Unraveling the Psychological Factors at Play

Blur: NFT | Blur: NFT login | Blur: NFT connect | WalletConnect | Traders | What Is Blur Crypto

Blur: NFT | Blur: NFT login | Blur: NFT connect | WalletConnect | Traders | What Is Blur Crypto

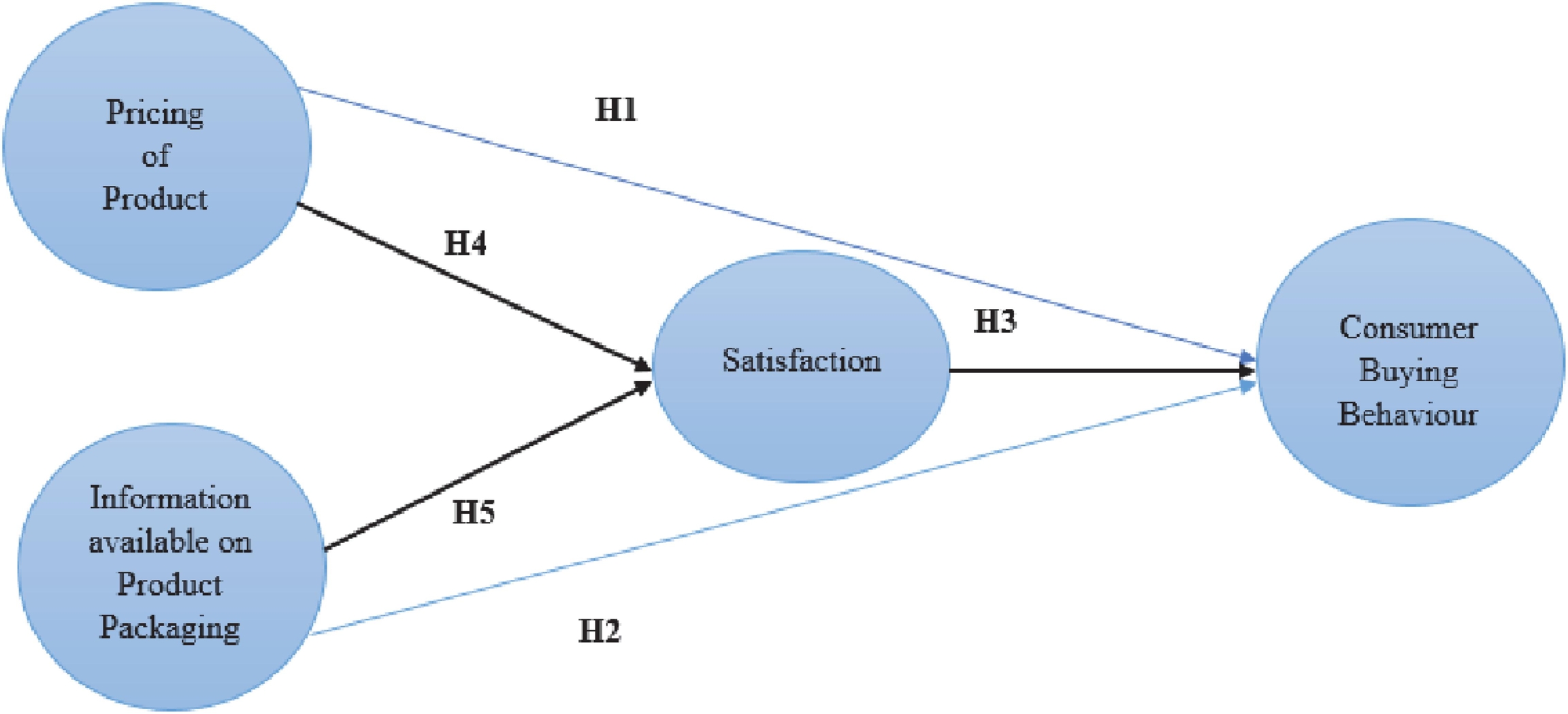

In today's fast-paced and competitive market, businesses are constantly exploring new strategies to attract and retain customers. One strategy that has gained popularity in recent years is blur pricing. This pricing strategy involves offering a range of prices for the same product or service, creating a sense of uncertainty and complexity for consumers.

Blur pricing works by presenting consumers with multiple price options, each with different features or benefits. This intentional blurring of information can have a profound impact on consumer behavior, as it taps into psychological factors such as decision-making biases and the fear of missing out (FOMO).

One psychological factor at play in blur pricing is the anchoring effect. When presented with a range of prices, consumers tend to anchor their decision on the highest or lowest price point. This anchoring effect can influence consumers' perception of value and lead them to choose a higher-priced option, even if it may not be the best fit for their needs.

Additionally, the fear of missing out (FOMO) plays a significant role in consumer behavior when faced with blur pricing. Consumers may feel compelled to choose the highest-priced option out of fear that they might miss out on exclusive features or benefits. This fear of missing out taps into consumers' desire for social status and their willingness to pay a premium for a perceived "elite" experience.

Understanding the Impact of Blur Pricing

Blur pricing, also known as dynamic pricing or personalized pricing, is a strategy used by businesses to set flexible prices for their products or services based on various factors such as demand, time of purchase, and consumer behavior. This concept has gained popularity in recent years, particularly in the e-commerce industry, due to its potential to increase profits and create a personalized shopping experience for consumers.

Consumer Behavior and Perception

A key aspect of understanding the impact of blur pricing is examining consumer behavior and perception. Research has shown that consumers often perceive blur pricing as unfair or manipulative, as it gives the impression that prices are constantly changing to the disadvantage of the consumer. This perception can lead to a decrease in trust and loyalty towards the brand, ultimately affecting the buying decision process.

However, it is important to note that not all consumers perceive blur pricing negatively. Some consumers might perceive it as an opportunity to find better deals or discounts, leading to increased satisfaction and loyalty towards the brand. Understanding these individual differences in consumer perception is crucial for businesses to implement blur pricing successfully.

Psychological Factors

Several psychological factors influence consumer behavior and decision-making in the context of blur pricing. One such factor is the concept of loss aversion. Research suggests that consumers tend to be more sensitive to price increases than price decreases. This means that when prices are dynamically adjusted upwards, consumers are more likely to perceive it as a loss and react negatively.

Another factor is the influence of social comparison. When consumers see that others are getting better deals or discounts, they may feel a sense of unfairness or jealousy, leading to negative emotions and a decrease in purchase intention. Businesses need to carefully consider how to present blur pricing to minimize these negative effects and maintain a positive consumer perception.

Lastly, the framing effect plays a role in how consumers perceive blur pricing. The way prices are presented or framed can influence consumer decision-making. For example, presenting a price as a discount or a limited-time offer can create a sense of urgency and lead to increased purchase motivation. Understanding how to effectively frame prices can be a powerful tool for businesses to leverage blur pricing and encourage consumer behavior in their favor.

In conclusion, understanding the impact of blur pricing on consumer behavior and the psychological factors involved is essential for businesses to successfully implement this pricing strategy. By considering consumer perception, psychological factors, and carefully framing prices, businesses can create a positive shopping experience for consumers and achieve their pricing goals.

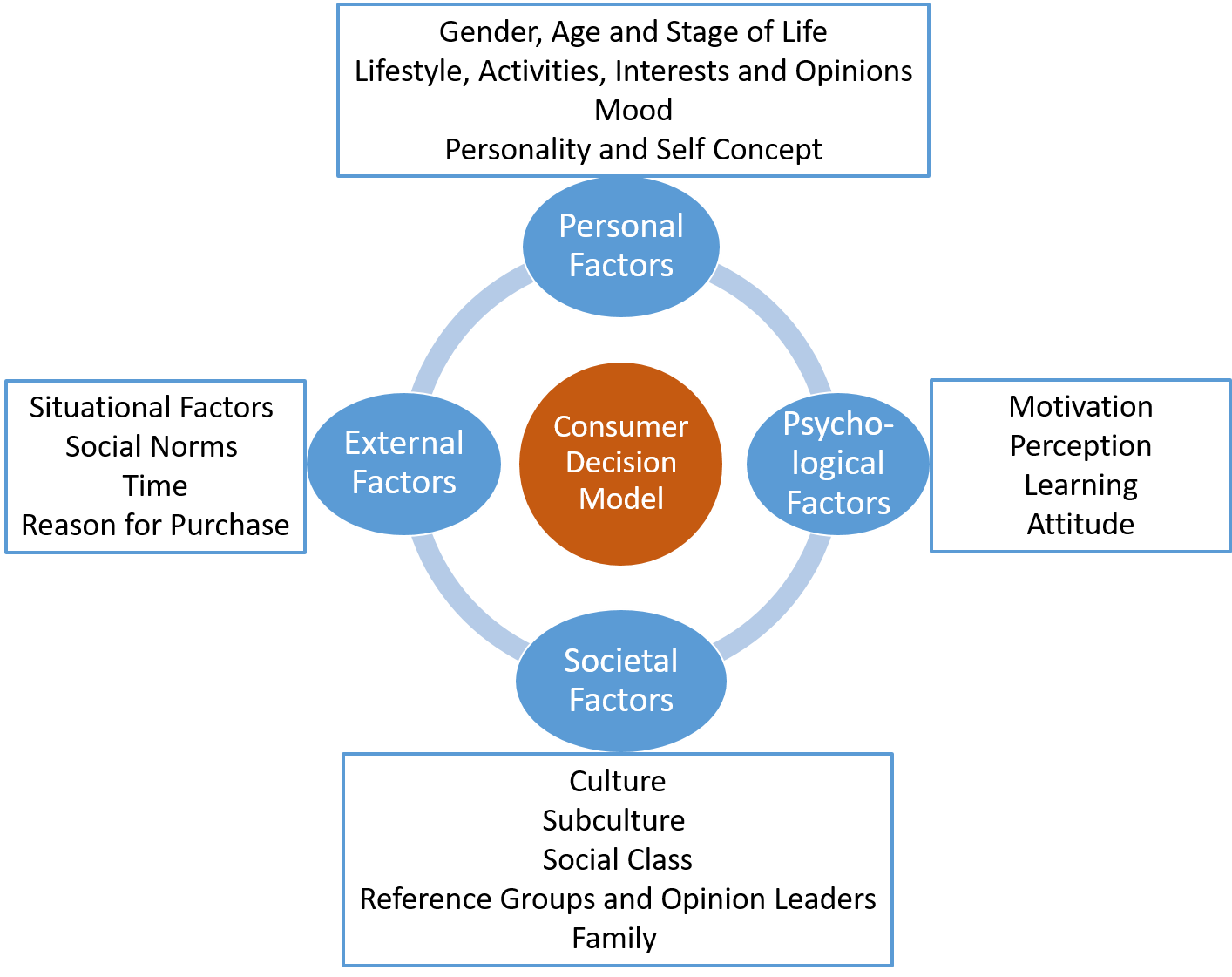

The Role of Consumer Behavior

Consumer behavior plays a crucial role in understanding the impact of blur pricing. When consumers are faced with blurred prices, their decision-making process is influenced by various psychological factors.

One key factor is the element of uncertainty. Blurred prices, which are intentionally kept vague or hidden, create a sense of mystery and intrigue. This uncertainty can increase consumer interest and engagement, as individuals are motivated to uncover the true value and meaning behind the price.

Additionally, the element of surprise can also influence consumer behavior. When consumers are faced with blurred prices, they may experience a sense of excitement and anticipation. This can lead to increased interest and a greater willingness to explore and discover new products or services.

The psychology of scarcity is another important factor to consider. When prices are blurred, consumers may perceive the product or service as scarce or exclusive. This perception can create a sense of urgency and drive individuals to make a purchase before the opportunity is lost.

Furthermore, the role of social proof cannot be ignored. When consumers see others engaging with blurred pricing, they may feel a sense of FOMO (fear of missing out) and be influenced to participate as well. This can create a domino effect, where consumer behavior is fueled by the actions and choices of others.

Overall, consumer behavior plays a crucial role in understanding the impact of blur pricing. The element of uncertainty, surprise, scarcity, and social proof all contribute to shaping consumer decision-making and engagement. To learn more about how blur pricing impacts consumer behavior, you can COME ACCEDERE ALL’ACCOUNT DI BLUR.IO and explore the fascinating world of blurred pricing.

Psychological Factors at Play

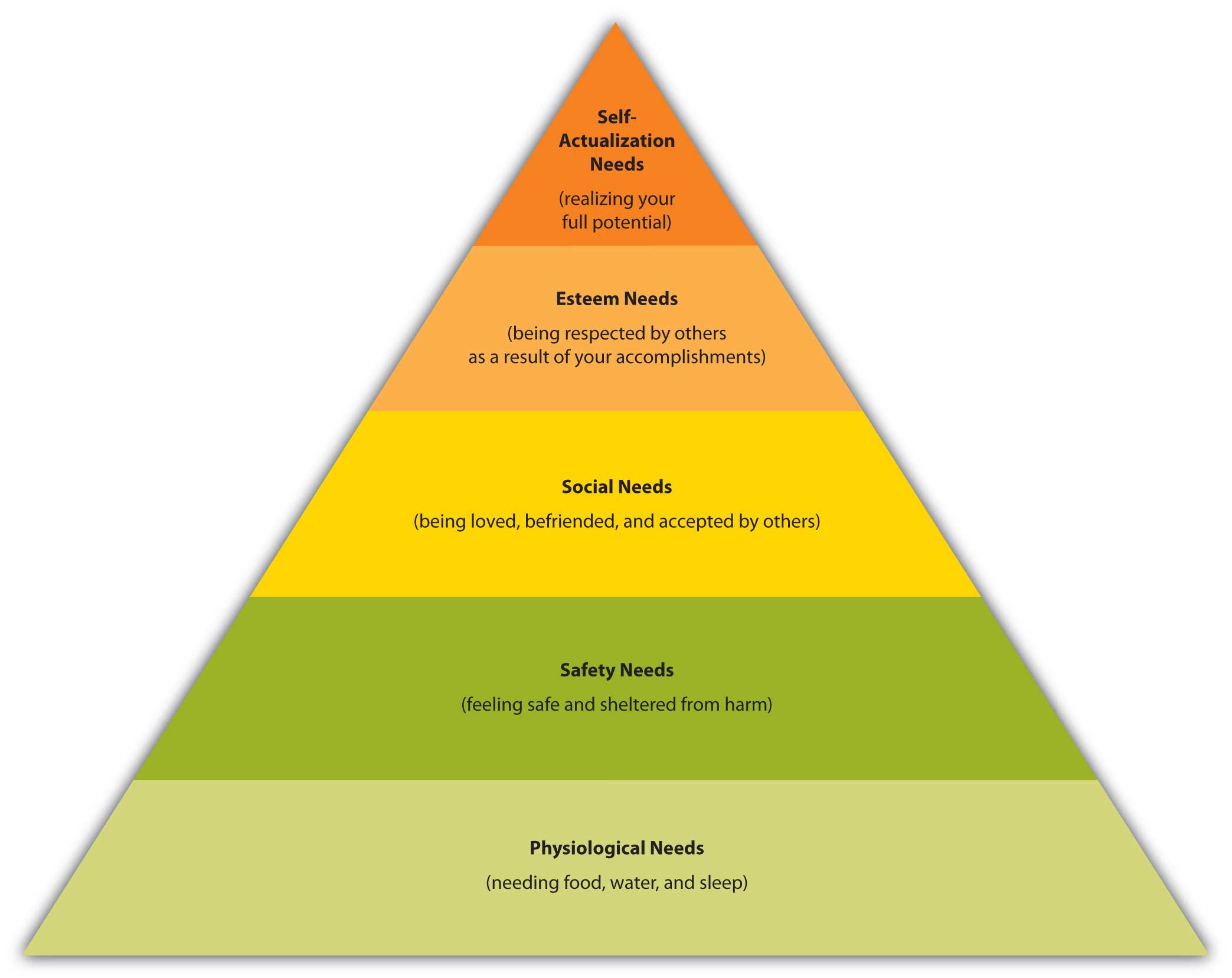

When it comes to blur pricing, there are several psychological factors at play that influence consumer behavior. These factors can have a significant impact on how consumers perceive and respond to different pricing strategies. Understanding these psychological factors is crucial for businesses looking to effectively implement blur pricing and maximize its benefits.

Loss aversion: Consumers are more sensitive to potential losses than gains. When presented with blur pricing, where prices change based on demand or other factors, consumers may feel a sense of loss if they miss out on a lower price. This fear of loss can drive them to make a purchase sooner rather than later.

Scarcity effect: Blur pricing can create a sense of scarcity, as consumers may believe that the lower prices are only available for a limited time or to a limited number of people. This feeling of scarcity can trigger a sense of urgency and a desire to take advantage of the lower prices before they increase.

Perceived value: The perception of value plays a significant role in consumer decision-making. When prices change dynamically, consumers may perceive higher value in a product or service offered at a lower price. This perception can lead to increased purchase intention and a higher willingness to pay.

Loss of control: Blur pricing can make consumers feel like they have less control over their purchasing decisions. This loss of control can create a feeling of vulnerability and increase the likelihood of impulse buying. Businesses can leverage this psychological factor by offering discounted prices during peak demand periods when consumers are more likely to make impulsive purchases.

Social proof: Consumers often look to the behavior of others when making purchasing decisions. Blur pricing can be influenced by social proof, where prices are adjusted based on the demand from other customers. This social proof can create a perception of popularity and desirability and encourage consumers to follow suit.

By understanding and leveraging these psychological factors, businesses can effectively implement blur pricing strategies to influence consumer behavior and maximize sales. However, it is essential for businesses to find the right balance between using these factors ethically and avoiding manipulative practices that can erode consumer trust.

The Connection between Blur Pricing and Purchase Decisions

Blur pricing, also known as dynamic pricing or surge pricing, is a pricing strategy employed by businesses to adjust prices based on various factors, such as demand, time of day, or customer behavior. This pricing model seeks to optimize revenue by maximizing profits during peak periods and offering lower prices when demand is low.

One of the primary goals of blur pricing is to influence consumer behavior and encourage purchase decisions. By introducing variable pricing, businesses aim to create a sense of scarcity and urgency, motivating consumers to make a purchase before prices potentially increase further.

Research has shown that blur pricing can have a significant impact on consumer behavior. When presented with fluctuating prices, consumers may experience cognitive dissonance, a psychological discomfort resulting from conflicting thoughts or beliefs. This discomfort can push individuals to make impulsive purchase decisions to resolve this internal conflict.

Another psychological factor involved in blur pricing is the fear of missing out (FOMO). When customers see prices increasing or the availability of a product decreasing, they may worry about missing out on a good deal or being left empty-handed. This fear can lead to a sense of urgency to make a purchase, even if it was not initially planned.

Blur pricing also taps into consumers' desire for instant gratification. By offering lower prices for a limited time or increasing prices gradually, businesses can capitalize on the psychological need for immediate satisfaction. Consumers may feel compelled to make a purchase to fulfill their desire for the product at a lower cost.

Additionally, blur pricing can create a sense of competitiveness among consumers. Seeing prices change in real-time or noticing that others are purchasing the product can trigger a fear of being left behind. This competitive mindset can push individuals to buy the product to keep up with others or gain a perceived advantage.

Overall, blur pricing plays on various psychological factors to influence purchase decisions. By creating a sense of urgency, scarcity, fear of missing out, and competitive motivation, businesses can drive consumers to make impulsive purchases and increase their revenue. To learn more about blur pricing and explore its impact on consumer behavior, visit CÓMO INICIAR SESIÓN EN BLUR.IO.

Influence of Perceived Value

Blur pricing, with its fluctuating and uncertain prices, often leads consumers to evaluate the perceived value of a product or service. Perceived value is a psychological construct that reflects consumers' overall assessment of the benefits and costs associated with a particular offering.

Factors Shaping Perceived Value

Several factors contribute to the formation of perceived value:

Price-Quality Relationship: Consumers often associate higher prices with better quality. Therefore, if a product or service is priced higher during the blurring process, consumers may perceive it as having higher value.

Promotional Offers: Special discounts or deals during a blurred pricing period can enhance perceived value as consumers perceive they are getting a better deal or saving money.

Past Experiences: Previous encounters with a product or service can influence perceived value. If a consumer has had positive experiences in the past, they may be more likely to perceive higher value, even at fluctuating prices.

Brand Image: Consumers' perceptions of a brand can influence perceived value. A strong and reputable brand image can create a perception of higher value, regardless of blur pricing.

Scarcity and FOMO: The fear of missing out on a good deal can increase perceived value. Blur pricing can capitalize on this by creating a sense of urgency and scarcity, leading consumers to perceive higher value.

Implications for Consumer Behavior

The influence of perceived value can impact consumer behavior in several ways:

Purchase Decisions: Consumers are more likely to make a purchase if they perceive high value in a product or service, even if the price is fluctuating.

Brand Loyalty: Positive perceptions of value can contribute to brand loyalty, as consumers associate the brand with high-quality, valuable offerings.

Word-of-Mouth: Satisfied customers who perceive high value are more likely to recommend the product or service to others, leading to positive word-of-mouth promotion.

Price Sensitivity: Consumers who highly value a product may exhibit lower price sensitivity, making them more willing to pay higher prices during blur pricing periods.

Customer Satisfaction: When consumers perceive high value and have positive experiences, they are more likely to be satisfied with their purchase and become repeat customers.

Understanding the influence of perceived value is crucial for both businesses and consumers in navigating the impact of blur pricing on consumer behavior. By considering the factors shaping perceived value and the implications for consumer behavior, businesses can effectively design and communicate their pricing strategies to maximize value perception and drive customer satisfaction and loyalty.

Effect of Price Sensitivity

Price sensitivity is a key psychological factor that influences consumer behavior, especially when it comes to blur pricing. The concept of blur pricing revolves around offering dynamic and variable prices to consumers based on various factors such as demand, supply, and individual buyer characteristics. This pricing strategy aims to maximize profitability by charging different prices to different customers for the same product or service.

One of the main reasons why blur pricing can be effective is because of price sensitivity. Price sensitivity refers to the degree to which consumers are responsive to changes in price. Some consumers are highly price-sensitive and are more likely to switch brands or delay their purchase decisions when the price of a product or service increases. On the other hand, some consumers are less price-sensitive and are willing to pay a premium for a product or service they perceive as being of high value.

When it comes to blur pricing, price-sensitive consumers may be more likely to take advantage of price fluctuations and wait for lower prices before making a purchase. They may constantly monitor prices and make purchasing decisions based on the best price available. On the other hand, less price-sensitive consumers may be less impacted by price fluctuations and may be willing to pay more for convenience or other benefits, regardless of the price changes.

Another aspect of price sensitivity is the perceived fairness of prices. Consumers may perceive dynamic pricing as unfair or unethical if they feel that they are being charged unfair prices compared to others. This perception can negatively impact their purchasing decisions and overall satisfaction with the brand or company. It is important for companies implementing blur pricing to communicate transparently about their pricing strategies and justify the price variations to mitigate any potential negative impact on consumer trust and loyalty.

Conclusion

Price sensitivity plays a significant role in the effectiveness of blur pricing. Understanding the degree of price sensitivity among different consumer segments can help companies implement effective pricing strategies. It is important for companies to consider the psychological factors involved in price sensitivity and ensure that blur pricing is implemented in a fair and transparent manner. By doing so, companies can maximize profitability while maintaining consumer trust and satisfaction.

For further information on blur pricing, please visit CÓMO INICIAR SESIÓN EN BLUR.IO.

Implications for Brand Loyalty

The implementation of blur pricing strategies can have significant implications for brand loyalty. The use of dynamic pricing can create a sense of uncertainty and inconsistency in pricing, which can erode consumer trust and loyalty to a brand. When consumers perceive that prices are changing frequently, they may feel cheated or taken advantage of, which can lead to negative attitudes towards the brand.

Additionally, blur pricing can lead to price perception issues. When consumers are not presented with clear and transparent pricing information, they may struggle to understand the true value of a product or service. This can make them question whether they are getting a fair deal or if they are being overcharged. As a result, consumers may be more inclined to explore other brands and options, which can lead to a decrease in brand loyalty.

Furthermore, the inconsistency in pricing caused by blur pricing can also lead to confusion and decision paralysis for consumers. When prices for a product or service are constantly changing, consumers may find it difficult to make a purchasing decision. They may constantly question whether they are getting the best deal or if they should wait for a better offer. This uncertainty can lead to a decrease in brand loyalty as consumers may opt for brands with more consistent pricing strategies.

It is important for brands to carefully consider the impact of blur pricing on brand loyalty. While dynamic pricing strategies can be effective for maximizing profits in the short term, the long-term implications on brand loyalty and customer relationships should not be overlooked. Brands should aim to strike a balance between implementing innovative pricing strategies and maintaining transparency and consistency in their pricing practices to build trust and retain loyal customers.

Exploring the Strategies behind Blur Pricing

Blur pricing, also known as price dispersion or price uncertainty, is a pricing strategy employed by businesses to create ambiguity and confusion in consumers' minds when it comes to pricing. This technique involves offering a range of prices for the same product or service, thereby blurring the boundaries and causing consumers to question the true value and fairness of the purchase.

There are several strategies companies use to implement blur pricing effectively:

1. Anchoring: Anchoring is a cognitive bias where individuals rely heavily on the first piece of information offered when making decisions. By presenting a high-priced option first, companies can create an anchor that influences consumers' perception of value. When subsequent lower-priced options are presented, consumers may perceive them as more affordable and, therefore, more attractive.

2. Framing: Framing involves presenting the same price in different ways to influence consumers' perceptions. For example, pricing a product at $99 may seem more appealing than pricing it at $100 because it is presented as "under $100." By framing the price in a way that emphasizes the positive aspects, companies can make the price more attractive and increase the likelihood of purchase.

3. Bundling: Bundling is a strategy where companies group multiple products or services together and offer them at a single price. This creates a sense of cost-saving and perceived value for consumers. By offering a bundle at a slightly higher price than an individual item, businesses can encourage consumers to choose the bundle and feel like they are getting a better deal.

4. Dynamic Pricing: Dynamic pricing involves adjusting prices based on real-time market demand and consumer behavior. By utilizing algorithms and data analysis, companies can set prices higher during peak demand periods and lower them during slower periods. This strategy creates a sense of urgency and scarcity, as consumers may feel pressured to make a purchase before the price increases.

5. Personalization: Personalization involves tailoring prices to individual consumers based on their preferences, purchasing history, or demographic information. By offering personalized discounts or deals, companies can create a sense of exclusivity and make consumers feel special. This strategy can increase customer loyalty and encourage repeat purchases.

Overall, blur pricing strategies are designed to exploit psychological biases and create a perceived sense of value for consumers. By understanding these strategies, consumers can become more aware of their decision-making processes and make more informed choices when faced with blur pricing tactics.

Dynamics of Dynamic Pricing

Dynamic pricing, also known as surge pricing or demand-based pricing, is a pricing strategy where businesses adjust the prices of their products or services based on various factors such as demand, supply, and market conditions. This pricing approach has gained significant popularity due to advancements in technology and the ability to collect and analyze large amounts of data in real-time.

One of the key dynamics of dynamic pricing is its ability to influence consumer behavior. By constantly changing prices, businesses can create a sense of urgency, prompting consumers to make immediate purchasing decisions. The perception of a limited-time offer or a price increase in the near future can lead to impulse buying behavior, driving up sales and revenue for businesses.

Another important aspect of dynamic pricing is its impact on consumer psychology. Studies have shown that consumers often feel a sense of excitement or satisfaction when they find a good deal or a lower price compared to the regular price. This psychological factor, known as the "thrill of the hunt," can lead to increased customer satisfaction and loyalty.

1. Increased revenue: Dynamic pricing allows businesses to maximize their revenue by adjusting prices based on demand and other market factors. By charging higher prices during peak periods or high demand, businesses can capitalize on the willingness of customers to pay more.

2. Improved competitiveness: Dynamic pricing enables businesses to stay competitive in a rapidly changing market. By monitoring and adjusting prices in real-time, businesses can respond to changes in the market and ensure their prices remain attractive to customers.

3. Better inventory management: By adjusting prices based on demand, businesses can optimize their inventory management processes. They can reduce inventory of products that are not selling well by lowering prices, while increasing prices for products that are in high demand to avoid stockouts.

In conclusion, the dynamics of dynamic pricing revolve around its impact on consumer behavior and the psychological factors involved. By constantly changing prices, businesses can drive consumer behavior, create a sense of urgency, and influence purchasing decisions. Furthermore, dynamic pricing offers several benefits for businesses, including increased revenue, improved competitiveness, and better inventory management.

Creating the Illusion of Scarcity

Scarcity is a powerful psychological factor that can influence consumer behavior in various contexts. When it comes to pricing strategies, one effective way to tap into the power of scarcity is through the use of blur pricing.

Blur pricing involves presenting consumers with dynamic pricing that fluctuates based on various factors like demand, time, or inventory levels. By creating an illusion of scarcity, businesses can invoke a sense of urgency and a fear of missing out (FOMO) in consumers, ultimately leading them to make quicker purchasing decisions.

The Fear of Missing Out

Fear of missing out is a psychological phenomenon where individuals feel anxious or apprehensive about missing out on an opportunity or experience that others are enjoying. In the context of blur pricing, the fear of missing out can push consumers to buy a product or service before the price increases or the opportunity disappears.

This fear is intensified by the illusion of scarcity created through blur pricing. By highlighting limited inventory or time-limited offers, businesses can trigger a sense of urgency in consumers, making them believe that if they don't act quickly, they will miss out on a great deal or a highly desirable item.

The Power of Scarcity

Scarcity is a powerful motivator that influences consumer behavior. When people perceive something to be scarce or difficult to obtain, they tend to assign it a higher value. This value perception can drive consumers to make purchasing decisions more impulsively, even if they might not have considered the purchase otherwise.

Blur pricing leverages the power of scarcity by creating an artificial sense of limited availability. By presenting time-limited offers or limited quantities, businesses can tap into consumers' fear of missing out and motivate them to take immediate action.

However, it's crucial for businesses to strike a balance when using blur pricing. If the illusion of scarcity is too obvious or consumers feel manipulated, it can backfire and create negative associations with the brand or product.

In conclusion, creating the illusion of scarcity through blur pricing is an effective strategy to influence consumer behavior. By tapping into the fear of missing out and leveraging the power of scarcity, businesses can generate a sense of urgency and increase conversion rates.

The Power of Personalized Pricing

Personalized pricing is a powerful tool that has the potential to significantly impact consumer behavior. By tailoring prices to individual consumers based on various factors, businesses can tap into the psychological motivations that drive purchasing decisions.

One of the main advantages of personalized pricing is its ability to appeal to consumers' sense of fairness. When prices are customized to each individual based on their specific circumstances, it creates a perception of fairness and equality. This can lead to increased trust in the business and a willingness to make purchases.

Additionally, personalized pricing can leverage the power of personalization and customization. By offering different price points and options based on individual preferences, businesses can create a sense of exclusivity and uniqueness. This can make consumers feel special and valued, leading to increased loyalty and repeat purchases.

Psychological factors also play a significant role in the effectiveness of personalized pricing. For example, the concept of "blurred pricing" where prices are intentionally presented in a way that is unclear or difficult to compare, can create a sense of urgency and scarcity. This can trigger consumers' fear of missing out (FOMO) and impulse buying behavior.

Furthermore, personalized pricing can tap into consumers' psychological desire for value and perceived savings. By offering personalized discounts or deals based on individual purchasing history or preferences, businesses can create a perception of saving money. This can lead to increased satisfaction and a positive perception of the business.

In conclusion, personalized pricing has the power to influence consumer behavior in numerous ways. By appealing to fairness, personalization, exclusivity, and psychological factors such as FOMO and the desire for savings, businesses can leverage personalized pricing strategies to their advantage.

Analysis of Consumer Response to Blur Pricing

Blur pricing is a pricing strategy that involves dynamically adjusting prices based on various factors such as demand, time, location, and customer behavior. It is a technique often used by retailers to optimize revenue and profit. Understanding the impact of blur pricing on consumer behavior is essential for businesses to effectively implement this strategy.

1. Perception and Trust

Consumers may perceive blur pricing as unfair or manipulative if they feel that they are being charged different prices for the same product or service. This can lead to a loss of trust in the business and a negative perception of the brand. Therefore, transparency and clear communication about the pricing strategy are essential to maintain consumer trust.

2. Price Sensitivity

Blur pricing can also have an impact on consumer price sensitivity. Consumers who are more price-sensitive may be more likely to notice and compare prices, resulting in a potential decrease in sales if they find alternative options. On the other hand, consumers who are less price-sensitive may be more willing to pay higher prices, leading to increased revenue for the business.

Increase in Sales

Less price-sensitive consumers

Decrease in Sales

More price-sensitive consumers

Understanding the price sensitivity of different consumer segments is crucial for businesses to effectively implement blur pricing and maximize revenue.

In conclusion, the analysis of consumer response to blur pricing involves understanding consumer perception and trust, as well as their price sensitivity. By considering these factors, businesses can develop strategies to ensure that blur pricing is implemented in a way that maintains consumer trust and maximizes revenue.

Emotional Reactions

Blur pricing, with its dynamic and fluctuating prices, can evoke a range of emotional reactions in consumers. These emotional responses play a significant role in shaping consumer behavior and decision-making processes. Understanding the psychological factors behind these emotional reactions is crucial for businesses to effectively utilize blur pricing strategies.

1. Surprise

One common emotional reaction to blur pricing is surprise. Consumers may experience surprise when they encounter unexpected price changes or variations in pricing across different platforms or time periods. This surprise can create a sense of urgency or intrigue, prompting consumers to further investigate the product or service being offered.

2. Frustration

On the other hand, blur pricing can also lead to feelings of frustration. Consumers may feel frustrated when prices increase suddenly, causing them to miss out on a previously perceived bargain. This frustration can deter repeat purchases and erode consumer trust in the business.

In some cases, frustration may even turn into anger if consumers perceive the pricing practices as unfair or manipulative. Businesses must be careful to strike a balance between maximizing profits and maintaining consumer goodwill.

3. Exhilaration

Blur pricing can also generate exhilaration in some consumers. The thrill of finding a heavily discounted item or outsmarting the pricing algorithm can create a sense of excitement and satisfaction. This emotional response may lead to higher engagement and increased spending from these consumers.

4. Confusion

Blur pricing can be complex and confusing for consumers, resulting in feelings of uncertainty and confusion. The constant fluctuations in prices and the lack of transparency may make it difficult for consumers to make informed decisions. This confusion can lead to indecisiveness or even a decision to postpone the purchase altogether.

Businesses must address this confusion by providing clear and accurate pricing information, as well as educating consumers about the benefits of blur pricing and the underlying mechanisms driving the price changes.

5. Trust and Loyalty

Finally, emotional reactions to blur pricing can also influence trust and loyalty. Transparent and consistent pricing practices can build trust and reinforce positive emotional responses, fostering consumer loyalty and advocacy. Conversely, opaque or unpredictable pricing can erode trust and create skepticism among consumers.

By understanding and addressing the emotional reactions that blur pricing can evoke, businesses can create more impactful pricing strategies and enhance consumer experiences. In a world of constantly evolving pricing models, emotional intelligence will play a crucial role in shaping the future of consumer behavior.

Response to Anchoring

Anchoring is a cognitive bias that occurs when individuals rely too heavily on an initial piece of information (the anchor) when making decisions. In the context of blur pricing, anchoring can have a significant impact on consumer behavior and perception of value.

When consumers are presented with a range of price options, the initial anchor price can influence their perception of what a fair price should be. For example, if the anchor price is set at a very high level, consumers may perceive the actual price as a great deal, even if it is still higher than what they would normally be willing to pay. On the other hand, if the anchor price is relatively low, consumers may perceive the actual price as too expensive, even if it is actually a good value.

The anchoring effect can also influence consumers' willingness to pay and their negotiation strategies. Research has shown that individuals tend to make higher initial offers and higher final purchase prices when they are exposed to a high anchor price. This suggests that businesses can use anchoring to their advantage by strategically setting the anchor price to increase the perceived value of their products or services.

However, it is important to note that the anchoring effect is not always reliable. Some individuals may be more resistant to anchoring and may be less influenced by the initial anchor price. Additionally, individuals who are more knowledgeable about the product or have prior experience with similar pricing strategies may be able to mitigate the effects of anchoring.

Overall, understanding the psychological factors involved in anchoring can be valuable for businesses implementing blur pricing strategies. By effectively utilizing anchoring, businesses can shape consumer perceptions and increase the likelihood of consumer engagement and purchase.

Perceived Fairness and Trust

Perceived fairness plays a crucial role in shaping consumer behavior when it comes to blur pricing strategies. When consumers perceive the pricing strategy as fair, they are more likely to trust the company and its products or services. On the other hand, when the pricing strategy is perceived as unfair, it can lead to a decrease in trust and a negative impact on consumer behavior.

One factor that influences perceived fairness is transparency. If the company is transparent about how the blur pricing strategy works, consumers are more likely to perceive it as fair. This can be achieved by providing clear information about the factors that determine the final price, such as supply and demand dynamics or operational costs. Transparent pricing helps consumers understand the rationale behind the fluctuating prices and reduces the perception of arbitrary or manipulative pricing tactics.

In addition to transparency, consistency is another important factor in shaping the perceived fairness of blur pricing. When consumers perceive that the pricing strategy is consistently applied and not selectively used to take advantage of certain customers, they are more likely to view it as fair. Inconsistencies in pricing, such as offering different prices to different customers for the same product or service, can lead to a sense of unfairness and erode trust.

Trust is closely linked to perceived fairness, and it is essential for maintaining a positive relationship between the company and the consumer. When consumers trust a company, they are more likely to continue doing business with them and be more forgiving when issues arise. However, a lack of trust can lead to reduced loyalty and negative word-of-mouth, which can have a significant impact on the company's reputation and overall success.

To build trust and enhance perceived fairness, companies employing blur pricing strategies should focus on open communication, consistent application of pricing, and transparent policies. By fostering a sense of fairness and trust, companies can maximize the positive impact of blur pricing on consumer behavior and ensure long-term customer satisfaction.

What is blur pricing and how does it impact consumer behavior?

Blur pricing is a pricing strategy where prices are intentionally made unclear or ambiguous to consumers. This can include pricing tiers, hidden fees, or complex pricing structures. The impact of blur pricing on consumer behavior is that it can lead to confusion and frustration, making it more difficult for consumers to make informed purchasing decisions. It can also create an illusion of value or a sense of urgency, leading consumers to make impulsive purchases.

What are some psychological factors involved in blur pricing?

There are several psychological factors involved in blur pricing. One is the scarcity effect, where consumers perceive limited availability or time-limited offers, leading to a sense of urgency to make a purchase. Another factor is the decoy effect, where a higher-priced option is presented alongside other options to make them seem more attractive. The anchoring effect is also present, where an initial price is set as a reference point, influencing consumers' perception of subsequent prices. Additionally, the ambiguity of blur pricing can lead to decision paralysis, as consumers struggle to evaluate the true value of the product or service.

How can blur pricing affect consumer trust?

Blur pricing can negatively impact consumer trust in several ways. When consumers encounter hidden fees or unexpected additional charges, it can lead to feelings of mistrust and deception. The lack of transparency in blur pricing can also make consumers question the integrity of the company, as they may perceive the pricing strategy as manipulative or exploitative. This can result in a loss of trust and a reluctance to engage in future transactions with the company.

Are there any strategies that consumers can use to protect themselves from blur pricing?

Yes, there are strategies that consumers can employ to protect themselves from blur pricing. One strategy is to carefully read the terms and conditions and look for any hidden fees or charges before completing a purchase. Comparison shopping can also be helpful, as it allows consumers to evaluate different pricing options and identify any discrepancies or misleading pricing tactics. Additionally, seeking out reviews and recommendations from other consumers can provide insights into the legitimacy and value of a product or service.

What are the potential legal implications of blur pricing?

The legal implications of blur pricing can vary depending on the jurisdiction and specific practices employed. In some cases, blur pricing tactics may be considered deceptive or misleading advertising, which is illegal in many countries. However, proving deceptive intent or establishing clear guidelines for what constitutes blur pricing can be challenging. Some countries have implemented consumer protection laws that require businesses to disclose all fees and charges upfront, which can help mitigate the negative impact of blur pricing on consumers.

What is blur pricing?

Blur pricing refers to a pricing strategy used by companies where they intentionally obfuscate the true price of a product or service, making it difficult for consumers to determine the actual cost. This can be achieved through various methods such as hidden fees, dynamic pricing, or bundled packages.

How does blur pricing affect consumer behavior?

Blur pricing can have a significant impact on consumer behavior. When consumers are unable to easily determine the true cost of a product or service, they may feel a sense of uncertainty and mistrust towards the company. This could lead to hesitation in making a purchase or a feeling of being deceived. It may also result in consumers spending more than they initially intended, as the hidden costs become apparent only after the purchase decision is made.

What are the psychological factors involved in blur pricing?

There are several psychological factors that come into play with blur pricing. One of them is the anchoring effect, where consumers anchor their perception of the value of a product or service based on the initial price they see, rather than the true cost. This can lead to consumers being more willing to pay higher prices than they normally would. Additionally, blur pricing can exploit consumers' aversion to loss by making them feel like they are missing out on a deal or opportunity if they don't purchase the product or service.

Blur: NFT | Blur: NFT login | Blur: NFT connect | WalletConnect | Traders | What Is Blur Crypto

2022-2024 @ Understanding the impact of blur pricing on consumer behavior and the psychological factors involved