deciphering the unpredictable market trends.

Blur: NFT | Blur: NFT login | Blur: NFT connect | WalletConnect | Traders | What Is Blur Crypto

Blur: NFT | Blur: NFT login | Blur: NFT connect | WalletConnect | Traders | What Is Blur Crypto

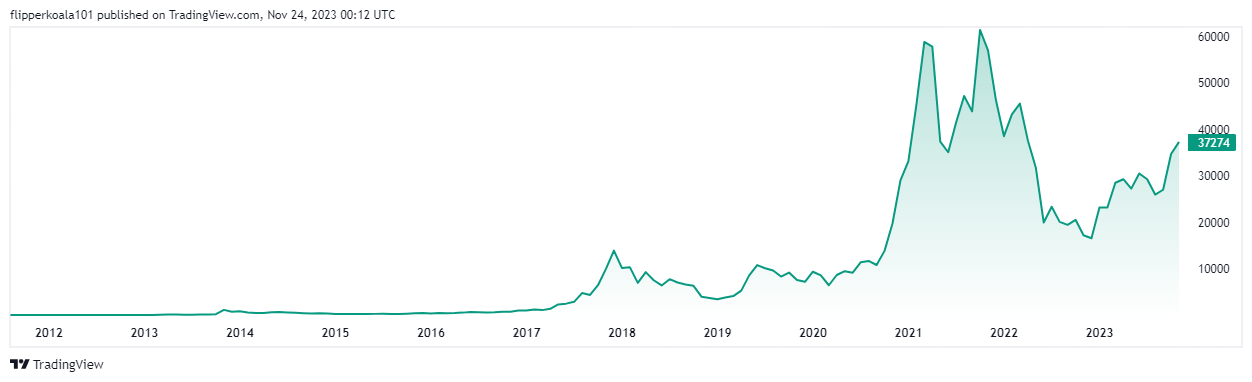

Since the inception of cryptocurrencies, their prices have experienced extreme volatility, making it a hot topic of discussion and speculation among investors and traders alike. Cryptocurrency price fluctuations have baffled even the most experienced financial experts, leading to a surge in research and analysis to decipher the patterns and factors influencing these movements.

The decentralized nature of cryptocurrencies, coupled with the absence of a central authority, has contributed to the unpredictability of their prices. Unlike traditional currencies controlled by governments and central banks, cryptocurrencies are subject to market forces and the behavior of traders, creating a highly unstable environment.

One of the major factors influencing cryptocurrency price fluctuations is market sentiment. The value of cryptocurrencies is heavily tied to investor confidence and perceptions of their future prospects. Positive news and developments in the industry can lead to a surge in prices, while negative news or regulatory actions can cause a sharp decline in value, reflecting the volatile nature of the market.

Furthermore, the lack of transparency and regulation in the cryptocurrency market adds to the uncertainty surrounding price fluctuations. The absence of clear guidelines and oversight makes it difficult to predict how market participants will react to various events, further amplifying the volatility.

As the popularity and adoption of cryptocurrencies continue to grow, unraveling the uncertain terrain of price fluctuations becomes increasingly crucial. Analyzing historical data, studying market trends, and understanding the underlying technology behind cryptocurrencies are just some of the methods researchers and investors are employing to gain insights into this enigmatic landscape.

Understanding the Factors Affecting Cryptocurrency Prices

Cryptocurrency prices are known for their volatile nature, constantly experiencing fluctuations that can be difficult to predict. Many factors contribute to these price changes, making it essential for investors to understand the underlying dynamics that influence the market. By gaining insight into these factors, investors can make more informed decisions and potentially capitalize on this emerging digital asset class.

Market Demand and Supply: One of the primary factors that affects cryptocurrency prices is the basic economic principle of demand and supply. When the demand for a particular cryptocurrency exceeds the available supply, the price tends to rise. Conversely, when there is an oversupply or lack of demand, prices tend to decrease.

Regulatory Environment: The regulatory environment around cryptocurrencies can have a significant impact on their prices. Government regulations, policies, and decisions can influence investor sentiment and market stability. Positive regulatory developments, such as the recognition of cryptocurrencies as legal tender or the establishment of clear frameworks, often lead to increased adoption and price appreciation. Conversely, negative regulatory actions or uncertainty can lead to a decline in prices.

Market Sentiment: The sentiment of market participants can heavily influence cryptocurrency prices. Positive news, such as the integration of cryptocurrencies into mainstream financial systems or the involvement of prominent companies in the industry, tends to instill confidence and drive up prices. Conversely, negative news, such as security breaches or regulatory crackdowns, can create fear and uncertainty, leading to price declines.

Technological Advancements: Technological advancements and innovations in the cryptocurrency space can also impact prices. New developments, such as the introduction of scalable blockchains, improved security protocols, or enhanced privacy features, often generate excitement and attract investor attention. These advancements can lead to increased demand and potential price appreciation.

Market Manipulation: Cryptocurrency markets are susceptible to manipulation, which can artificially inflate or deflate prices. Manipulative practices, such as pump and dump schemes or spoofing, can create misleading price movements. It is crucial for investors to be aware of these risks and exercise caution.

Understanding these factors can provide valuable insights into the complex nature of cryptocurrency price fluctuations. By staying informed and monitoring market dynamics, investors can navigate the uncertain terrain of cryptocurrency investing more effectively.

The Role of Investor Sentiment in Cryptocurrency Volatility

Investor sentiment plays a significant role in shaping the volatility of cryptocurrencies. The prices of these digital assets are heavily influenced by the decisions, emotions, and actions of investors.

When investors are confident about the future prospects of a particular cryptocurrency, they tend to buy more, driving up its price. This positive sentiment can create a self-fulfilling prophecy, leading to further price increases and attracting more investors.

Conversely, when investors become fearful or uncertain about the market, they may sell their holdings, causing the price to drop. This negative sentiment can create a downward spiral, as more investors start to panic and sell, further depressing the price.

Market sentiment can be driven by many factors, including news events, regulatory announcements, technological advancements, and even social media trends. Positive or negative sentiments expressed by influential individuals or organizations can also have a significant impact on investor behavior and subsequently on cryptocurrency prices.

Moreover, the nature of cryptocurrencies themselves can amplify the effect of investor sentiment. Their decentralized and unregulated nature makes them highly susceptible to speculative trading and irrational market behavior. This can lead to extreme price swings and increased volatility.

It is important for investors to be aware of the role of sentiment in cryptocurrency volatility. By understanding and analyzing market sentiment, investors can make more informed decisions, mitigate risks, and potentially capitalize on market trends.

In conclusion, investor sentiment is a key driver of cryptocurrency volatility. Positive or negative emotions and actions of investors can influence the prices of digital assets. Awareness and analysis of market sentiment can help investors navigate the uncertain terrain of cryptocurrency price fluctuations.

The Impact of Regulatory Measures on Cryptocurrency Markets

Regulatory measures play a crucial role in shaping the landscape of cryptocurrency markets. As governments around the world grapple with the challenges and opportunities posed by cryptocurrencies, their decisions on regulations can have a significant impact on the price and stability of these digital assets.

One of the key factors that affect cryptocurrency markets is the level of regulatory clarity. When there is uncertainty surrounding the legal status of cryptocurrencies or the rules governing their use, investors and traders may become hesitant and cautious, resulting in increased price volatility. On the other hand, clear and well-defined regulations can provide confidence and stability, attracting institutional investors and further mainstream adoption.

Regulatory measures can also influence the accessibility and liquidity of cryptocurrency markets. Restrictions or bans on cryptocurrency trading can limit the ability of individuals and businesses to participate, reducing market activity and potentially affecting price dynamics. Conversely, regulatory frameworks that encourage innovation and foster a supportive environment can attract more participants and increase liquidity, leading to a more robust and vibrant market.

Furthermore, regulatory measures can address concerns regarding fraud, scams, and money laundering in the cryptocurrency space. By implementing rigorous compliance requirements, such as Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations, governments can help protect investors and ensure the integrity of the market. However, it's important to strike a balance between safeguarding against illicit activities and fostering innovation without stifling the potential of cryptocurrencies.

Connettersi a Blur.io: Esplorazione delle caratteristiche e dei vantaggi di Blur.io

In conclusion, regulatory measures have a significant impact on cryptocurrency markets. Clarity in regulations, accessibility, liquidity, and addressing concerns regarding fraud and money laundering are important aspects that can shape the price fluctuations and overall stability of the cryptocurrency market.

The Relation Between Cryptocurrency Prices and Market Demand

One of the key factors driving the price fluctuations of cryptocurrencies is the market demand. The relationship between cryptocurrency prices and market demand can be complex and influenced by various factors.

Market demand refers to the desire of buyers to acquire a specific cryptocurrency at a given price. When there is high demand for a particular cryptocurrency, its price tends to rise. On the other hand, when there is low demand, the price tends to decline.

Several factors can affect market demand for cryptocurrencies. One of the main factors is investor sentiment. If investors perceive the cryptocurrency market as a profitable investment opportunity, they are more likely to demand and purchase cryptocurrencies, driving up their prices.

News and events also play a crucial role in shaping market demand. Positive news like the adoption of cryptocurrencies by major companies or countries can increase the demand and subsequently the price of cryptocurrencies. Conversely, negative news such as regulatory actions or security breaches can lead to a decrease in demand and a decline in prices.

Moreover, market demand can also be influenced by the overall economic conditions. During times of economic uncertainty or crisis, investors may seek refuge in cryptocurrencies as an alternative investment, leading to an increase in demand and prices.

Additionally, market demand can vary depending on the specific cryptocurrency. Popular and well-established cryptocurrencies like Bitcoin and Ethereum tend to have higher market demand compared to lesser-known or newly introduced cryptocurrencies.

In conclusion, the relation between cryptocurrency prices and market demand is a crucial aspect to consider when analyzing price fluctuations. The dynamics of market demand, influenced by factors such as investor sentiment, news events, and overall economic conditions, can significantly impact the value of cryptocurrencies.

The Influence of Media Attention on Cryptocurrency Price Movements

The cryptocurrency market is highly sensitive to media attention, with news stories and influencers having a significant impact on the price movements of various cryptocurrencies. This influence is driven by several key factors.

1. Market Sentiment: Media coverage can create positive or negative sentiment towards cryptocurrencies, affecting investor confidence and driving buying or selling behavior. Positive news coverage highlighting the potential of blockchain technology or successful cryptocurrency projects can fuel a bullish market sentiment, leading to price increases. Conversely, negative news stories, such as security breaches or regulatory crackdowns, can generate fear and uncertainty, causing prices to decline.

2. Awareness and Adoption: Media attention plays a crucial role in raising awareness and driving adoption of cryptocurrencies. Positive news stories about successful projects, partnerships, or endorsements can attract new investors and increase demand, leading to price appreciation. Conversely, negative coverage highlighting scams, hacks, or regulatory concerns can deter potential investors and reduce demand, resulting in price decreases.

3. Hype and FOMO: Media attention can create hype and fear of missing out (FOMO) among investors. FOMO is a powerful psychological motivator that can lead to irrational buying behavior and price spikes. When cryptocurrencies receive significant media coverage, investors may fear missing out on potential profits and rush to buy, driving up prices. However, this hype-driven demand is often short-lived and can result in price corrections or crashes once the hype subsides.

4. Manipulation: Media attention can also be manipulated by market participants to influence cryptocurrency prices. Pump-and-dump schemes, where individuals or groups artificially inflate the price of a cryptocurrency through false or exaggerated news, are prevalent in the industry. By creating a buzz through media attention, these actors can entice other investors to buy, causing the price to rise before selling their holdings and profiting from the subsequent price collapse.

Conclusion: Media attention exerts a significant influence on cryptocurrency price movements by shaping market sentiment, driving adoption, amplifying hype and FOMO, and enabling manipulation. As the cryptocurrency market continues to evolve, investors must be wary of the impact that media coverage can have on their investment decisions and consider multiple sources of information before making trading choices.

The Effect of Economic Indicators on Cryptocurrency Valuations

In the uncertain world of cryptocurrency, numerous factors contribute to the volatility and fluctuations in digital asset prices. While the market sentiment and news play significant roles in shaping these price movements, economic indicators also have a profound impact on cryptocurrency valuations.

Economic indicators, such as GDP growth, inflation rates, unemployment rates, and interest rates, provide valuable insights into the overall economic health of a country or region. These indicators influence investor sentiment and decision-making, thereby affecting cryptocurrency markets as well.

For example, when a country experiences high inflation rates, individuals may seek alternative assets to protect the value of their wealth. Cryptocurrencies, with their decentralized nature and limited supply, can serve as a hedge against inflation. As a result, increased demand for cryptocurrencies can drive up their prices.

Similarly, interest rate changes implemented by central banks can impact cryptocurrency valuations. Lower interest rates often encourage borrowing and investment, which can lead to increased demand for cryptocurrencies as investors search for higher returns. Conversely, rising interest rates can make traditional investments more appealing, diverting funds away from cryptocurrencies and putting downward pressure on their prices.

The performance of traditional financial markets also plays a role in the valuation of cryptocurrencies. During times of economic uncertainty or market downturns, investors may flock to safe-haven assets like gold or bonds, leading to a decline in cryptocurrency prices. Conversely, when traditional markets are performing well, investors may have more risk appetite and allocate a portion of their portfolio to cryptocurrencies, driving up prices.

Understanding the relationship between economic indicators and cryptocurrency valuations is crucial for investors and market participants. By monitoring the prevailing economic conditions and staying updated on key indicators, investors can make more informed decisions regarding their cryptocurrency holdings.

Connettersi a Blur.io: Esplorazione delle caratteristiche e dei vantaggi di Blur.io provides a platform for exploring the features and advantages of Blur.io, a leading cryptocurrency trading platform that leverages advanced algorithms and artificial intelligence to predict market trends and optimize trading strategies.

The Role of Technology Innovation in Shaping Cryptocurrency Prices

Technology innovation plays a crucial role in shaping the prices of cryptocurrencies. The emergence of blockchain technology, which underpins most cryptocurrencies, has revolutionized the financial industry and introduced new possibilities for businesses and consumers alike.

One of the main reasons why technology innovation affects cryptocurrency prices is the scalability and security improvements it brings to the network. As cryptocurrencies gain popularity and transaction volumes increase, the efficiency and speed of the underlying technology become crucial. Innovations such as the Lightning Network, which allows for faster and cheaper transactions, have a direct impact on the perceived value of cryptocurrencies.

Another area where technology innovation influences cryptocurrency prices is in the development of decentralized applications (dApps). These applications are built on top of blockchain platforms and offer new functionalities and use cases for cryptocurrencies. When a new dApp with innovative features is released, it can attract significant attention and drive up the demand for the associated cryptocurrency.

Smart Contracts

The introduction of smart contracts allowed for programmable transactions and opened up a wide range of possibilities for businesses. Cryptocurrencies associated with platforms that support smart contracts, such as Ethereum, saw significant price increases as the adoption of these contracts grew.

Privacy Enhancements

Technological advancements in privacy and anonymity features have attracted users concerned about data protection. Cryptocurrencies that offer enhanced privacy, such as Monero or Zcash, have seen increased demand and subsequently higher prices.

Scalability Solutions

As the transaction volumes of cryptocurrencies increase, scalability solutions like sharding or layer-two protocols become crucial. Cryptocurrencies that successfully implement these solutions tend to gain credibility and attract investors, leading to price appreciation.

In conclusion, technology innovation plays a significant role in shaping cryptocurrency prices. Improvements in scalability, security, and the development of innovative applications all contribute to the perceived value and demand for cryptocurrencies. As the cryptocurrency industry continues to evolve, it is crucial to monitor and understand the impact of technology innovation on prices.

The Impact of Security Breaches on Cryptocurrency Market Confidence

With the rising popularity of cryptocurrencies, security breaches have become a major concern for investors and participants in the cryptocurrency market. These breaches can have a significant impact on market confidence and overall trust in cryptocurrencies.

When a security breach occurs, it often leads to a loss of funds or personal information for cryptocurrency users. This loss can be devastating and erode trust in the security measures of the cryptocurrency platform. Investors may become wary of investing in cryptocurrencies, as they fear that their funds could be at risk.

Loss of Confidence

One of the immediate effects of a security breach in the cryptocurrency market is a loss of confidence among market participants. Users may feel that their personal information is no longer safe and that their funds are vulnerable to theft. This loss of confidence can lead to a decrease in trading volume and liquidity in the cryptocurrency market.

Additionally, security breaches can damage the reputation of cryptocurrencies as a whole. The perception of cryptocurrencies as a secure and trustworthy form of investment may be shattered, leading to a decline in adoption and acceptance.

Regulatory Scrutiny

Security breaches in the cryptocurrency market often attract regulatory scrutiny. Governments and regulatory bodies may step in to investigate the incident, implement stricter regulations, and impose fines on the platform or exchange that experienced the breach. This increased oversight can further shake market confidence and make investors more hesitant to engage with cryptocurrencies.

Loss of investor confidence

Decreased trading volume and liquidity

Damaged reputation of cryptocurrencies

Decline in adoption and acceptance

Increased regulatory scrutiny

Stricter regulations and fines

In conclusion, security breaches can have a detrimental impact on cryptocurrency market confidence. Loss of investor confidence, a damaged reputation, and increased regulatory scrutiny are all potential consequences of such breaches. It is crucial for cryptocurrency platforms and exchanges to prioritize security measures to maintain trust and foster a secure environment for market participants.

The Connection Between Global Events and Cryptocurrency Price Fluctuations

One of the key factors that contribute to the volatile nature of cryptocurrency prices is the influence of global events. The decentralized and borderless nature of cryptocurrencies makes them particularly susceptible to external factors and market sentiment.

Financial Crises and Economic Uncertainty

Financial crises and economic uncertainty have a profound impact on cryptocurrency prices. During times of economic instability, investors often flock to safe-haven assets such as gold or government bonds. However, in recent years, cryptocurrencies have emerged as a new type of safe-haven asset for some investors. For example, during the COVID-19 pandemic in 2020, the global economic downturn led to a surge in demand for Bitcoin as investors sought alternative stores of value.

Regulatory Changes

The regulatory landscape surrounding cryptocurrencies is constantly evolving, and changes in regulations can significantly impact their prices. Positive regulatory developments, such as the approval of a cryptocurrency exchange-traded fund (ETF) or the adoption of cryptocurrency-friendly regulations by a major country, can lead to increased investor confidence and a surge in prices. On the other hand, negative regulatory news, such as a proposed ban on cryptocurrency trading, can lead to panic selling and a sharp decline in prices.

Technological Advancements

Technological advancements and innovations in the blockchain space can also influence cryptocurrency prices. For example, the launch of a new cryptocurrency with advanced features and improved scalability can attract investors and drive up its price. Similarly, breakthroughs in blockchain technology, such as the development of a more efficient consensus algorithm or the implementation of privacy-enhancing features, can have a positive impact on the prices of cryptocurrencies that utilize these advancements.

Market Sentiment and Media Influence

Market sentiment and media coverage play a crucial role in shaping cryptocurrency prices. Positive news coverage, such as mainstream media outlets featuring success stories of early cryptocurrency investors, can create a sense of FOMO (fear of missing out) and attract new investors, driving up prices. On the other hand, negative news, such as reports of cryptocurrency hacks or regulatory crackdowns, can cause panic selling and a decline in prices. Additionally, social media platforms and online forums can amplify the impact of news and market sentiment, as discussions and debates about cryptocurrency investments can influence investor behavior.

Financial Crises and Economic Uncertainty

Can lead to increased demand as alternative stores of value

Regulatory Changes

Positive developments can increase investor confidence, negative news can lead to panic selling

Technological Advancements

New features and improved scalability can attract investors

Market Sentiment and Media Influence

Positive news can drive up prices, negative news can cause panic selling

The Influence of Supply and Demand Dynamics on Cryptocurrency Values

The cryptocurrency market is known for its highly volatile nature, with prices often experiencing dramatic fluctuations in short periods of time. One of the key factors that contribute to these price fluctuations is the delicate balance between supply and demand dynamics.

Supply:

The supply of a cryptocurrency refers to the total number of coins or tokens that are available in the market at any given time. In the case of Bitcoin, for example, there is a fixed supply of 21 million coins that will ever be in existence. This limited supply creates scarcity, which can drive up the value of the currency as demand increases.

Cryptocurrencies with a smaller supply often have higher value because they are considered to be more scarce. On the other hand, cryptocurrencies with a larger supply may have lower value due to their abundance in the market. Additionally, factors such as mining rewards and token burn mechanisms can also impact the supply dynamics of a cryptocurrency.

Demand:

The demand for a cryptocurrency is influenced by various factors, including market trends, investor sentiment, and technological advancements. When demand for a cryptocurrency increases, it can drive up the price. This can be driven by factors such as increased adoption, positive news coverage, or investor speculation.

Market Equilibrium:

The interaction between supply and demand determines the equilibrium price of a cryptocurrency. When demand exceeds supply, the price tends to increase. Conversely, when supply exceeds demand, the price tends to decrease.

Market Manipulation:

It is important to note that supply and demand dynamics can also be influenced by market manipulation. Cryptocurrency markets are relatively unregulated, making them susceptible to practices such as price manipulation, wash trading, and pump and dump schemes. These manipulative activities can distort the true supply and demand dynamics of a cryptocurrency, leading to artificial price fluctuations.

Conclusion

The influence of supply and demand dynamics on cryptocurrency values cannot be overstated. Understanding the delicate balance between supply and demand is crucial for investors and traders in predicting and analyzing price movements. However, it is also important to be aware of the potential for market manipulation, as this can significantly impact the true value of a cryptocurrency.

The Relationship Between Bitcoin and Altcoin Prices

Bitcoin, as the first and most well-known cryptocurrency, often sets the tone for the entire cryptocurrency market. Altcoins, on the other hand, refer to all other types of cryptocurrencies that are not Bitcoin. These include Ethereum, Ripple, Litecoin, and many others.

There is a strong relationship between the prices of Bitcoin and altcoins. When the price of Bitcoin rises or falls, it tends to have a significant impact on the prices of altcoins. This is because Bitcoin is often used as a benchmark or reference point for the entire cryptocurrency market.

When the price of Bitcoin goes up, investors and traders in the cryptocurrency market tend to become more optimistic. This optimism often spills over into altcoins, leading to an increase in their prices as well. Investors may see altcoins as an opportunity to diversify their cryptocurrency holdings and potentially make even higher returns than Bitcoin.

Conversely, when the price of Bitcoin goes down, it can lead to a decrease in the prices of altcoins. This is because there may be a general sense of fear and uncertainty in the market, causing investors to sell off their altcoin holdings and seek the relative safety of Bitcoin.

However, it's important to note that altcoins can also have independent price movements that are not directly influenced by Bitcoin. Factors such as technological advancements, regulatory developments, and market demand for specific altcoins can all play a role in their price fluctuations.

It's also worth mentioning that the relationship between Bitcoin and altcoin prices can vary over time. In some cases, altcoin prices may move in tandem with Bitcoin, while in other cases, they may move in the opposite direction. Understanding these market dynamics and how they impact price fluctuations is crucial for investors and traders in the cryptocurrency space.

- Bitcoin often sets the tone for the entire cryptocurrency market.

- Altcoin prices tend to be influenced by the price movements of Bitcoin.

- Optimism or pessimism in the market can cause corresponding movements in altcoin prices.

- Altcoins can also have independent price movements based on other factors.

- The relationship between Bitcoin and altcoin prices can vary over time.

The Role of Speculative Trading in Driving Cryptocurrency Price Swings

One of the key factors contributing to the volatility of cryptocurrency prices is speculative trading. Speculators play a significant role in driving price swings as they buy and sell digital assets with the expectation of making a profit from short-term price movements.

How Speculative Trading Works

Speculative trading involves buying cryptocurrencies at a low price and then selling them at a higher price, usually within a short timeframe. Traders rely on various technical and fundamental analysis tools to predict price movements and make informed trading decisions.

Speculators use leverage and margin trading to amplify potential profits, but these strategies also increase the risk of significant losses. As a result, speculative trading can lead to extreme price swings in the cryptocurrency market.

The Impact on Cryptocurrency Prices

The influx of speculative trading can have a significant impact on cryptocurrency prices. When speculators flood the market, buying large amounts of a particular cryptocurrency, it can drive the price up rapidly. Conversely, when speculators sell off their holdings, it can cause a steep decline in prices.

This volatility can make it challenging for long-term investors and merchants to use cryptocurrencies as a stable medium of exchange. Fluctuating prices can deter businesses from accepting digital currencies and individuals from holding them as a store of value.

Speculative trading can provide liquidity to the cryptocurrency market.

The volatility caused by speculative trading can lead to significant financial losses for inexperienced traders.

Speculators can help discover the true market value of cryptocurrencies.

Market manipulation by speculators can distort the actual value of cryptocurrencies.

Speculative trading can create opportunities for arbitrage.

Increased speculative trading can contribute to market bubbles and subsequent crashes.

Overall, while speculative trading can bring liquidity and efficiency to the cryptocurrency market, it also introduces a level of unpredictability and risk. Understanding and managing the role of speculation is crucial for investors and regulators to navigate the uncertain terrain of cryptocurrency price fluctuations.

What are the main factors that cause cryptocurrency price fluctuations?

Cryptocurrency price fluctuations can be caused by several factors, including market demand and supply, regulatory changes, technological advancements, investor sentiment, and macroeconomic factors.

Why are cryptocurrency prices so volatile?

Cryptocurrency prices are volatile due to several reasons. Firstly, the cryptocurrency market is relatively young and still developing, which means it is more prone to price swings. Additionally, the decentralized nature of cryptocurrencies and lack of regulation can make them more susceptible to manipulation and speculation. Finally, the relatively small market size of cryptocurrencies compared to traditional assets also contributes to their volatility.

How do regulatory changes impact cryptocurrency prices?

Regulatory changes can have a significant impact on cryptocurrency prices. Positive regulations, such as countries legalizing or adopting cryptocurrencies, often lead to increased demand and price appreciation. On the other hand, negative regulations, such as banning or restricting cryptocurrencies, can cause prices to decline as market participants become uncertain about the future of the asset class.

Are there any patterns or indicators that can predict cryptocurrency price fluctuations?

There are various patterns and indicators that traders and analysts use to predict cryptocurrency price fluctuations. Some common indicators include moving averages, relative strength index (RSI), volume analysis, and chart patterns. However, it is important to note that no indicator or pattern can guarantee accurate predictions, as cryptocurrency prices are influenced by a multitude of factors and are inherently volatile.

How do macroeconomic factors affect cryptocurrency prices?

Macroeconomic factors, such as interest rates, inflation, and geopolitical events, can impact cryptocurrency prices. For example, if the global economy is experiencing a financial crisis or if there is heightened geopolitical tension, investors may turn to cryptocurrencies as a hedge, leading to increased demand and price appreciation. Similarly, if there are concerns about inflation or the stability of fiat currencies, cryptocurrencies may experience increased demand.

Why do cryptocurrency prices fluctuate so much?

Cryptocurrency prices fluctuate due to various factors such as market demand, investor sentiment, regulatory developments, and technological advancements. The lack of a central authority and the speculative nature of the market also contribute to the high volatility.

Blur: NFT | Blur: NFT login | Blur: NFT connect | WalletConnect | Traders | What Is Blur Crypto

2022-2024 @ Unraveling the uncertain terrain of cryptocurrency price fluctuations