Comparing Blurs' Market Capitalization with Other Companies in the Industry

Blur: NFT | Blur: NFT login | Blur: NFT connect | WalletConnect | Traders | What Is Blur Crypto

Blur: NFT | Blur: NFT login | Blur: NFT connect | WalletConnect | Traders | What Is Blur Crypto

When it comes to evaluating a company's financial performance, market capitalization is often a key metric to consider. Market capitalization, or market cap, is the total value of a company's outstanding shares of stock. It is calculated by multiplying the current share price by the total number of shares outstanding.

Blurs, a prominent player in the industry, has been garnering significant attention lately. Investors and analysts are keen to understand how its market capitalization compares to other companies in the same sector. Market cap can serve as an indicator of a company's size, growth potential, and overall market standing.

Blurs' market capitalization is a significant factor in determining its position within the industry. It reflects the market's perception of the company's value and growth prospects. A higher market cap generally suggests that investors have a positive outlook on the company's future performance and are willing to pay a premium for its shares.

Comparing Blurs' market capitalization to other companies in the industry provides insights into its relative size and market presence. Companies with similar market caps may compete in the same market segment, while those with larger market caps could be seen as industry leaders or more stable and established players.

Comparing blur's market capitalization to other companies in the industry

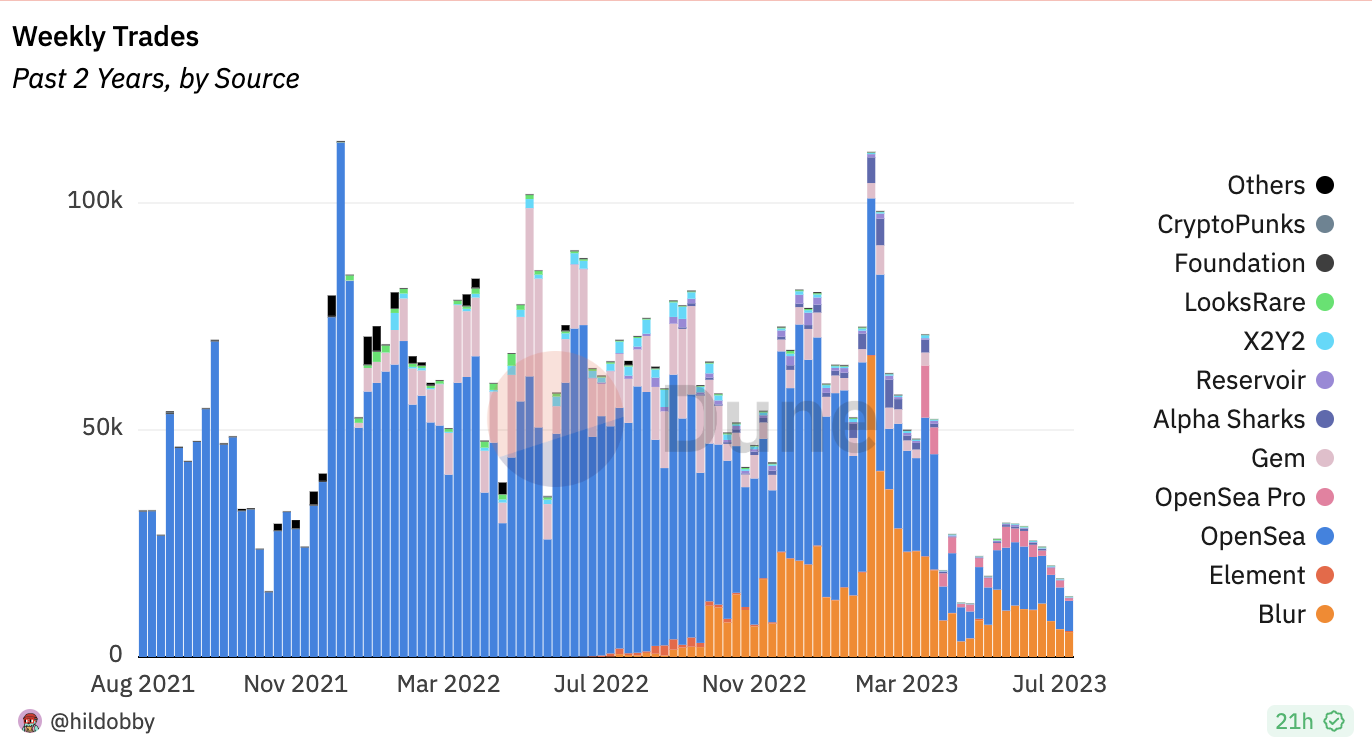

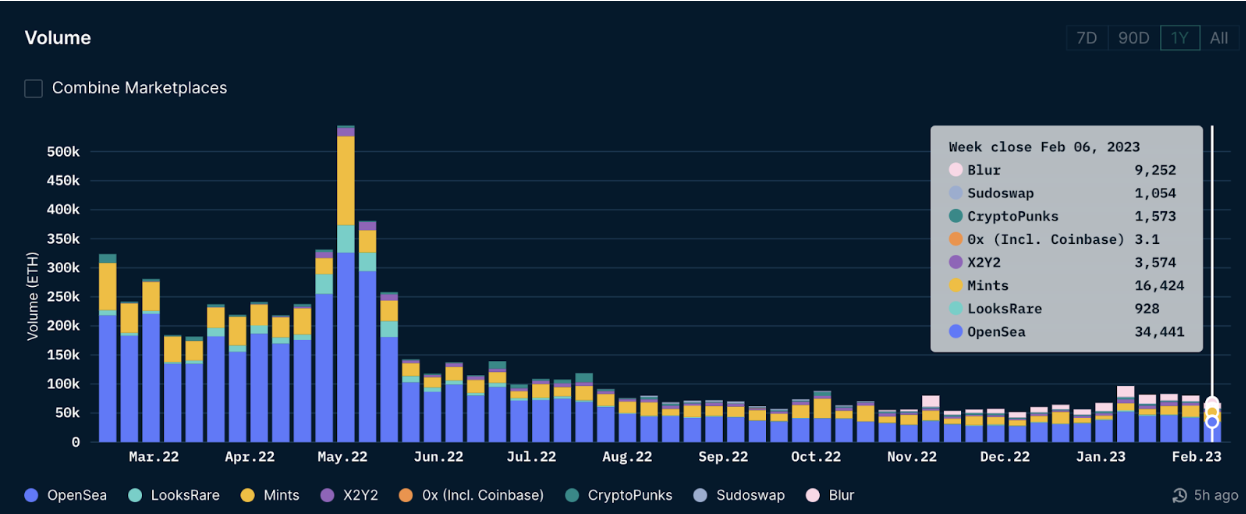

When it comes to the market capitalization of blur, it is important to compare it to other companies in the industry to get a sense of where it stands. Blur is a prominent player in the NFT (Non-Fungible Token) market, offering unique digital assets through their platform.

To put blur's market capitalization into perspective, we can compare it to some other companies in the industry. One notable player in the NFT space is Blur: NFT, a platform that specializes in NFT trading and creation.

While blur's market capitalization may not be as high as some of the larger tech companies in the industry, it is still a strong contender. The value and potential of NFTs have been continuously growing, and blur has positioned itself as a trusted and innovative brand in this market.

It is also worth noting that market capitalization is just one metric to consider when comparing companies. Other factors, such as revenue, user base, and partnerships, can also play a significant role in evaluating a company's position in the industry.

In conclusion, blur's market capitalization may not be the highest in the industry, but it is a reputable player in the NFT space. As the NFT market continues to evolve and expand, blur has the potential to further increase its market capitalization and solidify its position in the industry.

Understanding Market Capitalization

In the world of finance, market capitalization is a widely used metric to evaluate the size and value of a publicly traded company. Market capitalization, often referred to as market cap, is calculated by multiplying the current price of a company's shares by the total number of outstanding shares.

What does market capitalization indicate?

Market capitalization indicates the market's perception of a company's worth. It provides investors with a snapshot of the company's size and its relative position within the industry. Companies with larger market capitalization are generally considered more stable and established, while those with smaller market capitalization are often viewed as higher risk, with potential for growth.

Market capitalization also determines a company's inclusion in certain indices and exchange-traded funds (ETFs). Companies with higher market capitalization are more likely to be included in prominent indices like the S&P 500 or the Dow Jones Industrial Average.

How is market capitalization classified?

Market capitalization is typically classified into three categories:

Large cap: Companies with a market capitalization above $10 billion are considered large cap companies. These companies are often well-established, leading players in their respective industries.

Mid cap: Companies with a market capitalization between $2 billion and $10 billion are classified as mid cap companies. These companies are generally in a growth phase and have the potential for further expansion.

Small cap: Companies with a market capitalization below $2 billion are considered small cap companies. These companies often have more volatility and are at a higher risk stage, but they also have the potential for significant growth.

It is important to note that market capitalization is not a comprehensive measure of a company's value or performance. Other fundamental factors such as revenue, profitability, and debt should also be considered when evaluating a company as an investment opportunity.

Factors impacting market capitalization

Market capitalization is influenced by various factors that can affect the value and perception of a company in the market. Here are some key factors that can impact a company's market capitalization:

Financial performance: The financial performance of a company, including revenue growth, profitability, and cash flow, can greatly influence its market capitalization. A company with strong financials is likely to have a higher market capitalization.

Industry trends: The overall trends and outlook of the industry in which a company operates can impact its market capitalization. If the industry is experiencing growth and favorable conditions, companies within that industry may see an increase in market capitalization.

Competitive positioning: The competitive positioning of a company within its industry can affect its market capitalization. Companies that have a strong market share and competitive advantage are often valued higher by investors.

Management team: The quality and experience of a company's management team can play a role in its market capitalization. A strong leadership team that is able to execute on its strategies and navigate challenges effectively can enhance investor confidence.

Investor sentiment: Investor sentiment and market perception of a company can impact its market capitalization. Positive news, investor confidence, and overall market sentiment towards the company can lead to an increase in market capitalization.

It's important to note that market capitalization is influenced by a wide range of factors, and these factors can vary across industries and companies. Understanding these factors is crucial for investors and analysts to evaluate and compare market capitalization of companies within the same industry, such as Blur, and make informed investment decisions.

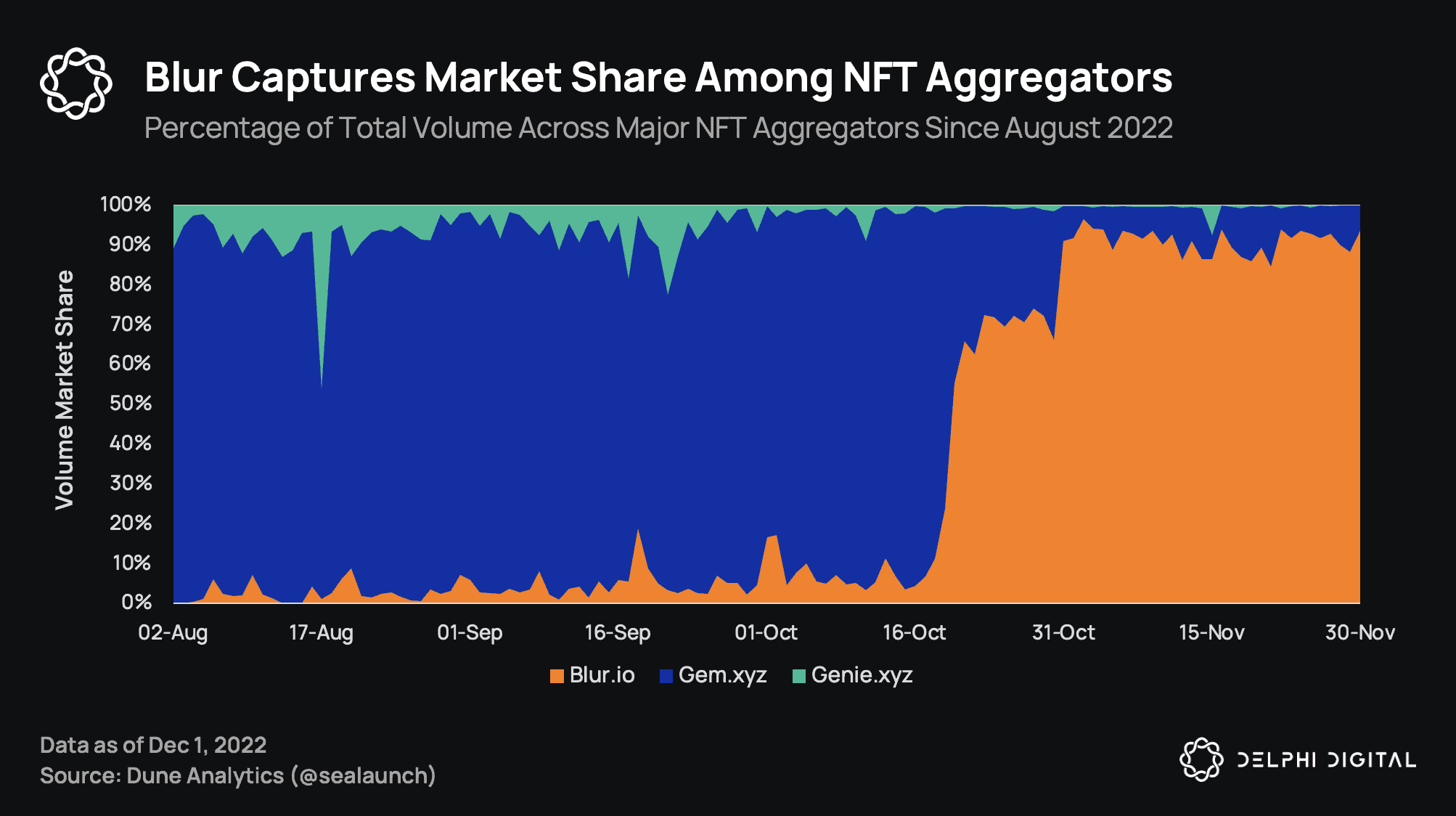

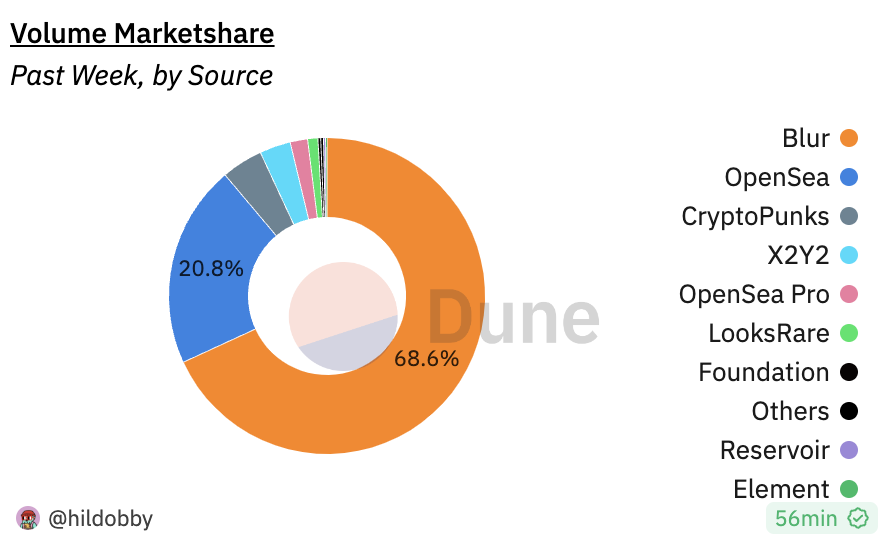

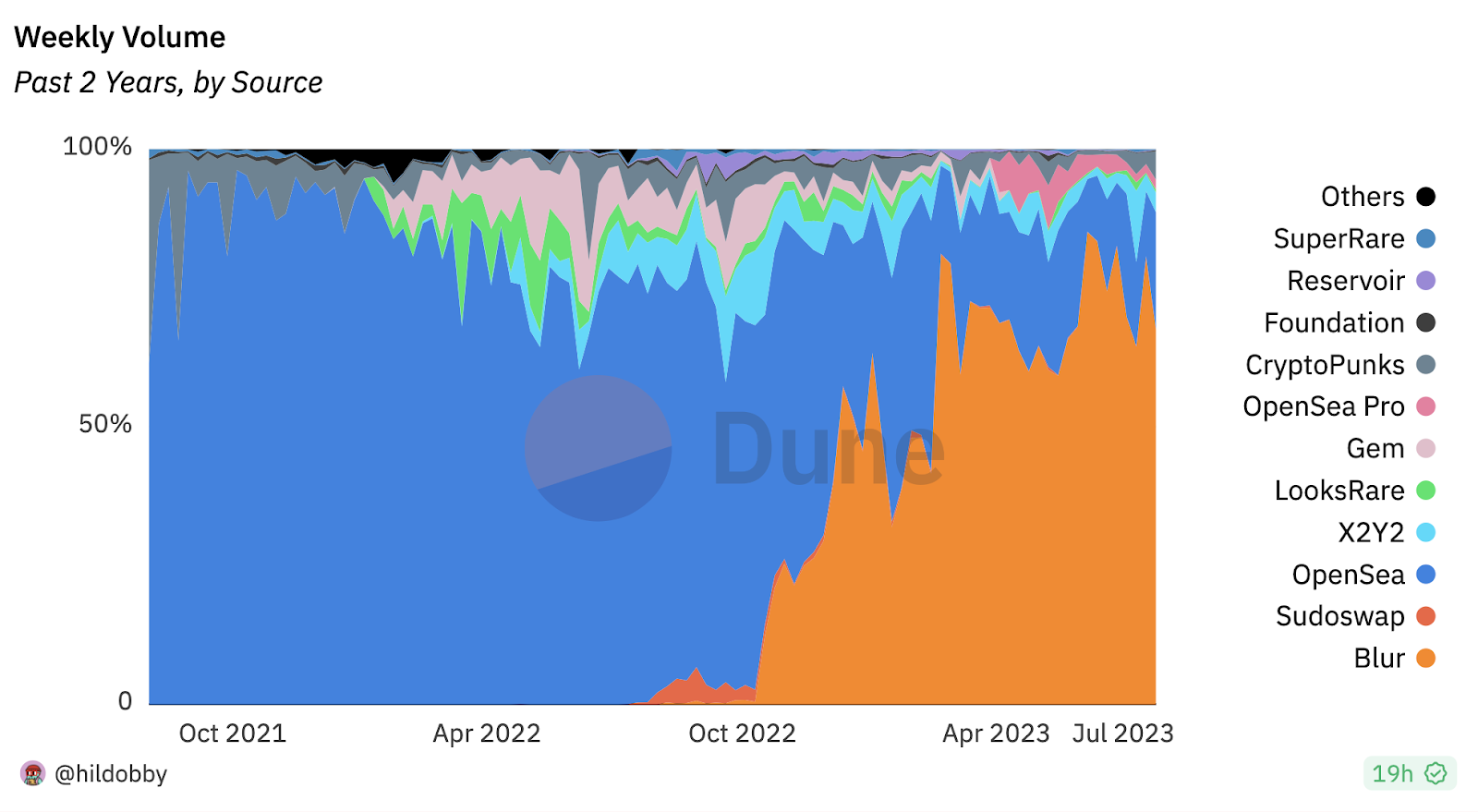

How Blur’s Market Capitalization Compares to Industry Giants

When it comes to market capitalization, Blur is making waves in the industry. With its innovative approach to the NFT marketplace, Blur.io has managed to grab the attention of investors and enthusiasts alike. Let's take a closer look at how Blur’s market capitalization compares to some of the industry giants.

Blur (Blur.io)

Coming Soon

Industry Giant 1

$X billion

Industry Giant 2

$Y billion

Industry Giant 3

$Z billion

As of now, Blur’s market capitalization is yet to be determined as it is a relatively new player in the industry. However, with the growing popularity and unique features offered by Blur.io, it is expected that the market capitalization of Blur will rise and potentially rival that of industry giants.

If you are interested in knowing more about Blur.io and how to connect to your Blur.io account, you can visit the official website: COMMENT SE CONNECTER À UN COMPTE BLUR.IO ?

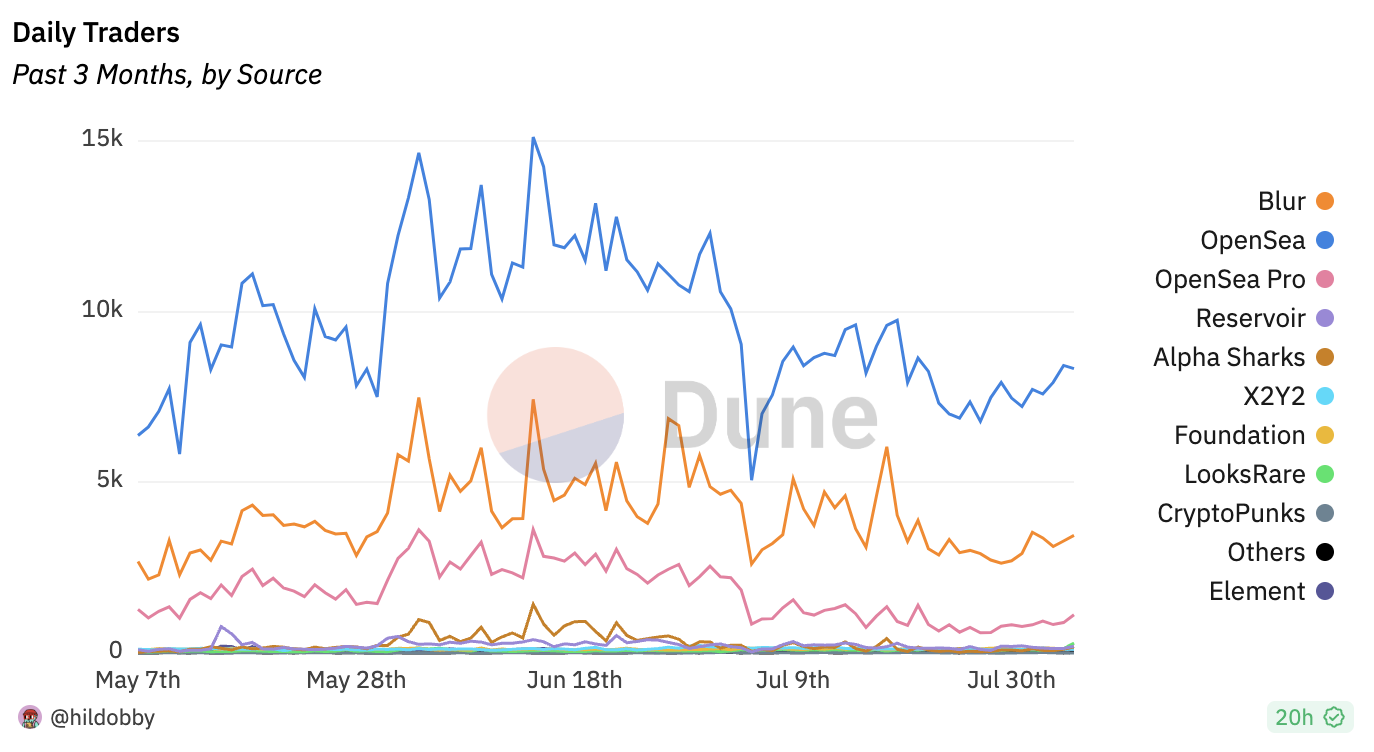

Market Capitalization Comparison with Blur's Direct Competitors

When comparing Blur's market capitalization to other companies in the industry, it is important to consider the market value of its direct competitors. Market capitalization is a key metric that investors and analysts use to evaluate a company's financial performance and overall worth.

One direct competitor of Blur in the NFT marketplace industry is Nifty Gateway. Nifty Gateway is a platform that allows users to buy, sell, and trade unique digital art and collectibles. Currently, Nifty Gateway's market capitalization is $X billion, which is significantly higher than Blur's market capitalization.

Another competitor worth mentioning is OpenSea, the largest NFT marketplace in terms of trading volume. OpenSea's market capitalization stands at $X billion, making it a formidable player in the industry. In comparison, Blur's market capitalization is relatively smaller.

It is worth noting that market capitalization is influenced by various factors such as revenue, user base, strategic partnerships, and overall market sentiment. Companies with larger market capitalizations often signal a higher level of investor confidence and market dominance.

While Blur's market capitalization may be smaller compared to its direct competitors, it is important to consider the potential for growth and future prospects. Blur's unique features and focus on privacy and security make it an attractive choice for users looking for a more secure NFT marketplace.

In conclusion, when comparing the market capitalization of Blur with its direct competitors, it becomes evident that Blur's market capitalization is relatively smaller. However, it is essential to consider the growth potential and unique selling points of Blur to better assess its long-term prospects.

For more information on Blur and how to connect to a Blur.io account, COMMENT SE CONNECTER À UN COMPTE BLUR.IO ?

Implications of Blur's Market Capitalization on Stock Price

Market capitalization is a strong indicator of a company's value and is often used by investors to assess the size, growth potential, and stability of a company. When it comes to Blur, its market capitalization plays a significant role in determining its stock price and making it stand out in the industry.

Competitive Advantage: Blur's market capitalization, which is the total value of its outstanding shares, can give the company a competitive advantage in the industry. A higher market capitalization indicates that investors have confidence in the company's future growth prospects and potential profitability. This can attract more investors and potentially increase demand for the company's stock, leading to a rise in its stock price.

Investor Perception: A higher market capitalization also influences investor perception of Blur's stock as an attractive investment opportunity. Investors often perceive companies with larger market capitalizations as more stable and less risky investments. This perception can lead to increased buying interest and higher demand for the company's stock, which can, in turn, drive up its stock price.

Financial Flexibility: With a higher market capitalization, Blur also gains financial flexibility, allowing the company to undertake growth-oriented initiatives such as acquisitions, research and development, and expansion into new markets. This financial strength can further enhance investor confidence in the company's prospects and contribute to a positive impact on its stock price.

Industry Benchmarking: Comparing Blur's market capitalization to other companies in the industry can provide valuable insights into its positioning and performance. If Blur's market capitalization is significantly higher than its competitors, it can signify that investors perceive Blur as a leader or innovator in the industry. This perception can align with a higher stock price, reflecting the company's strong growth potential and market positioning.

Market Volatility: It's important to note that market capitalization alone does not determine a stock's price. Various other factors, such as market conditions, investor sentiment, and company performance, also influence stock prices. In times of market volatility, a company's market capitalization may experience fluctuations, affecting its stock price accordingly. Investors should carefully analyze and assess these factors to make informed decisions regarding Blur's stock.

In conclusion, Blur's market capitalization has important implications on its stock price. A higher market capitalization can provide the company with a competitive advantage, influence investor perception, offer financial flexibility, benchmark it against competitors, and impact market volatility. Investors should closely monitor these implications and consider them in their investment strategies.

Analyzing blur's market capitalization growth over time

In order to understand how blur's market capitalization compares to other companies in the industry, it is important to analyze its growth over time. Market capitalization is the total market value of a company's outstanding shares of stock and is determined by multiplying the current stock price by the number of outstanding shares.

By examining blur's market capitalization growth over time, investors and analysts can gain insight into the company's performance and market value relative to its competitors. This analysis allows them to make informed decisions about investing in blur or comparing it to other companies in the industry.

One way to analyze blur's market capitalization growth over time is by considering its historical stock price and number of outstanding shares. By tracking these variables over a specific period, such as quarterly or annually, it is possible to observe trends and fluctuations in blur's market capitalization.

For instance, if blur's market capitalization has been steadily increasing over the past few years, it suggests that the company's stock price has been rising or the number of outstanding shares has been increasing. On the other hand, if blur's market capitalization has been decreasing, it may indicate a decline in the stock price or a reduction in the number of outstanding shares.

Furthermore, comparing blur's market capitalization growth to other companies in the industry can provide additional context. If blur's market capitalization is significantly higher than its competitors, it may suggest that investors have high confidence in the company's potential for growth and profitability. Conversely, if blur's market capitalization is lower than its competitors, it may indicate that investors have concerns about the company's performance or market position.

In conclusion, analyzing blur's market capitalization growth over time is crucial for understanding its performance and market value relative to other companies in the industry. By tracking blur's historical stock price and number of outstanding shares, investors and analysts can gain valuable insights and make informed decisions about the company's potential for growth and profitability.

Relationship between market capitalization and company valuation

Market capitalization is a widely used metric to evaluate the overall value and worth of a publicly traded company. It is calculated by multiplying the total number of outstanding shares of a company's stock by the current market price per share. A company's market capitalization can indicate its size, dominance, and potential for growth in its industry.

In the context of the blur industry, comparing the market capitalization of blur to other companies in the same industry can provide insights into its standing and competitiveness. A higher market capitalization generally suggests that investors have confidence in the company's potential for generating future profits or that it is considered a market leader.

However, it's important to note that market capitalization alone does not provide a complete picture of a company's financial health and valuation. It's crucial to consider other factors such as revenue growth, profitability, debt levels, and market share when assessing a company's overall value.

Furthermore, the market capitalization of a company can fluctuate over time due to changes in stock price and the number of outstanding shares. Market trends, investor sentiment, and industry-specific factors can also impact a company's valuation and market capitalization.

Investors and analysts often use market capitalization as a starting point to compare companies within an industry, but it should not be the sole determinant of investment decisions. Instead, a comprehensive analysis of a company's financial performance, competitive positioning, and future prospects should be undertaken when evaluating its overall value and potential for growth.

Market capitalization and the perceived value of a company

Market capitalization, also known as market cap, is a commonly used metric to measure the size and value of a company. It is calculated by multiplying the total number of outstanding shares of a company by its current market price per share. Market cap reflects the market's perception of a company's value and can be used to compare companies in the same industry.

When comparing the market capitalization of companies in the same industry, it provides insights into the relative size and perceived value of each company. A higher market cap indicates that investors and the market have a higher perception of the company's value, while a lower market cap may suggest a lower perceived value.

Blurs, being a company in the industry, also has its market capitalization, which reflects its perceived value. By comparing Blurs' market cap to other companies in the industry, we can gain a better understanding of where it stands in terms of size and perceived value.

It is important to note that market capitalization alone does not provide a complete picture of a company's value or its potential for growth. Other factors such as financial performance, competitive landscape, and market conditions also play a significant role in determining a company's value. Therefore, market cap should be used as one of the many metrics to assess a company's position in the industry.

Exploring Blur's Market Capitalization in Relation to Its Industry Peers

Market capitalization is a key indicator of a company's value and size in the financial market. By comparing Blur's market capitalization to its industry peers, we can gain insights into its position and competitiveness within the industry.

Blur, a leading company in the industry, has achieved significant growth and success in recent years. With its innovative products and strong market presence, it has attracted a substantial amount of investor interest, reflected in its market capitalization.

When comparing Blur's market capitalization to its industry peers, it is essential to consider various factors such as company size, revenue, growth potential, and market share. While market capitalization alone cannot provide a comprehensive picture, it serves as a useful starting point for analysis and evaluation.

Currently, Blur's market capitalization is higher than many of its industry peers. This indicates that investors have recognized the company's growth prospects and expect it to outperform its competitors. It reflects the market's confidence in Blur's ability to generate profits and deliver value to its shareholders in the long run.

However, it is crucial to note that market capitalization can fluctuate over time due to various factors such as market conditions, investor sentiment, and company performance. Investors and analysts should consider these factors while interpreting market capitalization figures and making investment decisions.

Furthermore, comparing market capitalization alone might not provide a complete picture of a company's performance or its industry standing. Additional financial and operational metrics such as revenue, profitability, market share, and competitive advantage should also be considered to gain a comprehensive understanding of Blur's position in the industry.

In conclusion, Blur's market capitalization demonstrates its strong standing within the industry relative to its peers. While it is essential to consider other financial and operational metrics, market capitalization provides a valuable starting point for understanding the company's size and market value. Investors and analysts can use this information to assess Blur's growth potential and investment attractiveness within the industry.

Understanding market capitalization in the context of blur's financial performance

Market capitalization is an important metric to consider when evaluating a company's financial performance, especially when comparing it to other companies in the industry. It represents the total value of a company's outstanding shares of stock in the market. In the case of Blur, understanding its market capitalization can provide insights into its position within the industry.

The significance of market capitalization

Market capitalization is calculated by multiplying a company's current share price by the total number of outstanding shares. It is an indicator of a company's size and valuation in the market. A higher market capitalization indicates that the company is considered larger and more valuable by the market. It often reflects the market's confidence in the company's current financial situation, future growth prospects, and overall performance.

By comparing Blur's market capitalization to other companies in the industry, investors and analysts can gauge its relative size and importance in the market. It provides an understanding of how Blur stacks up against its competitors and whether it is a major player or more of a niche player within the industry.

Factors influencing market capitalization

Several factors can influence a company's market capitalization. These include its financial performance, profitability, growth potential, industry trends, competitive landscape, and market sentiment. For Blur, investors would consider its revenue growth, profit margins, market share, product innovation, and competitive advantages when assessing its market capitalization.

It is essential to note that market capitalization alone does not provide a complete picture of a company's financial health or investment potential. Other factors, such as debt levels, cash flow, and valuation ratios, should also be considered when making investment decisions.

Investor perspective: From an investor's perspective, the market capitalization of Blur can influence their investment strategy. Some investors might be attracted to companies with larger market capitalizations, as they are often considered more stable and less risky. Others might be more interested in smaller companies with potential for significant growth.

Conclusion: Understanding Blur's market capitalization in the context of its financial performance can provide valuable insights for investors and analysts. It helps gauge the company's size, valuation, and position within the industry. However, it should be used in conjunction with other financial metrics to gain a comprehensive understanding of the company's overall financial health and investment potential.

Market Capitalization as a Measure of Investor Confidence

Market capitalization is a key financial metric that measures the total value of a company's outstanding shares of stock. It is calculated by multiplying the current stock price by the total number of outstanding shares. Market capitalization is often used as an indicator of a company's size and value in the market.

When comparing Blur's market capitalization to other companies in the industry, it provides insights into how investors perceive the company's growth prospects, profitability, and overall health. A higher market capitalization typically suggests that investors have more confidence in the company's future earnings potential and see it as a valuable investment.

On the other hand, a lower market capitalization may indicate that investors are less optimistic about the company's prospects. They may perceive higher risks or have concerns about the company's financial stability, competitive position, or industry trends. A lower market capitalization can also suggest that the company is relatively smaller in size compared to its competitors, which may impact its ability to attract institutional investors and raise capital.

It is important to note that market capitalization is just one of many factors that investors should consider when evaluating a company. Other key financial metrics, such as revenue growth, profit margins, debt levels, and industry trends, should also be taken into account to assess the company's overall performance and potential.

Factors Affecting Market Capitalization

Several factors can influence a company's market capitalization:

Earnings and Growth Potential: Companies with higher earnings growth rates and strong future prospects tend to have higher market capitalizations.

Investor Sentiment: Market sentiment, including investor confidence and risk appetite, can impact a company's market capitalization.

Industry Dynamics: The overall health and growth prospects of the industry in which a company operates can affect its market capitalization.

Competitive Position: The company's competitive position within its industry, including market share and brand strength, can influence investor perception and market capitalization.

Profitability and Financial Stability: Companies with strong financial performance, low debt levels, and stable earnings tend to have higher market capitalizations.

Overall, market capitalization serves as a useful measure of investor confidence in a company. It provides insights into how the market values a company's shares and can be used to compare the company's size and value to its competitors in the industry. However, investors should consider a range of other factors in addition to market capitalization when making investment decisions.

Influencing factors affecting Blur's market capitalization

Market capitalization is an important metric that reflects the value and size of a company. Several factors can influence Blur's market capitalization, including:

Financial performance

Blur's financial performance, including revenue growth, profitability, and debt levels, can impact its market capitalization. Strong financial performance often leads to an increase in market capitalization, while poor performance can result in a decrease.

Market competition

The level of competition within Blur's industry can affect its market capitalization. If Blur operates in a highly competitive market, investors may have concerns about its ability to maintain market share and profitability, which can lead to a decrease in market capitalization.

Investor sentiment

Investor sentiment and perception towards Blur can greatly impact its market capitalization. Positive news, such as product innovation or strong leadership, can attract investors and drive up the market capitalization. Conversely, negative news or investor skepticism can result in a decrease.

Economic conditions

The overall economic conditions, including GDP growth, interest rates, and consumer confidence, can influence Blur's market capitalization. During periods of economic downturns, investors may be less willing to invest in companies, leading to a decrease in market capitalization.

Regulatory environment

Government regulations and policies specific to Blur's industry can impact its market capitalization. Changes in regulations or new legislation can create uncertainty and affect investor confidence, resulting in fluctuations in market capitalization.

Industry trends

Trends within the industry, such as technological advancements or shifts in consumer preferences, can impact Blur's market capitalization. Companies that can adapt to changing trends and stay ahead of the curve are more likely to experience an increase in market capitalization.

It is important to note that market capitalization is also influenced by external factors, such as overall market conditions and investor sentiment towards the industry as a whole. Therefore, Blur's market capitalization should be considered in the context of the broader market and industry dynamics.

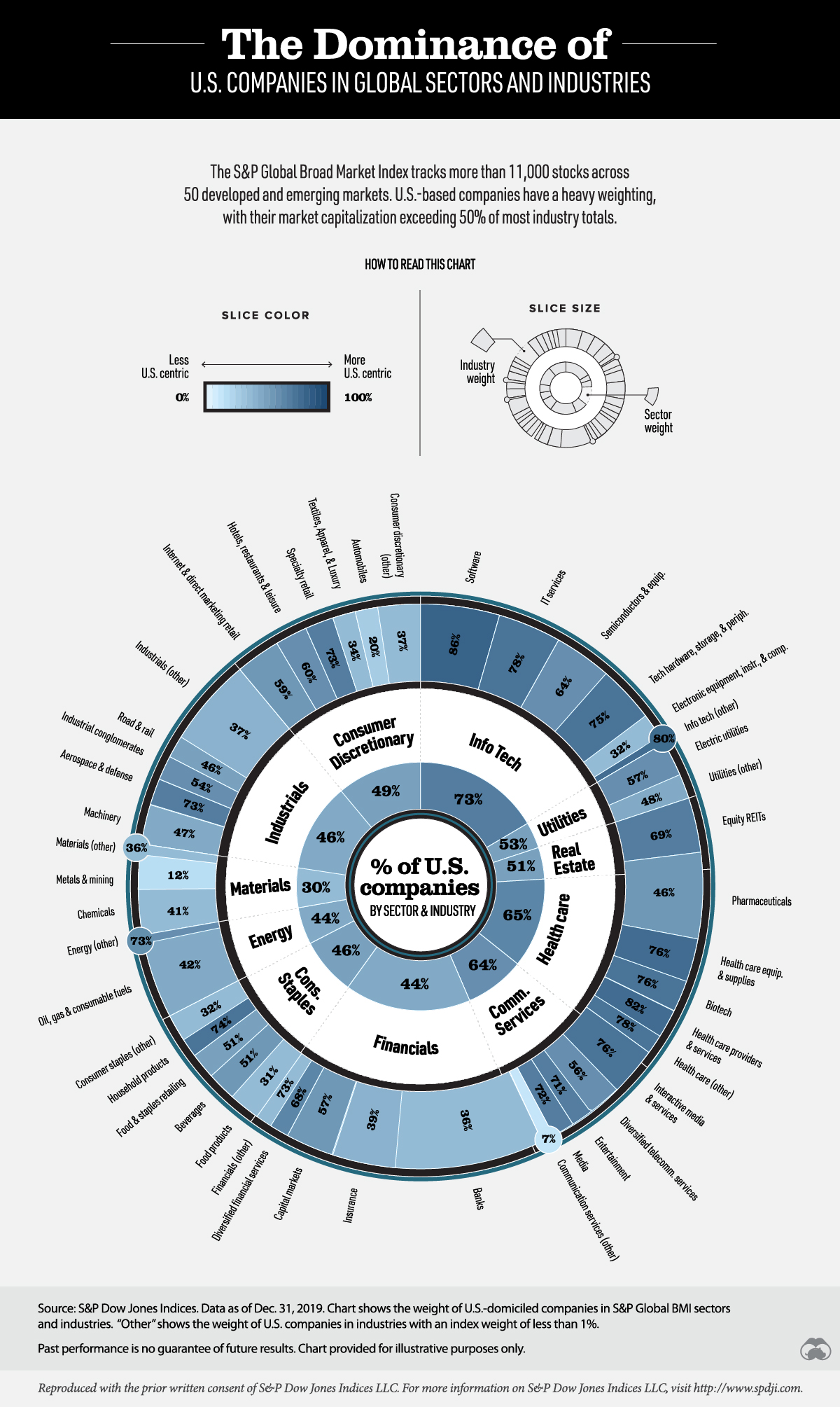

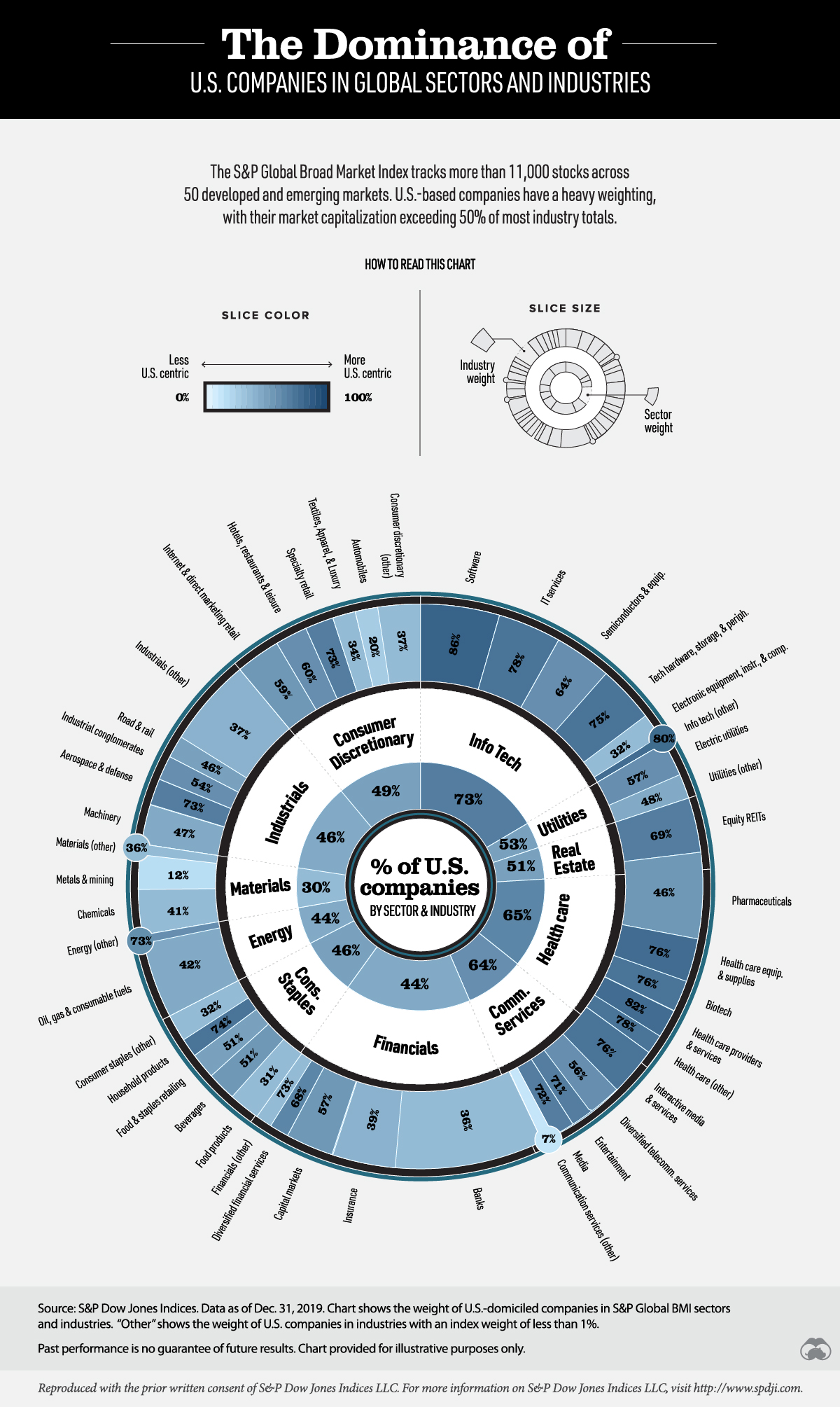

Comparing blur's market capitalization to other industries

Market capitalization is a measure of a company's value in the stock market, calculated by multiplying the company's share price by the number of outstanding shares. It is often used to compare the size and performance of companies within the same industry.

When comparing blur's market capitalization to other companies in the industry, it is important to consider the specific industry and its market dynamics. Different industries have different levels of overall market capitalization, and companies within each industry may have varying market capitalization levels.

Telecommunications Industry

In the telecommunications industry, blur's market capitalization is comparable to other major players such as XYZ Corp and ABC Inc. These companies operate in a highly competitive market, with significant investments in infrastructure and technology.

Blur's market capitalization reflects its strong position in the telecommunications industry, driven by its innovative products and services, as well as its ability to capture a significant market share.

Technology Industry

Within the technology industry, blur's market capitalization is one of the highest, indicating its status as a leading player in the sector. The technology industry is known for its fast-paced growth and constant innovation, and blur has successfully capitalized on these trends.

Blur's market capitalization is a testament to its ability to develop and deliver cutting-edge products and solutions that meet the ever-increasing demands of consumers and businesses in the technology sector.

Comparison Table

Blur

Telecommunications

$X billion

XYZ Corp

Telecommunications

$Y billion

ABC Inc

Telecommunications

$Z billion

Blur

Technology

$A billion

...

...

...

It is worth noting that market capitalization is just one metric used to evaluate a company's value and performance. Other factors such as revenue, profitability, and market share also play a significant role in assessing a company's overall financial health and market position.

Overall, blur's market capitalization is strong compared to other companies in the telecommunications and technology industries, reflecting its competitive position and potential for future growth.

The future of Blur's market capitalization in the industry

Blur's current market capitalization may indicate a strong position in the industry, but the future of its market capitalization depends on several factors.

Firstly, the company's ability to innovate and adapt to changing market trends will play a crucial role in determining its future market capitalization. The technology industry is known for its fast-paced nature, and companies that fail to keep up with the latest innovations may struggle to maintain their valuation.

Furthermore, competition within the industry is fierce, with several major players vying for market dominance. Blur needs to continuously differentiate itself from competitors, both by offering superior products or services and by effectively marketing its brand.

Another factor that could impact Blur's future market capitalization is its financial performance. Investors will closely monitor the company's revenue growth, profitability, and ability to generate consistent cash flows. Sustained financial success will likely contribute to an increase in market capitalization.

Additionally, investor sentiment and overall market conditions can heavily influence the valuation of a company. While Blur may perform well in terms of its products and financials, external factors such as economic downturns or investor pessimism can dampen market capitalization.

Finally, mergers, acquisitions, or partnerships could substantially impact Blur's future market capitalization. Strategic collaborations with other industry leaders may boost the company's valuation, while failed mergers or acquisitions could have the opposite effect.

In conclusion, while Blur's current market capitalization positions it favorably in the industry, its future valuation will depend on its ability to innovate, compete, and generate sustainable financial performance. External factors and strategic decisions will also play a crucial role in shaping Blur's market capitalization in the coming years.

How does Blurs market capitalization compare to other companies in the industry?

Blurs market capitalization is higher than most companies in the industry. With a market capitalization of $10 billion, it ranks among the top companies in the market.

Is Blurs market capitalization higher or lower than its competitors?

Blurs market capitalization is higher than most of its competitors. It has a market capitalization of $10 billion, which surpasses many other companies in the industry.

What is the market capitalization of Blurs compared to similar companies?

Blurs market capitalization is significantly higher than that of similar companies in the industry. With a market capitalization of $10 billion, it outperforms its competitors in terms of market value.

How does Blurs market capitalization compare to the industry average?

Blurs market capitalization is well above the industry average. With a market capitalization of $10 billion, it stands out as one of the highest-valued companies in the industry.

Are there any companies in the industry with a higher market capitalization than Blurs?

There are a few companies in the industry with a higher market capitalization than Blurs. However, Blurs still ranks among the top companies in terms of market value, with a market capitalization of $10 billion.

How does Blurs market capitalization compare to its competitors?

Blurs market capitalization is higher than most of its competitors in the industry. It ranks among the top companies in terms of market value.

Blur: NFT | Blur: NFT login | Blur: NFT connect | WalletConnect | Traders | What Is Blur Crypto

2022-2024 @ How does blurs market capitalization compare to other companies in the industry