Exploring the Potential Risks and Advantages of NFTs on the Bitcoin Blockchain

Blur: NFT | Blur: NFT login | Blur: NFT connect | WalletConnect | Traders | What Is Blur Crypto

Blur: NFT | Blur: NFT login | Blur: NFT connect | WalletConnect | Traders | What Is Blur Crypto

In recent years, the rise of Non-Fungible Tokens (NFTs) has captured the attention of both the mainstream media and the cryptocurrency community. NFTs, which represent unique items such as digital art, music, and collectibles on the blockchain, have revolutionized the way we perceive ownership and value in the digital realm. While NFTs offer exciting opportunities, there are also potential dangers and benefits that need to be carefully examined.

On the one hand, NFTs have opened up a whole new world of possibilities for artists, musicians, and creatives. With NFTs, artists can monetize their digital creations, bypassing intermediaries like galleries and record labels. This allows for greater independence and control over their work, as well as the potential for higher profits. NFTs also enable artists to establish direct connections with their fans and supporters, fostering a deeper sense of community and collaboration.

However, the rapid growth of the NFT market has raised concerns about potential dangers. One major concern is the environmental impact of NFTs. The process of minting an NFT on the Bitcoin blockchain consumes a significant amount of energy, contributing to carbon emissions. Critics argue that this contradicts the ethos of sustainability often associated with blockchain technology. It is essential to find solutions that mitigate the environmental impact of NFTs, such as exploring alternative blockchains with lower energy consumption.

Another danger associated with NFTs is the potential for fraud and copyright infringement. The decentralized nature of blockchain technology makes it challenging to regulate and enforce copyright laws. This creates a fertile ground for the unauthorized reproduction and sale of digital assets. Additionally, the hype surrounding NFTs has attracted scammers and fraudsters who prey on unsuspecting buyers. As the NFT market continues to evolve, it is crucial for strengthened regulations and mechanisms to protect both artists and buyers from these risks.

While the dangers of NFTs are real, so are the benefits. NFTs have the potential to provide a new source of income for content creators, granting them greater control and recognition for their work. Moreover, NFTs offer an exciting new avenue for investment and speculation. Buyers can invest in unique digital assets that have the potential to appreciate in value over time. This opens up new opportunities for individuals to participate in the art and collectibles market, which was previously reserved for a select few.

In conclusion, the rise of NFTs on the Bitcoin blockchain presents both dangers and benefits. The environmental impact, potential for fraud, and copyright infringement are real concerns that need to be addressed. However, NFTs also offer exciting opportunities for artists, musicians, and investors. By examining these dangers and benefits, we can work towards a more sustainable and inclusive future for the NFT market.

Examining the Potential Risks and Rewards of NFTs on the Bitcoin Blockchain

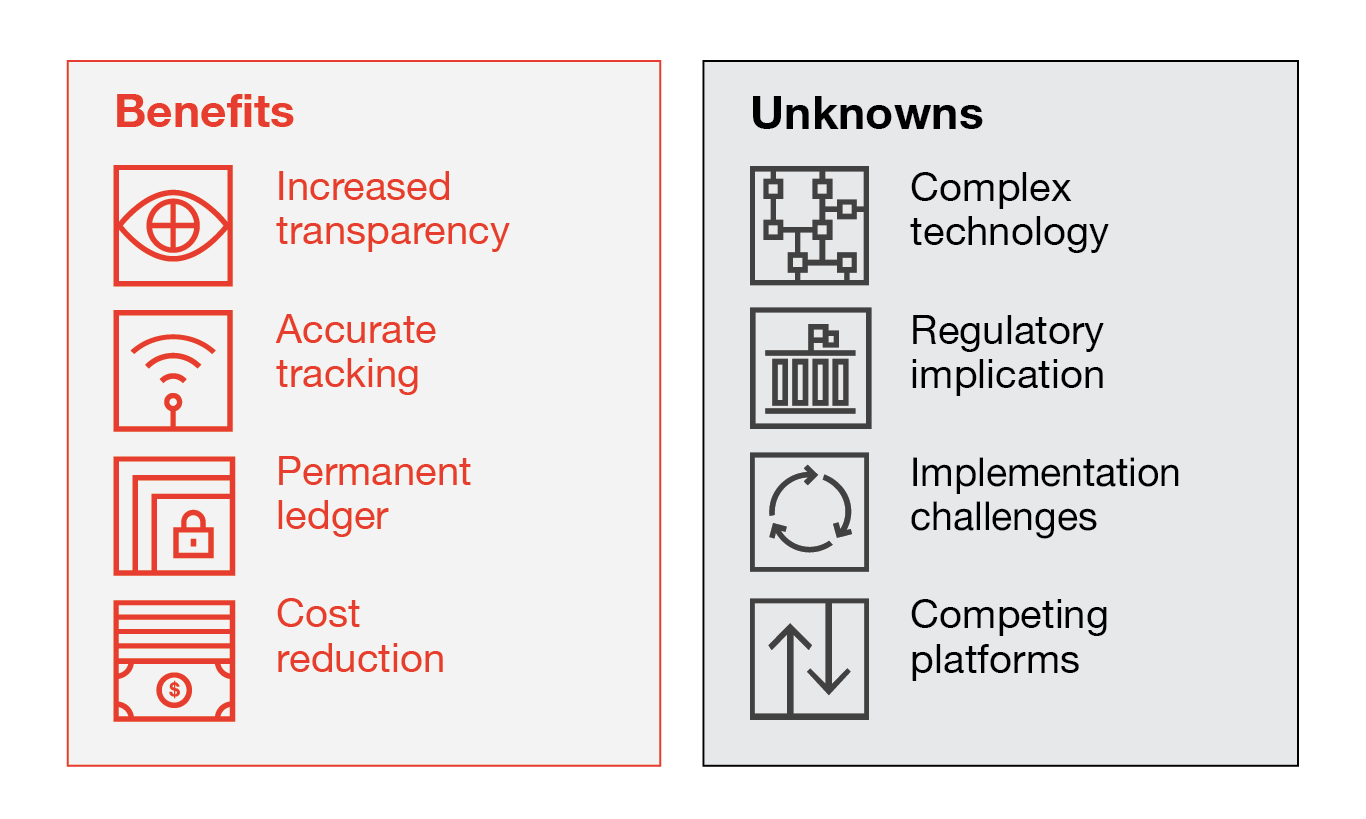

The rise of non-fungible tokens (NFTs) has brought new possibilities and challenges to the Bitcoin blockchain. While NFTs have gained significant attention for their ability to represent unique digital assets, there are both risks and rewards associated with their integration into the Bitcoin ecosystem.

Potential Risks

Increased Network Congestion: As NFTs gain popularity, the transaction volume on the Bitcoin blockchain may increase significantly, leading to network congestion and higher transaction fees for all users.

Environmental Impact: The energy consumption of the Bitcoin network is already a concern, and the addition of NFTs could exacerbate the environmental impact, as minting and trading NFTs requires computational power.

Scalability Issues: The Bitcoin blockchain was not designed to handle the large amounts of data associated with NFTs. As NFTs become more prevalent, scalability issues may arise, potentially slowing down the network and compromising its efficiency.

Security Vulnerabilities: Introducing NFTs to the Bitcoin blockchain may introduce new security vulnerabilities. Smart contracts powering NFTs could be susceptible to exploitation, potentially leading to loss of user funds.

Potential Rewards

Increased Adoption of Bitcoin: The integration of NFTs can attract new users to the Bitcoin ecosystem, driving further adoption and increasing the value of the underlying cryptocurrency.

Asset Tokenization: NFTs allow for the tokenization of real-world assets, such as art, music, and collectibles. This tokenization can enable fractional ownership, liquidity, and easier transferability, unlocking new financial opportunities.

Increased Visibility and Exposure: NFTs have caught the attention of mainstream media and celebrities, providing an opportunity to educate a broader audience about the benefits and potential of blockchain technology.

Enhanced Creativity and Innovation: NFTs empower creators to monetize their digital work directly, bypassing intermediaries. This can incentivize artists, musicians, and content creators to explore new possibilities, leading to greater creativity and innovation.

As the integration of NFTs on the Bitcoin blockchain continues to evolve, it is important to carefully consider and navigate these potential risks and rewards. Proper governance, technological advancements, and community collaboration will be essential in maximizing the benefits while mitigating the drawbacks.

Understanding NFTs and their impact on the digital art market

NFTs, or non-fungible tokens, have gained significant attention in recent years and are revolutionizing the way digital art is bought, sold, and owned. These unique tokens are built on the blockchain technology, specifically the Bitcoin blockchain, and provide artists with a new way to monetize their digital creations.

With NFTs, artists can tokenize their artworks, making them easily transferable and scarce. This creates a sense of exclusivity and ownership in the digital art market, allowing artists to sell their work directly to collectors without the need for intermediaries like galleries or auction houses.

One of the key benefits of NFTs is the ability to prove ownership and authenticity of digital art. Each NFT contains metadata that verifies the originality of the artwork, as well as the history of its ownership. This eliminates the risk of forgeries and provides artists with a secure way to protect and monetize their creations.

Furthermore, NFTs provide artists with the opportunity to earn royalties from secondary sales. Traditional art sales often result in artists losing out on future profits as their works appreciate in value. However, with NFTs, artists can set smart contracts that automatically distribute royalties to them whenever their works are resold in the digital art market.

The impact of NFTs on the digital art market

While NFTs offer many benefits to artists, they also come with their own set of challenges. One of the main concerns is the environmental impact of NFTs on the Bitcoin blockchain. The mining process required to create and transact NFTs consumes a significant amount of energy, raising questions about the sustainability of the digital art market.

Additionally, the sudden influx of NFTs has led to an oversaturation of the digital art market, making it difficult for individual artists to stand out and make sales. There are also concerns about the speculative nature of NFTs, with some critics comparing the market to a bubble that may burst at any moment.

Nevertheless, NFTs have opened up new possibilities for artists and collectors alike. Platforms like Blur.io offer unique features and benefits, such as increased visibility for artists and access to a global network of collectors. These platforms are continuously evolving to address the challenges and explore new opportunities within the digital art market.

In conclusion, NFTs have had a profound impact on the digital art market, offering artists new ways to monetize their work and prove ownership. While there are concerns regarding the environmental sustainability and market saturation, the potential benefits and innovations that NFTs bring to the art world cannot be ignored.

Analyzing the scalability challenges of the Bitcoin blockchain for NFT transactions

The rise of non-fungible tokens (NFTs) has brought considerable attention to the potential of blockchain technology in the art and collectibles industry. However, as NFTs gain popularity, the limitations of the Bitcoin blockchain are becoming more apparent, particularly when it comes to scalability.

Scalability Issues

The Bitcoin blockchain was originally designed for processing peer-to-peer electronic cash transactions, making it well-suited for monetary transfers. However, the addition of NFT transactions poses unique challenges due to the nature of these digital assets.

One scalability challenge is the limited block size of the Bitcoin blockchain. Each block can only accommodate a certain number of transactions, and with the increasing use of NFTs, the block size may reach its capacity quickly. This limitation can result in higher fees and longer confirmation times, which could impede the usability of NFTs on the Bitcoin blockchain.

Another challenge is the need for increased storage capacity. NFTs often involve larger file sizes compared to traditional Bitcoin transactions, as they may include images, videos, or other multimedia elements. Storing these files on the blockchain requires more space, which can contribute to scalability issues, as the size of the blockchain would grow exponentially.

Solutions to Scalability Challenges

To address the scalability challenges for NFT transactions on the Bitcoin blockchain, several potential solutions have been proposed:

Layer 2 solutions: Implementing layer 2 solutions such as the Lightning Network could help alleviate the burden on the main chain by facilitating off-chain transactions. This would reduce congestion and improve scalability for NFT transactions.

Sidechains: Utilizing sidechains can provide a separate blockchain dedicated to NFT transactions, allowing for increased scalability without overloading the main Bitcoin blockchain.

Optimized transaction formats: Designing more efficient transaction formats specifically tailored for NFTs could help reduce their impact on the block size and storage requirements.

It's important to note that these solutions come with their own set of trade-offs, and careful consideration is needed to ensure the security and decentralization of the Bitcoin network while addressing scalability challenges.

In conclusion, while the Bitcoin blockchain has played a significant role in the rise of NFTs, its scalability limitations for NFT transactions cannot be ignored. Addressing these challenges will require innovative solutions to maintain the efficiency and accessibility of NFTs on the Bitcoin blockchain.

To learn more about NFTs and the potential impact on the art and collectibles industry, please visit BLUR.IO アカウントへのログイン方法.

Evaluating the environmental concerns associated with NFTs on the Bitcoin network

The rise of NFTs (non-fungible tokens) on the Bitcoin blockchain has come with a growing concern over their environmental impact. As the popularity of NFTs continues to increase, so does the demand for blockchain transactions, which in the case of Bitcoin relies on a proof-of-work consensus mechanism. This mechanism requires significant energy consumption, leading to a substantial carbon footprint.

Energy Consumption

The energy consumption associated with the Bitcoin network is a direct result of the computing power required to solve complex mathematical puzzles, known as mining. As the number of NFT transactions increases, so does the competition among miners to validate and record these transactions, resulting in higher energy consumption.

According to some estimates, the energy consumed by the Bitcoin network exceeds that of certain countries. This level of energy consumption has a significant environmental cost, as it relies primarily on fossil fuels for electricity generation. The burning of fossil fuels contributes to greenhouse gas emissions and environmental degradation.

Carbon Footprint

The carbon footprint of the Bitcoin network has been a subject of debate and concern. The energy consumption associated with mining Bitcoin contributes to the production of greenhouse gases, which are a primary driver of climate change. Additionally, the extraction of fossil fuels for electricity generation has environmental consequences, including deforestation and habitat destruction.

It's worth noting that there have been efforts to transition to more sustainable energy sources for Bitcoin mining, such as renewable energy. However, the majority of Bitcoin mining currently relies on fossil fuels, making it an ongoing concern in terms of its environmental impact.

Furthermore, the carbon footprint associated with NFTs extends beyond the energy consumption of the Bitcoin network itself. The creation and storage of NFTs often involve multiple blockchain transactions, each contributing to the overall energy consumption and carbon footprint. This additional layer of energy consumption further adds to the environmental concerns.

Overall, the increasing popularity of NFTs on the Bitcoin network raises valid concerns about their environmental impact. The energy consumption and carbon footprint associated with the mining process and the multitude of blockchain transactions required for NFT creation and storage are significant factors to consider in evaluating the sustainability of this emerging industry.

Exploring the potential for fraud and copyright infringement in the NFT space

As the popularity of NFTs continues to rise, there is a growing concern regarding the potential for fraud and copyright infringement within the NFT space. Although NFTs offer unique opportunities for creators and collectors, they also present challenges and risks.

One of the main issues is the ease with which NFTs can be created and sold, which opens the door for fraudulent activities. Due to the decentralized nature of blockchain technology, it can be difficult to verify the authenticity and ownership of an NFT. This creates a breeding ground for scammers who may attempt to sell counterfeit or stolen NFTs.

Copyright infringement is another area of concern in the NFT ecosystem. NFTs are often associated with digital artworks and other forms of media. Without proper licensing and permission from the original creators, individuals may create and sell NFTs of copyrighted material. This not only undermines the value of the original artwork but also raises legal and ethical issues.

Moreover, there is a lack of clear regulations and standards in the NFT space. This makes it challenging to address fraud and copyright infringement effectively. While blockchain technology provides transparency, the responsibility falls on the platform creators and the participants in the NFT market to establish guidelines and policies for preventing fraudulent activities.

To mitigate these risks, several initiatives have emerged. Some platforms are implementing stricter verification processes to ensure the authenticity of NFTs. Additionally, collaborations with content creators and licensing agencies can help establish a system that protects the rights of artists and prevents unauthorized use of their work.

Ultimately, the potential for fraud and copyright infringement in the NFT space calls for increased awareness and diligence from both collectors and creators. By staying informed and supporting platforms that prioritize authenticity and legal compliance, we can foster a more secure and sustainable NFT ecosystem.

Considering the Economic Implications of NFTs on the Bitcoin Blockchain

Non-fungible tokens (NFTs) have gained significant attention and popularity in recent years, revolutionizing the way we think about digital ownership and the creation of unique digital assets. NFTs are primarily associated with art, collectibles, and virtual real estate, but they have the potential to impact various industries, including the Bitcoin blockchain.

The Advantages of NFTs on the Bitcoin Blockchain

NFTs offer several potential economic benefits when integrated with the Bitcoin blockchain:

Increased Liquidity: By tokenizing unique assets and allowing them to be traded on the Bitcoin blockchain, NFTs can potentially improve liquidity for illiquid assets. Traditional assets, such as real estate or artwork, can be divided into smaller fractions, enabling broader ownership and easier transferability.

Global Accessibility: The Bitcoin blockchain operates on a decentralized network, making NFTs accessible to a global audience. This accessibility allows artists, creators, and collectors from all over the world to participate in NFT markets and benefit from potential economic opportunities.

Smart Contract Functionality: NFTs rely on smart contracts, which can include specific terms and conditions for royalties and resale rights. This functionality ensures that artists and creators receive a percentage of future sales, even after the initial sale of an NFT. It allows for continued monetization and incentivizes creators to produce more content.

Potential Risks and Challenges

While NFTs on the Bitcoin blockchain offer economic opportunities, there are also potential risks and challenges that need to be considered:

Volatility: Bitcoin is known for its price volatility, and this volatility can impact the value of NFTs traded on the Bitcoin blockchain. The fluctuating value of Bitcoin can lead to uncertainty and potential loss of value for NFT holders.

Scalability: The Bitcoin blockchain has limited scalability, causing challenges when integrating NFTs. As NFTs become more popular, the congestion on the Bitcoin network could lead to slower transaction times and increased fees. This scalability issue may hinder the growth and adoption of NFTs on the Bitcoin blockchain.

Energy Consumption: The Bitcoin blockchain relies on proof-of-work mining, which requires substantial computational power and energy consumption. The environmental impact of Bitcoin mining has raised concerns, and the integration of NFTs may exacerbate the energy consumption issue.

In conclusion, the integration of NFTs on the Bitcoin blockchain has the potential to bring various economic benefits, such as increased liquidity, global accessibility, and smart contract functionality. However, there are also risks and challenges, including the volatility of Bitcoin, scalability issues, and the energy consumption associated with Bitcoin mining. As the NFT space continues to evolve, it is essential to carefully analyze and address these economic implications to ensure the long-term sustainability and success of NFTs on the Bitcoin blockchain.

Examining the role of regulation and consumer protection in the NFT market

The growing popularity of Non-Fungible Tokens (NFTs) has raised concerns about the need for regulation and consumer protection in the market. As NFTs become more mainstream, it is crucial to examine the role of regulations in ensuring a fair and transparent marketplace for buyers and sellers.

Currently, the NFT market operates on the Ethereum blockchain, which has a decentralized and self-governed nature. This lack of regulation poses risks to consumers, as there is no central authority overseeing transactions and protecting participants from fraud or scams. As a result, there have been instances of high-profile scams and copyright infringements in the NFT space.

Regulation can play a significant role in addressing these concerns and establishing standards for the NFT market. It can help protect consumers by ensuring that digital assets are authentic, verifiable, and properly represented. This could involve implementing KYC (Know Your Customer) requirements to verify the identity of sellers and establish their ownership rights.

In addition to fraud prevention, regulations can also address copyright infringement issues that have arisen in the NFT market. Artists and creators need protection and the ability to claim ownership of their work. Implementing regulations that enforce proper attribution and copyright protection can prevent plagiarism and unauthorized use of intellectual property.

Consumer protection is another crucial aspect that regulations can address. Purchasing an NFT is often accompanied by significant financial investments. Clear rules and regulations can help ensure that buyers have access to accurate and complete information about the NFT and its underlying assets. This includes providing detailed descriptions, provenance information, and any associated rights or licenses.

1. Fraud prevention and protection against scams

2. Copyright protection for artists and creators

3. Ensuring accurate and complete information for buyers

However, it is crucial to strike a balance when implementing regulations in the NFT market. Overregulation can stifle innovation and limit the potential growth of the industry. Therefore, any regulations should be carefully designed to address the specific risks and challenges in the NFT space without stifling creativity and entrepreneurial opportunities.

In conclusion, the role of regulation and consumer protection in the NFT market is vital for fostering a fair, transparent, and secure marketplace. Regulations can help prevent fraud, protect intellectual property rights, and ensure that buyers have access to accurate information. Striking the right balance is essential to promote growth and innovation in the NFT space while minimizing risks for consumers.

Discussing the Impact of NFTs on the Decentralization of the Bitcoin Network

NFTs, or Non-Fungible Tokens, have gained significant popularity in recent years. These unique digital assets, which are stored on the Bitcoin blockchain, have raised concerns about their impact on the decentralization of the network.

One of the main benefits of NFTs is their ability to provide artists and content creators with a new way to monetize their work. By tokenizing digital art, music, or other forms of media, creators can sell and trade their unique pieces directly on the blockchain. This has the potential to empower artists and reduce the dependence on intermediaries, such as art galleries or music labels.

However, the increasing use of NFTs has also raised concerns about the centralization of the Bitcoin network. As more transactions are being made with NFTs, the demand for block space and transaction fees increases. This can lead to a situation where only those who can afford high fees can participate in the network, potentially excluding smaller users or businesses.

Furthermore, the storage of NFT data on the blockchain can also impact the decentralization of the network. As more data is added to the blockchain, the size of the blockchain grows, making it more difficult for individuals to run full nodes. This could result in a centralization of the network, with only a few entities capable of maintaining the entire blockchain.

It is important to carefully examine the impact of NFTs on the decentralization of the Bitcoin network as their popularity continues to grow. Solutions such as layer 2 scaling solutions or alternative blockchains specifically designed for NFTs may need to be explored to mitigate the potential centralization risks.

Se connecter à Blur.io : Explorer les caractéristiques et les avantages de Blur.io

Examining the potential for NFTs to revolutionize ownership and provenance

Non-fungible tokens (NFTs) have recently gained significant attention in the world of blockchain and cryptocurrency. While NFTs can represent a wide range of digital assets, such as artwork, music, or even virtual real estate, their potential to revolutionize ownership and provenance is an exciting prospect.

One of the key benefits of NFTs is their ability to provide verifiable proof of ownership. Traditionally, proving ownership of digital assets has been a challenge, with the risk of fraud and counterfeit prevalent. However, with NFTs, ownership can be securely recorded on the blockchain, providing an immutable and transparent history of ownership transfers. This has the potential to greatly enhance the value and trustworthiness of digital assets.

Furthermore, NFTs can also fundamentally change the concept of provenance, which refers to the chronology of the ownership, custody, or location of a historical object. With traditional physical assets, provenance can be difficult to trace, leading to uncertainties regarding authenticity and value. However, NFTs can attach provenance data directly to digital assets, allowing for easy verification and validation of their history.

For example, consider a piece of digital artwork. With an NFT, the artist and previous owners can be easily tracked and verified, ensuring that the piece is authentic and can be appropriately attributed. This transparency and traceability can revolutionize the art market, reducing the risk of fraud and promoting fair compensation for artists.

Moreover, NFTs can empower creators by enabling them to monetize their work and retain more control over its distribution. Through the use of smart contracts, artists can set royalties for each subsequent sale of their NFTs, ensuring a constant stream of income. This can greatly benefit artists who have traditionally struggled to earn a fair living from their creations.

However, it is crucial to also consider the potential dangers of NFTs. The current hype surrounding NFTs has led to an influx of low-quality and overpriced digital assets, which can ultimately devalue the market. Additionally, the environmental impact of NFTs, especially on the Bitcoin blockchain, should not be ignored, as the energy consumption required for transactions can be significant.

In conclusion, while NFTs have the potential to revolutionize ownership and provenance, it is essential to approach this technology with caution and consider the possible risks. By addressing these issues and leveraging the transformative power of NFTs, we can unlock new opportunities for creators and collectors alike.

Assessing the future of NFTs and their integration with other blockchain technologies

The rise of non-fungible tokens (NFTs) has led to a wave of excitement and speculation about their potential impact on various industries, including art, gaming, and collectibles. While NFTs are currently primarily associated with the Ethereum blockchain, it's worth exploring their future prospects and the potential for integration with other blockchain technologies, particularly the Bitcoin blockchain.

One of the main challenges facing NFTs is scalability, as the Ethereum blockchain has faced congestion and high transaction fees due to the popularity of NFTs. This has led to discussions around the possibility of integrating NFTs with the Bitcoin blockchain, given its robustness and scalability. Integration with Bitcoin would potentially allow for a more secure and stable platform for NFT transactions, as well as open up new possibilities for cross-chain interoperability.

Furthermore, the integration of NFTs with the Bitcoin blockchain could also address concerns about environmental impact. Unlike Ethereum, the Bitcoin blockchain uses a consensus mechanism known as Proof-of-Work (PoW), which requires significant computational power and energy consumption. By leveraging the existing infrastructure and security of the Bitcoin blockchain, NFTs could benefit from a more sustainable approach to transaction validation.

An integration between NFTs and the Bitcoin blockchain would also bring a new level of liquidity to the NFT market. Bitcoin, with its wide adoption and large market capitalization, would provide a robust and reliable asset base for NFTs, enhancing their value and appeal to potential investors. This integration could also enable the creation of decentralized exchanges (DEXs) for NFTs, allowing for seamless peer-to-peer trading without the need for intermediaries.

However, there are also potential challenges to the integration of NFTs with the Bitcoin blockchain. Bitcoin's scripting language is not as flexible as Ethereum's, which could limit the functionality and complexity of NFTs built on the Bitcoin blockchain. Additionally, the integration process would require collaboration and coordination among developers and stakeholders, as well as addressing any compatibility issues between the two blockchains.

Scalability and transaction fees

Limited scripting language

Security and stability

Collaboration and coordination

Sustainability and environmental impact

Compatibility issues

Liquidity and market appeal

In conclusion, the future of NFTs and their integration with other blockchain technologies, particularly the Bitcoin blockchain, holds exciting possibilities. While there are potential benefits, such as scalability, security, sustainability, and liquidity, there are also challenges that need to be addressed. Overall, this integration could revolutionize the NFT market and unlock new opportunities for creators, investors, and enthusiasts.

Exploring the cultural and societal implications of NFTs on the Bitcoin blockchain

NFTs (Non-Fungible Tokens) have gained significant attention and popularity in recent years, particularly within the realm of the blockchain technology. These unique digital assets have not only revolutionized the art market but have also sparked broader discussions about their cultural and societal implications.

One of the notable cultural implications of NFTs is the democratization of art ownership. Traditionally, art has been limited to a privileged few who could afford to invest in physical artworks or visit exclusive galleries. However, with NFTs, artists can now directly sell their digital creations to a global audience, bypassing the traditional art market gatekeepers. This opens up new avenues for artists from diverse backgrounds and allows for a more inclusive and diverse art scene.

In addition to democratization, NFTs also raise questions about the value and authenticity of art in the digital age. The concept of owning a unique digital asset challenges the traditional notion of physical ownership. While some argue that owning an NFT proves authenticity and ownership of a digital artwork, others question the underlying value and scarcity of these digital assets. This debate has sparked discussions about the nature of art, its intrinsic value, and the role of NFTs in reshaping the art market.

Moreover, the societal implications of NFTs go beyond the art world. NFTs have demonstrated the potential for creators from various fields, such as music, film, and literature, to monetize their work directly, without relying on intermediaries. This has the potential to empower individual creators and disrupt traditional industries. However, it also raises concerns about copyright infringement and the protection of intellectual property in the digital realm.

On the other hand, the environmental impact of NFTs is also a pressing concern. The majority of NFTs are minted on the Ethereum blockchain, which consumes a significant amount of energy. The carbon footprint of NFTs has raised alarms among environmentalists, leading to debates about the sustainability of blockchain technology and the need for more eco-friendly alternatives.

In conclusion, NFTs have profound cultural and societal implications that extend beyond the art market. While they offer new opportunities for artists and creators, they also raise questions about the value, authenticity, and environmental impact of digital assets. As the adoption of NFTs expands, it becomes vital to explore and address these implications to ensure a responsible and sustainable integration of NFTs in our society.

What are the possible dangers of NFTs on the Bitcoin blockchain?

There are several possible dangers associated with NFTs on the Bitcoin blockchain. One concern is that the increased demand for NFTs could contribute to higher transaction fees and slower confirmation times on the Bitcoin network. Additionally, there is also the risk of scam projects and fraudulent NFT sales, where individuals could be tricked into buying fake or stolen digital assets. Lastly, the environmental impact of NFTs on the Bitcoin blockchain is a growing concern, as the process of minting and trading NFTs requires a significant amount of energy.

What are the benefits of NFTs on the Bitcoin blockchain?

There are several benefits associated with NFTs on the Bitcoin blockchain. One major advantage is the increased liquidity and accessibility for digital assets that NFTs offer. By tokenizing digital art or collectibles on the Bitcoin blockchain, artists and creators can reach a wider audience and have an easier time selling and transferring ownership of their creations. Additionally, the decentralized nature of the Bitcoin blockchain ensures that NFT ownership and transactions are transparent and secure, reducing the risk of fraud or misrepresentation.

How do NFTs affect the price of Bitcoin?

The impact of NFTs on the price of Bitcoin is subject to much debate and speculation. Some argue that the increased popularity and demand for NFTs could drive more users to purchase Bitcoin in order to participate in the NFT marketplaces. This increased demand could potentially drive up the price of Bitcoin. On the other hand, critics argue that the energy-intensive process of minting and trading NFTs on the Bitcoin blockchain could have a negative environmental impact, leading to a decrease in the perceived value and adoption of Bitcoin. Ultimately, the relationship between NFTs and the price of Bitcoin is complex and can be influenced by various factors.

Are there any regulations in place for NFTs on the Bitcoin blockchain?

Currently, there are no specific regulations in place for NFTs on the Bitcoin blockchain. The decentralized and relatively anonymous nature of the blockchain makes it challenging for regulatory bodies to establish comprehensive guidelines for the NFT market. However, there are existing regulations surrounding fraud, intellectual property rights, and money laundering that may apply to certain aspects of NFTs. As the NFT market continues to evolve and gain mainstream attention, it is likely that regulators will begin to address the unique challenges and risks associated with this emerging asset class.

What is the environmental impact of NFTs on the Bitcoin blockchain?

The environmental impact of NFTs on the Bitcoin blockchain is a growing concern. The process of minting and trading NFTs requires a significant amount of computational power, which in turn consumes a large amount of energy. Bitcoin's proof-of-work consensus mechanism, which is used to validate transactions on the blockchain, is notorious for its high energy consumption. This has led to criticism of NFTs and their potential contribution to carbon emissions. Some argue that the environmental impact of NFTs outweighs their benefits, while others believe that the industry will find ways to mitigate its carbon footprint, such as through the use of more energy-efficient blockchain technologies.

What are NFTs and how do they work on the Bitcoin blockchain?

NFTs, or non-fungible tokens, are unique digital tokens that represent ownership or proof of authenticity of a particular digital asset or piece of content. On the Bitcoin blockchain, NFTs can be created using additional layers or protocols, such as the Omni Layer, to add information about the digital asset or content being tokenized. The ownership and transaction history of the NFT is recorded on the Bitcoin blockchain, ensuring transparency and immutability.

What are some potential dangers of NFTs on the Bitcoin blockchain?

One potential danger of NFTs on the Bitcoin blockchain is the risk of high transaction fees and network congestion. Since the Bitcoin blockchain is primarily designed for secure and decentralized value transfer, the addition of NFTs, which require more data storage and processing, can increase the load on the network. This can lead to higher fees and slower transaction times for users. Additionally, the use of additional layers or protocols introduces potential security vulnerabilities and complexities.

What are the benefits of NFTs on the Bitcoin blockchain?

One of the main benefits of NFTs on the Bitcoin blockchain is the enhanced security and immutability provided by the decentralized and transparent nature of the blockchain. By recording ownership and transaction history on the Bitcoin blockchain, NFTs can provide proof of authenticity and provenance for digital assets and content, reducing the risk of fraud or forgery. Additionally, the integration of NFTs with the most well-known and established blockchain network can further increase the visibility and adoption of NFTs.

How can NFTs impact the Bitcoin blockchain ecosystem?

The introduction of NFTs on the Bitcoin blockchain can have several impacts on the ecosystem. First, it can attract new users and developers who are interested in creating and trading NFTs. This can lead to increased network activity and potentially higher demand for Bitcoin. Second, it can provide additional use cases for the Bitcoin blockchain beyond simple value transfer, promoting innovation and development of new applications. However, it can also pose scalability challenges and potential conflicts with the primary purpose of the Bitcoin blockchain as a secure and decentralized store of value.

Are NFTs on the Bitcoin blockchain considered environmentally friendly?

NFTs on the Bitcoin blockchain, just like any other transaction or activity on the network, consume energy and contribute to carbon emissions. The Bitcoin network relies on a consensus mechanism called proof-of-work (PoW), which requires significant computational power and energy consumption. While efforts are being made to improve energy efficiency and explore alternative consensus mechanisms, it is important to consider the environmental impact of NFTs on the Bitcoin blockchain and seek sustainable solutions.

Blur: NFT | Blur: NFT login | Blur: NFT connect | WalletConnect | Traders | What Is Blur Crypto

2022-2024 @ Examining the possible dangers and benefits of nfts on the bitcoin blockchain