Analysing the potential obstacles and advantages in the forthcoming era of blur tokenomics

Blur: NFT | Blur: NFT login | Blur: NFT connect | WalletConnect | Traders | What Is Blur Crypto

Blur: NFT | Blur: NFT login | Blur: NFT connect | WalletConnect | Traders | What Is Blur Crypto

The world of cryptocurrency has seen significant developments over the years, but the future holds even more potential for growth and innovation. One area that is gaining increasing attention is blur tokenomics, a concept that combines the power of blockchain technology with the principles of decentralized finance. This article will explore the potential challenges and opportunities that lie ahead in the future of blur tokenomics.

Blur tokenomics, at its core, is a system that aims to create a decentralized ecosystem where users can trade and transact without intermediaries. The technology behind blur tokenomics is based on the principles of blockchain, which ensures transparency, immutability, and security. By eliminating the need for third-party intermediaries, blur tokenomics has the potential to revolutionize industries such as finance, supply chain management, and even governance.

However, as with any emerging technology, there are challenges that need to be addressed. One of the main challenges in blur tokenomics is scalability. As the number of users and transactions increase, blockchain networks can become congested, leading to slow transaction speeds and high fees. Overcoming these scalability challenges is crucial for blur tokenomics to reach its full potential.

Another challenge that blur tokenomics faces is regulation. As the technology continues to evolve and disrupt traditional industries, regulatory frameworks struggle to keep up. This lack of clarity and uncertainty can hinder the adoption of blur tokenomics on a larger scale. Finding the right balance between innovation and regulation will be essential in shaping the future of blur tokenomics.

Despite the challenges, there are also exciting opportunities ahead. The potential for financial inclusion is immense, as blur tokenomics can provide access to financial services for individuals in underserved areas. Additionally, blur tokenomics has the potential to unlock new business models and incentivize collaboration through decentralized governance structures. These opportunities have the potential to transform industries and empower individuals worldwide.

In conclusion, the future of blur tokenomics holds both challenges and opportunities. Finding solutions for scalability and regulatory hurdles will be crucial for the technology to realize its full potential. However, the potential for financial inclusion and transformative business models make blur tokenomics an exciting frontier to explore. As the technology continues to evolve, it will be fascinating to see how blur tokenomics shapes the future of decentralized finance and beyond.

Evolving Trends in Blur Tokenomics

As the world of blockchain continues to advance, the field of tokenomics is constantly evolving as well. Blur Tokenomics, in particular, has seen a number of emerging trends that are shaping its future.

One of the most notable trends in Blur Tokenomics is the increased focus on community-driven initiatives. With the rise of decentralized finance (DeFi), many projects are now incorporating community governance systems where token holders have a say in project decisions. This not only increases decentralization but also strengthens the sense of ownership and participation among token holders.

Another significant trend is the integration of non-fungible tokens (NFTs) into Blur Tokenomics. NFTs provide a unique and verifiable way of representing ownership of digital assets, allowing for the creation of new monetization opportunities within the blur ecosystem. With the growing popularity of NFTs, we can expect to see more projects utilizing this technology to enhance their tokenomics.

Furthermore, interoperability is becoming a key focus in Blur Tokenomics. As various blockchain networks continue to emerge, the ability for different tokens to seamlessly interact and transfer value becomes crucial. Interoperability protocols and bridges are being developed to overcome the limitations of blockchain silos, opening up new possibilities for cross-chain transactions and collaborations.

Additionally, sustainability is gaining traction in Blur Tokenomics. With increasing concerns about the environmental impact of blockchain technology, projects are exploring more eco-friendly alternatives. This includes utilizing proof-of-stake (PoS) consensus mechanisms, which consume less energy compared to traditional proof-of-work (PoW) systems, as well as actively supporting carbon offset initiatives.

In conclusion, the future of Blur Tokenomics is being shaped by a number of evolving trends. From community-driven initiatives and the integration of NFTs to interoperability and sustainability, these trends reflect the industry's commitment to innovation and adaptation. As the field continues to mature, we can expect to see even more exciting developments in the world of Blur Tokenomics.

Emerging Technologies in Blur Tokenomics

As the world of cryptocurrencies continues to evolve, so does the field of tokenomics. Blur Token (BLUR) is at the forefront of this innovation, adopting cutting-edge technologies to create a unique and dynamic ecosystem.

One of the emerging technologies driving Blur Tokenomics is blockchain. By leveraging the power of decentralized ledgers, Blur Token ensures transparency, security, and immutability in its transactions. Users can trust that their digital assets are protected and that transactions are validated through a distributed network of nodes.

Another technology that is reshaping Blur Tokenomics is non-fungible tokens (NFTs). These unique digital assets provide individuals with ownership of one-of-a-kind items, such as artwork, music, and virtual real estate. Blur Token has embraced the NFT trend by creating a marketplace where users can buy, sell, and trade these digital collectibles.

The integration of artificial intelligence (AI) is also revolutionizing Blur Tokenomics. By implementing machine learning algorithms, Blur Token can analyze user behavior, identify trends, and make data-driven predictions. This AI-powered approach enables the platform to offer personalized recommendations, improve user experience, and optimize the allocation of resources.

Furthermore, Blur Tokenomics leverages smart contracts to automate and streamline operations. With self-executing contracts, the need for intermediaries or third parties is minimized, reducing costs and potential risks. Smart contracts also enable the creation of new financial instruments, such as decentralized lending and borrowing platforms, further expanding the capabilities of Blur Token.

These emerging technologies are just the beginning of what Blur Tokenomics has in store. As the ecosystem continues to evolve, new innovations will undoubtedly arise, paving the way for even more exciting opportunities. By leveraging the potential of blockchain, NFTs, AI, and smart contracts, Blur Token aims to revolutionize the way we engage with digital assets and the broader cryptocurrency market.

To learn more about Blur Tokenomics and explore the possibilities, please visit BLUR.IO.

Risks and Security Considerations in Blur Tokenomics

As with any emerging technology and economic system, there are inherent risks and security considerations that need to be addressed in Blur tokenomics. While Blur offers exciting opportunities for decentralization, transparency, and financial inclusivity, it also introduces new challenges that must be taken seriously.

1. Smart Contract vulnerabilities

One of the main risks in Blur tokenomics is the potential vulnerabilities in the smart contracts that power the decentralized applications. Smart contracts are self-executing contracts with the terms of the agreement directly written into code. Any bugs or vulnerabilities in the code can be exploited by malicious actors to steal or manipulate funds.

To mitigate this risk, rigorous security audits and code reviews should be conducted before deploying any smart contract. Additionally, continuous monitoring and updates are necessary to address any newly discovered vulnerabilities. Community involvement and bug bounty programs can also help identify and fix potential issues.

2. Privacy concerns

Blur tokenomics aims to provide privacy and anonymity in transactions. While this is a notable feature, it also raises concerns regarding illicit activities such as money laundering and illegal transactions. Regulators and law enforcement agencies may scrutinize the network and its users, potentially leading to increased regulatory pressure and compliance requirements.

To address this risk, Blur tokenomics should strike a balance between privacy and compliance. Implementing privacy features that adhere to anti-money laundering (AML) and know your customer (KYC) regulations can help alleviate regulatory concerns while still maintaining user privacy.

3. User adoption and liquidity

A critical challenge in Blur tokenomics is achieving widespread user adoption and ensuring sufficient liquidity in the ecosystem. Without a robust user base and active trading markets, the value and utility of Blur tokens could be severely limited.

To overcome this challenge, effective marketing and education campaigns are crucial in creating awareness and attracting users to the Blur ecosystem. Furthermore, partnerships with existing platforms and exchanges can help drive liquidity and enable seamless integration with other blockchain ecosystems.

4. External threats

Blur tokenomics is susceptible to external threats such as hacking attempts, phishing attacks, and social engineering. Malicious actors may target individual users, exchanges, or even the underlying blockchain network itself.

To mitigate external threats, users should be educated on best security practices, such as using hardware wallets, employing strong passwords, and avoiding suspicious links or emails. Exchanges and platform operators should enforce strict security measures, including multi-factor authentication and regular security audits.

In conclusion, while Blur tokenomics presents exciting opportunities for the future, it's essential to address the associated risks and security considerations. By prioritizing security measures, implementing privacy features compliant with regulations, and focusing on user adoption and liquidity, the Blur ecosystem can navigate these challenges and pave the way for a thriving and secure decentralized future.

For more information on the Blur tokenomics and how to log in to your BLUR.IO account, you can visit the official website: BLUR.IO 계정에 로그인하는 방법.

Future of Decentralized Finance in Blur Tokenomics

Decentralized finance (DeFi) is revolutionizing the traditional financial system by leveraging blockchain technology. With the emergence of Blur Tokenomics, a new era of decentralized finance is on the horizon. Blur Tokenomics aims to address the challenges and optimize the opportunities presented by the rapidly evolving DeFi landscape.

Challenges:

1. Scalability: One of the main challenges facing decentralized finance is scalability. As the number of users and transactions increases, the current blockchain infrastructure may not be able to handle the growing demands. Blur Tokenomics is exploring solutions like layer 2 solutions and sharding to enhance scalability and improve transaction speed.

2. Interoperability: DeFi platforms often operate in isolation, limiting their potential for collaboration and growth. Blur Tokenomics envisions a future where different DeFi protocols can seamlessly interact and share data, enabling users to access a wide range of financial services from a single platform.

3. User Experience: The complexity of DeFi platforms can deter new users from participating in decentralized finance. Blur Tokenomics is committed to enhancing the user experience by creating intuitive and user-friendly interfaces that make it easier for individuals to navigate and engage with DeFi protocols.

Opportunities:

1. Financial Inclusion: DeFi has the potential to bring financial services to the unbanked and underbanked populations around the world. Blur Tokenomics aims to leverage decentralized finance to provide these individuals with access to banking services, loans, and investment opportunities, empowering them to improve their financial well-being.

2. Transparency: One of the key advantages of blockchain technology is its ability to provide transparent and auditable transactions. Blur Tokenomics aims to leverage this transparency to build trust in decentralized finance, ensuring that users can verify the integrity of transactions and smart contracts.

3. Innovation: Blur Tokenomics believes that decentralized finance can drive innovation in the financial sector by enabling the development of new financial products and services. Through decentralized governance and open-source protocols, Blur Tokenomics aims to foster a collaborative environment where developers can continuously innovate and improve upon existing DeFi solutions.

In conclusion, the future of decentralized finance in Blur Tokenomics holds immense potential. By addressing the current challenges and leveraging the opportunities presented by DeFi, Blur Tokenomics aims to create a more inclusive, transparent, and innovative financial ecosystem that empowers individuals around the world.

Regulatory Landscape for Blur Tokenomics

As the world of decentralized finance (DeFi) continues to evolve, the regulatory landscape for blur tokenomics is becoming increasingly important. Governments and regulatory bodies around the world are starting to take notice of the potential risks and opportunities that blur tokenomics can bring. Here are some key aspects of the regulatory landscape for blur tokenomics:

1. Jurisdictional Variations: Different countries have varying approaches to regulating blur tokenomics. Some jurisdictions have embraced it and are actively working on creating regulatory frameworks to foster its growth, while others are taking a more cautious approach and are still evaluating the potential risks and benefits.

2. Compliance and KYC: As blur tokenomics involves financial transactions, compliance with know-your-customer (KYC) and anti-money laundering (AML) regulations is crucial. To ensure the legitimacy and transparency of blur token transactions, regulators are likely to require projects and platforms to implement robust KYC and AML procedures.

3. Investor Protection: Protecting investors is a major concern for regulators in the blur tokenomics space. Given the highly speculative nature of token investments and the potential for fraud, regulators are likely to enforce strict rules regarding disclosure, investor education, and the offering of tokens to retail investors.

4. Market Integrity: To maintain market integrity, regulators are likely to focus on preventing market manipulation, insider trading, and other unfair practices in the blur tokenomics space. This may involve monitoring trading activities, imposing trading restrictions, and implementing measures to ensure fair and transparent markets.

5. Cross-Border Transactions: Blur tokenomics is inherently global, and cross-border transactions are common. Regulators will need to work together to establish frameworks for cross-border regulatory cooperation, information sharing, and enforcement to address potential regulatory arbitrage and ensure consistent oversight.

6. Innovation and Sandbox Approaches: To encourage innovation while ensuring regulatory compliance, some jurisdictions may establish regulatory sandboxes or innovation hubs. These frameworks provide a controlled environment for startups and projects to test their blur tokenomics models while allowing regulators to observe and understand the risks and benefits involved.

Overall, the regulatory landscape for blur tokenomics is still evolving and varies across jurisdictions. As the technology continues to advance and gain mainstream adoption, regulators will play a crucial role in shaping and managing its growth, striking a balance between fostering innovation and protecting investors and market integrity.

Integration of Artificial Intelligence in Blur Tokenomics

As the world becomes more digitized and interconnected, the power of artificial intelligence (AI) has become increasingly apparent. AI has the ability to analyze vast amounts of data, identify patterns and trends, and make predictions and recommendations based on that analysis.

When it comes to tokenomics, AI can play a vital role in enhancing and optimizing the efficiency of the blur token ecosystem. By integrating AI technologies into blur tokenomics, several challenges can be addressed, and opportunities can be explored.

One of the primary challenges in blur tokenomics is ensuring a fair and balanced distribution of tokens among users. AI algorithms can help to achieve this by analyzing various factors, such as user behavior, network interactions, and token holdings, to determine the most equitable distribution mechanism. This could involve dynamically adjusting token rewards based on user contributions or implementing personalized token distribution algorithms.

Another area where AI can make a significant impact is in predicting market trends and volatility. By analyzing market data, sentiment analysis, and other relevant factors, AI algorithms can generate accurate forecasts and predictive models. This can assist users in making informed decisions and potentially maximizing their returns on token investments.

Furthermore, AI can enhance the security and privacy of the blur token ecosystem. AI-powered systems can identify suspicious activities and potential threats, such as fraudulent transactions or malicious attacks, in real-time. By continuously monitoring the network and applying advanced anomaly detection algorithms, AI can provide a robust security layer, minimizing the risks associated with token transactions.

AI can also contribute to the optimization of resource allocation within the blur token ecosystem. By analyzing the demand and supply patterns, AI algorithms can help determine the most efficient distribution of tokens for various purposes, such as network maintenance, development, and incentivizing user participation. This can lead to better resource utilization and overall system performance.

1. Improved fairness in token distribution

2. Enhanced market trend prediction and decision-making

3. Strengthened security and privacy measures

4. Optimal resource allocation and utilization

In conclusion, the integration of AI in blur tokenomics has the potential to revolutionize the efficiency, fairness, and security of the token ecosystem. By leveraging AI technologies, the challenges can be mitigated, and new opportunities can be explored, ultimately leading to a more robust and thriving ecosystem.

Impact of Blockchain Technology on Blur Tokenomics

The emergence of blockchain technology has revolutionized various industries, and tokenomics is no exception. Blur tokenomics, which focuses on privacy and anonymity, can benefit significantly from the implementation of blockchain technology.

Transparency: Blockchain technology introduces a high level of transparency to Blur tokenomics. Every transaction recorded on the blockchain is visible to all participants, ensuring transparency and eliminating the need for intermediaries. This transparency can establish trust among users and enhance the overall credibility of the Blur ecosystem.

Anonymity and Privacy: Blockchain technology allows for pseudonymous transactions, which aligns well with the core principles of Blur tokenomics. Users can transact without revealing their identities, ensuring anonymity and privacy. This feature attracts individuals who value the confidentiality of their transactions and encourages wider adoption of Blur tokens.

Security: Blockchain technology provides a robust security infrastructure for Blur tokenomics. The decentralized nature of blockchain ensures that no single point of failure exists, making it difficult for hackers to manipulate or compromise the system. Additionally, the use of cryptographic techniques guarantees the integrity and authenticity of transactions, enhancing the security of Blur tokenomics.

Efficiency: The use of blockchain technology can significantly improve the efficiency of Blur tokenomics. Transactions are processed at a faster rate, reducing the overall transaction time and increasing the scalability of the system. Additionally, the automation and smart contract capabilities of blockchain eliminate the need for manual intervention, streamlining the tokenomics processes and driving operational efficiency.

Global Accessibility: Blockchain technology has the potential to make Blur tokenomics globally accessible. With blockchain, cross-border transactions can be executed seamlessly without the need for intermediaries or traditional banking systems. This enables individuals from all over the world to participate in Blur tokenomics, fostering a more inclusive and diverse ecosystem.

Community Governance: Blockchain technology allows for decentralized governance mechanisms, giving users a say in the development and direction of Blur tokenomics. With the use of voting mechanisms and smart contracts, decision-making processes can be transparent, fair, and inclusive. This empowers the Blur community and encourages active participation and engagement.

In conclusion, the integration of blockchain technology into Blur tokenomics brings numerous benefits. Transparency, anonymity, security, efficiency, global accessibility, and community governance are just a few of the advantages that blockchain technology offers. As blockchain continues to evolve, it is expected that Blur tokenomics will further benefit from the advancements in this technology, creating a more robust and innovative privacy-focused ecosystem.

Advancements in Privacy and Anonymity in Blur Tokenomics

Privacy and anonymity have always been crucial aspects in the world of digital transactions. In the context of blur tokenomics, advancements in technology have led to innovative solutions that address these concerns, making transactions more private and anonymous than ever before.

1. Confidential Transactions

One of the key advancements in privacy and anonymity in blur tokenomics is the implementation of confidential transactions. These transactions ensure that the amount transferred is encrypted, making it impossible for anyone to determine the exact value being transferred without the necessary private key. This not only protects the privacy of the individuals involved but also makes it difficult for any external party to track the flow of funds.

2. Ring Signatures

Another advancement in blur tokenomics is the integration of ring signatures. Ring signatures allow individuals to sign a transaction on behalf of a group, making it impossible to identify the actual signer. This ensures that the privacy and anonymity of all individuals involved are maintained. By obscuring the true identity of the signer, ring signatures greatly enhance the privacy and anonymity of transactions in blur tokenomics.

In addition to these advancements, blur tokenomics also incorporates other privacy-enhancing technologies such as stealth addresses and decentralized mixing. Stealth addresses enable users to generate unique addresses for each transaction, making it difficult to link the sender and receiver. Decentralized mixing, on the other hand, utilizes a network of participants to mix transactions, further obfuscating the flow of funds and ensuring a high level of privacy and anonymity.

Confidential transactions

Ring signatures

Stealth addresses

Decentralized mixing

In summary, the future of blur tokenomics looks promising in terms of privacy and anonymity. With advancements in technology, individuals can expect transactions to be more private and anonymous than ever before. From confidential transactions to ring signatures and other privacy-enhancing technologies, blur tokenomics is paving the way for a truly secure and private digital economy.

Sustainable and Green Solutions in Blur Tokenomics

As the world is becoming more conscious of the environmental impact of various industries, it is important for tokenomics to align with sustainable and green solutions. In the context of blur tokenomics, there are several opportunities to incorporate eco-friendly practices.

One potential solution is to incentivize users to take environmentally friendly actions through the use of blur tokens. For example, users could earn blur tokens by participating in activities that reduce their carbon footprint, such as carpooling or using renewable energy sources. This would not only encourage individuals to adopt more sustainable habits, but also contribute to the overall reduction of carbon emissions.

Another way to promote sustainability in blur tokenomics is by supporting green projects and initiatives. Token holders could vote on which projects should receive funding, with a focus on those that align with environmental goals. This would not only provide financial support for green initiatives, but also create a sense of community and shared responsibility among token holders.

In addition, transparency and accountability are crucial in ensuring that blur tokenomics remains sustainable and green. Token issuers should provide comprehensive information about their environmental impact and ongoing efforts to reduce it. This could include regular reports on carbon emissions, energy usage, and waste management practices. By being transparent about their environmental impact, token issuers can build trust with their community and demonstrate their commitment to sustainability.

Lastly, collaboration with other eco-friendly projects and organizations can further enhance the impact of blur tokenomics on sustainability. By partnering with environmental nonprofits or sustainable businesses, token issuers can leverage their resources and expertise to drive meaningful change. This could involve joint initiatives, shared networks, or even co-creation of eco-friendly solutions.

Overall, integrating sustainable and green practices into blur tokenomics can not only improve the environmental impact of the industry, but also create new opportunities for token holders to contribute to a more sustainable future. With the right strategies and collaborations, blur tokenomics has the potential to be a catalyst for positive change in the global sustainability landscape.

Role of Smart Contracts in Blur Tokenomics

In the future of Blur tokenomics, smart contracts will play a crucial role in ensuring the transparency, security, and efficiency of the ecosystem. Smart contracts are self-executing contracts with the terms of the agreement directly written into code. These contracts automatically execute once certain conditions are met, ensuring that all parties involved adhere to the rules.

Smart contracts will enable Blur tokenomics to operate autonomously, without the need for intermediaries or third-party intervention. This will eliminate the potential for human error and the risk of fraud, as the contracts will execute based on predetermined conditions and cannot be tampered with.

With the integration of smart contracts, Blur tokenomics will be able to facilitate various functions, such as:

Automated Transactions: Smart contracts will enable seamless and secure transactions within the Blur ecosystem. Users can confidently exchange Blur tokens without relying on centralized exchanges or brokers.

Decentralized Governance: Smart contracts will allow for decentralized decision-making within the Blur community. Token holders can participate in voting and governance processes, ensuring a fair and inclusive ecosystem.

Rewards and Incentives: Smart contracts will automate the distribution of rewards and incentives to participants based on predefined rules. This will encourage active participation and engagement within the Blur community.

Token Locking and Vesting: Smart contracts can be utilized to lock and vest Blur tokens for a specific period or until certain conditions are met. This feature can be used to incentivize long-term holding and discourage speculative behavior.

Integrating smart contracts into Blur tokenomics will not only provide a secure and efficient infrastructure but also enhance user trust and confidence. Users can have full visibility of the contract's terms, ensuring a fair and transparent ecosystem.

By incorporating smart contracts, Blur tokenomics will empower individuals to have greater control over their financial activities and participate actively in the Blur community. It will pave the way for a more decentralized and democratic financial system.

For more information about Blur tokenomics, please visit Blur traders.

Tokenization of Real-World Assets in Blur Tokenomics

The concept of tokenization refers to the process of converting real-world assets, such as real estate, stocks, or commodities, into digital assets that can be stored and traded on a blockchain. With the rise of Blur Tokenomics, the tokenization of real-world assets becomes a promising opportunity for investors and asset owners alike.

Tokenizing real-world assets offers several advantages. First and foremost, it allows for fractional ownership, enabling investors to purchase a fraction of an asset rather than the entire asset. This opens up investment opportunities to a wider range of individuals, including those with limited capital. Additionally, tokenization enables increased liquidity as these digital assets can be easily traded on decentralized exchanges.

Furthermore, tokenization eliminates the need for intermediaries, such as brokers or custodians, reducing transaction costs and improving efficiency. It also enhances transparency and security as all transactions are recorded on the blockchain, providing a verifiable and immutable record of ownership.

However, tokenizing real-world assets also presents challenges. One major hurdle is regulatory compliance. Different jurisdictions have varying regulations related to securities, property rights, and financial transactions. Overcoming these regulatory challenges requires close collaboration between blockchain developers, legal experts, and regulators to ensure compliance with existing frameworks.

Another challenge lies in the valuation of these tokenized assets. Determining the value of real-world assets can be complex and subjective, requiring accurate appraisal and valuation methodologies. Developing standardized valuation models and establishing trusted independent auditors will be crucial for the success of tokenized assets.

Despite these challenges, the tokenization of real-world assets in Blur Tokenomics holds immense potential. It democratizes access to investment opportunities, increases liquidity, reduces transaction costs, and enhances transparency. As blockchain technology continues to evolve and regulatory frameworks adapt, we can anticipate a brighter future for blur tokenomics and the tokenization of real-world assets.

Opportunities in Blur Tokenomics for Developing Economies

The emergence of blur tokenomics presents numerous opportunities for developing economies to address their financial and economic challenges. With the potential to revolutionize traditional economic systems, blur tokenomics can provide new avenues for growth, inclusion, and financial empowerment.

Increased Access to Capital

One of the key opportunities in blur tokenomics for developing economies is increased access to capital. Traditional financial systems often exclude individuals and businesses that lack a well-established credit history or collateral. Blur tokenomics can enable decentralized finance (DeFi) platforms, allowing people to apply for loans, access liquidity, and partake in investment opportunities without relying on traditional intermediaries. This can foster greater access to capital for underserved communities, promoting entrepreneurship, job creation, and economic development.

Financial Inclusion

Blur tokenomics has the potential to bridge the gap of financial inclusion in developing economies. Many individuals in these countries lack access to basic financial services, such as bank accounts or credit. By leveraging blockchain technology, blur tokenomics can provide secure and affordable financial services to the unbanked and underbanked populations. This can empower individuals and communities by enabling them to save, receive remittances, access insurance, and engage in digital transactions, ultimately contributing to poverty reduction and economic stability.

Reduced Transaction Costs

The adoption of blur tokenomics can significantly reduce transaction costs, which is particularly beneficial for developing economies. Traditional cross-border remittances and international payments often involve high fees and long processing times. By leveraging decentralized cryptocurrencies and blockchain technology, blur tokenomics enables near-instantaneous and low-cost transactions. This can facilitate international trade, cross-border transfers, and remittances, making it more efficient and affordable for individuals and businesses to engage in global economic activities.

Efficient Resource Allocation

Blur tokenomics can also facilitate more efficient resource allocation in developing economies. By tokenizing assets and creating decentralized marketplaces, blur tokenomics enables the fractional ownership of assets, such as real estate, intellectual property, or agricultural produce. This can unlock the value of illiquid assets, promote transparent and fair transactions, and enable more efficient allocation of resources. For example, smallholder farmers could tokenize their land and access financing for investments, leading to improved agricultural productivity and food security.

In conclusion, blur tokenomics offers significant opportunities for developing economies to address financial and economic challenges. By increasing access to capital, promoting financial inclusion, reducing transaction costs, and facilitating efficient resource allocation, blur tokenomics can contribute to sustainable economic growth, poverty reduction, and empowerment of individuals and communities.

Growth of Decentralized Exchanges in Blur Tokenomics

In the world of blur tokenomics, decentralized exchanges (DEXs) have emerged as a vital part of the ecosystem. These platforms allow for peer-to-peer trading of tokens without the need for intermediaries, such as traditional centralized exchanges.

The growth of DEXs has been fueled by several factors. Firstly, there is a growing demand for privacy and security in token trading. With DEXs, users have full control over their funds and can trade anonymously, without the need to provide personal information to a centralized exchange.

Moreover, DEXs offer greater transparency and trust compared to centralized exchanges. On a DEX, all operations are executed on-chain, meaning that they can be audited by anyone, ensuring a fair and tamper-proof trading environment.

Advantages of DEXs in Blur Tokenomics

One of the primary advantages of DEXs in blur tokenomics is the ability to trade directly from a personal wallet. Users do not need to deposit their funds onto a centralized exchange and can trade directly from their wallets, increasing security and reducing the risk of hacks or theft.

Another advantage is the elimination of a single point of failure. Centralized exchanges are vulnerable to hacks or system failures, which can lead to users losing their funds. DEXs, on the other hand, do not have a central server or entity that can be targeted, making them more resilient to attacks.

DEXs also offer a wide range of token options. With centralized exchanges, users are limited to the tokens listed on the platform. In contrast, DEXs allow for the trading of any token that is compatible with the underlying blockchain, providing users with more opportunities and options.

Challenges and Future Opportunities

While DEXs have experienced significant growth in blur tokenomics, they still face several challenges. One of the main challenges is scalability. Many DEXs currently operate on Ethereum, which has limited scalability due to network congestion and high gas fees. As blur tokenomics continues to grow, there will be a need for DEXs to scale to accommodate a larger user base and increased trading volume.

Another challenge is the lack of liquidity on some DEXs. Liquidity refers to the availability of buyers and sellers for a particular token. Currently, some DEXs have low liquidity, leading to wider spreads and slippage for users. Solving the liquidity issue will be crucial for the continued growth and adoption of DEXs in blur tokenomics.

Despite these challenges, there are several future opportunities for DEXs in blur tokenomics. The development of Layer 2 solutions, such as Ethereum's Optimistic Rollups or other blockchain platforms like Polkadot, can help alleviate scalability issues and improve the user experience on DEXs.

Additionally, the integration of decentralized finance (DeFi) protocols with DEXs can further enhance their functionality. DeFi protocols, such as lending and borrowing platforms, can provide additional value to DEX users by allowing them to earn interest on their holdings or leverage their positions.

In conclusion, the growth of decentralized exchanges in blur tokenomics presents exciting opportunities for users to trade tokens in a secure, transparent, and customizable manner. While DEXs face challenges, such as scalability and liquidity, the future looks promising as new technologies and protocols are developed to address these issues.

Challenges in Achieving Mass Adoption of Blur Tokenomics

As Blur tokenomics gain more attention and interest, there are several challenges that need to be addressed in order to achieve mass adoption. These challenges include:

Lack of Awareness and Education

One of the main challenges in achieving mass adoption of Blur tokenomics is the lack of awareness and education. Many people are still not familiar with how tokenomics work and the potential benefits they offer. Therefore, it is crucial to educate the public and raise awareness about the advantages of Blur tokenomics in order to encourage mass adoption.

Complexity and Usability

Another challenge is the complexity and usability of Blur tokenomics. For mass adoption to occur, the tokenomics should be easily understandable and user-friendly. Complexity and technical jargon can deter new users from embracing Blur tokenomics. Therefore, efforts should be made to simplify the concepts and provide user-friendly interfaces that make it easy for anyone to participate.

Additionally, improving the scalability and speed of the tokenomics is important to ensure smooth and efficient transactions, especially as the user base grows.

Furthermore, interoperability with other tokenomics and blockchain networks is crucial to enable seamless integration and interaction between different platforms and applications.

Regulatory Environment

The ever-changing regulatory environment poses a significant challenge for the mass adoption of Blur tokenomics. Governments and regulatory bodies are still developing frameworks to govern the use of cryptocurrencies and tokenomics. The lack of clear regulations and potential legal uncertainties can create barriers to mass adoption, as individuals and businesses may be hesitant to engage with Blur tokenomics due to concerns about compliance and legal implications.

Educating regulators and lawmakers about the benefits of Blur tokenomics and working towards clear and favorable regulations can help overcome this challenge and pave the way for mass adoption.

Overall, while the future of Blur tokenomics holds immense potential, addressing these challenges will be crucial in achieving mass adoption. By raising awareness, improving usability, and navigating the regulatory landscape, Blur tokenomics can become more accessible and widely accepted by individuals, businesses, and governments worldwide.

Interoperability and Collaboration in Blur Tokenomics

Interoperability and collaboration play vital roles in the future of Blur tokenomics. As the blockchain industry continues to evolve and mature, it is becoming increasingly clear that the success of individual projects is intertwined with the ability to work together and integrate seamlessly with other platforms.

One potential challenge in blur tokenomics is ensuring cross-chain compatibility. As blockchain platforms and networks continue to emerge, it is important to create interoperability solutions that allow tokens, data, and assets to move freely between different networks. This will enable users to access a wider range of services and opportunities, ultimately driving innovation and growth within the blur ecosystem.

Collaboration between different projects and teams is also crucial for the success of blur tokenomics. By working together, developers and entrepreneurs can leverage their respective strengths, sharing knowledge and resources to create more robust and versatile solutions. This collaboration can take various forms, such as cross-platform partnerships, joint development initiatives, or even shared liquidity pools. The key is to foster an environment of openness and cooperation, where ideas and innovations can flourish.

Furthermore, collaboration with traditional financial institutions and regulators is another aspect to consider in the future of blur tokenomics. By establishing relationships and partnerships with legacy institutions, the blockchain industry can gain wider acceptance and pave the way for mainstream adoption. This collaboration can help address regulatory challenges, create new avenues for investment, and provide users with more confidence in the security and legitimacy of the blur ecosystem.

To facilitate interoperability and collaboration, the blur community must prioritize the development of standardized protocols and frameworks. These frameworks should be designed to enable seamless integration between different blockchain networks and projects, creating a unified and interconnected ecosystem. Additionally, clear governance structures and guidelines should be established to ensure transparency and fairness in collaborative efforts.

In conclusion, interoperability and collaboration are essential components of the future of blur tokenomics. By fostering an environment of openness and cooperation, the blur ecosystem can pave the way for innovation, growth, and mainstream adoption. By prioritizing the development of interoperability solutions, establishing collaborations with traditional institutions, and creating standardized frameworks, the blur community can unlock the full potential of tokenomics in the years to come.

DeFi Governance Models and Challenges in Blur Tokenomics

In the world of decentralized finance (DeFi), governance plays a crucial role in determining the direction of a project. Blur Tokenomics, being a part of the DeFi ecosystem, also faces its own set of challenges when it comes to governance models and decision-making processes.

One of the main challenges in DeFi governance is achieving decentralization while maintaining efficiency. Blur Tokenomics needs to strike a balance between giving power to a wide range of stakeholders and ensuring that decisions can be made in a timely manner. This can be particularly challenging as the project grows and attracts more participants.

Another challenge is ensuring transparency and accountability in governance processes. Blur Tokenomics should strive to provide clear and accessible information about decision-making, voting mechanisms, and overall project development. This helps build trust among participants and fosters a healthy and inclusive community.

Additionally, the complexity of decentralized systems poses challenges in designing effective governance models for Blur Tokenomics. With multiple stakeholders, competing interests, and technical intricacies, finding a governance structure that can accommodate these complexities is crucial. It requires careful consideration of factors such as token distribution, voting mechanisms, and incentives.

Another aspect to consider is the potential for governance capture or manipulation. Blur Tokenomics needs to implement safeguards to prevent undue influence from malicious actors or large token holders. This can include measures such as limiting voting power, implementing checks and balances, and having transparent decision-making processes.

Lastly, governance in Blur Tokenomics should be adaptable to changing market conditions and technological advancements. As the DeFi ecosystem evolves, so should the governance models and mechanisms. This requires active engagement from the community and continuous improvement of processes to ensure the project remains relevant and resilient.

In conclusion, governance models in Blur Tokenomics face various challenges in achieving decentralization, transparency, efficiency, and adaptability. Overcoming these challenges requires careful consideration of factors such as decentralization, transparency, complexity, manipulation prevention, and adaptability. By addressing these challenges, Blur Tokenomics can foster a robust and inclusive governance ecosystem that drives the project's success in the future of DeFi.

What are the potential challenges in the future of blur tokenomics?

The potential challenges in the future of blur tokenomics include regulatory hurdles, scalability issues, and competition from other blockchain projects.

How can blur tokenomics overcome the regulatory hurdles?

Blur tokenomics can overcome regulatory hurdles by working closely with policymakers and ensuring compliance with existing regulations. Additionally, advocating for clear and favorable regulations for blockchain projects can also help overcome these challenges.

What opportunities does the future of blur tokenomics hold?

The future of blur tokenomics holds various opportunities, including increased adoption of blockchain technology, integration with other industries, and the potential for financial inclusivity and transparency.

How can blur tokenomics achieve scalability?

Blur tokenomics can achieve scalability through the implementation of layer 2 solutions, such as sidechains or state channels. These solutions allow for faster and more cost-effective transactions, improving the overall scalability of the network.

What kind of competition does blur tokenomics face?

Blur tokenomics faces competition from other blockchain projects that offer similar solutions or target the same market. Some of the competition may come from established projects with larger user bases and more established networks.

What are blur tokenomics?

Blur tokenomics refers to the economic system and principles behind the Blur token. It involves the distribution, supply, and utility of the token in the Blur ecosystem.

What challenges may arise in the future of blur tokenomics?

In the future, challenges in blur tokenomics could include regulatory issues, scalability problems, market volatility, and maintaining the balance between token supply and demand.

How can blur tokenomics provide opportunities for investors?

Blur tokenomics can provide opportunities for investors through potential price appreciation of the token, staking rewards, access to exclusive features and services within the Blur ecosystem, and participation in governance decisions.

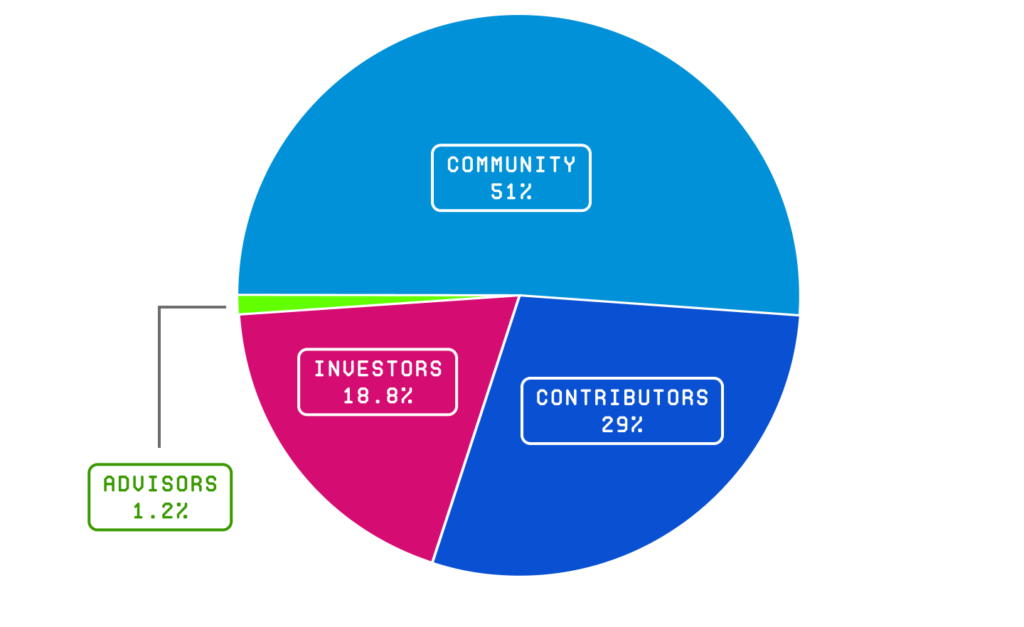

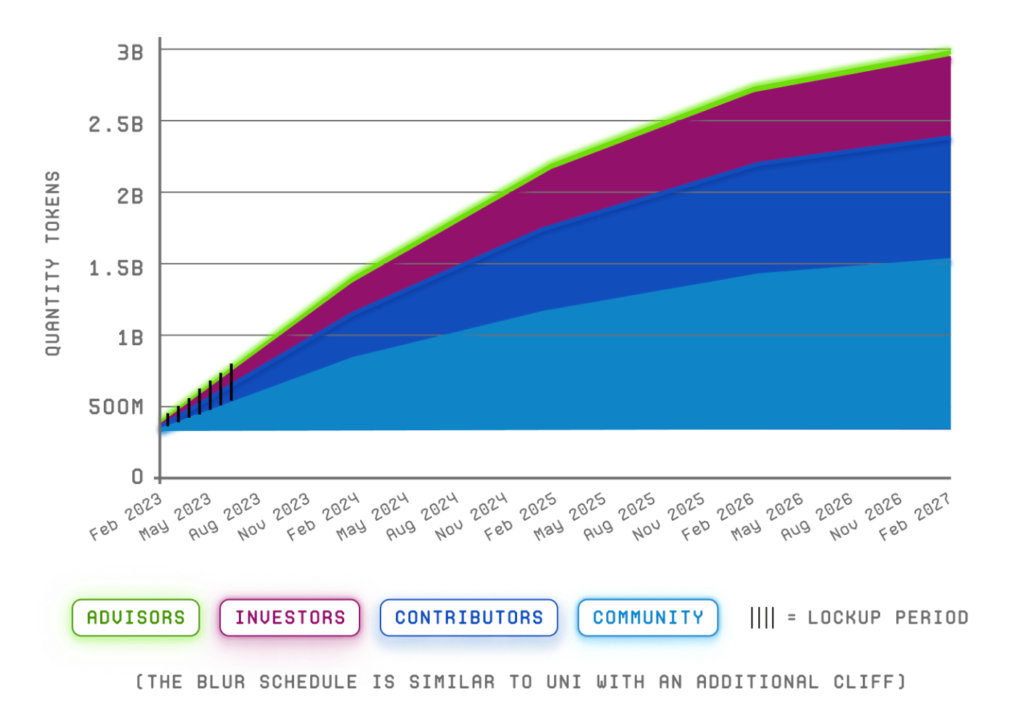

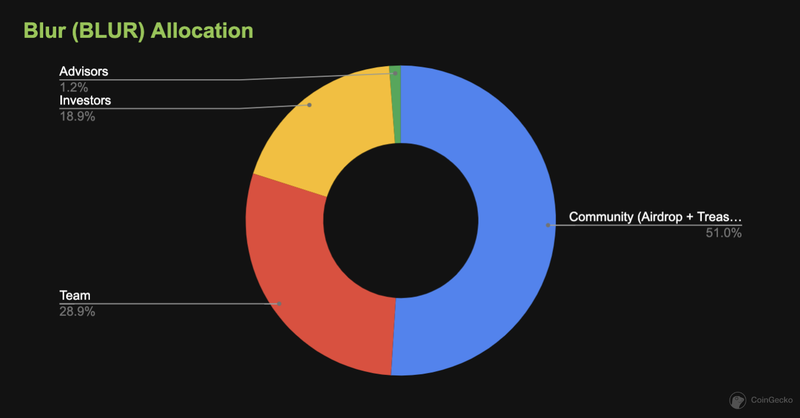

What role does token distribution play in blur tokenomics?

Token distribution is a crucial aspect of blur tokenomics. It determines how the token is allocated to different stakeholders, such as developers, investors, and community members. Proper token distribution ensures a fair and balanced ecosystem where everyone has a stake in Blur's success.

Can you explain the concept of token utility in blur tokenomics?

Token utility in blur tokenomics refers to the various ways in which the Blur token can be used within the ecosystem. This can include using the token to pay for services, accessing premium features, voting on governance proposals, and participating in token staking to earn rewards.

Blur: NFT | Blur: NFT login | Blur: NFT connect | WalletConnect | Traders | What Is Blur Crypto

2022-2024 @ Exploring the potential challenges and opportunities in the future of blur tokenomics