Debunking Myths and Revealing the Truth

Blur: NFT | Blur: NFT login | Blur: NFT connect | WalletConnect | Traders | What Is Blur Crypto

Blur: NFT | Blur: NFT login | Blur: NFT connect | WalletConnect | Traders | What Is Blur Crypto

In the fast-paced world of cryptocurrencies, media coverage plays a pivotal role in shaping market sentiments and influencing prices. From sensational headlines to expert analysis, the media has the power to create trends, spread fear, or drive investor excitement. However, amidst the noise and hype, it is essential to separate reality from myth when it comes to the impact of media on cryptocurrency prices.

Media frenzy or market mover?

One common belief is that media coverage alone can cause significant price fluctuations in the volatile cryptocurrency market. While it is true that news stories can trigger short-term price movements, the overall impact is often exaggerated. Cryptocurrency prices are influenced by a wide range of factors, including market demand, technological advancements, government regulations, and overall market sentiment. Therefore, it is crucial to critically analyze media reports and consider multiple factors before attributing price changes solely to media coverage.

Unmasking the myths surrounding media and cryptocurrency prices

Another prevalent myth is that media takes a giant step in intentionally manipulating cryptocurrency prices for their gains. While it is undeniable that media outlets have their biases and interests, the idea that they systematically manipulate prices is largely unfounded. Cryptocurrency markets are highly decentralized and driven by a diverse group of participants, including retail traders, institutional investors, and market makers. Their collective actions, rather than media coverage alone, ultimately determine price movements.

Separating reality from myth: Analyzing the impact of media on cryptocurrency prices

The cryptocurrency market is known for its volatility, with prices often experiencing drastic fluctuations. One factor that has been widely discussed as a potential influence on cryptocurrency prices is the media. In this article, we will delve into the impact of media coverage on cryptocurrency prices, separating reality from myth.

The power of media in shaping perception

Media coverage plays a significant role in shaping public perception of cryptocurrency. Positive news and articles about cryptocurrency can generate enthusiasm and attract new investors, resulting in an increase in demand and potentially driving up prices. Conversely, negative media coverage can create fear and uncertainty, leading to a decrease in demand and possibly causing prices to drop. It is essential to acknowledge the power of the media in shaping perception and understand its potential impact on cryptocurrency prices.

The fine line between information and speculation

When analyzing media impact on cryptocurrency prices, it is crucial to differentiate between reliable information and speculative content. Reliable and well-researched news articles, expert opinions, and market analysis can provide valuable insights into the cryptocurrency market and influence investor decisions. However, speculation and rumors circulated in the media can create a frenzy and result in irrational market behavior. Investors must be cautious and verify information from credible sources before making any investment decisions.

To illustrate the influence of media, let's look at a recent example. When a renowned financial news outlet reported that a major online retailer was considering accepting a popular cryptocurrency as a form of payment, the news had an immediate positive effect on the cryptocurrency's price. Investors and traders saw this as a sign of increased adoption and demand, driving up prices within minutes.

The importance of critical thinking

In the world of cryptocurrency, it is crucial to separate reality from myth and exercise critical thinking when interpreting media coverage. Not all news and articles are created equal, and it is essential to evaluate their credibility and consider multiple perspectives. Checking the credibility of the source, cross-referencing information, and conducting independent research are key to making informed decisions and avoiding falling victim to misinformation.

In conclusion, media coverage can have a significant impact on cryptocurrency prices. Positive or negative news can influence market sentiment, driving demand and affecting prices. However, it is essential to approach media coverage with caution and exercise critical thinking to separate reality from myth. By staying informed and relying on reliable sources of information, investors can navigate the cryptocurrency market with greater confidence.

For more information about cryptocurrency and NFTs, you can visit Blur: NFT login and explore the diverse world of digital assets.

The relationship between media and cryptocurrency prices

The role of media in influencing cryptocurrency prices cannot be underestimated. With the advent of social media and instant news dissemination, information about cryptocurrencies spreads far and wide, shaping public perception and consequently impacting their prices.

The media plays a crucial role in shaping the narrative surrounding cryptocurrencies. Positive news articles, interviews with industry influencers, or endorsements from high-profile figures can significantly boost investor confidence and drive up prices. Conversely, negative media coverage, such as reports of hacking incidents or regulatory crackdowns, can cause panic selling and lead to price drops.

It is important to note that media coverage can often be driven by hype and speculation, rather than factual analysis. News outlets often compete to be the first to release breaking news, which can lead to inaccurate or incomplete information being circulated. This can create a sense of frenzy in the market, with investors making rash decisions based on incomplete information.

Furthermore, the rise of social media platforms has given rise to a new phenomenon known as "pump and dump" schemes. In these scenarios, individuals or groups manipulate cryptocurrency prices through coordinated efforts on social media, artificially inflating prices before selling off their holdings and causing prices to plummet. These schemes rely on the influence of media platforms to disseminate information and manipulate market sentiment.

In conclusion, the relationship between media and cryptocurrency prices is complex and multifaceted. While media coverage can provide valuable insights and analysis, it can also be misleading and driven by speculative hype. As investors, it is crucial to conduct thorough research and critically evaluate media sources before making investment decisions. For a reliable and secure NFT marketplace, you can visit Blur: NFT login.

Understanding the media hype surrounding cryptocurrency

In recent years, the world of cryptocurrency has garnered significant media attention. From headlines about skyrocketing Bitcoin prices to stories of overnight millionaires, the media has played a vital role in shaping the public's perception of cryptocurrency. However, it is crucial to separate reality from myth when analyzing the impact of media on cryptocurrency prices.

One of the key factors contributing to the media hype surrounding cryptocurrency is the emergence of blockchain technology. This revolutionary technology forms the backbone of cryptocurrencies and has the potential to disrupt various industries. As a result, media outlets and journalists have been keen to cover the developments in this field, often highlighting the potential benefits and risks associated with cryptocurrencies.

Another significant driver of media hype is the speculative nature of cryptocurrency markets. The extreme volatility and unpredictable price movements have made cryptocurrencies a hot topic for journalists and investors alike. When the price of Bitcoin or any other major cryptocurrency experiences a significant surge or plummet, it invariably attracts media attention and fuels the frenzy around digital currencies.

Furthermore, the rise of social media platforms has amplified the media hype surrounding cryptocurrency. Twitter, Reddit, and other online communities have become hubs for discussion, speculation, and meme culture related to cryptocurrencies. Influencers and celebrities often take to these platforms to share their thoughts and opinions on digital currencies, further fueling the media hype.

It is important, however, to approach the media hype surrounding cryptocurrency with caution. While media coverage can undoubtedly impact cryptocurrency prices in the short term, it is essential to consider other fundamental factors that drive market movements. Factors such as regulatory decisions, technological advancements, and adoption rates also play significant roles in shaping the value of cryptocurrencies.

Therefore, when analyzing the impact of media on cryptocurrency prices, it is crucial to separate the noise from the real signals. As an investor or enthusiast, it is important to conduct thorough research, evaluate reliable sources, and stay informed about the latest developments in the cryptocurrency space. By doing so, one can navigate through the media hype and make well-informed decisions.

The role of social media in shaping cryptocurrency prices

Social media plays a significant role in shaping cryptocurrency prices. With the rise of platforms like Twitter, Facebook, Reddit, and Telegram, investors and traders are now turning to these platforms to gather information, discuss market trends, and make decisions.

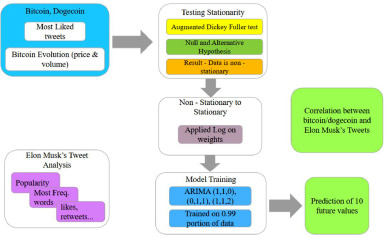

One of the ways social media impacts cryptocurrency prices is through the spread of news and information. Viral news and announcements can quickly spread across social media platforms, leading to a surge in cryptocurrency prices. For example, when a prominent figure like Elon Musk tweets about a specific cryptocurrency, it can cause a significant spike in its value.

Social media also amplifies the impact of market sentiments and investor emotions. Positive or negative sentiments expressed by influential figures or a large number of users can sway the market and influence cryptocurrency prices. A positive sentiment can lead to a buying frenzy, while a negative sentiment can result in a sell-off, causing prices to plummet.

Furthermore, social media platforms have become a breeding ground for rumors, speculation, and misinformation. False or exaggerated claims can quickly go viral, causing panic or excitement among investors and leading to volatile price movements. It is crucial for traders and investors to critically analyze the information they come across on social media and separate reality from myth.

The real-time nature of social media also gives investors a platform for discussing and sharing insights with fellow traders. Cryptocurrency communities on platforms like Reddit and Telegram create a sense of community and foster a collective intelligence that can impact market sentiments and, consequently, cryptocurrency prices.

Overall, it is undeniable that social media has a substantial influence on cryptocurrency prices. Investors and traders should be cautious, verify information, and analyze market trends and sentiments before making any investment decisions based on social media activity.

How media narratives influence investor sentiment in the cryptocurrency market

In the fast-paced world of cryptocurrency, media narratives play a crucial role in shaping investor sentiment. The decentralized nature of cryptocurrencies often makes it difficult for investors to assess their true value, leading them to rely heavily on information and narratives provided by the media.

Media narratives can significantly impact investor sentiment, leading to sharp price movements in the cryptocurrency market. Positive narratives, such as reports of increasing adoption or endorsements by influential figures, can drive up investor confidence and result in a surge in cryptocurrency prices. On the other hand, negative narratives, such as reports of regulatory crackdowns or security breaches, can create fear and uncertainty, causing investors to sell off their holdings and leading to price declines.

The power of media influence

With the advent of social media platforms and online news outlets, information spreads rapidly and reaches a wide range of investors. This accessibility to information has made media narratives even more influential in shaping investor sentiment. Individuals who are not well-versed in the intricacies of cryptocurrency technology often rely on media reports to make investment decisions.

Media narratives can also create a herd mentality in the cryptocurrency market. When a particular narrative gains traction, it can lead to a wave of investors following suit and reacting in a similar manner. This collective behavior can cause prices to move rapidly, creating a cycle of positive or negative sentiment that is largely driven by media narratives.

The need for critical analysis

Given the significant impact of media narratives on investor sentiment, it is important for investors to critically analyze the information they receive. Relying solely on media reports can lead to biased decision-making and irrational exuberance or fear in the cryptocurrency market.

Investors should consider multiple sources of information and cross-validate facts before making investment decisions. They should also be aware of the potential biases and agendas of media outlets, as narratives can be influenced by various factors such as advertising revenue or personal interests.

By conducting thorough research and staying informed about the underlying fundamentals of cryptocurrencies, investors can separate reality from myth and make more informed investment decisions. Understanding the influence of media narratives on investor sentiment is crucial in navigating the volatile cryptocurrency market.

Examining the correlation between media coverage and cryptocurrency market volatility

The rise of cryptocurrencies has been accompanied by a growing interest from the media. News outlets, social media platforms, and online forums actively discuss and report on the latest developments in the crypto world. As a result, it is essential to examine the correlation between media coverage and cryptocurrency market volatility.

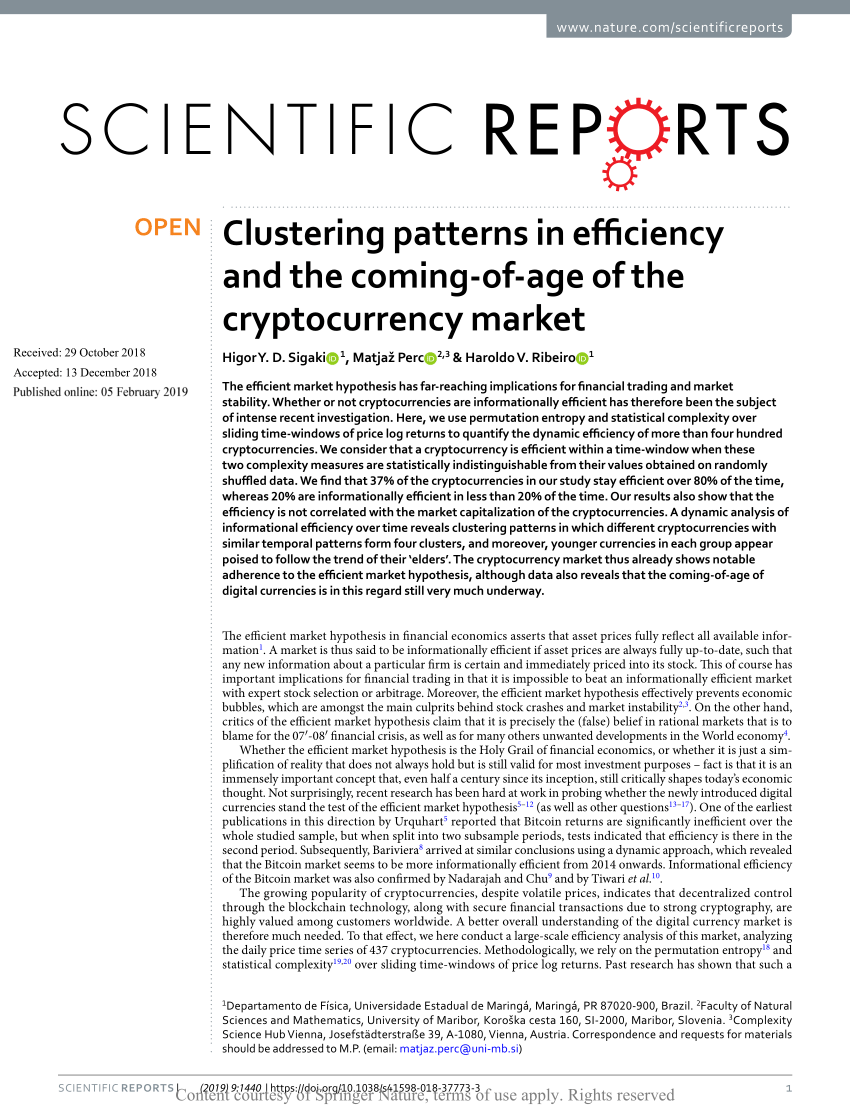

Numerous studies have shown a strong link between media sentiment and cryptocurrency price movements. Positive news coverage often leads to increased demand and, subsequently, a rise in prices. On the other hand, negative news can trigger panic selling, causing a market downturn. This implies that the media has the power to influence investor sentiment and, consequently, cryptocurrency market volatility.

One key aspect to consider is the role of influential figures and media outlets in shaping public opinion about cryptocurrencies. High-profile individuals, such as Elon Musk, have the ability to sway market sentiment with a single tweet. Similarly, major news organizations can impact the market through the reach and credibility of their reporting.

Furthermore, the speed and accessibility of online media have intensified the impact of news on cryptocurrency prices. With information readily available at the click of a button, investors can quickly react to news, amplifying market movements. This rapid response can create an environment of increased volatility as market participants seek to capitalize on the latest updates.

However, it is vital to approach the relationship between media coverage and cryptocurrency market volatility with caution. While the media can undoubtedly influence short-term price movements, the long-term value of cryptocurrencies is determined by various factors, including technological advancements, regulatory developments, and market demand.

To fully understand the correlation between media coverage and the cryptocurrency market, comprehensive data analysis is crucial. By examining news articles, social media sentiment, and market data, researchers can gain insights into how media coverage affects market volatility. This analysis can help investors make better-informed decisions and separate reality from myth surrounding cryptocurrencies.

Media-driven FUD (Fear, Uncertainty, and Doubt) in the cryptocurrency space

Media-driven FUD, or Fear, Uncertainty, and Doubt, is a phenomenon that has a significant impact on cryptocurrency prices. FUD refers to the spreading of negative or misleading information about cryptocurrencies or the blockchain technology in order to create doubt and fear among investors and market participants.

The media plays a crucial role in shaping public opinion and influencing investor sentiment. In the cryptocurrency space, media outlets have the power to sway market prices through the dissemination of news, articles, and opinions. This influence can result in extreme volatility and irrational behavior in the market.

One common form of media-driven FUD is the spread of false information related to regulatory crackdowns or bans on cryptocurrencies by governments. Such news can create panic among investors, leading to a sell-off and a subsequent price drop. However, in many cases, these reports turn out to be exaggerated or simply untrue, causing unnecessary market turbulence.

Another way media-driven FUD affects cryptocurrency prices is through the promotion of hacking or security breaches. News reports highlighting the vulnerability of cryptocurrency exchanges or wallets can instill fear in investors, causing them to withdraw their funds from the market. This can lead to a sharp decline in prices and a loss of confidence in the overall industry.

It is important for investors and market participants to be aware of the impact of media-driven FUD and to separate reality from myth. By researching and verifying information from multiple sources, individuals can make more informed decisions and avoid being swayed by false narratives.

In conclusion, media-driven FUD plays a significant role in the cryptocurrency space, often leading to volatility and irrational behavior in the market. Investors should be cautious of the information they consume and should rely on multiple sources to make informed decisions. By separating reality from myth, investors can better navigate the cryptocurrency market and mitigate the impact of media-driven FUD.

The influence of mainstream media on cryptocurrency adoption

The rise of cryptocurrencies has been closely tied to the influence of mainstream media. The media plays a significant role in shaping public perception and understanding of cryptocurrencies, which in turn affects their adoption.

Mainstream media outlets, such as newspapers, television, and online news platforms, have the power to reach a wide audience and shape their opinions. When reputable media sources cover cryptocurrencies, it provides legitimacy and credibility to the concept.

Positive coverage can generate interest and curiosity among individuals who may have previously been skeptical or unaware of cryptocurrencies. It can also attract traditional investors who are looking for alternative investment opportunities.

On the other hand, negative or sensationalized media coverage can have a detrimental impact on cryptocurrency adoption. Media reports highlighting scams, hacks, or government regulations can create fear and uncertainty among potential users and investors.

Furthermore, the media has the ability to influence the public's perception of the risks associated with cryptocurrencies. Misleading or superficial coverage can lead to misconceptions and misunderstandings, deterring individuals from exploring or adopting cryptocurrencies.

It is important for individuals to critically evaluate media coverage and seek additional information from reliable sources. By doing so, they can separate reality from myth and make informed decisions regarding cryptocurrency adoption.

In summary, mainstream media plays a crucial role in shaping public perception and understanding of cryptocurrencies. Positive coverage can drive adoption by increasing interest and attracting traditional investors, while negative or misleading coverage can create barriers to adoption. It is essential for individuals to be critical consumers of media content to ensure they have a clear and accurate understanding of cryptocurrencies.

Debunking popular misconceptions about cryptocurrency perpetuated by the media

Cryptocurrency has become a widely discussed topic in the media, often leading to the perpetuation of various misconceptions. These misconceptions can mislead the general public and hinder their understanding of the true nature and potential of cryptocurrencies. In this section, we will debunk some of the most common misconceptions about cryptocurrency that are perpetuated by the media:

Cryptocurrency is only used for illegal activities:

One of the most prevalent misconceptions is that cryptocurrency is primarily used for illegal activities, such as money laundering and buying illicit goods. While it is true that cryptocurrencies have been used in some illegal transactions in the past, the majority of cryptocurrency transactions are legitimate and used for legal purposes. Cryptocurrencies offer a secure and efficient method of making transactions, and they are increasingly being adopted by various industries.

Cryptocurrency is just a speculative bubble:

Another misconception perpetuated by the media is that cryptocurrency is just a speculative bubble waiting to burst. While the cryptocurrency market is known for its volatility, it is incorrect to label the entire industry as a bubble. Cryptocurrencies, like any other asset class, experience price fluctuations based on various factors, such as market demand, regulatory developments, and investor sentiment. However, cryptocurrency technology has the potential to revolutionize several industries, and there is genuine value underlying many cryptocurrencies.

Cryptocurrency is not regulated:

Many believe that cryptocurrencies operate in an unregulated environment, making them a breeding ground for scams and illegal activities. However, this is a misconception. While the regulatory landscape for cryptocurrencies is still evolving, many countries have introduced regulations to govern cryptocurrency exchanges, initial coin offerings (ICOs), and other crypto-related activities. Additionally, reputable cryptocurrency projects adhere to know-your-customer (KYC) and anti-money laundering (AML) regulations to ensure regulatory compliance.

Cryptocurrency is only used by tech-savvy individuals:

It is often believed that cryptocurrency is only used by tech-savvy individuals with a deep understanding of blockchain technology. While it is true that some technical knowledge may be required to fully utilize cryptocurrencies, there are user-friendly cryptocurrency wallets and platforms that make it accessible to a wider audience. Moreover, as the technology matures and becomes more user-friendly, the barriers to entry for the general public are gradually decreasing.

Cryptocurrency is a tool for tax evasion:

The media sometimes portrays cryptocurrency as a tool for tax evasion due to its perceived anonymity. While certain privacy-focused cryptocurrencies provide a level of anonymity, most mainstream cryptocurrencies allow transactions to be traced on the blockchain. Additionally, tax authorities are becoming more knowledgeable about cryptocurrencies and are implementing measures to track and tax cryptocurrency transactions appropriately.

By debunking these popular misconceptions, we can paint a more accurate picture of the cryptocurrency industry and help individuals make informed decisions about their involvement in this rapidly evolving space.

The impact of media speculation on cryptocurrency investment decisions

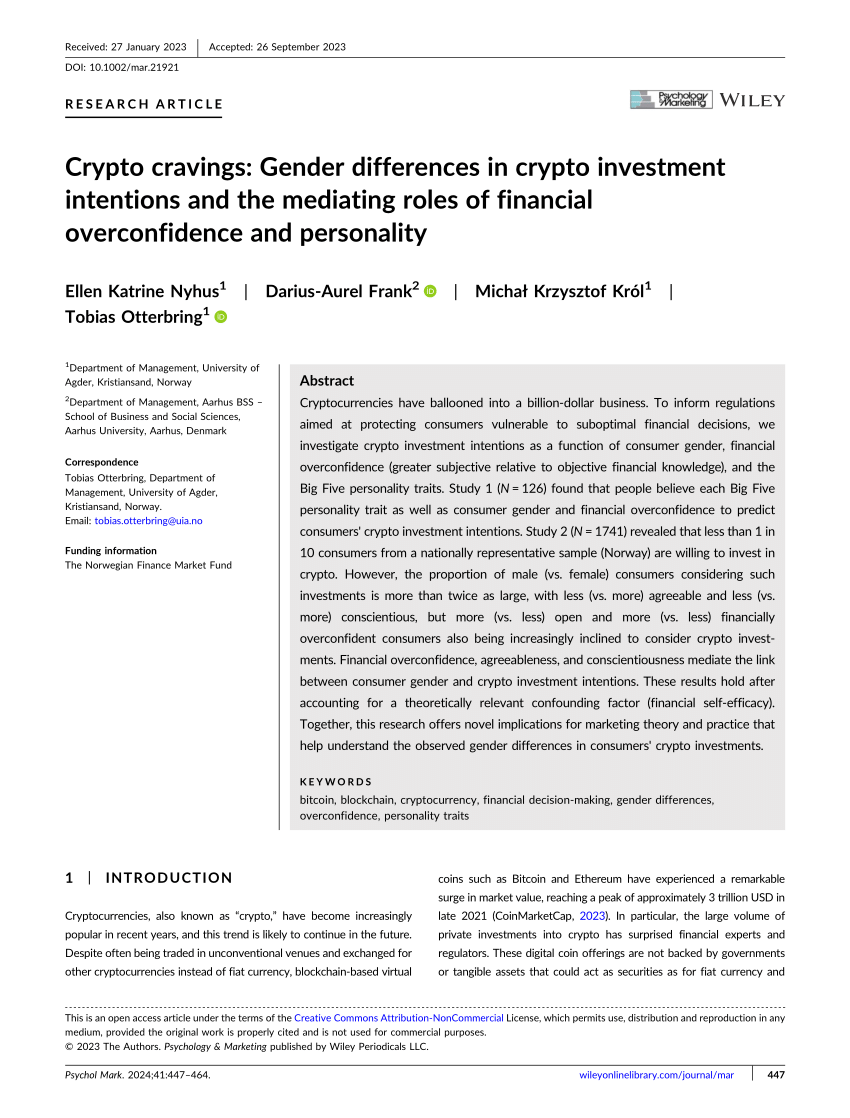

The rise of cryptocurrencies has brought both excitement and skepticism among investors. One of the key factors influencing cryptocurrency prices and investment decisions is the media speculation surrounding them.

The power of media speculation

Media speculation plays a crucial role in shaping the perception of cryptocurrencies and influencing investment decisions. News outlets, social media platforms, and online forums heavily contribute to the dissemination of information and opinions about cryptocurrencies.

One of the key ways media speculation impacts cryptocurrency investment decisions is through the creation of hype or fear. Positive news or speculation can create a sense of FOMO (fear of missing out) among investors, leading to increased demand and subsequently higher prices. Conversely, negative news or speculation can trigger panic selling and drive prices down.

The dangers of media speculation

While media speculation can have a significant impact on cryptocurrency prices, it is important for investors to approach the information with caution. The cryptocurrency market is highly volatile, and reacting solely based on media speculation can be risky.

Media outlets often have their biases, and the information they provide may not always be accurate or objective. Additionally, the speed at which news spreads through social media can lead to a herd mentality among investors, causing prices to spiral out of control.

Strategies for navigating media speculation

When making cryptocurrency investment decisions, it is essential to consider multiple sources of information and conduct thorough research. Relying on reputable and trustworthy news outlets, as well as seeking insights from experts in the field, can help mitigate the impact of media speculation.

Furthermore, investors should focus on the underlying fundamentals and long-term viability of cryptocurrencies rather than getting swayed by short-term media hype. Developing a strategy based on thorough analysis and risk assessment can help navigate the volatile nature of the market.

Verify the credibility of sources

Stay updated with reliable news outlets

Consult with experts and experienced investors

Consider the long-term potential of cryptocurrencies

Diversify investment portfolio to spread risk

Keep emotions in check and avoid impulsive decisions

By being aware of the impact of media speculation and adopting a rational approach, investors can make more informed decisions and separate reality from myth in the cryptocurrency market.

Exploring the role of fake news in shaping cryptocurrency market trends

The cryptocurrency market is highly susceptible to the influence of news and media, and this includes the impact of fake news. Fake news refers to false or misleading information presented as factual, which can easily go viral and spread quickly through social media platforms and online news sources.

The speed and reach of fake news

Fake news has the potential to affect cryptocurrency prices due to its ability to manipulate market sentiment, create artificial demand or supply, and influence investor behavior. This is especially true in an industry like cryptocurrency, where information spreads rapidly and traders often make quick decisions based on news and social media trends.

One of the main reasons why fake news can have such a significant impact on cryptocurrency markets is the speed at which it can spread. With the advent of social media platforms like Twitter and Reddit, news can go viral within minutes, potentially causing a sudden surge or drop in cryptocurrency prices.

Market manipulation through fake news

Fake news can be used as a tool for market manipulation, allowing individuals or groups to create false narratives that can influence trading decisions and manipulate prices for their own benefit. By spreading false information about a particular cryptocurrency, traders can create FOMO (fear of missing out) or FUD (fear, uncertainty, and doubt) among investors, leading to increased buying or selling activity.

Additionally, fake news can be used to spread rumors or create hype around certain projects or partnerships, artificially inflating the value of a cryptocurrency. This can attract new investors who believe they are getting involved in a promising venture, only to realize later that the news was false or exaggerated.

The importance of fact-checking

To mitigate the impact of fake news on cryptocurrency market trends, it is crucial for investors and traders to engage in thorough fact-checking before making any significant trading decisions. This can involve verifying the credibility of news sources, cross-referencing information, and staying updated on official announcements from reputable cryptocurrency projects.

Furthermore, regulatory bodies and industry organizations have started taking steps to combat fake news in the cryptocurrency market. Initiatives such as transparency standards, independent audits, and stricter regulations aim to promote accurate information dissemination and protect investors from fraudulent practices.

Keep an eye on reliable news sources and publications.

Always cross-reference information before making trading decisions.

Stay updated on official announcements and project updates from reputable sources.

Be skeptical of sensational headlines and unsubstantiated claims.

Participate in community discussions and forums to get a broader perspective on news events.

By being vigilant and critical of news sources and information, investors can separate reality from myth and make informed decisions that are less influenced by fake news in the cryptocurrency market.

The future of media influence on cryptocurrency prices

As the cryptocurrency market continues to grow and evolve, the role of media in determining price trends has become increasingly significant. In the past, media coverage has had a profound impact on the volatility of cryptocurrency prices, with sensational headlines and speculative reporting causing wild fluctuations. However, the future of media influence on cryptocurrency prices is likely to undergo significant changes.

Real-time data and social media

With the advent of social media platforms and real-time data sources, investors now have access to a wealth of information that can shape their decisions. Social media platforms, such as Twitter and Reddit, can quickly spread news and opinions about cryptocurrencies, influencing sentiment and ultimately affecting prices. The speed at which information travels on these platforms means that investors must be vigilant and discerning in their analysis, as misinformation can spread just as quickly as accurate news.

Furthermore, real-time data platforms provide investors with up-to-date information on market trends and sentiment. Analyzing this data can help investors separate reality from myth and make informed decisions based on accurate information rather than relying solely on media-driven narratives.

The rise of decentralized media

Another aspect of the future of media influence on cryptocurrency prices is the rise of decentralized media. Traditional media outlets have historically dominated the narrative surrounding cryptocurrencies, with their biases and agendas shaping public perception. However, decentralized media platforms, such as blockchain-based news aggregators, are emerging as alternative sources of information.

Decentralized media platforms have the potential to provide unbiased and transparent reporting, free from the influences of centralized authorities. This can help foster a more informed and educated investor community, where decisions are based on facts rather than sensationalism. As these platforms gain popularity and trust within the cryptocurrency community, their influence on prices may increase, as investors turn to them for accurate and reliable information.

However, it is important to note that the future of media influence on cryptocurrency prices is not solely determined by the media itself. Investors also play a critical role in shaping market trends and price movements. It is ultimately the investors' reactions to media coverage that drive price fluctuations, highlighting the importance of critical thinking and a thorough understanding of the underlying fundamentals of cryptocurrencies.

In summary, the future of media influence on cryptocurrency prices lies in the emergence of real-time data and social media platforms, as well as the rise of decentralized media. While media coverage will continue to shape market sentiment, investors have more tools at their disposal to separate reality from myth. As the cryptocurrency market matures, it is crucial for investors to stay informed, critically analyze information, and make decisions based on accurate and reliable sources.

How does media impact cryptocurrency prices?

Media plays a significant role in influencing cryptocurrency prices. Positive or negative news can create a ripple effect in the market, affecting the demand and supply dynamics of cryptocurrencies. For example, when news outlets report about a particular cryptocurrency being adopted by big companies or governments, it can lead to a surge in its price. Similarly, negative news like regulatory crackdowns or security breaches can cause a drop in cryptocurrency prices.

Can media hype artificially inflate cryptocurrency prices?

Yes, media hype can artificially inflate cryptocurrency prices. Positive news coverage, excessive speculation, and influencers promoting certain cryptocurrencies can create a buying frenzy, leading to an increase in prices that may not be sustainable in the long run. This is known as a "pump-and-dump" scheme, where the price is artificially increased, and once enough people have bought the cryptocurrency, the price crashes.

Is it possible for the media to create a negative perception of cryptocurrencies?

Yes, the media can create a negative perception of cryptocurrencies. Sensationalized stories about scams, hacks, or illegal activities involving cryptocurrencies can lead to fear and skepticism among potential investors. Additionally, negative comments or warnings from influential figures or regulatory bodies can further contribute to a negative perception and impact cryptocurrency prices.

Are there any instances where the media misrepresented the impact of cryptocurrencies?

Yes, there have been instances where the media misrepresented the impact of cryptocurrencies. Due to the complex nature of the subject, media outlets may oversimplify or misinterpret information, leading to inaccurate or exaggerated reports. This can create confusion among investors and distort the actual impact of cryptocurrencies on the economy or financial markets.

How can investors separate myth from reality when it comes to cryptocurrency information reported in the media?

Investors can separate myth from reality by conducting thorough research and analysis. It is important to cross-reference information from multiple reliable sources and verify the credibility of the information before making any investment decisions. Additionally, investors should be cautious of overly positive or negative news and consider the long-term fundamentals of cryptocurrencies rather than short-term media hype.

Blur: NFT | Blur: NFT login | Blur: NFT connect | WalletConnect | Traders | What Is Blur Crypto

2022-2024 @ Separating reality from myth analyzing the impact of media on cryptocurrency prices