgency among investors, leading to increased demand and higher prices.

Furthermore, the issuance rate of new coins or tokens also affects the supply. Cryptocurrencies with a fixed issuance rate, like Ethereum, may have a more predictable supply, which can impact their value. Conversely, cryptocurrencies with a rapidly increasing supply may experience lower demand and price volatility.

It's worth noting that the supply and demand dynamics in cryptocurrency markets can be influenced by various external factors. Regulatory changes, technological advancements, market sentiment, and global events all play a role in shaping the supply and demand landscape for cryptocurrencies.

In conclusion, understanding the role of supply and demand is essential for evaluating the value of cryptocurrencies. By analyzing factors such as utility, scarcity, and external influences, investors can make informed decisions and navigate the volatility of cryptocurrency markets.

Decoding the Impact of Market Sentiment on Cryptocurrency Prices

Market sentiment plays a crucial role in the volatile world of cryptocurrency prices. Although cryptocurrencies are decentralized and operate on a blockchain, their value is still greatly influenced by human emotions and sentiments in the market.

Positive market sentiment, driven by factors such as the adoption of cryptocurrencies by institutions and positive regulatory developments, can lead to a surge in demand and ultimately drive up prices. On the other hand, negative market sentiment can trigger panic selling and cause prices to plummet.

One of the ways to measure market sentiment is through sentiment analysis of social media and news platforms. Analyzing the sentiment of cryptocurrency-related posts and articles can provide valuable insights into the prevailing sentiment in the market. Machine learning algorithms can be utilized to analyze the sentiment of large volumes of data quickly and accurately.

Another factor that contributes to market sentiment is investor behavior. Greed and fear are inherent characteristics of the human psyche, and they often dictate market sentiment. When investors are optimistic and greedy, prices tend to rise rapidly as they rush to buy. Conversely, when fear takes over and investors become pessimistic, prices experience a sharp decline.

Market sentiment can also be influenced by major events and announcements. For example, the launch of a new cryptocurrency exchange or the integration of cryptocurrencies into a mainstream payment system can generate a positive sentiment and drive up prices. Similarly, negative events like hacking incidents or regulatory crackdowns can create panic and cause prices to plummet.

It is important for traders and investors to closely monitor market sentiment to make informed decisions. By staying updated with the latest news, following market influencers, and utilizing sentiment analysis tools, they can gain insights into the prevailing sentiment and potential price movements.

Overall, market sentiment plays a significant role in determining cryptocurrency prices. Understanding and decoding the impact of market sentiment is essential for traders and investors to navigate the volatile cryptocurrency market and make profitable trading decisions.

The Hidden Gems: Identifying Undervalued Cryptocurrencies

When it comes to cryptocurrency investments, it's easy to get caught up in the hype surrounding the popular coins like Bitcoin and Ethereum. But what if there were hidden gems in the vast sea of cryptocurrencies, waiting to be discovered?

Identifying undervalued cryptocurrencies can be a lucrative investment strategy. These hidden gems have the potential to skyrocket in value once their true worth is recognized by the market.

1. Research and Analysis

One of the key steps in identifying undervalued cryptocurrencies is thorough research and analysis. This involves studying the project behind the cryptocurrency, its technology, team, and community. Look for projects that have a clear use case, strong development roadmap, and passionate community support.

Examining the market trends and comparing the cryptocurrency's current price to its historical performance can also provide valuable insights. If you notice that a particular coin is significantly undervalued compared to its past trends, it may be a hidden gem worth considering.

2. Evaluating Market Sentiment

Market sentiment plays a crucial role in the valuation of cryptocurrencies. Understanding the overall sentiment towards a particular coin can help you identify undervalued opportunities. Keep an eye on social media platforms, forums, and news sources to gauge the sentiment of the crypto community.

Additionally, monitoring the trading volume and liquidity of a cryptocurrency is essential. If a coin is highly undervalued but has low trading volume and liquidity, it may be a sign that it's not gaining enough attention from investors yet.

3. Seek Expert Opinions and Diversify

Don't be afraid to seek advice from cryptocurrency experts and influencers. Following their analysis and insights can give you an edge in identifying undervalued cryptocurrencies. However, always do your due diligence and conduct your research before making any investment decisions.

Diversification is also crucial when investing in undervalued cryptocurrencies. Spread your investments across different projects and coins to mitigate risks. This way, even if one investment doesn't perform as expected, you have other potential hidden gems that can compensate for any losses.

Remember, uncovering undervalued cryptocurrencies requires patience, research, and a deep understanding of the market. By following these steps and staying informed about the latest developments in the crypto industry, you can increase your chances of identifying the next hidden gem.

The Dark Side of Cryptocurrency Prices: Manipulation and Market Distortion

Cryptocurrency prices have become a topic of great interest and speculation in recent years. While these digital assets offer the promise of financial freedom and decentralized control, their prices can also be subject to manipulation and market distortion. In this article, we will explore the dark side of cryptocurrency prices and the tactics that are used to manipulate them.

One of the main methods used to manipulate cryptocurrency prices is through spoofing. Spoofing involves creating fake buy or sell orders to create the illusion of demand or supply. This can artificially inflate or deflate the price of a particular cryptocurrency, leading to traders being misled and making poor investment decisions. Spoofing is particularly common in less liquid markets, where large orders can have a greater impact.

Another tactic used to manipulate cryptocurrency prices is wash trading. Wash trading involves an individual or group of individuals placing buy and sell orders for the same cryptocurrency to create the appearance of active trading. This can artificially increase trading volumes and give the impression of a vibrant and liquid market. Wash trading can be used to lure unsuspecting investors into buying or selling cryptocurrencies at inflated prices, only for them to find out that the market is not as active as it seems.

In addition to spoofing and wash trading, pump and dump schemes are also prevalent in the cryptocurrency market. These schemes involve artificially inflating the price of a particular cryptocurrency through aggressive marketing and promotion. Once the price has been pumped up, the individuals behind the scheme sell off their holdings, causing the price to crash and resulting in losses for unsuspecting investors. Pump and dump schemes are often coordinated through social media platforms and online forums, making it difficult for regulators to trace the individuals involved.

Market manipulation and distortion can have serious consequences for investors and the overall stability of the cryptocurrency market. It erodes trust and confidence, leading to a loss of faith in the asset class as a whole. Regulators and exchanges are working to combat these manipulative practices, implementing measures such as surveillance systems and stricter trading regulations.

As investors, it is important to be aware of the dark side of cryptocurrency prices and to exercise caution when making investment decisions. Researching the cryptocurrency, its market liquidity, and the presence of manipulative practices can help to mitigate the risks associated with market manipulation. By staying informed and vigilant, investors can navigate the cryptocurrency market with greater confidence and protect their investments.

Exploring the Relationship Between Regulatory Actions and Cryptocurrency Prices

The world of cryptocurrency is constantly evolving, with prices that can be highly volatile and influenced by a multitude of factors. One factor that has a significant impact on cryptocurrency prices is regulatory actions taken by governments and financial institutions.

Government Regulations

Government regulations play a crucial role in shaping the cryptocurrency market. When a government introduces regulations, it can have both positive and negative effects on cryptocurrency prices.

On the one hand, regulations can provide legitimacy to the cryptocurrency industry, which can boost investor confidence and lead to increased demand. This increased demand can in turn drive up cryptocurrency prices. Additionally, regulations can help protect investors from fraudulent activities and scams, making cryptocurrencies a safer investment option.

On the other hand, regulatory actions can also have a negative impact on cryptocurrency prices. For example, if a government imposes strict regulations that make it difficult for individuals and businesses to use cryptocurrencies, it can lead to decreased adoption and ultimately lower prices. Additionally, negative sentiments from investors due to regulatory uncertainties can also cause price fluctuations.

Financial Institution Actions

While government regulations have a direct impact on cryptocurrency prices, actions taken by financial institutions can also affect the market. Financial institutions, such as central banks or major investment firms, can influence the demand and supply of cryptocurrencies through various means.

For example, when a major investment firm announces its intention to invest in cryptocurrencies, it can create a positive sentiment among investors and drive up prices. On the other hand, if a central bank announces a ban or restrictions on cryptocurrency trading, it can create a negative sentiment and lead to price decreases.

Financial institutions also have the power to influence prices indirectly by introducing or withdrawing support for cryptocurrency-related services. For example, if a major payment processor starts accepting cryptocurrencies as a form of payment, it can increase the demand for cryptocurrencies and drive up prices.

Conclusion

Regulatory actions and financial institution actions have a significant impact on cryptocurrency prices. Government regulations can provide legitimacy and protection to the industry, but they can also create uncertainties that lead to price fluctuations. Financial institutions, on the other hand, can directly or indirectly affect demand and supply, influencing prices accordingly.

As the cryptocurrency market continues to grow and mature, understanding the relationship between regulatory actions, financial institution actions, and cryptocurrency prices becomes increasingly important for investors and traders.

The Elusive Connection Between News and Cryptocurrency Market Volatility

The cryptocurrency market is notorious for its volatility, with prices often experiencing extreme fluctuations in short periods of time. Many factors contribute to this volatility, including market sentiment, investor behavior, and technological developments. However, one factor that is often cited as having a significant impact on cryptocurrency prices is news.

News as a Catalyst

News has the potential to act as a catalyst for cryptocurrency market volatility. Positive news, such as the announcement of partnerships or the adoption of cryptocurrencies by major companies, can drive prices up as investors perceive these events as indications of future value. On the other hand, negative news, such as regulatory crackdowns or security breaches, can lead to a sharp decline in prices as investors lose confidence in the market.

The Challenges of Measuring Impact

While the concept of news impacting cryptocurrency prices seems intuitive, quantifying the exact relationship between the two is a complex task. One challenge is the sheer volume of news that is generated daily. Cryptocurrency news is disseminated through a wide range of sources, including social media, news websites, and specialized cryptocurrency platforms.

Another challenge is the subjective nature of news interpretation. Different investors may react differently to the same news, depending on their individual perceptions, risk tolerances, and investment strategies. This makes it difficult to establish a clear cause-and-effect relationship between news events and market volatility.

The Role of Sentiment Analysis

To overcome these challenges, researchers have turned to sentiment analysis techniques. Sentiment analysis involves analyzing text data to determine the sentiment expressed in the news. By examining the tone and content of news articles, social media posts, and other sources, researchers can gain insights into the sentiment surrounding cryptocurrencies at a given time.

These sentiment analysis techniques can help to identify patterns and correlations between news sentiment and market volatility. For example, if a particular cryptocurrency experiences a surge in positive sentiment, researchers can examine whether this correlates with an increase in prices.

Conclusion

While the connection between news and cryptocurrency market volatility is elusive, there is evidence to suggest that news does have an impact on prices. However, accurately measuring this impact and predicting future market movements based on news alone remains a challenge. As the cryptocurrency market continues to mature, further research and advancements in sentiment analysis techniques may provide a deeper understanding of this relationship.

Understanding the Role of Fear and Greed in Cryptocurrency Price Movements

When it comes to cryptocurrency price movements, there are a few key factors that play a significant role. One of these factors is the role of fear and greed in shaping the market.

The Role of Fear

Fear is a powerful emotion that can drive individuals to act impulsively and irrationally. In the cryptocurrency market, fear often manifests itself in the form of panic selling. When the price of a cryptocurrency starts to decline rapidly, fear can quickly spread among investors, leading them to sell their holdings in an attempt to minimize their losses.

This mass selling can then further drive down the price of the cryptocurrency, creating a snowball effect. This is often referred to as a "market crash" and can result in significant losses for those who bought the cryptocurrency at higher prices.

Fear can also be fueled by negative news and events surrounding a particular cryptocurrency. For example, reports of hacks, regulatory crackdowns, or other security concerns can cause investors to worry about the future prospects of the cryptocurrency and prompt them to sell.

The Role of Greed

On the other hand, greed is another powerful emotion that can influence cryptocurrency price movements. Greed is often characterized by a desire for quick profits and can lead investors to buy into a cryptocurrency when its price is surging.

When a cryptocurrency experiences a rapid increase in price, many investors are enticed by the idea of making significant profits in a short period of time. This can create a buying frenzy, as more and more investors rush to get in on the action.

However, this excessive buying can also contribute to a market bubble. When the price of a cryptocurrency becomes detached from its underlying value, it is often due to greed-driven speculation. Eventually, this bubble can burst, leading to a sharp decline in price and significant losses for those who bought in at the peak.

In conclusion, understanding the role of fear and greed is crucial when analyzing cryptocurrency price movements. These emotions can have a significant impact on market dynamics and can lead to both rapid price increases and dramatic declines. By keeping these factors in mind, investors can make more informed decisions and navigate the cryptocurrency market with greater confidence.

The Art of Technical Analysis: Uncovering Patterns in Cryptocurrency Prices

Technical analysis is the practice of studying historical price movements to predict future price movements in financial markets. When it comes to cryptocurrencies, technical analysis becomes even more crucial due to the volatile nature of these digital assets.

One of the core principles of technical analysis is the belief that price patterns repeat themselves over time, allowing traders to make informed decisions. These patterns can be identified through various tools and indicators, such as trendlines, support and resistance levels, and moving averages.

By analyzing these patterns, traders aim to identify entry and exit points for their trades, maximizing their potential profits. For example, a trader may look for a bullish pattern, such as an ascending triangle, to indicate a potential upward price movement. Conversely, a bearish pattern, such as a head and shoulders pattern, may indicate a potential downward price movement.

It is important to note that technical analysis does not guarantee accurate predictions. Price patterns can fail, and market sentiment can change rapidly. However, many traders believe that by combining technical analysis with other indicators, such as fundamental analysis and market news, they can increase their chances of making successful trades.

The art of technical analysis requires both skill and experience. It involves recognizing patterns, interpreting them correctly, and making informed decisions based on the available information. Traders often spend hours studying charts, analyzing data, and refining their strategies to gain a competitive edge in the cryptocurrency market.

In conclusion, the art of technical analysis plays a crucial role in uncovering patterns in cryptocurrency prices. By studying historical price movements and utilizing various tools and indicators, traders can make informed decisions and potentially profit from the volatile nature of cryptocurrencies. However, it is important to remember that technical analysis is not foolproof and should be used in conjunction with other analysis techniques for the best results.

The Power of Data: Utilizing Analytics to Predict Cryptocurrency Price Trends

In the volatile world of cryptocurrency trading, staying ahead of the game is crucial for investors and traders alike. One powerful tool that can give traders an edge in this ever-changing market is data analytics. By leveraging the power of data, traders can gain valuable insights into market trends and make informed decisions about buying and selling cryptocurrencies.

Data analytics involves the collection, analysis, and interpretation of data to uncover patterns, correlations, and trends. In the context of cryptocurrency trading, this means analyzing various data points, such as historical prices, trading volume, market sentiment, and external factors like news events and regulatory changes.

One of the key advantages of data analytics is its ability to identify patterns and trends that may not be immediately apparent to human traders. By using sophisticated algorithms and statistical models, data analysts can uncover hidden relationships and predict future price movements. This can help traders make more accurate predictions and improve their overall profitability.

There are several ways in which data analytics can be applied to predict cryptocurrency price trends. One common approach is to use technical analysis, which involves analyzing historical price and volume data to identify patterns that can indicate future price movements. This can include using indicators like moving averages, relative strength index (RSI), and Bollinger Bands.

Another approach is sentiment analysis, which involves analyzing social media posts, news articles, and other sources of information to gauge market sentiment. By determining whether the overall sentiment is positive or negative, traders can gain insights into how the market might react and adjust their trading strategies accordingly.

Machine learning algorithms can also be used to predict cryptocurrency price trends. By training algorithms on historical data, they can learn to recognize patterns and make predictions about future price movements. This can be particularly useful in a market like cryptocurrency, where traditional models may not be as effective due to its unique characteristics.

In conclusion, data analytics plays a crucial role in predicting cryptocurrency price trends. By harnessing the power of data, traders can gain valuable insights into market trends and make more informed decisions. Whether it's through technical analysis, sentiment analysis, or machine learning, data analytics can provide traders with a competitive edge in the highly volatile world of cryptocurrency trading.

Navigating the Uncertainty: Strategies for Managing Cryptocurrency Price Risk

Investing in cryptocurrencies can offer lucrative opportunities, but it also comes with inherent risks due to the volatility of their prices. Navigating the uncertainty and effectively managing cryptocurrency price risk is crucial for any investor in this market. Here are some strategies to consider:

Diversification: Diversifying your cryptocurrency portfolio can help mitigate risk. By investing in a variety of cryptocurrencies, you spread out your investments and reduce the impact of price fluctuations in a single currency.

Research and Analysis: Conduct thorough research on the cryptocurrencies you are interested in. Look into their underlying technology, development team, adoption rate, and market trends. This knowledge will help you make informed decisions and reduce exposure to speculative assets.

Setting Stop-Loss Orders: Use stop-loss orders to limit potential losses. A stop-loss order triggers a sale when the cryptocurrency's price reaches a predetermined level. This can help protect your investment by automatically selling before significant losses occur.

Stay Informed: Stay up-to-date with news and market developments. Cryptocurrency prices can be influenced by various factors, such as regulatory changes, technological advancements, or economic events. Being aware of these factors can help you anticipate price movements and make timely investment decisions.

Utilize Risk Management Tools: Consider using risk management tools like options or futures contracts. These financial instruments can provide hedging strategies, allowing you to protect against potential downside risks or lock in profits.

Investment Horizon: Have a clear investment horizon in mind. Cryptocurrency markets can be highly volatile in the short term, but historically, they have shown long-term growth potential. Setting realistic expectations and having a long-term strategy can help you stay focused and overcome short-term price fluctuations.

Remember, managing cryptocurrency price risk requires a combination of strategy, knowledge, and discipline. By diversifying your portfolio, conducting thorough research, and utilizing risk management tools, you can navigate the uncertainty and increase your chances of achieving favorable investment outcomes in the cryptocurrency market.

What is the article about?

The article is about exploring the hidden factors that contribute to the fluctuation in cryptocurrency prices.

Why do cryptocurrency prices fluctuate so much?

Cryptocurrency prices fluctuate due to a variety of reasons, including supply and demand, market sentiment, regulatory changes, and technological advancements.

How can I uncover the obscurity in cryptocurrency prices?

Uncovering the obscurity in cryptocurrency prices requires analyzing various factors such as trading volume, market trends, news events, and fundamental analysis of the underlying technology and project.

What are some hidden factors that affect cryptocurrency prices?

Some hidden factors that affect cryptocurrency prices include insider trading, market manipulation, whale activity, and the influence of large institutional investors.

Are there any tools or strategies to predict cryptocurrency prices?

There are various tools and strategies that can be used to analyze cryptocurrency prices, such as technical analysis, sentiment analysis, and using trading indicators. However, it is important to note that predicting cryptocurrency prices is extremely difficult and not guaranteed.

What is the importance of uncovering the obscurity in cryptocurrency prices?

Uncovering the obscurity in cryptocurrency prices is important because it allows investors and traders to make informed decisions. When the true value of a cryptocurrency is hidden or manipulated, it can lead to false market trends and potential financial losses. By exploring and uncovering the hidden worth, investors can gain a better understanding of the market and make more accurate predictions.

How can one explore and uncover the hidden worth in cryptocurrency prices?

Exploring and uncovering the hidden worth in cryptocurrency prices can be done through thorough research and analysis. This includes studying the fundamentals of a cryptocurrency, analyzing market trends, and identifying any factors that may be artificially inflating or deflating its price. It may also involve staying updated with news and developments in the cryptocurrency industry to understand the potential impact on prices. Additionally, technical analysis and charting can be used to identify patterns and trends that may help uncover hidden worth.

What are the potential risks of hidden worth in cryptocurrency prices?

The potential risks of hidden worth in cryptocurrency prices include market manipulation, false market trends, and potential financial losses for investors. When the true value of a cryptocurrency is obscured, it can lead to inflated prices and create a bubble that eventually bursts. This can result in significant losses for those who bought in at inflated prices. Additionally, hidden worth can attract fraudulent activities and scams in the cryptocurrency market, further increasing the risks for investors.

Blur: NFT | Blur: NFT login | Blur: NFT connect | WalletConnect | Traders | What Is Blur Crypto

2022-2024 @ Exploring the hidden worth uncovering the obscurity in cryptocurrency prices