The Impact of Speculation on the Fluctuation of Cryptocurrency Prices

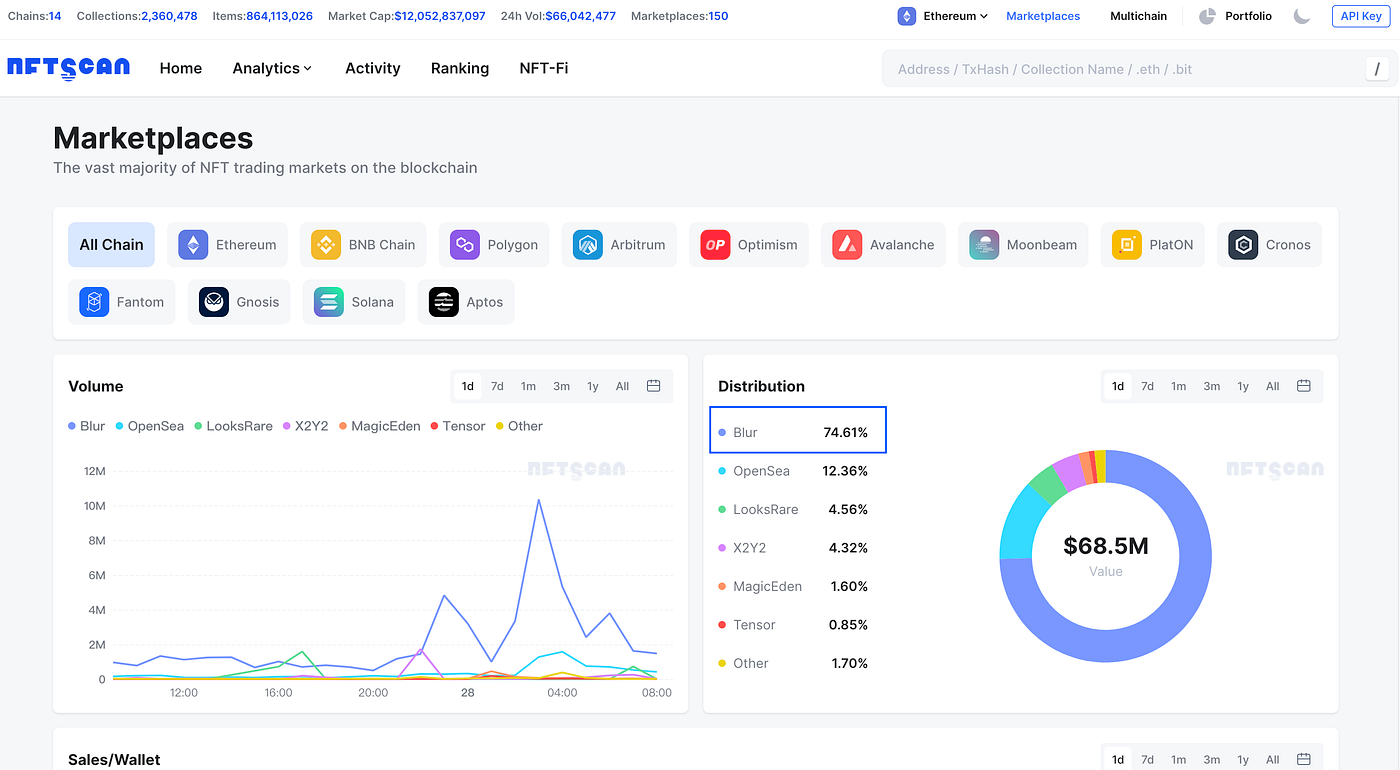

Blur: NFT | Blur: NFT login | Blur: NFT connect | WalletConnect | Traders | What Is Blur Crypto

Blur: NFT | Blur: NFT login | Blur: NFT connect | WalletConnect | Traders | What Is Blur Crypto

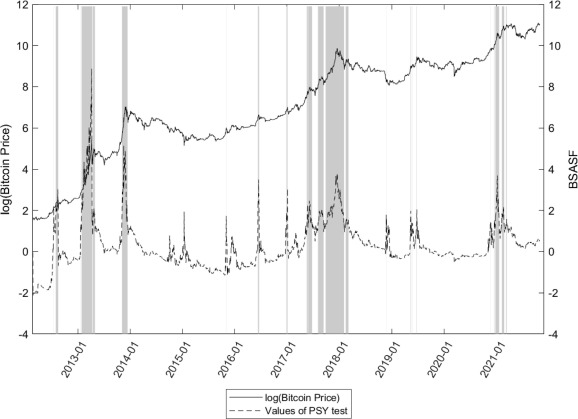

Speculation plays a significant role in the formation of cryptocurrency prices. Cryptocurrencies are often characterized by their high volatility, and speculation exacerbates this volatility by influencing the supply and demand dynamics of these digital assets. Speculators are individuals or entities that buy or sell cryptocurrencies based on their expectations of future price movements rather than their inherent value.

Speculation can have both positive and negative effects on cryptocurrency prices. On one hand, speculators can drive up the prices of cryptocurrencies through their buying activity. When speculators anticipate that the price of a particular cryptocurrency will increase, they may buy large quantities of it, driving up demand and therefore its price. This can create a positive feedback loop, where rising prices attract more speculators, further increasing demand and driving prices even higher.

On the other hand, speculation can also lead to sharp price drops. When speculators expect a decline in the price of a cryptocurrency, they may sell large quantities of it, leading to an increase in supply and a subsequent decrease in price. This can trigger panic selling among other market participants, leading to a further decline in price. Speculators can amplify price movements in both directions, making cryptocurrency markets highly volatile and difficult to predict.

Furthermore, speculation can also lead to price bubbles and market manipulation. In the absence of regulations and oversight, some speculators may engage in manipulative practices to artificially inflate or deflate cryptocurrency prices for their own gains. This can create a false sense of value and lead to inflated prices that are not justified by the underlying fundamentals of the cryptocurrency. When the bubble eventually bursts, prices can crash, causing significant losses for those who bought at inflated prices.

In conclusion, speculation plays a crucial role in the formation of cryptocurrency prices. While it can drive up prices through increased demand, it can also lead to sharp price drops and market manipulation. Understanding the influence of speculation in cryptocurrency markets is essential for investors and traders who seek to navigate the highly volatile and unpredictable nature of these digital assets.

What is speculation?

Speculation refers to the practice of trading or investing in assets, such as cryptocurrencies, with the expectation of making a profit based on future price movements. Speculators attempt to predict and take advantage of short-term fluctuations in prices, rather than investing for the long term.

Speculators in the cryptocurrency market often base their decisions on various factors, such as market trends, news events, and technical analysis. They may also use leverage or margin trading to amplify potential gains or losses. Speculation can be both lucrative and risky, as it involves taking positions based on assumptions about future price movements.

Opportunity for high returns

Potential for significant losses

Short-term profit potential

Increased market volatility

Flexibility and speed of trading

Lack of fundamental analysis

Can provide liquidity to the market

May contribute to market bubbles

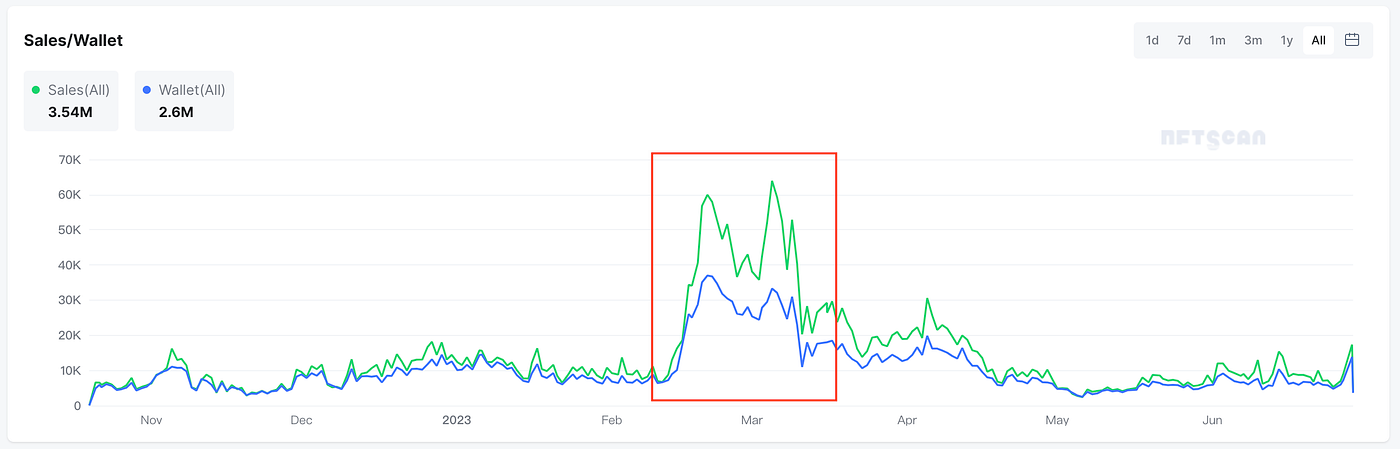

Speculation in the crypto market has a significant impact on the formation of blurred prices. The actions of speculators can lead to rapid price changes and price manipulation. When large numbers of speculators buy or sell a particular cryptocurrency, it can create artificial demand or supply, driving prices up or down.

Furthermore, speculative trading can create a self-fulfilling prophecy, where the expectations and actions of speculators influence market sentiment and further fuel price movements. This can result in a cycle of speculative buying and selling, leading to increased volatility and the formation of speculative bubbles.

Overall, speculation plays a crucial role in the cryptocurrency market, shaping price movements and market dynamics. Understanding and managing speculation is essential for investors and traders looking to navigate the blurred prices of cryptocurrencies.

Understanding Crypto Prices

Cryptocurrency prices are influenced by various factors, and understanding these factors is essential for investors and traders. One significant factor that impacts crypto prices is speculation.

Speculation refers to the act of buying or selling cryptocurrencies based on the expectation of future price movements, rather than the intrinsic value of the asset. Speculators play a vital role in the crypto market, as their activities can greatly influence price volatility and liquidity.

Speculation can create both positive and negative effects on crypto prices. On one hand, positive speculation, driven by investors' optimism and positive market sentiments, can drive prices higher. This can attract more buyers and investors, leading to further price increases.

On the other hand, negative speculation can lead to a decline in crypto prices. Fear, uncertainty, and market manipulation can drive speculators to sell their holdings, causing prices to drop. This can create a domino effect, where more sellers join in and prices continue to spiral downwards.

It is important to note that speculation is not the only factor influencing crypto prices. Other factors, such as market demand, regulatory developments, macroeconomic events, and technological advancements, also play significant roles.

To better understand crypto prices, it is crucial to consider the broader market dynamics and the interplay between different factors. Traders and investors need to analyze and assess various information sources, including news, market trends, and technical indicators, to make informed decisions.

Furthermore, it is important to be aware of the risks associated with trading and investing in cryptocurrencies. The crypto market is highly volatile and unpredictable, and prices can fluctuate rapidly. It is essential to exercise caution and conduct thorough research before making any investment decisions.

In conclusion, speculation is one of the key factors influencing the formation of crypto prices. Understanding the impact of speculation and considering other fundamental and technical factors is crucial for anyone interested in the cryptocurrency market.

For more information about blur.io, please visit WIE MAN SICH BEI BLUR.IO ANMELDET.

How speculation affects crypto prices

Speculation plays a significant role in the formation of cryptocurrency prices. As the crypto market has become more mainstream, speculation has become a driving force behind price movements. In this article, we will explore how speculation influences crypto prices and the factors that contribute to its impact.

Influence of investor sentiment

Speculation is heavily influenced by investor sentiment. Positive sentiment can lead to increased buying activity and drive up prices, while negative sentiment can lead to selling pressure and cause prices to decline. Crypto prices are often driven by market psychology rather than fundamental value, making them susceptible to fluctuation based on sentiment alone.

News and announcements

News and announcements also play a significant role in fueling speculation. Positive news, such as partnerships, regulatory developments, or technological advancements, can create excitement and attract investors, leading to increased demand and higher prices. Conversely, negative news, such as security breaches or regulatory crackdowns, can spark panic and result in price drops as investors sell off their holdings.

For example, an announcement of a major exchange listing or the integration of a new cryptocurrency in a popular platform can generate speculation about increased adoption and future price appreciation, prompting investors to buy and hold the asset.

Market manipulation

Speculation is further amplified by market manipulation. Crypto markets are known for their lack of regulation and oversight, making them susceptible to manipulation by influential individuals or groups. Manipulators can create artificial price movements by spreading false information, orchestrating pump and dump schemes, or utilizing trading bots.

It is important for investors to be aware of these manipulative practices and conduct thorough research before making investment decisions. Understanding the fundamentals of a cryptocurrency and being able to differentiate between genuine value and speculative hype is crucial to navigating the market successfully.

In conclusion, speculation significantly influences the formation of cryptocurrency prices. Investor sentiment, news and announcements, and market manipulation all contribute to the volatility and unpredictability of crypto prices. As the crypto market continues to evolve, it is essential for investors to stay informed and exercise caution when engaging in speculative trading.

If you're interested in exploring the features and advantages of the Blur.io NFT marketplace, you can visit Conexión a Blur.io: Explorar las características y ventajas de Blur.io.

Factors influencing speculation in the crypto market

Speculation in the cryptocurrency market is driven by various factors that can significantly impact the formation of crypto prices. These factors include:

1. Market Sentiment

Market sentiment plays a crucial role in shaping speculation in the crypto market. Positive sentiment can lead to a surge in demand and prices, as investors perceive cryptocurrencies as a lucrative investment opportunity. Conversely, negative sentiment can contribute to a loss of confidence and a decrease in prices.

2. News and Media Coverage

The media plays a significant role in shaping public perception and driving speculation in the crypto market. News about regulatory developments, technological advancements, or major cryptocurrency-related events can trigger increased buying or selling activity, leading to price volatility.

3. Market Manipulation

The cryptocurrency market is susceptible to market manipulation, which can heavily influence speculation. Whales, who hold large amounts of cryptocurrencies, have the power to create artificial demand or sell-offs, leading to significant price movements that may not necessarily reflect the true value of the underlying asset.

4. Investor Fear and Greed

Investor psychology, often driven by fear and greed, plays a critical role in speculation. When investors fear missing out on potential gains, they may eager to buy, driving up prices. Conversely, when fear dominates the market, panic selling can lead to a rapid decline in prices.

In conclusion, speculation in the crypto market is shaped by various factors, including market sentiment, media coverage, market manipulation, and investor psychology. Understanding these factors and their influence is crucial for investors to make informed decisions and navigate the volatile crypto market.

Role of media in crypto speculation

The media plays a significant role in shaping the perception and speculation around cryptocurrencies. With its wide reach and influence, the media has the power to impact the prices of cryptocurrencies, including blur crypto, through its coverage and analysis. Media outlets, including online platforms, news channels, and social media, are frequently used by investors and traders to gather information about the crypto market and make trading decisions.

The media's coverage of crypto-related news, such as regulatory decisions, technological advancements, market trends, and investment strategies, can fuel speculation and affect the prices of cryptocurrencies. Positive coverage highlighting the potential of cryptocurrencies, such as blur crypto, can lead to an increase in demand and subsequent price appreciation, while negative news can create fear and panic, causing prices to plummet.

Moreover, the media's role in spreading rumors and unverified information can significantly influence the formation of blurry crypto prices. False or exaggerated reports about partnerships, endorsements, or upcoming developments can create hype and speculative buying, leading to price bubbles. Conversely, negative rumors or fake news can trigger panic selling and market crashes.

Media platforms also provide a platform for experts, analysts, and influencers to share their opinions and predictions about the future of cryptocurrencies. These predictions, whether accurate or not, can shape market sentiment and drive speculative behavior. Traders and investors often rely on these predictions to make trading decisions, leading to increased volatility and speculative trading volumes.

It is important to note that media coverage of cryptocurrencies is not always based on factual analysis or reliable sources. Sensationalist headlines and clickbait articles can attract attention and generate website traffic, regardless of their accuracy. Therefore, it is crucial for investors and traders to critically evaluate the information presented by the media and rely on verified sources before making any investment decisions.

Table:

Positive coverage highlighting the potential of cryptocurrencies and blur crypto

Increase in demand and subsequent price appreciation

Negative news, rumors, or fake news

Fear and panic leading to price declines

Experts' predictions and opinions

Shaping market sentiment and driving speculative behavior

Sensationalist headlines and clickbait articles

Unreliable information and potential misleading impact on decision-making

In conclusion, the media plays a crucial role in crypto speculation, including blur crypto. Its coverage, analysis, and opinions can significantly impact the prices of cryptocurrencies, both positively and negatively. However, investors and traders should exercise caution, critically evaluate the information provided by the media, and rely on verified sources to make informed trading decisions.

For more information on blur crypto and related topics, you can visit the Wallet Connect website.

Psychological aspects of crypto speculation

Speculation in the cryptocurrency market is heavily influenced by psychological factors. One such factor is the fear of missing out (FOMO). FOMO occurs when individuals see others making significant profits from a particular cryptocurrency and feel the need to jump on the bandwagon before it's too late. This fear drives up the demand for the crypto, causing its price to rise rapidly.

Another psychological aspect of crypto speculation is greed. Greed can lead investors to buy into cryptocurrencies with the hope of making quick and substantial profits. This greed-driven buying can artificially inflate the prices of certain cryptos, creating a bubble-like situation. When the bubble eventually bursts, prices plummet, causing significant losses for those who bought in at the peak.

Additionally, speculation in the crypto market can be influenced by herd mentality. When individuals see others buying a particular cryptocurrency, they are more likely to follow suit, assuming that those individuals have some insider knowledge or expertise. This herd mentality can create massive price fluctuations as large groups of investors buy or sell simultaneously based on the actions of others.

Fear and panic also play a significant role in crypto speculation. When negative news or rumors spread about a particular cryptocurrency, fear can cause investors to sell off their holdings quickly, driving down the price. Similarly, when positive news spreads, it can cause a surge in buying as investors fear missing out on potential profits. These emotional reactions can exacerbate price volatility in the market.

It is important for investors to be mindful of these psychological aspects when engaging in crypto speculation. Understanding the influence of fear, greed, herd mentality, and emotions can help investors make more informed decisions and avoid falling victim to market manipulations.

Risks associated with speculative trading

Speculative trading in the crypto market poses certain risks that investors need to be aware of:

1. Volatility:

The highly volatile nature of cryptocurrencies makes it a risky asset class for speculation. Prices can fluctuate significantly within short periods of time, leading to potential losses for traders who are unable to accurately predict market movements.

2. Lack of regulation:

The crypto market is largely unregulated, which means that there are fewer protections in place for investors. This lack of oversight and transparency can make it easier for manipulative practices, such as pump and dump schemes, to occur, leading to potential monetary losses.

3. Market manipulation:

Speculative trading can be influenced by market manipulation, where certain individuals or groups with significant holdings in a particular cryptocurrency can artificially inflate or deflate prices to their advantage. This can lead to misleading price signals and cause losses for other traders.

4. Information asymmetry:

Speculators often rely on information that is not widely available to the public, such as insider tips or rumors, to make investment decisions. This information asymmetry creates an unfair advantage for those who have access to privileged information, increasing the risks for individual traders who are not privy to this information.

5. Emotional biases:

Speculative trading can be influenced by emotional biases, such as fear or greed, which can cloud judgment and lead to irrational decision-making. This can result in impulsive trades based on short-term market movements, rather than a well thought-out investment strategy, increasing the potential for losses.

Overall, while speculative trading can be lucrative for some, it comes with inherent risks that investors must consider before entering the crypto market. It is important to conduct thorough research, develop a sound risk management strategy, and be prepared for potential losses when engaging in speculative trading.

Examples of speculation in the crypto market

1. Initial Coin Offerings (ICOs): ICOs are a popular way for startups to raise funds by selling their own tokens or cryptocurrencies to investors. Speculators often participate in ICOs hoping that the tokens they purchase will increase in value once they hit the market. However, not all ICOs are successful, and speculators can face significant losses if the project fails.

2. Pump and Dump Schemes: In these schemes, a group of individuals artificially inflates the price of a particular cryptocurrency by buying up large amounts of it and creating hype around it. Once the price reaches a peak, they sell off their holdings, causing the price to crash. Speculators who are not part of the scheme may be enticed by the sudden price rise and end up buying at a high price, only to experience losses when the scheme unravels.

3. Whale Manipulation: Crypto markets are known for their relatively low liquidity, which means that large traders, also known as whales, have the ability to manipulate prices by buying or selling significant amounts of a particular cryptocurrency. Speculators who are aware of these market dynamics may take advantage of the price movements caused by whale activity to make profitable trades.

4. Media Hype and Market Speculation: News and media coverage can greatly influence the prices of cryptocurrencies. Speculators often buy or sell based on the latest news or speculation about future developments in the crypto market. For example, positive news about a particular cryptocurrency being adopted by a major company or government can cause its price to skyrocket as speculators rush to buy in.

5. Technical Analysis and Trading Algorithms: Many crypto speculators use technical analysis and trading algorithms to predict price movements and make profitable trades. These strategies involve studying patterns in price charts, indicators, and other market data to identify potential buying or selling opportunities. However, relying solely on technical analysis can be risky, as it does not account for fundamental factors that can significantly impact crypto prices.

Conclusion

Speculation plays a significant role in the formation of crypto prices. Examples such as ICOs, pump and dump schemes, whale manipulation, media hype, and technical analysis all demonstrate the influence of speculation on the crypto market. However, it is important for investors to approach speculation with caution and conduct thorough research before making investment decisions, as the crypto market can be highly volatile and unpredictable.

Regulation of speculative activities

Speculation in the cryptocurrency market can have a significant impact on the formation of blur crypto prices. As a result, governments and regulatory bodies around the world have begun to implement measures to regulate and monitor speculative activities in the crypto market.

1. Licensing and Registration

One approach to regulate speculative activities is through licensing and registration requirements for crypto exchanges, trading platforms, and other entities involved in cryptocurrency transactions. By requiring these entities to obtain proper licenses and registrations, regulatory bodies can ensure that they are operating within the legal framework and are subject to oversight.

2. Market Surveillance and Manipulation Detection

Regulatory bodies are also implementing market surveillance systems that monitor activities in the cryptocurrency market to detect and prevent market manipulation. These systems use advanced technologies, such as data analysis and algorithms, to identify suspicious patterns or abnormal trading behaviors that may indicate market manipulation.

Additionally, regulatory bodies are working on implementing stricter regulations to prevent insider trading and other fraudulent activities that can distort crypto prices and negatively impact market stability.

3. Investor Protection Measures

Regulators are also introducing measures to protect investors from speculative activities. This includes implementing disclosure requirements for crypto projects and tokens, enforcing transparency and accountability in fundraising processes, and promoting investor education to ensure that individuals understand the risks and volatility associated with crypto investments.

1. Increased market stability

1. Balancing regulation with innovation

2. Protection of investors

2. Global regulatory coordination

3. Reduction of market manipulation

3. Keeping up with rapidly evolving technology

Overall, the regulation of speculative activities in the cryptocurrency market aims to foster a secure and transparent environment for investors while minimizing the negative impact of speculation on crypto prices.

Can speculation be beneficial for the crypto market?

Speculation in the crypto market has always been a controversial and debatable topic. Some argue that speculation can be beneficial for the crypto market, while others believe it can lead to excessive price volatility and market manipulation.

One of the main arguments in favor of speculation is that it can help bring liquidity to the market. Speculators, who buy and sell cryptocurrencies based on their expectations of future price movements, create a more active and liquid marketplace. This increased liquidity can make it easier for buyers and sellers to enter and exit positions, which in turn can lead to narrower bid-ask spreads and lower transaction costs.

Additionally, speculation can help drive innovation and adoption in the crypto market. When investors speculate on the potential future value of a cryptocurrency, they are essentially betting on its long-term success. This can provide funding and resources for crypto projects, allowing them to develop their technology, improve security measures, and explore new use cases. In this way, speculation can contribute to the growth and development of the crypto ecosystem.

Furthermore, speculation can also serve as an early indicator of market sentiment and potential price movements. Traders and investors often analyze market trends, news, and other factors to make informed investment decisions. By observing the activity and behavior of speculators, market participants can gain insights into the market's expectations and adjust their own strategies accordingly.

However, it is important to note that speculation can also have negative consequences. Excessive speculation can lead to price bubbles, where the price of a cryptocurrency far exceeds its fundamental value. This can create a volatile market environment and increase the risk of major price corrections. Moreover, speculation can also attract market manipulators who engage in fraudulent practices, such as pump-and-dump schemes, to artificially inflate or deflate prices.

In conclusion, while speculation can bring benefits to the crypto market such as increased liquidity, innovation, and market sentiment insights, it also carries risks of excessive volatility and market manipulation. To ensure a healthy and sustainable crypto market, it is essential to strike a balance and establish regulations that prevent manipulative practices while fostering a supportive environment for speculators.

The relationship between speculation and market volatility

Speculation plays a significant role in driving the volatility of the cryptocurrency market. The interaction between speculation and market prices is often a complex and intricate process, influenced by various factors such as investor sentiment, market trends, and news events. Understanding this relationship is crucial for investors and traders to make informed decisions and manage risks effectively.

1. Speculation amplifies price movements

Speculators in the cryptocurrency market aim to profit from short-term price fluctuations by buying low and selling high. Their trading activities can further magnify the market movements and increase volatility. When speculators enter the market with a large volume of buy orders, it can push prices higher. Conversely, when they start selling off their holdings in anticipation of a price decline, it can result in a significant downward pressure on prices.

2. Speculation fueled by information asymmetry

Information asymmetry, where some market participants have access to more information than others, plays a crucial role in speculation. Speculators with access to exclusive information or insights can make profitable trades before the information becomes public knowledge. This creates an uneven playing field and can lead to exaggerated price movements. The rapid dissemination of information in the digital age contributes to a heightened speculation-driven environment, as news and rumors spread rapidly, impacting market sentiment and prices.

3. Speculation and market sentiment

Speculation is heavily influenced by market sentiment, which refers to the overall feeling or attitude of market participants towards the direction of the market. Positive sentiment can lead to increased speculative buying, driving prices higher, while negative sentiment can trigger panic selling, causing prices to decline rapidly. The herd mentality also plays a role, as speculators tend to follow the crowd. If a particular cryptocurrency is gaining attention and experiencing significant price movements, more speculators may jump in, contributing to further volatility.

In conclusion, speculation is a major contributing factor to the volatility of crypto markets. The actions and sentiments of speculators can cause rapid price fluctuations, amplifying market volatility. Understanding the dynamics between speculation and market volatility is essential for investors and traders looking to navigate the crypto market successfully.

Ways to Minimize the Impact of Speculation on Crypto Prices

Speculation plays a significant role in the formation of crypto prices, often leading to extreme volatility and unpredictability. However, there are several strategies that can be implemented to minimize the impact of speculation on crypto prices:

1. Increased Market Transparency: Providing investors with better access to relevant market information can help minimize speculation. Real-time data on trading volumes, order books, and historical price trends can enable market participants to make informed investment decisions, reducing the reliance on speculative behavior.

2. Regulatory Frameworks: Implementing proper regulations can help stabilize crypto markets and deter speculative activity. Proactive regulatory oversight, including measures to prevent market manipulation and enforce strict compliance with anti-money laundering (AML) and know-your-customer (KYC) regulations, can foster investor confidence and discourage excessive speculation.

3. Education and Awareness: Educating market participants about the risks and benefits of cryptocurrencies can help mitigate speculative behavior. Providing educational resources, conducting awareness campaigns, and promoting responsible investment practices can empower investors to make rational decisions based on fundamental analysis rather than speculative impulses.

4. Long-Term Investment Perspective: Encouraging a long-term investment perspective can help dampen the impact of short-term speculation on crypto prices. Promoting the idea of holding cryptocurrencies as a store of value or as a long-term investment instrument rather than a speculative asset can contribute to price stability and reduce the influence of speculative trading.

5. Enhanced Market Infrastructure: Strengthening the infrastructure of crypto markets can help reduce speculation-induced price fluctuations. Improvements in trading platforms, such as increased liquidity, faster transaction speed, and enhanced security measures, can facilitate smoother market operations and deter excessive speculative trading.

6. Institutional Participation: Increased participation of institutional investors in the crypto market can contribute to price stability. Institutional investors typically have a longer-term investment horizon and employ more sophisticated investment strategies, which can offset the speculative behavior of individual retail traders and promote a more rational price formation process.

7. Collaborative Efforts: Collaboration between industry stakeholders, regulators, and market participants is crucial in minimizing the impact of speculation on crypto prices. A coordinated approach towards establishing best practices, sharing information, and developing risk management frameworks can help create a more transparent and resilient crypto market ecosystem.

By implementing these strategies, it is possible to reduce the adverse effects of speculation on crypto prices and foster a more stable and mature market environment.

Long-term investment strategies versus speculative trading

When it comes to investing in cryptocurrencies, there are two main approaches: long-term investment strategies and speculative trading. Each strategy has its own pros and cons, and understanding them can help investors make informed decisions.

Long-term investment strategies

Long-term investment strategies involve buying and holding cryptocurrencies for an extended period, typically years, with the expectation of their value increasing over time. This approach is often favored by investors who believe in the long-term potential of cryptocurrencies and their underlying technology.

One advantage of long-term investment strategies is that they require less active management and monitoring compared to speculative trading. Investors can take a "buy and hold" approach, focusing on the overall performance of the market rather than short-term price fluctuations.

Additionally, long-term investors may benefit from the compounding effect, where their investments grow exponentially over time. This strategy allows investors to ride out market volatility and potentially benefit from the overall growth of the cryptocurrency market.

Speculative trading

Speculative trading involves buying and selling cryptocurrencies based on short-term price movements. Traders aim to profit from price volatility by taking advantage of short-term price fluctuations.

One advantage of speculative trading is the potential for quick profits. Traders can enter and exit positions in a short period, allowing them to take advantage of price movements and potentially generate high returns. However, this approach also carries a higher risk, as the market can be unpredictable and volatile.

Speculative trading requires active monitoring and analysis of market trends, technical indicators, and other factors that can impact prices. Traders need to be skilled in identifying patterns and trends, as well as managing risk and setting appropriate stop-loss orders.

It's important to note that while speculative trading can be profitable, it also carries a higher risk of losses. The cryptocurrency market is known for its volatility, and prices can fluctuate rapidly.

Ultimately, the choice between a long-term investment strategy and speculative trading depends on an investor's risk tolerance, time horizon, and investment goals. Some may prefer the stability and potential long-term gains of a buy-and-hold approach, while others may be more drawn to the potential quick profits of speculative trading.

Regardless of the chosen strategy, it's essential for investors to conduct thorough research, stay informed about market developments, and establish a clear investment plan to navigate the cryptocurrency market effectively.

Evaluating the Impact of Speculation on Crypto Adoption

Speculation plays a significant role in the volatility of cryptocurrency prices, and this volatility can have both positive and negative effects on the adoption of cryptocurrencies.

On one hand, speculation can drive up the price of a particular cryptocurrency, creating a sense of excitement and FOMO (fear of missing out) among potential investors. This increased price can attract new buyers who see the potential for significant profits in a short period of time. As more people invest in cryptocurrencies, the demand for them increases, leading to higher prices and increased adoption.

However, speculation can also have a negative impact on crypto adoption. The volatility caused by speculators can create a sense of uncertainty and risk among potential users. Many people may be hesitant to invest in or use cryptocurrencies if they believe that the price can change dramatically overnight. This hesitancy can slow down adoption rates and hinder the growth of the crypto market.

Furthermore, speculation can lead to market manipulation and scams. Some individuals or groups may artificially inflate the price of a cryptocurrency through coordinated buying and selling, also known as "pump and dump" schemes. These dishonest practices can create a distrustful environment that discourages potential adopters from entering the market.

To evaluate the impact of speculation on crypto adoption, it is important to analyze both the positive and negative effects it has on the market. This can be done through tracking price movements, monitoring trading volumes, and studying user sentiments. By understanding how speculation influences the behavior of investors and potential users, policymakers and analysts can develop strategies to mitigate its negative effects and promote the adoption of cryptocurrencies in a more stable and sustainable manner.

- Increased demand and higher prices

- Uncertainty and risk perception

- Attraction of new investors

- Market manipulation and scams

- Excitement and FOMO

The Future of Speculation in the Crypto Market

Speculation has long been a driving force in the cryptocurrency market, and its influence on the formation of crypto prices cannot be underestimated. As the crypto market continues to evolve, it is important to consider how speculation will shape its future.

1. Increased Institutional Involvement: With the growing interest from institutional investors, speculation in the crypto market is likely to become more sophisticated and strategic. Institutional investors have the resources and expertise to conduct in-depth analysis and make informed investment decisions. This could lead to a more stable market with less volatility.

2. Regulatory Uncertainty: The crypto market is still largely unregulated, which leaves room for speculation to thrive. However, as governments and regulatory bodies around the world develop a clearer regulatory framework for cryptocurrencies, speculation may be curbed. Increased regulation could lead to more transparency and accountability, reducing the impact of speculation on prices.

3. Technological Advancements: The crypto market is driven by technological advancements, such as blockchain technology and decentralized finance (DeFi). These advancements open up new possibilities for speculation, as they create new investment opportunities and trading strategies. As technology continues to evolve, speculation in the crypto market is likely to evolve as well.

4. Education and Awareness: As more people become educated about cryptocurrencies, speculation may become more informed and calculated. The crypto market is still relatively new and many investors and traders are still learning about the opportunities and risks involved. As education and awareness increase, speculation may become more sophisticated, leading to a more mature market.

5. Market Manipulation: Speculation can also lead to market manipulation, where individuals or groups intentionally manipulate prices for personal gain. While market manipulation is illegal in regulated markets, it is more prevalent in the crypto market due to its lack of regulation. As the crypto market matures and regulations are put in place, market manipulation may be reduced, leading to a more fair and transparent market.

In conclusion, speculation will continue to play a significant role in the crypto market. However, its impact on price formation is likely to change as the market evolves, with increased institutional involvement, regulatory developments, technological advancements, education, and awareness, and the potential reduction of market manipulation. It is important for investors and traders to understand the dynamics of speculation and its potential influence on crypto prices.

What is speculation and how does it affect the prices of cryptocurrencies?

Speculation is the act of buying and selling assets, including cryptocurrencies, with the expectation of making a profit. When it comes to cryptocurrencies, speculation can have a significant impact on their prices. As more people speculate on a particular cryptocurrency, the demand for it increases, driving up its price. However, if speculation decreases or negative news arises, it can lead to a decrease in demand, causing the price to drop. Speculation therefore plays a crucial role in the formation of cryptocurrency prices.

Can speculation alone cause significant fluctuations in crypto prices?

Yes, speculation alone can cause significant fluctuations in crypto prices. Because the cryptocurrency market is still relatively new and lacks regulation, it is highly susceptible to the influence of speculators. Speculators can drive prices up or down based on their expectations or sentiment about a particular cryptocurrency. These fluctuations can occur rapidly, leading to substantial gains or losses for investors.

How does speculation differ from long-term investment in cryptocurrencies?

Speculation and long-term investment in cryptocurrencies differ mainly in time horizon and mindset. Speculation focuses on short-term price movements and aims to profit from them quickly. Speculators may buy and sell cryptocurrencies multiple times within a day or week. On the other hand, long-term investment involves holding cryptocurrencies for an extended period, usually months or years, with the expectation of significant growth in value over time. Long-term investors typically ignore short-term price fluctuations and focus on the overall potential of the cryptocurrency they hold.

Are there any risks associated with speculating on cryptocurrencies?

Yes, there are risks associated with speculating on cryptocurrencies. The high volatility of cryptocurrency prices can lead to substantial losses if speculators make incorrect predictions or fail to react quickly to market changes. Speculation also requires active monitoring of market trends, news, and sentiment, which can be time-consuming and mentally demanding. Additionally, the lack of regulation in the cryptocurrency market makes it more susceptible to manipulation and fraudulent activities, posing additional risks to speculators.

Is it possible for speculation to stabilize the prices of cryptocurrencies?

No, speculation alone cannot stabilize the prices of cryptocurrencies. Speculation is driven by market sentiment and individual expectations, which can change rapidly. While speculation may temporarily drive prices up or down, ultimately, the stability of cryptocurrency prices depends on various factors, including market demand, adoption, regulation, and overall market conditions. Stabilizing cryptocurrency prices would require broader market forces and factors beyond speculation alone.

How does speculation affect the volatility of cryptocurrency prices?

Speculation is one of the main factors that contribute to the volatility of cryptocurrency prices. When there is a high level of speculation in the market, it can lead to rapid price changes as traders buy and sell based on their speculations about the future price movements. This can create a cycle of buying and selling, causing prices to fluctuate dramatically.

Why is speculation so prevalent in the cryptocurrency market?

Speculation is more prevalent in the cryptocurrency market compared to traditional markets due to several reasons. First, cryptocurrencies are highly volatile and can experience significant price swings in short periods of time, making them attractive for speculative trading. Second, the lack of regulation and oversight in the cryptocurrency market allows for more speculative activity. Finally, the decentralized nature of cryptocurrencies and the ability to trade 24/7 attracts traders who thrive on speculation.

Blur: NFT | Blur: NFT login | Blur: NFT connect | WalletConnect | Traders | What Is Blur Crypto

2022-2024 @ How speculation influences the formation of blur crypto prices