Investing in Ethereum NFTs

Blur: NFT | Blur: NFT login | Blur: NFT connect | WalletConnect | Traders | What Is Blur Crypto

Blur: NFT | Blur: NFT login | Blur: NFT connect | WalletConnect | Traders | What Is Blur Crypto

In recent years, the world of collectibles has undergone a dramatic transformation. What was once a niche hobby for enthusiasts has now become a global phenomenon, attracting the attention of investors from all walks of life. And at the forefront of this revolution are Ethereum NFTs.

Ethereum, the second-largest cryptocurrency by market capitalization, has revolutionized the way we think about digital assets. With its blockchain technology, Ethereum has made it possible to create unique, verifiable, and scarce digital tokens called non-fungible tokens (NFTs).

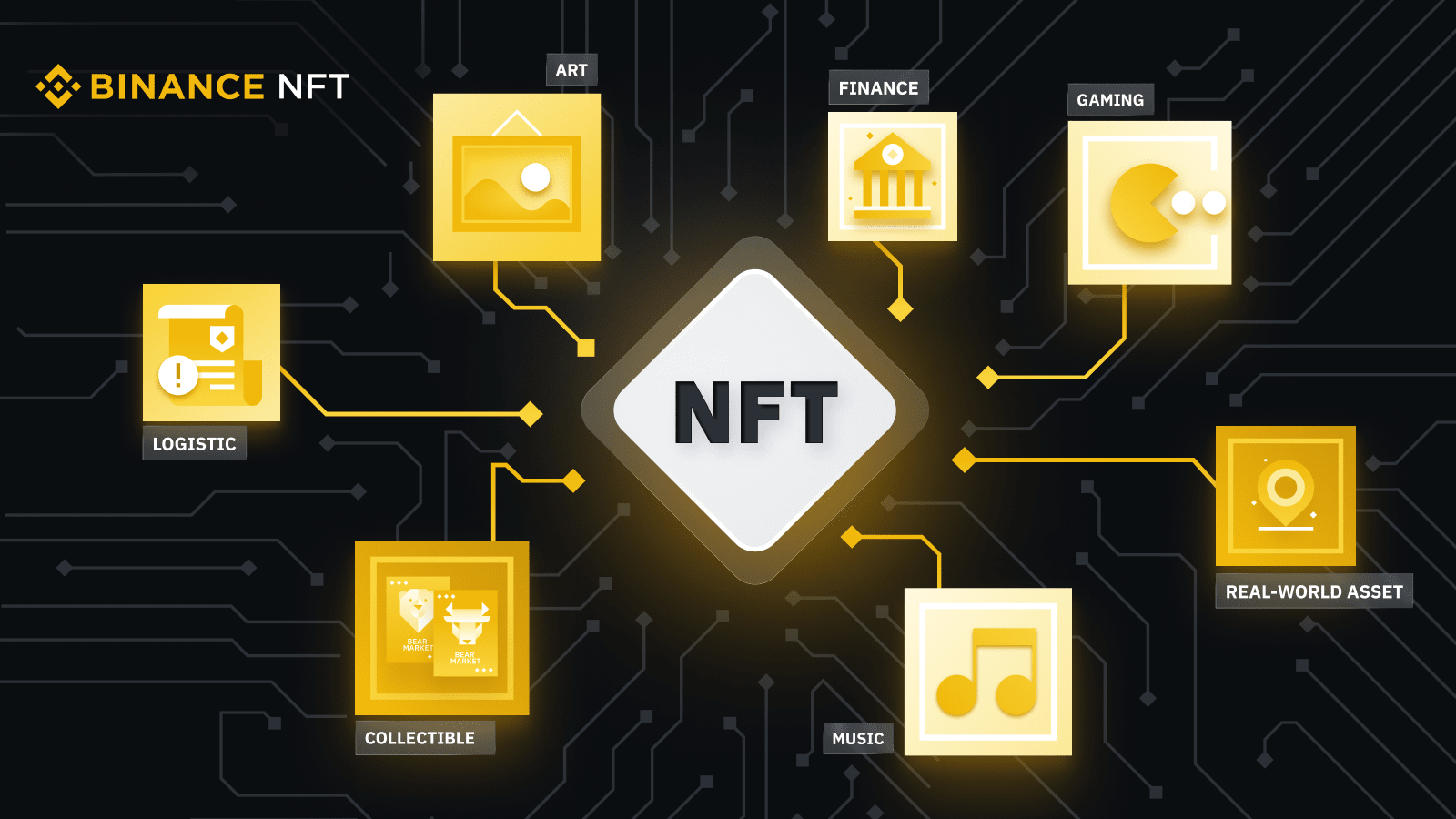

Unlike cryptocurrencies such as Bitcoin, which are fungible and can be exchanged on a one-to-one basis, NFTs represent one-of-a-kind assets that can be bought, sold, and owned by individuals. From digital art and virtual real estate to collectible trading cards and music, NFTs have opened up a whole new world of possibilities for collectors and investors alike.

Investing in Ethereum NFTs offers several advantages over traditional collectibles. First and foremost, NFTs provide provable ownership and provenance, as each token is linked to a unique identifier on the Ethereum blockchain. This means that the authenticity and ownership of an NFT can be easily verified, ensuring that collectors are getting what they pay for.

Furthermore, the open and decentralized nature of the Ethereum blockchain provides transparency and trust, eliminating the need for intermediaries such as auction houses or art dealers. This not only reduces costs but also makes it easier for collectors to discover and acquire rare and valuable assets.

As the world continues to embrace the digital transformation, investing in Ethereum NFTs has become an exciting and lucrative opportunity. Whether you are a seasoned collector or a curious investor, exploring the world of Ethereum NFTs can offer endless possibilities and rewards.

Understanding Ethereum NFTs

Ethereum NFTs, or Non-Fungible Tokens, have emerged as a revolutionary technology in the world of collectibles. Unlike traditional cryptocurrencies like Bitcoin or Litecoin, which are fungible and can be exchanged on a one-to-one basis, NFTs are unique and indivisible digital assets that represent ownership or proof of authenticity for a specific item or piece of content.

One of the key features of Ethereum NFTs is their ability to be securely stored and traded on the Ethereum blockchain. Each NFT has its own distinct digital signature, ensuring that it cannot be replicated or forged. This immutability guarantees that the ownership and provenance of a collectible can be easily verified, increasing its value and potential for investment.

Ethereum NFTs have opened up new opportunities for creators, artists, and collectors alike. Digital artists can use NFTs to mint and sell their unique digital creations, allowing them to retain ownership and receive royalties whenever their work is bought or sold. This has empowered artists to monetize their digital art in a way that was not previously possible.

Collectors can now own and trade NFTs in a decentralized manner, without relying on intermediaries like auction houses or galleries. The transparent nature of the Ethereum blockchain ensures that every transaction and ownership transfer can be tracked and verified, eliminating the risk of counterfeit or stolen collectibles.

The Benefits of Investing in Ethereum NFTs:

Diversification: Investing in Ethereum NFTs provides diversification within the cryptocurrency market. NFTs offer a unique investment opportunity that is independent of traditional stocks, bonds, or commodities. This diversification can help reduce risk and potentially increase overall portfolio returns.

Potential for High Returns: The value of Ethereum NFTs has skyrocketed in recent years, with some rare collectibles selling for millions of dollars. As the market for NFTs continues to grow and mature, there is significant potential for high returns on investment.

Ownership and Control: By investing in Ethereum NFTs, investors gain direct ownership and control over their digital assets. This eliminates the need for intermediaries and allows investors to freely buy, sell, or hold their NFTs as they see fit.

Supporting Artists and Creators: Investing in Ethereum NFTs directly benefits artists and creators, as they receive royalties and recognition for their work. By supporting the NFT ecosystem, investors play a crucial role in promoting and sustaining digital art.

Conclusion

Ethereum NFTs have revolutionized the concept of collectibles by providing a secure and decentralized platform for buying, selling, and owning digital assets. With their unique properties and potential for high returns, investing in Ethereum NFTs offers an exciting opportunity for both collectors and investors.

What are Collectibles?

Collectibles are physical or digital objects that people acquire and cherish due to their uniqueness, rarity, or sentimental value. These items can range from traditional items like stamps, coins, and baseball cards to more modern ones like digital art, virtual items, and non-fungible tokens (NFTs).

NFTs have gained significant attention lately, thanks to the Ethereum blockchain. NFTs can represent ownership of a digital asset, such as artwork, music, videos, or virtual real estate, ensuring its scarcity and authenticity. Owning an NFT is like owning a one-of-a-kind item in the digital world.

The concept of collectibles has evolved over time, influenced by technological advancements and changing consumer preferences. Today, many collectors are shifting their focus to digital collectibles, as they offer unique opportunities and advantages.

Digital collectibles allow for easier storage, display, and transferability. They eliminate the need for physical storage space and offer seamless sharing and trading capabilities via blockchain technology. Additionally, the value of digital collectibles is not limited by geographical boundaries and can be bought and sold globally.

Ethereum, as a blockchain platform, has played a significant role in the evolution of collectibles, particularly with the rise of Ethereum-based NFTs. NFT marketplaces like BLUR.IO provide a platform for artists and collectors to interact, trade, and showcase their digital artworks securely and transparently.

Investing in Ethereum NFTs opens up a whole new world of possibilities for collectors and investors. The market for digital collectibles is booming, attracting attention from both art enthusiasts and tech-savvy investors. With the ability to tokenize and own unique digital assets, the potential for value appreciation and scarcity-driven demand is high.

In conclusion, collectibles have evolved from physical items to include digital assets and NFTs. Ethereum has played a crucial role in this evolution, providing a platform for the creation and trading of NFTs. The digital collectibles market is growing rapidly, offering unique investment opportunities and a new way to appreciate and own one-of-a-kind artworks and assets.

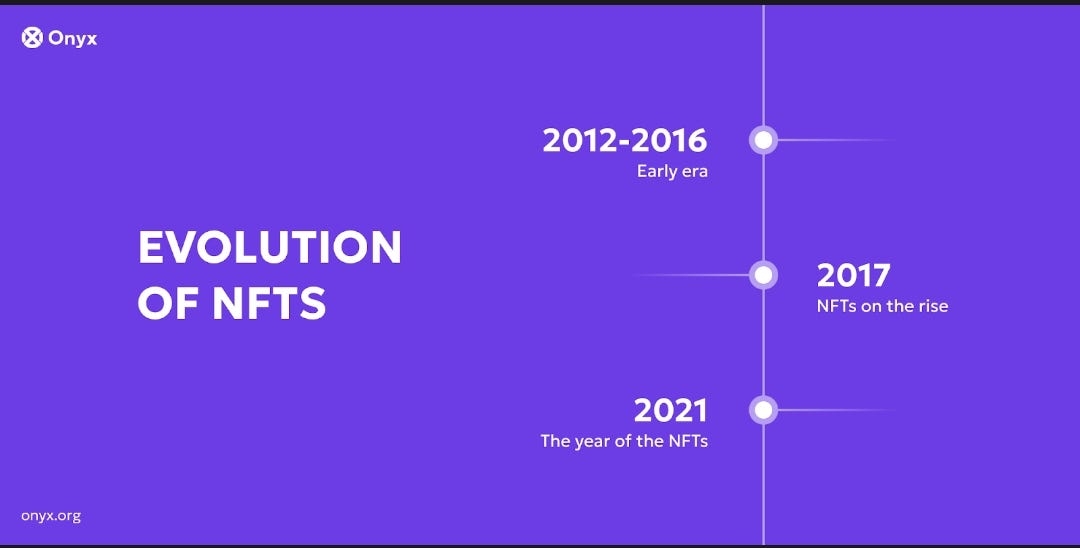

The Rise of NFTs

NFTs, or non-fungible tokens, have experienced a significant rise in popularity in recent years. These digital assets, built on the Ethereum blockchain, have revolutionized the concept of collectibles and ownership in the digital age.

One of the main factors contributing to the rise of NFTs is their unique nature. Unlike cryptocurrencies such as Bitcoin or Ethereum, which are fungible and can be exchanged on a one-to-one basis, NFTs are indivisible and cannot be directly swapped for another token. This indivisibility gives NFTs their value and uniqueness, making them highly sought after by collectors and enthusiasts.

Another significant aspect of NFTs is their ability to represent ownership of digital content. Through smart contracts, creators can tokenize their digital assets, including art, music, videos, and even virtual real estate. This allows artists and content creators to monetize their work in ways previously not possible, providing a new level of financial and creative freedom.

The rise of NFTs has also been fueled by the growing interest and adoption of blockchain technology. As more individuals and institutions recognize the potential of decentralized systems, the demand for NFTs has increased. Additionally, the ease of buying and selling NFTs on various marketplaces has made them more accessible to a wider audience.

One notable platform that has contributed to the rise of NFTs is Blur.io. WIE MAN SICH BEI BLUR.IO ANMELDET on Blur.io allows users to explore a diverse range of NFTs, including artwork, collectibles, and virtual assets. With its user-friendly interface and robust security measures, Blur.io has become a go-to platform for NFT enthusiasts.

In conclusion, the rise of NFTs marks a new era in the world of collectibles and digital ownership. As more individuals recognize the value and potential of NFTs, we can expect to see further innovation and growth in this space.

Exploring the NFT Boom

The world of non-fungible tokens (NFTs) has exploded in recent years, capturing the attention of collectors, investors, and artists alike. NFTs are a type of digital asset that utilize blockchain technology to establish unique ownership and authenticity.

One of the main factors contributing to the NFT boom is the ability to tokenize and trade digital artworks. Artists can now create unique pieces of digital art, secure them with NFTs, and sell them directly to collectors. This has opened up a whole new world of possibilities for artists to monetize their work and reach a global audience.

Collectors are also drawn to NFTs because of the potential for value appreciation. Unlike physical collectibles, such as trading cards or stamps, NFTs can be easily bought, sold, and traded on various online marketplaces. This liquidity and potential for profit have attracted a new wave of investors to the NFT space.

The NFT boom has also led to the creation of virtual worlds and metaverses where users can interact with digital assets. Players can buy virtual land, buildings, and unique items using NFTs, creating a whole new economy within these immersive digital environments. This convergence of gaming and art has further fueled the popularity of NFTs.

However, the NFT boom has also raised concerns about environmental impact and potential scams. The energy consumption required for blockchain transactions and the carbon footprint of NFTs have led to debates about sustainability. Additionally, the market has been plagued by fraudulent activity, with some buyers unknowingly purchasing counterfeit or stolen digital assets.

Despite these challenges, the NFT boom shows no signs of slowing down. The potential for artists to monetize their digital creations, the liquidity and profit potential for collectors and investors, and the exciting possibilities of virtual worlds have all contributed to the rapid growth of the NFT market.

As the technology continues to evolve and more people become aware of NFTs, it will be interesting to see how this digital revolution transforms the art and collectibles industry.

Impact on the Art Market

Investing in Ethereum NFTs has had a significant impact on the art market. Traditionally, art collectors and investors would have to rely on physical artworks and galleries to exhibit and sell their pieces. However, with the emergence of NFTs and blockchain technology, the art market has undergone a transformation.

Firstly, NFTs allow artists to directly showcase and sell their work to a global audience without the need for intermediaries. This has democratized the art market and given artists more control over their creations.

Furthermore, the blockchain technology behind Ethereum NFTs ensures the authenticity and provenance of artworks. Every transaction and ownership change is recorded on the blockchain, making it impossible to counterfeit or alter the artwork. This has increased trust and transparency in the art market, attracting more collectors and investors.

The impact of Ethereum NFTs on the art market can also be seen in terms of valuation. Rarity and uniqueness are key factors in determining the value of physical artworks, and the same applies to NFTs. Collectors are willing to pay hefty sums for rare and valuable NFT art. This has created a new avenue for artists to monetize their work and receive fair compensation for their talent.

Moreover, Ethereum NFTs have opened up possibilities for new art forms and collaborations. Digital artists can create immersive and interactive experiences that go beyond traditional mediums. Additionally, artists can collaborate with musicians, designers, and other creators to produce multi-dimensional artworks.

This shift towards Ethereum NFTs has also attracted traditional art institutions and galleries. They are now exploring ways to incorporate digital art into their collections and exhibitions. This integration of digital and physical art creates new opportunities for both artists and collectors.

In conclusion, investing in Ethereum NFTs has revolutionized the art market. It has empowered artists, increased trust and transparency, created new valuation models, and opened up possibilities for new art forms and collaborations. As the market continues to evolve, it is essential for artists, collectors, and investors to stay informed and adapt to this growing digital landscape.

For more information on investing in Ethereum NFTs and the evolution of collectibles, check out the BLUR.IO website for insights and resources.

The Evolution of Collectibles

Collectibles have come a long way since the days of trading cards and comic books. With the rise of the internet and digital technology, a new form of collectibles has emerged: non-fungible tokens (NFTs).

NFTs are unique digital assets that are stored on a blockchain, making them one-of-a-kind and easily verifiable. They can represent various types of digital content, such as artwork, music, videos, and even virtual real estate.

The Rise of NFTs

The popularity of NFTs exploded in early 2021, with high-profile sales grabbing headlines. Artists and creators have flocked to the NFT market, seeing it as a new way to monetize their work and connect directly with their audience.

One of the key advantages of NFTs is that they come with proof of ownership and provenance, which can be essential for collectibles. Buyers can be confident in the authenticity and rarity of the digital assets they acquire.

Investing in Ethereum NFTs

Ethereum has become the preferred blockchain for NFTs due to its flexibility and robustness. The Ethereum network allows for the creation and trading of NFTs with relative ease.

Investing in Ethereum NFTs can be an exciting and potentially lucrative opportunity. Rare and highly sought-after NFTs can fetch significant sums at auction or on secondary markets. However, it’s important to conduct thorough research and consider factors such as the artist's reputation, the scarcity of the NFT, and its potential for future value appreciation.

As with any investment, there are risks involved, and the value of NFTs can be volatile. It’s crucial to stay informed and diversify your portfolio to mitigate these risks.

Conclusion

The world of collectibles has undergone a radical transformation with the emergence of NFTs. Digital assets can now be owned, traded, and collected in a way that was not possible before, opening up new opportunities for both creators and investors.

However, the NFT market is still relatively new, and its long-term viability is uncertain. As the technology continues to evolve, it will be fascinating to see how NFTs shape the future of collectibles and the broader art market.

Traditional vs. Digital Collectibles

Collectibles have been a popular investment for centuries. Traditional collectibles, such as stamps, coins, and sports memorabilia, have always held value and generated interest among collectors. However, with the advent of blockchain technology, digital collectibles, known as Non-Fungible Tokens (NFTs), have emerged as a new and exciting investment opportunity.

The Appeal of Traditional Collectibles

Traditional collectibles have a long history and are often seen as tangible pieces of history. They can evoke nostalgia and offer a physical connection to the past. Collectors enjoy the thrill of finding rare items, researching their value, and displaying them in their collections. Traditional collectibles also have established marketplaces and auction houses where they can be bought and sold.

However, traditional collectibles also have limitations. They can be expensive to acquire and store, as they often require physical space and specialized storage solutions. Additionally, verifying the authenticity and provenance of traditional collectibles can be challenging, as forgeries exist and documentation can be lost over time.

The Rise of Digital Collectibles

With the rise of blockchain technology, digital collectibles have gained popularity. NFTs are digital assets that represent ownership or proof of authenticity of a particular item, whether it be artwork, music, or virtual real estate. They are stored on decentralized ledgers, such as the Ethereum blockchain, which allows for transparent and verifiable ownership records.

Digital collectibles offer several advantages over their traditional counterparts. They are easily accessible to a global audience, as they can be bought, sold, and traded online. Digital collectibles also do not require physical storage, reducing associated costs. Additionally, the blockchain technology behind NFTs ensures provenance and authenticity, as each transaction is recorded and cannot be altered.

However, digital collectibles also face criticism. Some argue that the digital nature of NFTs diminishes the emotional connection and sense of ownership that traditional collectibles offer. Additionally, concerns about environmental impact and energy consumption associated with blockchain technology have been raised.

Overall, traditional collectibles and digital collectibles offer different experiences and investment opportunities. While traditional collectibles provide a tangible connection to history, digital collectibles offer accessibility, provenance, and potential for growth in a rapidly evolving digital landscape. As technology continues to advance, the world of collectibles is likely to continue evolving, with both traditional and digital collectibles coexisting and appealing to different types of collectors.

Benefits of Investing in Ethereum NFTs

1. Unique Ownership:

One of the primary benefits of investing in Ethereum NFTs is the concept of unique ownership. Unlike traditional collectibles where multiple copies may exist, each Ethereum NFT is one-of-a-kind and cannot be replicated. This uniqueness adds value and rarity to the NFT, making it more appealing to collectors and investors.

2. Digital Verification:

Ethereum NFTs use blockchain technology to verify and record ownership, ensuring the authenticity of the digital asset. This digital verification process eliminates the risk of counterfeit or fake collectibles, providing peace of mind to investors.

3. Global Accessibility:

Investing in Ethereum NFTs allows individuals from around the world to participate in the market. With a decentralized nature, Ethereum NFTs can be bought, sold, and traded by anyone with an internet connection, eliminating geographic barriers and expanding investment opportunities.

4. Potential for High Returns:

As the popularity and adoption of Ethereum NFTs continue to grow, there is a potential for high returns on investment. Some NFTs have sold for millions of dollars, showcasing the earning potential for savvy investors who are able to identify valuable and sought-after collectibles.

5. Diverse Investment Options:

Ethereum NFTs span a wide range of categories, from digital art and music to virtual real estate and virtual goods. This diverse selection allows investors to find their niche and invest in areas that align with their interests and passions, making the investment journey more enjoyable and rewarding.

6. Greater Flexibility:

Investing in Ethereum NFTs offers greater flexibility compared to traditional collectibles. Unlike physical collectibles that require storage and maintenance, Ethereum NFTs can be securely stored in digital wallets, providing easy access and management. Additionally, NFTs can be easily bought or sold on various online marketplaces, providing liquidity and flexibility for investors.

7. Potential for Future Innovation:

With the evolution of technology and the creative possibilities within the Ethereum NFT ecosystem, there is the potential for future innovation and advancement. Investing in Ethereum NFTs allows individuals to be a part of this exciting journey, as new concepts and applications of NFTs continue to emerge.

Conclusion:

Investing in Ethereum NFTs offers unique ownership, digital verification, global accessibility, potential for high returns, diverse investment options, greater flexibility, and the potential for future innovation. As the NFT market continues to evolve, it presents an exciting opportunity for individuals to participate in the evolution of collectibles and potentially reap financial rewards.

Investing in Ethereum NFTs

Ethereum NFTs, or Non-Fungible Tokens, have emerged as a revolutionary way for collectors and investors to buy and sell digital assets. These unique tokens, built on the Ethereum blockchain, allow for the ownership and transfer of digital items such as art, music, and virtual land. This has opened up a whole new world of opportunities for those looking to invest in collectibles.

One of the key advantages of investing in Ethereum NFTs is their authenticity and scarcity. Unlike physical collectibles, NFTs can be directly linked to their creators and verified as one-of-a-kind items. This makes them highly desirable among collectors, and as a result, their value can appreciate significantly over time.

Another benefit of investing in Ethereum NFTs is the liquidity they offer. NFTs can be easily bought and sold on various online platforms, providing investors with a way to quickly realize their gains. Additionally, the Ethereum blockchain ensures that ownership is transparent and verifiable, eliminating the need for intermediaries.

Furthermore, investing in Ethereum NFTs allows for diversification. Collectors can choose from a wide range of digital assets, including artwork, music, virtual real estate, and even virtual goods for video games. This flexibility allows investors to explore different markets and potentially capitalize on emerging trends.

However, it's important to note that investing in Ethereum NFTs also comes with risks. The market for NFTs is still relatively new and volatile, with prices often fluctuating dramatically. Additionally, the value of an NFT is determined by factors such as demand, reputation of the creator, and the overall popularity of the asset. Therefore, thorough research and due diligence are crucial before making any investment.

In conclusion, investing in Ethereum NFTs presents a unique opportunity for collectors and investors to enter the world of digital assets. The authenticity, liquidity, and diversification offered by NFTs make them an appealing choice for those looking to expand their investment portfolio. However, it's important to approach this market with caution and stay informed about the latest trends and developments.

How to Start Investing in Ethereum NFTs

If you're interested in investing in Ethereum NFTs, here are some steps to get you started:

Set up an Ethereum wallet: To begin investing in Ethereum NFTs, you'll need to have an Ethereum wallet. There are different types of wallets available, such as hardware wallets, software wallets, and web wallets. Choose the wallet that suits your needs and set it up.

Fund your wallet: Once you have your Ethereum wallet, you'll need to fund it with some Ether (ETH), which is the native cryptocurrency of the Ethereum blockchain. You can purchase Ether through various cryptocurrency exchanges.

Choose an NFT marketplace: After you have funded your wallet, you'll need to choose an NFT marketplace where you can buy and sell Ethereum NFTs. Some popular NFT marketplaces include OpenSea, Rarible, and SuperRare. Research these marketplaces and decide which one is right for you.

Educate yourself: Before diving into investing in Ethereum NFTs, it's important to educate yourself about the concept of NFTs, how they work, and the potential risks and rewards involved. Read articles, watch videos, and join online communities to gain a deeper understanding of the NFT space.

Start small: As a beginner, it's advisable to start small when investing in Ethereum NFTs. Begin by purchasing lower-priced NFTs and gradually increase your investments as you gain more experience and confidence.

Research and evaluate NFTs: When considering investing in a particular Ethereum NFT, it's essential to research and evaluate the NFT's value, background, rarity, and potential for future growth. Look for NFTs with strong concepts, unique features, and a community of supporters.

Stay updated: The Ethereum NFT space is rapidly evolving, and new projects are constantly being launched. Stay updated with the latest news and developments in the NFT ecosystem to make informed investment decisions.

Manage your investments: Just like any other investment, it's crucial to manage your Ethereum NFT investments carefully. Keep track of your purchases, monitor the market trends, and consider diversifying your portfolio to minimize risk.

Connect with the community: Engaging with the Ethereum NFT community can be a valuable way to learn, share insights, and discover new investment opportunities. Join online forums, social media groups, and attend virtual events to connect with like-minded individuals.

Remember, investing in Ethereum NFTs involves risk, and it's important to do your due diligence and make informed decisions. Take the time to learn, explore, and enjoy the evolving world of Ethereum NFT investing.

Risks and Considerations

Investing in Ethereum NFTs comes with its fair share of risks and considerations that potential investors should be aware of. It is important to thoroughly research and understand the market before diving in.

One key risk is the volatility of the NFT market. Prices for NFTs can be highly volatile, with values fluctuating drastically in a short period of time. This volatility can make it difficult to determine the true value of an NFT and can lead to significant financial losses if prices drop suddenly.

Another consideration is the potential for fraud and scams in the NFT space. Due to the digital nature of NFTs and the lack of regulation, there is a risk of purchasing counterfeit or stolen NFTs. It is important to only purchase NFTs from reputable platforms and to conduct thorough due diligence before making any transactions.

The environmental impact of NFTs is also a concern. The process of minting NFTs on the Ethereum blockchain requires a considerable amount of energy, contributing to carbon emissions. This has led to criticism from environmentalists who argue that the popularity of NFTs is harmful to the environment.

Additionally, the future of the NFT market is uncertain. While NFTs have gained significant attention and popularity in recent years, there is no guarantee that this trend will continue. It is possible that the market could become oversaturated or that interest in NFTs could wane, leading to a decrease in value.

Finally, investors should be cautious of the potential for scams and fraudulent behavior in the Ethereum NFT market. Due to the decentralized nature of blockchain technology, it can be difficult to track down and recover funds lost to scams. It is important to exercise caution and to thoroughly research any platforms or individuals before engaging in transactions.

Overall, investing in Ethereum NFTs can be an exciting and potentially lucrative opportunity, but it is not without its risks. It is important for investors to carefully consider these risks and to make informed decisions before entering the market.

Understanding the Ethereum Network

The Ethereum network is a decentralized platform that enables developers to build and deploy smart contracts. It is powered by its native cryptocurrency called Ether (ETH).

At its core, Ethereum is a blockchain-based platform that aims to provide a secure and trustless environment for executing programmable agreements and applications. It was proposed by Vitalik Buterin in late 2013 and launched in 2015.

One of the distinguishing features of the Ethereum network is its ability to support and execute smart contracts. Smart contracts are self-executing agreements with the terms of the agreement being directly written into code. These contracts run exactly as programmed without any possibility of censorship, downtime, fraud, or third-party interference.

Ethereum’s decentralized architecture is made possible through the use of its global network of computers, known as nodes. These nodes work together to validate and store all transactions and smart contracts on the Ethereum blockchain.

The Ethereum blockchain is a public ledger that stores a record of all transactions, enabling transparent and verifiable transactions. It is secured through a consensus mechanism called Proof of Work (PoW), which requires miners to solve complex mathematical puzzles to validate new blocks and add them to the blockchain.

In addition to its native cryptocurrency Ether (ETH), Ethereum also supports the creation and exchange of non-fungible tokens (NFTs). NFTs are unique digital assets that represent ownership or proof of authenticity of a particular item or piece of content.

With its versatile features and vibrant ecosystem, the Ethereum network has become a popular platform for various decentralized applications (dApps), including decentralized finance (DeFi) protocols, decentralized exchanges (DEXs), and digital collectibles marketplaces.

Smart contracts

Enable self-executing agreements without intermediaries

Decentralized architecture

Provides security, censorship resistance, and transparency

Public blockchain

Enables transparent and verifiable transactions

Support for NFTs

Allows for the creation and exchange of unique digital assets

What is Ethereum?

Ethereum is a decentralized, open-source blockchain platform that enables developers to build and deploy smart contracts and decentralized applications (dApps).

Launched in 2015 by Vitalik Buterin, Ethereum has gained significant traction in the crypto community and is currently the second-largest cryptocurrency by market capitalization after Bitcoin. What sets Ethereum apart from Bitcoin is its ability to support programmable contracts and applications.

At the core of Ethereum is its virtual machine, the Ethereum Virtual Machine (EVM). The EVM is a Turing-complete runtime environment that executes smart contracts and enables developers to create decentralized applications that run on the Ethereum blockchain.

Smart Contracts

Smart contracts are self-executing contracts with the terms of the agreement directly written into code. These contracts automatically execute without the need for intermediaries or third parties, providing transparency, security, and efficiency.

With Ethereum, developers can write and deploy smart contracts on the blockchain. These smart contracts are executed by thousands of nodes on the Ethereum network, ensuring their immutability and security.

Decentralized Applications (dApps)

Ethereum also enables the development and deployment of decentralized applications (dApps). These are applications that run on a peer-to-peer network of computers rather than a centralized server.

dApps leverage the transparency, security, and immutability of the Ethereum blockchain to offer various services, ranging from decentralized finance (DeFi) platforms to non-fungible token (NFT) marketplaces.

Overall, Ethereum has revolutionized the blockchain space by providing a platform for developers to build and deploy decentralized applications and smart contracts. Its programmability and vibrant ecosystem have made it a popular choice for developers, investors, and enthusiasts looking to explore the potential of blockchain technology.

How NFTs Work on the Ethereum Network

NFTs, or non-fungible tokens, are a type of digital asset that represent ownership or proof of authenticity of a unique item or piece of content, such as artwork, music, or virtual real estate, on the Ethereum blockchain. Unlike cryptocurrencies like Bitcoin or Ethereum, which are fungible and can be exchanged on a one-to-one basis, NFTs have unique properties and cannot be exchanged on a like-for-like basis.

At the core of NFT technology is the use of smart contracts on the Ethereum network. Smart contracts are self-executing contracts with the terms of the agreement directly written into lines of code. These contracts contain the rules and logic that govern the behavior of the NFT, including its ownership, transferability, and any royalties or rights associated with it.

When an artist or creator wants to mint an NFT, they typically use an NFT marketplace or platform that is built on top of the Ethereum blockchain. They upload their unique item or content and create a smart contract that represents it as an NFT. This smart contract specifies the properties and characteristics of the NFT, including its name, description, image, and any additional metadata.

To create an NFT, the artist or creator pays a fee in ether (ETH) to cover the transaction fees and processing costs on the Ethereum network. Once the NFT is minted, it is assigned a unique token ID, which is stored on the Ethereum blockchain. This token ID serves as the identifier for the NFT and is used to track its ownership and transferability.

Once minted, the NFT can be bought, sold, or traded on various NFT marketplaces or platforms. These marketplaces connect buyers and sellers, facilitating the exchange of NFTs for ether or other cryptocurrencies. Each transaction is recorded on the Ethereum blockchain, providing a transparent and immutable record of ownership.

One of the key benefits of NFTs on the Ethereum network is the ability to verify the authenticity and provenance of a digital asset. The blockchain acts as a public ledger, allowing anyone to view the transaction history and ownership records of an NFT. This provides a level of trust and transparency that is not available in traditional collectibles.

As the popularity of NFTs continues to grow, developers are exploring new use cases and applications for this technology. From virtual worlds and gaming to digital identity and decentralized finance, NFTs are revolutionizing the concept of ownership and unlocking new opportunities for creators, collectors, and investors.

What are NFTs?

NFTs, or non-fungible tokens, are unique digital assets that can represent ownership of a specific item or piece of content. Unlike cryptocurrencies like Bitcoin, which are interchangeable and have equal value, NFTs have distinct characteristics and cannot be exchanged on a one-to-one basis.

How can I invest in Ethereum NFTs?

To invest in Ethereum NFTs, you will need to have an Ethereum wallet and some ETH (Ether) to purchase the NFTs. You can then browse NFT marketplaces, such as OpenSea or Rarible, and find NFTs that catch your interest. Once you find an NFT you want to invest in, you can place a bid or buy it outright using your Ethereum wallet.

What makes Ethereum NFTs valuable?

Ethereum NFTs derive their value from scarcity, desirability, and the community surrounding them. Some NFTs represent unique digital artwork, collectibles, or virtual properties, which can have a high demand among collectors and enthusiasts. The limited supply and the uniqueness of these assets can drive up their value in the market.

Are Ethereum NFTs a good investment?

Whether Ethereum NFTs are a good investment depends on various factors, including the specific NFTs you choose to invest in and the overall market trends. While some NFTs have sold for millions of dollars, there is also a risk of investing in overhyped or low-quality NFTs. It's important to do your research, understand the market, and assess the potential risks and rewards before investing in Ethereum NFTs.

What is the future of Ethereum NFTs?

The future of Ethereum NFTs is still uncertain, but there is a growing interest and adoption of NFTs in various industries. These digital assets are being utilized in art, gaming, music, virtual real estate, and more. As blockchain technology advances and more people become familiar with NFTs, it's possible that their use cases and value will continue to evolve, making them an integral part of the digital economy.

What are NFTs?

NFTs, or non-fungible tokens, are unique digital assets that are stored on the blockchain. Unlike cryptocurrencies such as Bitcoin or Ethereum, which are interchangeable and can be exchanged for one another, NFTs represent something unique and cannot be replaced by something else.

How does investing in Ethereum NFTs work?

Investing in Ethereum NFTs involves purchasing unique digital assets that are stored on the Ethereum blockchain. These assets can range from digital collectibles, artwork, virtual real estate, and more. Investors can buy and sell these NFTs on various marketplaces, with the potential for their value to increase over time. However, it's important to do thorough research and understand the risks associated with investing in NFTs before getting started.

Blur: NFT | Blur: NFT login | Blur: NFT connect | WalletConnect | Traders | What Is Blur Crypto

2022-2024 @ Investing in ethereum nfts the evolution of collectibles