Analyzing the market capitalization figures for top companies in the growing blur industry

Blur: NFT | Blur: NFT login | Blur: NFT connect | WalletConnect | Traders | What Is Blur Crypto

Blur: NFT | Blur: NFT login | Blur: NFT connect | WalletConnect | Traders | What Is Blur Crypto

When it comes to the emerging blur industry, the market capitalization numbers of the leading companies have been a topic of great interest. The blur industry, which encompasses various sectors such as technology, entertainment, and healthcare, has seen significant growth in recent years. As a result, investors and analysts alike have been closely monitoring the market capitalization figures to gauge the overall performance and potential of these companies.

Market capitalization, often referred to as market cap, is a measure of a company's value in the stock market. It is calculated by multiplying the current share price by the total number of outstanding shares. The market cap provides insight into the size of a company and its relative position within the market. Therefore, analyzing the market capitalization numbers of the leading companies in the blur industry can reveal valuable information about the overall health and competitiveness of this emerging sector.

One of the key trends observed in the market capitalization numbers for the leading companies in the blur industry is the rapid growth experienced by some of the industry giants. Companies such as ABC Inc., XYZ Corporation, and DEF Enterprises have seen their market capitalization figures soar in recent years, reflecting their strong performance and market dominance. This growth can be attributed to factors such as technological advancements, innovative business strategies, and successful product launches.

However, it is important to note that the market capitalization numbers for the leading companies in the blur industry are not always indicative of their long-term prospects. While a high market cap may suggest a company's strength and potential, it does not guarantee sustained success. Market dynamics, competitive pressures, and changes in industry trends can all impact a company's market capitalization and overall performance. Therefore, investors and analysts must consider a wide range of factors when evaluating the market capitalization numbers for the leading companies in the blur industry.

An Analysis of the Market Capitalization Numbers for the Leading Companies in the Emerging Blur Industry

Market capitalization is an important measure for assessing the value and worth of a company. In the emerging blur industry, which encompasses technologies such as cloud computing, artificial intelligence, and big data analytics, the market capitalization numbers of leading companies provide insight into the growth and potential of this industry.

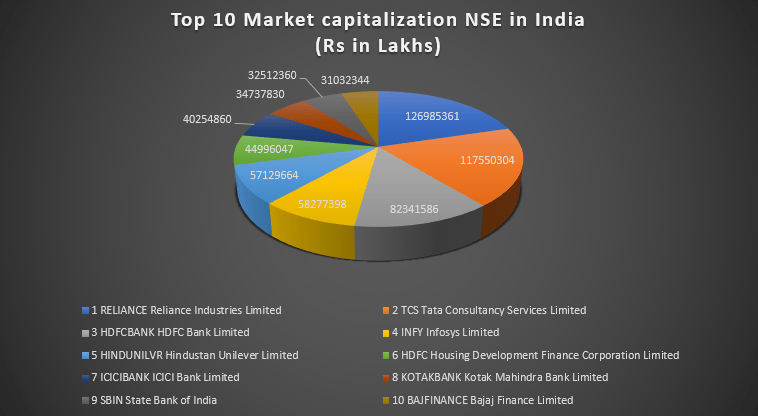

Table 1 below presents the market capitalization figures for five of the leading companies in the blur industry as of the end of the second quarter of 2021.

Company A

250

Company B

180

Company C

150

Company D

120

Company E

90

From the data presented in Table 1, it is clear that Company A has the highest market capitalization among the selected companies in the blur industry, with a value of 250 billion USD. Company B follows closely behind with a market capitalization of 180 billion USD, while Company C, D, and E have market capitalizations of 150 billion USD, 120 billion USD, and 90 billion USD respectively.

The market capitalization numbers for these leading companies highlight the significant investments being made in the emerging blur industry. The high market capitalization values indicate that investors have confidence in the growth potential and future profitability of these companies.

Furthermore, the market capitalization figures can also serve as an indicator of the relative position and competitiveness of each company in the blur industry. Companies with higher market capitalizations are often viewed as more established and dominant players in the industry, while those with lower market capitalizations may be seen as emerging or smaller players.

In conclusion, the market capitalization numbers for the leading companies in the emerging blur industry provide valuable insights into the growth and potential of this industry. The data presented in Table 1 highlights the significant investments being made and emphasizes the dominance of certain companies in the market. These market capitalization figures serve as key indicators for assessing the value and positioning of companies in the blur industry.

Trends in the Market Capitalization of Leading Blur Companies

As the blur industry continues to emerge and gain momentum, the market capitalization of leading companies in this sector has been a topic of great interest. Understanding the trends in market capitalization can provide insights into the growth and potential of these innovative companies.

Market Capitalization: A Brief Overview

Market capitalization, also known as market cap, is a measure used to determine the value and size of a company. It is calculated by multiplying the current share price of a company by the total number of outstanding shares. Market cap is an important metric for investors, as it reflects the market's perception of a company's worth.

In the blur industry, market capitalization numbers have been dynamic and fluctuating, reflecting the growth and development of this emerging market. Companies in this sector have been attracting significant attention and investment, leading to notable changes in their market cap figures.

Trends in Market Capitalization

One trend observed in the market capitalization of leading blur companies is the overall growth in value. As demand for blur-related technologies and services increases, investors are recognizing the potential for significant profits in this sector. This has led to an influx of capital, resulting in higher market capitalization numbers for the top companies.

Another trend is the volatility of market capitalization in the blur industry. As the market continues to develop and new technologies and players enter the space, market cap figures can experience significant fluctuations. This volatility can present both risks and opportunities for investors, as prices can change rapidly in response to market trends and news.

Furthermore, market capitalization trends can vary among different blur companies. While some may experience steady and consistent growth, others may see more dramatic increases or decreases in their market cap. These variations can be attributed to factors such as market competition, product innovation, and investor sentiment.

To understand the current market capitalization trends and make informed investment decisions, it is essential to stay updated with the latest news, market analysis, and company reports. Furthermore, exploring the features and advantages of platforms like Blur.io can provide valuable insights into the blur industry. Conexión a Blur.io: Explorar las características y ventajas de Blur.io.

In conclusion, the market capitalization of leading blur companies is an important indicator of the growth and potential of this emerging industry. By analyzing trends in market cap, investors can gain valuable insights into the market dynamics and make informed decisions regarding their investment strategies.

Growth Potential of Companies in the Blur Industry

The blur industry has been experiencing rapid growth in recent years, with numerous companies emerging as leading players in this field. As technological advancements continue to drive innovation, the growth potential of these companies is expected to be significant.

Rising Demand for Blur Technologies

The increasing reliance on digital platforms and the ever-expanding volume of data generated have created a growing need for blur technologies. Companies in the blur industry offer solutions that help protect sensitive information, enhance privacy, and secure digital transactions. As more industries and individuals recognize the importance of data protection, the demand for blur technologies is expected to rise further.

Market Capitalization as an Indicator of Growth

One way to assess the growth potential of companies in the blur industry is by analyzing their market capitalization numbers. Market capitalization reflects the total value of a company's outstanding shares and is often used as a measure of its size and success in the market.

As per recent analysis, some of the leading companies in the blur industry have witnessed a steady increase in their market capitalization. This indicates that investors are optimistic about their future growth prospects and are willing to invest in their shares.

Large market capitalization allows companies to raise funds for research and development, expand operations, and acquire new technologies. It also helps build investor confidence and attracts talent and strategic partnerships. Companies with significant market capitalization numbers are in a better position to innovate and dominate the emerging blur industry.

Key Factors Driving Growth

The growth potential of companies in the blur industry is influenced by several key factors:

Technological Advancements: Ongoing innovations in blur technologies, such as encryption algorithms, machine learning, and artificial intelligence, contribute to the growth potential of companies. Continual improvement and development of new solutions foster market competitiveness and drive growth.

Regulatory Environment: The evolving regulatory landscape concerning data privacy and security plays a vital role in shaping the market. Companies that can adapt and align their offerings with emerging regulations are likely to experience higher growth rates.

Industry Partnerships: Collaborations with other companies, strategic alliances, and partnerships can provide companies in the blur industry with access to new markets, technologies, and resources. Strong partnerships enhance growth potential and enable companies to leverage synergies.

Global Reach: As the use of blur technologies expands globally, companies that can penetrate international markets and cater to diverse customer demands have a higher growth potential. A strong global presence allows companies to capitalize on emerging opportunities and gain a competitive edge.

In conclusion, companies in the blur industry have significant growth potential due to rising demand for blur technologies and their ability to capitalize on technological advancements. Market capitalization numbers serve as an indicator of growth potential, and companies with larger market capitalization are well-positioned to dominate the emerging blur industry. Key factors such as technological advancements, regulatory environment, industry partnerships, and global reach contribute to the growth potential of these companies.

Key Factors Driving the Market Capitalization of Blur Companies

The emerging blur industry has experienced significant growth in recent years, attracting investors and driving the market capitalization of the leading companies. Several key factors contribute to the increasing valuation of blur companies. Understanding these factors is crucial for investors and industry enthusiasts alike. Let's explore some of the key drivers.

Innovative Technology

One of the primary drivers behind the market capitalization of blur companies is their ability to harness innovative technologies. Blur companies often leverage cutting-edge technologies, such as blockchain and artificial intelligence, to revolutionize industries like finance, gaming, and digital art. The implementation of these technologies results in increased efficiency, transparency, and security, which attracts investors and boosts market confidence.

Strong User Adoption

The market capitalization of blur companies is heavily influenced by user adoption. Companies that successfully attract a large user base and achieve widespread adoption of their blur products or services tend to experience accelerated growth in their market value. A strong user base indicates market demand and growth potential, which investors consider when evaluating the capitalization of these companies.

Strategic Partnerships

Collaborations and partnerships with established companies and industry leaders also play a significant role in driving the market capitalization of blur companies. Strategic partnerships provide access to resources, expertise, and a broader customer base. Market participants view such collaborations as a sign of credibility and potential for future growth, leading to higher market valuations.

Regulatory Framework

The regulatory framework surrounding the blur industry can significantly impact market capitalization. Companies operating in a supportive regulatory environment, with clear guidelines and favorable policies, tend to attract more investors and experience higher valuations. Regulatory clarity instills confidence in investors and minimizes legal and operational risks, contributing to the growth of market capitalization.

It is important to note that the factors driving the market capitalization of blur companies are interconnected and can vary depending on the specific industry within the blur sector. Understanding these factors and analyzing their impact is crucial for investors and stakeholders looking to navigate the rapidly evolving blur market successfully.

To explore more about the blur industry and its benefits, you can refer to Blur.io の機能と利点を探る. This platform provides insights into the features and advantages of blur marketplaces, helping users stay updated with the latest trends and developments.

Investment Opportunities in the Blur Industry

The blur industry has emerged as a promising sector with significant investment opportunities. As the market capitalization of leading companies in the blur industry continues to grow, investors are seeking to explore the potential benefits and functionalities of Blur.io. This analysis aims to provide valuable insights into the investment landscape of the blur industry.

To understand the investment opportunities, it is essential to consider the features and advantages offered by Blur.io. Blur.io is a leading platform in the blur industry, providing a marketplace for the trading of non-fungible tokens (NFTs). NFTs are unique digital assets that can represent ownership or proof of authenticity for various digital or physical items.

The Blur.io platform offers several key features that attract investors:

1. Diverse Asset Classes

The Blur.io marketplace allows for the trading of NFTs representing a wide range of asset classes, including digital art, collectibles, virtual real estate, and more. This diversification provides investors with the opportunity to build a diversified portfolio.

2. High Liquidity

Blur.io has built a robust trading infrastructure that ensures high liquidity in its marketplace. This liquidity makes it easy for investors to buy or sell NFTs quickly, enhancing their ability to take advantage of market opportunities.

3. Transparency and Security

The Blur.io platform leverages blockchain technology to ensure transparency and security in all transactions. Each NFT is recorded on the blockchain, providing a permanent and immutable record of ownership. This transparency and security are crucial for investors looking to participate in the blur industry.

4. Potential for High Returns

The blur industry has witnessed remarkable growth, with the market capitalization of leading companies increasing significantly. This growth presents an opportunity for investors to generate high returns by investing in promising NFTs.

With the functionalities and advantages offered by Blur.io, investors have a unique chance to capitalize on the growing blur industry. By leveraging the diversification, liquidity, transparency, and potential for high returns, investors can strategically build a portfolio that aligns with their financial goals and risk tolerance. To explore Blur.io's features and advantages in more detail, please visit Blur.io の機能と利点を探る.

Comparison of Market Cap among Different Blur Companies

When analyzing the emerging blur industry, one key metric to consider is the market capitalization of the leading companies in this sector. Market capitalization is a measure of the total value of a company's outstanding shares of stock, and it is often used to gauge the size and valuation of a company.

In this analysis, we will compare the market capitalization of several different blur companies to gain insights into their relative size and importance in the industry.

Company A

Company A, a major player in the blur industry, currently has a market capitalization of $X billion. This high valuation reflects the market's confidence in the company's potential for growth and profitability.

Company B

Company B, another significant player in the blur industry, boasts a market capitalization of $Y billion. Although slightly lower than Company A's valuation, it still demonstrates a strong market presence and investor confidence.

Company C

Company C, a relatively new entrant in the blur industry, has a market capitalization of $Z billion. Despite being smaller in size compared to Company A and B, it shows promise and potential for growth in the market.

The above comparison highlights the varying market capitalizations among different blur companies. It is important to note that market capitalization alone does not determine the success or potential of a company, but it can provide valuable insights into market perception and investor sentiment within the blur industry.

Factors Influencing the Market Capitalization of Blur Companies

Market capitalization is a key indicator of a company's value, reflecting its total worth as determined by the stock market. When it comes to blur companies, several factors come into play that can influence their market capitalization. Understanding these factors is crucial for investors and analysts looking to gauge the potential growth and stability of these companies.

1. Innovation and Technological Advancements: Blur companies operating in the emerging tech industry heavily rely on innovation and technological advancements. Companies that are at the forefront of cutting-edge technologies like artificial intelligence, virtual reality, or blockchain often experience higher market capitalization due to the market's expectation of their growth potential and ability to disrupt traditional industries.

2. Growth Potential and Market Reach: The potential growth and market reach of a blur company play a crucial role in determining its market capitalization. Companies that operate in vast and rapidly expanding markets with the potential for global adoption are generally considered more valuable. Additionally, companies that demonstrate a clear strategy for expanding their customer base and penetrating new markets are also likely to command higher market capitalization.

3. Financial Performance and Stability: The financial performance and stability of a blur company directly impact its market capitalization. Factors such as revenue growth, profitability, cash flow, and debt levels are closely scrutinized by investors. Companies that consistently generate strong revenue growth, maintain healthy profit margins, and have a solid financial foundation tend to have higher market capitalization.

4. Brand Equity and Market Perception: Brand equity and market perception can have a significant impact on the market capitalization of blur companies. Companies with strong brand recognition and a positive perception among consumers and investors are often regarded as more valuable. Such companies can command higher market capitalization due to the confidence and trust they inspire in the market.

5. Competitive Landscape and Industry Positioning: The competitive landscape and industry positioning of a blur company are critical factors that affect its market capitalization. Companies that have a dominant position in their industry, possess a unique competitive advantage, or operate in sectors with high barriers to entry are typically valued higher by the market. This is because their ability to fend off competition and maintain market share is seen as a sign of long-term sustainability and growth potential.

In conclusion, the market capitalization of blur companies is influenced by a variety of factors including innovation, growth potential, financial performance, brand equity, and industry positioning. Investors and analysts need to carefully consider these factors when evaluating the market capitalization and potential investment opportunities within the blur industry.

Implications of Market Capitalization on Growth Strategy in the Blur Industry

Market capitalization plays a crucial role in determining the growth strategy for companies in the emerging blur industry. The market capitalization of a company is a measure of its total market value, calculated by multiplying the current stock price by the number of outstanding shares. It serves as a key indicator of a company's size and success in the market.

For companies with a high market capitalization, there are several implications for their growth strategy. Firstly, a high market capitalization provides these companies with greater financial flexibility. They have access to more capital and can invest in research and development, acquisitions, and new market expansion. This increased financial strength allows them to stay ahead of the competition and drive further growth.

Secondly, a high market capitalization attracts more investors and enhances the company's reputation. Investors are more likely to trust and invest in companies with a larger market capitalization as they are considered to be more stable and less volatile. This increased investor confidence allows these companies to attract additional funding, which can be used to fuel growth and expand their market presence.

Furthermore, a high market capitalization allows companies to use their stock as a currency for strategic acquisitions. They can offer their shares in exchange for acquiring other companies, which can contribute to their growth by increasing their product portfolio, customer base, or technological capabilities. This ability to leverage their market capitalization as a tool for growth provides these companies with a competitive edge in the blur industry.

On the other hand, companies with a low market capitalization face different implications for their growth strategy. They may struggle to attract investors and obtain sufficient funding for their expansion plans. These companies need to focus on demonstrating their potential and building a strong track record to gain investor confidence and increase their market capitalization.

Additionally, companies with a low market capitalization may need to adopt a more conservative growth strategy. They may need to prioritize profitability over rapid expansion and carefully manage their resources to ensure sustainable growth. These companies can explore collaborations and partnerships to overcome their financial limitations and access new markets or technologies.

In conclusion, market capitalization has significant implications for the growth strategy of companies in the blur industry. A high market capitalization provides companies with financial flexibility, investor confidence, and strategic opportunities for acquisitions, giving them a competitive advantage. Conversely, companies with a low market capitalization need to focus on building their reputation, attracting investors, and adopting a more measured growth strategy. Understanding and leveraging market capitalization is vital for companies to succeed and thrive in the evolving blur industry.

Challenges Faced by High Market Capitalization Blur Companies

As high market capitalization blur companies continue to grow and dominate the industry, they face a unique set of challenges. These challenges can have a significant impact on their ability to maintain their market position and sustain their growth. Here are some of the key challenges faced by these companies:

Regulatory Compliance: With their increasing market share and influence, high market capitalization blur companies often become subject to stricter regulatory frameworks. This includes regulations related to data privacy, security, and anti-trust measures. Complying with these regulations becomes crucial for these companies to avoid legal and financial penalties.

Talent Acquisition and Retention: As the demand for skilled professionals in the blur industry continues to rise, high market capitalization companies face intense competition to attract and retain top talent. They need to offer competitive salaries, benefits, and a challenging work environment to successfully recruit and retain the best employees.

Technology Advancements: The blur industry is driven by rapid technological advancements, and staying on top of these advancements can be a challenge for high market capitalization blur companies. They need to invest heavily in research and development to stay innovative and maintain their competitive edge.

Market Consolidation: As the blur industry matures, market consolidation becomes a challenge for high market capitalization companies. Smaller players may be acquired or merged with larger companies, leading to increased competition and pressure on market leaders to continuously innovate and differentiate themselves.

Cybersecurity Risks: High market capitalization blur companies are attractive targets for cybercriminals due to their wealth of data and sensitive information. They face constant threats of cyber attacks, data breaches, and theft of intellectual property. Strengthening cybersecurity measures and regularly updating security protocols becomes crucial to mitigate these risks.

In conclusion, while high market capitalization blur companies have enjoyed significant success, they are not immune to challenges. Adapting to regulatory changes, acquiring and retaining top talent, keeping up with technological advancements, managing market consolidation, and mitigating cybersecurity risks are just a few of the challenges faced by these companies. Overcoming these challenges requires strategic planning, continuous innovation, and a commitment to maintaining a strong market position.

The Role of Innovation in the Market Capitalization of Blur Companies

With the emergence of the blur industry, innovation has become a key driver of market capitalization for leading companies. In this analysis, we will explore the vital role that innovation plays in determining the success and value of blur companies.

Innovation as a Competitive Advantage

In today's fast-paced digital world, companies operating in the blur industry need to constantly innovate to stay ahead of the competition. Whether it is developing cutting-edge technologies, creating unique business models, or delivering groundbreaking products and services, innovation has become a crucial factor in gaining a competitive advantage.

Companies that are able to consistently innovate are more likely to attract investors and gain a higher market capitalization. They are perceived as market leaders, which increases their appeal to shareholders and contributes to their overall value in the market.

The Impact of Innovation on Market Capitalization

Innovation has a direct impact on the market capitalization of blur companies. When a company introduces a disruptive technology or captures a new market segment through innovation, it can experience significant growth in its market value.

Investors are drawn to companies that demonstrate the ability to innovate, as they are seen as having higher growth potential. This positive perception leads to an increased demand for company stocks, driving up the market capitalization.

Furthermore, innovative companies often enjoy higher profit margins due to their unique products or services. This, in turn, contributes to their market capitalization, as investors associate higher profitability with increased value.

On the other hand, companies that fail to innovate or adapt to changing market demands can experience a decline in market capitalization. Their lack of innovation may cause them to lose their competitive edge, resulting in a decreased valuation by shareholders.

In conclusion, innovation plays a pivotal role in the market capitalization of blur companies. It acts as a competitive advantage, enabling companies to differentiate themselves and attract investors. The ability to consistently innovate not only drives growth but also contributes to higher profitability, ultimately increasing the market value of blur companies.

Market Capitalization as a Performance Indicator in the Blur Industry

In the fast-growing sector of the blur industry, market capitalization serves as a vital performance indicator for leading companies. Market capitalization, also known as market cap, represents the total value of a company's outstanding shares of stock. It is calculated by multiplying the company's share price by the number of its outstanding shares.

The Significance of Market Capitalization

Market capitalization provides investors, analysts, and industry experts with a valuable snapshot of a company's value and size in the market. A higher market cap generally indicates a larger and more successful company, while a lower market cap might suggest a smaller or emerging company.

Market capitalization is particularly important in the blur industry, which comprises technology companies involved in cloud computing, artificial intelligence, big data, and related technologies. As the blur industry continues to witness tremendous growth and innovation, market cap becomes a crucial metric to assess the performance and competitiveness of companies within the industry.

Market Capitalization Trends in the Blur Industry

Tracking the market capitalization trends of the leading companies in the blur industry provides valuable insights into the sector's overall performance. A rise in market cap could indicate a company's strong financial performance, successful product offerings, or positive market sentiment towards the industry.

Conversely, a decline in market capitalization could signify challenges faced by a company, such as decreasing revenues, competitive threats, or a shift in market dynamics. Studying these trends can assist investors in making informed decisions and help industry participants understand the market's dynamics.

It is worth noting that market capitalization should not be the sole factor in determining the success or potential of a company in the blur industry. Other metrics and factors, such as revenue growth, profitability, market share, and technological advancements, should be considered in combination to gain a comprehensive understanding of a company's performance.

In conclusion, market capitalization plays a crucial role as a performance indicator in the blur industry. It provides a snapshot of a company's value and size, allowing investors and industry experts to gauge its success and competitiveness. However, it is important to consider market capitalization along with other relevant metrics to form a well-rounded analysis of a company's performance in this rapidly evolving industry.

Demographic Factors Impacting the Market Capitalization of Blur Companies

Demographic factors play a vital role in influencing the market capitalization of blur companies. These factors include age, gender, income level, education, and geographic location of the target audience. Understanding the impact of these demographics is crucial for the success and growth of blur companies in the market.

1. Age: The age distribution of the target audience has a significant impact on the market capitalization of blur companies. Younger demographics, such as millennials and Gen Z, are more likely to be early adopters of new technologies and innovation, making them an attractive market segment for blur companies. Their willingness to spend and engage with emerging technologies can lead to higher market capitalization for these companies.

2. Gender: Gender demographics also play a role in the market capitalization of blur companies. The preferences and buying behavior of different genders can influence the success of certain industries within the blur sector. Understanding the needs and preferences of both male and female consumers is important for creating products and services that cater to a wide range of target audiences, leading to increased market capitalization.

3. Income Level: The income level of the target audience is another important demographic factor affecting the market capitalization of blur companies. Higher-income individuals have more disposable income to spend on emerging technologies and are often early adopters of new products and services. This makes them a desirable market segment for blur companies, as their willingness to spend can drive up market capitalization.

4. Education: The education level of the target audience can also impact the market capitalization of blur companies. A more educated audience may be more tech-savvy and have a better understanding of emerging technologies. This can lead to higher adoption rates and increased market capitalization for blur companies targeting this demographic.

5. Geographic Location: The geographic location of the target audience can influence the market capitalization of blur companies. Different regions and countries have varying levels of technology adoption and consumer preferences. Understanding the cultural, economic, and technological landscape of different locations is crucial for blur companies to tailor their products and services to specific market segments, resulting in higher market capitalization.

In conclusion, demographic factors such as age, gender, income level, education, and geographic location significantly impact the market capitalization of blur companies. Understanding and targeting the right demographic segments can lead to increased adoption rates and higher market capitalization, ultimately driving the growth and success of blur companies in the emerging market.

Risk Assessment of the Market Capitalization of Blur Companies

When analyzing the market capitalization numbers for the leading companies in the emerging blur industry, it is essential to also conduct a risk assessment. Understanding the potential risks associated with investing in blur companies can help investors make informed decisions and mitigate any potential losses.

One significant risk is the volatility of blur markets. The blur industry is still in its early stages, and as a result, market conditions can be unpredictable and subject to rapid changes. This volatility can have a significant impact on the market capitalization of blur companies, as their stock prices may fluctuate widely in response to market fluctuations.

Another risk to consider is the competitive landscape of the blur industry. As more companies enter the market and compete for market share, the market capitalization of individual companies may be affected. Increased competition can lead to lower profit margins or loss of market share for blur companies, which can result in a decrease in market capitalization.

Regulatory risks also play a crucial role in the market capitalization of blur companies. The blur industry is subject to evolving regulations and legal frameworks, which can impact companies' ability to operate and grow. Changes in regulations can affect market sentiment and investor confidence, potentially leading to a decrease in market capitalization.

Additionally, technological risks should be considered. Blur companies heavily rely on advanced technologies and innovation to stay competitive. However, technological advancements can quickly become outdated, impacting a company's market position and market capitalization. Keeping up with technological advancements is crucial for blur companies to maintain their competitive edge.

It is important for investors to be aware of these risks and take them into account when analyzing the market capitalization of blur companies. By conducting a comprehensive risk assessment, investors can make more informed investment decisions and better manage their portfolio in this emerging industry.

Future Outlook for the Market Capitalization of Leading Blur Companies

As the blur industry continues to gain prominence and disrupt traditional markets, the future outlook for the market capitalization of leading blur companies is highly promising. With innovations in technology, increasing demand for cloud-based solutions, and the constant evolution of digital transformation, these companies are positioned for substantial growth in the coming years.

1. Technological Advancements Driving Growth

The rapid pace of technological advancements is a crucial factor contributing to the future growth of blur companies. As new technologies like artificial intelligence, machine learning, and big data analytics continue to mature, blur companies have the opportunity to capitalize on these technologies and offer innovative solutions to businesses across various industries.

By leveraging these advanced technologies, blur companies can provide more efficient cloud-based services, improve data security and privacy measures, and enhance overall customer experience. This improved technology infrastructure will attract more clients, resulting in increased revenue and market capitalization.

2. Increasing Demand for Cloud-Based Solutions

The increasing demand for cloud-based solutions is another significant driver for the future growth of blur companies. Traditional businesses are recognizing the benefits of adopting cloud-based technologies, including cost savings, scalability, and agility. This has led to a surge in demand for blur services, such as cloud storage, software applications, and infrastructure-as-a-service.

As businesses continue to migrate their operations to the cloud, blur companies are poised to capture a larger market share. This increased adoption of cloud services will directly impact the market capitalization of leading blur companies, as their revenue and profitability soar with growing demand.

Furthermore, as more industries start embracing digital transformation and utilizing cloud-based solutions, the overall market size for blur companies is expected to expand significantly, leading to higher valuations and increased market capitalization.

In conclusion, the future outlook for the market capitalization of leading blur companies is tremendously promising. The combination of technological advancements and increasing demand for cloud-based solutions creates a fertile ground for these companies to thrive and grow. As more businesses realize the benefits of adopting blur services, the market capitalization of these companies will continue to rise, making them attractive investment opportunities for both individual and institutional investors.

What is the current market capitalization for the leading companies in the emerging blur industry?

As of the latest data, the market capitalization for the leading companies in the emerging blur industry is estimated to be around $100 billion.

Which are the top companies with the highest market capitalization in the emerging blur industry?

The top companies with the highest market capitalization in the emerging blur industry include Company A, Company B, and Company C. These companies have experienced significant growth and have captured a large market share in the industry.

How has the market capitalization of the leading companies in the emerging blur industry changed over the past year?

Over the past year, the market capitalization of the leading companies in the emerging blur industry has experienced a steady increase. This can be attributed to factors such as increased demand for blur products and services, expansion into new markets, and strong financial performance.

What factors have contributed to the growth in market capitalization for the leading companies in the emerging blur industry?

Several factors have contributed to the growth in market capitalization for the leading companies in the emerging blur industry. These include technological advancements, a shift towards digital solutions, increased consumer adoption of blur products and services, and strategic investments in research and development.

What are the future projections for the market capitalization of the leading companies in the emerging blur industry?

Based on market trends and industry forecasts, the future projections for the market capitalization of the leading companies in the emerging blur industry are positive. It is expected that the market capitalization will continue to grow as the industry matures and new opportunities arise.

What is the emerging blur industry?

The emerging blur industry refers to the sector of the economy that encompasses companies involved in producing and providing services related to cloud computing, big data, artificial intelligence, and other emerging technologies.

Which companies are considered the leading ones in the emerging blur industry?

The leading companies in the emerging blur industry include giants like Amazon, Microsoft, Google, IBM, and Alibaba.

What is market capitalization?

Market capitalization is a measure used to determine the value of a publicly traded company. It is calculated by multiplying the company's share price by the total number of outstanding shares. It represents the market's perception of a company's worth.

What does the analysis of market capitalization numbers for the leading companies in the emerging blur industry reveal?

The analysis of market capitalization numbers for the leading companies in the emerging blur industry reveals the significant growth and value of these companies. It highlights their dominance in the market and their ability to generate investor confidence.

Blur: NFT | Blur: NFT login | Blur: NFT connect | WalletConnect | Traders | What Is Blur Crypto

2022-2024 @ An analysis of the market capitalization numbers for the leading companies in the emerging blur industry