An In-Depth Guide

Blur: NFT | Blur: NFT login | Blur: NFT connect | WalletConnect | Traders | What Is Blur Crypto

Blur: NFT | Blur: NFT login | Blur: NFT connect | WalletConnect | Traders | What Is Blur Crypto

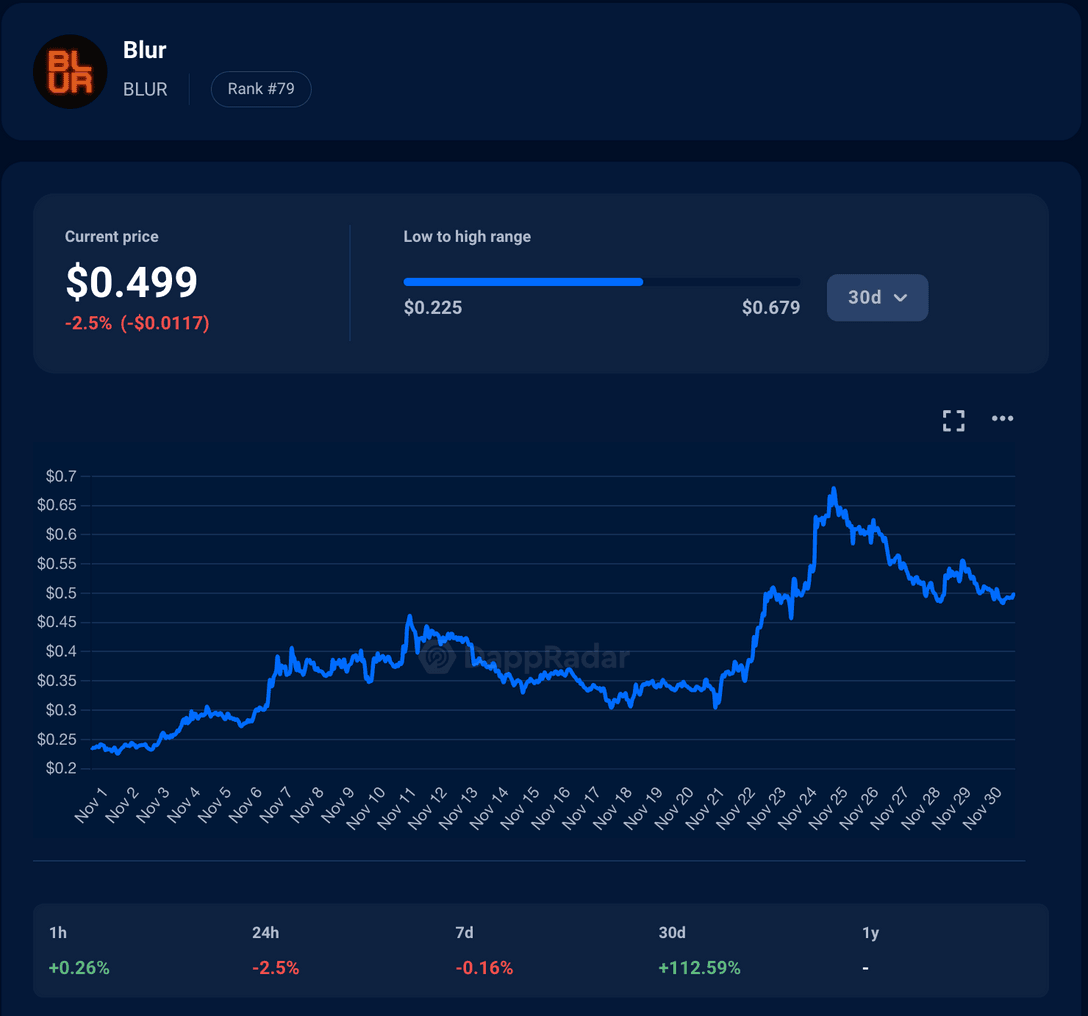

Welcome to the world of cryptocurrency, where digital currencies are taking the financial industry by storm. One cryptocurrency that has been making waves is Blur. As a newcomer to the crypto world, it is essential to have all the necessary information to grasp this innovative form of currency. Whether you're looking to invest, trade, or simply understand what all the buzz is about, this comprehensive guide will walk you through the essential details of Blur cryptocurrency.

Blur is a privacy-focused cryptocurrency that empowers users to transact securely and anonymously. Unlike traditional currencies, Blur operates on a decentralized network called blockchain, which ensures transparency and security. With Blur, your financial transactions are shielded from prying eyes, offering a level of privacy not found in traditional banking systems.

Blur utilizes cutting-edge technology called "obfuscation" to obscure the sender, receiver, and transaction amount. This ensures that your financial information remains confidential, protecting you from potential identity theft or fraud. As an individual, you have complete control over your financial data, empowering you to make secure transactions without fear of compromise.

Blur cryptocurrency operates on its blockchain, enabling fast and secure transactions. Unlike traditional banking systems, which may take several days to process transactions, Blur enables near-instantaneous transfers. With Blur, you can send funds to anyone, anywhere in the world, within seconds. This makes it an attractive option for individuals and businesses looking for efficient and convenient ways to transact.

The Basics of Cryptocurrency

Cryptocurrency is a digital or virtual form of currency that uses cryptography for security. Unlike traditional currencies, such as the US dollar or the Euro, cryptocurrency is decentralized and operates on a technology called blockchain. This means that it is not controlled by any central authority, such as a government or a financial institution.

One of the most well-known cryptocurrencies is Bitcoin, which was created in 2009 by an anonymous person or group of people using the pseudonym Satoshi Nakamoto. Bitcoin and other cryptocurrencies like Ethereum, Ripple, and Litecoin can be used for various purposes, such as buying goods and services, investing, or even as a store of value.

Cryptocurrencies are based on blockchain technology, which is a decentralized ledger that records all transactions across a network of computers. Each transaction is encrypted and added to a block, and once a block is completed, it is added to the blockchain. This makes it incredibly difficult for hackers to manipulate or alter the transaction history.

One key feature of cryptocurrencies is their security. They use complex cryptographic algorithms to secure transactions, making them highly secure and resistant to fraud. However, it's important to note that while cryptocurrencies are secure, the platforms and exchanges used to buy, sell, and store them can still be vulnerable to hacking.

Another important aspect of cryptocurrencies is their volatility. The prices of cryptocurrencies can be highly volatile and can change rapidly, often dramatically. This means that their value can rise or fall significantly within a short period of time. As a result, investing in cryptocurrencies can be highly risky and requires careful consideration and research.

In conclusion, cryptocurrencies are a digital form of currency that operates on blockchain technology. They are decentralized, secure, and highly volatile. To learn more about cryptocurrencies and start your journey in the world of digital assets, you can visit Blur: NFT login.

Understanding Blockchain Technology

Blockchain technology is the backbone of cryptocurrencies like Bitcoin, Ethereum, and many others. It is a distributed ledger system that allows for secure, transparent, and decentralized transactions.

How does it work?

At its core, a blockchain consists of a chain of blocks, each containing a list of transactions. These blocks are cryptographically linked to each other, creating an immutable record of all transactions ever made on the network. This means that once a transaction is recorded on the blockchain, it cannot be altered or deleted.

Decentralization and Consensus

One of the key features of blockchain technology is its decentralized nature. Instead of relying on a central authority like a bank or government, blockchain networks are maintained by a network of participants, known as nodes. These nodes work together to validate and verify transactions through a consensus mechanism, such as proof of work or proof of stake.

Security and Transparency

Blockchain technology provides a high level of security due to its decentralized nature and cryptographic algorithms. Transactions recorded on the blockchain are secured using encryption techniques, making it difficult for hackers to alter or manipulate the data. Additionally, the transparent nature of the blockchain allows anyone to view and audit the transaction history, promoting trust and accountability.

Smart Contracts

Blockchain technology enables the creation and execution of smart contracts. Smart contracts are self-executing contracts with the terms of the agreement directly written into code. They automatically execute when the conditions specified in the contract are met, removing the need for intermediaries and reducing the risk of fraud.

Potential Applications

Blockchain technology has the potential to revolutionize various industries beyond the realm of cryptocurrencies. It can be used for secure and transparent supply chain management, decentralized identity verification, voting systems, and much more. The ability to create tamper-proof, auditable records has wide-ranging implications for businesses and governments alike.

Overall, understanding blockchain technology is essential for anyone looking to grasp the fundamental concepts behind cryptocurrencies. Its decentralized nature, security features, and potential applications make it a groundbreaking technology that has the potential to reshape various aspects of our society.

Types of Cryptocurrencies

There are thousands of cryptocurrencies available in the market, each with its own unique features and use cases. Here are some of the most popular types:

1. Bitcoin (BTC): Bitcoin is the first and most well-known cryptocurrency. It was created in 2009 by an anonymous person or group known as Satoshi Nakamoto. Bitcoin operates on a decentralized network, allowing users to make peer-to-peer transactions without the need for intermediaries.

2. Ethereum (ETH): Ethereum is a blockchain-based platform that enables developers to build and deploy smart contracts and decentralized applications (DApps). Ether is the native cryptocurrency of the Ethereum network, which is used to pay for transaction fees and computational services.

3. Ripple (XRP): Ripple is both a cryptocurrency and a digital payment protocol. It aims to enable fast, low-cost international money transfers and remittances. Unlike Bitcoin and Ethereum, Ripple does not operate on a blockchain. Instead, it uses a consensus algorithm to validate transactions.

4. Litecoin (LTC): Litecoin was created in 2011 as a "lite" version of Bitcoin. It offers faster transaction confirmation times and a different hashing algorithm. Litecoin is often referred to as silver to Bitcoin's gold.

5. Cardano (ADA): Cardano is a blockchain platform that aims to provide a more secure and sustainable infrastructure for the development and execution of smart contracts. ADA is the cryptocurrency used within the Cardano network.

6. Stellar (XLM): Stellar is a blockchain platform designed to facilitate fast and low-cost cross-border transactions. It aims to connect financial institutions and individuals, making it easier to move money across borders. XLM is the native cryptocurrency of the Stellar network.

7. Bitcoin Cash (BCH): Bitcoin Cash is a hard fork of Bitcoin that aims to improve scalability and transaction speed. It has a larger block size than Bitcoin, allowing for more transactions to be processed in each block.

8. Dogecoin (DOGE): Dogecoin was created in 2013 as a fun and lighthearted cryptocurrency. It features the Shiba Inu dog from the "Doge" meme as its logo. Despite its origins as a joke, Dogecoin has gained a large following and is often used for charitable causes.

9. Monero (XMR): Monero is a privacy-focused cryptocurrency that aims to provide secure and untraceable transactions. It uses advanced cryptographic techniques to ensure the anonymity of its users and the confidentiality of their transactions.

10. Polkadot (DOT): Polkadot is a multi-chain platform that enables different blockchains to interoperate and share information. It aims to provide a scalable infrastructure for the development and deployment of decentralized applications.

These are just a few examples of the wide variety of cryptocurrencies available in the market. Each cryptocurrency has its own unique features and potential use cases, catering to different needs and preferences of cryptocurrency users.

How Cryptocurrencies are Created

Cryptocurrencies are created through a process known as mining. Mining involves solving complex mathematical problems using powerful computers. This process helps secure the cryptocurrency network and verify transactions.

When a miner successfully solves a mathematical problem, they add a new block to the cryptocurrency's blockchain. This block contains a list of recent transactions that have been verified.

Miners are rewarded for their work with newly created cryptocurrency coins. For example, in the case of Bitcoin, every time a new block is added to the blockchain, the miner responsible for solving the problem is awarded a certain amount of Bitcoins.

Most cryptocurrencies have a limited supply, meaning there is a maximum number of coins that can ever be created. This scarcity helps create value for the cryptocurrency. As more people mine and use the cryptocurrency, the difficulty of the mathematical problems increases to ensure a steady supply of new coins.

It's important to note that not all cryptocurrencies are created through mining. Some cryptocurrencies, known as pre-mined or ICO (Initial Coin Offering) coins, are created and distributed to investors before they are made available to the public. These coins usually serve a specific purpose within a blockchain project.

Additionally, some newer cryptocurrencies use different consensus mechanisms such as proof-of-stake (PoS) or delegated proof-of-stake (DPoS) instead of mining. These mechanisms rely on different principles to secure the network and create new coins.

If you're interested in exploring the world of cryptocurrencies, Blur: NFT login provides a secure platform for buying, selling, and trading various cryptocurrencies and NFTs.

Investing in Cryptocurrencies

Cryptocurrencies have gained significant popularity in recent years, and many investors are drawn to the potential high returns they offer. However, investing in cryptocurrencies carries certain risks and requires careful consideration.

Educate Yourself: Before investing in cryptocurrencies, it is crucial to educate yourself about the basics of blockchain technology, the different types of cryptocurrencies available, and the factors that affect their value. Understanding the market dynamics and staying updated with the latest trends can help you make informed investment decisions.

Start Small: If you are new to cryptocurrency investing, it is advisable to start with a small investment. This allows you to get familiar with the market and its volatility without risking a significant amount of capital.

Diversify Your Portfolio: Just like traditional investing, diversification is key when it comes to cryptocurrencies. Invest in a variety of different cryptocurrencies to spread the risk and potentially maximize your returns. However, be cautious not to over-diversify and dilute your investment potential.

Choose a Reliable Exchange: When buying and selling cryptocurrencies, it is essential to choose a reliable and secure cryptocurrency exchange platform. Research different exchanges, read user reviews, and consider factors such as security measures, liquidity, and fees before making a decision.

Stay Updated: The cryptocurrency market is highly volatile and subject to rapid changes. It is important to stay updated with the latest news, market trends, and regulatory developments. Following reputable sources and joining cryptocurrency communities can provide valuable insights and help you make informed investment decisions.

Consider Long-Term Investments: While some investors engage in short-term trading, others prefer a long-term investment approach for cryptocurrencies. Research and identify cryptocurrencies with strong fundamentals and long-term growth potential. Be patient and willing to hold your investments for an extended period to potentially benefit from future price appreciation.

Manage Risk: As with any investment, managing risk is crucial when investing in cryptocurrencies. Set a realistic budget for your investments, diversify your portfolio, and consider implementing risk-management strategies, such as stop-loss orders or taking profits at certain price levels.

Be Mindful of Security: Cryptocurrency investments are prone to security risks, such as hacking or scams. Take necessary precautions to secure your digital assets by using secure wallets, enabling two-factor authentication, and being cautious of phishing or fraudulent activities.

Seek Professional Advice: If you are unsure about investing in cryptocurrencies or need guidance, it is advisable to seek professional advice from a financial advisor or cryptocurrency expert. They can provide personalized insights based on your financial goals and risk tolerance.

Only Invest What You Can Afford to Lose: Cryptocurrency investing can be highly volatile and unpredictable. It is important to only invest an amount that you can afford to lose without affecting your financial stability. Never invest borrowed money or funds that are necessary for your essential expenses.

Remember, investing in cryptocurrencies carries risks, and past performance does not guarantee future results. It is essential to conduct thorough research, consider your risk tolerance, and make informed decisions when investing in cryptocurrencies.

Security Measures for Cryptocurrency

When it comes to dealing with cryptocurrency, security should always be a top priority. With the increasing popularity of cryptocurrencies, hackers and fraudsters are constantly looking for ways to exploit vulnerabilities and steal users' funds. Therefore, it is crucial for cryptocurrency owners to take necessary security measures to protect their digital assets. Here are some essential security measures to consider:

1. Use Strong Passwords

One of the most basic yet important security measures is to use strong passwords for all your cryptocurrency accounts. Avoid using common passwords or easily guessable ones. Instead, create a unique password that includes a combination of uppercase and lowercase letters, numbers, and special characters. Additionally, it is advisable to change your passwords regularly to minimize the risk of unauthorized access.

2. Enable Two-Factor Authentication

Two-factor authentication (2FA) adds an extra layer of security to your cryptocurrency accounts. It requires users to provide a second piece of information, typically a temporary code sent to their registered email address or mobile device, in addition to their password. By enabling 2FA, even if someone manages to obtain your password, they will still need the second factor to gain access to your account.

Additionally, consider using hardware wallets or offline wallets for storing your cryptocurrencies, as they provide greater security compared to online wallets. Hardware wallets store your private keys offline, making it harder for hackers to access your funds. Offline wallets, such as paper wallets or cold storage, keep your private keys completely offline, minimizing the risk of online attacks.

3. Stay Updated with Security Best Practices

The cryptocurrency landscape is constantly evolving, and new security threats emerge regularly. Therefore, it is essential to stay updated with the latest security best practices. Follow reputable cryptocurrency news sources and forums to learn about new security risks and how to mitigate them. Additionally, pay attention to software updates and patches released by cryptocurrency wallets and exchanges, as they often include security enhancements.

In conclusion, safeguarding your cryptocurrency investments requires implementing robust security measures. By using strong passwords, enabling two-factor authentication, and staying updated with security best practices, you can significantly reduce the risk of falling victim to hacks and scams. Remember, the security of your cryptocurrency assets is in your hands, so prioritize security to protect your digital wealth.

The Role of Cryptocurrency Exchanges

Cryptocurrency exchanges play a vital role in the world of digital currencies. These online platforms enable users to buy, sell, and trade various cryptocurrencies such as Bitcoin, Ethereum, and more. They act as intermediaries, connecting buyers and sellers on their platforms and facilitating the exchange of digital assets.

Exchanges offer a range of essential services that make it easy for individuals and institutional investors to participate in the cryptocurrency market. Some common features include:

Trading and Market Access

Cryptocurrency exchanges provide users with a user-friendly interface and trading tools to buy and sell digital assets. These platforms allow individuals to enter the market and start trading cryptocurrencies easily. Additionally, exchanges offer market access, ensuring that users can trade various cryptocurrencies at their convenience.

Liquidity

One of the critical functions of cryptocurrency exchanges is to provide liquidity to the market. By bringing together a large number of buyers and sellers, exchanges allow for efficient price discovery and faster transactions. This liquidity ensures that users can easily buy or sell their cryptocurrencies without significant price variations.

Security

Cryptocurrency exchanges prioritize the security of user funds. They employ robust security measures such as encryption, two-factor authentication, and cold storage to protect user accounts and assets from potential cyber-attacks. However, it is crucial for users to choose reputable exchanges and take additional security measures, such as setting strong passwords and regularly updating them.

One such reputable exchange is Blur: NFT login. This platform offers a secure and user-friendly environment for trading and investing in cryptocurrencies. It ensures high liquidity, fast transactions, and top-notch security, giving users peace of mind while navigating the cryptocurrency market.

Overall, cryptocurrency exchanges play a pivotal role in facilitating the growth and adoption of digital currencies. They provide the necessary infrastructure and services for individuals and institutional investors to engage in the cryptocurrency market effectively.

The Legal and Regulatory Environment for Cryptocurrencies

Cryptocurrencies, such as Bitcoin and Ethereum, operate in a complex legal and regulatory environment that varies from country to country. While some governments have embraced cryptocurrencies as a legitimate form of currency or investment, others have adopted a more cautious or even hostile approach. Understanding the legal and regulatory landscape is crucial for individuals and businesses involved in cryptocurrencies.

Legal Recognition and Classification

The legal status of cryptocurrencies varies widely across jurisdictions. In some countries, cryptocurrencies are recognized as legal tender and enjoy the same legal protection as traditional currencies. In others, they are classified as commodities, assets, or securities, subject to specific regulations and oversight. Some countries have banned or restricted their use altogether.

Licensing and Compliance

When it comes to operating cryptocurrency businesses, obtaining the necessary licenses and ensuring compliance with applicable regulations is essential. Different jurisdictions have different requirements for cryptocurrency exchanges, wallet providers, and other crypto-related businesses. These requirements may include registration, financial reporting, customer due diligence, and anti-money laundering measures.

Consumer Protection and Investor Rights

Many countries have implemented consumer protection measures to safeguard individuals using cryptocurrencies. These measures may include disclosure requirements, anti-fraud provisions, and mechanisms for resolving disputes. Investors in cryptocurrency projects are also protected by securities laws and regulations that aim to prevent fraud and ensure transparency.

Taxation

The tax treatment of cryptocurrencies varies widely around the world. Some countries treat them as assets subject to capital gains tax, while others consider them as virtual currency and subject them to sales tax. It is important for individuals and businesses to understand their tax obligations related to cryptocurrency transactions to avoid legal issues and penalties.

International Cooperation

Given the global nature of cryptocurrencies, international cooperation and coordination between governments and regulatory bodies are becoming increasingly important. Many countries are working together to develop common frameworks and standards to address cross-border issues, such as money laundering, terrorist financing, and tax evasion.

Conclusion:

As cryptocurrencies continue to gain popularity and mainstream adoption, the legal and regulatory environment surrounding them will evolve. Individuals and businesses involved in cryptocurrencies should stay informed about the latest developments in their respective jurisdictions to ensure compliance and protect themselves from legal and financial risks.

The Pros and Cons of Using Cryptocurrency

Cryptocurrency has gained significant popularity in recent years as a decentralized form of digital currency. While it offers several advantages, there are also some drawbacks to consider.

One of the biggest advantages of using cryptocurrency is the potential for increased security and privacy. Transactions made with cryptocurrency are anonymous and cannot be easily traced back to the individuals involved. This makes it attractive to those who value their privacy and want to protect their financial information.

Another advantage is the low transaction fees associated with cryptocurrency. Traditional banking systems often charge high fees for international transactions or when sending money across borders. Cryptocurrency transactions, on the other hand, typically have lower fees and can be completed quickly.

Furthermore, cryptocurrency offers increased accessibility to financial services. In many countries, millions of people lack access to traditional banking systems. Cryptocurrency can provide them with a means of transferring and storing money without the need for a bank account.

However, there are also some cons to using cryptocurrency. One of the main concerns is the potential for price volatility. Cryptocurrency prices can fluctuate rapidly and dramatically, which can lead to financial loss if not managed properly.

Another drawback is the lack of regulation and oversight. Cryptocurrency operates outside the traditional banking system, which means there are fewer consumer protections in place. This can make it more challenging to recover funds in the event of fraud or theft.

Additionally, the limited acceptance of cryptocurrency as a payment method is still a disadvantage. While some businesses and online platforms accept cryptocurrency, it is not yet widely accepted. This limits its utility as a currency in day-to-day transactions.

In conclusion, cryptocurrency offers several advantages, such as increased security, low transaction fees, and accessibility to financial services. However, it also has drawbacks, including price volatility, lack of regulation, and limited acceptance. Before using cryptocurrency, it is important to carefully consider these pros and cons to make an informed decision.

The Impact of Cryptocurrency on the Global Economy

Over the past decade, cryptocurrency has emerged as a disruptive force in the global economy. With its decentralized nature and promise of financial freedom, it has attracted a growing number of users, investors, and businesses worldwide.

One of the key impacts of cryptocurrency on the global economy is its potential to revolutionize the financial system. Unlike traditional banking systems, cryptocurrency offers lower transaction fees, faster cross-border payments, and increased accessibility. This can benefit individuals and businesses, especially those in developing countries where traditional banking systems are often inefficient and inaccessible.

Cryptocurrency also has the potential to reduce financial inequality. With traditional banking systems, individuals in underserved communities may struggle to access financial services and face high fees. Cryptocurrency provides an alternative, allowing individuals to store, send, and receive money without needing a traditional bank account. This can empower the unbanked population and enable greater financial inclusion.

Another impact of cryptocurrency on the global economy is its potential to disrupt traditional financial intermediaries. Blockchain technology, which underlies most cryptocurrencies, allows for secure and transparent transactions without the need for intermediaries such as banks or payment processors. This has the potential to reduce costs associated with intermediation and streamline financial processes.

Furthermore, cryptocurrency has the potential to spur innovation and drive economic growth. The blockchain technology behind cryptocurrency can be applied to various industries beyond finance, such as supply chain management, healthcare, and voting systems. This opens up new opportunities for businesses and entrepreneurs to develop innovative solutions and create new jobs.

However, cryptocurrency also presents challenges to the global economy. Its volatile nature and lack of regulation can lead to price manipulation and market instability. Moreover, the anonymity associated with cryptocurrencies can facilitate illegal activities such as money laundering and illicit transactions. These challenges highlight the need for regulation and oversight to ensure the proper functioning of the cryptocurrency market.

In conclusion, cryptocurrency has had a significant impact on the global economy. It has the potential to revolutionize the financial system, reduce financial inequality, disrupt traditional intermediaries, spur innovation, and drive economic growth. However, it also poses challenges that need to be addressed to fully harness its potential benefits. As the cryptocurrency market continues to evolve, its impact on the global economy is likely to become even more pronounced.

Future Trends in Cryptocurrency

As cryptocurrency continues to gain popularity and acceptance, it is important to consider the future trends that will shape the industry. Here are some of the key trends to watch out for:

1. Increased Security Measures

With the rise in cyber attacks and hacking incidents, the future of cryptocurrency will see increased security measures to protect digital assets. Cryptocurrency exchanges and wallets will implement advanced encryption techniques and multi-factor authentication to safeguard user funds.

2. Central Bank Digital Currencies (CBDC)

Central banks around the world are exploring the concept of issuing their own digital currencies. CBDCs could facilitate faster, more secure transactions, and provide governments with better control over their monetary systems. This trend may lead to increased adoption and integration of cryptocurrency into the traditional financial system.

3. Decentralized Finance (DeFi)

Decentralized finance, or DeFi, has gained significant attention in recent years. DeFi applications allow users to access financial services without the need for intermediaries, such as banks. This trend is expected to continue growing, with more projects and decentralized exchanges emerging, offering a wide range of financial services on the blockchain.

4. Integration of Artificial Intelligence

The integration of artificial intelligence (AI) in the cryptocurrency space is predicted to have a significant impact. AI technologies can enhance security measures, improve trading strategies, and provide more accurate price predictions. As AI continues to evolve, it will likely play a crucial role in the future development of cryptocurrency.

5. Regulation and Compliance

As the cryptocurrency industry matures, governments around the world will likely implement regulations to ensure investor protection and combat illegal activities. Increased regulation may bring more legitimacy to the sector, but it could also create challenges for privacy-focused cryptocurrencies and decentralized systems. Striking a balance between regulation and innovation will be crucial for the future of cryptocurrency.

In conclusion, the future of cryptocurrency holds immense potential. With increased security, the advent of CBDCs, the growth of DeFi, the integration of AI, and the implementation of regulations, the cryptocurrency industry will continue to evolve. It is an exciting time for investors, developers, and enthusiasts as they navigate these future trends and seize the opportunities they present.

Cryptocurrency and Privacy

Privacy has always been a major concern when it comes to financial transactions. Cryptocurrency, with its decentralized nature and advanced cryptography, offers a new level of privacy and security.

One of the main advantages of cryptocurrency is that it allows users to make anonymous transactions. Unlike traditional banking systems, where every transaction is linked to the user's identity, cryptocurrency transactions are pseudonymous. This means that users can maintain a level of privacy while making transactions.

However, it is important to note that while cryptocurrency transactions are pseudonymous, they are not completely anonymous. All transactions are recorded on a public ledger called the blockchain, which is accessible to anyone. This means that while the user's identity may not be directly linked to the transactions, their transaction history can still be traced.

There are certain cryptocurrencies, such as Monero and Zcash, that offer enhanced privacy features. These cryptocurrencies use advanced techniques such as ring signatures and zero-knowledge proofs to obfuscate transaction details and make it difficult to trace them back to the sender or recipient.

In addition to pseudonymity, cryptocurrency also provides enhanced security and privacy through the use of encryption. Every transaction is encrypted using complex mathematical algorithms, making it extremely difficult for hackers to intercept or manipulate the data.

It is also worth mentioning that cryptocurrency users have full control over their funds and can choose to disclose their identity only when necessary. Unlike traditional banks, which require personal information for account creation and verification, cryptocurrency wallets can be created anonymously.

Anonymous transactions

Enhanced security through encryption

Full control over funds

Transaction history can still be traced

Not completely anonymous

Requires technical knowledge to ensure privacy

In conclusion, cryptocurrency offers a new level of privacy and security compared to traditional banking systems. While it is not completely anonymous, it provides pseudonymity and encryption to protect user identities and transaction details. As the technology continues to evolve, we can expect further advancements in privacy features.

Ethical Considerations in Cryptocurrency

Cryptocurrencies have gained significant popularity in recent years, revolutionizing the way we perceive and interact with traditional financial systems. While the technology behind cryptocurrencies offers numerous benefits, it also raises several ethical considerations that need careful examination.

1. Security and Privacy: One of the primary concerns in the cryptocurrency market is the security and privacy of users' transactions and personal information. The decentralized nature of cryptocurrencies makes them vulnerable to hacking and other cyber-attacks. Ethical considerations should focus on developing robust security measures to protect users' assets and data.

2. Inclusivity and Accessibility: Cryptocurrencies have the potential to empower individuals who lack access to traditional banking services. However, ethical questions arise regarding the inclusivity of cryptocurrency platforms. Efforts must be made to ensure that technological barriers, such as the digital divide, do not exclude certain groups from participating in the cryptocurrency ecosystem.

3. Fraud and Scams: The decentralized and anonymous nature of cryptocurrencies makes them attractive to individuals involved in fraudulent activities. Ethical considerations should involve the development of mechanisms to identify and prevent fraudulent transactions, protecting innocent users from financial loss.

4. Environmental Impact: Cryptocurrency mining requires substantial computing power, which consumes vast amounts of energy. As the industry grows, ethical considerations must address the environmental impact of cryptocurrency mining and explore more sustainable alternatives.

5. Regulatory Compliance: Cryptocurrencies operate in a legal gray area in many jurisdictions. Ethical considerations should focus on promoting compliance with regulations to prevent money laundering, terrorist financing, and other illicit activities associated with cryptocurrencies.

6. Volatility and Speculation: Cryptocurrencies are known for their high volatility, attracting speculators seeking quick profits. Ethical considerations should emphasize responsible investment practices and educate individuals about the risks involved in cryptocurrency trading.

7. Social and Economic Equality: Cryptocurrencies have the potential to reshape the global financial landscape, but ethical considerations must address potential inequalities that may arise from their widespread adoption. Efforts should be made to ensure that the benefits of cryptocurrencies are distributed equitably and do not exacerbate existing social and economic disparities.

In conclusion, while cryptocurrencies offer numerous benefits, it is crucial to address the ethical considerations associated with their use. By focusing on security, inclusivity, fraud prevention, environmental impact, regulatory compliance, responsible investment, and social equality, the cryptocurrency ecosystem can strive for a more ethical and sustainable future.

Common Challenges in Cryptocurrency Adoption

While cryptocurrency has gained significant popularity in recent years, there are still several challenges that hinder its widespread adoption. These challenges can vary from technical limitations to regulatory concerns. Below, we discuss some of the common challenges faced by individuals and businesses when it comes to cryptocurrency:

1. Volatility

One of the major challenges in cryptocurrency adoption is its volatility. The value of cryptocurrencies can fluctuate greatly within short periods of time, leading to uncertainty and risk for users. This volatility makes it difficult for individuals to use cryptocurrencies as a reliable store of value or medium of exchange.

2. Scalability

Scalability is another significant challenge in the adoption of cryptocurrencies. As the number of users and transactions increase, the blockchain networks can become congested, resulting in slower transaction times and higher fees. This scalability issue needs to be addressed for widespread adoption of cryptocurrencies in day-to-day transactions.

3. Security

Security concerns are a major barrier to cryptocurrency adoption. While the underlying blockchain technology is considered secure, there have been instances of hacking, fraud, and theft in the cryptocurrency ecosystem. Users often have to rely on complex wallet systems and strong security measures to protect their digital assets, which can be intimidating for newcomers.

4. Regulatory Uncertainty

The lack of clear and consistent regulations surrounding cryptocurrencies is a significant challenge for adoption. Different countries have varied approaches to regulate cryptocurrencies, which creates uncertainty for businesses and individuals. Regulatory frameworks are needed to provide clarity on issues such as taxation, investor protection, and anti-money laundering measures.

5. Lack of User-Friendly Interfaces

For mass adoption, cryptocurrencies need to have user-friendly interfaces and seamless user experiences. Currently, the process of acquiring and using cryptocurrencies can be complex and confusing for non-technical users. Improvements in user interfaces, wallet designs, and educational resources are necessary to attract and retain a wider user base.

6. Education and Awareness

Many individuals are still not aware of what cryptocurrencies are and how they work. The lack of education and awareness about cryptocurrencies is a significant barrier to adoption. Efforts are needed to educate the general public about the benefits and risks of cryptocurrencies to increase adoption and understanding.

Volatility

The value of cryptocurrencies can fluctuate greatly within short periods of time, leading to uncertainty and risk for users.

Scalability

As the number of users and transactions increase, blockchain networks can become congested, resulting in slower transaction times and higher fees.

Security

Security concerns, including hacking, fraud, and theft, are major barriers to cryptocurrency adoption.

Regulatory Uncertainty

The lack of clear regulations surrounding cryptocurrencies creates uncertainty for businesses and individuals.

Lack of User-Friendly Interfaces

The complex and confusing process of acquiring and using cryptocurrencies deters non-technical users.

Education and Awareness

The lack of education and awareness about cryptocurrencies is a significant barrier to adoption.

What is cryptocurrency?

Cryptocurrency is a digital or virtual form of currency that uses cryptography for security. It operates independently of a central bank and allows for secure and anonymous transactions.

How does cryptocurrency work?

Cryptocurrency works on a technology called blockchain, which is a decentralized network of computers that maintain a digital ledger of transactions. When a transaction occurs, it is verified by the network and added to the blockchain.

What are the advantages of using cryptocurrency?

Using cryptocurrency offers several advantages, including faster and cheaper cross-border transactions, increased privacy and security, and the potential for investment and financial growth.

Is cryptocurrency legal?

The legality of cryptocurrency varies from country to country. While some countries have embraced cryptocurrency and have regulations in place, others have banned or restricted its use. It is important to be aware of the legalities in your own country.

What are the risks of investing in cryptocurrency?

Investing in cryptocurrency carries several risks, including volatility, lack of regulation, potential for fraud, and the possibility of losing your investment. It is important to do thorough research and only invest what you can afford to lose.

Blur: NFT | Blur: NFT login | Blur: NFT connect | WalletConnect | Traders | What Is Blur Crypto

2022-2024 @ A comprehensive guide to blur cryptocurrency essential information to grasp