Understanding how market sentiment affects the price of blurred coins.

Blur: NFT | Blur: NFT login | Blur: NFT connect | WalletConnect | Traders | What Is Blur Crypto

Blur: NFT | Blur: NFT login | Blur: NFT connect | WalletConnect | Traders | What Is Blur Crypto

Blur Coin, a cryptocurrency that emerged in 2017, has been gaining attention in the digital market. As with any other cryptocurrency, the value of Blur Coin is influenced by various factors. One of these factors, which has proven to be significant, is market sentiment.

Market sentiment refers to the overall attitude and perception of traders and investors towards a particular cryptocurrency. It can be influenced by a wide range of factors, including economic indicators, news events, and social media trends. When market sentiment is positive, it usually leads to an increase in demand for a cryptocurrency, which in turn drives up its price. Conversely, when market sentiment is negative, it often results in a decrease in demand and a decline in price.

The influence of market sentiment on Blur Coin price can be seen through the fluctuating values it has experienced over the years. During periods of positive sentiment, Blur Coin has seen significant price surges, with investors rushing to buy the cryptocurrency in the hopes of making a profit. On the other hand, when negative sentiment starts to dominate the market, the price of Blur Coin may plummet as investors sell off their holdings, fearing further losses.

Monitoring market sentiment is crucial for traders and investors looking to make informed decisions about trading Blur Coin. By understanding the current sentiment and how it may change in the future, traders can strategize and adjust their positions accordingly. Additionally, market sentiment can also provide valuable insights into the broader market trends and help identify potential investment opportunities.

Overall, the influence of market sentiment on Blur Coin price cannot be underestimated. As traders and investors continue to navigate the volatile cryptocurrency market, being aware of and analyzing market sentiment can be a key factor in achieving successful trading outcomes. It is important to stay vigilant and adapt to changes in sentiment to capitalize on the potential opportunities that arise.

The Impact of Market Sentiment on Blur Coin Price

Market sentiment plays a crucial role in determining the price of Blur Coin, the primary cryptocurrency used within the Blur NFT Marketplace. The price of Blur Coin is subject to significant fluctuations due to changes in market sentiment, which can either boost or suppress its value.

Understanding Market Sentiment

Market sentiment refers to the overall attitude or outlook of investors and traders towards a particular asset or market. It is largely driven by emotions such as fear, greed, optimism, and pessimism. Positive market sentiment typically leads to increased buying activity and higher prices, while negative market sentiment can result in selling pressure and declining prices.

Various factors contribute to market sentiment, including economic indicators, political events, market news, and social media trends. These influences can shape the perception of investors and ultimately impact the demand and price of Blur Coin.

The Effect on Blur Coin Price

When market sentiment is positive, investors perceive Blur Coin as a valuable asset with potential for growth. This optimism leads to increased buying pressure, as investors anticipate future price appreciation. As a result, the price of Blur Coin tends to rise in response to positive market sentiment.

Conversely, when market sentiment turns negative, investors may become more cautious or fearful. They may sell their Blur Coin holdings, leading to a decrease in demand and a potential decline in price. Negative market sentiment can arise from factors such as negative news surrounding cryptocurrencies, regulatory changes, or a general downturn in the broader market.

The role of social media should not be underestimated in shaping market sentiment. Platforms such as Twitter, Reddit, and dedicated Blur Coin communities can amplify positive or negative sentiment through discussions, recommendations, and shared experiences. It is crucial for investors and traders to stay informed and analyze the sentiment expressed on these platforms.

It is important to note that market sentiment is a subjective concept and can be influenced by irrational factors. FOMO (fear of missing out) and FUD (fear, uncertainty, doubt) can both drive exaggerated market sentiment, leading to excessive price movements in either direction.

Overall, the influence of market sentiment on Blur Coin price cannot be ignored. Investors and traders should closely monitor market sentiment indicators, news, and social media trends to make informed decisions about buying or selling Blur Coin.

To stay updated with the latest news and developments in the Blur NFT Marketplace, log in to your BLUR.IO account. Regularly checking market sentiment and being aware of any significant changes can help you navigate the unpredictable nature of cryptocurrency markets and make better investment choices.

Understanding the Relationship

The relationship between market sentiment and Blur Coin price is a complex one. Market sentiment refers to the overall attitude and opinion of market participants towards a particular asset or investment. In the case of Blur Coin, market sentiment plays a crucial role in driving its price up or down.

When market sentiment is positive, investors tend to have a favorable view of Blur Coin, believing that its value will increase in the future. This optimism can lead to increased demand for Blur Coin, causing its price to rise. On the other hand, when market sentiment is negative, investors may have a pessimistic view of Blur Coin, expecting its value to decline. This negative sentiment can result in reduced demand for Blur Coin, leading to a decrease in its price.

Market sentiment can be influenced by various factors, including market news, economic indicators, and investor behavior. For example, positive news about the development of Blur Coin's underlying technology, such as the release of new features or partnerships, can improve market sentiment and drive up its price. Similarly, negative news, such as security breaches or regulatory scrutiny, can dampen market sentiment and cause Blur Coin's price to drop.

It is important for investors to understand the relationship between market sentiment and Blur Coin price in order to make informed investment decisions. Monitoring market sentiment can help investors anticipate price movements and adjust their strategies accordingly. By staying up-to-date with the latest news and developments in the Blur Coin ecosystem, investors can better gauge market sentiment and make more accurate predictions about its future price.

To stay informed about the latest news and updates in the Blur Coin ecosystem, you can log in to your BLUR.IO account. This will provide you with access to important information that can help you understand market sentiment and make better investment decisions.

Market Sentiment and Cryptocurrency Trading

Cryptocurrency trading is not only influenced by technical analysis and fundamental factors, but also by market sentiment. Market sentiment refers to the overall attitude or feeling of traders and investors towards a particular coin or the cryptocurrency market as a whole. It is driven by factors such as news, social media, and general market perception.

Market sentiment plays a significant role in determining the price and trend of a cryptocurrency like blur coin. Positive market sentiment can create a bullish trend, leading to an increase in demand and subsequently, higher prices. On the other hand, negative market sentiment can result in a bearish trend, causing a decrease in demand and lower prices.

Traders and investors closely monitor market sentiment as it can provide valuable insights into future price movements. They use various tools and techniques to analyze market sentiment, such as sentiment analysis algorithms, social media sentiment trackers, and news sentiment indicators.

Understanding market sentiment can help traders make informed decisions and better manage their cryptocurrency portfolios. For example, if market sentiment is positive towards blur coin, traders may consider buying or holding the coin as it is likely to experience price appreciation. Conversely, if market sentiment is negative, traders may consider selling or avoiding blur coin to minimize potential losses.

It is important to note that market sentiment is not solely based on objective facts and analysis. It is also influenced by emotions and psychological biases. Fear and greed often drive market sentiment, leading to exaggerated price movements and market volatility.

Therefore, traders should be aware of the potential impact of market sentiment on cryptocurrency trading and take it into account when making investment decisions. It is recommended to combine market sentiment analysis with other technical and fundamental analysis techniques to have a comprehensive understanding of the market.

To stay updated on market sentiment and the latest news related to blur coin, traders can visit the official BLUR.IO website. The website provides information about the coin, its market performance, and news updates that can influence market sentiment.

Factors Influencing Market Sentiment

Market sentiment refers to the overall attitude and mood of traders and investors towards a particular market or asset. It can have a significant impact on the price and volatility of a cryptocurrency like Blur Coin. Several factors influence market sentiment, including:

Economic Conditions

The state of the economy plays a crucial role in shaping market sentiment. Positive economic conditions, such as low unemployment rates, robust GDP growth, and stable inflation, tend to create a positive sentiment among investors. Conversely, negative economic conditions, such as high unemployment rates, economic recession, or inflationary pressures, can result in a negative sentiment.

News and Media

The news and media also have a substantial impact on market sentiment. Positive or negative news related to the cryptocurrency market, regulatory developments, technological advancements, or any significant events can shape investor sentiment. Positive news can create optimism and drive demand, while negative news can lead to fear and sell-offs.

Market Trends and Momentum

The direction of market trends and the overall momentum can influence market sentiment. If a cryptocurrency like Blur Coin is experiencing a bear market or a significant price decline, it can create a negative sentiment among investors. On the other hand, if the market is in a bull trend or experiencing a significant price rally, it can generate a positive sentiment and attract more investors.

Social Media and Online Communities

Social media platforms and online communities have become powerful influencers of market sentiment. Discussions, opinions, and sentiments shared on platforms like Twitter, Reddit, and various cryptocurrency forums can quickly spread and shape market sentiment. Influential figures, celebrities, or industry experts can also sway market sentiment with their views and endorsements.

Market Manipulation

Market manipulation, such as pump-and-dump schemes or coordinated buying/selling by large investors or groups, can artificially influence market sentiment. These manipulative practices can create a false sense of optimism or fear, leading to significant price fluctuations. It is essential to be aware of such manipulation and consider it when assessing market sentiment.

Overall, market sentiment is a complex phenomenon influenced by various factors, including economic conditions, news and media, market trends, social media, and market manipulation. Understanding and monitoring these factors can help investors gauge market sentiment and make informed decisions regarding their investments in Blur Coin or any other cryptocurrency.

News and Media Coverage

News and media coverage play a significant role in influencing market sentiment towards Blur Coin. Positive or negative news stories, articles, and reports can greatly impact the market's perception of the coin, leading to price fluctuations.

When reputable news outlets report on Blur Coin, it generates interest and can attract new investors, causing the price to rise. On the other hand, negative news stories or scandals surrounding the coin can erode trust and confidence, leading to a decrease in price.

Blur Coin also benefits from media coverage within the cryptocurrency community. Popular cryptocurrency news websites and blogs often provide updates and analysis on Blur Coin, which can influence sentiment among cryptocurrency enthusiasts. Positive reviews, for example, can generate excitement and boost investor confidence.

Social media also plays a crucial role in spreading news and shaping market sentiment. As users share news articles and opinions on platforms like Twitter and Reddit, it can create a viral effect and influence the investment decisions of others.

To stay informed about the latest news and media coverage, Blur Coin investors can follow trusted news outlets, join cryptocurrency forums, and actively engage in social media discussions. By keeping an eye on the news and media sentiment, investors can make more informed decisions about buying or selling Blur Coin.

Social Media Trends and Sentiment

Social media plays a vital role in shaping public opinion and influencing market sentiment. With the advent of platforms like Twitter, Facebook, and Reddit, individuals have gained the ability to share their thoughts and opinions on a massive scale.

Many investors and analysts closely monitor social media trends to gauge the sentiment surrounding a particular topic or asset, such as the price of a Blur coin. By analyzing the discussions, posts, and comments related to Blur coin on social media platforms, market participants can gain insights into the prevailing sentiment among the general public.

There are different ways to track social media trends and sentiment. Some analysts use sentiment analysis tools that utilize natural language processing algorithms to determine whether a post or comment expresses positive, negative, or neutral sentiment towards Blur coin. These tools can help identify potential shifts in sentiment and gauge the overall public opinion.

Additionally, hashtags and trending topics on social media platforms provide a glimpse into the level of public interest and engagement with Blur coin. When a particular hashtag related to Blur coin trends on social media, it indicates that the topic is gaining attention and generating discussions among the users.

Furthermore, influential figures and key opinion leaders in the cryptocurrency space often have a significant impact on market sentiment. Their social media posts or comments can sway public opinion and potentially influence Blur coin's price. Investors pay close attention to the sentiment expressed by these individuals as their views can impact market sentiment and subsequent trading decisions.

However, it is essential to approach social media trends and sentiment with caution. While they can provide valuable insights into the prevailing sentiment, they are not always a reliable indicator of future market movements. The information shared on social media platforms can be biased or manipulated, making it crucial to verify and cross-reference information from various sources.

In conclusion, social media trends and sentiment can significantly impact the market sentiment surrounding Blur coin. Monitoring discussions, sentiment analysis tools, and tracking hashtags can provide valuable insights into public opinion. However, it is essential to exercise caution and verify information from multiple sources to make informed trading decisions.

Macro-economic Indicators

Macro-economic indicators play a crucial role in assessing the overall health and performance of an economy. These indicators provide key insights into the economic conditions and trends that can influence the price of blur coin. Market sentiment is often driven by these indicators as investors make decisions based on the outlook of the economy.

Gross Domestic Product (GDP): GDP is one of the most important indicators and measures the total value of all goods and services produced within a country during a specific period. A growing GDP indicates a strong economy, which can have a positive impact on blur coin price as investors view it as a reliable and stable asset.

Inflation Rate: Inflation refers to the gradual increase in the prices of goods and services over time. A high inflation rate can erode the purchasing power of fiat currencies and drive investors towards alternative assets like blur coin, leading to an increase in its price.

Interest Rates: Interest rates set by central banks have a significant impact on the economy. Lower interest rates typically stimulate borrowing and spending, which can boost economic growth and positively affect blur coin price. Conversely, higher interest rates can make borrowing more expensive and dampen economic activity, potentially leading to a decrease in the price of blur coin.

Unemployment Rate: The unemployment rate measures the percentage of the labor force that is without a job and actively seeking employment. High unemployment rates can indicate a struggling economy, causing investors to seek alternative investments such as blur coin. This increased demand can drive up the price of blur coin.

Consumer Confidence: Consumer confidence reflects the overall optimism or pessimism of consumers about the future state of the economy. Positive consumer confidence can lead to increased spending and investment, which can have a positive impact on blur coin price.

Government Policies: Government policies, such as tax reforms, regulations, and stimulus packages, can significantly impact the economy and subsequently the price of blur coin. Favorable policies that promote economic growth can lead to increased demand for blur coin and drive up its price.

Global Economic Events: Global economic events, such as geopolitical tensions, recessions, trade wars, and pandemics, can have a significant impact on market sentiment and blur coin price. Investors closely monitor these events and adjust their investment strategies accordingly, which can cause fluctuations in blur coin price.

It is important for investors and traders to stay updated on these macro-economic indicators and understand their potential impact on the price of blur coin. By analyzing these indicators, market sentiment can be better understood, allowing for more informed investment decisions.

Government Regulations and Policies

In the world of cryptocurrencies, government regulations and policies play a significant role in shaping the market sentiment of a particular coin, including blur coin. As a relatively new and evolving technology, cryptocurrencies have caught the attention of governments around the world, who are trying to understand and regulate this innovative form of digital currency.

1. Legal Status:

The legal status of cryptocurrencies varies from country to country. Some governments have embraced cryptocurrencies, recognizing them as legitimate forms of payment and investment. In these countries, blur coin and other cryptocurrencies enjoy a positive market sentiment due to clear regulations and supportive policies. On the other hand, countries that have banned or imposed strict regulations on cryptocurrencies can create a negative environment for blur coin, leading to decreased market sentiment.

2. Future Outlook:

The future outlook for cryptocurrencies, including blur coin, is greatly influenced by government regulations and policies. Governments that adopt a proactive and supportive stance towards cryptocurrencies can create a positive market sentiment, attracting investors and fostering innovation in the industry. Conversely, governments that impose restrictive regulations or express skepticism about cryptocurrencies can create uncertainty and a negative sentiment, impacting the price and adoption of blur coin.

3. AML and KYC Regulations:

To address concerns about money laundering and illegal activities, governments have implemented Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations for cryptocurrency exchanges and businesses. Compliance with these regulations can enhance the transparency and credibility of blur coin, increasing investor confidence and improving market sentiment.

4. Taxation:

Government policies on cryptocurrency taxation can also influence market sentiment. Clear and favorable taxation policies can attract investors and encourage the use of blur coin for transactions. Conversely, excessively high or unclear taxation can create uncertainty and hinder the adoption of cryptocurrencies, leading to a negative market sentiment.

Conclusion:

Government regulations and policies have a significant impact on the market sentiment of blur coin and other cryptocurrencies. Clear regulations, positive government stances, and supportive policies can create a positive market sentiment, attracting investors and fostering the growth of the cryptocurrency industry. On the other hand, restrictive regulations, bans, or uncertainty can create a negative sentiment, inhibiting the growth and adoption of blur coin.

Investor Psychology and Emotions

Investor psychology plays a crucial role in shaping market sentiment and, consequently, impacting the price of Blur Coin. Emotions such as fear, greed, and optimism can significantly influence investment decisions, leading to market fluctuations.

Fear: When investors are driven by fear, they tend to sell their assets in anticipation of a potential market downturn. This sudden increase in selling pressure can cause the price of Blur Coin to decline rapidly. Fearful investors may also avoid entering the market altogether, which can further impact market sentiment negatively.

Greed: On the other hand, greed can contribute to market optimism and higher prices. When investors see the price of Blur Coin rising, they may fear missing out on potential profits, leading to increased buying pressure. As more investors enter the market, the demand for Blur Coin increases, resulting in price appreciation.

Market Sentiment and Behavioral Biases

Market sentiment is also influenced by various behavioral biases that affect investor decision-making. These biases can lead to irrational behavior and market inefficiencies.

Confirmation bias: Investors tend to seek information that confirms their pre-existing beliefs, leading to selective perception. If investors have a positive outlook for Blur Coin, they may only pay attention to news and analysis that supports their optimistic view, leading to potentially biased investment decisions.

Herding behavior: Investors often show a tendency to follow the crowd and imitate the actions of others. When a large number of investors start buying or selling Blur Coin, it can create a domino effect, amplifying market sentiment and affecting the coin's price. This herd mentality can lead to exaggerated price movements, both upward and downward.

The Role of Rationality and Emotional Control

While emotions and psychology play a significant role in market sentiment, rationality and emotional control are essential for long-term investment success. Being aware of one's emotions and biases can help investors make more informed decisions and avoid succumbing to market sentiments driven by fear or greed.

Research and thorough analysis are crucial for making rational investment decisions. By focusing on fundamental factors, such as the underlying technology, market demand, and competition, investors can make more objective investment choices, detached from emotional influences.

Additionally, maintaining emotional control during times of market volatility is pivotal. Avoiding impulsive decisions and staying disciplined with investment strategies can help investors mitigate the impact of market sentiment on Blur Coin prices.

Overall Market Conditions

When examining the influence of market sentiment on Blur Coin price, it is important to consider the overall market conditions. The cryptocurrency market is known for its volatility, with prices often experiencing significant fluctuations over short periods of time. Factors such as investor sentiment, economic indicators, regulatory developments, and technological advancements can all have a profound impact on market conditions.

One key factor that can influence market conditions is investor sentiment. If investors have a positive outlook on the cryptocurrency market, they are more likely to buy coins, leading to an increase in demand and potentially driving up prices. Conversely, if investors have a negative sentiment, they may sell their coins, causing a decrease in demand and potentially driving down prices.

Economic indicators also play a crucial role in shaping market conditions. Factors such as inflation, interest rates, and unemployment rates can impact investor confidence and their willingness to invest in cryptocurrencies. For example, if inflation is high and interest rates are low, investors may seek alternative assets like cryptocurrencies to protect their wealth, potentially driving up prices.

Regulatory developments are another important consideration when assessing market conditions. Changes in regulations can impact market sentiment, as they can introduce new opportunities or limitations for cryptocurrency adoption. For instance, if a country introduces favorable regulations that encourage cryptocurrency usage, it can lead to increased investor confidence and potentially drive up prices.

Technological advancements also play a significant role in shaping market conditions. Innovations such as improved scalability, enhanced security, and increased usability can enhance the overall appeal of cryptocurrencies, leading to increased demand and potentially driving up prices. On the other hand, technological vulnerabilities or challenges can negatively impact market sentiment and potentially drive down prices.

In conclusion, when analyzing the influence of market sentiment on Blur Coin price, it is essential to consider the overall market conditions. Factors such as investor sentiment, economic indicators, regulatory developments, and technological advancements can all contribute to the volatility of the cryptocurrency market and ultimately impact the price of Blur Coin.

Measuring Market Sentiment

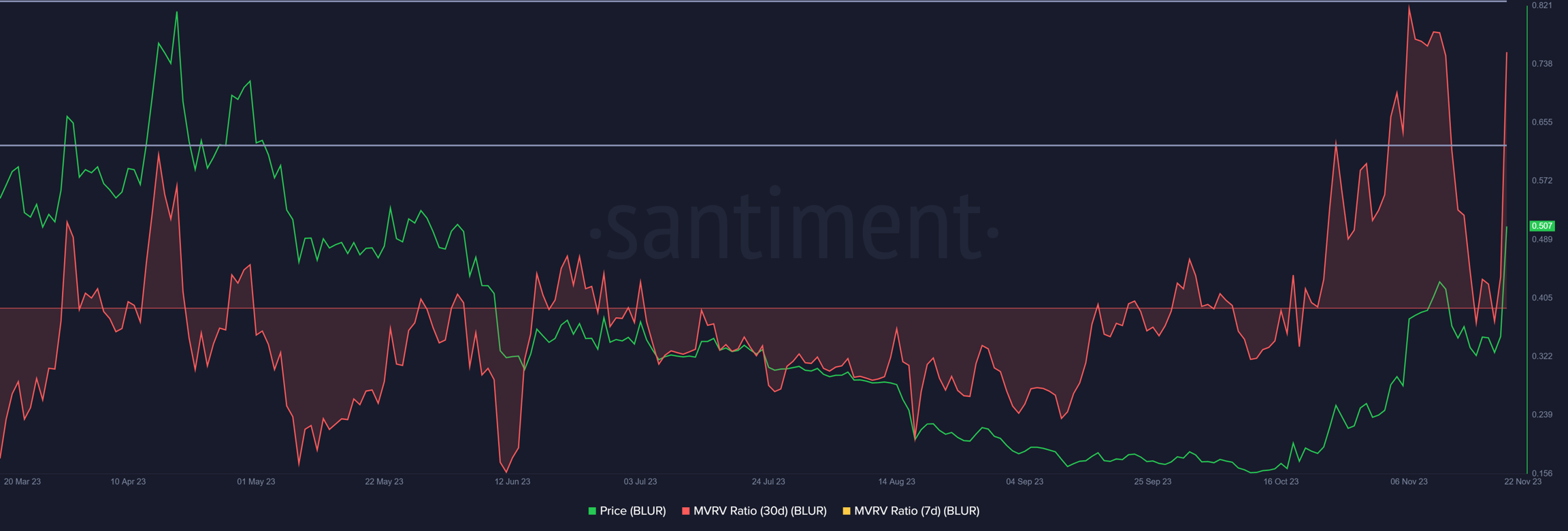

Market sentiment refers to the overall feeling or attitude of traders and investors towards a particular asset or market. It can greatly influence the price and direction of a cryptocurrency like Blur Coin. Measuring market sentiment can be challenging since it is subjective and can change rapidly. However, there are several key indicators and tools that can help gauge market sentiment:

1. Price Action Analysis

Examining the price patterns and trends of Blur Coin can provide insights into market sentiment. Bullish price action, such as rising prices and higher highs, indicates positive sentiment, while bearish price action, such as falling prices and lower lows, indicates negative sentiment. Technical analysis tools like trend lines, moving averages, and candlestick patterns can aid in identifying market sentiment.

2. Volume Analysis

Volume analysis involves studying the trading volume of Blur Coin. High trading volume coupled with increasing prices suggests positive market sentiment, indicating that buyers are actively participating in the market. On the other hand, high trading volume with decreasing prices may indicate negative sentiment, as sellers are dominating the market.

3. Sentiment Indicators

Sentiment indicators can provide a quantitative measure of market sentiment. These indicators utilize various data sources and algorithms to analyze social media posts, news articles, and other sources of information to determine the overall sentiment towards Blur Coin. Some commonly used sentiment indicators include the Fear and Greed Index, CryptoPanic Sentiment Index, and the Crypto Fear & Greed Sentiment Gauge.

Caution: It's important to interpret sentiment indicators with care, as they may not always accurately reflect actual market sentiment. They can be influenced by noise, biases, and manipulation.

4. News Analysis

Keeping track of news and announcements related to Blur Coin can provide insights into market sentiment. Positive news, such as partnerships, adoption by major companies, or regulatory developments, can boost market sentiment and drive up prices. Conversely, negative news, such as security breaches, bans, or negative regulatory actions, can negatively impact sentiment and result in price declines.

Overall, measuring market sentiment is a combination of technical analysis, quantitative indicators, and staying informed about market news and events. By analyzing these factors, traders and investors can gain a better understanding of the prevailing market sentiment towards Blur Coin and make more informed decisions.

Sentiment Analysis Tools

Sentiment analysis is a valuable tool used to gauge the overall sentiment of market participants towards a specific topic or asset, such as Blur coin. It involves analyzing and interpreting social media posts, news articles, forum discussions, and other forms of online content to determine whether the sentiment is positive, negative, or neutral.

1. Natural Language Processing (NLP) Libraries

One of the most commonly used tools for sentiment analysis is natural language processing (NLP) libraries. These libraries, such as NLTK (Natural Language Toolkit) and spaCy, provide a set of functions and algorithms that allow developers to preprocess and analyze text data.

These libraries often include pre-trained sentiment analysis models that can be used to classify text into positive, negative, or neutral sentiment. Developers can also train their own models using labeled data to achieve better accuracy for specific tasks.

2. Social Media Monitoring Tools

Social media monitoring tools, such as Hootsuite and Brandwatch, can be used to gather and analyze social media data related to Blur coin. These tools provide features that allow users to track mentions, hashtags, and sentiment analysis of online conversations.

By monitoring social media platforms like Twitter, Facebook, and Reddit, market participants can gain valuable insights into the sentiment of the community towards Blur coin. They can identify trends, track influential users, and understand the overall sentiment dynamics in real-time.

3. News and Media Analysis Tools

News and media analysis tools, such as Google News API and LexisNexis, can be utilized to analyze news articles and other media sources for sentiment towards Blur coin. These tools often incorporate natural language processing techniques to extract relevant information and identify sentiment.

By analyzing news articles and other media sources, market participants can be aware of any significant events or announcements that may impact the sentiment towards Blur coin. This information can be used to make informed decisions and adjust trading strategies accordingly.

4. Opinion Mining and Sentiment Analysis (OMSA) Frameworks

Opinion Mining and Sentiment Analysis (OMSA) frameworks, such as VADER (Valence Aware Dictionary and sEntiment Reasoner) and SentiWordNet, are specifically designed for sentiment analysis tasks. These frameworks provide pre-trained models and lexicons to analyze the sentiment of the given text.

OMSA frameworks use lexical databases and sentiment dictionaries to assign polarity scores to words and phrases, enabling the calculation of sentiment intensity. These frameworks are particularly useful for analyzing social media data and short texts that often contain informal language and slang.

In conclusion, sentiment analysis tools offer a variety of approaches and techniques to analyze the sentiment of market participants towards Blur coin. These tools enable market participants to gain valuable insights into market sentiment, make informed decisions, and adjust their trading strategies accordingly.

Experienced Trader Intuition

Experienced traders often rely on their intuition to make investment decisions in the cryptocurrency market. This intuition is developed over years of experience and is based on their analysis of market trends, patterns, and other factors that can influence coin prices.

Intuition can be seen as a subconscious understanding of the market that cannot be easily explained or quantified. It is a gut feeling that helps traders identify potential opportunities and risks.

Reading Market Sentiment

One aspect of experienced trader intuition is the ability to read market sentiment accurately. Market sentiment refers to the overall attitude or feeling of market participants towards a particular asset. It can be bullish (positive) or bearish (negative).

Experienced traders can gauge market sentiment by analyzing factors such as news, social media discussions, and the behavior of other traders. They look for signs of excitement or fear that may indicate an upcoming price movement.

Using Intuition Wisely

While intuition can be a valuable tool, it should not be the sole basis for making investment decisions. Experienced traders combine their intuition with thorough analysis and research. They use technical analysis tools, fundamental analysis, and data-driven insights to validate or invalidate their intuitive feelings.

It is important for traders to trust their intuition but also be open to questioning their assumptions and adapting their strategies based on new information. Risk management is crucial in trading, and experienced traders recognize the importance of setting stop-loss orders and diversifying their portfolios.

In conclusion, experienced traders rely on their intuition to navigate the cryptocurrency market. However, they also recognize the importance of combining intuition with analysis and research to make informed investment decisions.

Strategies for Trading in Market Sentiment

Market sentiment plays a crucial role in the trading of financial assets, including cryptocurrencies like blur coin. Understanding and effectively utilizing market sentiment can greatly enhance your trading strategy and improve your profitability. Here are some strategies to consider:

1. Stay Informed

Staying informed about the latest news and developments in the cryptocurrency market is essential for analyzing market sentiment. Keep track of major news events, economic indicators, regulatory announcements, and social media trends that could impact the sentiment towards blur coin. This information will help you make informed trading decisions.

2. Technical Analysis

Utilizing technical analysis can provide valuable insights into market sentiment. Analyzing price charts, patterns, and indicators can help you identify trends and anticipate potential price movements. Look for patterns that indicate buying or selling pressure, and use this information to time your trades accordingly.

3. Social Media Monitoring

Social media platforms, such as Twitter and Reddit, can provide valuable insights into market sentiment. Monitor discussions, hashtags, and sentiment analysis tools to gauge the overall sentiment towards blur coin. However, exercise caution as social media sentiment can be influenced by manipulation and hype.

Note: While social media can provide valuable insights, it should not be the sole basis for your trading decisions. Always use it in conjunction with other analysis techniques.

4. Sentiment Analysis Tools

There are various sentiment analysis tools and platforms available that can help you gauge market sentiment towards blur coin. These tools analyze social media feeds, news articles, and other sources of information to provide an overall sentiment score. Use these tools to complement your own analysis and validate your trading decisions.

5. Diversify Your Portfolio

Another strategy to mitigate the impact of market sentiment is to diversify your portfolio. Holding a mix of different cryptocurrencies can help spread the risk and minimize the impact of negative sentiment towards a particular coin. Diversification can also provide opportunities to capitalize on positive sentiment towards other cryptocurrencies.

Remember, market sentiment can be volatile and subject to rapid changes. It is important to continually reassess and adjust your trading strategy based on the evolving market sentiment and new information.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Trading cryptocurrencies involves risks, and you should conduct thorough research and seek professional advice before making any investment decisions.

Risk Management and Market Sentiment

Risk management is a crucial aspect of investing in the cryptocurrency market, especially when it comes to the volatile nature of blur coin price. Market sentiment plays a significant role in determining price movements, and understanding how to manage the associated risks is essential for investors.

One of the key aspects of risk management is staying informed about market sentiment. This involves analyzing various factors that can influence the overall mood and attitude of cryptocurrency investors. Factors such as news events, social media trends, and economic indicators can all impact market sentiment. By monitoring these factors closely, investors can gauge the overall perception of blur coin and make more informed decisions.

Another facet of risk management is diversification. Cryptocurrency investments should never be concentrated in a single coin, as this exposes investors to a higher level of risk. By diversifying their portfolio, investors can spread out their risks and potentially mitigate the impact of negative market sentiment on blur coin price. Diversification can involve investing in multiple cryptocurrencies or even other asset classes such as stocks or bonds.

Setting clear investment goals and sticking to a predetermined strategy is also crucial for risk management. Emotional decision-making based on market sentiment can lead to impulsive actions that may result in unfavorable outcomes. By defining investment goals and establishing a strategy, investors can reduce the influence of short-term market sentiment and focus on long-term objectives.

In addition to these measures, risk management also involves implementing proper risk controls, such as stop-loss orders and position sizing. These tools help investors limit potential losses and protect their investments from sudden shifts in market sentiment. By setting appropriate risk limits and using these tools effectively, investors can safeguard their capital and navigate the unpredictable nature of blur coin price.

Overall, risk management is essential for investors looking to navigate the influence of market sentiment on blur coin price. By staying informed, diversifying their portfolio, setting clear goals, and implementing risk controls, investors can navigate the volatile cryptocurrency market with greater confidence. By understanding and managing the risks associated with market sentiment, investors can make more informed decisions and potentially achieve their investment objectives.

What is market sentiment?

Market sentiment refers to the overall feeling or attitude of traders and investors towards a particular market or asset. It can be positive, negative, or neutral, and influences the buying and selling decisions of market participants.

How does market sentiment affect blu coin price?

Market sentiment plays a crucial role in determining blu coin price. In a positive market sentiment, where traders and investors are optimistic about the future of blu coin, the demand increases, driving up the price. Conversely, in a negative market sentiment, where there is fear or uncertainty, the demand decreases, causing the price to drop.

Are there any other factors besides market sentiment that influence blu coin price?

Yes, besides market sentiment, there are other factors that influence blu coin price. These include supply and demand dynamics, technological developments, regulatory changes, economic indicators, and news events related to blu coin or the broader cryptocurrency market.

Can market sentiment cause sharp price fluctuations in blu coin?

Yes, market sentiment can cause sharp and sudden price fluctuations in blu coin. If there is a significant change in market sentiment, such as a shift from positive to negative or vice versa, it can lead to increased volatility and rapid price movements as traders and investors adjust their positions accordingly.

How can one analyze market sentiment for blu coin?

There are several methods and tools that can be used to analyze market sentiment for blu coin. These include monitoring social media discussions, sentiment analysis of news articles and forum posts, tracking trading volume and price movements, and using specialized sentiment indicators or sentiment analysis platforms.

How does market sentiment affect the price of Blur Coin?

Market sentiment plays a crucial role in determining the price of Blur Coin. When market sentiment is positive, and there is a widespread belief that the cryptocurrency market will perform well, it often leads to an increase in demand for Blur Coin, driving its price up. On the other hand, if market sentiment turns negative, and there is fear and uncertainty among investors, it can result in a decrease in demand for Blur Coin, causing its price to drop.

What factors contribute to market sentiment?

Market sentiment is influenced by various factors. Some of the key factors include economic indicators, news events, government regulations, investor confidence, and overall market trends. For example, positive economic indicators such as strong GDP growth or low unemployment rates can lead to optimistic market sentiment, while negative news events or regulatory crackdowns can create a negative sentiment among investors.

Can market sentiment alone determine the price of Blur Coin?

No, market sentiment alone cannot solely determine the price of Blur Coin. While market sentiment can have a significant impact on short-term price fluctuations, the price of any cryptocurrency is determined by a combination of factors, including supply and demand dynamics, technological developments, market liquidity, and overall market conditions. It is crucial to consider a holistic view of the cryptocurrency market and not rely solely on market sentiment when assessing the price of Blur Coin.

Blur: NFT | Blur: NFT login | Blur: NFT connect | WalletConnect | Traders | What Is Blur Crypto

2022-2024 @ The influence of market sentiment on blur coin price