An in-depth analysis of the various factors that influence the price fluctuations of Blur Coin.

Blur: NFT | Blur: NFT login | Blur: NFT connect | WalletConnect | Traders | What Is Blur Crypto

Blur: NFT | Blur: NFT login | Blur: NFT connect | WalletConnect | Traders | What Is Blur Crypto

Blur coin, a popular cryptocurrency, has experienced significant price fluctuations in recent years. Understanding the factors that contribute to these fluctuations is crucial for investors and traders alike. In this comprehensive analysis, we will delve into the various factors that influence the price of blur coin and shed light on why it is a highly volatile asset in the cryptocurrency market.

One of the primary factors that affect the price of blur coin is market demand. Like any other asset, the price of blur coin is determined by the forces of supply and demand. When there is a high demand for blur coin, its price tends to increase, and vice versa. Factors such as increased adoption, positive market sentiment, and favorable regulations can all contribute to increased demand and, consequently, higher prices.

Another influential factor is the overall market sentiment towards cryptocurrencies. As the cryptocurrency market is highly speculative, even news related to other cryptocurrencies can impact the price of blur coin. For example, if there is negative news about the security or regulation of cryptocurrencies in general, it can create a sense of fear and uncertainty among investors, leading to a decrease in the price of blur coin.

In addition to market demand and overall market sentiment, technological advancements and updates also play a role in price fluctuations. Blur coin, like other cryptocurrencies, is built on blockchain technology, and any updates or improvements to this technology can impact the price. If there are significant advancements in blockchain technology that enhance the security, scalability, or functionality of blur coin, it can lead to increased investor confidence and, subsequently, a rise in price.

Lastly, external factors such as economic conditions, geopolitical events, and government regulations can affect the price of blur coin. For example, if a country were to announce strict regulations or bans on cryptocurrencies, it could lead to a decrease in demand and a subsequent drop in price. Similarly, economic recessions or political instability can impact investor sentiment and result in price fluctuations.

In conclusion, the price fluctuations of blur coin are influenced by a multitude of factors, ranging from market demand and overall market sentiment to technological advancements and external events. While it remains a highly volatile asset, understanding these factors can help investors make more informed decisions and navigate the cryptocurrency market with greater confidence.

Factors Affecting Price Fluctuations of Blur Coin

Price fluctuations in the cryptocurrency market are driven by various factors, and Blur Coin is no exception. Understanding these factors is crucial for investors and traders looking to analyze and predict price movements. In this article, we will explore some of the key factors that contribute to the price fluctuations of Blur Coin.

1. Market Demand and Adoption

The demand for Blur Coin is a significant factor that affects its price. If there is a high demand from investors and users, the price of Blur Coin is likely to increase. On the other hand, if the demand decreases, the price may decline. Factors influencing demand include utility, network effects, and market sentiment.

The adoption of Blur Coin in real-world applications and industries also plays a role in its price fluctuations. Increased adoption can lead to a surge in demand, driving up the price. Conversely, slow adoption or lack of real-world use cases may negatively impact the price.

2. Market Liquidity and Trading Volume

Liquidity refers to the ease of buying or selling Blur Coin on the market. Higher liquidity generally leads to less price volatility, as there are more buyers and sellers readily available. Conversely, low liquidity can result in larger price fluctuations.

Trading volume, or the total amount of Blur Coins traded within a specific period, is another important factor. Higher trading volumes indicate increased market activity and may contribute to price volatility. Traders should pay attention to both liquidity and trading volume when analyzing price trends.

3. Regulatory Environment

The regulatory environment can have a significant impact on the price of Blur Coin. Government regulations, policies, and legal frameworks can influence its adoption, market acceptance, and overall perception among investors.

Positive regulatory developments, such as the recognition of Blur Coin as a legal currency or the establishment of clear guidelines, can boost market confidence and potentially drive up the price. Conversely, negative regulatory actions or uncertainty may lead to price decreases or instability.

Overall, the price fluctuations of Blur Coin are influenced by a combination of market demand, adoption, liquidity, trading volume, and the regulatory environment. Traders and investors should carefully monitor these factors and conduct comprehensive analysis to make informed decisions in the volatile cryptocurrency market.

Market Demand Analysis

The market demand for Blur Coin plays a significant role in determining its price fluctuations. The demand for Blur Coin is influenced by various factors, including its utility, popularity, and investor sentiment.

One of the main drivers of market demand for Blur Coin is its utility within the Blur raders platform. Blur raders is a decentralized marketplace for buying and selling Blur Coin and other digital assets. The platform allows users to trade Blur Coin for various purposes, including participating in NFT (non-fungible token) sales, collecting rare digital artworks, and investing in digital assets. The increasing popularity and adoption of Blur raders have created a growing demand for Blur Coin, which positively impacts its price.

Another factor that influences market demand is the overall popularity of Blur Coin. The perception of Blur Coin as a valuable and innovative cryptocurrency attracts investors and enthusiasts, leading to increased demand. Additionally, the limited supply of Blur Coin, with a maximum of 35,000,000 coins, enhances its scarcity and contributes to its desirability.

Investor sentiment also plays a crucial role in determining market demand for Blur Coin. Positive news, such as new partnerships, development updates, or regulatory support, can create a positive sentiment among investors, leading to increased demand. On the other hand, negative news or perceived risks can negatively affect market demand and result in price declines.

In conclusion, market demand for Blur Coin is influenced by its utility within the Blur raders platform, its popularity, and investor sentiment. Analyzing these factors can provide insights into the potential future price fluctuations of Blur Coin.

Supply and Mining Difficulty

The supply of a cryptocurrency like Blur Coin plays a significant role in its price fluctuations. It refers to the total number of coins that are available in the market or in circulation. When the supply of Blur Coin is low, it can lead to an increase in its price, as the demand for the limited number of coins increases. Conversely, when the supply of Blur Coin is high, it can lead to a decrease in its price, as there is more supply than demand.

In addition to supply, mining difficulty also affects the price fluctuations of Blur Coin. Mining difficulty refers to the level of computational effort required to mine new coins. The mining difficulty is adjusted periodically to ensure that new coins are not mined too quickly or too slowly. If the mining difficulty is high, it means that it is more challenging to mine new coins, which can affect the supply of Blur Coin.

When the mining difficulty is high, it may discourage miners from participating in the process, resulting in a slower rate of new coin creation. This can lead to a decrease in the supply of Blur Coin, as fewer coins enter the market. On the other hand, when the mining difficulty is low, it may attract more miners, resulting in a faster rate of new coin creation and an increase in the supply of Blur Coin.

Therefore, to understand the price fluctuations of Blur Coin, it is crucial to monitor both the supply of coins in circulation and the mining difficulty. These factors can provide valuable insights into the overall market dynamics and help investors make informed decisions.

Investor Sentiment and Market Hype

Investor sentiment and market hype play a crucial role in determining the price fluctuations of Blur Coin. These factors are influenced by the perception and emotions of investors, as well as the overall market sentiment towards Blur Coin.

When positive sentiment and hype surround Blur Coin, investors tend to become more optimistic and enthusiastic about its potential. This can lead to increased demand and buying pressure, causing the price of Blur Coin to rise. In such cases, investors perceive Blur Coin as a valuable investment opportunity and believe that its value will continue to grow in the future.

On the other hand, negative sentiment and hype can lead to a decrease in demand and selling pressure for Blur Coin. This can result in a decline in its price. When investors perceive Blur Coin as a risky investment or believe that its value may decrease in the future, they may decide to sell their holdings, contributing to a downward price movement.

Market hype also plays a significant role in the price fluctuations of Blur Coin. Hype can be generated through various means, such as media coverage, social media influencers, or promotional activities. When Blur Coin receives significant attention and hype, it can attract more investors who want to benefit from the perceived value increase. This increased demand can drive up the price of Blur Coin.

However, it is important to note that investor sentiment and market hype are subjective and can be influenced by various factors, including news events, technological developments, regulatory changes, and overall market conditions. Therefore, it is crucial for investors to carefully analyze and evaluate these factors before making investment decisions related to Blur Coin.

In conclusion, investor sentiment and market hype are significant factors that affect the price fluctuations of Blur Coin. Positive sentiment and hype can increase demand and drive up the price, while negative sentiment and hype can decrease demand and lead to a decline in price. Understanding and monitoring investor sentiment and market hype are essential for investors who want to navigate the volatile cryptocurrency market effectively.

Economic News and Events

Economic news and events play a significant role in influencing the price fluctuations of Blur Coin. Investors and traders closely monitor economic indicators and events to make informed decisions about buying or selling cryptocurrencies. Here are some key economic news and events that can impact the price of Blur Coin:

1. Monetary Policy Changes

The decisions made by central banks regarding monetary policy have a direct impact on the price of Blur Coin. In particular, changes in interest rates and the introduction of new economic stimulus measures can affect the demand for cryptocurrencies and consequently their prices.

2. Macroeconomic Indicators

Macroeconomic indicators, such as gross domestic product (GDP), inflation rates, and employment figures, provide valuable insights into the overall health of an economy. Positive economic data can lead to increased investor confidence and a higher demand for cryptocurrencies, pushing up their prices.

Gross Domestic Product (GDP)

A higher GDP indicates a strong economy, which can lead to increased demand for cryptocurrencies and higher prices.

Inflation Rates

Higher inflation rates can erode the purchasing power of traditional currencies, leading investors to seek out alternative stores of value such as cryptocurrencies.

Employment Figures

Positive employment figures indicate a healthy job market, which can boost consumer spending and overall economic activity, potentially driving up the price of cryptocurrencies.

It's important for cryptocurrency traders and investors to stay updated on economic news and events as they can have a significant impact on the price fluctuations of Blur Coin.

Cryptocurrency Regulations

The regulations surrounding cryptocurrencies play a significant role in the price fluctuations of Blue Coin. As a decentralized and digital currency, Blue Coin is subject to various regulatory measures imposed by governments and financial institutions.

1. Legal Status:

The legal status of cryptocurrencies varies across different countries and regions. Some countries have fully embraced cryptocurrencies and have enacted clear regulations, while others have banned or imposed strict restrictions on them. The legal status directly impacts the adoption and use of Blue Coin, which in turn affects its demand and price.

2. Government Policies:

Government policies and interventions can greatly influence the price of Blue Coin. Governments can regulate cryptocurrencies through taxation, anti-money laundering (AML) policies, and Know Your Customer (KYC) regulations. Additionally, governments can also influence the market sentiment towards Blue Coin through public statements and official announcements.

3. Market Surveillance:

Regulators have the ability to monitor and surveil cryptocurrency markets to detect potential market manipulation and fraud. Instances of market manipulation can lead to drastic price fluctuations, as seen in the case of previous cryptocurrency scams. Increased market surveillance can enhance market stability and investor confidence in Blue Coin.

4. Exchange Regulations:

The regulation of cryptocurrency exchanges can have a significant impact on the price of Blue Coin. Regulations regarding exchanges involve licensing requirements, security standards, and anti-money laundering measures. Stringent regulations on exchanges can limit the trading volume and liquidity of Blue Coin, affecting its price.

5. International Cooperation:

Cryptocurrencies operate on a global scale, and international cooperation among countries is essential in regulating this new asset class. Collaboration between countries in sharing information and coordinating regulatory efforts can help establish a cohesive framework for Blue Coin's regulation, ensuring a more stable and predictable market.

In conclusion, the regulations surrounding cryptocurrencies have a profound impact on the price fluctuations of Blue Coin. Legal status, government policies, market surveillance, exchange regulations, and international cooperation all contribute to shaping the market dynamics and investor sentiment towards Blue Coin.

Trading Volume and Liquidity

The trading volume and liquidity of Blur Coin are important factors that can significantly affect its price fluctuations in the market.

The trading volume refers to the total number of Blur Coin units that are traded on various cryptocurrency exchanges within a given period. High trading volume indicates a higher level of market activity and interest in Blur Coin, while low trading volume suggests a lack of interest or limited availability of Blur Coin.

Liquidity, on the other hand, refers to the ease with which Blur Coin can be bought or sold without significantly impacting its price. A higher liquidity indicates a larger number of buyers and sellers in the market, resulting in lower price spreads and higher trading volumes. Lower liquidity, on the other hand, can make it difficult to buy or sell Blur Coin without significantly affecting its price.

To analyze the relationship between trading volume, liquidity, and price fluctuations of Blur Coin, we can look at historical data and market trends. By comparing the trading volume and liquidity levels during periods of high price fluctuations with those during periods of relative price stability, we can identify any correlations or patterns.

Impact of Trading Volume and Liquidity on Price Fluctuations

The trading volume and liquidity of Blur Coin can have a significant impact on its price fluctuations. Higher trading volume and liquidity can provide more price stability by ensuring that there are enough buyers and sellers in the market. This can help prevent drastic price movements caused by large buy or sell orders.

In contrast, lower trading volume and liquidity can increase the likelihood of price manipulation and volatility. A relatively small number of buyers or sellers can have a larger impact on the price due to low market activity. This can lead to larger price spreads and more significant price fluctuations.

Furthermore, low liquidity can make it difficult to execute large buy or sell orders without significantly impacting the price. This can result in slippage, where the actual execution price differs from the expected price, which can be particularly problematic for large orders or institutional investors.

Data Analysis and Conclusion

By analyzing the trading volume and liquidity data of Blur Coin in relation to its price fluctuations, we can gain insights into the market dynamics and the factors influencing price movements. This analysis can help investors and traders make informed decisions based on the current market conditions and future price predictions.

Overall, trading volume and liquidity play crucial roles in determining the price fluctuations of Blur Coin. Higher trading volume and liquidity can provide more price stability, while lower trading volume and liquidity can increase the likelihood of price manipulation and volatility. Therefore, it is essential to monitor these factors closely when evaluating the trading potential of Blur Coin.

Market Speculation and Manipulation

Market speculation and manipulation play a significant role in the price fluctuations of Blur Coin. Speculation refers to the act of buying or selling Blur Coin based on anticipated future price movements rather than its intrinsic value. Market participants often speculate on the potential growth of Blur Coin, leading to increased buying or selling activity.

Speculative activities can influence the price of Blur Coin in several ways:

1. Demand and Supply Dynamics

Market speculation on Blur Coin can create artificial demand or supply, influencing market dynamics. For instance, if speculators anticipate a surge in Blur Coin's value, they may buy large quantities of the coin, creating increased demand and potentially driving up the price. Conversely, if speculators expect a decline in Blur Coin's price, they may sell masses of the coin, leading to an oversupply and potential price decrease.

2. Herd Mentality

Market speculation often leads to a herd mentality among investors and traders. When speculators notice a trend of increasing Blur Coin prices, they may fear missing out on potential gains and join the buying frenzy. This collective behavior can create price bubbles or spikes, commonly followed by a rapid price correction when the speculative demand fades.

3. Insider Trading

Market manipulation can also occur through insider trading, where individuals or groups have access to non-public information that can influence Blur Coin's price. Such information asymmetry allows them to profit from trading ahead of public announcements or events that may affect the coin's value. Insider trading is illegal and can distort market prices, impacting investors' confidence.

It is essential to recognize the role of market speculation and manipulation when analyzing price fluctuations in Blur Coin. Understanding these factors can help investors make informed decisions and navigate the volatile cryptocurrency market.

Technology Updates and Development

In the rapidly evolving world of cryptocurrencies, technology plays a crucial role in determining the price fluctuations of blur coin. As new technologies are developed and implemented, they have a direct impact on the value of this digital asset. This section explores some of the latest technological updates and developments that have influenced the price of blur coin.

1. Blockchain Technology: The underlying technology behind blur coin is blockchain, which is a decentralized ledger system that ensures transparency and security in transactions. Any updates or advancements in blockchain technology can significantly affect blur coin's price. For example, the emergence of scalable and energy-efficient blockchains can lead to increased adoption and demand for blur coin.

2. Smart Contracts: Smart contracts are self-executing contracts with the terms of the agreement directly written into code. Blur coin utilizes smart contracts to facilitate secure and automated transactions. Any improvements or upgrades in smart contract technology can enhance the functionality and value proposition of blur coin, thereby impacting its price.

3. Privacy Enhancements: Blur coin focuses on providing enhanced privacy features to its users, allowing for anonymous and untraceable transactions. Ongoing developments in privacy-enhancing technologies, such as zero-knowledge proofs and ring signatures, can make blur coin even more attractive to privacy-conscious individuals, leading to increased demand and price appreciation.

4. Integration with Other Technologies: Blur coin's compatibility and integration with other technologies can also influence its price. For instance, if blur coin can be seamlessly integrated into widely used platforms or applications, it may lead to increased adoption and demand for the cryptocurrency, ultimately affecting its price.

5. Security Measures: With the increasing threat of cyber attacks and hacking attempts, security measures are of utmost importance for cryptocurrencies like blur coin. Any improvements or advancements in security protocols can instill confidence among investors and users, positively impacting the price of blur coin.

6. Community and Development Updates: Regular updates, improvements, and contributions by the blur coin community and development team are crucial for the growth and sustainability of the cryptocurrency. Positive announcements, such as new features, partnerships, or major upgrades, can generate enthusiasm and attract more investors, resulting in price fluctuations.

Conclusion:

The technological landscape surrounding blur coin is constantly evolving, fueling the price fluctuations of this digital asset. Blockchain technology, smart contracts, privacy enhancements, integration with other technologies, security measures, and community participation all play a significant role in shaping the price dynamics of blur coin. Staying informed about the latest technological updates and development in the cryptocurrency industry is essential for understanding and predicting the price movements of blur coin.

Competitor Analysis

When analyzing the price fluctuations of Blur Coin, it is crucial to consider the competitive landscape within the cryptocurrency market. In this section, we will conduct a comprehensive competitor analysis to understand how other cryptocurrencies impact the price of Blur Coin.

Bitcoin: As the pioneer and most popular cryptocurrency, Bitcoin plays a significant role in influencing the prices of other cryptocurrencies, including Blur Coin. When Bitcoin experiences price fluctuations, it often creates a ripple effect, causing other cryptocurrencies to follow suit. Traders and investors often compare the performance of Blur Coin with Bitcoin, making it an important competitor to consider.

Ethereum: As the second-largest cryptocurrency by market capitalization, Ethereum also has a significant impact on the price of Blur Coin. Ethereum's blockchain technology and smart contract capabilities make it a strong competitor in the market. Changes in Ethereum's price can sway investor sentiment and affect the overall demand for cryptocurrencies, including Blur Coin.

Ripple: Ripple is a unique cryptocurrency that focuses on enabling fast, low-cost international money transfers. While Blur Coin serves a different purpose, Ripple's performance can still impact its price. Investors may choose between investing in Ripple or Blur Coin, depending on their perceived utility and potential for growth.

Litecoin: Often referred to as the "silver" to Bitcoin's "gold," Litecoin is another cryptocurrency that competes with Blur Coin. Litecoin offers faster transaction confirmation times and a different mining algorithm, attracting a specific set of investors. Fluctuations in Litecoin's price can influence investor sentiment and indirectly impact the demand for Blur Coin.

Other cryptocurrencies: Besides the mentioned cryptocurrencies, there is a vast array of other digital currencies that Blur Coin competes against. These include but are not limited to Bitcoin Cash, Cardano, Polkadot, and Chainlink. Each cryptocurrency poses unique features and value propositions, creating a competitive landscape that affects the price fluctuations of Blur Coin.

In conclusion, analyzing the competitors of Blur Coin is essential to understanding the factors influencing its price fluctuations. Bitcoin, Ethereum, Ripple, Litecoin, and other cryptocurrencies all contribute to shaping the cryptocurrency market dynamics, which ultimately impact the value of Blur Coin.

Global Economic Factors

The price fluctuations of Blur Coin are heavily influenced by various global economic factors. These factors can have a significant impact on the supply and demand dynamics, ultimately affecting the price of the cryptocurrency.

Inflation

Inflation is one of the key economic indicators that can impact the value of Blur Coin. If a country experiences high inflation rates, investors may turn to cryptocurrencies like Blur Coin as a hedge against inflation and a store of value. This increased demand can drive up the price of Blur Coin.

Interest Rates

Global interest rates also play a crucial role in determining the price of Blur Coin. When interest rates are low, borrowing costs decrease, which can stimulate economic activities and increase investment in cryptocurrencies. Conversely, high interest rates may lead to reduced demand for Blur Coin as investors seek higher yields in other investment opportunities.

Furthermore, changes in central bank policies regarding interest rates can directly impact Blur Coin's price. Shifts towards more accommodative monetary policies can lead to increased liquidity and potentially drive up the price of the cryptocurrency.

It is important to note that these economic factors do not act in isolation. They often interact with each other, as well as with other factors such as geopolitical events, trade policies, and technological advancements. Analyzing and understanding these global economic factors is crucial for investors and traders looking to forecast and navigate the price fluctuations of Blur Coin.

For more information on Blur Coin and its market, you can visit the Blur.io website.

Government Policies and Decisions

Government policies and decisions play a crucial role in influencing the price fluctuations of blur coin. Various government actions, such as regulations, legislations, and economic policies, can directly impact the value of blur coin in the market.

One of the most significant factors is the regulatory framework established by governments around the world. Governments may introduce regulations to protect consumers, prevent money laundering, and combat illicit activities in the cryptocurrency market. These regulations can impact the demand and supply of blur coin, potentially leading to price fluctuations.

Another aspect is the government's stance on cryptocurrency and blockchain technology. The decisions made by governments, such as whether to embrace or resist the use of cryptocurrencies, can significantly impact blur coin's value. Positive government support may lead to increased adoption and investment in blur coin, driving up its price. Conversely, negative government sentiment can cause investors to lose confidence, resulting in price declines.

Economic policies, such as monetary and fiscal measures, can also influence the price of blur coin. Government actions, such as interest rate changes or tax policies, can affect the overall economy and investor sentiment, consequently impacting blur coin's value in the market.

Regulations

Can impact demand and supply, leading to price fluctuations.

Government Stance

Positive support can drive up adoption and investment, while negative sentiment can result in price declines.

Economic Policies

Changes in interest rates or tax policies can affect the overall economy and investor sentiment, thereby impacting blur coin's value.

In conclusion, government policies and decisions have a significant impact on the price fluctuations of blur coin. It is crucial for investors and traders to closely monitor and analyze government actions and their potential implications on the cryptocurrency market.

Security and Privacy Concerns

When it comes to investing or trading in Blur Coin, it is crucial to consider the security and privacy concerns associated with this cryptocurrency. Like all digital currencies, Blur Coin is vulnerable to various security threats and privacy breaches that can affect its value and price fluctuations.

One of the key concerns when dealing with Blur Coin is the risk of hacking and cyber attacks. Cryptocurrencies are attractive targets for hackers due to their decentralized nature and the potential for large financial gains. Therefore, investors and traders need to be cautious and take necessary security measures to protect their Blur Coin holdings.

Another security concern related to Blur Coin is the risk of fraud and scams. As the cryptocurrency market is still relatively new and unregulated, it is important to be aware of potential fraudulent activities. Investors should be cautious of suspicious investment schemes and offers that seem too good to be true. They must conduct thorough research and verify the legitimacy of any platform or company before investing in Blur Coin.

In addition to security concerns, privacy is another major issue associated with Blur Coin. While the blockchain technology behind this cryptocurrency ensures transparency and immutability of transactions, it also raises concerns about privacy. Some people may prefer to keep their financial transactions private and anonymous, which is not always possible with Blur Coin.

It is essential for users to understand that while their transactions may be anonymous, their activities on the blockchain can still be traced. This lack of total anonymity can create privacy concerns for some individuals who want to keep their financial information private.

To address these security and privacy concerns, developers and users of Blur Coin need to continuously improve security measures and develop innovative solutions. This includes implementing multi-factor authentication, using secure wallets, and educating users about best practices for protecting their Blur Coin assets.

In conclusion, security and privacy concerns play a significant role in the price fluctuations of Blur Coin. Investors and traders need to be aware of the risks associated with this cryptocurrency and take appropriate measures to protect their investments and personal information.

Partnerships and Collaborations

In the world of cryptocurrency, partnerships and collaborations play a crucial role in determining the price fluctuations of a coin like Blur. By forming strategic partnerships and collaborations with other organizations, Blur can expand its reach, increase adoption, and establish itself as a valuable player in the market.

Partnerships with Exchanges

One significant factor that affects the price of Blur is its listing on various cryptocurrency exchanges. By partnering with reputable exchanges, Blur can ensure that its coin is readily available for trading and can be easily bought and sold by investors. Additionally, being listed on multiple exchanges increases the liquidity of the coin and enhances its overall market value.

Collaborations with Other Cryptocurrencies

Collaborating with other cryptocurrencies can also have a significant impact on the price fluctuations of Blur. By partnering with well-known and established coins, Blur can benefit from their credibility and reputation. This collaboration can lead to increased trust in Blur and attract more investors, resulting in a rise in the coin's price.

Furthermore, collaborations can also bring about technological advancements. By joining forces with other cryptocurrencies, Blur can explore new blockchain technology and solutions that can enhance its overall functionality and attract more users.

Increased Exposure: Partnerships and collaborations can help Blur reach a wider audience and gain more visibility in the cryptocurrency market.

Blur partnering with a popular blockchain news platform to promote their coin and educate the community.

Market Expansion: Collaborating with other cryptocurrencies can open new markets for Blur and attract a broader user base.

Blur teaming up with a decentralized finance (DeFi) platform to offer financial services for Blur coin holders.

Enhanced Technology: By collaborating with other cryptocurrencies, Blur can access new technologies and solutions that can improve its blockchain and overall functionality.

Blur partnering with a blockchain research organization to develop unique features for their coin.

In conclusion, partnerships and collaborations are essential factors determining the price fluctuations of Blur. By forming strategic alliances with exchanges and other cryptocurrencies, Blur can increase its exposure, expand its market, and enhance its technology, resulting in a positive impact on its price.

User Adoption and Engagement

In the world of cryptocurrencies, user adoption and engagement play a crucial role in determining the price fluctuations of coins like Blur. When more users adopt a particular coin and actively engage with it, it creates a higher demand, which can potentially drive up the price.

User adoption refers to the number of individuals or businesses that start using a specific cryptocurrency, in this case, Blur coin. As more people become aware of Blur and its benefits, they may choose to invest in it or use it for transactions. This increased adoption can create a positive impact on the price of Blur.

Factors Influencing User Adoption

Several factors can influence user adoption of Blur coin:

Technology: A user-friendly and secure technology platform can attract more users to Blur coin. If the wallet and transaction process are easy to use and understand, more people are likely to adopt the cryptocurrency.

Marketplace Acceptance: The acceptance of Blur coin by online marketplaces and businesses is crucial for user adoption. When users can use Blur coin to make purchases or trade on various platforms, it increases its appeal and adoption rate.

Brand and Reputation: A strong brand image and a positive reputation are essential for user adoption. Users are more likely to trust and adopt a cryptocurrency like Blur if it has a solid reputation and is backed by reputable individuals or organizations.

Security and Privacy: Users value security and privacy when it comes to cryptocurrencies. The more secure and private Blur coin transactions are, the more likely users are to adopt it.

Ease of Integration: Blur coin's ease of integration with existing systems and processes can significantly impact user adoption. If integrating Blur into existing platforms is seamless and efficient, businesses and individuals are more likely to adopt it.

User Engagement and Price Fluctuations

User engagement refers to the active involvement of users with Blur coin. When users actively use Blur coin for transactions, trading, or holding, it can contribute to price fluctuations. Increased user engagement indicates higher demand and trading volumes, which can influence the price of Blur.

Factors that can influence user engagement include:

Community Support: A vibrant and supportive community around Blur coin can encourage users to actively engage with it. When users see a strong community backing Blur, they are more likely to participate and engage with the coin.

Market Volatility: The volatility of the cryptocurrency market can affect user engagement. Higher price fluctuations can attract more traders and speculators, leading to increased user engagement with Blur coin.

Utility and Benefits: The utility and benefits offered by Blur coin can drive user engagement. If Blur provides unique features, incentives, or advantages over other cryptocurrencies, users are more likely to actively engage with it.

Marketing and Awareness: Effective marketing efforts and increased awareness can boost user engagement. When users are informed about the benefits and potential of Blur coin through marketing campaigns and educational materials, they are more likely to engage with it.

Developer Activity: Active development and improvement of Blur coin's technology and features can contribute to user engagement. Regular updates, bug fixes, and new functionalities can keep users interested and engaged with the coin.

In conclusion, user adoption and engagement are significant factors that affect the price fluctuations of Blur coin. Increased user adoption creates a higher demand, while active user engagement indicates higher trading volumes and demand. Factors influencing user adoption and engagement include technology, marketplace acceptance, brand reputation, security and privacy, ease of integration, community support, market volatility, utility and benefits, marketing and awareness, and developer activity.

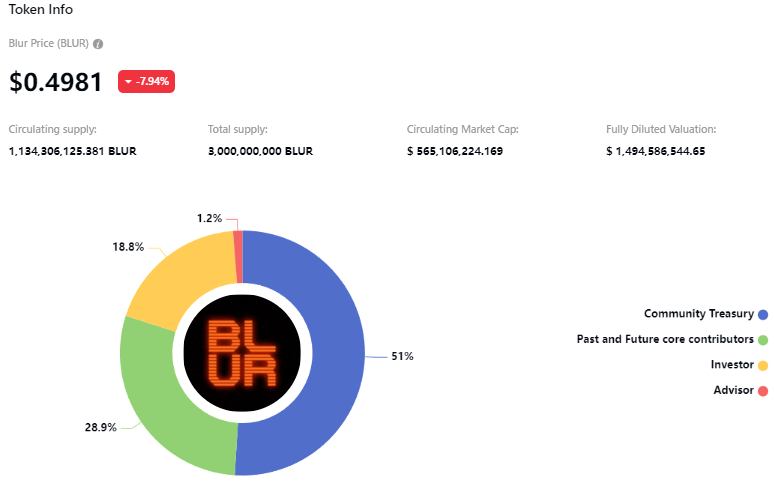

Token Distribution and Circulation

Token distribution and circulation play a crucial role in understanding the price fluctuations of Blur Coin. The distribution of tokens refers to how they are initially allocated and made available to the market.

Initial Token Distribution

The initial distribution of Blur Coin tokens was done through a token sale, where a certain percentage of the total token supply was sold to investors and contributors. This allowed the project to raise funds for further development and marketing efforts. The initial token sale helped establish the value of Blur Coin in the market and set the initial price.

Circulation and Supply

Once the initial distribution is complete, the tokens start circulating in the market. The circulation of tokens refers to how they are bought, sold, and transferred among individuals and entities. The total supply of Blur Coin tokens also plays a significant role in price fluctuations.

When there is a limited supply of tokens available and a high demand from investors, the price tends to increase due to scarcity. Conversely, if there is a large supply of tokens in the market and less demand, the price may decrease.

Exchanges

The availability of Blur Coin on various exchanges can impact the price. Higher liquidity and trading volume often lead to price stability and gradual increases.

Whale Activities

Large token holders, often referred to as whales, can impact the price by buying or selling significant amounts of Blur Coin. Their actions can cause price volatility and sudden price fluctuations.

Token Burn

Token burn refers to the deliberate process of permanently removing tokens from circulation. This can lead to a decrease in the total token supply and potentially increase the token price.

Token Unlocking

In some cases, tokens are locked or vested for a certain period before being fully available for circulation. The unlocking of these tokens can impact the supply and potentially affect the token price.

Understanding the token distribution and circulation dynamics of Blur Coin is essential for investors and traders to make informed decisions. Factors such as initial distribution, circulation channels, and token-related events can significantly influence the price fluctuations of Blur Coin.

What is Blur Coin?

Blur Coin is a cryptocurrency that implements privacy features, allowing users to conduct transactions with a high level of anonymity.

What are the factors that affect the price fluctuations of Blur Coin?

The price fluctuations of Blur Coin can be influenced by several factors, including market demand, overall cryptocurrency market trends, regulatory developments, technological advancements, and macroeconomic factors.

How does market demand affect the price of Blur Coin?

Market demand is a key factor that affects the price of Blur Coin. When there is high demand for Blur Coin, the price tends to increase as buyers are willing to pay more for it. Conversely, when demand is low, the price may decrease due to sellers offering it at lower prices to attract buyers.

What role do regulatory developments play in the price fluctuations of Blur Coin?

Regulatory developments can have a significant impact on the price of Blur Coin. Positive regulatory news, such as governments adopting cryptocurrency-friendly policies or recognizing the potential of privacy coins, can lead to an increase in demand and thus a higher price. On the other hand, negative regulatory developments, such as bans or restrictions on the use of privacy coins, can negatively affect the price.

How do technological advancements influence the price of Blur Coin?

Technological advancements in the field of privacy and security can have a positive impact on the price of Blur Coin. If Blur Coin introduces innovative features or improves its privacy protocols, it may attract more users and investors, which can lead to an increase in demand and ultimately drive up the price.

What factors contribute to the price fluctuations of blur coin?

There are several factors that contribute to the price fluctuations of blur coin. Some of the key factors include market demand, supply and demand dynamics, market sentiment, macroeconomic factors, regulatory environment, competition, and technological advancements.

How does market demand affect the price of blur coin?

Market demand plays a significant role in the price fluctuations of blur coin. When there is high demand for blur coin, the price tends to increase as buyers are willing to pay a premium for it. On the other hand, when the market demand is low, the price may decrease as sellers are willing to sell at a lower price to attract buyers.

Blur: NFT | Blur: NFT login | Blur: NFT connect | WalletConnect | Traders | What Is Blur Crypto

2022-2024 @ Factors affecting the price fluctuations of blur coin a comprehensive analysis