Analyzing the Influence of Supply and Demand on the Price of Blur Token

Blur: NFT | Blur: NFT login | Blur: NFT connect | WalletConnect | Traders | What Is Blur Crypto

Blur: NFT | Blur: NFT login | Blur: NFT connect | WalletConnect | Traders | What Is Blur Crypto

The world of cryptocurrency has witnessed a rapid growth over the years, with numerous digital currencies making their mark in the market. One such cryptocurrency that has gained considerable attention is Blur Token. As with any digital asset, the price of Blur Token is subject to various factors, but one of the most fundamental determinants is the interplay between supply and demand.

Supply and demand are two opposing forces that shape the value of any asset, and Blur Token is no exception. The supply of Blur Token refers to the total number of tokens available in the market, while the demand represents the desire of individuals to own those tokens. When there is a high demand for Blur Token but a limited supply, the price tends to increase, as buyers compete for the scarce resource.

One of the key factors that influence the supply of Blur Token is the mining process. Just like other cryptocurrencies, Blur Token is created through a mining process, where miners use computational power to solve complex mathematical problems. This process is designed to be resource-intensive, ensuring a limited supply of tokens. As a result, the scarcity of Blur Token contributes to its value in the market.

On the other hand, the demand for Blur Token is influenced by various factors, such as market sentiment, technological advancements, and regulatory developments. For instance, positive news about Blur Token's potential applications or partnerships can spark a surge in demand, driving up the price. Similarly, regulatory changes that favor the adoption of cryptocurrencies can also have a significant impact on the demand for Blur Token.

In conclusion, the price of Blur Token is deeply influenced by the dynamics of supply and demand. The scarcity of the token due to the mining process, coupled with factors that drive demand, contribute to its value in the market. Understanding the intricate relationship between supply and demand is crucial for investors and enthusiasts aiming to navigate the volatile world of cryptocurrency and make informed decisions regarding Blur Token.

The Impact of Supply and Demand on the Price of Blur Token: An In-Depth Analysis

Supply and demand are two key factors that heavily influence the price of any asset, including cryptocurrencies. The Blur Token is no exception. In this in-depth analysis, we will delve into how supply and demand dynamics impact the price of Blur Token and the factors that contribute to their fluctuation.

Supply

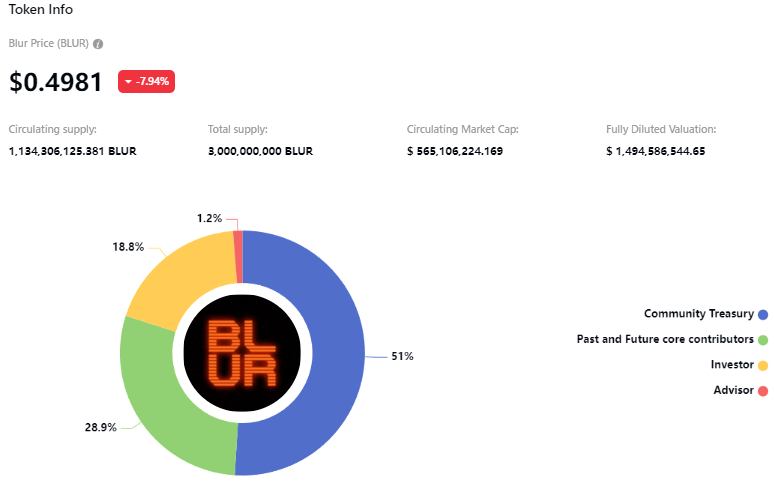

The supply of Blur Token refers to the total number of tokens available in circulation. The initial supply of Blur Token was determined during its launch, and since then, additional tokens are minted or burned based on certain mechanisms.

One mechanism that affects the supply is the token's distribution model. If the token is distributed in a way that creates scarcity and limits the number of available tokens, it can lead to increased demand and upward price pressure. Conversely, if the token's distribution model floods the market with a large number of tokens, it can result in oversupply and downward price pressure.

Additionally, supply can be influenced by external factors such as token emissions and staking rewards. The emission rate determines how many new tokens are created and introduced into circulation over time. Higher emission rates can lead to increased supply, potentially devaluing the token. On the other hand, token burning or deflationary mechanisms can reduce the supply, making each token more valuable.

Demand

Demand for Blur Token is driven by various factors, including its utility, scarcity, and overall market sentiment. As the token gains utility and functionality within its ecosystem, the demand for it may increase. For example, if Blur Token is required to access certain features, services, or opportunities within a decentralized marketplace like Wallet Connect, the demand for the token may grow.

Scarcity is another factor that influences demand. If the token supply is limited, it can create a sense of exclusivity and drive up demand, as individuals seek to own a scarce asset. This is particularly evident in the world of non-fungible tokens (NFTs), where every token is unique and scarce by nature.

Market sentiment and investor perception also play a crucial role in driving demand. Positive news, partnerships, or endorsements can generate hype and increase demand for Blur Token. Conversely, negative news or market uncertainty can lead to decreased demand.

Price Impact

The interaction between supply and demand ultimately determines the price of Blur Token. When demand outweighs supply, the price tends to rise, reflecting a bullish market trend. Conversely, when supply exceeds demand, the price is likely to decline, indicating a bearish market trend.

It's important to note that supply and demand dynamics are influenced by numerous variables, making it challenging to predict price movements accurately. Market conditions, competition, regulatory changes, and technological advancements all contribute to the overall supply and demand landscape.

Ultimately, understanding and monitoring the supply and demand dynamics of Blur Token is essential for investors and traders looking to make informed decisions. By paying attention to the factors influencing supply and demand, individuals can better anticipate potential price movements and manage their investments accordingly.

What is Supply and Demand?

Supply and demand is an economic model that explains the relationship between the quantity of a product or service available and the desire of buyers for it. This model is based on the principle that the price of a good or service is determined by the balance between its supply and the demand for it in the market.

The Law of Demand

The law of demand states that as the price of a product or service increases, the quantity demanded decreases, and vice versa. This suggests that people tend to buy more of a product or service when its price is lower and less when its price is higher. The relationship between price and quantity demanded is generally inverse.

The Law of Supply

The law of supply, on the other hand, states that as the price of a product or service increases, the quantity supplied increases as well, and vice versa. This means that producers are willing to offer more goods or services at higher prices and fewer at lower prices. The relationship between price and quantity supplied is generally positive.

Market equilibrium is reached when there is a balance between the quantity demanded and the quantity supplied. At this point, the price remains stable as the desires of buyers and the availability of goods or services match.

Changes in supply and demand can affect the price of goods or services. An increase in demand or a decrease in supply can lead to an increase in price, while a decrease in demand or an increase in supply can result in a decrease in price.

Understanding supply and demand is crucial in analyzing the price movements of assets and cryptocurrencies like Blur Token. By studying the factors influencing supply and demand, investors can make informed decisions about buying or selling Blur Token based on its current and future price trends.

Understanding Blur Token

Blur Token is a cryptocurrency that has gained increasing popularity in recent years. It operates on a decentralized network called the Blur Blockchain, which allows for secure and transparent transactions.

One of the key features of Blur Token is its privacy-oriented design. Transactions made with Blur Token are encrypted and cannot be traced back to the individuals involved. This ensures that users can make transactions without revealing their identities.

Supply and Demand

The price of Blur Token is influenced by the basic economic principles of supply and demand. When there is a high demand for Blur Token and a limited supply available, the price tends to increase. Conversely, when the supply exceeds the demand, the price may decrease.

The supply of Blur Token is predetermined through a process known as mining. Miners use powerful computers to solve complex mathematical problems, and in return, they are rewarded with newly minted Blur Tokens. This process helps regulate the supply of Blur Token in the market.

The demand for Blur Token can be influenced by various factors, including market sentiment, adoption by businesses, and technological advancements. As more individuals and businesses recognize the benefits of Blur Token, the demand for it may increase, driving up the price.

Market Volatility

It is important to note that the price of Blur Token can be highly volatile. The cryptocurrency market is known for its price fluctuations, and Blur Token is no exception. Factors such as regulatory developments, market speculation, and macroeconomic events can cause sudden price changes.

Investors and traders should be aware of the risks associated with market volatility and make informed decisions when buying or selling Blur Token. Additionally, it is important to stay updated with the latest news and developments in the Blur Token ecosystem to understand how they may impact the price.

Use Cases

While Blur Token is primarily used as a form of digital currency, it also has various other use cases. It can be used for online purchases, remittances, and even as a store of value. Some individuals may also choose to hold Blur Token as an investment, speculating that its price will increase over time.

Furthermore, Blur Token can be used in decentralized applications (DApps) built on top of the Blur Blockchain. These DApps offer various functionalities such as decentralized finance (DeFi), gaming, and social networking.

In conclusion, Blur Token is a privacy-oriented cryptocurrency that operates on the Blur Blockchain. Its price is influenced by the principles of supply and demand, and it is subject to market volatility. Understanding the various use cases of Blur Token can help individuals make informed decisions when engaging with this digital currency.

Factors Affecting Supply of Blur Token

1. Mining Difficulty:

Mining difficulty refers to the computational power required to solve the complex mathematical problems necessary to mine new Blur tokens. As the difficulty increases, the supply of new tokens decreases. This is because higher mining difficulty leads to longer blocks, resulting in fewer tokens being added to the supply.

2. Block Rewards:

Block rewards are the incentives given to miners for successfully solving the mathematical problems. The number of tokens awarded as block rewards can directly affect the supply. If the block rewards are high, more miners will be motivated to participate, leading to an increase in the supply of Blur tokens. Conversely, if the block rewards are reduced, the supply will decrease.

3. Mining Equipment:

The availability and efficiency of mining equipment can impact the supply of Blur tokens. Technological advancements in mining hardware can increase the computational power, allowing miners to mine more tokens in less time. This can lead to an increase in the token supply. Conversely, if mining equipment becomes obsolete or unavailable, the supply may decrease.

4. Investor Demand:

Investor demand plays a crucial role in influencing the supply of Blur tokens. If there is high demand from investors, it can create an incentive for miners to increase their mining activities, thereby increasing the token supply. On the other hand, if investor demand drops, miners may reduce their mining activities, resulting in a decrease in the supply of Blur tokens.

5. Token Burning:

Token burning refers to the deliberate destruction or removal of tokens from circulation. It can be done through various methods, such as reducing a portion of the token supply or repurchasing tokens from the market. Token burning can affect the supply by reducing the total number of tokens available, which can create scarcity and potentially increase the token's value.

In conclusion, several factors can affect the supply of Blur tokens, including mining difficulty, block rewards, mining equipment, investor demand, and token burning. It is important to consider these factors when analyzing the impact of supply and demand on the price of Blur token.

Factors Affecting Demand for Blur Token

The demand for Blur Token is influenced by various factors that play a crucial role in determining its price. Here are some key factors that affect the demand for Blur Token:

1. Utility and Functionality

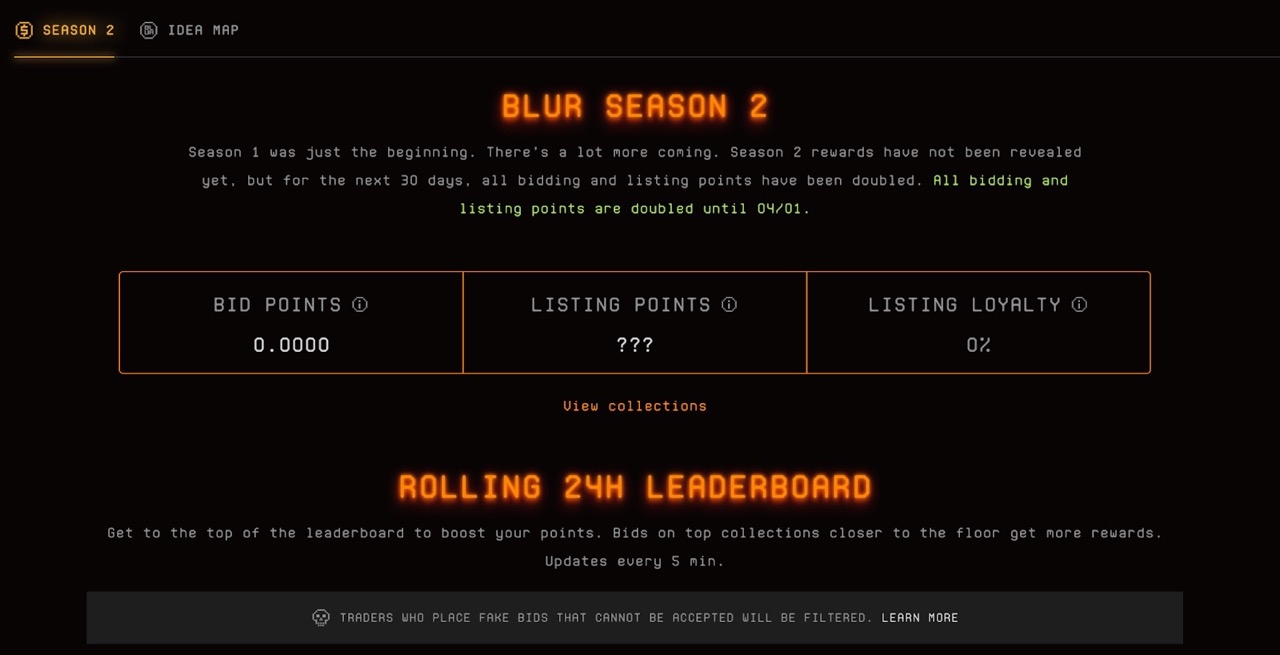

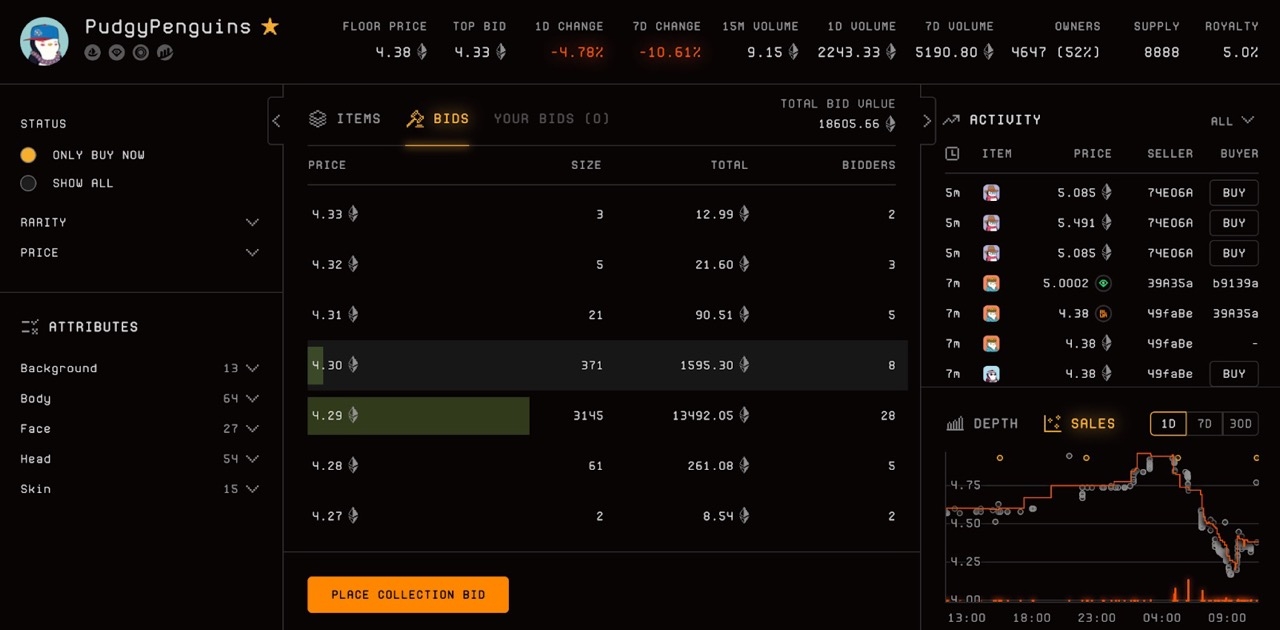

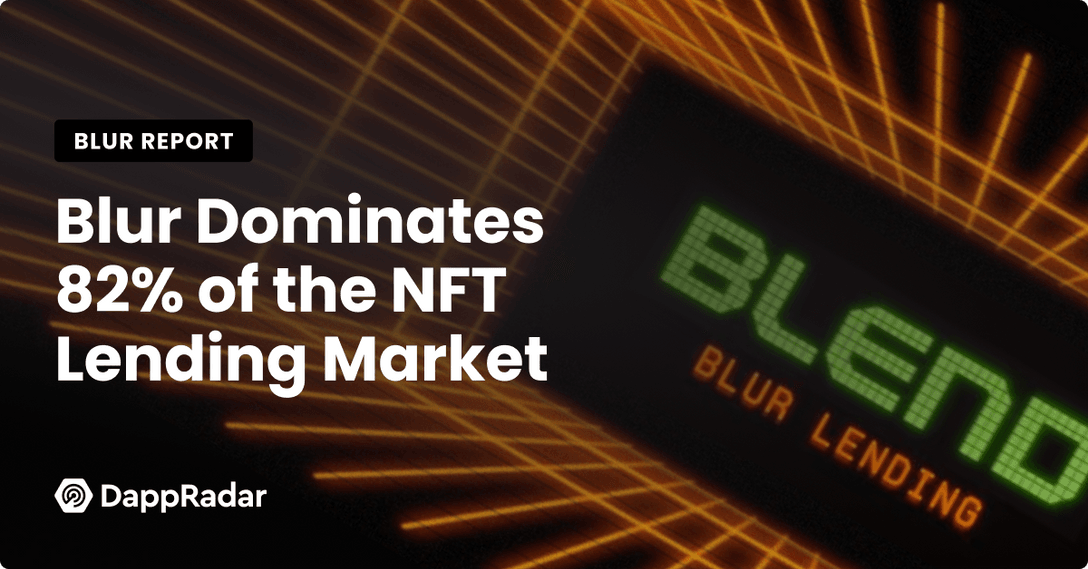

The utility and functionality of Blur Token greatly impact its demand. As Blur Token is used within the Blur NFT Marketplace, its demand increases with the popularity and usage of the platform. Users require Blur Token to participate in auctions, purchase or trade NFTs, and access various features offered by the marketplace. The more active users and transactions on the Blur NFT Marketplace, the higher the demand for Blur Token.

2. Rarity and Scarcity

Blur Token is often associated with unique and limited-edition NFTs, which are inherently scarce. The scarcity of these NFTs drives up the demand for Blur Token, as collectors and investors seek to acquire rare digital assets through the marketplace. Higher demand for these rare NFTs can create a ripple effect, indirectly increasing the demand for Blur Token.

3. Market Speculation

The speculative nature of the cryptocurrency market can significantly influence the demand for Blur Token. Speculators and investors closely monitor the Blur NFT Marketplace and its associated token, seeking opportunities for profit. Positive market sentiment, such as news about successful NFT sales, partnerships, or influential artists joining the marketplace, can create a surge in demand for Blur Token as speculators aim to benefit from potential price appreciation.

4. Integration with Other Platforms

The integration of Blur Token and the Blur NFT Marketplace with other popular platforms and services can contribute to increased demand. Integration with widely used wallets, exchanges, and social media platforms can expand the reach and accessibility of Blur Token, attracting more users and driving up demand.

5. Regulation and Legal Framework

The regulatory environment and legal framework surrounding NFTs and cryptocurrencies can significantly impact the demand for Blur Token. Positive regulatory developments, such as clear guidelines and increased acceptance of NFTs, can instill confidence in users and investors, leading to higher demand for Blur Token. Conversely, negative regulatory actions or uncertainties may hinder the demand and adoption of Blur Token.

These factors, among others, contribute to the overall demand for Blur Token and can influence its price fluctuations in the market. Stay up to date with the latest developments in Blur NFT Marketplace and explore the benefits of Blur Token by connecting your wallet through Wallet Connect.

How Supply and Demand Interact

In the world of economics, supply and demand are two fundamental factors that dictate the price of any given product or asset. The same holds true for blur token. Understanding how supply and demand interact is crucial for comprehending the price fluctuations of blur token.

Supply

The supply of blur token refers to the total number of tokens available in the market. It is determined by the amount of token initially issued and any subsequent token creation or destruction. The supply is finite and controlled by various mechanisms defined by the token's protocol.

When the supply of blur token is limited, its scarcity increases. As a result, the demand for the token might rise as investors anticipate potential future value. Conversely, if the supply increases beyond the demand, the value of the token may decrease.

Demand

Demand represents the desire and willingness of investors, traders, and users to hold or acquire blur token. Demand is influenced by various factors such as market sentiment, investment trends, technological advancements, and regulatory developments.

The demand for blur token can be affected by several factors. For example, if blur token gains popularity and trust among users and investors, the demand for it might increase. Similarly, if blur token finds its utility in various industries or applications, its demand could rise significantly.

Moreover, specific events like partnerships, listings on major exchanges, or regulatory endorsements can create a surge in demand for blur token. Conversely, negative news or market sentiments can lead to a decline in demand.

Interaction between Supply and Demand

The price of blur token is determined by the equilibrium between its supply and demand. When the demand exceeds the supply, the price tends to increase due to the scarcity of available tokens. Conversely, if the supply surpasses the demand, the price may decrease.

The interaction between supply and demand can create a dynamic and volatile market for blur token. The equilibrium can be disrupted by various factors, leading to price fluctuations. Understanding the dynamics of supply and demand is essential for investors and traders to make informed decisions.

In conclusion, the price of blur token is influenced by the dynamic interaction between its supply and demand. The scarcity or abundance of supply, coupled with the desire and willingness of investors to hold or acquire the token, plays a crucial role in determining its value. Monitoring the supply and demand factors helps stakeholders in the blur token ecosystem assess market trends and make strategic investment decisions.

Price Determination in Blur Token Market

The price of Blur token is determined by the forces of supply and demand in the market. The equilibrium price is found where the quantity of Blur tokens supplied by sellers matches the quantity demanded by buyers.

Supply refers to the amount of Blur tokens that sellers are willing and able to sell at a given price level. It is influenced by factors such as the cost of production, the number of Blur tokens available, and the expectations of future prices. When the price of Blur token increases, sellers are willing to supply more tokens to take advantage of higher profits.

Demand, on the other hand, represents the quantity of Blur tokens that buyers are willing and able to purchase at a given price level. It is influenced by factors such as consumer preferences, income levels, and the availability of substitutes. When the price of Blur token decreases, buyers are willing to demand more tokens as they become relatively cheaper.

The interaction of supply and demand in the Blur token market leads to price adjustments. If there is excess demand, where buyers want to purchase more tokens than sellers are willing to supply at the current price, the price of Blur token will increase. This increase in price signals to sellers that they can earn higher profits, leading to an increase in the quantity supplied and a decrease in quantity demanded, eventually restoring equilibrium.

Conversely, if there is excess supply, where sellers are willing to supply more tokens than buyers are willing to purchase at the current price, the price of Blur token will decrease. This decrease in price encourages buyers to demand more tokens as they become relatively cheaper, leading to an increase in quantity demanded and a decrease in quantity supplied, bringing the market back to equilibrium.

Market Dynamics

The price determination in the Blur token market is subject to various market dynamics. These dynamics can include changes in consumer preferences, technological advancements, regulatory developments, and market speculation.

For instance, if there is a sudden surge in demand for Blur tokens due to a new application or a partnership announcement, the price of Blur token may increase as buyers scramble to acquire tokens. Conversely, if there is negative news or regulatory uncertainty surrounding the use of Blur tokens, it may lead to a decrease in demand and a subsequent price decline.

Moreover, market speculation can also play a role in determining the price of Blur tokens. Traders and investors may anticipate future price movements based on market trends, news, or technical analysis. This speculation can lead to price volatility and short-term price deviations from the fundamental supply and demand factors.

Wallet Connect

To participate in the Blur token market and interact with buyers and sellers, users can utilize the Wallet Connect feature. Wallet Connect allows users to securely connect their digital wallets and conduct transactions on the Blur NFT Marketplace. This enables users to engage in the buying and selling of Blur tokens and contribute to the price determination process.

Cost of production

New applications

Number of Blur tokens available

Negative news

Expectations of future prices

Regulatory developments

Consumer preferences

Market speculation

Income levels

Availability of substitutes

Effects of Finite Supply on Price

The supply of blur tokens in the market is limited, which means that there is a finite amount available for purchase. This limited supply can have a significant impact on the price of the blur token.

Increased Demand and Scarcity

As the demand for blur token increases, and the supply remains finite, the price of the token tends to rise. This is because more people are competing to purchase the limited number of tokens available, driving up the price to achieve equilibrium in the market. The scarcity of the blur token creates a sense of urgency among buyers, further fueling demand and increasing the price.

Supply and Demand Imbalance

If the demand for blur tokens exceeds the available supply, there will be a shortage of tokens in the market. This can result in a rapid increase in price as buyers are willing to pay a premium to secure the limited number of tokens available. The supply and demand imbalance can lead to price volatility as buyers and sellers adjust their expectations based on the scarcity of the token.

On the other hand, if the supply of blur tokens exceeds the demand, the price may decrease as sellers compete to attract buyers. This can occur if there is a sudden influx of new tokens into the market or a decrease in demand for the token. The oversupply of tokens can drive down prices as sellers lower their prices to entice buyers.

Long-term Price Trends

The finite supply of blur tokens can also contribute to long-term price trends. As the total supply of tokens diminishes, the scarcity of the token increases, potentially leading to higher prices over time. Additionally, if the demand for blur tokens continues to grow, the limited supply may create a situation where the token becomes highly valuable and sought after.

However, it is important to note that the price of blur tokens is also influenced by other factors such as market sentiment, technological advancements, and regulatory changes. Therefore, while the finite supply of blur tokens plays a significant role in determining the price, it should be considered alongside other market dynamics when analyzing the overall impact on price.

Effects of Increased Demand on Price

When the demand for Blur Token increases, it has a direct impact on its price. There are several key effects that can be observed when the demand for Blur Token rises:

Increase in Price: As demand for Blur Token surges, more buyers enter the market, willing to purchase the token at a higher price. This increased competition causes the price of Blur Token to rise.

Reduced Supply: With higher demand, existing holders of Blur Token may become increasingly unwilling to sell, holding onto their tokens in anticipation of further price increases. This reduced supply, coupled with rising demand, creates a scarcity, further driving up the price.

Market Speculation: As demand increases, market participants may speculate on the future value of Blur Token. This speculation can further drive up the price, as buyers anticipate higher returns on their investment.

Market Volatility: Increased demand can lead to higher price volatility. This volatility occurs as buyers and sellers adjust their positions and react to market fluctuations. Sharp price movements may occur as demand rapidly changes.

Market Manipulation: In some instances, increased demand can attract manipulators attempting to artificially inflate the price of Blur Token. These manipulators may employ various tactics, such as false news or coordinated buying, to drive up the price for their own gain.

Overall, increased demand for Blur Token leads to an increase in its price, creating opportunities for profit but also exposing market participants to higher levels of volatility and potential manipulation.

Inelasticity of Supply and Demand for Blur Token

When analyzing the impact of supply and demand on the price of Blur Token, it is important to consider the concept of elasticity. Elasticity refers to the responsiveness of supply and demand to changes in price. If supply or demand is elastic, it means that a small change in price will lead to a proportionally larger change in quantity demanded or supplied. On the other hand, if supply or demand is inelastic, it means that a change in price will have a relatively small effect on quantity demanded or supplied.

In the case of Blur Token, both the supply and demand for the token tend to be relatively inelastic. This inelasticity can be attributed to several factors.

1. Limited production capacity

1. Limited substitutes

2. High production costs

2. High brand loyalty

3. Long manufacturing lead times

3. Unique features and benefits

On the supply side, the inelasticity of Blur Token can be attributed to factors such as limited production capacity, high production costs, and long manufacturing lead times. These factors make it difficult for suppliers to quickly adjust the quantity of Blur Token supplied in response to changes in price. As a result, even if the price of Blur Token were to increase significantly, the supply would only be able to increase by a relatively small amount.

On the demand side, the inelasticity of Blur Token can be attributed to limited substitutes, high brand loyalty, and unique features and benefits. These factors make it challenging for consumers to find alternative tokens or switch to other brands. As a result, even if the price of Blur Token were to increase, the quantity demanded would only decrease slightly, as consumers are willing to pay a higher price for the unique features and benefits provided by Blur Token.

In conclusion, the supply and demand for Blur Token are relatively inelastic due to factors such as limited production capacity, high production costs, limited substitutes, high brand loyalty, long manufacturing lead times, and unique features and benefits. This inelasticity contributes to the stability of the price of Blur Token, as small changes in supply or demand have only a limited impact on the quantity and price of the token.

Impact of Speculation on Blur Token Price

Speculation plays a significant role in influencing the price of Blur token. Investors who speculate on the future value of Blur token often buy or sell it based on their expectations of its price movement, which can create significant price fluctuations.

Market Sentiment

The sentiment of investors and traders in the market greatly affects the price of Blur token. Positive market sentiment, driven by optimistic expectations of future developments and adoption of the token, can lead to increased demand and, subsequently, higher prices. Conversely, negative sentiment can result in decreased demand and lower prices.

News and Announcements

News and announcements regarding Blur token, such as partnerships, listings on exchanges, or technological advancements, can greatly impact the price. Positive news often triggers increased speculation and buying pressure, leading to price surges. Conversely, negative news can dampen sentiment and trigger selling pressure, causing the price to drop.

It is important to note that speculation can create volatility in the price of Blur token. The high volatility can attract both short-term traders looking to profit from price swings and long-term investors who believe in the long-term potential of the token.

However, excessive speculation can lead to market bubbles, where prices become artificially inflated, detached from the actual value of the token. It is crucial for investors to carefully evaluate the fundamental value of Blur token and not solely rely on speculation when making investment decisions.

Market Manipulation and Price Volatility

Market manipulation refers to illegal activities aimed at artificially influencing the price of a security or an asset. In the case of the blur token, market manipulation can have a significant impact on its price volatility. This section will discuss some common forms of market manipulation and their potential effects on the price of the blur token.

Pump and Dump: This is a form of market manipulation where a group of individuals artificially inflate the price of a token by spreading positive rumors or manipulating the market to create a buying frenzy. Once the price has reached a peak, the manipulators sell their holdings, causing the price to plummet. This can lead to significant price volatility and potential losses for unsuspecting investors.

Wash Trading: Wash trading involves buying and selling the same token simultaneously to create the illusion of high trading volume. This can mislead investors into thinking that there is significant demand for the token, leading to increased buying and potentially driving up the price. However, in reality, no genuine trading activity is taking place, and the price is artificially inflated. When the manipulators stop wash trading, the price may experience a sharp decline.

Spoofing: Spoofing involves placing fake orders to deceive other traders into thinking that there is a large order book and significant demand for the token. This can lead to increased buying activity and a temporary spike in the price. Once other traders start to buy, the manipulators cancel their fake orders, causing the price to drop. This can result in price volatility and potential losses for traders.

Front Running: Front running refers to a practice where traders exploit non-public information to place orders ahead of larger orders, causing the price to move in their favor. This can create price volatility as other traders may try to chase the price movement or adjust their strategies based on the sudden price change.

Spoofy: "Spoofy" is a term used to describe a specific market manipulator who allegedly possesses the power to control the price of cryptocurrencies, including the blur token. Spoofy is thought to use large buy or sell orders to influence the market and manipulate prices. While the existence and actions of Spoofy are debated, the notion of a single entity manipulating the market can create fear and uncertainty, leading to price volatility.

Market manipulation can have a significant impact on the price volatility of the blur token. It is important for investors and traders to be aware of these manipulative practices and exercise caution when trading the token. Regulatory efforts and increased transparency in the cryptocurrency market can help mitigate market manipulation and reduce price volatility.

Supply and Demand Forecast

In order to understand the impact of supply and demand on the price of Blur Token, it is necessary to forecast the future trends. The supply of Blur Token is determined by the number of tokens in circulation and the rate at which new tokens are issued. The demand, on the other hand, is influenced by factors such as investor sentiment, technological advancements, and regulatory developments.

Considering the current market conditions and the growing interest in the cryptocurrency space, it is expected that the demand for Blur Token will continue to increase in the near future. The increasing popularity of decentralization, privacy, and blockchain technology is driving the demand for cryptocurrencies like Blur Token.

Furthermore, as Blur Token gains more recognition and adoption, the demand for it is likely to increase even further. As more individuals and businesses start using Blur Token for transactions and investments, the demand will rise, putting upward pressure on the price.

On the supply side, the issuance rate of Blur Token is predetermined and designed to gradually decrease over time. This ensures a limited supply and scarcity, which can contribute to price appreciation. As the supply becomes more constrained, the demand-supply gap is likely to widen, further influencing the token's price.

However, it is important to note that the future price of Blur Token will also be affected by various external factors such as market volatility, regulatory changes, and technological advancements. These factors can have unpredictable impacts on the supply and demand dynamics, making it challenging to accurately forecast the token's price.

In conclusion, based on the current market trends and the growing demand for cryptocurrencies, including Blur Token, it is reasonable to expect that the price of Blur Token will continue to rise in the near future. However, it is crucial to monitor market conditions and evaluate the impact of external factors to understand the precise supply and demand dynamics and make informed predictions about the token's price.

Regulatory and Legal Factors

When it comes to the price of blur token, regulatory and legal factors play a significant role. The cryptocurrency market is highly influenced by government regulations and policies that are put in place to protect investors and prevent fraudulent activities.

One of the key regulatory factors that can impact the price of blur token is the legality of cryptocurrency in different countries. Some countries have embraced cryptocurrencies and have created favorable regulatory frameworks, which can positively impact token prices. On the other hand, countries that have banned or heavily restricted cryptocurrencies can have a negative impact on the price of blur token.

Additionally, regulations related to financial institutions and exchanges can also affect the price of blur token. For example, if a country imposes strict KYC (Know Your Customer) and AML (Anti-Money Laundering) regulations on cryptocurrency exchanges, it can increase the compliance costs for these exchanges. As a result, the trading volumes of blur token may decrease, which can have a downward pressure on its price.

Furthermore, regulatory actions taken by prominent countries or regulators can have a spill-over effect on the global cryptocurrency market, including the price of blur token. For instance, if a major country introduces new regulations that are perceived as negative for the overall cryptocurrency market, it can lead to panic-selling and a decrease in demand for blur token.

It's also important to consider the legal status of blur token itself, as it can impact its price. If blur token is deemed as a security by regulatory authorities, it may be subject to additional compliance requirements and restrictions. This can have a negative impact on its price, as it may limit the number of potential buyers and traders.

Legalization of cryptocurrencies

Positive impact if legalized, negative if banned

Regulations on financial institutions and exchanges

Increased compliance costs may decrease trading volumes

Global regulatory actions

Panic-selling and decreased demand

Legal status of blur token

If deemed as a security, may have negative impact

In conclusion, regulatory and legal factors are important considerations when analyzing the price of blur token. The actions and policies of governments and regulatory authorities can either support or hinder the growth and adoption of cryptocurrencies, which in turn, can impact the price of blur token.

What is blur token?

Blur token is a digital asset that is used in the Blur Network ecosystem. It is built on a decentralized blockchain and can be used for various purposes, including privacy-focused transactions and decentralized applications.

How does supply and demand affect the price of blur token?

The price of blur token is influenced by the principles of supply and demand. When the demand for blur token increases and the supply remains constant, the price tends to rise. On the other hand, if the supply of blur token increases while the demand remains constant, the price may decrease. Therefore, the balance between supply and demand plays a crucial role in determining the price of blur token.

What factors can affect the supply of blur token?

There are several factors that can impact the supply of blur token. One key factor is the rate at which new blur tokens are created through mining or other mechanisms. If the rate of token creation is high, the supply will increase. Additionally, if there are any changes to the rules or protocols governing the issuance of blur token, it can also affect the supply. Other factors include token burns or destruction, which can reduce the total supply of blur token.

How does market demand influence the price of blur token?

Market demand for blur token has a significant impact on its price. If there is high demand for blur token, more people will be willing to buy it, leading to an increase in price. On the other hand, if the demand is low, sellers may have to lower their prices to attract buyers, which can result in a decrease in price. Factors such as the popularity of the Blur Network ecosystem, the perceived value of blur token, and market trends can all influence the level of demand.

Can the price of blur token be manipulated?

While it is possible for the price of blur token to be manipulated in the short term due to factors such as market manipulation or insider trading, in the long run, the price is mostly determined by the balance between supply and demand. The decentralized nature of blockchain technology makes it more difficult for any single entity to manipulate the price on a large scale. However, it is still important for investors to be cautious and to consider multiple factors when making investment decisions.

What is the blur token?

The blur token is a digital token that is used within the Blur platform. It can be used for various purposes such as incentivizing users to contribute computing power, buying and selling resources on the platform, and participating in decentralized applications (DApps).

Blur: NFT | Blur: NFT login | Blur: NFT connect | WalletConnect | Traders | What Is Blur Crypto

2022-2024 @ The impact of supply and demand on the price of blur token an in depth analysis