A comprehensive review of past trends and fluctuations

Blur: NFT | Blur: NFT login | Blur: NFT connect | WalletConnect | Traders | What Is Blur Crypto

Blur: NFT | Blur: NFT login | Blur: NFT connect | WalletConnect | Traders | What Is Blur Crypto

The BLUR token has been making waves in the cryptocurrency market, attracting both seasoned investors and newcomers alike. As the popularity of this digital asset continues to soar, it becomes essential to understand its past patterns and fluctuations in price.

In this article, we will delve into a comprehensive historical analysis of the BLUR token's price, tracing its journey from its inception to the present day. By examining the past patterns, we aim to uncover valuable insights that can aid investors in making informed decisions and predicting future market trends.

We will explore significant milestones, major fluctuations, and influential factors that have shaped the BLUR token's price over time. Through this analysis, we hope to shed light on the underlying dynamics and factors that make the BLUR token a unique and potentially lucrative investment opportunity.

Whether you are a seasoned cryptocurrency investor or someone looking to dip their toes into the world of digital assets, understanding the historical patterns of the BLUR token's price fluctuations is an invaluable exercise. Join us on this journey as we unravel the mysteries of the BLUR token's past and gain insights into its future prospects.

Examining the Past Patterns

Understanding the past patterns of blur token price fluctuations can provide valuable insights for investors and traders. By analyzing historical data, we can identify recurring trends and patterns that may influence future price movements. This analysis can assist in making informed decisions and developing effective trading strategies.

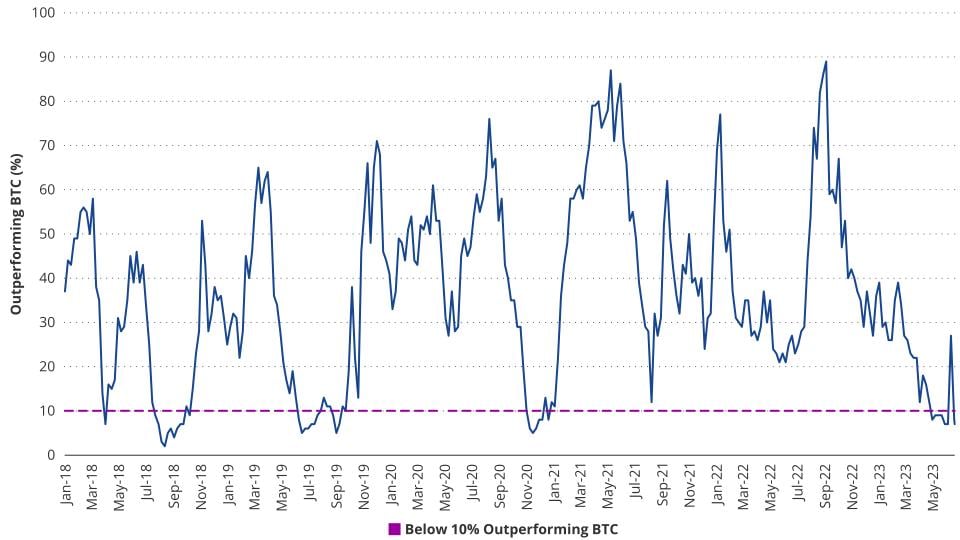

One way to examine the past patterns is through a quantitative analysis using statistical tools. By plotting the historical price data on a chart, we can visually observe patterns such as uptrends, downtrends, or periods of sideways movement. Additionally, various technical indicators such as moving averages, oscillators, and trend lines can be applied to identify specific patterns or signals.

Another approach is a qualitative analysis, which involves studying the fundamental factors that may have contributed to the past price fluctuations. This includes analyzing market trends, news events, regulatory changes, and developments within the blur token ecosystem. By understanding these underlying factors, we can gain insights into the potential drivers of future price movements.

Furthermore, conducting a comparative analysis can be beneficial in examining past patterns. This involves comparing the price fluctuations of blur token with other cryptocurrencies or traditional assets. By identifying correlations or divergences, we can determine whether blur token price movements are influenced by broader market trends or specific factors unique to the token.

1. Historical data provides a valuable reference point for analyzing current and future price movements.

1. Past patterns may not accurately predict future price movements as market conditions and variables change.

2. Identifying recurring patterns can help in developing trading strategies based on historical performance.

2. Overreliance on past patterns can lead to biased decision-making and missed opportunities.

3. By understanding the factors behind past price fluctuations, investors can make more informed decisions.

3. Historical analysis may not account for unexpected events or black swan events that can significantly impact price movements.

In conclusion, examining past patterns of blur token price fluctuations can be a valuable tool for investors and traders. Both quantitative and qualitative analyses, as well as comparative analysis, can provide insights into potential future price movements. However, it is important to exercise caution and consider other factors such as current market conditions and unexpected events when making investment decisions.

Blurr Token Price Fluctuations

The price of Blurr Token, the native cryptocurrency of the Blur.io platform, has experienced significant fluctuations over time. Understanding and analyzing these price movements can provide valuable insights for investors and traders alike.

Blurr Token's price is influenced by various factors, including market demand, trading volume, and overall market sentiment. By examining historical data, we can observe recurring patterns and trends that indicate potential buying or selling opportunities.

Historical Analysis

Conducting a historical analysis of Blurr Token's price can help identify patterns and trends that may repeat in the future, offering valuable insights for traders and investors. By studying the price movements over different time periods, we can analyze the price volatility and make informed decisions.

It is essential to consider various factors that may impact Blurr Token's price, such as market news, partnership announcements, platform developments, and overall market conditions. By staying updated with the latest information, traders and investors can make more accurate predictions regarding future price movements.

To gain a comprehensive understanding of Blurr Token's price fluctuations and the potential impact on the Blur.io platform, it is crucial to connect with the official Blur.io website, available at Connect to Blur.io: Exploring the Features and Advantages of Blur.io. This platform provides detailed information about the cryptocurrency, including its utility, tokenomics, and recent updates.

By utilizing the historical analysis and staying informed through official channels, investors can make better-informed decisions regarding the Blurr Token price fluctuations, potentially maximizing their investment returns while minimizing risks.

A Historical Analysis

When examining the past patterns of Blur Token price fluctuations, a historical analysis provides valuable insights into the token's performance over time. By studying the trends and cycles of Blur Token's price movements, investors and traders can make informed decisions about their investments.

One key aspect of a historical analysis is identifying significant events or milestones that have influenced Blur Token's price in the past. These events can range from the launch of new features or partnerships to major market developments or regulatory changes. Understanding how Blur Token responded to these events can help predict its future behavior in similar situations.

Furthermore, analyzing historical price data can reveal patterns, such as seasonal variations or recurring trends. By identifying these patterns, investors can potentially take advantage of predictable price movements to optimize their trading strategies.

Another crucial aspect of a historical analysis is examining the correlation between Blur Token's price and external factors, such as overall market sentiment, economic indicators, or technological advancements. Understanding these correlations can help investors gauge the broader market conditions and make more accurate predictions about the token's future performance.

In addition to quantitative data, a historical analysis also includes qualitative information about Blur Token's development and community. This includes assessing the progress of the project, evaluating the team's achievements, and analyzing the level of community engagement and adoption. These factors can greatly influence the token's price and should be considered during a comprehensive analysis.

In conclusion, conducting a historical analysis of Blur Token's price fluctuations provides valuable insights for investors and traders. By studying the token's past performance, analyzing significant events, identifying patterns, and considering qualitative factors, individuals can make informed decisions about their investments. For more information on Blur.io and its features and advantages, connect to Blur.io: Exploring the features and benefits of Blur.io.

Understanding Token Price Movements

Examining the past patterns of Blur token price fluctuations can provide valuable insights into understanding and predicting future price movements. By analyzing historical data, investors can identify potential trends and patterns that can help make informed investment decisions.

Factors Influencing Token Price

Several factors can impact the price of Blur tokens. Understanding these factors is crucial in comprehending token price movements:

Market Demand: The demand for Blur tokens can significantly impact their price. If there is high demand and limited supply, the price is likely to increase. Conversely, if the demand diminishes or the supply increases, the price may decline.

Token Utility: The utility and functionality of Blur tokens within the Blur ecosystem can also influence their price. If Blur tokens have a clear use case and provide specific benefits, their value is likely to rise.

Regulatory Environment: The regulatory environment surrounding cryptocurrencies and tokens, in general, can impact the price of Blur tokens. Changes in regulations or legal restrictions can lead to price volatility.

Market News: News and events related to Blur, such as partnerships, technological advancements, or market integration, can sway investor sentiment and affect token price.

Trends and Patterns

By examining historical price data, investors can identify trends and patterns that can assist in predicting future price movements. Some common patterns observed include:

Upward Trends: These occur when the token price consistently rises over a defined period. Upward trends can indicate positive market sentiment and increasing demand.

Downward Trends: These occur when the token price consistently declines over a defined period. Downward trends can indicate negative market sentiment or a decrease in demand.

Consolidation: This occurs when the token price moves within a relatively narrow range, showing a period of stability. Consolidation patterns suggest indecisiveness among investors or a balanced market.

Volatility: Fluctuations in token price that occur rapidly and unpredictably can indicate market volatility. High volatility can offer opportunities for quick gains but also increases the risk.

It is important to note that past price performance does not guarantee future results. Token price movements can be influenced by various factors and are subject to market dynamics. A comprehensive understanding of these factors and the ability to analyze trends can enhance decision-making and optimize investment strategies in the cryptocurrency market.

Analyzing Historical Data

The analysis of historical data is a key component in understanding the past patterns of Blur Token price fluctuations. By examining the data from previous time periods, we can gain insights into the factors that influenced the price movement and identify potential trends or patterns.

One important aspect of analyzing historical data is determining the timeframe to study. Different timeframes may reveal different patterns or trends, so it is essential to choose a timeframe that is relevant to the research question. For example, a short-term analysis may focus on daily or weekly price movements, while a long-term analysis may consider monthly or yearly data.

Once the timeframe is established, various statistical techniques can be employed to analyze the data. These techniques may include calculating the mean, median, or mode of the price data to determine the central tendency. Additionally, measures of dispersion such as standard deviation or variance can provide insights into the volatility of the price fluctuations.

To further understand the relationship between variables, correlation analysis can be conducted. This analysis examines the degree to which two variables are related to each other. For example, we may analyze the correlation between the Blur Token price and external factors such as market conditions or news events.

In addition to statistical analysis, visual representations of the historical data can be beneficial. Charts and graphs can help identify patterns, trends, or anomalies in the price fluctuations. Common types of charts include line charts, candlestick charts, or moving average charts.

Overall, analyzing historical data plays a vital role in understanding the past patterns of Blur Token price fluctuations. By examining the data using statistical techniques and visual representations, researchers can gain insights into the factors that influenced the price movement and potentially predict future trends.

Identifying Trends and Patterns

Examining the past patterns of blur token price fluctuations allows us to identify several trends and patterns that can provide valuable insights into the future performance of the token. By analyzing historical data, we can make informed predictions and make better decisions when it comes to trading and investing in blur tokens.

One of the key trends that we can observe is the cyclical nature of blur token prices. They tend to go through periods of significant growth followed by periods of consolidation or even decline. These cycles can be attributed to various factors such as market sentiment, demand and supply dynamics, and external events impacting the crypto market.

Another pattern that we can identify is the correlation between blur token prices and other cryptocurrencies. In many cases, blur tokens tend to follow the overall trends of the crypto market. If the market is experiencing a bull run, blur token prices are likely to increase as well. On the other hand, during bearish market conditions, blur token prices may decline.

Furthermore, we can observe patterns in the price movements of blur tokens based on specific events or announcements. For example, the launch of a new feature or partnership can often lead to a surge in price as it increases investor confidence and attracts new buyers. Similarly, negative news or regulatory actions can have a detrimental effect on blur token prices.

It is also important to note that blur token prices can be influenced by market manipulation and speculative behavior. Recognizing these patterns can help us distinguish between genuine market trends and artificial price manipulations, allowing us to make more accurate predictions and informed trading decisions.

By identifying these trends and patterns, we can gain a better understanding of how blur token prices are likely to behave in the future. This knowledge can be used to develop effective trading strategies, manage risks, and maximize returns in the highly volatile crypto market.

Factors Influencing Price Fluctuations

Examining the past patterns of Blur Token price fluctuations, several factors have been identified that can influence the price of the cryptocurrency. These factors include:

Market Demand

The level of demand for Blur Tokens in the market can significantly impact their price. If there is high demand and limited supply, the price is likely to increase. Conversely, if demand decreases or supply increases, the price may decrease.

Regulatory Changes

Government regulations and policies regarding cryptocurrencies can have a substantial impact on their price. Any positive regulatory changes that support the use of cryptocurrencies can lead to a price increase, while negative changes can result in a decrease.

Market Sentiment

The general sentiment and perception of Blur Tokens and the overall cryptocurrency market can influence their price. Positive news and favorable market sentiment can drive up the price, while negative news and bearish sentiment can cause a decline.

Market Manipulation

Market manipulations, such as pump-and-dump schemes or whale activities, can artificially inflate or deflate the price of Blur Tokens. These manipulative actions can misrepresent the true value of the cryptocurrency, leading to price fluctuations.

Technological Advances

Advances in technology, particularly developments related to the Blur Token's underlying blockchain network, can impact its price. Improvements in scalability, security, and functionality can increase investor confidence and drive up the price.

These are just a few of the many factors that can influence the price of Blur Tokens. It is important for investors and traders to carefully analyze and consider these factors when making decisions related to their investments.

Market Volatility and its Effects

Market volatility refers to the rapid and significant changes in the price of a financial asset or security. It is often characterized by large price swings, increased trading volume, and heightened market uncertainty. In the context of blur token price fluctuations, understanding market volatility is crucial for investors and traders as it can have various effects on the market.

Causes of Market Volatility

Market volatility can be influenced by a range of factors, such as economic indicators, geopolitical events, market sentiment, and investor behavior. Economic indicators like GDP growth, inflation rates, and interest rates can impact market volatility as they reflect the overall health and stability of an economy. Geopolitical events, such as political instability or trade tensions between countries, can also trigger market volatility by creating uncertainty and affecting investor confidence.

Market sentiment plays a crucial role in market volatility, as it is driven by the collective feelings and perceptions of market participants. Positive sentiment can lead to bullish market conditions, characterized by rising prices and low volatility. On the other hand, negative sentiment can contribute to bearish market conditions, marked by falling prices and high volatility.

Effects of Market Volatility

The effects of market volatility can be both positive and negative, depending on the perspective of market participants.

For traders, market volatility can present lucrative opportunities for making profits. Higher volatility often leads to wider price spreads, providing traders with more potential for earning substantial returns. Volatile markets also tend to have increased trading volume, which can result in better liquidity and improved trading opportunities.

However, increased market volatility also poses greater risks for traders. The rapid and unpredictable price movements can result in significant losses if trades are not properly managed. Volatile markets can trigger sharp reversals, causing traders to suffer from sudden, unfavorable price changes.

For long-term investors, market volatility can create challenges and opportunities. Volatile markets may lead to short-term decreases in portfolio values, causing temporary losses. However, they can also provide opportunities for long-term investors to enter or exit positions at more favorable prices.

Nevertheless, market volatility can test the patience and emotional resilience of long-term investors. The uncertainty and frequent price fluctuations may tempt them to make impulsive decisions driven by fear or greed, potentially leading to suboptimal investment outcomes.

In summary, market volatility is a natural and inherent characteristic of financial markets. It is influenced by a variety of factors and can have both positive and negative effects on market participants. Understanding market volatility and its effects is crucial for investors and traders to make informed decisions and navigate the complex dynamics of the financial markets.

Examining Past Performance

When examining the past performance of Blur Token price fluctuations, it is important to analyze historical data to gain insights into patterns and trends. By looking at how the price has changed over time, we can better understand the potential factors and drivers for these fluctuations.

Price Fluctuations

Blur Token has experienced various price fluctuations throughout its history. These fluctuations can be influenced by a range of factors, including market demand, investor sentiment, and external events.

Examining the past performance of Blur Token reveals that it has had periods of both growth and decline. There have been times when the price has experienced significant increases, followed by abrupt drops. Similarly, there have been periods of stability, where the price has remained relatively constant.

Trends and Patterns

By analyzing the historical price data, certain trends and patterns can be observed. For example, there may be seasonal or cyclical patterns that influence the price fluctuations. Additionally, certain events or announcements may have a significant impact on the price.

It is also important to consider the overall market trends and the performance of other cryptocurrencies when examining the past performance of Blur Token. Cryptocurrency markets are highly interconnected, and the performance of one token can be influenced by broader market dynamics.

Furthermore, it is essential to differentiate between short-term fluctuations and long-term trends. Short-term fluctuations may be driven by day-to-day market sentiment, while long-term trends may be indicative of broader market shifts.

Conclusion

Examining the past performance of Blur Token price fluctuations provides valuable insights into the factors and trends that have influenced its price over time. By understanding these patterns, investors and traders can make more informed decisions about their investments and develop strategies to navigate the volatile cryptocurrency market.

Comparing Short-term and Long-term Fluctuations

When examining the price fluctuations of Blur Token, it is essential to analyze both short-term and long-term trends to gain a comprehensive understanding of its performance in the market.

Short-term Fluctuations

Short-term fluctuations refer to the price changes that occur within a relatively brief period, typically days or weeks. These fluctuations are influenced by various factors, including market demand, investor sentiment, and news events.

By studying short-term price patterns, traders can identify potential opportunities for quick gains or minimize losses by taking advantage of market volatility. Technical analysis tools such as moving averages, relative strength index, and Bollinger Bands can be used to help predict short-term price movements.

However, it is important to note that short-term price fluctuations can be highly unpredictable and subject to sudden changes. Therefore, it is crucial to exercise caution and conduct thorough research before making any trading decisions based on short-term trends.

Long-term Fluctuations

On the other hand, long-term fluctuations in the price of Blur Token refer to price changes that occur over an extended period, usually months or years. These fluctuations are influenced by fundamental factors such as market adoption, technological developments, regulatory changes, and macroeconomic conditions.

Long-term investors often focus on analyzing the underlying fundamentals of a cryptocurrency like Blur Token to assess its long-term growth potential. Factors such as the project's team, technology, partnerships, and market demand play a crucial role in determining the long-term price trend.

While long-term fluctuations may not provide immediate gains, they offer the opportunity to invest in a project with a strong foundation and the potential for sustainable growth. Understanding long-term trends can help investors make informed decisions and develop a long-term investment strategy.

In conclusion, comparing short-term and long-term fluctuations of Blur Token's price is essential for gaining a comprehensive perspective on its market performance. Short-term fluctuations offer opportunities for quick gains but come with high volatility, while long-term fluctuations provide insights into a project's fundamental strengths and growth potential.

Insights from the Historical Data

Examining the historical data of blur token price fluctuations can provide valuable insights into past patterns and trends. By analyzing the price movements over a certain period of time, we can identify potential factors that have influenced the price of the blur token.

One interesting observation from the historical data is the presence of price volatility. The blur token price has shown significant fluctuations, with periods of rapid increase or decline. These fluctuations may be attributed to various factors such as market demand, investor sentiment, or external events.

Another insight from the historical data is the presence of price cycles. The blur token price has exhibited cyclical patterns, with periods of growth followed by periods of consolidation or correction. These cycles may be influenced by market trends, supply and demand dynamics, or regulatory changes.

Furthermore, the historical data can shed light on the correlation between the blur token price and other cryptocurrencies or asset classes. By studying the price movements of different cryptocurrencies or comparing them to traditional assets, we can gain insights into market dynamics and potential interdependencies.

Additionally, analyzing the historical data can help identify key support and resistance levels for the blur token price. These levels, based on historical price levels where buying or selling pressure has been significant, can serve as important indicators for future price movements.

In conclusion, examining the historical data of blur token price fluctuations provides valuable insights into past patterns and trends. These insights can be used to better understand the factors influencing the price, identify cycles and trends, analyze correlations with other assets, and identify key support and resistance levels. Such analysis can inform investment decisions and aid in predicting future price movements.

Lessons Learned from Previous Fluctuations

Examining the past patterns of blur token price fluctuations can provide valuable insights for investors and traders. Here are some key lessons we can learn:

1. Market Volatility is Inevitable

One of the main lessons learned from previous fluctuations is that market volatility is inevitable. The price of blur token, like any other cryptocurrency, is influenced by multiple factors such as market sentiment, investor speculation, and external events. Understanding and accepting the inherent volatility in the market can help investors make more informed decisions and manage their risk effectively.

2. Past Performance is Not Indicative of Future Results

Another important lesson is that past performance is not indicative of future results. Just because the blur token price behaved in a certain way in the past does not mean it will continue to do so in the future. Market dynamics can change quickly, and new factors can come into play that can impact the price. Therefore, it is important to continually analyze and adapt to new information rather than relying solely on past patterns.

3. Diversification is Key

Diversification is a fundamental lesson that applies to any investment strategy. Spreading out investments across different assets can help mitigate the impact of price fluctuations in a single asset. By diversifying their portfolio, investors can reduce the overall volatility and potential risk they face. Therefore, it is advisable to consider investing in a range of cryptocurrencies and other assets alongside blur token to build a well-rounded portfolio.

4. Monitoring Market Trends is Crucial

Keeping a close eye on market trends and developments is crucial for success in cryptocurrency investing. By monitoring factors such as news, regulatory changes, and overall market sentiment, investors can gain valuable insights that can help them make better decisions. Staying informed and adapting to new market conditions can assist investors in taking advantage of potential opportunities or minimizing potential risks.

5. Emotional Discipline is Essential

6. Use of Stop-Loss Orders

7. Long-Term Perspective is Key

In conclusion, examining the past patterns of blur token price fluctuations provides important lessons for investors and traders. By understanding the inevitability of market volatility, the limitations of relying solely on past performance, the importance of diversification, the need for monitoring market trends, and the value of emotional discipline and a long-term perspective, investors can enhance their decision-making process and increase their chances of success.

Applying Knowledge to Future Investment Decisions

Based on the historical analysis of blur token price fluctuations, we can derive valuable insights to make informed investment decisions in the future. By examining the patterns and trends of past blur token prices, investors can gain a better understanding of the market dynamics and make more informed investment choices.

1. Identifying Seasonal Patterns

One important aspect of analyzing historical blur token price is identifying any seasonal patterns that may exist. By examining historical data, we can identify if there are specific time periods during which the blur token price typically experiences a significant increase or decrease. This knowledge can be valuable in planning investment strategies, such as buying or selling blur tokens at specific times of the year to maximize returns.

2. Analyzing Price Correlations

Another key element of historical analysis is studying the price correlations between blur token and other relevant assets or market indices. By analyzing the relationship between blur token prices and other variables, investors can gain insights into potential investment opportunities or risks. For example, if there is a strong positive correlation between blur token price and a specific stock or commodity, it may indicate a potential investment opportunity in that asset.

Identifying seasonal patterns in blur token price fluctuations

Timing investments to take advantage of seasonal trends

Analyzing price correlations with other assets

Finding investment opportunities based on price relationships

Examining historical volatility levels

Adjusting risk management strategies accordingly

3. Examining Historical Volatility Levels

Examining the historical volatility levels of blur token prices can provide crucial information for developing effective risk management strategies. By understanding how volatile the blur token market has been in the past, investors can adjust their risk tolerance and position sizing accordingly. Additionally, analyzing historical volatility levels can help investors identify periods of high uncertainty and adjust their investment strategies accordingly.

In conclusion, applying knowledge derived from the historical analysis of blur token price fluctuations is essential for making well-informed future investment decisions. By identifying seasonal patterns, analyzing price correlations, and examining historical volatility levels, investors can gain valuable insights and adjust their investment strategies accordingly to maximize returns and manage risks effectively.

Strategies to Navigate Price Volatility

Price volatility is a common phenomenon in the world of cryptocurrencies, and the Blur token is no exception. Fluctuations in the token's price can be caused by a variety of factors, including market demand, investor sentiment, and changes in regulatory or technological landscape.

Holding Long-Term

One strategy to navigate price volatility is to hold onto your Blur tokens for the long-term. By taking a long-term approach, you are less affected by short-term price fluctuations and more focused on the potential growth of the token over time. This strategy requires patience and a belief in the long-term success of the project.

Dollar-Cost Averaging

Dollar-cost averaging is another strategy that can help navigate price volatility. This approach involves investing a fixed amount of money into Blur tokens at regular intervals, regardless of the token's price. By consistently buying tokens over a period of time, you can reduce the impact of short-term price fluctuations and potentially benefit from lower average prices.

Disclaimer: Dollar-cost averaging does not guarantee profits and should not be considered as financial advice. Cryptocurrency investments carry risks, and it is essential to conduct thorough research and seek professional guidance before making any investment decisions.

Furthermore, it is crucial to keep up with the latest news and developments in the Blur token ecosystem. Changes in technology, partnerships, or regulatory landscape can have a significant impact on the token's price. Staying informed can help you make more informed investment decisions and react to price volatility more effectively.

In conclusion, price volatility is a normal part of the cryptocurrency market, and there are strategies that investors can employ to navigate these fluctuations. Holding long-term, practicing dollar-cost averaging, and staying informed about the token's ecosystem are some of the ways to manage price volatility effectively.

The Role of Fundamental Analysis

Fundamental analysis plays a crucial role in understanding the past patterns and future fluctuations in the price of blur tokens. By examining the underlying factors that drive the value of blur tokens, investors can make informed decisions based on the intrinsic value of the asset.

One key aspect of fundamental analysis is evaluating the project's roadmap and development team. Blur.io, the platform behind blur tokens, has a dedicated team of developers and advisors who are committed to building a robust and innovative NFT ecosystem. This commitment to the project's development and growth can be a strong indicator of a token's long-term potential.

Another important factor to consider is the adoption and demand for blur tokens. As the platform gains more users and generates a larger user base, the demand for blur tokens can increase. This can be influenced by factors such as the platform's reputation, usability, and utility. Investors should assess the current adoption trends and partnerships to gauge the potential for future growth.

Furthermore, keeping an eye on the market trends and competitor analysis can provide valuable insights. By comparing blur tokens with other similar projects and analyzing their performance, it is possible to identify strengths and weaknesses. This analysis can help investors understand the relative position of blur tokens and make better-informed decisions.

Lastly, it is crucial for investors to pay attention to regulatory developments and legal compliance. Any regulatory actions or legal uncertainties can significantly impact the price and viability of blur tokens. Staying informed about the latest regulations and ensuring adequate compliance measures are in place is essential for minimizing risks and maximizing returns.

In conclusion, fundamental analysis is a key component in assessing the price fluctuations of blur tokens. By evaluating factors such as the project's development, adoption trends, market analysis, and regulatory compliance, investors can make informed decisions. Utilizing fundamental analysis, investors can gain a better understanding of the intrinsic value of blur tokens and make more accurate predictions about their future performance. For more information about blur tokens and how to register on the blur.io platform, visit WIE MAN SICH BEI BLUR.IO ANMELDET.

What is the blur token price?

The blur token price is the current value of a blur token in relation to a specific currency, such as USD or BTC.

How has the blur token price fluctuated over time?

The blur token price has experienced various fluctuations over time. It has seen periods of both growth and decline, with some significant spikes and drops.

What factors have influenced the price fluctuations of blur tokens?

Several factors can influence the price fluctuations of blur tokens, including market demand, investor sentiment, regulatory developments, technological advancements, and overall market conditions.

Has there been any correlation between the blur token price and other cryptocurrencies?

Yes, there has been some correlation between the blur token price and other cryptocurrencies. During certain periods, when the overall cryptocurrency market experienced significant fluctuations, the blur token price showed similar trends.

Can historical data on blur token price fluctuations be used to predict future trends?

While historical data can provide insights into past patterns, it is not a definitive indicator of future trends. The cryptocurrency market is highly volatile and subject to various external factors, making it difficult to predict future price movements solely based on historical data.

What is the historical analysis of blur token price fluctuations?

The historical analysis of blur token price fluctuations examines the past patterns of price changes for blur tokens. It looks at how the price has moved over time, identifying trends and patterns that may help predict future movements.

Can the historical analysis of blur token price fluctuations predict future price movements?

While historical analysis can provide insights into past price movements, it cannot accurately predict future price movements. The cryptocurrency market is highly volatile and influenced by numerous factors, making it difficult to make accurate predictions based solely on historical data.

Blur: NFT | Blur: NFT login | Blur: NFT connect | WalletConnect | Traders | What Is Blur Crypto

2022-2024 @ Examining the past patterns of blur token price fluctuations a historical analysis