Understanding the Importance of Market Capitalization in the Present Turbulent Market Climate

Blur: NFT | Blur: NFT login | Blur: NFT connect | WalletConnect | Traders | What Is Blur Crypto

Blur: NFT | Blur: NFT login | Blur: NFT connect | WalletConnect | Traders | What Is Blur Crypto

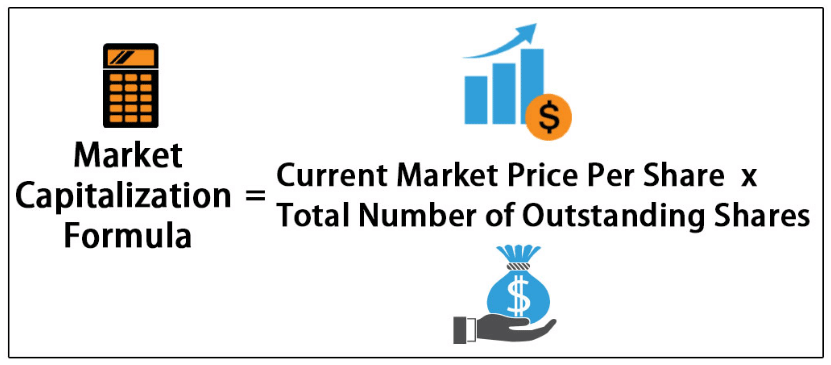

Market capitalization, often referred to as "market cap," is a key metric used by investors to assess the size and value of a company. It is calculated by multiplying the current market price of a company's stock by the total number of shares outstanding. Market cap is an important factor that can greatly influence investment decisions, especially in today's uncertain market environment.

In today's highly volatile and unpredictable market, market capitalization provides investors with a valuable insight into the stability and relative size of a company. A company with a large market cap is generally considered to be more stable and less susceptible to sudden market fluctuations compared to smaller companies with a lower market cap.

Furthermore, market capitalization can also serve as a useful indicator of a company's growth potential. Companies with a smaller market cap, also known as small-cap stocks, tend to have more room for growth compared to large-cap stocks. This is because smaller companies often have greater flexibility to explore new markets, invest in research and development, and implement innovative strategies to drive growth.

However, it's important to note that market capitalization is not the only factor to consider when making investment decisions. Other key factors such as the company's financial health, competitive position, and industry trends should also be taken into account. Additionally, it's crucial for investors to diversify their portfolios and not solely rely on market cap as a measure of investment potential.

In conclusion, market capitalization plays a significant role in today's uncertain market environment. It provides valuable insights into a company's stability, growth potential, and relative size. By considering market cap along with other important factors, investors can make more informed decisions and mitigate the risks associated with investing in today's volatile market.

The Importance of Market Capitalization

Market capitalization refers to the total value of a company's outstanding shares of stock. It is a widely used metric in the financial world and holds significant importance in today's uncertain market environment. Here are some key reasons why market capitalization is crucial:

Investor Perception: Market capitalization is often seen as an indicator of a company's size and stability. Investors tend to view large-cap companies (with high market capitalizations) as more established and less risky, while small-cap companies (with low market capitalizations) are perceived as having more growth potential but higher risk.

Investment Opportunities: Market capitalization allows investors to identify investment opportunities. Through market capitalization, investors can categorize stocks into different segments such as large-cap, mid-cap, and small-cap, enabling them to choose stocks that align with their investment objectives and risk tolerance.

Market Performance: Changes in market capitalization reflect the overall performance of the stock market. When the market capitalizations of many companies increase, it indicates a bullish market sentiment, while declining market capitalizations indicate a bearish sentiment. Monitoring market capitalization trends can help investors gauge market conditions.

Comparison and Benchmarking: Market capitalization enables investors to compare companies within the same industry or sector. It provides a basis for benchmarking performance and evaluating relative valuations. Companies with similar market capitalizations are often compared to assess their competitive positions and growth prospects.

In the uncertain market environment of today, understanding market capitalization is essential for investors to make informed decisions. Whether investing in large-cap stocks for stability or seeking growth opportunities in small-cap stocks, market capitalization serves as a valuable tool in assessing and navigating the financial markets.

Discover the features and benefits of Blur.io by connecting with Blur.io. Join the platform and explore the world of innovative financial solutions.

Understanding market capitalization

Market capitalization is a crucial metric used by investors and analysts to evaluate the size, value, and performance of a company in the stock market. It is calculated by multiplying a company's total outstanding shares by its current stock price.

Market capitalization reflects the market's perception of a company's worth and can be used to compare companies of different sizes and in different industries. It provides insights into a company's growth potential, risk profile, and the degree of investor interest.

A company's market capitalization can be categorized into three main groups:

1. Large cap

A large cap company typically has a market capitalization of $10 billion or more. These are well-established companies with a proven track record and stable earnings. Investors consider large cap stocks as relatively safer investments due to their established market positions and typically lower volatility compared to smaller companies.

2. Mid cap

Mid cap companies have a market capitalization between $2 billion and $10 billion. These companies are generally growing rapidly and have the potential for significant expansion. Investing in mid cap stocks can offer a balance between growth potential and risk.

3. Small cap

Small cap companies have a market capitalization of less than $2 billion. These companies are often in the early stages of development and may have higher growth potential. However, they also come with higher risks due to their limited resources and market presence.

Understanding a company's market capitalization is crucial for investors as it helps identify investment opportunities that align with their risk tolerance and investment goals. It provides a framework for evaluating the size, value, and growth potential of a company in the context of the broader market.

For more information on market capitalization and its significance in today's uncertain market environment, you can COMMENT SE CONNECTER À UN COMPTE BLUR.IO? to gain access to a comprehensive analysis and expert insights.

Market capitalization and investor confidence

Market capitalization, also known as market cap, is a key metric that investors use to evaluate the size and worth of a company. It is calculated by multiplying the company's total outstanding shares by the current market price per share. Market cap provides valuable information about a company's value and its standing in the market.

Investor confidence plays a crucial role in the market and can have a significant impact on market capitalization. When investors have confidence in a company, they are more likely to invest in its stock, leading to an increase in demand and a rise in stock price. This, in turn, contributes to the company's market capitalization.

Market capitalization and investor perception

Market capitalization can reflect investor perception of a company's growth potential, stability, and overall market position. Companies with high market capitalization are often seen as more established and financially secure, attracting more investors and increasing their confidence in the company's prospects.

On the other hand, companies with low market capitalization may be perceived as riskier investments, as they may have less extensive operational histories or face greater market competition. This can result in decreased investor confidence and lower market capitalization.

Market capitalization in uncertain market environments

In uncertain market environments, market capitalization can serve as an important indicator of investor confidence. During periods of volatility or economic downturns, investors may become more risk-averse and less willing to invest in stocks with high market capitalization.

However, for companies with strong fundamentals and a solid market position, market capitalization can provide a source of stability and investor confidence. Investors may view these companies as reliable long-term investments, even in uncertain times.

Market capitalization can be used to compare the size of different companies in a specific industry.

Market capitalization alone may not provide a complete picture of a company's financial health or future prospects.

High market capitalization can attract institutional investors and increase liquidity in a company's stock.

Market capitalization can be influenced by short-term market fluctuations, potentially leading to volatile stock prices.

Market capitalization can be used as a benchmark for stock performance and valuation.

Companies with low market capitalization may face challenges in accessing capital or attracting investors.

In conclusion, market capitalization is a crucial factor in the evaluation of companies and can have a significant impact on investor confidence. It reflects investor perception and can serve as an indicator of a company's growth potential and market position. However, it is important to consider market capitalization in conjunction with other financial metrics and factors to gain a comprehensive understanding of a company's overall value and prospects.

Market Capitalization and Financial Stability

Market capitalization is a key indicator used to evaluate the financial stability of a company in today's uncertain market environment. It represents the total value of all outstanding shares of a company's stock and is calculated by multiplying the current share price by the number of shares outstanding.

High market capitalization indicates that a company has a larger market presence and is considered financially stable. It reflects investor confidence in the company's ability to generate profits and sustain growth over the long term.

Financial stability is crucial for companies to weather market fluctuations and economic uncertainties. Companies with high market capitalization often have access to more capital, which provides them with greater flexibility and resources during challenging times.

Furthermore, high market capitalization makes a company more attractive to investors and can help attract institutional investors. These investors often have strict investment criteria and prioritize companies with strong financial stability.

Market capitalization also plays a crucial role in determining a company's weightage in stock market indices, such as the S&P 500 or Dow Jones Industrial Average. Companies with larger market capitalization have a higher impact on the performance of these indices, making them crucial for portfolio diversification and benchmarking.

In today's uncertain market environment, where volatility and unpredictability are common, market capitalization provides investors and analysts with a valuable metric to assess a company's financial stability and potential for growth. It serves as a reliable indicator of a company's market presence and investor confidence.

For more information on market capitalization and how it influences financial stability, you can visit COMMENT SE CONNECTER À UN COMPTE BLUR.IO ? to gain insight and guidance.

Market capitalization and company valuation

Market capitalization, also known as market cap, is a key metric used to assess the value of a company in the stock market. It is calculated by multiplying the current share price of a company by the total number of outstanding shares. Market cap provides investors with a snapshot of a company's size and worth in the market.

Importance of market capitalization

Market capitalization plays a crucial role in determining the investment potential of a company. It helps investors identify the size and stability of a company, as well as its growth prospects. Companies with higher market caps are often considered more established and less risky, while those with lower market caps may offer higher growth potential.

Investors often use market capitalization as a filtering criterion when constructing their investment portfolios. Large-cap stocks, which have higher market caps, are usually included in the portfolios of conservative investors seeking stable returns. On the other hand, small-cap stocks, with lower market caps, are more attractive to aggressive investors looking to maximize their growth potential.

Calculating valuation

Market capitalization is an important factor in calculating the valuation of a company. It provides a baseline value for the company's equity and is often used in comparison to other valuation metrics such as price-to-earnings (P/E) ratio and price-to-sales (P/S) ratio.

To assess the valuation of a company, investors may compare its market cap to its financial performance indicators. For example, a company with a high market cap but low earnings may be considered overvalued. On the other hand, a company with a low market cap but strong earnings growth potential may be seen as undervalued.

However, it is important to note that market capitalization alone does not provide a complete picture of a company's value. Investors should consider other factors such as industry dynamics, market trends, and competitive landscape when evaluating a company's worth.

In summary, market capitalization is a critical metric for investors to assess the size, stability, and growth potential of a company. It plays a vital role in determining the investment attractiveness and valuation of a company, but it should be considered in conjunction with other factors for a comprehensive analysis.

Market capitalization and investment potential

Market capitalization plays a crucial role in determining the investment potential of a company. It is a measure of the market value of a company's outstanding shares of stock, which can provide insight into the company's overall worth and growth prospects. Investors often use market capitalization as an indicator to assess the size and stability of a company, as well as its risk level.

In general, large-cap companies with high market capitalizations are considered more stable and less risky investments. These companies have established themselves in the market and tend to have a solid financial foundation. They often have diversified revenue streams, strong management teams, and significant resources, which can contribute to their long-term success.

On the other hand, small-cap companies with lower market capitalizations may have greater growth potential but are generally considered more volatile. These companies typically have a smaller market presence and may face more challenges in terms of capital resources and market competition. However, they can often provide investors with higher returns if they successfully execute their growth strategies.

Investors should consider their risk tolerance and investment goals when assessing companies based on market capitalization. Both large-cap and small-cap companies have their advantages and disadvantages, and a well-diversified portfolio may include a mix of both. It's important to thoroughly research and analyze a company's financials, competitive position, industry trends, and management before making any investment decisions.

Large-cap companies:

Stable and established

Diversified revenue streams

Strong management teams

Significant resources

Small-cap companies:

Greater growth potential

Higher volatility

Smaller market presence

Potential for higher returns

In conclusion, market capitalization is an important factor to consider when evaluating investment potential. It can provide valuable insights into the size, stability, and growth prospects of a company. Understanding the risks and rewards associated with both large-cap and small-cap companies can help investors make informed decisions and build a well-diversified investment portfolio.

The role of market capitalization in uncertain markets

In uncertain markets, market capitalization plays a crucial role in guiding investment decisions. Market capitalization refers to the total value of a company's outstanding shares of stock, calculated by multiplying the current market price per share by the total number of shares outstanding.

One of the key reasons why market capitalization is important in uncertain markets is because it serves as an indicator of a company's size and stability. Companies with larger market capitalizations are often seen as more stable and less likely to be impacted significantly by market volatility. This is because larger companies have a more established market presence, greater access to resources, and a more diverse revenue stream, which provides them with a level of resilience to weather market uncertainties.

Investors in uncertain markets often consider market capitalization as an important factor when choosing where to invest their funds. Larger companies with higher market capitalizations are often perceived as a safer investment option due to their perceived stability. On the other hand, smaller companies with lower market capitalizations may be more vulnerable to market volatility and may carry a higher level of risk.

Market capitalization is also closely related to liquidity. Companies with larger market capitalizations tend to have higher trading volumes and more active markets for their shares. This higher liquidity can be beneficial in uncertain markets as it allows investors to buy or sell shares more easily without significantly impacting the stock's price.

Furthermore, market capitalization is often used as a basis for market indices, such as the S&P 500 or the Dow Jones Industrial Average, which provide benchmarks for overall market performance. These indices typically include companies with larger market capitalizations, as they are considered to be representative of the broader market. Thus, market capitalization has a significant impact on overall market trends and can shape investor sentiment.

In conclusion, market capitalization is a crucial factor in uncertain markets as it provides insights into a company's size, stability, and liquidity. By considering market capitalization, investors can make more informed investment decisions and navigate through uncertain market conditions with a better understanding of risk and potential returns.

Market capitalization as a measure of risk

Market capitalization is a widely used measure to assess the size and value of a company in the stock market. However, it also serves as an important indicator of the level of risk associated with investing in a particular stock or asset.

Companies with higher market capitalization typically have a more established presence in the market, indicating a higher level of stability and lower risk. These companies often have a well-diversified product portfolio, strong market share, and solid financials. As a result, they are less likely to face sudden declines in their stock prices compared to smaller companies with lower market capitalization.

On the other hand, smaller companies with lower market capitalization generally exhibit higher volatility and risk. These companies are often in the early stages of their growth and may have more limited resources, making them susceptible to market downturns and other external factors. Due to their smaller size, they are also more sensitive to changes in investor sentiment and can experience sharper price fluctuations.

Investors need to consider the market capitalization of a company when assessing the risk associated with investing in its stock or asset. A company with a large market capitalization may offer lower potential returns compared to a smaller company, but it also comes with lower risk. Conversely, investing in a smaller company with lower market capitalization may offer higher potential returns, but also carries a higher level of risk.

It is important to note that market capitalization is just one of many factors to consider when evaluating investment risk. Other factors, such as industry trends, competitive positioning, management team, and financial health, should also be taken into account. Diversifying investments across companies of different market capitalizations can help mitigate risk and optimize portfolio returns.

In conclusion, market capitalization serves as an important measure of risk in today's uncertain market environment. Larger companies with higher market capitalization are generally seen as less risky, while smaller companies with lower market capitalization are deemed to have higher levels of risk. However, it is essential to take into account other factors when evaluating investment risk, and diversifying across companies of different market capitalizations can help manage risk effectively.

Market capitalization and volatility

Market capitalization refers to the total value of a company's outstanding shares of stock. It is a useful metric for investors to assess the size and worth of a company in the market. In uncertain market environments, market capitalization can play a significant role in determining the level of volatility a company's stock may experience.

Companies with large market capitalizations tend to be more stable and less volatile compared to smaller companies. This is because larger companies often have more diversified revenue streams, stronger financial positions, and established market positions. As a result, they are generally considered safer investments and may experience less dramatic price fluctuations.

On the other hand, smaller companies with lower market capitalizations tend to be more volatile. These companies may have a higher level of risk due to factors such as limited resources, dependence on a specific market or product, and potential for greater competition. As a result, their stock prices may exhibit larger swings in response to market conditions.

Investors should consider a company's market capitalization when assessing the potential volatility of its stock. By understanding the size and stability of a company, investors can make more informed decisions about the level of risk they are comfortable taking on. Additionally, market capitalization can help investors identify opportunities in volatile markets by identifying companies that may be undervalued or overlooked by the market.

It is important to note that market capitalization is not the sole indicator of volatility, and other factors such as industry trends, economic conditions, and company-specific factors can also influence stock price movements. However, market capitalization provides a useful starting point for investors to assess the potential risks and rewards associated with investing in a company.

In conclusion, market capitalization is an important measure for investors to consider in relation to volatility. Understanding the size and stability of a company can help investors assess the potential risks and rewards associated with investing in its stock. By considering market capitalization, investors can make more informed decisions and navigate uncertain market environments more effectively.

Market capitalization as an indicator of market trends

Market capitalization, often referred to as market cap, is a key metric used by investors to assess the value and size of a publicly traded company. It is calculated by multiplying the current share price by the total number of outstanding shares. This metric provides valuable insights into market trends and can be used as an indicator of a company's overall market value.

Market cap serves as a benchmark for investors to gauge the company's growth potential and attractiveness. A higher market cap generally implies a more established and stable company, while a lower market cap may indicate a smaller or higher-risk company.

By analyzing market cap, investors can gain an understanding of market trends and potential investment opportunities. Companies with rapidly increasing market caps may indicate that investors have confidence in their growth prospects, while declining market caps may be a sign of market uncertainty or negative sentiment towards a company.

Market cap can also be used to compare companies within the same industry or sector. Investors can assess a company's relative performance by comparing its market cap to its peers. This analysis can help identify companies that may be undervalued or overvalued compared to their competitors.

Furthermore, market cap is often used as a basis for the construction of various stock market indices, such as the S&P 500 or Dow Jones Industrial Average. These indices track the performance of stocks with specific market cap ranges and provide a snapshot of broader market trends.

Overall, market capitalization is a critical metric that investors should consider when evaluating investment opportunities. It provides valuable insights into market trends, company size, and investor sentiment. By understanding market cap and its implications, investors can make more informed decisions in today's uncertain market environment.

Market capitalization and industry performance

Market capitalization is a key indicator of a company's size and value. It reflects the total market value of a company's outstanding shares of stock, calculated by multiplying the current stock price by the number of shares outstanding. In today's uncertain market environment, understanding the relationship between market capitalization and industry performance is crucial for investors.

Market capitalization provides insights into the competitiveness and growth potential of companies within an industry. It helps investors gauge the overall health and stability of an industry by analyzing the collective market value of its constituent companies. A high market capitalization indicates that investors have confidence in the industry's prospects, indicating a strong performance.

Large-cap companies

Large-cap companies, those with market capitalizations above $10 billion, often demonstrate more stability and lower volatility compared to their smaller counterparts. This is because large-cap companies usually have established market positions, established customer bases, and diverse revenue streams. Their size and market leadership can provide a level of stability that helps them weather market downturns more effectively.

Moreover, large-cap companies tend to have access to more capital, allowing them to invest in research and development, explore new markets, and acquire other companies. This enables them to adapt to changing market conditions and maintain their competitiveness. As a result, large-cap stocks can be seen as a safe investment option for investors seeking long-term stability.

Small-cap and mid-cap companies

On the other hand, small-cap and mid-cap companies, with market capitalizations below $10 billion, are often characterized by higher growth potential and higher levels of volatility. These companies typically operate in niche markets or emerging industries, which may offer greater opportunities for growth but also come with increased risks.

Small-cap and mid-cap companies may experience more significant price fluctuations due to their dependence on a few key products or markets. However, they can also provide higher returns if they are successful in capturing market share or expanding into new areas. Investors interested in smaller companies should be prepared for higher risk but also the potential for greater rewards.

Overall, understanding the relationship between market capitalization and industry performance is essential for investors to make informed investment decisions. By considering the market capitalization of companies within an industry, investors can gain insights into the industry's overall health and stability, as well as the growth potential and risk levels associated with different company sizes. This knowledge can help investors build a well-rounded portfolio that aligns with their risk tolerance and investment goals.

The Impact of Market Capitalization on Investment Strategies

Market capitalization, also known as market cap, is a key metric used by investors to evaluate the size and value of a company. It represents the total market value of a company's outstanding shares of stock and is calculated by multiplying the current share price by the number of outstanding shares.

Market capitalization plays a significant role in investment strategies, as it provides insight into a company's size, growth potential, and overall risk profile. Different investment strategies often focus on companies of varying market capitalizations, each with its own set of advantages and considerations.

Large-Cap Companies

Large-cap companies are typically defined as those with a market capitalization of $10 billion or more. These companies are often well-established industry leaders with a proven track record of stability and consistent performance. Investments in large-cap companies are generally considered less risky, offering stability and the potential for steady dividend income. These companies are often attractive to conservative and income-oriented investors.

However, large-cap companies may face challenges in achieving high growth rates due to their size. While they may still experience growth, it is typically at a slower pace compared to smaller companies. Despite this, large-cap companies often have strong cash flows and financial resources, allowing them to weather economic downturns more effectively.

Small-Cap Companies

Small-cap companies, on the other hand, have market capitalizations generally ranging from $300 million to $2 billion. These companies are often younger and less established, with higher growth potential and more room for expansion. Investments in small-cap companies can offer the opportunity for significant capital appreciation, but they also come with higher risk and volatility.

Smaller companies may face challenges in terms of access to capital and market awareness. However, they can also be more agile and nimble in responding to market conditions, allowing them to capitalize on new opportunities and innovations.

Mid-Cap Companies

Mid-cap companies fall somewhere between large-cap and small-cap companies, with market capitalizations typically ranging from $2 billion to $10 billion. These companies often combine the strengths of both large and small-cap companies, offering a balance of growth potential and stability.

Mid-cap companies may have established market positions and growth opportunities, but they might also face challenges in terms of scalability. They can be attractive investments for investors seeking a mix of stability and growth, as they often have more growth potential compared to large-cap companies.

In conclusion, market capitalization has a profound impact on investment strategies. Determining the appropriate allocation to large-cap, small-cap, or mid-cap companies requires careful consideration of an investor's risk tolerance, investment goals, and time horizon. A well-diversified portfolio may include a combination of companies of various market capitalizations to both manage risk and maximize potential returns.

Market Capitalization and Portfolio Diversification

Market capitalization is an important factor to consider when diversifying a portfolio in today's uncertain market environment. It refers to the total value of a company's outstanding shares of stock and provides investors with an indication of the size and scale of a company.

One key benefit of considering market capitalization in portfolio diversification is the ability to spread investment risk. By including companies with different market capitalizations in a portfolio, investors can diversify their exposure to different market segments and reduce the impact of any single company's performance on their overall portfolio.

Large Cap Companies

Large cap companies, or those with a market capitalization above a certain threshold, are typically well-established companies with stable operations. These companies often have a proven track record and may offer stability and steady growth. Including large cap companies in a portfolio can help reduce the volatility associated with smaller companies, providing a more balanced and diversified investment approach.

Example: Companies like Apple, Microsoft, and Amazon are considered large cap companies due to their substantial market capitalizations.

Small Cap Companies

On the other end of the spectrum, small cap companies have a lower market capitalization and are typically younger or less established companies. While small cap companies may carry more risk due to their higher growth potential and increased volatility, they also have the potential for significant returns. Including small cap companies in a portfolio can provide exposure to innovative and high-growth companies and potentially enhance overall portfolio performance.

Example: Emerging technology companies or startups often fall into the small cap category due to their smaller market capitalizations.

In conclusion, market capitalization plays a crucial role in portfolio diversification. By including companies of different sizes in a portfolio, investors can spread their risk across different market segments and potentially enhance their overall returns. However, it is important to carefully assess the risk associated with each market capitalization category and allocate investments accordingly to maintain a well-balanced and diversified portfolio.

Market capitalization and long-term investments

Market capitalization, also known as market cap, is a financial metric that represents the total value of a company's outstanding shares of stock. It is calculated by multiplying the current share price by the total number of outstanding shares. Market capitalization is widely used by investors to gauge the size and worth of a company.

When it comes to long-term investments, market capitalization plays a crucial role in making informed investment decisions. Companies with a large market capitalization are generally considered more stable and less risky compared to companies with a smaller market cap. This is because larger companies often have a long track record of success and are less likely to go out of business.

Investing in companies with a larger market cap can provide investors with greater stability and a higher level of confidence. These companies tend to have more financial resources, allowing them to weather economic downturns and invest in growth opportunities. Additionally, larger companies often attract institutional investors, which can provide additional stability and liquidity to the stock.

The benefits of investing in large-cap companies

Investing in large-cap companies can offer several benefits for long-term investors:

Stability: Large-cap companies tend to have a more established business model and a history of generating consistent revenue and profits. This stability can provide investors with a greater sense of security.

Dividends: Many large-cap companies have a history of paying regular dividends to their shareholders. These dividends can provide a steady stream of income and enhance the overall return on investment.

Growth potential: While large-cap companies may not experience the same level of growth as smaller companies, they still have the potential to grow over the long term. These companies often have the resources to invest in research and development, acquisitions, and new market expansion.

The risks of investing in large-cap companies

Although large-cap companies are generally considered less risky, there are still some risks associated with investing in these companies:

Market saturation: Larger companies may already have a significant market share in their respective industries, making it difficult to sustain high levels of growth.

Slow decision-making: Large corporations may be slower to adapt to changing market conditions and implement new strategies. This can limit their ability to stay competitive.

Market volatility: While large-cap companies are generally more stable, they are still subject to market fluctuations and economic downturns. Investors need to be prepared for short-term volatility in stock prices.

Overall, market capitalization is an important factor to consider when making long-term investments. It can provide insights into a company's size, stability, and growth potential. However, it's important to conduct thorough research and consider other fundamental and technical factors before making any investment decisions.

Market capitalization and short-term investments

When considering the significance of market capitalization in today's uncertain market environment, it is important to also consider the role of short-term investments. Market capitalization, which is calculated by multiplying a company's current share price by its number of outstanding shares, serves as a key indicator of a company's size and value in the market.

Short-term investments, on the other hand, are financial instruments that are typically held for a period of less than one year. These investments are often seen as a way for companies to generate quick returns and manage liquidity. They can include cash equivalents, such as treasury bills and money market funds, as well as short-term bonds and commercial paper.

Market capitalization and short-term investments are closely related as they both reflect the financial health and stability of a company. A company with a large market capitalization is typically seen as more stable and less volatile, which can make it an attractive investment option for short-term investors.

However, it is important to note that market capitalization alone should not be the sole factor in determining the suitability of short-term investments. Other factors, such as the company's financial performance, industry trends, and market conditions, should also be taken into consideration.

In today's uncertain market environment, short-term investments can provide investors with opportunities to capitalize on market fluctuations and generate quick profits. However, they also come with risks, as market conditions can change rapidly and short-term investments can be more susceptible to volatility.

Therefore, investors should carefully assess the relationship between market capitalization and short-term investments and consider their risk tolerance and investment goals before making any decisions. By understanding the significance of market capitalization and considering it alongside other factors, investors can make more informed decisions and navigate today's uncertain market environment more effectively.

Market capitalization and investment returns

Market capitalization, or market cap, is a term that refers to the total value of a company's outstanding shares of stock. It is calculated by multiplying the current market price of a stock by the total number of outstanding shares. Market cap is an important metric that investors and analysts use to evaluate the size and performance of a company.

When it comes to investment returns, market capitalization can play a significant role. Studies have shown that companies with different market capitalizations tend to have different levels of risk and return. Generally, larger companies with higher market capitalizations tend to be more stable and have lower volatility compared to smaller companies with lower market capitalizations.

Investing in large-cap companies, which are typically well-established and have a track record of stability, can be seen as a conservative investment strategy. These companies often have a diversified portfolio of products and services, a strong financial position, and a history of generating consistent profits. As a result, they are considered less risky and may provide steady returns over the long term.

However, investing in small-cap companies, which are typically smaller and less established, can offer higher growth potential. These companies often have innovative business models, niche markets, and the ability to adapt quickly to market changes. While small-cap stocks can be more volatile and carry a higher level of risk, they can also provide substantial returns for investors willing to take on the additional risk.

It's important to note that market capitalization should not be the sole factor considered when making investment decisions. Other factors, such as industry trends, financial performance, management team, and competitive landscape, should also be taken into account. Additionally, diversification across different market capitalizations can help investors balance risk and potential returns in their investment portfolios.

Conclusion

In today's uncertain market environment, market capitalization plays a crucial role in investment decision-making. It provides valuable insights into a company's size, stability, and growth potential. Investors should consider the risk and return characteristics associated with different market capitalizations when constructing their investment portfolios. By diversifying across different market caps, investors can potentially maximize their returns while managing their risk exposure.

Market capitalization and risk management

Market capitalization is an important factor to consider when it comes to risk management in the financial markets. It measures the total value of a company and reflects the investors' sentiment towards it. By analyzing market capitalization, investors can assess the risk associated with a particular investment and make informed decisions.

In uncertain market environments, market capitalization can provide valuable insights into the level of risk in the market. Companies with larger market capitalizations are generally considered less risky as they have a higher degree of stability and financial resources. On the other hand, companies with lower market capitalizations are often associated with higher risk, as they may be more susceptible to market volatility and economic downturns.

Investors can use market capitalization as a risk management tool by diversifying their portfolios. By investing in companies with different market capitalizations, investors can reduce their exposure to risk and improve the stability of their investments. This strategy allows them to balance the potential for higher returns from small-cap companies with the stability provided by larger-cap companies.

Furthermore, market capitalization can also be used as an indicator of liquidity risk. Companies with higher market capitalizations tend to have more liquid stocks, meaning they are easier to buy and sell without significantly impacting the stock price. This liquidity can provide investors with more flexibility in managing their portfolios and mitigating the risk of being unable to exit an investment quickly.

In conclusion, market capitalization plays a crucial role in risk management in today's uncertain market environment. By understanding and analyzing market capitalization, investors can make more informed decisions, diversify their portfolios, and manage their exposure to risk. It is essential for investors to consider market capitalization when assessing the risk associated with an investment and developing a risk management strategy.

What is market capitalization and why is it important?

Market capitalization refers to the total value of a company's outstanding shares of stock. It is calculated by multiplying the price of a company's stock by the number of shares outstanding. Market capitalization is important because it provides investors with an indication of the size and worth of a company. It can also be used as a benchmark for comparing different companies within the same industry.

How does market capitalization affect a company's stock price?

Market capitalization does not directly affect a company's stock price. The stock price is determined by various factors, including supply and demand dynamics, company performance, and investor sentiment. However, market capitalization can indirectly impact stock price perception. Companies with larger market capitalization often attract more institutional investors, which can result in higher demand for the stock and potentially drive up the stock price.

Are there any limitations to using market capitalization as a measure of a company's value?

Yes, there are limitations to using market capitalization as a measure of a company's value. Market capitalization only considers the value of a company's equity and does not take into account other financial metrics such as debt level, cash flow, or profitability. Additionally, market capitalization can be influenced by market fluctuations and investor sentiment, which may not reflect the true underlying value of a company. Therefore, it is important to consider other factors and financial metrics when evaluating a company's value.

How does market capitalization determine the risk level of a company?

Market capitalization can provide an indication of the risk level of a company. Generally, smaller companies with lower market capitalization are considered riskier investments because they may have less financial stability, limited resources, and higher volatility. On the other hand, larger companies with higher market capitalization are often viewed as less risky because they tend to have more established operations, stronger financial positions, and greater market presence. However, it is important to note that risk should not be solely based on market capitalization, as other factors such as industry dynamics and company-specific risks should also be considered.

Can market capitalization be used to predict future stock performance?

Market capitalization alone cannot be used to predict future stock performance. While market capitalization provides information about the size and worth of a company, there are numerous other factors that can affect stock performance, including company fundamentals, industry trends, economic conditions, and market sentiment. Investors should consider a comprehensive analysis of these factors, along with market capitalization, when making investment decisions.

What is market capitalization?

Market capitalization is a measure of a company's value in the stock market. It is calculated by multiplying the company's current share price by the total number of outstanding shares. This measure helps investors and analysts gauge the size and worth of a company.

How is market capitalization important in today's uncertain market environment?

Market capitalization is particularly important in today's uncertain market environment because it provides a snapshot of the market's perception of a company's value. In times of uncertainty, investors often turn to larger, more stable companies with higher market capitalizations as a safer investment option.

What are the different categories of market capitalization?

The categories of market capitalization typically used are large cap, mid cap, and small cap. Large cap companies have the highest market capitalization, usually exceeding $10 billion. Mid cap companies have a market capitalization between $2 billion and $10 billion, while small cap companies have a market capitalization below $2 billion.

How does market capitalization affect a company's ability to raise capital?

Market capitalization can impact a company's ability to raise capital. A larger market capitalization indicates that a company is more established, financially stable, and has a higher level of investor confidence. This can make it easier for the company to raise capital through the issuance of new shares or debt.

Is market capitalization the only factor to consider when evaluating a company?

No, market capitalization is just one factor to consider when evaluating a company. Other important factors include the company's financial health, growth prospects, industry position, management team, and competitive landscape. It is important to take a comprehensive approach and analyze multiple factors before making investment decisions.

Blur: NFT | Blur: NFT login | Blur: NFT connect | WalletConnect | Traders | What Is Blur Crypto

2022-2024 @ The significance of market capitalization in todays uncertain market environment