How the top 10 cryptocurrencies influence the bitcoin network and shape the industry's development.

Blur: NFT | Blur: NFT login | Blur: NFT connect | WalletConnect | Traders | What Is Blur Crypto

Blur: NFT | Blur: NFT login | Blur: NFT connect | WalletConnect | Traders | What Is Blur Crypto

In recent years, cryptocurrencies have become a global phenomenon, with Bitcoin leading the pack as the most popular and widely recognized digital currency. However, Bitcoin is not alone in the crypto world. There are now thousands of different cryptocurrencies available, each with its own unique features and potential impact on the industry. In this article, we will explore the top 10 cryptocurrencies and their effect on the Bitcoin network, as well as the evolution of the overall cryptocurrency industry.

Bitcoin remains the undisputed king of the cryptocurrency world and has had a significant impact on both the market and the underlying technology. It was the first decentralized digital currency, introduced by an anonymous person or group of people under the pseudonym Satoshi Nakamoto. Bitcoin's success has paved the way for the development of numerous other digital currencies, often referred to as altcoins.

Ethereum is one of the most significant altcoins and has had a profound effect on the industry. Unlike Bitcoin, Ethereum is not just a cryptocurrency but also a platform that enables developers to build decentralized applications (dApps) using smart contracts. This innovation has opened up a world of possibilities and has fostered the growth of a thriving ecosystem of projects and tokens based on the Ethereum blockchain.

Ripple, another influential cryptocurrency, aims to revolutionize the way money is transferred globally. Unlike Bitcoin and Ethereum, Ripple is not based on blockchain technology. Instead, it utilizes a distributed consensus ledger, known as the XRP Ledger, to enable fast and low-cost international transactions. This approach has garnered significant attention from financial institutions and has the potential to reshape the traditional banking industry.

Other top cryptocurrencies, such as Litecoin, Bitcoin Cash, Cardano, and Stellar, each bring their own unique contributions to the industry. From faster transaction speeds to improved scalability and enhanced privacy features, these altcoins have pushed the boundaries of what is possible with digital currencies. Their collective influence on the Bitcoin network and the cryptocurrency industry as a whole cannot be understated.

In conclusion, the top 10 cryptocurrencies have had a profound impact on the Bitcoin network and the evolution of the industry. Bitcoin paved the way for the development of countless altcoins, each with its own potential to change the way we think about money and technology. From decentralized applications to improved transaction speeds and global remittance solutions, these cryptocurrencies are reshaping the future of finance. As the industry continues to grow and evolve, it will be fascinating to see how these cryptocurrencies and others develop and the impact they will have on our world.

The Impact of Top 10 Cryptocurrencies

Bitcoin (BTC): As the original cryptocurrency, Bitcoin has had a significant impact on the entire industry. It paved the way for the development of other cryptocurrencies and introduced the concept of a decentralized digital currency.

Ethereum (ETH): Ethereum introduced the concept of smart contracts, which revolutionized the way applications can be built on the blockchain. Its impact on the industry is evident in the rise of decentralized finance (DeFi) and the creation of numerous tokens and projects.

Ripple (XRP): Ripple's technology is focused on cross-border payments and has made significant strides in improving the efficiency and speed of international transactions. Its impact is felt in the financial sector, where banks and other institutions are utilizing its technology.

Bitcoin Cash (BCH): Bitcoin Cash was created as a result of a hard fork from Bitcoin and aims to address the scalability issues of the original cryptocurrency. Its impact lies in offering faster and cheaper transactions compared to Bitcoin.

Cardano (ADA): Cardano is a blockchain platform that aims to provide a more secure and sustainable infrastructure for the development of decentralized applications. Its impact is seen in its focus on academic research and peer-reviewed development.

Litecoin (LTC): Often referred to as the silver to Bitcoin's gold, Litecoin was one of the first altcoins and introduced several improvements over Bitcoin, including faster block generation time and a different hashing algorithm. Its impact lies in offering a more efficient alternative to Bitcoin.

Polkadot (DOT): Polkadot is a multi-chain platform that enables different blockchains to interoperate and share information. Its impact lies in its ability to foster innovation and connectivity between different blockchain networks.

Chainlink (LINK): Chainlink provides decentralized oracle services, which allow smart contracts to securely interact with real-world data. Its impact is seen in enabling the development of more complex and reliable decentralized applications.

Stellar (XLM): Stellar is a platform designed to facilitate fast and low-cost cross-border payments, similar to Ripple. Its impact lies in its focus on providing financial services to the unbanked and underbanked populations.

Polkadot (DOT): Polkadot is a multi-chain platform that enables different blockchains to interoperate and share information. Its impact lies in its ability to foster innovation and connectivity between different blockchain networks.

The impact of these top 10 cryptocurrencies extends beyond their individual features and use cases. They have collectively contributed to the growth and maturation of the cryptocurrency industry as a whole. Together, they have introduced new technologies, improved upon existing ones, and opened up opportunities for innovation in various sectors. Their impact on the Bitcoin network and the evolution of the industry cannot be understated.

Bitcoin Network: A Global Phenomenon

The Bitcoin network has emerged as a global phenomenon, revolutionizing the way we perceive and interact with digital currencies. With its decentralized nature and unique blockchain technology, Bitcoin has gained traction and transformed the financial landscape.

Since its inception in 2009, Bitcoin has paved the way for the development of over 10,000 cryptocurrencies. These cryptocurrencies, including popular ones like Ethereum, Litecoin, and Ripple, have had a significant impact on the Bitcoin network and the evolution of the industry.

Conexión a Blur.io: Explorar las características y ventajas de Blur.io

The Influence of Top 10 Cryptocurrencies

The top 10 cryptocurrencies, such as Bitcoin, Ethereum, and Ripple, play a crucial role in shaping the Bitcoin network. These cryptocurrencies are often used for trading, investment, and remittance purposes, creating a global demand for blockchain technology and cryptocurrencies as a whole.

Bitcoin, as the pioneering cryptocurrency, serves as a benchmark for the entire industry. Its significant market capitalization and widespread adoption make it the most influential cryptocurrency in the market. Other cryptocurrencies often follow Bitcoin's price movements and market trends.

The Evolution of the Industry

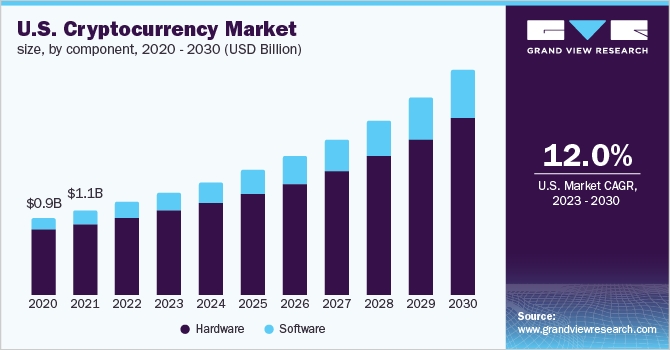

The emergence of various cryptocurrencies has spurred innovation and competition in the industry. Blockchain technology, the underlying technology behind cryptocurrencies, has been adopted by businesses and governments worldwide for various applications, including supply chain management, identity verification, and decentralized finance.

Furthermore, the growth of the cryptocurrency industry has led to the establishment of cryptocurrency exchanges and wallets, providing users with convenient platforms to buy, sell, and store cryptocurrencies securely. These developments have increased accessibility and widened the user base, contributing to the global reach of the Bitcoin network.

The Bitcoin network continues to evolve, adapting to the changing needs and challenges of the industry. As cryptocurrencies gain more mainstream acceptance, the potential impact of the top 10 cryptocurrencies will likely continue to shape the future of the Bitcoin network.

Understanding the Evolution of the Cryptocurrency Industry

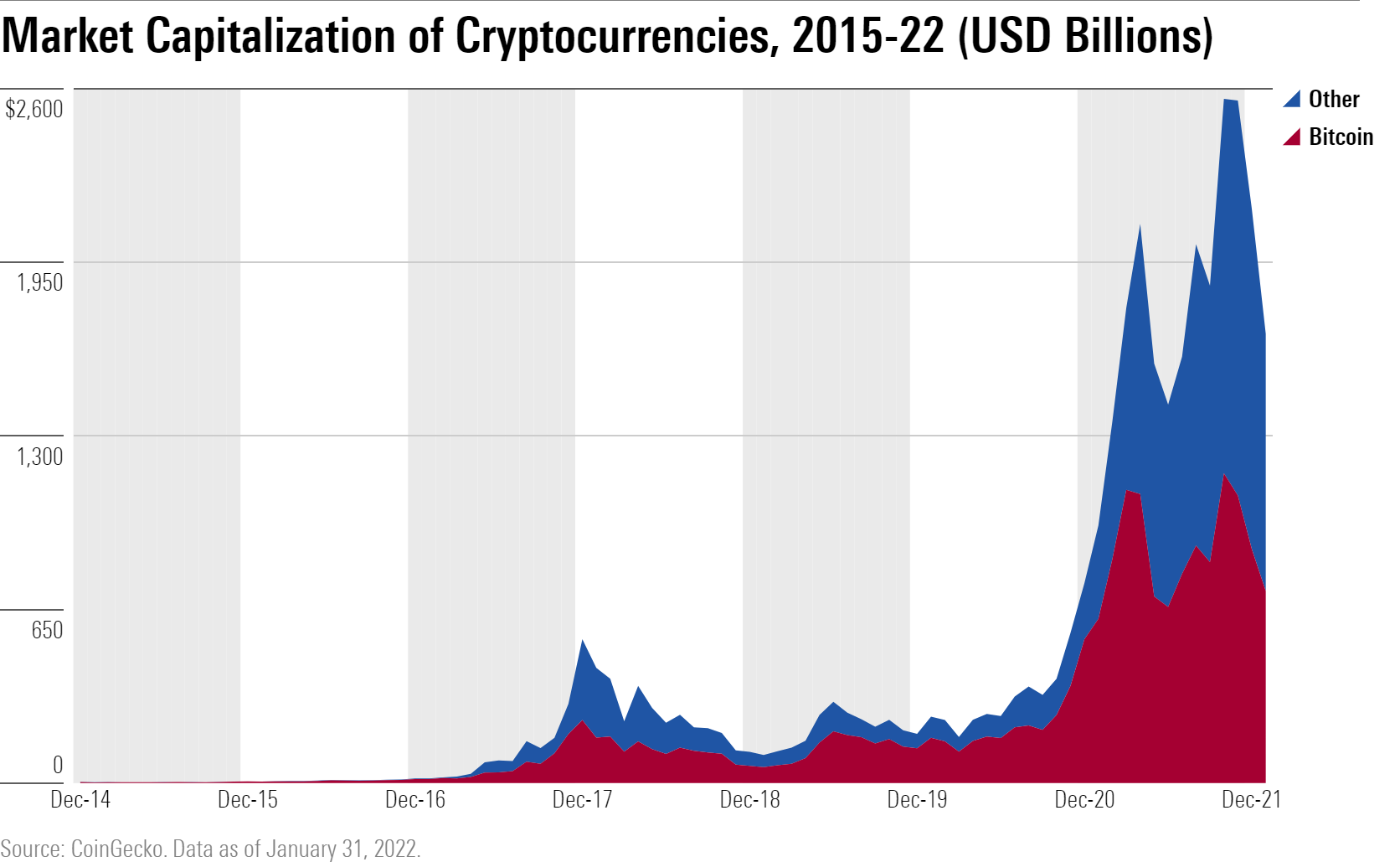

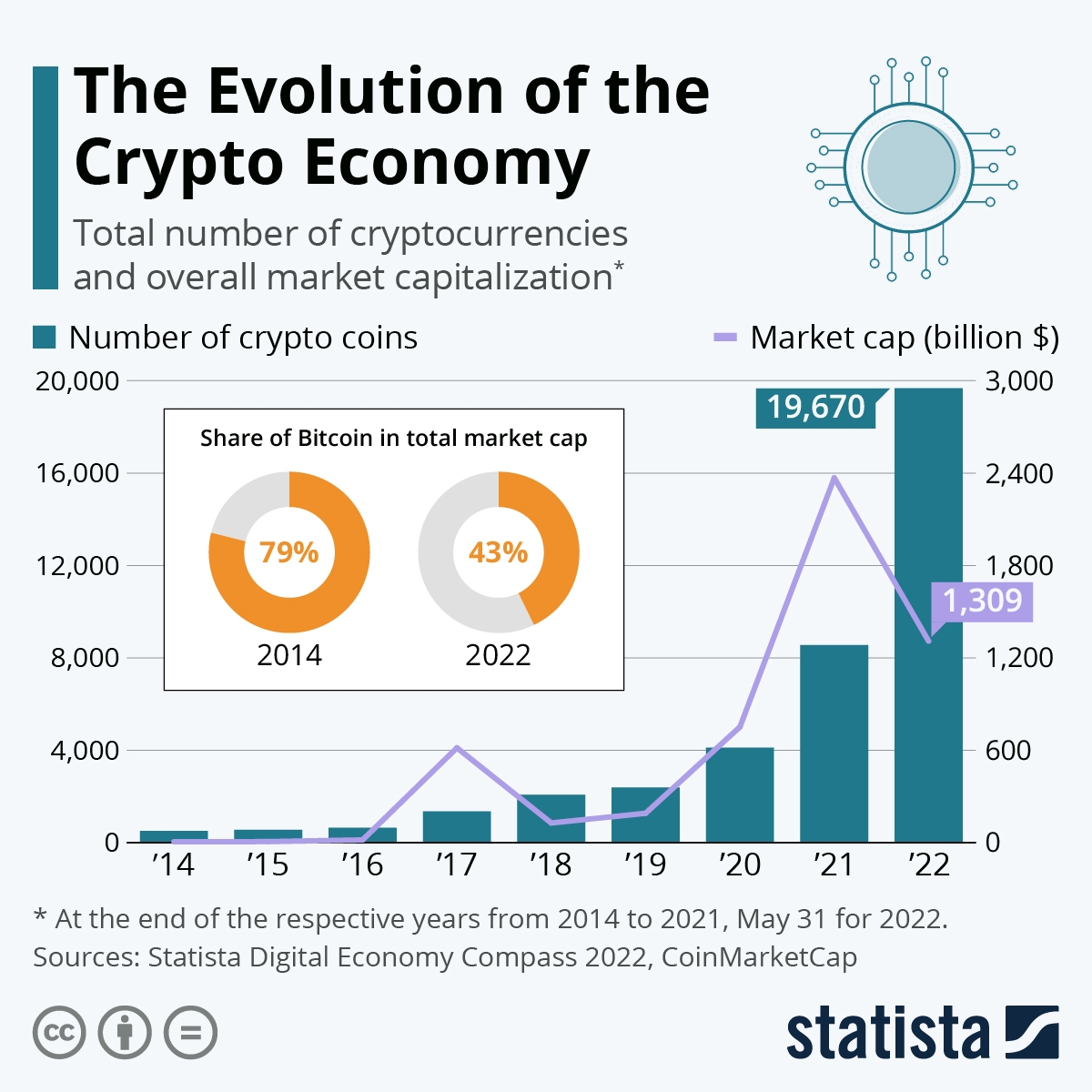

The cryptocurrency industry has gone through significant evolution since the introduction of Bitcoin in 2009. What started as a niche concept for digital currency has now become a global phenomenon with a market capitalization of over $2 trillion. To understand the evolution of the cryptocurrency industry, it is essential to explore the key milestones and trends that have shaped its development.

Bitcoin, the first decentralized cryptocurrency, laid the foundation for the industry. Its release introduced the concept of blockchain technology, a decentralized ledger that enables secure and transparent transactions. Bitcoin's success sparked a wave of innovation, leading to the creation of new cryptocurrencies known as altcoins.

Altcoins, or alternative cryptocurrencies, offered various improvements and innovations compared to Bitcoin. Some focused on increasing transaction speed, while others prioritized privacy or scalability. Ethereum, launched in 2015, introduced smart contracts, which allowed for the creation of decentralized applications (DApps) on its blockchain. This opened up a new avenue for blockchain technology applications beyond digital currency transactions.

The growth of altcoins and the emergence of new blockchain platforms paved the way for Initial Coin Offerings (ICOs). ICOs became a popular method for startups to raise funds by selling their own tokens in exchange for established cryptocurrencies like Bitcoin or Ethereum. While ICOs offered exciting opportunities for investment, they also brought regulatory concerns, resulting in increased scrutiny from authorities.

The cryptocurrency industry faced significant challenges in terms of security and scalability. Several high-profile hacking incidents highlighted the vulnerabilities of exchanges and wallets. The community responded by developing improved security measures and exploring alternative consensus algorithms, such as Proof-of-Stake (PoS), to address the scalability issues associated with Proof-of-Work (PoW) used by Bitcoin.

Regulatory frameworks for cryptocurrencies have also evolved, with governments adopting various approaches. Some countries embraced cryptocurrencies and blockchain technology, providing favorable regulatory environments to encourage innovation. Others imposed strict regulations to mitigate risks associated with money laundering and terrorist financing. The regulatory landscape continues to evolve, shaping the future of the cryptocurrency industry.

The evolution of the cryptocurrency industry has also been influenced by institutional adoption. Major financial institutions and corporations have started to embrace cryptocurrencies, recognizing their potential as an alternative asset class and a means of diversification. This institutional involvement has brought increased liquidity and legitimacy to the industry, attracting more investors and driving further innovation.

The DeFi (Decentralized Finance) boom has been another significant development in the cryptocurrency industry. DeFi refers to the use of blockchain technology and smart contracts to recreate traditional financial instruments and services without the need for intermediaries. It provides opportunities for decentralized lending, borrowing, and trading, enabling greater access to financial services globally.

Looking ahead, the cryptocurrency industry is poised for further growth and evolution. The ongoing development of blockchain technology, advancements in scalability and privacy solutions, and increasing regulatory clarity will shape the industry's future. As more individuals and institutions recognize the potential of cryptocurrencies, the industry will continue to mature and redefine finance as we know it.

Ripple: Revolutionizing Cross-Border Transactions

In the world of cryptocurrency, Ripple stands out as a revolutionary force in the realm of cross-border transactions. With its XRP token, Ripple offers a faster, more efficient, and cost-effective way to send money across borders than traditional banking systems.

The Need for Innovation

Traditionally, cross-border transactions have been slow and expensive. Banks rely on a complex network of intermediaries, such as correspondent banks, to facilitate these transactions. This results in delays, high fees, and a lack of transparency.

The Ripple Solution

Ripple aims to solve these issues with its decentralized protocol and digital asset, XRP. Unlike other cryptocurrencies, Ripple doesn't require mining, making it more environmentally friendly and cost-effective. Additionally, its consensus algorithm allows for near-instant transaction confirmation and settlement, eliminating the need for intermediaries.

Ripple's technology, known as RippleNet, is a global network of banks and payment providers that use the XRP token to facilitate cross-border transactions. By using XRP as a bridge currency, Ripple enables fast and low-cost transfers in any fiat currency, eliminating the need for multiple conversions.

The Impact on the Bitcoin Network

Ripple's emergence as a popular cryptocurrency has had an impact on the Bitcoin network. Bitcoin, being the first and most well-known cryptocurrency, has faced scalability issues due to its limited transaction capacity. Ripple's faster and more efficient system has showcased the need for scalability in the industry, pushing Bitcoin developers to explore solutions such as the Lightning Network.

Furthermore, Ripple's success has highlighted the demand for cryptocurrencies that can serve as a tool for practical applications. While Bitcoin remains a store of value and an investment asset, Ripple's focus on solving real-world problems has attracted the attention of businesses and financial institutions looking for efficient cross-border payment solutions.

In conclusion, Ripple's XRP token and its innovative technology have revolutionized cross-border transactions by offering a faster, more cost-effective, and transparent alternative to traditional banking systems. Its impact on the Bitcoin network and the evolution of the cryptocurrency industry as a whole cannot be ignored.

Ethereum: The Platform for Smart Contracts and Decentralized Applications

Ethereum is a blockchain platform that was created by Vitalik Buterin in 2015. It is known for its ability to support smart contracts and decentralized applications (DApps). While Bitcoin was the first cryptocurrency to gain mainstream attention, Ethereum takes the concept of blockchain technology even further.

One of the key features of Ethereum is its support for smart contracts. Smart contracts are self-executing contracts with the terms of the agreement directly written into code. These contracts can automatically execute when certain conditions are met, which eliminates the need for intermediaries and streamlines processes. Ethereum's decentralized nature ensures that these contracts are tamper-proof and resistant to censorship.

The Ethereum Virtual Machine (EVM)

Ethereum's platform is powered by the Ethereum Virtual Machine (EVM), which enables the execution of smart contracts. The EVM is a runtime environment that runs on the Ethereum network and allows for the development, deployment, and execution of smart contracts.

Developers can write smart contracts using Ethereum's programming language, Solidity. These contracts can then be deployed and executed on the Ethereum network. This opens up a world of possibilities for developers to create decentralized applications that can interact with each other on the Ethereum blockchain.

The Impact on the Bitcoin Network

Ethereum's emergence has had a significant impact on the Bitcoin network and the overall cryptocurrency industry. While Bitcoin remains the most well-known cryptocurrency, Ethereum has introduced new capabilities that go beyond simple peer-to-peer transactions.

With the rise of decentralized finance (DeFi), Ethereum has become a popular platform for a wide range of financial applications such as lending, borrowing, and trading. These applications have attracted significant attention and investment, fueling the growth of the Ethereum network.

The increased usage of the Ethereum network has also put pressure on the Bitcoin network, which has struggled to handle the growing demand. Ethereum's ability to support a wide range of decentralized applications has made it a preferred choice for many developers and users.

Ethereum's smart contract functionality has revolutionized the way contracts are executed and enforced.

DeFi applications built on Ethereum have introduced new financial opportunities and disrupted traditional finance.

The scalability challenges faced by both Ethereum and Bitcoin highlight the need for further development and innovation in the industry.

In conclusion, Ethereum has established itself as the leading platform for smart contracts and decentralized applications. Its ability to support complex, programmable agreements has revolutionized the way transactions and contracts are executed. While Bitcoin paved the way for cryptocurrencies, Ethereum has taken blockchain technology to new heights.

Litecoin: Faster and Cheaper Transactions

Litecoin is one of the top 10 cryptocurrencies that has made a significant impact on the bitcoin network and the evolution of the industry. It was created in 2011 by Charlie Lee, a former Google engineer, and has since gained a strong following among cryptocurrency enthusiasts.

One of the main features that sets Litecoin apart from Bitcoin is its faster transaction confirmation time. While Bitcoin takes around 10 minutes to confirm a transaction, Litecoin only takes about 2.5 minutes. This makes Litecoin more suitable for everyday transactions, as users can enjoy faster confirmation times.

In addition to faster confirmation times, Litecoin also boasts cheaper transaction fees compared to Bitcoin. The average transaction fee for Litecoin is significantly lower than Bitcoin, making it more cost-effective for users who frequently make transactions. This affordability factor contributes to Litecoin's appeal as a viable alternative to Bitcoin.

The SegWit Upgrade

In 2017, Litecoin implemented the Segregated Witness (SegWit) upgrade, which further improved its transaction capacity and scalability. SegWit allows for more transactions to be included in a block, resulting in reduced congestion and lower fees. This upgrade has made Litecoin even more attractive for users looking for faster and cheaper transactions.

With the SegWit upgrade, Litecoin also became the first major cryptocurrency to activate this scaling solution. This achievement helped to showcase Litecoin's commitment to innovation and willingness to adopt improvements that benefit its users.

Liquidity and Acceptance

Litecoin's fast and cost-effective transactions have led to increased liquidity and acceptance among merchants and online businesses. Many merchants now accept Litecoin as a form of payment due to its lower fees and faster processing times.

Furthermore, Litecoin is often used as a testbed for implementing new technologies before they are adopted by Bitcoin. This testing and experimentation demonstrate Litecoin's active role in driving innovation and pushing the boundaries of what is possible in the cryptocurrency industry.

Litecoin offers faster transaction confirmation times compared to Bitcoin.

Litecoin has lower transaction fees, making it more cost-effective.

The SegWit upgrade has further improved Litecoin's transaction capacity and scalability.

Litecoin's fast and cheap transactions have led to increased acceptance among merchants.

Litecoin plays an active role in pushing the boundaries of innovation in the cryptocurrency industry.

Bitcoin Cash: The Fork that Sparked Controversy

Bitcoin Cash, also known as Bcash or BCH, is a cryptocurrency that was created as a result of a hard fork from Bitcoin in August 2017. The fork was led by a group of developers who believed that the original Bitcoin protocol had limitations in terms of scalability and transaction speed.

One of the main arguments put forth by the Bitcoin Cash supporters was the need for larger block sizes to accommodate more transactions and reduce fees. The Bitcoin Cash network increased the block size from 1 MB to 8 MB, allowing for faster and cheaper transactions.

However, the creation of Bitcoin Cash sparked a significant amount of controversy within the cryptocurrency community. Many Bitcoin enthusiasts believed that the fork was unnecessary and that it would only create confusion and divide the community. Some even accused the developers behind Bitcoin Cash of trying to hijack the Bitcoin brand for their own gain.

Despite the controversy, Bitcoin Cash gained a significant following and has become one of the top cryptocurrencies in terms of market capitalization. It has attracted the attention of both investors and traders who see it as an alternative to Bitcoin.

One notable feature of Bitcoin Cash is its compatibility with the Wallet Connect protocol. Wallet Connect allows users to interact with decentralized applications (DApps) directly from their wallets, providing a seamless and secure experience. This has further enhanced the usability and adoption of Bitcoin Cash in the cryptocurrency industry.

Main Features of Bitcoin Cash:

Larger block sizes to accommodate more transactions

Fast and cheap transactions

Compatibility with Wallet Connect for enhanced usability

Conclusion

Bitcoin Cash emerged as a controversial fork from Bitcoin, with proponents advocating for larger block sizes to address scalability issues. Despite the initial controversy, Bitcoin Cash has gained a significant following and has become a prominent cryptocurrency in the industry. Its compatibility with Wallet Connect has further enhanced its adoption and usability.

Cardano: Building a Secure and Sustainable Blockchain

Cardano is a blockchain platform that aims to be secure, sustainable, and scalable. It was founded by a team of academics and engineers who wanted to create a blockchain technology that could address the limitations of existing platforms like Bitcoin and Ethereum.

Security First

Cardano takes a security-first approach by employing formal verification methods to ensure the correctness of its code. This means that all software components and smart contracts on the Cardano blockchain are mathematically proven to be accurate, reducing the risk of vulnerabilities and malicious attacks.

Furthermore, Cardano uses the Ouroboros consensus algorithm, a proof-of-stake protocol that ensures the security and integrity of the network. By having a decentralized network of trusted validators, Cardano makes it extremely difficult for malicious actors to manipulate the blockchain.

Sustainability and Scalability

In addition to security, Cardano also focuses on sustainability and scalability. It aims to be a self-sustaining ecosystem by enabling the participation of ADA holders in the decision-making process through a democratic voting system. This ensures that the network evolves in a decentralized and transparent manner.

Cardano is also designed to handle a high volume of transactions. It utilizes a layered architecture that separates the settlement layer from the computation layer, allowing for parallel processing and increased scalability. This ensures that the Cardano blockchain can support a wide range of decentralized applications (dApps) and handle the demands of a global user base.

Overall, Cardano offers a unique combination of security, sustainability, and scalability. By leveraging formal methods and proof-of-stake consensus, it provides a blockchain platform that is highly secure and resistant to attacks. With its focus on democratic governance and layered architecture, Cardano is well-positioned to become a sustainable and scalable blockchain solution for the future.

Stellar: Connecting Financial Institutions for Seamless Payments

Stellar is a blockchain-based platform that aims to connect financial institutions and enable seamless cross-border payments. It was created in 2014 by Jed McCaleb, the co-founder of Ripple, with the goal of making money more fluid and accessible for all.

Unlike traditional banking systems, Stellar uses a decentralized network of servers, known as nodes, to verify and process transactions. This enables fast and low-cost payments, without the need for intermediaries or third-party fees.

The Stellar network has its own cryptocurrency, called Lumens (XLM), which serves as a bridge currency for transferring value between different fiat currencies. Lumens are used to facilitate transactions and prevent spam on the network.

One of Stellar's main features is its ability to facilitate cross-border transactions. Financial institutions can use the Stellar network to issue and transfer digital assets, such as stablecoins or fiat-backed cryptocurrencies, in a fast and secure manner. This reduces the time and cost associated with traditional cross-border transfers, making it an attractive solution for international payments.

Another key aspect of Stellar is its focus on financial inclusion. The platform aims to enable access to financial services for individuals who are unbanked or underbanked. Stellar allows anyone with a smartphone or internet connection to create a digital wallet and access a range of financial services, such as sending and receiving money, saving, and borrowing.

Stellar has received recognition for its partnerships with various financial institutions and organizations. For example, IBM has collaborated with Stellar to develop a cross-border payment solution known as IBM World Wire. Through this partnership, financial institutions can leverage the Stellar network to facilitate fast and secure payments in multiple currencies.

In conclusion, Stellar is a blockchain platform that connects financial institutions and enables seamless cross-border payments. It leverages decentralized servers to process transactions, has its own cryptocurrency (Lumens), and focuses on financial inclusion. With its partnerships and innovative technology, Stellar is positioning itself as a key player in the evolution of the financial industry.

EOS: Scalability and Governance for Decentralized Applications

EOS is a blockchain platform that aims to provide scalability and governance for decentralized applications (DApps). It was designed to address the limitations of other blockchain networks, such as Bitcoin and Ethereum, by offering faster transaction speeds and higher scalability.

One of the key features of EOS is its ability to process thousands of transactions per second, thanks to its delegated proof-of-stake (DPoS) consensus mechanism. This allows for the efficient execution of DApps and the seamless integration of various decentralized services.

EOS also introduces a unique governance model that aims to address the challenges of decentralized decision-making. The platform utilizes a Constitution and a voting system to ensure that all participants have a say in the development and maintenance of the network. This governance structure helps maintain the integrity and security of the platform, while also allowing for flexibility and adaptability.

Furthermore, EOS has gained significant traction within the cryptocurrency industry, positioning itself as one of the top 10 cryptocurrencies in terms of market capitalization. This success can be attributed to its focus on scalability and governance, which are crucial factors for the widespread adoption of blockchain technology.

In conclusion, EOS offers a scalable and efficient solution for decentralized applications with its robust consensus mechanism and unique governance model. Its success in the cryptocurrency market reflects the industry's recognition of the need for scalable blockchain platforms. To experience the benefits of EOS and explore its decentralized applications, users can utilize the Wallet Connect feature to connect their digital wallets to the EOS network.

Tron: Disrupting the Entertainment Industry with Blockchain Technology

Tron is a blockchain-based protocol that aims to revolutionize the entertainment industry. Launched in 2017 by Justin Sun, Tron seeks to create a decentralized platform for content creators and consumers, eliminating the need for intermediaries like streaming services and social media networks.

With the help of smart contracts and blockchain technology, Tron aims to enable direct and transparent transactions between content creators and consumers. This means that artists, musicians, filmmakers, and other creators can distribute their work and receive payments directly from their audience, without the need for traditional distribution channels.

Tron's native cryptocurrency, TRX, plays a central role in the ecosystem. Content creators can tokenize their work using TRX, allowing them to maintain complete ownership and control over their intellectual property. Consumers can then purchase and access the content using TRX, ensuring secure and efficient transactions.

Tron's disruptive potential lies in its ability to decentralize the entertainment industry and empower individual creators. By removing the dependence on centralized platforms, Tron provides a level playing field for creators of all sizes, enabling them to reach a global audience without the need for costly intermediaries.

In addition to its direct impact on the entertainment industry, Tron is also contributing to the overall evolution of the blockchain industry. The platform's popularity and success have led to increased interest in blockchain technology, particularly within the entertainment sector. As more creators and consumers become familiar with Tron's capabilities, they are likely to explore other blockchain-based solutions, further driving the adoption and innovation of the technology.

In conclusion, Tron is disrupting the entertainment industry by leveraging blockchain technology to create a decentralized platform for content creators and consumers. By eliminating intermediaries and enabling direct transactions, Tron empowers individual creators and provides a more efficient and transparent way to distribute and consume content. Furthermore, Tron's success is contributing to the broader evolution of the blockchain industry by increasing awareness and adoption of the technology.

What are the top 10 cryptocurrencies?

The top 10 cryptocurrencies are currently Bitcoin (BTC), Ethereum (ETH), Binance Coin (BNB), Tether (USDT), Cardano (ADA), XRP (XRP), Dogecoin (DOGE), Polkadot (DOT), Litecoin (LTC), and Bitcoin Cash (BCH).

How do the top 10 cryptocurrencies impact the Bitcoin network?

The top 10 cryptocurrencies have a significant impact on the Bitcoin network as they represent a large portion of the overall cryptocurrency market. The trading volume and demand for these cryptocurrencies can affect the price of Bitcoin, as investors often use Bitcoin as a base currency to buy other cryptocurrencies. Additionally, the development and adoption of new technologies by these cryptocurrencies can have an indirect impact on the Bitcoin network.

What is the evolution of the cryptocurrency industry?

The cryptocurrency industry has evolved rapidly since the creation of Bitcoin in 2009. Initially, Bitcoin was the only cryptocurrency, but over time, numerous other cryptocurrencies have been developed. The industry has seen advancements in technology, such as the introduction of smart contracts and decentralized finance (DeFi) applications. It has also witnessed increased regulatory scrutiny and institutional adoption. Overall, the industry has become more mature and diversified.

How does the price of Bitcoin affect the top 10 cryptocurrencies?

The price of Bitcoin often has a significant impact on the prices of other cryptocurrencies in the top 10. When the price of Bitcoin increases, it often leads to a domino effect, causing the prices of other cryptocurrencies to rise as well. Similarly, when the price of Bitcoin decreases, it can result in a decline in the prices of other cryptocurrencies. This correlation is due to the interconnectivity and market sentiment within the cryptocurrency ecosystem.

What are some challenges faced by the cryptocurrency industry?

The cryptocurrency industry faces several challenges, including regulatory uncertainty, security vulnerabilities, scalability issues, and the perception of being associated with illicit activities. Regulatory uncertainty can hinder the adoption and development of cryptocurrencies, as governments and financial institutions struggle to define and implement appropriate regulations. Security vulnerabilities are also a concern, as the industry is prone to hacking and fraud. Additionally, the scalability of blockchain technology is an ongoing challenge, as it needs to support a large number of transactions efficiently. Finally, the association of cryptocurrencies with criminal activities has led to a negative perception, which the industry is actively working to address.

How do the top 10 cryptocurrencies affect the bitcoin network?

The top 10 cryptocurrencies can have an impact on the bitcoin network in several ways. One of the main ways is through competition for miners. As these cryptocurrencies gain popularity, more miners may choose to mine them instead of bitcoin, which can lead to a decrease in the overall hash rate of the bitcoin network. Additionally, the top 10 cryptocurrencies can also influence the price of bitcoin. If there is increased demand for these cryptocurrencies, it could lead to a decrease in demand for bitcoin, affecting its price.

What are the top 10 cryptocurrencies currently?

The top 10 cryptocurrencies currently are bitcoin (BTC), ethereum (ETH), binance coin (BNB), tether (USDT), cardano (ADA), XRP (XRP), dogecoin (DOGE), polkadot (DOT), litecoin (LTC), and bitcoin cash (BCH).

How has the evolution of the cryptocurrency industry affected bitcoin?

The evolution of the cryptocurrency industry has had a significant impact on bitcoin. As more cryptocurrencies have been introduced, it has increased competition for bitcoin. This has led to the development of new technologies and innovations to improve the bitcoin network and make it more efficient. Additionally, the evolution of the cryptocurrency industry has also increased public awareness and adoption of digital currencies, which has positively influenced the overall value and acceptance of bitcoin.

Blur: NFT | Blur: NFT login | Blur: NFT connect | WalletConnect | Traders | What Is Blur Crypto

2022-2024 @ The impact of the top 10 cryptocurrencies on the bitcoin network and the evolution of the industry