The various factors that influence the price of blur tokens and how they contribute to a comprehensive understanding

Blur: NFT | Blur: NFT login | Blur: NFT connect | WalletConnect | Traders | What Is Blur Crypto

Blur: NFT | Blur: NFT login | Blur: NFT connect | WalletConnect | Traders | What Is Blur Crypto

As the popularity and usage of cryptocurrencies continue to rise, it is essential to comprehend the factors that influence the price of specific tokens. One such token gaining significant attention is the blur token. In this article, we will explore the various aspects that affect the value of blur tokens, allowing investors and enthusiasts to deepen their understanding and make informed decisions.

Market Demand and Supply: One of the primary factors influencing the price of blur tokens is the basic economic principle of supply and demand. When there is a high demand for blur tokens and a limited supply, the price tends to increase. Conversely, if the supply surpasses the demand, the price is likely to decrease. Understanding market dynamics and monitoring trends can help predict potential price movements.

Technological Advancements: advancements in the underlying technology behind blur tokens can significantly impact their value. As new features and functionalities are introduced, the token becomes more efficient and desirable, driving up its price. Additionally, improvements in security and scalability enhance user confidence, attracting more investors and positively influencing the token's worth.

Regulatory Landscape: The regulatory environment surrounding cryptocurrencies has a profound impact on their value, and blur tokens are no exception. Government policies, such as licensing requirements, taxation, and regulatory frameworks, can either uplift or hinder the price of blur tokens. Staying informed about the latest regulations and compliance measures is crucial for investors and stakeholders in the blur token ecosystem.

Market Sentiment: Investor sentiment plays a vital role in determining the price of blur tokens. Positive news, market optimism, and an overall bullish sentiment tend to drive up prices, while negative developments, fear, and a bearish sentiment can lead to price declines. Monitoring market sentiment through social media, news platforms, and investment communities can provide valuable insights into potential price movements.

Competition and Partnerships: The competitive landscape and strategic partnerships within the blur token ecosystem can also affect its price. Increased competition from similar projects may lead to lower prices, while partnerships with established companies or influential individuals can generate positive market sentiment and drive up the token's value. Evaluating the competitive landscape and keeping track of significant partnerships can help in understanding potential price fluctuations.

In conclusion, the price of blur tokens is influenced by a variety of factors, ranging from market demand and supply to technological advancements and regulatory developments. By gaining a deeper understanding of these factors and closely monitoring market dynamics, investors and enthusiasts can make more informed decisions regarding blur token investments.

Factors Affecting Blur Token Price

Blur tokens are a unique digital asset that have gained popularity in the NFT market. The price of blur tokens can vary greatly, and it is influenced by several factors. Understanding these factors can provide a deeper insight into the dynamics of blur token pricing.

1. Rarity of the Blur Token

Rarity plays a significant role in determining the price of a blur token. Tokens that have a limited supply or are part of a rare series tend to have a higher value. Collectors and investors are willing to pay a premium for tokens that are considered rare or exclusive.

2. Demand and Hype

The demand for blur tokens can greatly impact their price. If a particular token gains a lot of attention and hype on social media platforms or is endorsed by influencers, it can drive up demand and subsequently the price. The perception of value and the overall market sentiment also influence demand for these tokens.

3. Utility and Functionality

The utility and functionality of blur tokens can affect their price as well. Tokens that have real-world use cases, such as access to exclusive content or privileges, may have a higher value. Additionally, tokens that can be used within a specific ecosystem or platform can also command a premium.

Overall, the price of blur tokens is influenced by a combination of factors, including rarity, demand, and utility. It's important for potential buyers and investors to consider these factors when evaluating the price of blur tokens. For more information about blur tokens and how to access your account on Blur.io, please visit the official website.

Evaluation of Token Rarity

Token rarity plays a crucial role in determining the price of blur tokens in the marketplace. The rarer a token is, the more valuable it becomes. Rarity is determined by several factors, including:

Supply

The total number of tokens in circulation directly affects rarity. If the supply is limited, tokens are more likely to be rare and valuable.

Demand

The level of demand for particular tokens contributes to their rarity. Tokens that are highly sought after by users have higher rarity and higher prices in the market.

Accessibility

The ease with which tokens can be acquired also affects their rarity. Tokens that are difficult to obtain, such as those with limited distribution or exclusive access, are more likely to be rare and valuable.

Utility

The usefulness and functionality of tokens can also impact their rarity. Tokens that offer unique features, benefits, or capabilities are more likely to be rare and in demand.

Token rarity is often evaluated and categorized into different levels, such as common, uncommon, rare, and legendary. These classifications help users and collectors understand the relative scarcity and value of different tokens in the market.

Understanding token rarity is essential for both buyers and sellers in the blur token marketplace. Buyers can assess the potential value and investment return of acquiring rare tokens, while sellers can strategically price their tokens based on their rarity.

Demand from the Crypto Community

The demand for Blur tokens is greatly influenced by the interest and participation from the crypto community. As Blur.IO gains popularity, more and more crypto enthusiasts are getting involved in collecting and trading Blur tokens. With its unique features and diverse artwork, Blur.IO attracts a wide range of collectors who appreciate the digital art forms it offers.

The crypto community's demand for Blur tokens is driven by various factors. Firstly, the concept of owning and trading non-fungible tokens (NFTs) has gained immense traction in recent years. The crypto community recognizes the potential value and uniqueness of NFTs, and they see Blur tokens as a desirable addition to their digital asset portfolios.

Furthermore, the exclusivity and limited supply of Blur.IO's digital artworks also contribute to the demand. As the number of Blur tokens issued for a particular piece of artwork is limited, collectors strive to obtain these tokens to secure ownership rights over a specific artwork. The scarcity factor increases the desirability and value of Blur tokens among the crypto community.

Another significant factor driving demand from the crypto community is the potential investment opportunities that Blur tokens offer. Some collectors view Blur tokens as investment assets that have the potential to appreciate in value over time. They speculate that as Blur.IO becomes more established and gains wider recognition, the value of Blur tokens may increase, providing them with a lucrative return on their investment.

As a result of these factors, the demand for Blur tokens from the crypto community has been growing steadily. Crypto enthusiasts actively participate in Blur.IO's token sales, auctions, and secondary market trading, continually driving the demand for Blur tokens.

If you want to learn more about Blur.IO and how to access your account, you can visit the official website: COME ACCEDERE ALL’ACCOUNT DI BLUR.IO.

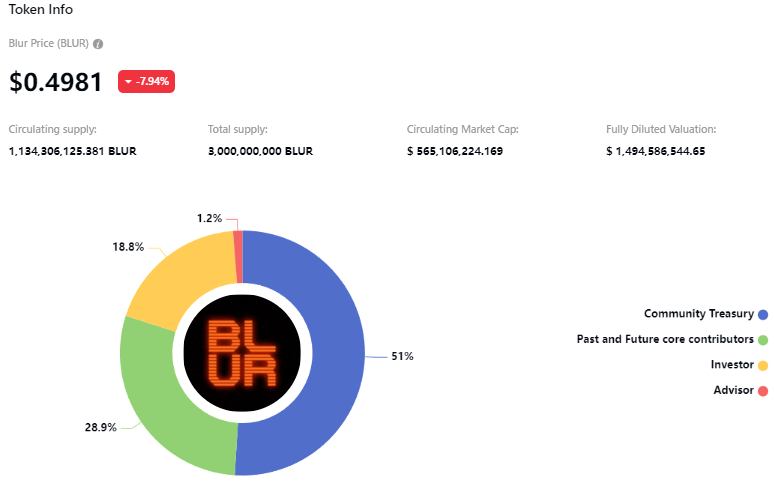

Supply and Distribution

The supply and distribution of blur tokens plays a crucial role in determining their price. The number of tokens available in the market directly impacts their scarcity and demand, ultimately affecting their value.

Blur tokens are distributed through various means, including initial coin offerings (ICOs), airdrops, and token sales. The distribution process determines the initial distribution of tokens among users and establishes the initial market supply.

The total supply of blur tokens is often fixed or predetermined, which means that no additional tokens can be minted or created beyond this limit. This fixed supply creates rarity and scarcity, which can drive up the price of individual tokens.

The distribution of blur tokens also involves different market participants, such as investors, collectors, and traders. Each participant may have different motivations and strategies for acquiring and holding blur tokens, which further influences their price.

Another factor that affects supply and distribution is the token vesting schedule. Some blur tokens may have a vesting period, which means that they are released gradually over time. This helps prevent a sudden flood of tokens in the market, allowing for a more controlled and gradual increase in the supply.

Overall, the supply and distribution of blur tokens are essential factors to consider when analyzing their price. The initial distribution, total supply, market participants, and vesting schedule all contribute to the dynamics of supply and demand, ultimately impacting the value of these tokens in the market.

For more information on blur tokens and how to access your blur.io account, please visit: COME ACCEDERE ALL’ACCOUNT DI BLUR.IO.

Utility and Functionality

The utility and functionality of Blur tokens play a crucial role in determining their price. The more useful and functional a token is, the higher its value is likely to be.

Blur tokens can serve various purposes depending on the project or platform they are associated with. Some tokens have a utility within a specific ecosystem, allowing users to access certain features or services. For example, a Blur token might allow users to purchase exclusive content, access premium features, or participate in governance decisions.

Furthermore, the functionality of Blur tokens can also influence their price. Tokens that have practical uses beyond the initial ICO phase are generally more valued by investors. This could include the ability to stake tokens for rewards, earn passive income through token dividends, or use tokens as a form of collateral.

Additionally, the scarcity of Blur tokens can enhance their utility and functionality. If the supply of tokens is limited, they may have increased value because of their scarcity. This scarcity can be achieved through various mechanisms such as token burning or locking up tokens for a certain period of time.

Integration with DeFi Platforms

Integration with decentralized finance (DeFi) platforms can significantly boost the utility and functionality of Blur tokens. By integrating with popular DeFi platforms like lending, borrowing, or yield farming protocols, Blur tokens can gain access to a larger user base and more diverse range of use cases.

For example, Blur tokens could be used as collateral for borrowing other cryptocurrencies, earning interest through lending platforms, or participating in liquidity pools for yield farming. These integrations can create additional demand for the tokens, driving up the price.

Market Demand and Adoption

Ultimately, the utility and functionality of Blur tokens are closely tied to market demand and adoption. If users find value in holding and using these tokens, and if the tokens gain widespread acceptance and adoption, their price is likely to increase.

Market demand can be influenced by factors such as the project's reputation, partnerships with established companies, or the overall interest in the project's vision and technology. Increased demand for Blur tokens can lead to higher prices as buyers are willing to pay a premium to acquire them.

In conclusion, the utility and functionality of Blur tokens are critical factors in determining their price. The usefulness of the tokens within a specific ecosystem, their functionality beyond the ICO phase, integration with DeFi platforms, and market demand all contribute to their value. As the blockchain industry continues to evolve, the utility and functionality of tokens will play an increasingly important role in the overall cryptocurrency market.

Market Sentiment and Perception

Market sentiment and perception play a crucial role in determining the price of blur tokens. The perception of investors and traders regarding the potential value of blur tokens can greatly influence the demand and supply dynamics in the market.

Positive market sentiment towards blur tokens can lead to increased buying pressure, pushing up their prices. This optimistic perception may be driven by various factors, such as positive news about the project, partnerships, or technological advancements. When investors believe that the blur token has a high potential for future growth and value appreciation, they are more likely to buy and hodl the tokens, resulting in increased demand and a higher price.

On the other hand, negative market sentiment can have the opposite effect. If investors perceive the blur token as overvalued or lacking potential, they may sell their tokens, leading to a decrease in demand and a decline in price. Negative news, regulatory restrictions, or concerns about the project's viability can all contribute to a negative sentiment, causing investors to lose confidence in the token's future prospects.

Furthermore, market sentiment and perception are often affected by external factors, such as overall market trends, economic conditions, or even social media discussions. For example, if there is a general bullish sentiment in the cryptocurrency market, it can positively influence the perception of blur tokens and drive their prices higher. Similarly, influential figures or social media influencers endorsing a project can also have a significant impact on market sentiment and the perceived value of tokens.

Positive News

Announcements of new partnerships, product launches, or successful implementations of the blur token.

Negative News

Regulatory crackdowns, security breaches, or scandals related to the blur token or the project behind it.

Overall Market Trends

If the cryptocurrency market as a whole is experiencing a bull run, it can positively affect the sentiment towards blur tokens.

Social Media Discussions

Conversations and opinions shared on social media platforms like Twitter, Reddit, or Telegram can influence the sentiment and perception of blur tokens.

Therefore, it is essential for investors and traders to closely monitor market sentiment, as it can provide valuable insights into the potential price movements of blur tokens. Understanding the factors influencing sentiment and perception can help investors make more informed decisions and navigate the volatility of the market.

Influencing Factors in the Blockchain Industry

The blockchain industry is a complex ecosystem influenced by various factors. Understanding these influencing factors is crucial for gaining insights into the dynamics of the industry and its impact on token prices. Here are some key factors that play a significant role in shaping the blockchain industry:

1. Technological Innovations

Technological advancements and innovations drive the blockchain industry forward. The development of new consensus algorithms, scalability solutions, and privacy-enhancing technologies can greatly impact the overall market sentiment and token prices. Projects that introduce groundbreaking solutions often attract attention and investor interest, leading to potential price surges.

2. Regulation and Legal Environment

Regulatory frameworks and legal environments greatly influence the blockchain industry. Governments' approach to blockchain and cryptocurrency regulation can determine the level of market acceptance and adoption. Clear and favorable regulations provide stability and foster investor confidence, resulting in positive price movements. Conversely, restrictive or uncertain regulations can lead to market volatility and negative price trends.

3. Market Sentiment and Investor Confidence

Market sentiment and investor confidence heavily influence token prices in the blockchain industry. Positive news, partnerships, and endorsements can create bullish sentiment, driving up demand and prices. Conversely, negative publicity, security breaches, or regulatory crackdowns can cause bearish sentiment, resulting in price declines. Monitoring and analyzing market sentiment can help predict price movements in the blockchain industry.

4. Adoption and Use Cases

The adoption and real-world use cases of blockchain technology and cryptocurrencies have a significant impact on token prices. Increased adoption by businesses, governments, and individuals can drive up demand, resulting in price appreciation. Projects with practical use cases and partnerships with established industries often attract attention and drive price movements.

5. Economic and Geopolitical Factors

Economic and geopolitical factors also influence the blockchain industry. Global economic conditions, inflation rates, geopolitical tensions, and trade policies can affect investor behavior and capital flows. Market participants often seek alternative assets, such as cryptocurrencies, during times of economic uncertainty or monetary policy changes. Understanding these global factors can provide insights into token price movements.

In conclusion, the blockchain industry is influenced by various factors that shape market dynamics and impact token prices. Technological innovations, regulation, market sentiment, adoption, and economic factors all play a crucial role in determining the direction of the industry. Monitoring and analyzing these influencing factors can help investors and participants gain a deeper understanding of the blockchain industry and make more informed decisions.

Integration with Existing Platforms

One of the key factors that can affect the price of blur tokens is the integration of this cryptocurrency with existing platforms. Integration with popular platforms can significantly increase the demand and adoption of blur tokens, leading to an increase in their price.

1. Integration with Social Media Platforms

Blur tokens can become more valuable if they are integrated with popular social media platforms like Twitter, Facebook, or Instagram. This integration can allow users to tip content creators or reward users for their engagement on these platforms. By adding blur tokens as a form of currency within social media platforms, the demand for these tokens may increase, making them more valuable.

2. Integration with E-commerce Platforms

Another way to increase the value of blur tokens is by integrating them with e-commerce platforms. Users can use blur tokens to purchase goods and services on these platforms, creating a new use case for these tokens. The integration with e-commerce platforms also opens the doors for more potential buyers and sellers to join the blur token ecosystem, consequently increasing the demand and price of the tokens.

In conclusion, the integration of blur tokens with existing platforms, such as social media and e-commerce platforms, can have a significant impact on their price. These integrations can increase the demand and adoption of blur tokens, ultimately making them more valuable in the market.

Regulatory Environment and Legal Considerations

The regulatory environment and legal considerations play a crucial role in determining the price of blur tokens. Cryptocurrencies, including blur tokens, are subject to various regulations and legal frameworks in different jurisdictions. Understanding these regulations and complying with them is essential for the success and stability of a cryptocurrency project.

Government Regulations

Government regulations can have a significant impact on the price of blur tokens. Different countries have different approaches to cryptocurrencies. Some governments embrace and support cryptocurrencies, providing a favorable regulatory environment. These jurisdictions often have clear guidelines and regulations that encourage the growth and adoption of cryptocurrencies, which can positively influence the price of blur tokens.

On the other hand, some governments are skeptical of cryptocurrencies and impose strict regulations or even ban their use. This can create uncertainty and hinder the widespread adoption of blur tokens, negatively affecting their price. Regulations related to know-your-customer (KYC) and anti-money laundering (AML) measures can also impact the price by introducing additional compliance costs and requirements.

Legal Considerations

Legal considerations are also crucial in determining the price of blur tokens. Cryptocurrencies operate within the existing legal frameworks, and any legal challenges or disputes can impact their price and overall market sentiment.

Intellectual property rights, for example, can play a role in determining the price of blur tokens. If there are patent disputes or the potential for intellectual property infringement, it can create uncertainty and legal battles that negatively affect the token's value.

Security laws and regulations are another legal consideration that can impact the price of blur tokens. Depending on the jurisdiction, regulatory authorities may require cryptocurrency projects to comply with specific security laws, such as obtaining licenses or registering as securities. Failure to meet these requirements can result in legal consequences and may affect the price of the tokens.

Legal considerations also extend to the legal structure of the cryptocurrency project. Ensuring compliance with corporate and contract laws is essential for the smooth operation of the project and the overall market perception of the tokens. Any legal discrepancies or challenges can lead to negative sentiment and affect the price of blur tokens.

Government Regulations

Can influence the price positively or negatively based on the regulatory environment in a specific jurisdiction

Legal Challenges

Can create uncertainty and negative sentiment, affecting the price of blur tokens

Intellectual Property Rights

Potential disputes can create uncertainty and legal battles, impacting the token's value

Security Laws and Regulations

Non-compliance can result in legal consequences and affect the price of blur tokens

Legal Structure

Any legal discrepancies or challenges can lead to negative sentiment and affect the price

Technological Advancements and Updates

Technological advancements and updates play a crucial role in influencing the price of blur tokens. In the fast-paced world of cryptocurrency, new technologies and updates are constantly introduced, which can have a drastic impact on the value of these digital assets. Here are some key factors related to technological advancements and updates that affect the price of blur tokens:

Blockchain Scalability Solutions: The scalability of the blockchain is a significant concern for blur tokens. Updates and advancements that address scalability issues can enhance the network's capacity to handle more transactions, resulting in increased demand and potentially driving up the price of blur tokens.

Security Enhancements: Any technological updates aimed at improving the security of the blockchain and blur tokens can have a positive impact on their price. People are more likely to invest in tokens that are backed by robust security measures, as it reduces the risk of hacks and other security breaches.

Interoperability: As blockchain technology evolves, interoperability becomes an important consideration. Updates that allow blur tokens to interact and integrate with other blockchain networks can create more use cases and utility for them, thereby increasing their value and price.

Smart Contract Functionality: Smart contracts are a fundamental component of many blockchain networks, including blur tokens. Technological advancements that enhance the functionality and capabilities of smart contracts can attract more users and developers, leading to higher demand and an increase in the price of blur tokens.

User Experience Improvements: Updates that focus on improving the user experience of blur tokens, such as faster transaction speeds and more intuitive interfaces, can make them more appealing to a wider audience. A positive user experience can drive up adoption and consequently influence the price of blur tokens.

Overall, technological advancements and updates are key factors in shaping the price of blur tokens. Investors and traders closely monitor these developments as they can provide valuable insights into the future potential and value of these digital assets.

Partnership and Collaboration Opportunities

Blur Token is open to forming partnerships and collaborations with various entities in order to enhance its ecosystem and drive the value of its tokens. By working together with other organizations, Blur Token aims to create synergies and explore new opportunities.

1. Exchanges and Wallet Providers

Blur Token seeks to partner with reputable exchanges and wallet providers to offer its tokens to a wider audience. By listing on more platforms, Blur Token can increase its liquidity and accessibility, attracting more users to its ecosystem.

2. Decentralized Applications (DApps) and Developers

Blur Token welcomes collaborations with DApps and developers who can integrate its token into their applications. By incorporating Blur Token into DApps, developers can offer unique features and experiences to their users, while also helping to increase the utility and demand for Blur tokens.

Blur Token can provide technical support and resources to facilitate the integration process, ensuring a seamless experience for both the developers and end-users.

3. Strategic Partnerships

Blur Token is interested in forming strategic partnerships with relevant organizations in the privacy and cybersecurity space. By collaborating with other industry leaders, Blur Token can leverage their expertise and resources to further enhance the privacy features of its ecosystem.

These partnerships can also lead to joint marketing initiatives and collaborations on research and development projects, strengthening the overall value proposition of Blur Token.

Ultimately, Blur Token is open to exploring partnership and collaboration opportunities that align with its mission of providing enhanced privacy solutions. By working together with like-minded organizations and individuals, Blur Token can continue to innovate and drive the adoption of its tokens.

Overall Economic Conditions

The overall economic conditions play a crucial role in determining the price of blur tokens. The market for blur tokens is influenced by various macroeconomic factors, such as the state of the national economy, inflation, interest rates, and fiscal policies implemented by the government.

1. National Economy: The overall health and performance of the national economy have a significant impact on the price of blur tokens. A strong and growing economy attracts more investors, leading to increased demand for blur tokens and potentially higher prices.

2. Inflation: Inflation refers to the general increase in prices over time. When the rate of inflation is high, the purchasing power of money decreases, and individuals tend to look for alternative investments to protect their wealth. Blur tokens can serve as a hedge against inflation, leading to increased demand and higher prices.

3. Interest Rates: Interest rates set by central banks affect borrowing costs and savings rates. When interest rates are low, borrowing becomes cheaper, encouraging individuals to invest in riskier assets like blur tokens. Lower interest rates can stimulate demand and potentially drive up the price of blur tokens.

4. Fiscal Policies: Government policies related to taxation, spending, and regulation can impact the overall economy and, consequently, the price of blur tokens. Expansionary fiscal measures, such as tax cuts or increased government spending, can boost economic growth and investor confidence, leading to higher demand for blur tokens and potentially higher prices.

Considering these overall economic conditions is vital for investors and traders to understand the factors that affect the price of blur tokens. By analyzing the macroeconomic environment, stakeholders can make informed decisions and predict potential price movements in the blur token market.

Investor Sentiment and Speculation

Investor sentiment and speculation play a crucial role in determining the price of blur tokens. These factors are driven by the emotions and expectations of investors, as well as their perceptions of the market.

1. Emotional Factors

Investors' emotions can heavily influence their decision-making process and, ultimately, the price of blur tokens. When investors feel optimistic about the future prospects and potential returns of blur tokens, they are more likely to buy and hold onto their investments, driving up the demand and price. Conversely, when investors become fearful or uncertain, they may sell off their holdings, leading to a decrease in price.

2. Market Perception

Investor sentiment is closely tied to market perception. If investors perceive that the market for blur tokens is booming and that there is a high demand, they are likely to invest, driving up the price. On the other hand, negative perceptions, such as concerns about the regulatory environment or doubts about the long-term viability of blur tokens, can lead to decreased investment and a decline in price.

3. Speculation

Speculation, or the act of making high-risk investments with the expectation of significant returns, also affects the price of blur tokens. When speculation is high, investors may buy blur tokens based on the belief that their price will increase in the future, regardless of the underlying value or fundamentals. This influx of speculative investment can create a temporary surge in price. However, if speculation dissipates, the price may decline rapidly, as there may not be sufficient demand from long-term investors.

In conclusion, investor sentiment and speculation are important factors that influence the price of blur tokens. Emotional factors, market perception, and speculative investments all contribute to the fluctuation and volatility of the token price. Therefore, it is important for investors to be aware of these factors and assess them in their decision-making process.

Future Growth and Potential of Blur Tokens

The future of Blur Tokens looks promising, with several factors indicating potential growth and value creation in the coming years.

1. Increasing Adoption and Usage

As more individuals and businesses recognize the benefits of blockchain technology and decentralized finance, the demand for Blur Tokens is expected to rise. The adoption of Blur Tokens as a medium of exchange and store of value can contribute to the growth of its ecosystem.

The ability to provide secure and private transactions through Blur's privacy features makes it an attractive option for individuals and businesses seeking to protect their financial privacy.

2. Enhanced Technology and Features

Blur Tokens continue to improve their technology and features to meet the evolving needs of the market. Ongoing research and development efforts aim to enhance privacy, security, and scalability, making Blur Tokens more efficient and user-friendly.

Integration with other blockchain platforms and applications can further expand the use cases and utility of Blur Tokens, driving their value and adoption.

3. Strategic Partnerships and Collaborations

By forming strategic partnerships and collaborations with other projects, Blur Tokens can tap into new markets and user bases. These partnerships can facilitate the integration of Blur Tokens into existing platforms, allowing for wider acceptance and usage.

Collaborations with established financial institutions, regulators, and government bodies can also help build trust and credibility for Blur Tokens in the wider market.

4. Market Sentiment and Investor Interest

Positive market sentiment and increased investor interest in blockchain and cryptocurrency projects can significantly impact the future growth of Blur Tokens. A growing community of supporters and investors can lead to increased liquidity, market depth, and overall value for Blur Tokens.

Furthermore, the overall adoption and acceptance of digital currencies globally can create more opportunities for Blur Tokens, driving their future growth.

Conclusion

The future growth and potential of Blur Tokens are closely tied to the overall adoption and acceptance of blockchain technology, as well as the demand for secure and private transactions. As the ecosystem continues to evolve and improve, Blur Tokens have the potential to become a prominent player in the digital currency space.

What are blur tokens?

Blur tokens are a form of digital currency that can be used to purchase services on the Blur platform. They are created through a process called mining, where powerful computers solve complex mathematical equations to validate transactions on the network.

How is the price of blur tokens determined?

The price of blur tokens is determined by supply and demand. If there are more people seeking to buy blur tokens than there are people selling them, the price will increase. Conversely, if there are more people selling blur tokens than there are people buying them, the price will decrease.

What factors can influence the price of blur tokens?

Several factors can influence the price of blur tokens. These include market demand, global economic conditions, regulatory actions, technological advancements, and investor sentiment. Changes in any of these factors can lead to fluctuations in the price of blur tokens.

How does the mining process affect the price of blur tokens?

The mining process plays a significant role in the price of blur tokens. As more people mine for blur tokens, the supply of tokens increases, which can lead to a decrease in price. Conversely, if fewer people mine for blur tokens, the supply decreases, which can drive up the price.

Is investing in blur tokens a good idea?

Whether investing in blur tokens is a good idea depends on various factors, including your risk tolerance, investment goals, and understanding of the market. It's essential to conduct thorough research and seek professional advice before making any investment decisions.

Blur: NFT | Blur: NFT login | Blur: NFT connect | WalletConnect | Traders | What Is Blur Crypto

2022-2024 @ Factors affecting the price of blur tokens gaining a deeper understanding