an in-depth analysis

Blur: NFT | Blur: NFT login | Blur: NFT connect | WalletConnect | Traders | What Is Blur Crypto

Blur: NFT | Blur: NFT login | Blur: NFT connect | WalletConnect | Traders | What Is Blur Crypto

In recent years, the rise of cryptocurrency has been met with increasing attention and scrutiny from governments around the world. Cryptocurrencies like Blur Coin have emerged as alternative forms of digital currency that operate independently of traditional banking systems. While the decentralization and anonymity that come with cryptocurrencies have their benefits, they also present challenges for governments seeking to regulate and monitor financial transactions.

Government regulations can have a significant impact on the price of Blur Coin, as they can affect the overall demand and supply dynamics of the cryptocurrency. When governments introduce regulations that restrict the use or trading of cryptocurrencies, it can dampen investor confidence and lead to a decrease in demand for Blur Coin. This decrease in demand can in turn lower the price of the cryptocurrency.

On the other hand, government regulations that promote the use and acceptance of cryptocurrencies can have a positive impact on the price of Blur Coin. For example, when a government creates a supportive regulatory framework that encourages businesses to accept Blur Coin as a form of payment, it can increase the demand for the cryptocurrency. This increased demand can drive up the price of Blur Coin as more people seek to acquire it.

Another factor to consider when analyzing the impact of government regulations on the price of Blur Coin is the level of regulatory certainty. Uncertainty regarding government regulations can create volatility in the cryptocurrency market, causing the price of Blur Coin to fluctuate. Investors may hesitate to enter the market or make significant investments if they are unsure of how regulations will impact the cryptocurrency. Therefore, clear and consistent government regulations can provide stability and foster investor confidence, positively influencing the price of Blur Coin.

In conclusion, government regulations play a crucial role in shaping the price of Blur Coin. Whether they introduce restrictions or provide a supportive framework, these regulations can significantly impact the demand and supply dynamics of the cryptocurrency. Additionally, the level of regulatory certainty also influences the price of Blur Coin. As governments continue to grapple with the challenges and opportunities presented by cryptocurrencies, their regulatory decisions will continue to shape the future of Blur Coin and other cryptocurrencies.

Economic Factors Affecting Blur Coin Price

The price of Blur Coin, like any other cryptocurrency, is influenced by various economic factors. These factors can have a significant impact on the demand and supply dynamics of Blur Coin, ultimately affecting its price. Here are some key economic factors that can affect the price of Blur Coin:

1. Market Demand and Adoption

The level of market demand for Blur Coin plays a crucial role in determining its price. If there is a higher demand for Blur Coin, it can drive up the price. Factors such as increased adoption by individuals, businesses, and institutions can lead to a surge in demand for Blur Coin, thereby affecting its price positively.

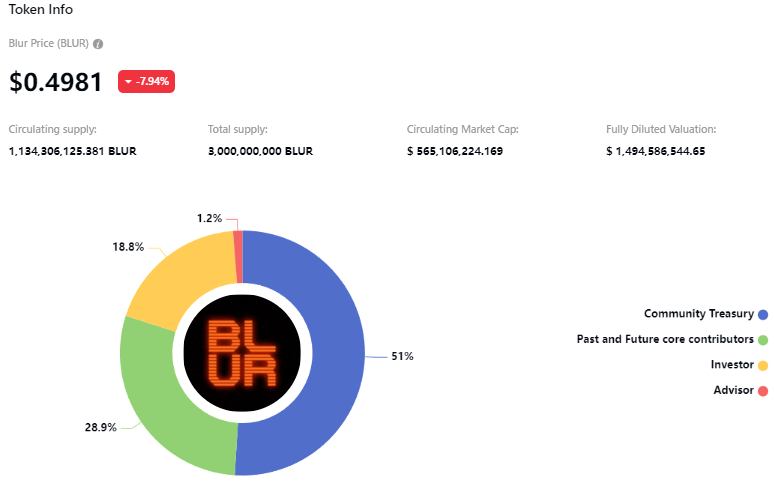

2. Supply of Blur Coin

The supply of Blur Coin in the market also affects its price. If there is a limited supply of Blur Coin and the demand is high, the price is likely to increase. Conversely, if the supply of Blur Coin outpaces the demand, the price may decrease.

3. Market Sentiment

The overall sentiment of the market towards cryptocurrencies, including Blur Coin, can greatly impact its price. Positive news, such as regulatory recognition and partnerships, can boost market sentiment and drive up the price. On the other hand, negative news or regulatory crackdowns can lead to a decline in market sentiment and adversely affect the price of Blur Coin.

4. Economic and Political Events

Economic and political events, both at a global and regional level, can influence the price of Blur Coin. Factors such as inflation, interest rates, government regulations, and geopolitical tensions can impact investor confidence and, subsequently, the price of Blur Coin.

5. Technological Developments

Technological advancements and developments in the cryptocurrency space can impact the price of Blur Coin. Innovations such as improvements in the blockchain technology, scalability solutions, and the development of decentralized applications can attract more investors and increase the demand for Blur Coin, thereby driving up its price.

It is important for investors and traders to keep an eye on these economic factors to make informed decisions regarding investing in Blur Coin. Monitoring the market demand, supply, sentiment, economic and political events, as well as technological advancements can provide valuable insights into the potential price trends of Blur Coin.

For further information and to explore the features and advantages of Blur.io, you can check out the official website: Connect with Blur.io: Explore the features and benefits of Blur.io.

Influence of Government Regulations on Blur Coin Price

Government regulations can have a significant impact on the price of Blur Coin. The regulations and policies imposed by a government can create both positive and negative effects on the price and value of Blur Coin, as well as the overall cryptocurrency market.

One of the key ways that government regulations influence the price of Blur Coin is through the legal framework surrounding its use and exchange. In some countries, governments have implemented strict regulations on cryptocurrencies, making it more difficult for individuals and businesses to use and trade Blur Coin. This can lead to a decrease in demand for Blur Coin, which in turn can cause its price to decline.

On the other hand, government regulations can also have a positive impact on the price of Blur Coin. Some governments have recognized the potential benefits of cryptocurrencies and have implemented favorable regulations that encourage their use. These regulations can attract investors and businesses to the cryptocurrency market, leading to an increase in demand for Blur Coin and subsequently driving up its price.

Another way that government regulations can affect the price of Blur Coin is through taxation policies. Governments may impose taxes on cryptocurrency transactions, which can impact the overall cost of buying and selling Blur Coin. Higher tax rates can discourage individuals and businesses from using Blur Coin, which can lead to a decrease in demand and a potential decrease in price.

Additionally, government regulations around investor protection and anti-money laundering measures can also impact the price of Blur Coin. Stricter regulations aimed at preventing fraudulent activities can provide a level of trust and security to investors, which can increase demand for Blur Coin and potentially drive up its price.

Government regulations that support and promote the use of cryptocurrencies can attract investors and businesses, increasing demand for Blur Coin and driving up its price.

Strict regulations and bans on cryptocurrencies can decrease the demand for Blur Coin and lead to a decline in its price.

Regulations aimed at preventing fraudulent activities and protecting investors can increase trust in Blur Coin, attracting more buyers and potentially increasing its price.

High taxation policies on cryptocurrency transactions can discourage individuals and businesses from using Blur Coin, leading to a decrease in demand and a potential decrease in price.

In conclusion, government regulations play a crucial role in shaping the price and value of Blur Coin. The impact can be both positive and negative, depending on the specific regulations implemented by the government. It is important for investors and traders to stay updated on the regulatory landscape to anticipate and adapt to potential changes in the price of Blur Coin.

Role of Supply and Demand in Blur Coin Price

When analyzing the impact of government regulations on the price of Blur Coin, it's important to take into consideration the fundamental economic concept of supply and demand. Supply and demand play a crucial role in determining the price and value of any cryptocurrency, including Blur Coin.

Supply

The supply of Blur Coin refers to the total amount of coins that are available in the market. It is influenced by factors such as mining rewards, the mining difficulty, and the rate at which new coins are minted. When the supply of Blur Coin increases, all other factors being equal, the price of Blur Coin tends to decrease. This is because there is a larger amount of coins available for buyers to purchase, leading to an oversupply and a decrease in price.

On the other hand, when the supply of Blur Coin decreases, the price tends to increase. This happens when the rate of minting new coins slows down or when there is a reduction in mining rewards. With a limited supply of coins available, buyers have to compete for the available coins, which drives up the price.

Demand

The demand for Blur Coin refers to the desire of buyers to purchase and hold the coin. Factors that influence demand include investor sentiment, market speculation, and the adoption of Blur Coin for practical use cases. When the demand for Blur Coin increases, all other factors being equal, the price tends to increase as well. This is because buyers are willing to pay a higher price to acquire the coin.

Conversely, when the demand for Blur Coin decreases, the price tends to decrease as well. If investors lose interest in Blur Coin or if there is a negative sentiment towards the cryptocurrency market as a whole, the demand for Blur Coin will decrease, leading to a decrease in price.

The interaction between supply and demand determines the equilibrium price of Blur Coin in the market. If the supply increases or the demand decreases, the price will decrease. On the other hand, if the supply decreases or the demand increases, the price will increase.

Government regulations can impact both the supply and demand for Blur Coin. For example, if a government imposes strict regulations that make mining more difficult or restrict the use of cryptocurrencies, the supply of Blur Coin may decrease. Similarly, if a government adopts favorable policies that encourage the adoption of cryptocurrencies, such as tax incentives or legal recognition, the demand for Blur Coin may increase.

Overall, the forces of supply and demand are essential in understanding the price dynamics of Blur Coin. Government regulations can influence these forces and have a significant impact on the price of the cryptocurrency.

Government Regulations on Blur Coin

Government regulations have a significant impact on the price and value of Blur Coin. As a decentralized cryptocurrency, Blur Coin is influenced by various regulatory measures implemented by governments around the world. These regulations can affect the demand, supply, and overall trading environment of Blur Coin.

One of the major regulatory factors affecting Blur Coin is the legal status and recognition of cryptocurrencies by governments. Some governments have taken a proactive approach by providing a clear legal framework for cryptocurrencies, which gives confidence to investors and businesses to engage in Blur Coin-related activities. In contrast, other governments have taken a cautious approach or even outright banned cryptocurrencies, creating uncertainty and hindering the growth of Blur Coin.

Government regulations related to anti-money laundering (AML) and know-your-customer (KYC) policies also impact Blur Coin. These regulations are aimed at preventing illegal activities such as money laundering and terrorist financing. While they are crucial for the overall integrity of the financial system, they also impose certain requirements on cryptocurrency exchanges and users, which can influence the ease of trading Blur Coin. Compliance with AML and KYC regulations may require additional verification steps and documentation, potentially affecting the liquidity and accessibility of Blur Coin.

Taxation policies are another area of government regulation that impact Blur Coin. Governments are increasingly recognizing the need to impose taxes on cryptocurrency transactions and holdings. These taxes can include capital gains tax, income tax, or even specific taxes on cryptocurrencies. The introduction of taxation policies can impact the profitability of investing in and using Blur Coin, as well as the behavior of users and businesses in the cryptocurrency ecosystem.

In addition to these factors, government regulations related to consumer protection, investor safeguards, and financial stability also play a role in shaping the price and value of Blur Coin. Measures aimed at protecting consumers and investors from fraud and scams can enhance trust in Blur Coin, contributing to its wider adoption and increased price. On the other hand, regulations that impose restrictions or limitations on cryptocurrency activities can create uncertainty and negatively impact Blur Coin.

Overall, government regulations on Blur Coin have a profound effect on its price and value. Clear and favorable regulatory frameworks can stimulate innovation, investment, and adoption of Blur Coin, leading to its appreciation. Conversely, stringent or unfavorable regulations can stifle its growth and diminish its value. Understanding and analyzing these regulatory dynamics is crucial for investors and stakeholders in the cryptocurrency market.

Overview of Government Regulatory Measures

In the realm of cryptocurrencies, such as Blur Coin, government regulations play a crucial role in shaping the market and determining its price dynamics. The introduction of regulations is aimed at providing a framework that ensures a fair and transparent environment for participants while also protecting them from potential risks and ensuring the stability of the overall financial system.

Government regulatory measures concerning cryptocurrencies vary across different jurisdictions, with some countries adopting a more progressive and open approach, while others opt for stricter controls. Common regulatory measures include:

Licensing and Registration:

Many governments require individuals and businesses engaged in cryptocurrency-related activities to obtain proper licenses or registrations, similar to the requirements placed on traditional financial institutions. This is done to ensure compliance with anti-money laundering (AML) and know your customer (KYC) regulations, as well as to safeguard against fraudulent activities.

Reporting and Taxes:

Most governments impose reporting requirements on cryptocurrency owners, exchanges, and businesses. This entails providing regular reports on transactions, assets held, and even personal identification information. Moreover, taxation frameworks pertaining to cryptocurrencies also differ among countries, with some imposing capital gains taxes while others consider them as a form of property subject to regular income taxes.

Market Surveillance and Enforcement:

Regulators often employ market surveillance strategies to monitor the trading activities and behavior of participants in the cryptocurrency market. This helps in identifying illegal activities such as market manipulation, insider trading, or illegal fundraisings. Enforcement actions are taken against entities found to be in violation of the regulations, which can include fines, cease-and-desist orders, or even criminal charges.

Investor Protection Measures:

Regulatory bodies put in place certain measures to protect investors from scams and frauds that are prevalent in the cryptocurrency market. These measures include educational campaigns, consumer warnings, and the establishment of investor complaint channels.

Government regulatory measures for cryptocurrencies aim to strike a balance between fostering innovation and safeguarding the interest of investors and the broader public. These regulations can significantly influence the price of Blur Coin by instilling investor confidence, ensuring market integrity, and mitigating potential risks associated with the unregulated nature of cryptocurrencies.

Effects of Government Licensing on Blur Coin Price

Government licensing can have a significant impact on the price of Blur Coin. Licensing refers to the process by which the government grants permission to individuals or companies to engage in certain activities, such as operating a cryptocurrency exchange or offering financial services related to cryptocurrencies.

One of the main effects of government licensing on the price of Blur Coin is increased trust and credibility. When a government licenses a cryptocurrency-related activity, it sets certain standards and regulations that the licensed entities must adhere to. This helps to ensure that the activities are conducted in a transparent and secure manner, which in turn increases trust among investors and users. As trust and credibility grow, more people are likely to invest in Blur Coin, leading to an increase in demand and price.

Another effect of government licensing is the reduction of illegal activities. By requiring entities to obtain a license, the government can keep a closer watch on the activities related to Blur Coin. This makes it harder for criminals to engage in money laundering, fraud, or other illicit activities. As a result, the perceived risk associated with Blur Coin decreases, attracting more potential investors and driving up the price.

However, government licensing can also have some negative effects on the price of Blur Coin. One such effect is the increased operating costs that come with obtaining and maintaining a license. Licenses often come with fees, compliance requirements, and ongoing audits or inspections. These additional costs can be passed on to users or investors in the form of higher transaction fees or trading costs, which can make Blur Coin less attractive and potentially hinder demand.

Additionally, government licensing may limit competition in the cryptocurrency market. Some licensing requirements can be stringent, making it difficult for new players to enter the market. This reduced competition can lead to a lack of innovation and potentially result in higher prices for Blur Coin due to the limited number of options available.

In conclusion, government licensing can have both positive and negative effects on the price of Blur Coin. While it can increase trust, reduce illegal activities, and enhance the credibility of the cryptocurrency, it can also introduce higher operating costs and limit competition. The overall impact will depend on the specific regulations and licensing requirements set by the government.

Impact of Taxation Policies on Blur Coin Price

Taxation policies play a significant role in determining the price of Blur Coin, a digital asset in the cryptocurrency market. These policies are implemented by governments to generate revenue and regulate the financial system. Let's explore the impact of taxation policies on Blur Coin price:

1. Capital Gains Tax

One of the most common taxation policies that can affect the price of Blur Coin is capital gains tax. When individuals or entities sell Blur Coin at a profit, they are generally subject to this tax. Higher capital gains tax rates can discourage investors from selling, leading to a decrease in supply and potentially increasing the price.

2. Transaction Taxes

Transaction taxes, also known as sales taxes or consumption taxes, can have a direct impact on the price of Blur Coin. If governments impose a tax on every transaction involving Blur Coin, it can increase the overall cost of acquiring and using the cryptocurrency. This additional cost may deter some potential buyers, reducing demand and potentially leading to a decrease in price.

To mitigate the impact of taxation policies, cryptocurrency exchanges and platforms often take measures to comply with regulations. They may incorporate tax calculators or have automatic tax withholding mechanisms to simplify the tax reporting process for users.

However, it is important to note that taxation policies can vary significantly between countries and jurisdictions. The impact of taxes on Blur Coin price will depend on the specific policies implemented and the overall regulatory environment.

In conclusion, taxation policies can have both direct and indirect effects on the price of Blur Coin. Investors and traders need to consider these policies and their potential impact when making decisions in the cryptocurrency market.

For more information on Blur Coin and its features, you can explore Conexión a Blur.io: Explorar las características y ventajas de Blur.io.

Government Subsidies and Their Effect on Blur Coin Price

Government subsidies can have a significant impact on the price of Blur coin. Subsidies are financial incentives provided by the government to support specific industries or activities. When subsidies are introduced into the market, they can directly impact the supply and demand dynamics of Blur coin.

One way that government subsidies can affect the price of Blur coin is by increasing the supply of the cryptocurrency. When the government provides subsidies to the mining industry, for example, it can incentivize more miners to enter the market. This increased supply of Blur coin can potentially lead to a decrease in its price as the market becomes flooded with more units of the cryptocurrency.

On the other hand, government subsidies can also impact the demand for Blur coin. Subsidies provided to businesses or individuals that use Blur coin for payments can incentivize more people to adopt and use the cryptocurrency. As the demand for Blur coin increases, its price may rise due to the limited supply in the market.

Moreover, government subsidies can indirectly affect the price of Blur coin by influencing market sentiment. When the government provides subsidies to a specific industry or activity, it sends a signal to investors and traders that this industry is worth investing in. This positive sentiment can drive up the demand for Blur coin, leading to an increase in its price.

However, it's essential to note that the impact of government subsidies on the price of Blur coin may not always be positive. Subsidies can distort market forces and create artificial demand, which can lead to price volatility and unsustainable growth. Additionally, if the government withdraws subsidies abruptly, it can have a negative impact on the price of Blur coin, causing it to plummet.

In conclusion, government subsidies can have a profound effect on the price of Blur coin. The introduction of subsidies can impact both the supply and demand dynamics of the cryptocurrency, leading to changes in its price. However, it's crucial to carefully monitor and analyze the consequences of government subsidies on the market to ensure sustainable growth and stability in the price of Blur coin.

Other Factors Influencing Blur Coin Price

In addition to government regulations, there are several other factors that can influence the price of Blur Coin. These factors are often intertwined and can have a significant impact on the overall market sentiment and demand for the cryptocurrency.

1. Market Demand and Adoption

The level of market demand for Blur Coin plays a crucial role in determining its value. Higher demand from investors and users can drive up the price, while lower demand can lead to a decrease in value. The adoption of Blur Coin in various industries and its perceived utility can also influence its price. If more businesses and individuals start accepting Blur Coin as a form of payment, it can create a positive market sentiment and increase the demand for the cryptocurrency.

2. Investor Sentiment

Investor sentiment and market speculation can have a significant impact on the price of Blur Coin. Positive news, partnerships, and developments surrounding the cryptocurrency can attract more investors and lead to an increase in price. On the other hand, negative news, regulatory uncertainties, or market volatility can create fear and uncertainty, leading to a decline in price. The overall market sentiment towards cryptocurrencies, in general, can also influence the price of Blur Coin.

It's important to note that the cryptocurrency market is highly speculative and influenced by various external factors such as global economic conditions, technological advancements, and market trends. These factors can significantly impact the price of Blur Coin and should be carefully considered by investors and traders.

Note: This article is for informational purposes only and should not be considered as financial advice. Cryptocurrency investments are subject to market risk, and individuals should conduct their own research before making any investment decisions.

Technological Advancements and Blur Coin Price

Technological advancements play a crucial role in determining the price of cryptocurrencies like Blur Coin. As innovations continue to shape the cryptocurrency market, Blur Coin is well-positioned to benefit from these advancements.

One of the key technological advancements that have had a significant impact on Blur Coin's price is the development of the Blur NFT Marketplace. This marketplace, accessible at What is Blur Crypto, allows users to buy, sell, and trade non-fungible tokens (NFTs) using Blur Coin. NFTs are unique digital assets that represent ownership of a particular item or piece of content, such as artwork or collectibles.

Increased Demand for Blur Coin

The emergence of the Blur NFT Marketplace has fueled increased demand for Blur Coin, driving its price higher. With the marketplace providing a platform for artists, creators, and collectors to monetize their work through NFTs, more individuals are seeking to acquire Blur Coin to participate in this growing ecosystem.

The ability to buy and sell NFTs using Blur Coin has also created a new avenue for investors looking to diversify their portfolios. As more investors recognize the potential value of NFTs and explore the benefits of Blur Coin as a currency within the Blur NFT Marketplace, demand for Blur Coin is expected to rise further, potentially pushing its price even higher.

Technological Innovation and Development

The continuous technological innovation and development within the blockchain and cryptocurrency space are also driving the price of Blur Coin. As new features and improvements are introduced, Blur Coin becomes more versatile and attractive to users.

For example, advancements in blockchain technology, such as the implementation of smart contracts, enhance the capabilities of Blur Coin. Smart contracts allow for self-executing agreements with predefined conditions, eliminating the need for intermediaries and reducing transaction costs. This increased efficiency and security make Blur Coin a more appealing option, positively impacting its price.

Moreover, ongoing developments in scalability solutions, such as layer-two protocols, address the issue of high transaction fees and slow transaction speeds, making Blur Coin more practical for everyday transactions.

Additionally, the integration of Blur Coin into other platforms and applications can also contribute to its price appreciation. By expanding its use cases and utility, Blur Coin becomes more widely adopted, attracting more users, investors, and developers.

In conclusion, technological advancements, particularly the development of the Blur NFT Marketplace and ongoing innovations within the cryptocurrency space, have played a significant role in determining the price of Blur Coin. As more individuals recognize the potential of Blur Coin and its applications, demand is expected to increase, potentially leading to further price appreciation.

Market Sentiments and Blur Coin Price

Market sentiments play a crucial role in shaping the price of Blur Coin. As a decentralized and speculative cryptocurrency, Blur Coin is greatly influenced by the investor's confidence and overall market sentiment.

When investors are optimistic about the future prospects of Blur Coin, they tend to buy more, leading to an increase in demand and subsequently driving up the price. On the other hand, when sentiment turns negative, and investors lose confidence in Blur Coin's potential, they tend to sell, causing a decrease in demand and a decline in price.

Market sentiments are influenced by various factors, such as technological advancements, market news, regulatory developments, and investor perceptions. For instance, positive news, such as the integration of Blur Coin into a popular payment platform or the announcement of a partnership with a renowned company, can create a bullish sentiment and drive the price upwards.

On the contrary, negative news, such as a major security breach or legal challenges faced by Blur Coin, can create a bearish sentiment and exert downward pressure on the price.

Government regulations also have a significant impact on market sentiments and Blur Coin's price. The introduction of favorable regulations, such as the recognition of Blur Coin as a legal tender or the establishment of clear guidelines for cryptocurrency trading, can enhance investor confidence and create a positive sentiment. This, in turn, can lead to an increase in demand and a rise in Blur Coin's price.

However, the imposition of strict regulations or the ban on Blur Coin can create uncertainty and a negative sentiment among investors. The fear of harsh regulations or an outright ban can trigger panic selling, resulting in a decline in demand and a decrease in Blur Coin's price.

Positive news and developments

Bullish sentiment

Upward pressure

Negative news and challenges

Bearish sentiment

Downward pressure

Favorable government regulations

Positive sentiment

Price increase

Strict regulations or bans

Negative sentiment

Price decrease

Therefore, it is crucial for investors and traders to closely monitor market sentiments and keep track of regulatory developments. By staying informed and understanding the impact of these factors on Blur Coin's price, investors can make more informed decisions and navigate the cryptocurrency market more effectively.

Competition and Blur Coin Price

Competition plays a significant role in determining the price of Blur Coin. As an open-source cryptocurrency, Blur Coin operates in a highly competitive market. The presence of other cryptocurrencies and digital assets creates a competitive environment where supply and demand dynamics influence the price.

Effect of Competition on Blur Coin Price

Competition affects Blur Coin price in several ways:

- Innovation and Development

Competition drives innovation and development in the cryptocurrency market, including the features and functionalities of Blur Coin. To stay relevant and compete with other cryptocurrencies, Blur Coin developers continuously work on improving the technology and introducing new features. This ongoing innovation can attract more users and investors, potentially leading to an increase in price.

- User Adoption

In a competitive market, user adoption plays a crucial role in determining the price of Blur Coin. The more users and merchants accept Blur Coin as a form of payment, the greater its utility value, and consequently, its demand. Increased adoption can create a positive feedback loop, driving the price of Blur Coin upwards.

- Market Share

Competing with other cryptocurrencies for market share can also affect the price of Blur Coin. If Blur Coin gains a larger market share compared to its competitors, it can attract more investors and traders, increasing demand and potentially leading to a higher price. Conversely, losing market share may negatively impact the price of Blur Coin.

Market Conditions and Competition

Market conditions and the competitive landscape can also influence the price of Blur Coin. Factors such as regulatory developments, government policies, and macroeconomic trends can impact the overall sentiment in the cryptocurrency market. Additionally, the performance and adoption of competing cryptocurrencies can also shape the investor sentiment towards Blur Coin.

Therefore, it is essential to consider the competitive environment and market conditions when analyzing the impact of government regulations on the price of Blur Coin. Competition can act as a catalyst, amplifying or dampening the effects of government regulations on Blur Coin price.

In conclusion, competition in the cryptocurrency market, including the presence of other cryptocurrencies and digital assets, plays a significant role in determining the price of Blur Coin. Factors such as innovation, user adoption, and market share can affect the demand and price of Blur Coin. Additionally, market conditions and the competitive landscape should be considered when analyzing the impact of government regulations on the price of Blur Coin.

Effects of Government Regulations on Blur Coin Users

Government regulations play a crucial role in shaping the environment in which Blur Coin users operate. These regulations can have both positive and negative effects on the users and their experience with the cryptocurrency. Here are some of the key effects that government regulations can have on Blur Coin users:

Increased Transparency: Government regulations often require cryptocurrency exchanges and platforms to maintain a high level of transparency. This can be beneficial for Blur Coin users as it helps them trust the ecosystem and make informed decisions. Users can have access to information such as transaction history, market data, and compliance records, which ultimately enhances the overall user experience.

Enhanced Security Measures: Government regulations may enforce stricter security measures on cryptocurrency platforms, reducing the risk of hacks and fraud. This is an important aspect for Blur Coin users who want to ensure the safety of their funds and personal information. Regulations can mandate platforms to implement robust security protocols, including multi-factor authentication, encryption, and cold storage, thereby providing users with a sense of security.

Additional Compliance Requirements: Government regulations may impose additional compliance requirements on Blur Coin users, such as Know Your Customer (KYC) and Anti-Money Laundering (AML) procedures. While these requirements may initially seem burdensome to users, they can help prevent illegal activities and ensure the legitimacy of the cryptocurrency ecosystem. It also helps users trust that they are engaging with verified and legitimate participants.

Limited Accessibility: In some cases, government regulations may impose restrictions or limitations on the accessibility of Blur Coin. For example, regulations may restrict certain individuals or entities from engaging in cryptocurrency transactions, making it more difficult for them to use Blur Coin. This can limit the user base and potentially impact the liquidity and adoption of the cryptocurrency.

Price Volatility: Government regulations can also have an impact on the price of Blur Coin. As regulations change or become more stringent, it can create uncertainty in the market, leading to price fluctuations. Users may experience increased volatility in the value of their Blur Coin holdings, which can affect their investment decisions and overall confidence in the cryptocurrency.

In conclusion, government regulations have both positive and negative effects on Blur Coin users. While regulations can enhance transparency, security, and legitimacy within the ecosystem, they may also impose additional compliance requirements and limit accessibility. Users should stay informed about the regulatory landscape to better understand the potential impact on their Blur Coin experience.

Impact of Regulations on Blur Coin Accessibility

Government regulations can have a significant impact on the accessibility of Blur Coin, making it either easier or more difficult for individuals to obtain and use this cryptocurrency. The following are some of the key factors that influence this accessibility:

Licensing and registration requirements: Governments may require cryptocurrency exchanges or platforms that deal with Blur Coin to obtain licenses or register with regulatory bodies. These requirements can create barriers to entry for new exchanges and limit the number of options available to potential Blur Coin users.

KYC and AML regulations: Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations aim to prevent illegal activities such as money laundering and terrorist financing. While these regulations are important for ensuring the integrity of the financial system, they can also make it more difficult for individuals to access Blur Coin as they are required to provide personal identification and other documentation.

Taxation: Governments may implement tax regulations that affect the use and accessibility of Blur Coin. For example, capital gains taxes on cryptocurrency transactions can deter individuals from buying or selling Blur Coin. Additionally, the complexity of tax reporting for cryptocurrencies can create a barrier for those unfamiliar with the process.

Restrictions on use: Governments can impose restrictions on how Blur Coin can be used, such as prohibiting certain types of transactions or limiting the amount of Blur Coin that can be transferred or held. These restrictions can limit the practicality and usability of Blur Coin, reducing its accessibility.

Consumer protection measures: Governments may implement regulations to protect consumers from fraudulent activities and scams related to cryptocurrencies. While these measures are important for safeguarding users, they can also add additional layers of complexity and requirements that may discourage individuals from using Blur Coin.

Overall, government regulations play a crucial role in shaping the accessibility of Blur Coin. While some regulations are necessary for ensuring the safety and integrity of the cryptocurrency market, excessive regulations or poorly designed policies can hinder its accessibility and limit its potential benefits for individuals.

Privacy and Security Concerns for Blur Coin Users

Blur Coin offers users a high level of privacy and security for their transactions. However, there are still some concerns that users should be aware of when using this digital currency.

Traceability: While Blur Coin transactions are generally untraceable, it is still important to note that the blockchain technology used in Blur Coin can potentially reveal information about the sender and receiver if not used properly. It is essential for users to take necessary precautions to protect their privacy.

Third-Party Risks: Third-party services, such as exchanges or payment processors, that interact with Blur Coin transactions may pose privacy and security risks. Users should carefully select and trust these services, as they may have access to sensitive information.

Wallet Security: Users need to ensure the security of their Blur Coin wallets to protect their funds. Storing wallets on secure devices, using strong passwords, and enabling two-factor authentication can help prevent unauthorized access and potential theft.

Network Surveillance: While Blur Coin itself provides privacy features, it is still possible for government agencies or other entities to monitor network traffic and potentially identify Blur Coin users. Users should consider using privacy tools, such as VPNs or proxy servers, to obfuscate their online activity.

Phishing Attacks: Users should be cautious of phishing attacks that aim to trick them into revealing their Blur Coin wallet credentials. It is important to verify the authenticity of any communication or website before entering sensitive information.

Overall, while Blur Coin offers enhanced privacy and security features, users should remain vigilant and take necessary precautions to ensure the confidentiality of their transactions and personal information.

Legal Implications for Blur Coin Users

Blur Coin, like any other cryptocurrency, is subject to a range of legal implications that users need to be aware of. These implications can have a significant impact on the price and regulation of Blur Coin.

Taxation: One of the key legal implications for Blur Coin users is taxation. Governments around the world are still developing regulations regarding the taxation of cryptocurrencies. Depending on the country, users may be required to report their Blur Coin holdings and pay taxes on any profits made from trading or selling Blur Coins. Failure to comply with tax regulations can result in penalties and legal consequences.

Money Laundering and Fraud: Due to the anonymous nature of cryptocurrency transactions, there is a risk of money laundering and other fraudulent activities. Governments have been introducing regulations to combat these issues, which can affect the price of Blur Coin. Users may be required to verify their identity, provide information about the origin of their funds, and comply with anti-money laundering (AML) regulations when trading or transferring Blur Coins.

Securities Laws: Blur Coin may also be subject to securities laws depending on its features and functionality. In certain jurisdictions, cryptocurrencies that are deemed to be securities may be subject to additional regulations, including mandatory registration with regulatory authorities. These regulations can affect the liquidity and trading of Blur Coin.

Consumer Protection: Governments have also started to address consumer protection issues related to cryptocurrencies. This includes protecting users from scams, ensuring the security of user funds, and enforcing transparency and disclosure requirements for cryptocurrency projects. Compliance with these regulations can increase trust and adoption of Blur Coin, which can in turn positively impact its price.

International Regulations: Finally, the legal implications for Blur Coin users also extend to international regulations. Cryptocurrencies are a global phenomenon, and users may need to comply with regulations and legislation in multiple countries if they engage in cross-border transactions or operate in different jurisdictions. International regulations can affect the price of Blur Coin through restrictions on trading, reporting requirements, and legal uncertainties.

Understanding the legal implications for Blur Coin users is crucial for ensuring compliance and minimizing risks. By staying informed about regulations and following legal requirements, users can contribute to the stability and positive development of Blur Coin in the long run.

What are the government regulations that impact the price of blur coin?

Government regulations such as restrictions on cryptocurrency trading, taxation policies, and the implementation of anti-money laundering measures can impact the price of blur coin.

How do government regulations on cryptocurrency trading affect the price of blur coin?

Government regulations on cryptocurrency trading can impact the price of blur coin by limiting the availability and liquidity of the coin, leading to decreased demand and ultimately lower prices.

What role do taxation policies play in impacting the price of blur coin?

Taxation policies can impact the price of blur coin by increasing the costs associated with holding or transacting in the coin. Higher taxes can reduce the attractiveness of blur coin as an investment or payment method, leading to lower demand and potentially lower prices.

How do anti-money laundering measures affect the price of blur coin?

Anti-money laundering measures, such as Know Your Customer (KYC) requirements and stricter regulations for cryptocurrency exchanges, can impact the price of blur coin by increasing the compliance costs for individuals and businesses transacting in the coin. These increased costs can reduce demand and put downward pressure on the price.

Are government regulations always negative for the price of blur coin?

No, government regulations can have both positive and negative impacts on the price of blur coin. While some regulations may introduce barriers and reduce demand, others may provide a framework for increased adoption and legitimacy, ultimately increasing demand and potentially driving up the price.

How do government regulations affect the price of blur coin?

Government regulations can have a significant impact on the price of blur coin. When a government imposes strict regulations or bans the use of cryptocurrencies, it can create uncertainty and fear among investors, leading to a decrease in demand and a drop in price. On the other hand, if a government adopts favorable regulations that promote the use of cryptocurrencies, it can generate confidence and attract more investors, resulting in an increase in demand and a rise in price.

Are there any specific examples of government regulations affecting the price of blur coin?

Yes, there have been several instances where government regulations have influenced the price of blur coin. For example, in 2017, when China banned initial coin offerings (ICOs) and cryptocurrency exchanges, the price of blur coin plummeted as investors feared the impact of the regulations. Conversely, in 2021, when El Salvador adopted Bitcoin as legal tender, it generated a positive sentiment among investors, leading to a surge in the price of blur coin and other cryptocurrencies.

Blur: NFT | Blur: NFT login | Blur: NFT connect | WalletConnect | Traders | What Is Blur Crypto

2022-2024 @ Analyzing the impact of government regulations on the price of blur coin