Comprehensive analysis reveals hidden patterns in cryptocurrency price fluctuations

Blur: NFT | Blur: NFT login | Blur: NFT connect | WalletConnect | Traders | What Is Blur Crypto

Blur: NFT | Blur: NFT login | Blur: NFT connect | WalletConnect | Traders | What Is Blur Crypto

Cryptocurrencies have experienced significant price fluctuations since their inception. While some argue that these fluctuations are random and unpredictable, others believe that hidden patterns can be found within the chaos. In this article, we will explore the concept of hidden patterns in crypto price fluctuations and provide a comprehensive analysis of the factors that influence them.

Hidden patterns in crypto price fluctuations refer to recurring trends or behaviors that are not immediately apparent to the casual observer. These patterns can be identified through careful analysis of historical price data and the consideration of various factors such as market sentiment, investor behavior, regulatory news, and technological developments.

By understanding these hidden patterns, traders and investors can gain valuable insights into the future direction of cryptocurrency prices. This knowledge can help them make more informed decisions, minimize risks, and potentially maximize profits.

This comprehensive analysis will delve into various aspects of crypto price fluctuations, including:

The role of market sentiment in shaping price movements

The impact of investor behavior on short-term and long-term price trends

The influence of regulatory news and government actions on cryptocurrency prices

The significance of technological advancements and innovations in shaping the crypto market

By examining these factors and their interplay, we aim to provide a deeper understanding of the hidden patterns in crypto price fluctuations. Whether you are a seasoned trader, a cryptocurrency enthusiast, or simply curious about the dynamics of the crypto market, this comprehensive analysis will offer valuable insights into the complexities of cryptocurrency price movements.

Understanding the Hidden Patterns in Crypto Price Fluctuations: A Comprehensive Analysis

The volatility of cryptocurrencies has fascinated researchers and investors alike. In an attempt to unravel the dynamics behind these price fluctuations, a comprehensive analysis is crucial. By understanding the hidden patterns, we can gain valuable insights into the crypto market.

Uncovering Historical Trends

One avenue to understand the hidden patterns is by analyzing historical data. By examining price movements over time, we can identify recurring trends and patterns that may provide clues about future fluctuations. This analysis requires the use of advanced statistical tools and algorithms to accurately capture the complexity of the crypto market.

For example, one observed pattern could be the occurrence of price spikes following major news events or market trends. By recognizing these patterns, investors can make informed decisions and potentially capitalize on these fluctuations.

The Role of Sentiment Analysis

Another factor that contributes to crypto price fluctuations is sentiment. The sentiment of investors and market participants can heavily influence the market. By employing sentiment analysis techniques, we can analyze social media posts, news articles, and other sources of information to gauge the overall sentiment towards a cryptocurrency.

For instance, if a significant number of positive posts and articles are published about a particular coin, it can create a bullish sentiment and potentially drive up prices. On the other hand, a flurry of negative sentiment can lead to a sell-off and a decrease in value.

Understanding the Relationship Between Cryptocurrencies

In addition to analyzing individual cryptocurrencies, it is essential to consider the relationships between different coins. Cryptocurrencies often exhibit interdependencies and correlations, meaning that the price movements of one coin can influence others.

By studying these relationships, we can uncover hidden patterns and better predict price fluctuations. For example, if there is a strong correlation between Bitcoin and Ethereum, a significant price movement in Bitcoin could indicate a potential movement in Ethereum as well.

By understanding these complex dynamics, investors can diversify their portfolios and make more informed investment decisions.

Conclusion

Understanding the hidden patterns in crypto price fluctuations requires a comprehensive analysis. By examining historical trends, utilizing sentiment analysis, and studying the relationships between cryptocurrencies, we can gain valuable insights into the market. With these insights, investors can make better-informed decisions and potentially capitalize on the unpredictable crypto market.

For more information on cryptocurrencies and the crypto market, you can visit BLUR.IO アカウントへのログイン方法. Stay informed and stay ahead in this fast-paced and ever-changing industry.

The Rise and Fall of Cryptocurrency Prices

Cryptocurrency has quickly captured the imagination of investors and traders around the world. The volatile nature of these digital assets has made them a popular choice for those seeking high-risk, high-reward opportunities. Understanding the patterns behind the rise and fall of cryptocurrency prices is crucial for anyone looking to navigate this fast-paced market.

One key factor that influences cryptocurrency prices is supply and demand. Unlike traditional currencies, cryptocurrencies have a limited supply, which creates a scarcity that can drive up prices. When demand outweighs supply, prices tend to rise. Conversely, when supply exceeds demand, prices will typically fall.

Market sentiment also plays a significant role in the price fluctuations of cryptocurrencies. News events, regulatory changes, and investor sentiment can all have a profound impact on the market. Positive news, such as the adoption of cryptocurrencies by major companies or the introduction of new technologies, often leads to price increases. Conversely, negative news, like regulatory crackdowns or security breaches, can cause prices to plummet.

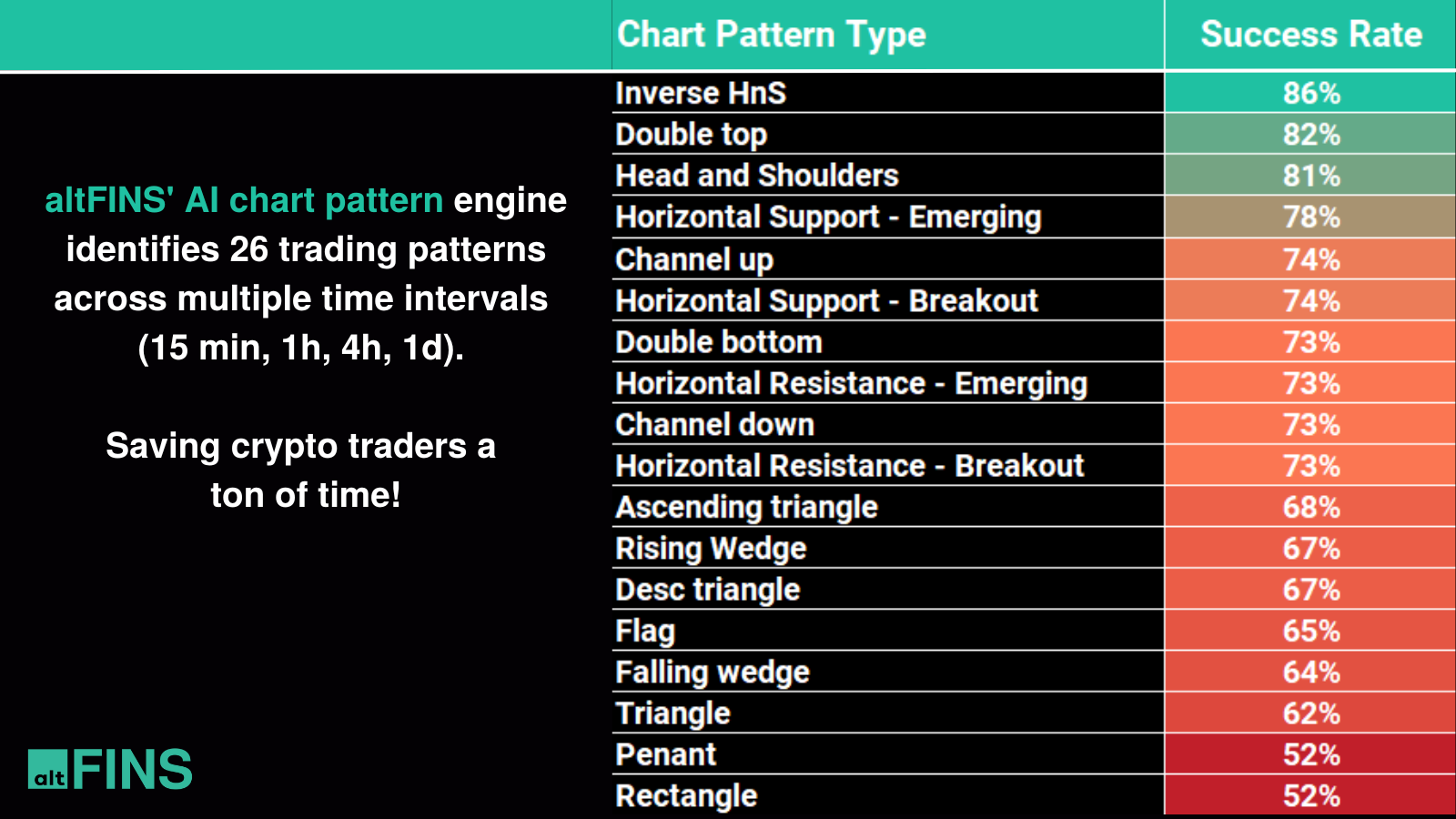

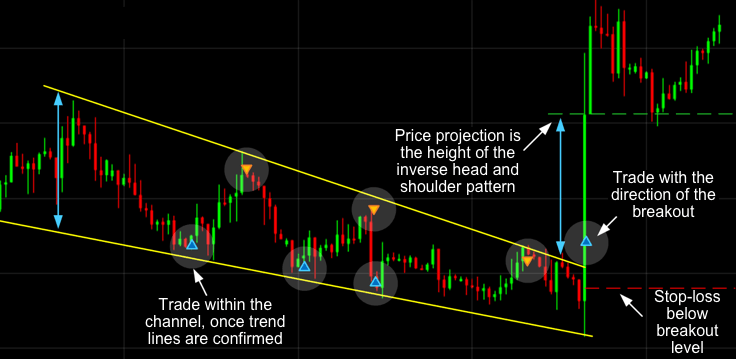

Technical analysis is another tool used to identify patterns in cryptocurrency price movements. Traders analyze historical price data, chart patterns, and indicators to make predictions about future price movements. Common technical analysis indicators include moving averages, relative strength index (RSI), and Bollinger Bands. These indicators can help traders identify trends, support and resistance levels, and potential buying or selling opportunities.

However, it's important to note that cryptocurrency markets are highly speculative and influenced by a variety of internal and external factors. In addition to supply and demand dynamics and market sentiment, other factors such as market manipulation, investor psychology, and global economic conditions can all contribute to price fluctuations.

To navigate the volatility of cryptocurrency markets, investors and traders must stay informed, conduct thorough research, and be prepared to adapt their strategies. Understanding the hidden patterns behind the rise and fall of cryptocurrency prices can help investors make more informed decisions and potentially capitalize on market opportunities.

Examining the factors affecting crypto price volatility

Cryptocurrency price volatility has been a constant topic of discussion among traders, investors, and enthusiasts. Understanding the factors that affect crypto price fluctuations can help market participants make better-informed decisions. In this section, we will examine some of the key factors that contribute to crypto price volatility.

1. Market Demand and Supply: Just like any other asset, the price of cryptocurrencies is influenced by the basic economic principle of supply and demand. When there is high demand for a particular cryptocurrency and the supply is limited, the price tends to increase. Conversely, when there is low demand and an excess supply, the price tends to decrease.

2. Regulatory Developments: Regulatory announcements and developments greatly impact the crypto market. Positive regulatory news, such as the recognition of cryptocurrencies by governments or the introduction of favorable regulations, can lead to an increase in demand and ultimately drive up prices. On the other hand, negative regulatory news can create uncertainty, resulting in decreased demand and price drops.

3. Market Sentiment: Crypto markets are heavily influenced by investor sentiment and emotions. Positive news, such as partnerships, new technological developments, or widespread adoption, can create optimism and drive up prices. Conversely, negative news like security breaches, hacks, or regulatory crackdowns can create fear and panic, leading to price drops.

4. Economic and Geopolitical Factors: Crypto prices can also be affected by broader economic and geopolitical factors. For example, during times of economic instability or political uncertainty, investors may flock to cryptocurrencies as a safe haven asset, driving up prices. Similarly, macroeconomic factors such as inflation, interest rates, and currency fluctuations can influence investor behavior and crypto prices.

5. Market Manipulation: The crypto market is known for its susceptibility to market manipulation. Activities such as pump and dump schemes, wash trading, and spoofing can artificially influence prices, leading to increased volatility. It is essential to be aware of these manipulative practices and their potential impact on crypto price movements.

Examining these factors and their interplay can provide valuable insights into understanding crypto price volatility. However, it's worth noting that the crypto market is highly complex and unpredictable, making it challenging to pinpoint specific factors that consistently drive price fluctuations. Therefore, it is crucial to conduct thorough research, analyze multiple variables, and stay updated with the latest news and trends to navigate the crypto market successfully.

For further exploration on the topic, you can check out Łączenie się z Blur.io: Odkrywanie funkcji i zalet Blur.io for discovering more about the functions and benefits of Blur.io.

Exploring the correlation between crypto prices and market sentiment

Understanding the correlation between crypto prices and market sentiment is essential for predicting price fluctuations and making informed investment decisions. Market sentiment refers to the overall attitude or feeling of investors towards a particular asset or market. It can be influenced by various factors such as news, social media discussions, economic indicators, and even investor psychology.

The Role of Market Sentiment in Crypto Prices

Market sentiment plays a crucial role in shaping crypto prices. Positive sentiment can drive prices higher as more investors are willing to buy, leading to increased demand and price appreciation. On the other hand, negative sentiment can lead to selling pressure, causing prices to decline.

One of the reasons why market sentiment matters in the crypto market is the relative absence of fundamental factors that usually drive traditional financial markets. Cryptocurrencies are primarily driven by speculation and investor sentiment, making it more sensitive to shifts in market sentiment.

Measuring Market Sentiment in the Crypto Market

There are various methods and indicators used to measure market sentiment in the crypto market. Some common approaches include:

Social Media Sentiment Analysis: Analyzing social media platforms like Twitter, Reddit, and Telegram to gauge the overall sentiment towards a particular cryptocurrency. This can be done by using natural language processing techniques to determine whether the sentiment is positive, negative, or neutral.

News Sentiment Analysis: Monitoring news articles and headlines related to cryptocurrencies to assess the sentiment of the news. Positive news may create bullish sentiment, while negative news can lead to bearish sentiment.

Blockchain Analytics: Tracking blockchain data such as transaction volume, on-chain activity, and whale movements to infer market sentiment. An increase in transaction volume or whale movements can indicate bullish sentiment, while a decrease may suggest bearish sentiment.

By combining these approaches and analyzing the data, it is possible to gain insights into market sentiment and its potential impact on crypto prices.

Overall, understanding the correlation between crypto prices and market sentiment is crucial for any crypto investor or trader. By keeping a close eye on market sentiment indicators, one can make more informed decisions and potentially capitalize on price fluctuations.

The impact of global events on cryptocurrency values

Cryptocurrency values are highly influenced by global events, such as economic developments, political decisions, and technological advancements. These events can have both positive and negative impacts on the value of cryptocurrencies, leading to significant price fluctuations.

One major event that can affect the value of cryptocurrencies is economic news. For example, when there is positive news about the global economy, investors may feel more confident and choose to invest in cryptocurrencies, leading to an increase in their value. On the other hand, negative economic news, such as a recession or a financial crisis, can lead investors to sell off their cryptocurrencies, causing a decrease in their value.

Political decisions also play an important role in shaping the value of cryptocurrencies. Government regulations and policies can have a significant impact on the adoption and acceptance of cryptocurrencies. For instance, when a government announces favorable regulations for cryptocurrencies, it can create a positive sentiment among investors and increase the value of cryptocurrencies. Conversely, if a government imposes strict regulations or bans cryptocurrencies altogether, it can lead to a drop in their value.

Technological advancements and innovations in the cryptocurrency space can also impact their value. For example, the introduction of a new feature or technology that enhances the security or scalability of a cryptocurrency can increase its value. Additionally, partnerships and collaborations between cryptocurrencies and established companies or institutions can create positive sentiment and result in an increase in their value.

Global events, such as natural disasters, geopolitical tensions, or major cybersecurity breaches, can also have an impact on cryptocurrency values. These events can create uncertainty and skepticism among investors, leading to a decrease in the value of cryptocurrencies as they are seen as risky assets.

In conclusion, the value of cryptocurrencies is influenced by a wide range of global events including economic news, political decisions, technological advancements, and unexpected events. Traders and investors in the cryptocurrency market need to stay informed about these events to make informed decisions and understand the potential impact on the value of cryptocurrencies.

Investigating the role of trading volume in price fluctuations

When it comes to understanding the intricate dynamics of cryptocurrency price fluctuations, one factor that cannot be overlooked is trading volume. Trading volume refers to the total number of shares or coins traded within a given period of time. In this section, we will delve into the significant role that trading volume plays in influencing price fluctuations in the crypto market.

The relationship between trading volume and price fluctuations

It is widely accepted that there exists a strong correlation between trading volume and price fluctuations in the cryptocurrency market. Higher trading volume indicates increased market activity and generally signifies the presence of active traders. When trading volume is high, it implies that there is a higher demand for a particular cryptocurrency, which can lead to an increase in its price.

Conversely, when trading volume is low, it suggests a lack of interest or trading activity in the market. This can result in lower prices as sellers may struggle to find buyers. In such situations, the market may experience higher price volatility and price fluctuations are more likely to occur.

The impact of trading volume on price trends

By analyzing the relationship between trading volume and price fluctuations, it is possible to identify certain patterns or trends. For example, a sudden increase in trading volume relative to historic averages can signal the beginning of a trend or a significant price movement. This can be particularly useful for traders who rely on technical analysis to make informed trading decisions.

In addition, monitoring trading volume can help identify when price trends are losing momentum or about to reverse. A decrease in trading volume may indicate that the market sentiment is shifting, leading to a potential change in price direction.

To gain a deeper understanding of the relationship between trading volume and price fluctuations, it is important to employ advanced analytical tools and techniques. By analyzing historical trading data and volume indicators, traders and analysts can gain valuable insights into the market's behavior and make more informed investment decisions.

Analyzing the Influence of Supply and Demand on Cryptocurrency Prices

Supply and demand play a crucial role in determining the price of cryptocurrencies. Understanding how these factors influence prices is essential for crypto investors and traders. Here, we delve into the intricacies of supply and demand dynamics in the crypto market.

Supply Factors

Max Supply: The maximum supply of a cryptocurrency impacts its price. Cryptocurrencies with limited supply tend to have a higher value due to scarcity.

Circulating Supply: The amount of a cryptocurrency available in the market affects its price. If the circulating supply is limited, the price tends to increase, while an excessive supply can lead to price depreciation.

Token Issuance: The rate at which new tokens are issued affects supply. Increased token issuance can lead to dilution of value and subsequent price drops, while a decreased issuance rate can exert upward pressure on prices.

Burn Events: Cryptocurrencies often have burn events where tokens are permanently removed from circulation. These events reduce supply and can contribute to price appreciation.

Demand Factors

Market Adoption: As more businesses and individuals embrace cryptocurrencies, demand increases. Increased demand usually leads to higher prices.

Investor Sentiment: Positive sentiment and growing interest from investors often drive up demand, pushing cryptocurrency prices higher. Conversely, negative sentiment can result in decreased demand and declining prices.

Regulatory Developments: Governments' stance towards cryptocurrencies influences demand. Favorable regulations often attract more users and investors, while strict regulations can dampen demand.

Technological Advancements: Innovations and advancements in blockchain technology can increase demand for cryptocurrencies. As new applications are developed, demand may surge, leading to price appreciation.

It's important to note that the interplay between supply and demand is complex, and various additional factors can impact cryptocurrency prices. Factors such as market liquidity, macroeconomic conditions, news events, and competition from other cryptocurrencies can also influence price fluctuations.

By analyzing and understanding the influence of supply and demand on cryptocurrency prices, investors and traders can make more informed decisions and develop effective trading strategies. It allows them to identify potential price trends and take advantage of profit opportunities in this volatile and ever-changing market.

Unveiling the hidden patterns in historical crypto price data

Understanding the historical price data of cryptocurrencies can provide valuable insights into the patterns that drive price fluctuations. By analyzing this data, researchers and investors can uncover hidden trends and make more informed decisions regarding buying and selling crypto assets.

One of the main things to consider when examining historical crypto price data is the overall market trend. By looking at long-term price charts, we can identify whether a particular cryptocurrency has been in a bull or bear market. This can help us understand how the price of a cryptocurrency may have been influenced by market conditions.

In addition to the overall market trend, it is important to look for specific patterns that may emerge in the price data. For example, some cryptocurrencies may experience frequent price cycles, where the price goes through periods of growth followed by periods of consolidation or decline. By identifying these cycles, we can potentially predict when a cryptocurrency is likely to experience a price increase or decrease.

Another important factor to consider when analyzing historical price data is the impact of external events on cryptocurrency prices. News events, regulatory changes, and market sentiment can all influence the price of a cryptocurrency. By examining the price data in the context of these events, we can gain a better understanding of how external factors may have affected price fluctuations.

When examining historical price data, it is also important to consider the volume of trading activity. Higher trading volumes can indicate increased market interest and can potentially lead to more significant price movements. By analyzing the relationship between price and trading volumes, we can gain insights into the strength of price trends and potential market reversals.

In conclusion, analyzing historical price data of cryptocurrencies can uncover hidden patterns and provide valuable insights into market trends. By understanding these patterns, investors and researchers can make more informed decisions and potentially benefit from price fluctuations in the crypto market.

Understanding the Relationship between Crypto Price Fluctuations and Investor Behavior

In the world of cryptocurrency, price fluctuations are a common occurrence. These fluctuations can often be attributed to changes in investor behavior. Understanding the relationship between crypto price fluctuations and investor behavior is crucial for both cryptocurrency traders and researchers seeking to gain insights into market trends.

1. Market Sentiment

One important aspect of investor behavior to consider is market sentiment. The sentiment of market participants can have a significant impact on the direction and intensity of price movements. Positive sentiment, for example, can drive prices higher as more investors buy into a particular cryptocurrency. On the other hand, negative sentiment can lead to a sell-off and subsequent price decline.

2. Trading Volume

The trading volume of a cryptocurrency can also provide valuable insights into investor behavior. Higher trading volume often indicates increased investor interest and can lead to significant price movements. Conversely, low trading volume may suggest a lack of interest or confidence, potentially resulting in more stable price levels.

Additionally, analyzing trading volume patterns, such as spikes or sudden increases, can help identify trends or market manipulation. For instance, a sudden surge in trading volume might indicate the presence of large-scale buyers or sellers influencing the market.

3. Fear and Greed

Fear and greed are two psychological factors that can strongly influence investor behavior in the cryptocurrency market. When investors are driven by fear, they tend to sell their holdings, leading to price declines. Conversely, when investors are driven by greed, they may rush to buy cryptocurrencies, causing prices to rise rapidly.

Monitoring indicators such as the Fear and Greed Index can provide insights into the prevailing investor sentiment and help predict potential price movements. Understanding these emotional factors can assist traders in making more informed decisions.

Conclusion

The relationship between crypto price fluctuations and investor behavior is complex and multifaceted. Factors such as market sentiment, trading volume, fear, and greed all play critical roles in shaping price movements. By examining these factors and analyzing patterns, researchers and traders can gain a deeper understanding of market dynamics and potentially anticipate future price fluctuations.

Identifying the driving forces behind sudden price surges in cryptocurrencies

Sudden price surges in cryptocurrencies are a common phenomenon that can have a significant impact on the market. Understanding the driving forces behind these surges is crucial for investors, traders, and researchers alike. In this section, we will explore some of the key factors that contribute to sudden price surges in cryptocurrencies.

Market Sentiment: Changes in market sentiment can play a crucial role in driving cryptocurrency prices. News, social media trends, and investor sentiment can all influence the perception of a cryptocurrency, leading to sudden surges in demand and subsequent price increases.

Market Manipulation: Cryptocurrency markets are vulnerable to manipulation due to their relatively low liquidity. Large investors or groups can influence prices through coordinated buying or selling, creating artificial demand or supply and causing sudden price spikes.

Regulatory Developments: News or announcements related to regulatory issues can strongly impact cryptocurrency prices. Changes in government regulations, legislation, or the legal status of cryptocurrencies can create uncertainty or confidence in the market, leading to sudden price movements.

Technological Advancements: Innovations and advancements in blockchain technology or cryptocurrency projects can drive prices up. Positive developments such as partnerships, new product releases, or protocol upgrades can generate excitement and attract new investors, resulting in sudden price surges.

Integration with Traditional Financial Markets: Increased acceptance and integration of cryptocurrencies into traditional financial systems can boost investor confidence and trigger sudden price increases. Factors such as the listing of cryptocurrencies on major exchanges, the launch of cryptocurrency-based financial products, or the involvement of institutional investors can all contribute to these surges.

While it is challenging to pinpoint the exact driving forces behind sudden price surges in cryptocurrencies, a combination of market sentiment, market manipulation, regulatory developments, technological advancements, and integration with traditional financial markets seem to be the key contributing factors. By understanding these factors and keeping a close eye on market dynamics, investors and traders can better anticipate and respond to sudden price movements.

The role of technical analysis in predicting crypto price movements

When it comes to predicting crypto price movements, one of the most widely used tools by traders and investors is technical analysis. Technical analysis is the study of historical price and volume data to identify patterns and trends that can help forecast future price movements.

Understanding market psychology:

Technical analysis takes into account the idea that price movements are not random, but rather influenced by market psychology and human behavior. By analyzing historical price patterns, technical analysts aim to gain insights into the market's collective behavior and sentiment.

Identifying support and resistance levels:

Technical analysis also involves identifying support and resistance levels. Support levels are price levels at which demand is expected to be strong enough to prevent the price from falling further, while resistance levels are price levels at which supply is expected to be strong enough to prevent the price from rising further. These levels can serve as potential entry and exit points for traders.

Spotting chart patterns:

Another important aspect of technical analysis is the identification of chart patterns. Chart patterns, such as triangles, head and shoulders, and double tops, can provide clues about potential price reversals or continuations. Traders use these patterns to make informed decisions about when to buy or sell a particular cryptocurrency.

Using technical indicators:

Technical analysts also utilize various technical indicators, such as moving averages, relative strength index (RSI), and Bollinger Bands, to further analyze price data. These indicators can help identify overbought or oversold conditions, as well as provide signals for potential trend reversals.

Limitations of technical analysis:

While technical analysis can be a valuable tool in predicting crypto price movements, it is important to note its limitations. Technical analysis is based on historical data and is therefore backward-looking. It cannot take into account unforeseen events or fundamental factors that may significantly impact the market. Additionally, technical analysis is subjective and open to interpretation, which can introduce bias and lead to erroneous predictions.

The importance of combining technical analysis with fundamental analysis

It is important for traders and investors to not solely rely on technical analysis when predicting crypto price movements. Fundamental analysis, which involves evaluating the underlying factors that drive the value of a cryptocurrency, is also crucial. Combining both technical and fundamental analysis can provide a more comprehensive understanding of market trends and increase the accuracy of price predictions.

Conclusion

Technical analysis plays a significant role in predicting crypto price movements by analyzing historical price patterns, identifying support and resistance levels, spotting chart patterns, and utilizing technical indicators. However, it is important to recognize the limitations of technical analysis and consider other factors, such as fundamental analysis, to make informed investment decisions.

The impact of regulatory decisions on cryptocurrency values

Regulatory decisions have a significant impact on the values of cryptocurrencies. As governments and regulatory bodies around the world continue to grapple with how to handle the rapidly evolving landscape of digital currencies, their decisions can have both positive and negative effects on the market.

Positive effects

In some cases, positive regulatory decisions can lead to an increase in cryptocurrency values. For example, when a government or regulatory body provides clarity on the legal status of cryptocurrencies and establishes clear guidelines for their use, investor confidence can be boosted. This may attract more participants to the market, driving up demand and subsequently increasing prices.

Additionally, regulatory decisions that aim to protect investors from fraud and other malicious activities can also have a positive impact on cryptocurrency values. When investors feel more secure in their transactions and holdings, they may be more willing to invest larger sums of money, which can drive up the prices of cryptocurrencies.

Negative effects

On the other hand, negative regulatory decisions can lead to a decline in cryptocurrency values. For instance, if a government implements strict regulations or bans the use of cryptocurrencies altogether, this can create uncertainty and fear among investors. The lack of a clear legal framework may lead to decreased demand and liquidity in the market, causing prices to fall.

Moreover, regulatory actions that are perceived as overly burdensome or restrictive can discourage innovation and limit the growth of the cryptocurrency industry. This can have a long-term negative impact on the values of cryptocurrencies as they may struggle to gain widespread adoption and acceptance.

Increased investor confidence

Uncertainty and fear among investors

Higher demand and prices

Decreased demand and liquidity

Protection from fraud and malicious activities

Discouragement of innovation

In conclusion, regulatory decisions can have a significant impact on the values of cryptocurrencies. Positive decisions can boost investor confidence and demand, leading to higher prices. Conversely, negative decisions can create uncertainty and hinder growth, causing prices to decline. As the cryptocurrency market continues to evolve, it is essential for governments and regulatory bodies to find a balance that fosters innovation while also ensuring investor protection.

Examining the effect of media coverage on crypto price fluctuations

The cryptocurrency market is highly influenced by various factors, and one significant factor is media coverage. The way the media portrays cryptocurrencies can have a substantial impact on their prices and overall market sentiment. In this section, we will examine the effect of media coverage on crypto price fluctuations.

Media coverage plays a vital role in shaping public opinion and influencing investor behavior. Positive news articles, interviews, or endorsements from influential figures can increase investors' confidence and attract new participants. As a result, the demand for cryptocurrencies can surge, leading to price increases.

On the other hand, negative news or critical reports can have adverse effects on crypto prices. FUD (Fear, Uncertainty, and Doubt) can quickly spread through media channels, causing panic-selling and market downturns. Moreover, regulatory news, government policies, or security breaches can significantly impact the valuation of cryptocurrencies.

It is essential to analyze media coverage quantitatively to understand the relationship between news sentiment and crypto price movements. Researchers have developed sentiment analysis tools and algorithms to measure the overall sentiment of news articles. By categorizing news sentiment as positive, negative, or neutral, it becomes possible to assess the impact of media coverage on crypto price fluctuations.

Additionally, media channels might contribute to the creation of market trends and speculative behavior. Intense coverage of certain cryptocurrencies can create hype and induce investors to buy or sell based on the perceived market sentiment. This "herd behavior" phenomenon can amplify price movements and increase market volatility.

Some studies have explored the correlation between media coverage and crypto price movements. They found that media sentiment has a statistically significant relationship with short-term price changes. However, it is important to note that causality is difficult to establish, as media coverage can also reflect market dynamics.

Overall, media coverage plays a crucial role in shaping perceptions and emotions related to cryptocurrencies. Understanding the influence of media sentiment on price fluctuations can provide valuable insights for investors and traders seeking to navigate the volatile cryptocurrency market successfully.

Leveraging data analytics to uncover hidden trends in crypto price data

The world of cryptocurrency is a dynamic and volatile market that experiences constant price fluctuations. These price changes can be attributed to various factors such as market sentiment, investor behavior, and global economic conditions.

However, understanding the underlying patterns in crypto price data can provide valuable insights for traders and investors. By leveraging data analytics techniques, it is possible to uncover hidden trends and gain a deeper understanding of the crypto market.

Data analytics enables us to analyze vast amounts of historical price data and identify patterns that are not immediately apparent to the naked eye. By using statistical models, machine learning algorithms, and visualization tools, we can extract meaningful insights from the data and make more informed decisions.

One approach to uncovering hidden trends is to identify recurring patterns and cycles in the price data. For example, by applying time series analysis techniques, we can identify seasonal fluctuations and trends that repeat at regular intervals. This knowledge can help traders anticipate market movements and optimize their trading strategies.

Another strategy is to analyze the correlation between different cryptocurrencies and external factors such as news sentiment or macroeconomic indicators. By identifying significant correlations, we can gain a better understanding of how various factors influence crypto prices and potentially predict future price movements.

Data analytics also enables us to conduct sentiment analysis by analyzing social media feeds, news articles, and other sources of information. By applying natural language processing techniques, we can gauge the overall sentiment towards specific cryptocurrencies and detect any emerging trends or sentiment shifts that may impact prices.

Overall, leveraging data analytics provides a powerful toolkit for uncovering hidden trends and patterns in crypto price data. By harnessing the power of statistical analysis, machine learning, and sentiment analysis, traders and investors can gain a competitive edge in the crypto market and make more informed decisions.

Disclaimer: Trading cryptocurrencies involves risk and may not be suitable for all investors. The information provided in this article is for informational purposes only and should not be considered as financial or investment advice.

The Future of Crypto Price Analysis: Advancements and Potential Challenges

In recent years, the field of crypto price analysis has witnessed significant advancements, driven by the rapid development of technology and the growing interest in the cryptocurrency market. As we look ahead, it is crucial to explore the potential advancements and challenges that lie ahead in order to better understand the future of crypto price analysis.

Advancements

1. Machine Learning and Artificial Intelligence: The application of machine learning and artificial intelligence algorithms has revolutionized the field of crypto price analysis. These technologies enable experts to analyze vast amounts of data and identify hidden patterns that might not be apparent to human observers. As machine learning and AI continue to evolve, we can expect even more accurate and efficient crypto price analysis tools.

2. Big Data: The availability of big data has provided researchers and analysts with a wealth of information to perform in-depth analysis of crypto price trends. By analyzing historical data, market trends, social media sentiments, and other relevant factors, experts can identify potential price patterns and make more informed predictions about the future movements of cryptocurrencies.

3. Data Visualization: Effective visualization of complex data sets has become crucial in the field of crypto price analysis. The use of interactive charts, graphs, and other visual tools makes it easier for analysts to spot trends and anomalies in price fluctuations. With advancements in data visualization techniques, we can expect more user-friendly and visually appealing tools for crypto price analysis.

Potential Challenges

1. Regulatory Uncertainty: The crypto market operates in a regulatory grey area in many jurisdictions. The lack of clear regulations can create uncertainty and volatility in the market, making it challenging for analysts to predict price movements accurately. As governments and regulatory bodies continue to develop frameworks for cryptocurrencies, it will be important for analysts to adapt their methodologies accordingly.

2. Data Quality: The quality and reliability of data are essential for accurate price analysis. However, the crypto market is highly volatile, and data sources may be subject to manipulation or inaccuracies. Ensuring the integrity of data used for analysis poses a significant challenge for crypto price analysts, and efforts must be made to validate and verify data from multiple sources.

3. Market Manipulation: The crypto market is susceptible to manipulation by influential actors, known as "whales," who have significant holdings of cryptocurrencies. These whales can influence prices by strategically buying or selling large volumes of cryptocurrencies. Detecting and accounting for market manipulation is a complex task for crypto price analysts and requires advanced tools and methodologies.

In conclusion, the future of crypto price analysis holds great promise with the advancements in machine learning, big data, and data visualization. However, it also presents potential challenges related to regulatory uncertainty, data quality, and market manipulation. By staying updated with the latest technological advancements and addressing these challenges, analysts can continue to improve their understanding of crypto price fluctuations and make more accurate predictions.

What is the purpose of the article "Understanding the hidden patterns in crypto price fluctuations a comprehensive analysis"?

The purpose of the article is to provide a comprehensive analysis of the hidden patterns in crypto price fluctuations.

What are some of the key findings mentioned in the article?

Some of the key findings mentioned in the article include the existence of hidden patterns in crypto price fluctuations, the impact of market sentiment on price movements, and the importance of technical analysis in predicting price trends.

How does market sentiment affect crypto price fluctuations?

Market sentiment plays a significant role in crypto price fluctuations. Positive sentiment can lead to price increases as more people buy into the market, while negative sentiment can cause prices to drop as people sell off their holdings.

What role does technical analysis play in understanding crypto price fluctuations?

Technical analysis is essential in understanding crypto price fluctuations as it allows traders to analyze historical price data, identify patterns, and make informed decisions based on market trends. It helps to predict future price movements and determine potential entry and exit points.

What are some of the challenges mentioned in analyzing crypto price patterns?

Some of the challenges mentioned in analyzing crypto price patterns include the high volatility of the market, the influence of market manipulation, and the difficulty in accurately predicting price movements due to numerous factors that impact the market.

What is the main purpose of the comprehensive analysis?

The main purpose of the comprehensive analysis is to understand the hidden patterns in crypto price fluctuations.

Why is it important to understand the hidden patterns in crypto price fluctuations?

Understanding the hidden patterns in crypto price fluctuations is important because it allows investors and traders to make informed decisions about buying and selling cryptocurrencies. It can help identify potential trends and predict future price movements.

What methods are used in the comprehensive analysis?

The comprehensive analysis utilizes various methods such as statistical analysis, data mining, and machine learning algorithms. These methods are applied to historical price data and other relevant factors to identify patterns and trends.

Can the comprehensive analysis accurately predict crypto price fluctuations?

The comprehensive analysis can provide insights and predictions on crypto price fluctuations, but it is important to note that the cryptocurrency market is highly volatile and unpredictable. While the analysis may identify patterns and trends, there is always a certain level of uncertainty and risk involved in cryptocurrency investments.

Blur: NFT | Blur: NFT login | Blur: NFT connect | WalletConnect | Traders | What Is Blur Crypto

2022-2024 @ Understanding the hidden patterns in crypto price fluctuations a comprehensive analysis