Analyzing the fundamental differences between blurry cryptocurrencies and traditional coins.

Blur: NFT | Blur: NFT login | Blur: NFT connect | WalletConnect | Traders | What Is Blur Crypto

Blur: NFT | Blur: NFT login | Blur: NFT connect | WalletConnect | Traders | What Is Blur Crypto

In the world of digital currencies, there are two main types of coins: blur cryptocurrency and traditional coins. While they may seem similar on the surface, there are fundamental variances that set them apart. This article will delve into the key differences between these two types of currency, providing an in-depth analysis of their respective characteristics and functionalities.

Blur cryptocurrency, such as Bitcoin, is a decentralized form of currency that operates on a peer-to-peer network. It utilizes cryptographic technology to secure transactions and control the creation of new units. The supply of blur cryptocurrency is limited, with a predetermined maximum number of coins that can ever be mined. This scarcity factor contributes to its value and has led to a surge in popularity and adoption in recent years.

On the other hand, traditional coins, like fiat currencies (USD, EUR, etc.), are issued and regulated by central banks and governments. These coins have physical representation in the form of paper money and coins, and their supply is not limited in the same way as blur cryptocurrency. The value of traditional coins is influenced by various factors, including government policies, economic indicators, and geopolitical events.

One of the key advantages of blur cryptocurrency is its decentralization. Unlike traditional coins that are controlled by centralized authorities, blur cryptocurrency is governed by a distributed network of computers. This means that no single entity has full control over the currency, making it less susceptible to manipulation and censorship. Additionally, blur cryptocurrency transactions are typically faster and more secure than traditional coin transactions due to the use of blockchain technology.

Comparison of Blur Cryptocurrency and Traditional Coins Analyzing the Fundamental Variances

In the rapidly evolving world of digital currencies, Blur cryptocurrency has emerged as a unique and innovative player. Blur offers a decentralized, secure, and transparent platform for transactions, with a focus on non-fungible tokens (NFTs) and their potential applications in various industries. To understand the fundamental variances between Blur cryptocurrency and traditional coins, let's delve deeper into their key features and characteristics.

Blur Cryptocurrency

Blur cryptocurrency operates on a blockchain-based network, utilizing advanced cryptographic technology to ensure the security and integrity of transactions. The primary focus of Blur is the creation and trading of NFTs, which are unique digital assets that represent ownership or proof of authenticity for various digital or physical items.

Blur offers a range of features that distinguish it from traditional coins:

NFT-focused: Blur places a significant emphasis on NFTs, providing a dedicated marketplace for creators, collectors, and enthusiasts. This focus allows for the exploration of new possibilities in art, gaming, collectibles, and more.

Decentralization: Blur operates on a decentralized network, ensuring that no single entity has control over transactions or user data. This decentralization fosters transparency, security, and user empowerment.

Smart contracts: Blur utilizes smart contract technology, enabling automated and self-executing agreements. This feature eliminates the need for intermediaries and enhances efficiency in transactions.

Community-driven governance: Blur's governance model involves active participation from the community through voting mechanisms. Users have a say in important decisions, ensuring a fair and inclusive ecosystem.

Blur cryptocurrency aims to revolutionize how we perceive and interact with digital assets, allowing for new avenues of creativity, ownership, and collaboration.

Traditional Coins

On the other hand, traditional coins, such as Bitcoin or fiat currencies like the USD or Euro, operate on centralized systems controlled by central banks or financial institutions. While traditional coins have been the norm for centuries, they have certain limitations that Blur cryptocurrency aims to address:

Limited utility: Traditional coins generally serve as a medium of exchange, but their utility is often confined to specific geographic areas or centralized platforms. Blur cryptocurrency, with its focus on NFTs, expands the utility of digital currencies beyond traditional boundaries.

Lack of transparency: In traditional financial systems, transactions are typically opaque, making it difficult to track funds or verify authenticity. Blur cryptocurrency, with its blockchain technology, offers enhanced transparency, enabling users to trace the origin and history of assets.

Intermediaries: Traditional coins rely on intermediaries, such as banks or payment processors, to facilitate transactions. These intermediaries may introduce delays, fees, or potential security risks. Blur cryptocurrency, with its decentralized nature, minimizes the need for intermediaries, streamlining transactions and reducing associated costs.

Governance: Traditional coins are governed by central authorities, whose decisions may not always align with the interests of the community. Blur cryptocurrency's community-driven governance ensures a more democratic and inclusive approach to decision-making.

By analyzing the fundamental variances between Blur cryptocurrency and traditional coins, it becomes clear that Blur offers a unique and compelling proposition in the world of digital currencies. With its focus on NFTs, decentralized approach, and community-driven governance, Blur cryptocurrency paves the way for a new era of digital asset ownership and collaboration.

For more information about Blur cryptocurrency, you can visit their official website: Blur: NFT login.

Understanding Cryptocurrency and Traditional Coins

When it comes to understanding the differences between cryptocurrency and traditional coins, it's important to first grasp the basic concepts of these two forms of currency. While traditional coins are physical and tangible, cryptocurrency is digital and relies on cryptographic technology for security.

Cryptocurrency

Cryptocurrency, such as Bitcoin and Ethereum, operates on a decentralized network called blockchain. This means that there is no centralized authority governing transactions, and instead, they are verified by a network of computers. Cryptocurrency transactions are pseudonymous, meaning that while the public address of the sender and receiver is recorded on the blockchain, their real-world identities are not necessarily known.

One of the key features of cryptocurrency is that it is scarce. Most cryptocurrencies have a limited supply, meaning that there will only ever be a certain number of coins in existence. This scarcity helps to maintain the value of cryptocurrency and can potentially lead to price appreciation over time.

Another important aspect of cryptocurrency is its security. Cryptocurrencies use cryptographic algorithms to ensure the integrity and security of transactions. This makes it extremely difficult for hackers to manipulate or counterfeit the currency.

Traditional Coins

Traditional coins, on the other hand, are physical forms of currency issued by a government or central bank. These include coins and banknotes that are widely accepted as a medium of exchange. Traditional coins rely on a centralized banking system, where transactions are recorded and regulated by financial institutions.

The value of traditional coins is often influenced by factors such as inflation, economic stability, and government policies. Unlike cryptocurrencies, traditional coins are not limited in supply and can be printed or minted as needed.

Traditional coins also offer a level of familiarity and simplicity for users. They can be easily stored, carried, and used for everyday transactions, making them a convenient form of currency for many people.

Decentralized

Centralized

Pseudonymous

Identifiable

Scarcity

Unlimited supply

Secure with cryptography

Relies on central authority

In conclusion, cryptocurrency and traditional coins have fundamental differences in terms of their nature, technology, and usage. While cryptocurrency offers decentralization, security, and scarcity, traditional coins provide familiarity, stability, and convenience. Understanding these differences is crucial for individuals looking to engage with either form of currency.

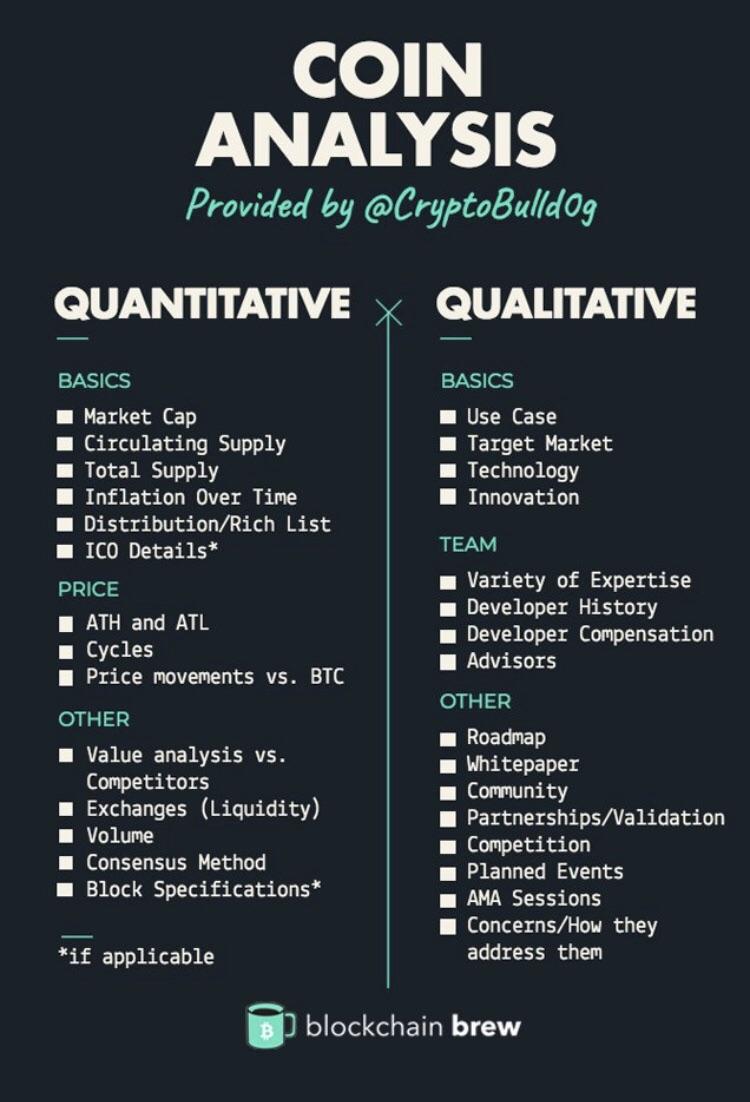

Key Differences between Cryptocurrency and Traditional Coins

Cryptocurrency:

1. Decentralization: Cryptocurrencies are decentralized digital currencies that operate on a technology called blockchain. There is no central authority or government controlling cryptocurrencies.

2. Anonymity: Cryptocurrency transactions can be conducted anonymously, providing users with privacy and security.

3. Limited Supply: Most cryptocurrencies have a limited supply, with a maximum number of coins that can ever be created. This scarcity can increase their value over time.

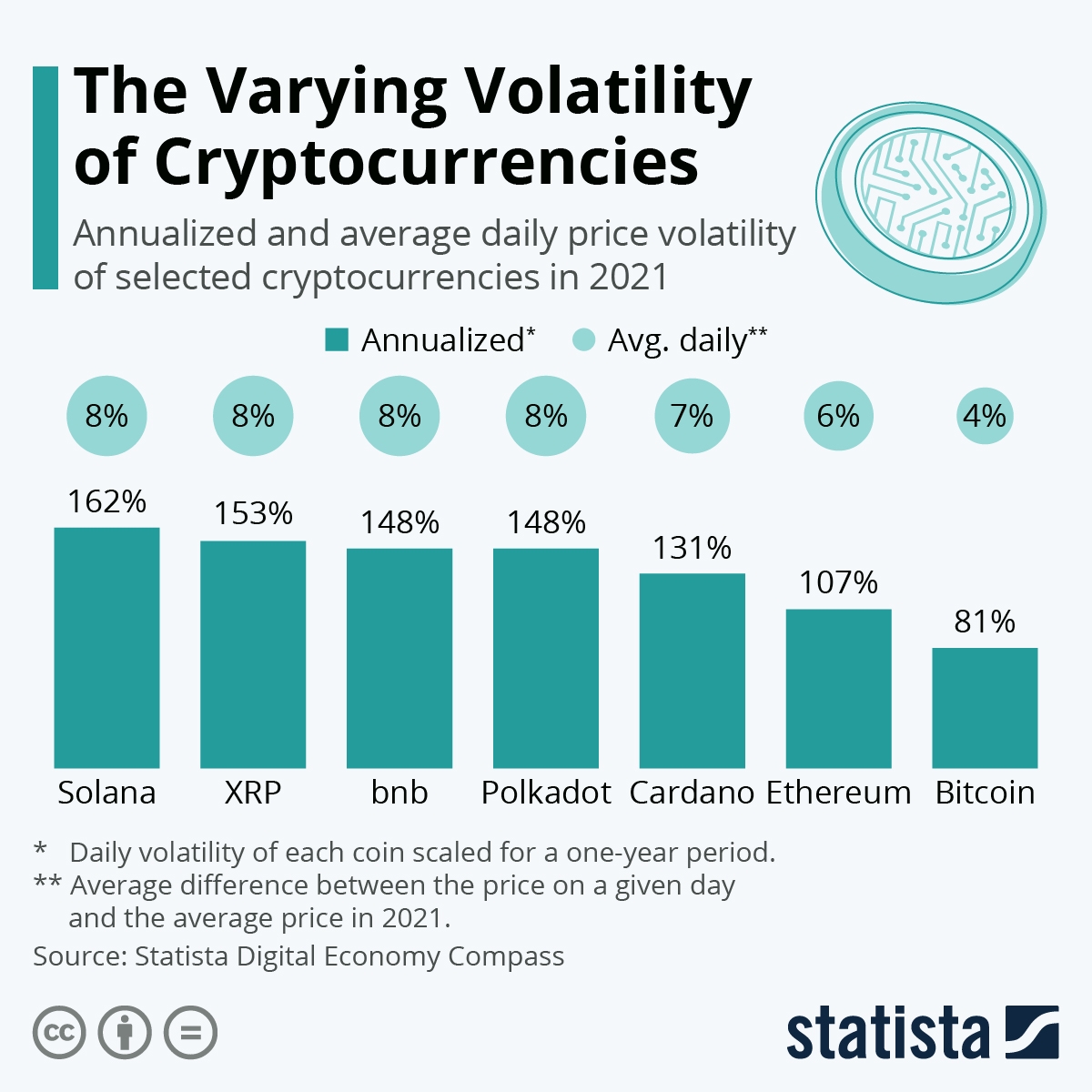

4. Volatility: Cryptocurrencies are known for their high volatility, with prices fluctuating rapidly. This volatility can present both opportunities and risks for investors.

Traditional Coins:

1. Centralized Control: Traditional coins, such as fiat currencies, are controlled and regulated by central banks and governments. They have monetary policies that determine the supply and value of the currency.

2. Identity Verification: Transactions involving traditional coins often require identity verification, as governments and financial institutions have regulations in place to prevent money laundering and fraudulent activities.

3. Unlimited Supply: Traditional coins do not have a capped supply, which means that central banks can print more money to increase the supply. This can lead to inflation and decrease the value of the currency.

4. Stability: Compared to cryptocurrencies, traditional coins tend to be more stable in terms of value. Central banks often use monetary policies to manage inflation and stabilize the economy.

In conclusion, the key differences between cryptocurrency and traditional coins lie in their decentralization, anonymity, limited supply, volatility (for cryptocurrencies) and centralized control, identity verification, unlimited supply, and stability (for traditional coins).

Examining the Technology Behind Cryptocurrency and Traditional Coins

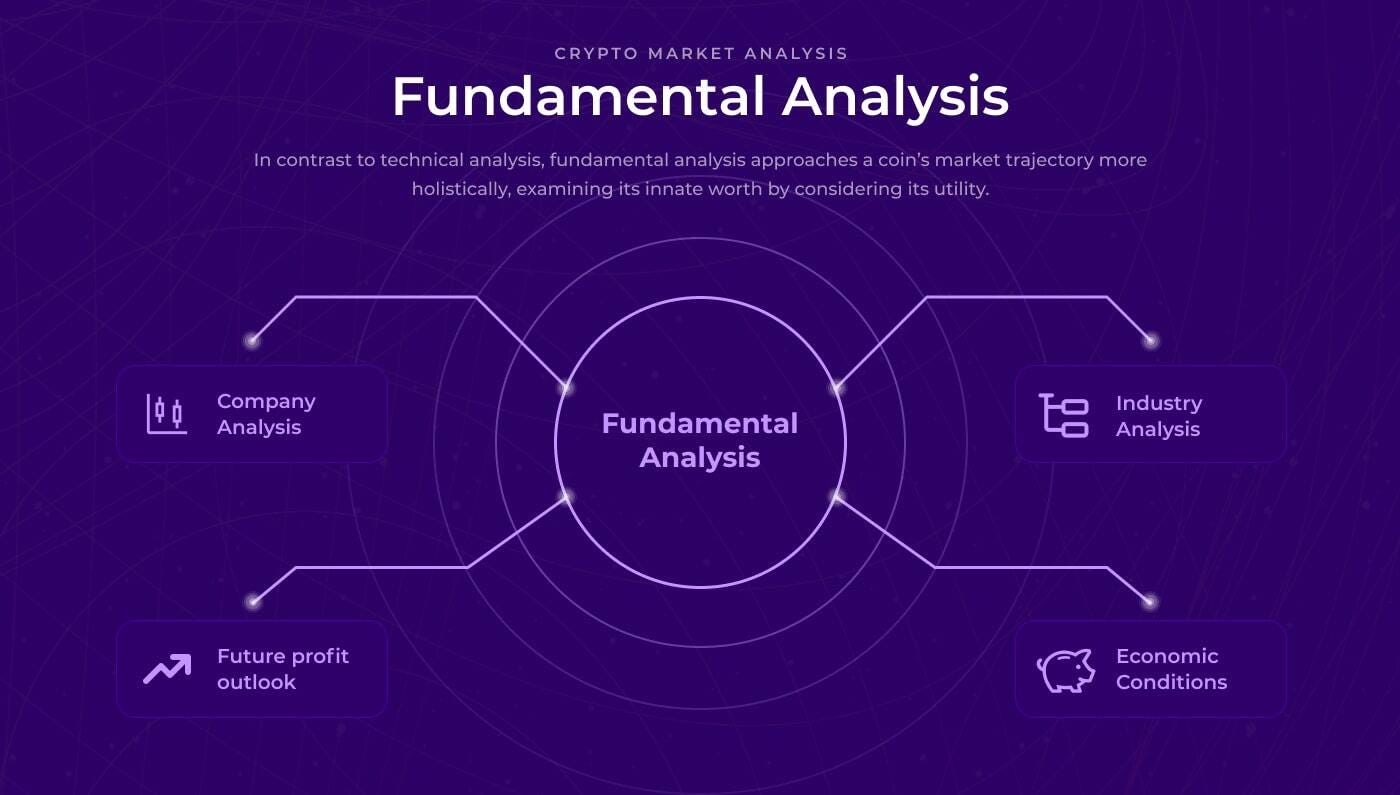

When it comes to the technology behind cryptocurrency and traditional coins, there are significant differences that set them apart. Understanding these differences is crucial to fully grasp the potential impact of cryptocurrencies like Blur, and their ability to transform various industries and financial systems.

One of the key distinguishing factors between cryptocurrency and traditional coins is the underlying technology that powers them. Cryptocurrencies like Blur are built on blockchain technology, which is a decentralized and distributed ledger system. This means that transactions are recorded and verified by a network of computers, known as nodes, rather than being controlled by a central authority, such as a bank or government.

This decentralized nature of blockchain technology brings several advantages to cryptocurrencies. Firstly, it eliminates the need for intermediaries, such as banks, to facilitate and verify transactions. This not only reduces costs but also increases the speed and efficiency of transactions. Additionally, the transparency and immutability of blockchain technology ensure that transactions cannot be tampered with, providing enhanced security and trust in the system.

Traditional coins, on the other hand, rely on a centralized system controlled by a central authority. Transactions are processed through financial institutions such as banks, which act as intermediaries. This introduces a level of trust in the system, as individuals need to rely on these intermediaries to facilitate and verify transactions.

Moreover, the technology behind cryptocurrencies like Blur enables the creation and implementation of smart contracts. These are self-executing contracts that automatically execute predefined terms and conditions when certain conditions are met. Smart contracts have the potential to revolutionize various industries, such as supply chain management and real estate, by automating and streamlining complex processes.

Overall, the technology behind cryptocurrencies like Blur, with its decentralized and transparent nature, offers numerous advantages over traditional coins. It provides increased security, faster and more efficient transactions, and the potential for innovative applications such as smart contracts. To experience the benefits of Blur and explore its potential, you can visit Blur: NFT login.

Security Features and Risks in Cryptocurrency and Traditional Coins

Security is a crucial aspect to consider when comparing cryptocurrency and traditional coins. Both types of currency have their own security features and inherent risks.

Cryptocurrency, such as Bitcoin, is built on blockchain technology, which provides a high level of security. The decentralized nature of blockchain makes it difficult for hackers to manipulate transactions and gain unauthorized access to funds. Additionally, cryptocurrency transactions are encrypted, adding an extra layer of security to the process. This encryption makes it highly unlikely for anyone to intercept or alter the transaction data.

Traditional coins, on the other hand, rely on centralized financial institutions for security. While these institutions have established security measures in place, they are still vulnerable to hacking, fraud, and theft. Traditional coins can also be counterfeited, which poses a significant risk in terms of security.

Another risk in both cryptocurrency and traditional coins is the possibility of losing access to funds. In the case of cryptocurrency, if users lose their private keys or forget their passwords, they may permanently lose access to their funds. This makes it crucial for individuals to take extra precautions in storing their cryptocurrency private keys securely.

Moreover, traditional coins can also be subject to theft or loss. If someone steals physical currency or if it gets lost or destroyed, there is no way to retrieve it. This makes traditional coins inherently less secure than cryptocurrency.

In conclusion, cryptocurrency offers a higher level of security compared to traditional coins. The decentralized nature, encryption, and difficulty in altering transactions in cryptocurrency make it more secure from hacking and fraud. However, the risk of permanently losing access to funds due to lost passwords or private keys remains a challenge for cryptocurrency users. Traditional coins, while relying on established financial institutions for security, are still susceptible to hacking, fraud, and counterfeiting.

Transaction Speed and Efficiency Comparison: Cryptocurrency vs. Traditional Coins

When it comes to transaction speed and efficiency, there are significant differences between cryptocurrency and traditional coins. Cryptocurrency transactions can occur almost instantly, while traditional coin transactions often require several intermediaries and can take days to complete.

Cryptocurrency transactions are processed on decentralized networks, which means there is no need for intermediaries such as banks or clearinghouses. Instead, transactions are verified and recorded on a blockchain by a network of computers called miners. This decentralized nature allows for faster and more efficient transactions, as there is no need to wait for approval from third parties.

On the other hand, traditional coin transactions rely on centralized systems, such as banks or payment processors, to facilitate transactions. These systems often involve multiple steps and verifications, which can introduce delays and increase the risk of errors or fraud. Additionally, traditional coin transactions may require manual processing by individuals, further adding to the time and cost involved.

Furthermore, the use of cryptocurrency eliminates the need for physical cash or checks, which reduces the time and effort required for handling and processing. Cryptocurrency transactions can be initiated and completed electronically, providing convenience and efficiency for both the sender and the recipient.

Overall, the transaction speed and efficiency of cryptocurrency are superior to traditional coins. The decentralized nature of cryptocurrency transactions allows for faster processing times, eliminates the need for intermediaries, and reduces the risk of errors or fraud. With the increasing adoption and development of cryptocurrency technology, it is likely that transaction speed and efficiency will continue to improve, further highlighting the advantages of cryptocurrency over traditional coins.

Analyzing the Financial Stability of Cryptocurrency and Traditional Coins

Financial stability is a crucial factor when comparing cryptocurrency and traditional coins. While traditional coins, such as fiat currencies issued by central banks, have established systems and regulations in place to ensure stability, cryptocurrency operates in a decentralized and largely unregulated environment.

Volatility

One of the primary differences between cryptocurrency and traditional coins is the level of volatility they exhibit. Cryptocurrencies, such as Bitcoin and Ethereum, are known for their extreme price fluctuations, often experiencing substantial gains or losses within a short period. Traditional coins, on the other hand, generally have more stable price movements due to centralized control and government interventions.

Market Manipulation

The decentralized nature of cryptocurrency creates an increased risk of market manipulation. Without proper regulation and oversight, it is easier for bad actors to artificially inflate or deflate the price of cryptocurrencies for their own gain. Traditional coins, being under the control of central banks and governments, have systems in place to combat market manipulation and protect the financial stability of their currency.

However, it is important to note that market manipulation can also be present in traditional markets, but regulatory bodies and authorities are generally more equipped to address and prevent such activities.

Government Influence

The influence of government and central banks is a significant factor in the stability of traditional coins. Governments can intervene in the market by implementing monetary policies, such as adjusting interest rates or controlling money supply, to stabilize their currency. Cryptocurrencies, in contrast, are not subject to government influence, which can make them more vulnerable to economic and political uncertainties.

Transparency

Transparency is another key difference between cryptocurrency and traditional coins. While traditional financial institutions are required to be transparent about their operations and financial data, cryptocurrencies often operate on decentralized blockchain networks, where transactions can be pseudonymous or anonymous. This lack of transparency in cryptocurrency transactions can make it harder to track illegal activities and prevent fraud.

In conclusion, the financial stability of cryptocurrency and traditional coins varies significantly due to factors such as volatility, market manipulation risks, government influence, and transparency. Traditional coins benefit from established regulations and systems, while cryptocurrency operates in a decentralized and relatively unregulated environment. These differences should be considered when analyzing the fundamental variances between the two.

Regulation and Legal Considerations in Cryptocurrency and Traditional Coins

Regulation and legal considerations play a significant role in the functioning of both cryptocurrency and traditional coins. However, the nature of regulation differs between these two types of currencies due to their decentralized and centralized nature, respectively.

Cryptocurrency Regulation

Cryptocurrencies operate in a decentralized manner, which poses challenges for regulators in terms of oversight and enforcement. The regulatory landscape for cryptocurrencies varies across jurisdictions, with some countries adopting a more stringent approach while others take a more permissive stance.

One key aspect of cryptocurrency regulation is the proper identification and authentication of users. As cryptocurrencies facilitate anonymous transactions, regulators are concerned about the potential misuse of digital currencies for illicit activities such as money laundering and terrorist financing. To address this, some countries have implemented Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations for cryptocurrency exchanges and wallet providers.

Another important area of regulation is taxation. Governments are increasingly recognizing cryptocurrencies as taxable assets and have established guidelines for their reporting and taxation. This includes capital gains tax on profits made from cryptocurrency investments and income tax on cryptocurrency mining and trading activities.

Traditional Coin Regulation

In contrast to cryptocurrencies, traditional coins such as fiat currencies are subject to strict regulatory frameworks enforced by central banks and government bodies. These regulations primarily focus on maintaining the stability of the financial system, preventing fraud, and ensuring the proper functioning of monetary policy.

Regulations for traditional coins include licensing requirements for banks and financial institutions, restrictions on the creation and circulation of currency, and measures to counter counterfeit currency. Central banks also play a crucial role in regulating interest rates, inflation, and foreign exchange markets to maintain monetary stability.

Additionally, traditional coins are subject to extensive consumer protection laws, ensuring that transactions are carried out fairly and securely. These laws cover areas such as payment processing, dispute resolution, and fraud prevention.

Conclusion:

Although both cryptocurrency and traditional coins face regulation and legal considerations, the approaches taken by regulators differ significantly. Cryptocurrencies operate in a decentralized and rapidly evolving environment, which poses unique challenges for regulators. Traditional coins, on the other hand, operate in a centralized and well-established regulatory framework. As the cryptocurrency market continues to mature, it is likely that regulators will continue to adapt and develop new regulations to address the growing complexities of digital currencies.

Decentralization and Control: Contrasting Cryptocurrency and Traditional Coins

Decentralization and control are fundamental aspects that distinguish cryptocurrency from traditional coins.

Cryptocurrency: Unlike traditional coins, cryptocurrencies are designed to operate on decentralized networks. This means that no central authority, such as a bank or government, has control over the transactions or the supply of the cryptocurrency. Instead, these functions are typically managed by a distributed network of computers, often referred to as nodes, which work together to maintain the integrity and security of the cryptocurrency.

One of the key benefits of decentralization in cryptocurrency is the enhanced level of transparency. Since transactions are recorded on a public ledger called the blockchain, anyone can view and verify the transactions. This transparency helps to prevent fraud and increases the confidence of users in the system.

However, the decentralized nature of cryptocurrency also poses some challenges. For example, the lack of central authority means that there is no central entity to hold responsible in case of theft or loss of funds. Additionally, the decentralized consensus mechanism used by cryptocurrencies, such as proof-of-work or proof-of-stake, requires significant computational power, which can contribute to high energy consumption.

Traditional Coins: In contrast, traditional coins are controlled by central authorities, such as central banks and governments. These entities have the power to regulate the supply of traditional coins and monitor the transactions that occur within their jurisdiction. They can also intervene in the event of fraud or illegal activities.

One of the advantages of central control in traditional coins is the ability to stabilize the value of the currency. Central banks have the authority to implement monetary policies, such as adjusting interest rates and managing inflation, to ensure stability in the value of the currency. This stability is often seen as desirable for businesses and individuals who rely on a consistent monetary system.

However, the centralized control of traditional coins also leaves them vulnerable to corruption and manipulation. In some cases, central authorities may use their power to devalue the currency or engage in unfair practices. Additionally, the centralized nature of traditional coins can limit accessibility, especially for individuals who are unbanked or living in countries with unstable or oppressive governments.

In conclusion, the contrasting nature of decentralization and control is a defining characteristic of cryptocurrency and traditional coins. While decentralization offers transparency and security in cryptocurrency, it also presents challenges and risks. On the other hand, the centralized control of traditional coins provides stability and regulation, but it can also lead to corruption and limited accessibility. Both approaches have their own advantages and disadvantages, which should be carefully considered when evaluating the use and adoption of different types of coins.

Scalability Analysis of Cryptocurrency and Traditional Coins

When comparing the scalability of cryptocurrency and traditional coins, it is important to consider several factors. Cryptocurrency, such as Blur, offers unique features and advantages that contribute to its scalability. On the other hand, traditional coins, like fiat currencies, have their own established systems that allow for scalable transactions.

Transaction Speed

With the implementation of blockchain technology, cryptocurrency transactions can occur in near real-time. The decentralized nature of cryptocurrency networks allows for faster verification and settlement. For example, Blur’s NFT marketplace offers quick and secure transactions through its Blur: NFT login.

Traditional coins can also offer fast transactions, especially with the use of electronic payment systems. However, the speed is often dependent on the banking infrastructure and the intermediaries involved in the process.

Scalability of Network

The scalability of cryptocurrency networks, such as Blur, can be easily achieved through the implementation of blockchain technology. The distributed design of the blockchain allows for multiple nodes to process transactions simultaneously, resulting in a more scalable network.

Traditional coins rely on centralized systems, such as banks and financial institutions, for transaction processing. While these systems have been optimized over the years, they can still face limitations when it comes to scalability.

Global Accessibility

Cryptocurrencies, like Blur, have global accessibility, allowing users from different parts of the world to participate in transactions. This eliminates the need for intermediaries and reduces transaction costs. Additionally, cryptocurrencies are not subject to geographical or political restrictions, further enhancing their scalability.

Traditional coins can be widely accessible, but they may be subject to various restrictions, such as currency exchange rates and international transaction fees. These factors can limit the scalability of traditional coins in cross-border transactions.

In conclusion, cryptocurrency, including Blur, offers unique scalability advantages compared to traditional coins. The implementation of blockchain technology, decentralized networks, and global accessibility contribute to the scalability of cryptocurrencies. However, traditional coins also offer fast transactions and established systems that allow for scalability within their existing frameworks.

Investment Opportunities Comparison: Cryptocurrency vs. Traditional Coins

When considering investment opportunities, it is essential to examine the fundamental differences between cryptocurrency and traditional coins. Both options provide unique advantages and disadvantages, attracting different types of investors. This article will explore the key characteristics of each investment option, allowing for a comprehensive comparison.

Volatility

Cryptocurrency markets are known for their high volatility, allowing for potentially significant returns but also carrying higher risks.

Traditional coins, such as gold or silver, tend to be more stable and offer a hedge against inflation and economic uncertainty.

Liquidity

Cryptocurrencies provide high liquidity, allowing for quick and seamless transactions, especially with established coins like Bitcoin and Ethereum.

Traditional coins may have lower liquidity, requiring more effort to buy/sell, especially for rare or collectible coins.

Accessibility

Cryptocurrencies offer accessibility to global markets 24/7, requiring only an internet connection and a digital wallet.

Traditional coins can be bought/sold through various channels, including banks, coin dealers, and online marketplaces, but may be subject to physical limitations and opening hours.

Security

Cryptocurrencies utilize advanced cryptographic techniques, providing secure transactions and immutability through blockchain technology.

Traditional coins offer physical security, as they can be stored in vaults or safes, but are susceptible to theft or loss.

Regulation

Cryptocurrency regulations vary globally, leading to potential legal uncertainties and risks for investors.

Traditional coins are often subject to well-established regulations, providing a higher level of investor protection.

Ultimately, the choice between cryptocurrency and traditional coins as investment opportunities depends on an individual's risk tolerance, investment goals, and personal preferences. While cryptocurrencies offer potential for higher returns and technological innovation, traditional coins provide stability and tangibility. It is advisable to conduct thorough research and seek professional advice before committing to any investment.

Evaluating the Privacy and Anonymity Features in Cryptocurrency and Traditional Coins

When it comes to privacy and anonymity, cryptocurrencies have often been hailed as a revolutionary alternative to traditional coins. While both forms of currency facilitate transactions, there are significant differences in terms of privacy and anonymity.

Privacy:

Traditional coins, such as fiat currency, often lack privacy features. Transactions made using traditional coins can be easily traced and tracked by financial institutions, governments, and third-party entities. This lack of privacy can expose individuals to various risks, including identity theft and fraud.

Cryptocurrencies, on the other hand, offer a certain level of privacy. With blockchain technology, transactions are recorded on a public ledger, but the identities of the individuals involved remain anonymous. This provides users with a higher level of privacy and protects them from potential privacy breaches.

Anonymity:

While cryptocurrencies offer privacy features, they also provide varying degrees of anonymity. Bitcoin, for example, is often described as pseudonymous, meaning that transactions are recorded on the blockchain using wallet addresses rather than personal information. However, with sophisticated analysis techniques, it is possible to trace transactions back to specific individuals.

Other cryptocurrencies, like Monero, offer stronger anonymity features. With features like ring signatures and stealth addresses, Monero transactions are highly private and nearly impossible to trace. This provides users with a higher level of anonymity, making it an attractive option for those seeking to protect their financial transactions.

Comparison:

When comparing privacy and anonymity features in cryptocurrencies and traditional coins, it is clear that cryptocurrencies provide better privacy and, in some cases, stronger anonymity. However, it is essential to note that using cryptocurrencies does not automatically guarantee complete privacy or anonymity. It is still crucial for users to take additional measures, such as using mixing services or hardware wallets, to enhance their privacy and protect their identity.

In conclusion, the rise of cryptocurrencies has brought forth new possibilities in terms of privacy and anonymity. While traditional coins lack these features, cryptocurrencies offer users a higher level of privacy and varying degrees of anonymity, depending on the specific cryptocurrency used. However, users must remain aware of their responsibilities regarding privacy and take appropriate measures to ensure their transactions remain private and anonymous.

Sustainability Analysis of Cryptocurrency and Traditional Coins

Introduction:

In today's rapidly changing financial landscape, the sustainability of various currencies is a topic of great importance. This analysis aims to compare the sustainability characteristics of cryptocurrency and traditional coins, highlighting their fundamental differences.

Environmental Impact:

Cryptocurrency, such as Bitcoin, has garnered criticism for its considerable environmental footprint. The mining process for cryptocurrencies necessitates extensive computational power and energy consumption, leading to a significant carbon footprint. In contrast, traditional coins, which rely on centralized banking systems, have a relatively smaller impact on the environment.

Transparency and Accountability:

One of the key advantages of cryptocurrency is its decentralized nature, which often enhances transparency and accountability. Blockchain technology, the underlying technology of most cryptocurrencies, offers a public and immutable ledger of transactions. Traditional coins, on the other hand, rely on centralized banking institutions, which may present challenges in terms of transparency and accountability.

Security:

Cryptocurrencies are often touted as being highly secure due to their cryptographic nature. The use of complex mathematical algorithms and encryption techniques makes it challenging for fraudulent activities to take place. On the contrary, traditional coins may be susceptible to counterfeiting and fraud, as physical currencies can be easily replicated.

Volatility:

Cryptocurrency markets are known for their high volatility, with prices experiencing significant fluctuations within short periods. This can make cryptocurrencies a risky investment option for some individuals or businesses. In contrast, traditional coins, such as government-issued currencies, tend to have more stable values and lower volatility, which can offer a sense of security for users.

Accessibility:

Cryptocurrency transactions can be conducted globally and virtually instantaneously, as long as there is internet access. This accessibility feature makes cryptocurrencies a viable alternative in regions lacking reliable banking infrastructure. Traditional coins, while widely accepted, may face limitations in terms of accessibility, especially in underdeveloped areas with limited financial services.

Conclusion:

In conclusion, the sustainability analysis of cryptocurrency and traditional coins reveals distinct variances between the two. While cryptocurrency offers advantages such as enhanced transparency and security, it also presents challenges in terms of environmental impact and volatility. Traditional coins, on the other hand, are more stable and widely accepted but may face limitations in terms of accessibility. Understanding these fundamental variances is crucial for individuals and businesses looking to make informed decisions in the evolving financial landscape.

Impact of Sustainability on Cryptocurrency and Traditional Coins

Cryptocurrencies and traditional coins have both faced scrutiny when it comes to their environmental impact and sustainability practices. In recent years, sustainability has become an increasingly important factor in the global economy, and it is now being considered in the context of digital assets.

Energy Consumption

One of the main concerns surrounding cryptocurrencies, such as Bitcoin, is their high energy consumption. The process of mining cryptocurrencies requires significant computational power, which in turn requires a considerable amount of electricity. This has led to debates about the environmental impact of cryptocurrencies and their contribution to carbon emissions.

In contrast, traditional coins do not require the same level of energy consumption for transaction processing. Although traditional financial systems still rely on energy-intensive infrastructure, the energy requirements are generally considered to be lower compared to the mining process of cryptocurrencies.

Environmental Sustainability Initiatives

In response to concerns about their environmental impact, some cryptocurrencies have implemented sustainability initiatives. For example, certain cryptocurrencies have explored alternative consensus mechanisms that are more energy-efficient, such as Proof-of-Stake (PoS) instead of Proof-of-Work (PoW).

Traditional coins have also made efforts to improve their environmental impact. Many commercial banks and financial institutions have implemented sustainability programs to reduce their carbon footprint. These initiatives include energy-efficient buildings, renewable energy sourcing, and carbon offsetting.

Transparency and ESG Considerations

With the increasing focus on sustainability and Environmental, Social, and Governance (ESG) factors, both cryptocurrencies and traditional coins are facing pressure to incorporate transparency in their operations. Investors and consumers are becoming more interested in understanding the environmental and social impact of their financial activities.

Some cryptocurrencies have decentralized and transparent transaction ledgers, known as blockchain technology, which provide an opportunity for greater transparency and accountability. However, the lack of regulation and standardization in the cryptocurrency space can make it difficult to assess the ESG factors of specific coins.

Traditional coins, on the other hand, are subject to more regulatory oversight, which means that they are required to comply with ESG guidelines and reporting standards. This allows for more assurance and transparency in terms of the environmental and social impact of traditional financial activities.

Overall, the impact of sustainability on cryptocurrencies and traditional coins is multifaceted. While cryptocurrencies face challenges in terms of energy consumption and lack of regulation, they also have the potential to leverage blockchain technology for greater transparency. Traditional coins, on the other hand, have more established sustainability initiatives but may lack the transformative potential of cryptocurrencies in terms of transparency and decentralization.

What are the fundamental differences between blur cryptocurrency and traditional coins?

Blur cryptocurrency and traditional coins differ in various fundamental aspects. Traditional coins are physical currencies issued and controlled by governments or central banks, while blur cryptocurrency is a digital form of currency created and maintained through cryptographic algorithms. Traditional coins are subject to inflation and can be counterfeited, while blur cryptocurrency is decentralized and has a limited supply. Additionally, blur cryptocurrency transactions can be anonymous, whereas traditional coin transactions are usually traceable.

Why is blur cryptocurrency considered decentralized?

Blur cryptocurrency is considered decentralized because its control is not centralized in the hands of any single authority or organization. Instead, it is maintained by a network of computers or nodes spread across the globe. These nodes work together to validate and record transactions in a decentralized ledger called a blockchain. This decentralized nature ensures that no single entity has complete control over the currency, making it resistant to censorship and manipulation.

Can traditional coins be counterfeited?

Yes, traditional coins can be counterfeited. Counterfeiting refers to the act of producing fake currency that resembles genuine coins. Counterfeit coins are meant to deceive people into accepting them as genuine currency. Counterfeiting can be a significant problem for traditional coins and can lead to economic loss and a loss of trust in the currency. In contrast, blur cryptocurrency is based on cryptographic algorithms, making it extremely difficult, if not impossible, to counterfeit.

Are blur cryptocurrency transactions anonymous?

Yes, blur cryptocurrency transactions can be anonymous. While traditional coin transactions are usually traceable, blur cryptocurrency offers a higher level of privacy and anonymity. When making a transaction with blur cryptocurrency, users are identified by their wallet addresses, which do not necessarily reveal their personal details. This anonymity can be beneficial for individuals who value privacy or wish to conduct transactions without disclosing their identities.

What is the advantage of a limited supply in blur cryptocurrency?

A limited supply in blur cryptocurrency provides several advantages. Firstly, it helps to maintain the value of the currency over time. With a limited supply, there is a cap on the number of coins that can ever be in circulation, which can prevent inflation. Additionally, a limited supply can create a sense of scarcity, making the cryptocurrency attractive to investors and potentially driving up its value. Finally, a limited supply can also contribute to the security of the cryptocurrency, as it reduces the risk of excessive mining or creation of new coins.

What are the fundamental differences between blur cryptocurrency and traditional coins?

The fundamental differences between blur cryptocurrency and traditional coins can be categorized into several aspects. Firstly, blur cryptocurrency operates on a decentralized network, whereas traditional coins are usually centralized and controlled by a central authority. Secondly, blur cryptocurrency utilizes blockchain technology for secure and transparent transactions, while traditional coins often rely on traditional banking systems. Additionally, blur cryptocurrency allows for greater privacy and anonymity in transactions, whereas traditional coins often require personal identification. Finally, blur cryptocurrency is often more volatile in terms of value, whereas traditional coins tend to have relatively stable prices.

How does blur cryptocurrency differ from traditional coins in terms of transaction security?

Blur cryptocurrency differs from traditional coins in terms of transaction security primarily through the use of blockchain technology. Blockchain technology enables blur cryptocurrency transactions to be recorded and verified on a decentralized network, making it difficult for any single entity to manipulate or alter the transaction data. This decentralized nature of blur cryptocurrency enhances security and reduces the risk of fraud or hacking. In contrast, traditional coins rely on centralized banking systems, which may be vulnerable to cyber attacks or internal breaches. Therefore, blur cryptocurrency offers a higher level of transaction security compared to traditional coins.

Blur: NFT | Blur: NFT login | Blur: NFT connect | WalletConnect | Traders | What Is Blur Crypto

2022-2024 @ Comparison of blur cryptocurrency and traditional coins analyzing the fundamental variances