Understanding the significance of market capitalization in an ever-changing investment landscape

Blur: NFT | Blur: NFT login | Blur: NFT connect | WalletConnect | Traders | What Is Blur Crypto

Blur: NFT | Blur: NFT login | Blur: NFT connect | WalletConnect | Traders | What Is Blur Crypto

In the world of investing, understanding market capitalization is crucial for making informed decisions. Market capitalization refers to the total value of a company's outstanding shares of stock, which is determined by multiplying the current share price by the number of shares outstanding. This metric provides investors and analysts with a snapshot of a company's size, as well as its potential for growth and profitability.

One of the main reasons why market capitalization is important is because it helps investors classify stocks into different categories based on their size. Companies are typically classified as large cap, mid cap, or small cap, depending on their market capitalization. Large cap stocks are those with a market capitalization of over $10 billion, while mid cap stocks have a market capitalization between $2 billion and $10 billion. Small cap stocks, on the other hand, have a market capitalization of less than $2 billion.

Understanding the classification of stocks based on market capitalization is essential because it can help investors determine their level of risk tolerance. Generally, large cap stocks are considered less volatile and less risky compared to small cap stocks. This is because larger companies often have a more established presence in the market, with a proven track record of generating consistent profits.

However, investing solely in large cap stocks may not always be the best strategy. While these stocks may offer more stability, they may also have limited potential for growth compared to smaller companies. Small cap stocks, on the other hand, have the potential for significant growth, but they are also more volatile and carry a higher level of risk. Therefore, diversifying one's portfolio with a mix of large cap, mid cap, and small cap stocks can help mitigate risk while maximizing potential returns.

The Significance of Market Capitalization in the Turbulent Investment Market

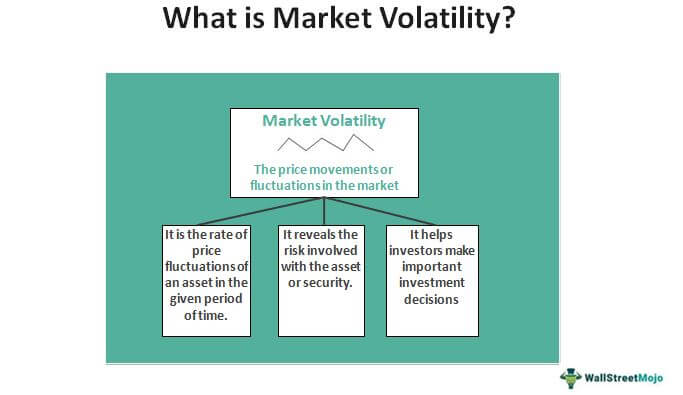

Market capitalization plays a crucial role in understanding the dynamics and risks associated with investing in the volatile market. It refers to the total value of a company's outstanding shares in the market, calculated by multiplying the current stock price by the number of shares outstanding.

Understanding Market Capitalization

Market capitalization provides investors with insight into a company's size and worth. It classifies companies into different categories, such as large-cap, mid-cap, and small-cap, based on their market value. These classifications further help investors make informed decisions, as each category presents its own set of opportunities and risks.

Large-cap companies are characterized by their stability and established market presence. They generally have a market capitalization higher than $10 billion and are likely to have a strong financial position. On the other hand, mid-cap companies have a market capitalization between $2 billion and $10 billion, offering a potential for growth and moderate risk. Small-cap companies, with a market capitalization below $2 billion, present higher risk but may also offer higher returns.

The importance of market capitalization lies in its ability to provide a snapshot of a company's value and size at any given time. This information allows investors to assess the potential risks and rewards of investing in a particular company.

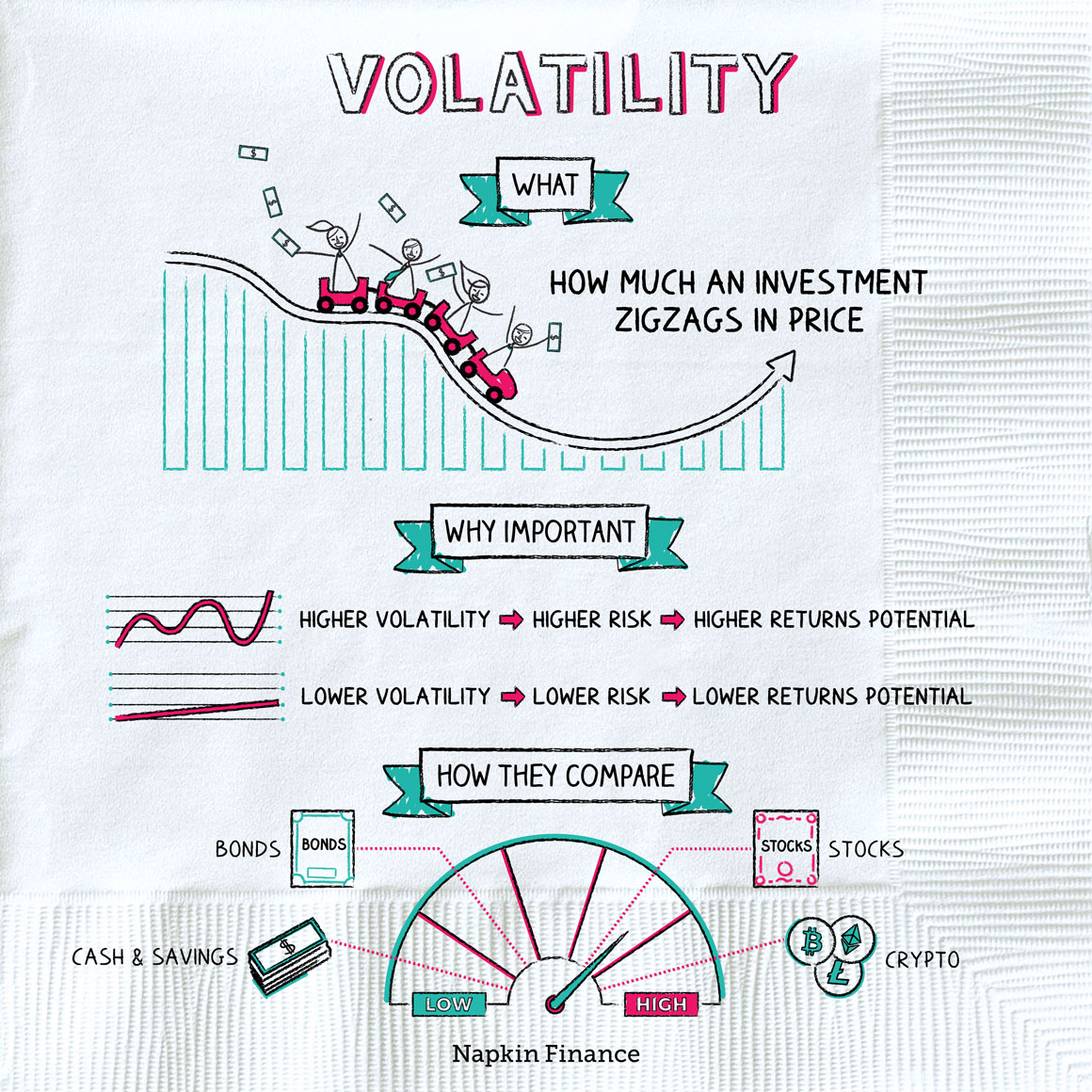

Market Capitalization and Volatility

Volatility is a common characteristic of the investment market, and market capitalization can help investors understand the level of risk associated with different stocks. Generally, smaller companies with lower market capitalization are more susceptible to market fluctuations and can experience higher levels of volatility. This is due to their smaller size and often limited resources, which can make them more vulnerable to economic changes and industry trends.

Conversely, large-cap companies tend to be more stable and less prone to rapid price fluctuations. Their larger market capitalization provides them with a cushion against market turbulence, as they have the resources and market presence to navigate through challenging times. However, it is important to note that even large-cap companies can be affected by macroeconomic factors and industry-specific events.

When investing in the volatile market, understanding market capitalization can help investors assess the potential risks and rewards associated with different stocks. It allows them to gauge the level of volatility and make informed decisions based on their risk tolerance and investment goals.

Conclusion

Market capitalization is a crucial metric for investors, particularly in the turbulent investment market. It provides valuable insights into a company's value, size, and level of risk. By understanding market capitalization, investors can make informed decisions and manage their portfolio accordingly.

For more information on investment opportunities and staying updated with the latest market trends, check out the Blur.io website. It offers a wealth of resources and tools to help investors navigate the volatile investment market.

Understanding Market Capitalization

Market capitalization, often referred to as market cap, is a measure used to determine the value and size of a publicly traded company. It is calculated by multiplying the company's current stock price by the total number of outstanding shares.

Market capitalization is an important metric because it provides insights into the overall worth and stability of a company. It is a key factor that investors consider when making investment decisions.

There are various categories of market capitalization, including:

Large-cap: These are companies with a market capitalization of over $10 billion. Large-cap companies are generally well-established and have a history of stable performance.

Mid-cap: These are companies with a market capitalization between $2 billion and $10 billion. Mid-cap companies are often in a growth phase and may offer potential for higher returns.

Small-cap: These are companies with a market capitalization between $300 million and $2 billion. Small-cap companies are generally younger and may have higher growth potential, but also come with higher risk.

Micro-cap: These are companies with a market capitalization under $300 million. Micro-cap companies are typically very small and may be more volatile.

Investors often use market capitalization as a way to determine the risk and potential return of an investment. Large-cap companies are considered less risky but may offer lower returns, while small-cap and micro-cap companies are generally riskier but may offer higher returns.

It is worth noting that market capitalization is not the only metric to consider when evaluating a company. Other factors, such as revenue growth, profitability, and industry trends, should also be taken into account to make informed investment decisions.

In conclusion, understanding market capitalization is crucial for investors as it provides insights into the size, stability, and potential of a company. By considering market capitalization alongside other relevant factors, investors can make more informed investment decisions in the volatile investment market.

Key Factors Affecting Market Capitalization

Market capitalization, or market cap, is a crucial metric that measures the total value of a company's outstanding shares of stock. It reflects the perception of the market regarding the company's worth. Several factors can impact a company's market capitalization, influencing its position in the volatile investment market. These key factors include:

1. Financial Performance

The financial performance of a company is one of the primary factors that affects its market capitalization. Investors analyze a company's revenue, earnings, profit margins, and other financial indicators to assess its potential for growth and profitability. A company with consistent and strong financial performance is likely to have a higher market capitalization compared to one with unstable or declining financials.

2. Industry Trends and Competitive Landscape

The industry trends and competitive landscape also play a significant role in determining a company's market capitalization. Investors consider the growth potential of the industry in which the company operates and evaluate its competitiveness relative to other players in the market. A company operating in a promising industry with favorable market conditions and a competitive advantage is more likely to attract investors and, consequently, have a higher market capitalization.

3. Investor Sentiment and Market Perception

Investor sentiment and market perception can heavily influence a company's market capitalization. Positive news, such as strong earnings reports, successful product launches, or strategic partnerships, can boost investor confidence and drive up the company's stock price, resulting in an increased market cap. Conversely, negative news, such as lawsuits, regulatory issues, or declining sales, can erode investor confidence and lead to a decrease in market capitalization.

4. Company Size and Growth Potential

The size and growth potential of a company also impact its market capitalization. Generally, larger companies tend to have higher market capitalizations due to their extensive operations and larger market shares. However, high-growth companies with innovative products or services and significant growth prospects often attract investors seeking high returns, leading to a higher market capitalization despite their smaller size.

5. Corporate Governance and Management

Corporate governance practices and the quality of management can influence a company's market capitalization. Investors assess the transparency, accountability, and effectiveness of a company's governance structure, as well as the track record and competence of its management team. Companies with strong corporate governance and competent management are more likely to inspire investor confidence and maintain a higher market capitalization.

Overall, market capitalization is influenced by a combination of financial performance, industry trends, investor sentiment, company size, and corporate governance. Investors and market participants carefully consider these key factors to make informed investment decisions and navigate the volatile investment market.

Market Capitalization and Investment Risk

Market capitalization is a key metric used by investors to assess the size and risk of a company or investment. By understanding market capitalization and how it relates to investment risk, investors can make more informed decisions about where to allocate their capital.

Market capitalization represents the total value of a company's outstanding shares of stock. It is calculated by multiplying the current market price per share by the total number of shares outstanding. This metric gives investors an idea of the overall size and worth of a company.

When it comes to investment risk, market capitalization plays a significant role. Generally, larger companies with higher market capitalizations have a lower risk profile compared to smaller companies. This is because larger companies tend to have more stable and diversified revenue streams, larger customer bases, and greater access to capital.

Smaller companies, on the other hand, often have higher growth potential but also come with higher risks. They may have limited market presence, less-established operations, and a higher dependency on a single product or market segment. These factors can make them more susceptible to fluctuations in the market, economic downturns, and other external factors.

Investors looking to minimize their risk exposure may prefer to invest in companies with higher market capitalizations. These companies are often referred to as "blue-chip" stocks and are typically found in more mature industries. While they may offer more stable returns, they may also have lower growth potential compared to smaller, high-growth companies.

On the other hand, investors seeking higher returns and are willing to accept higher risks may choose to invest in smaller companies with lower market capitalizations. These companies may have more room for growth and may offer the opportunity for significant returns if they can successfully execute their growth strategies.

It's important for investors to consider their risk tolerance, investment goals, and time horizon when deciding how much weight to give market capitalization in their investment decisions. While market capitalization can be a useful metric for assessing risk, it should not be the sole determinant of investment decisions.

JAK ZALOGOWAĆ SIĘ DO KONTA BLUR.IO

Market Capitalization Categories and Risk Levels

Market capitalization is an essential metric when assessing the risk levels associated with investments. It indicates the total value of a company's outstanding shares and helps investors determine its size and stability in the market. Market capitalization is typically classified into three main categories:

1. Large Cap

Large-cap companies have market capitalizations exceeding $10 billion. These companies are usually well-established, with a track record of consistent revenue and profits. They are recognized leaders in their industries and tend to have lower risk levels compared to small or mid-cap companies. Large-cap stocks are considered less volatile and attract conservative investors looking for stable returns over the long term.

2. Mid Cap

Mid-cap companies have market capitalizations ranging from $2 billion to $10 billion. These companies are typically in a growth phase and show potential for expansion. They may have smaller market shares compared to large-cap companies but still offer significant opportunities for investors. Mid-cap stocks usually have higher risk levels compared to large-cap stocks but also come with the potential for higher returns.

3. Small Cap

Small-cap companies have market capitalizations below $2 billion. These companies are often in the early stages of development and have high growth potential. However, they also carry higher risk levels due to their limited resources and market presence. Investing in small-cap stocks can be volatile and requires a higher risk tolerance. They are attractive to aggressive investors seeking substantial returns but are also more susceptible to market fluctuations.

Understanding the different market capitalization categories is crucial for investors to align their investment strategies and risk levels. It allows them to diversify their portfolios and balance the potential for returns with the associated risks. It is important to conduct thorough research and analysis when considering investments in different market capitalization categories to make informed decisions.

Large Cap

Exceeding $10 billion

Low

Mid Cap

$2 billion to $10 billion

Moderate

Small Cap

Below $2 billion

High

Impact of Market Capitalization on Investment Returns

Market capitalization is a key factor that investors consider when making investment decisions. It refers to the total value of a company's outstanding shares of stock, calculated by multiplying its current stock price by the number of shares outstanding.

Investors often classify companies into different market cap categories, such as large-cap, mid-cap, and small-cap. Each category represents companies of different sizes, which can have varying degrees of risk and return potential.

1. Large-Cap Companies

Large-cap companies are usually well-established and widely known. They have market capitalizations typically exceeding billions of dollars. These companies tend to be less volatile compared to smaller companies and are considered more stable. As a result, they offer lower but more predictable returns. Large-cap companies are preferred by risk-averse investors seeking long-term stability and steady income.

2. Mid-Cap Companies

Mid-cap companies have market capitalizations between large-cap and small-cap companies. They are often in a growth phase, with expansion plans and potential for increased market share. Mid-cap companies typically offer greater growth potential compared to large-cap companies but can be more volatile. Investors looking for a balance between growth and stability may find mid-cap companies attractive.

3. Small-Cap Companies

Small-cap companies have market capitalizations at the lower end of the spectrum. These companies are often young and in the early stages of growth. They have the potential for significant growth but come with higher risk. Small-cap companies can experience more volatility and are more sensitive to market fluctuations. Investors with a higher risk tolerance and seeking higher returns may consider investing in small-cap companies.

It's important to note that market capitalization is just one factor to consider when making investment decisions. Other factors, such as the company's financial health, industry trends, and overall market conditions, should also be taken into account.

In conclusion, understanding the impact of market capitalization on investment returns can help investors make informed decisions. Large-cap companies provide stability but lower returns, while mid-cap and small-cap companies offer greater growth potential but come with higher risk. By diversifying across market cap categories, investors can balance their risk and return objectives.

Growth Potential of Small-Cap Companies

Small-cap companies, which are typically defined as having a market capitalization between $300 million and $2 billion, can offer investors unique growth opportunities. While they may not have the same level of resources and visibility as larger companies, small caps have the potential to deliver significant returns over time.

Dynamic Nature

One of the key advantages of investing in small-cap companies is their dynamic nature. These companies often operate in niche markets or emerging industries, which can provide them with the potential for rapid growth. Unlike large-cap companies, small caps are more agile and able to adapt quickly to changing market conditions. This flexibility can enable them to capitalize on new trends and innovations, giving investors the opportunity to capture substantial gains.

Untapped Potential

Small-cap companies are often undiscovered gems in the investment market. They may be underrepresented in mainstream indexes and overlooked by institutional investors. However, this lack of attention can present an opportunity for long-term investors to find undervalued stocks with significant growth potential. As these companies grow and gain recognition, their stock prices have the potential to appreciate rapidly, offering investors substantial returns.

Moreover, small-cap companies have the potential to become acquisition targets for larger companies looking to expand or enter new markets. This can result in substantial gains for shareholders if an acquisition occurs at a premium price.

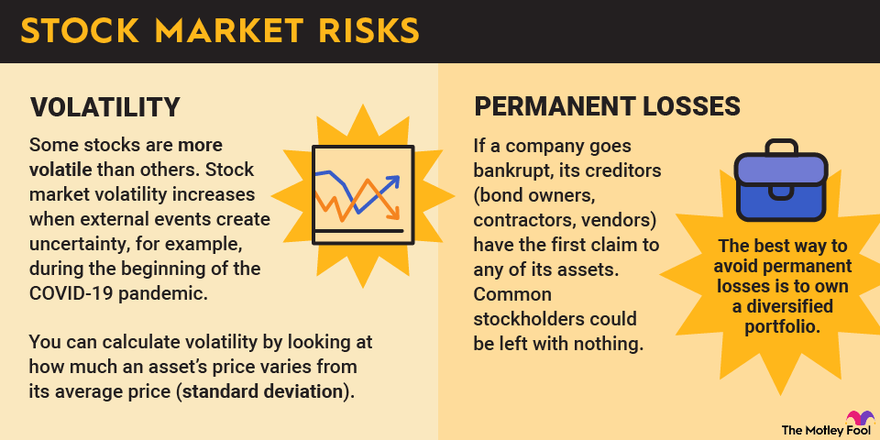

Risks and Volatility

While small-cap companies offer exciting growth potential, it is important to note that they come with higher risks and greater volatility compared to their larger counterparts. The relatively smaller size of these companies can make them more susceptible to market downturns, economic shocks, and specific industry risks. Additionally, small caps tend to have less diverse revenue streams, which can magnify the impact of any negative developments.

Investors considering small-cap investments should carefully assess their risk tolerance and investment horizon.

Due diligence is essential in researching small-cap companies before investing, including analyzing their financials, growth prospects, management team, and competitive landscape.

Patience is key when investing in small caps, as it may take time for their growth potential to be fully realized.

Overall, small-cap companies can offer investors an opportunity to access the growth potential of emerging industries and niche markets. However, due diligence and a thorough understanding of the associated risks are crucial for successful investment in this segment of the market.

Stability of Large-Cap Companies

Market capitalization serves as a key indicator of a company's stability in the volatile investment market. Large-cap companies, which are defined as those with market capitalizations exceeding $10 billion, often exhibit a higher level of resilience compared to their smaller counterparts.

One of the primary reasons for the stability of large-cap companies is their strong financial position. These companies typically have a long history of profitability, ample cash reserves, and low levels of debt. This financial strength allows them to weather economic downturns and uncertainties more effectively.

Additionally, large-cap companies often have established market positions and enjoy brand recognition. This provides them with a competitive advantage and makes it easier for them to generate consistent revenue and attract investments. Investors tend to gravitate towards these companies due to their track record of success and market dominance.

Furthermore, large-cap companies often exhibit more stable and predictable earnings growth compared to smaller companies. This stability is attractive to risk-averse investors who prioritize consistent returns on their investments. With a larger market presence, these companies can tap into multiple revenue streams and diversify their business operations.

In the volatile investment market, large-cap companies also tend to possess greater institutional ownership. Institutional investors, such as pension funds and mutual funds, often favor large-cap stocks due to their perceived lower risks. The higher level of institutional ownership provides these companies with a more stable shareholder base, which helps cushion any potential market shocks.

Overall, the stability of large-cap companies stems from their financial strength, established market positions, predictable earnings growth, and higher institutional ownership. These factors make them less vulnerable to market fluctuations and position them as more reliable investment options in the volatile investment market.

Opportunities and Risks in Mid-Cap Investing

When it comes to investing in the stock market, mid-cap companies can offer unique opportunities and risks. Mid-cap companies are defined as those with a market capitalization (market cap) between $2 billion and $10 billion. While they may not have the same level of visibility as large-cap companies, mid-caps can provide investors with the potential for growth and higher returns.

One of the main advantages of investing in mid-cap companies is the potential for growth. These companies are often in the growth phase, where they have proven their ability to compete in the market and are now expanding their operations. This growth potential can lead to increased stock prices and higher returns for investors.

The Mid-Cap Advantage

Mid-cap companies often have a niche market or product that sets them apart from their competitors. This uniqueness can give them a competitive advantage and make them attractive to investors. Additionally, mid-cap companies may be more nimble and flexible than their larger counterparts, allowing them to adapt quickly to market changes and take advantage of new opportunities.

The Risks of Mid-Cap Investing

While mid-cap companies can offer opportunities for growth, they also come with their fair share of risks. One of the main risks is the volatility of their stock prices. Due to their smaller size and potentially lower liquidity, mid-cap stocks can be more prone to significant price swings, especially during market downturns.

Another risk to consider is the potential for limited resources and financial stability. Mid-cap companies may not have the same access to capital as large-cap companies, which can make them more susceptible to economic downturns or unexpected challenges. It is crucial for investors to thoroughly research and analyze the financial health and stability of mid-cap companies before committing their funds.

In conclusion, mid-cap investing can offer unique opportunities for growth and higher returns. However, it is important for investors to be aware of the risks that come with investing in mid-cap companies. By carefully assessing the potential for growth and considering the associated risks, investors can make informed decisions and potentially benefit from the volatility of the mid-cap market segment.

Market Capitalization and Liquidity

Market capitalization, also known as market cap, is a key metric that investors use to evaluate the size and value of a company. It is calculated by multiplying the company's total outstanding shares by the current market price per share. Market capitalization helps investors understand the scale of a company and its relative importance in the market.

Liquidity, on the other hand, refers to the ease with which an asset can be bought or sold without causing a significant change in its price. In the context of market capitalization, liquidity plays a crucial role in determining the stability and attractiveness of an investment.

A company with a high market capitalization tends to have higher liquidity compared to smaller companies. This is because larger companies often have a larger number of shares outstanding, which facilitates greater trading volume and liquidity in the market. Investors generally prefer highly liquid stocks as they provide greater flexibility and faster execution of trades.

Furthermore, market capitalization and liquidity can also affect the volatility of a stock. Stocks with high market capitalization and liquidity are often less volatile compared to those with lower market capitalization. This is because larger companies with higher market cap are generally more stable and less susceptible to sudden price swings caused by relatively small buy or sell orders.

Investors also consider liquidity when evaluating the risk associated with an investment. Stocks with low liquidity may not be as attractive as they pose a higher risk of price manipulation or difficulty in exiting a position quickly. Therefore, market capitalization and liquidity go hand in hand in helping investors make informed investment decisions.

Overall, understanding the relationship between market capitalization and liquidity is essential for investors in navigating the volatile investment market. By considering these factors, investors can mitigate risks and make better investment choices that align with their goals and risk tolerance.

Market Capitalization and Portfolio Diversification

One of the key factors to consider when building an investment portfolio is market capitalization. Market capitalization represents the total value of a company's outstanding shares of stock.

Portfolio diversification is an important strategy for investors to manage risk and maximize returns. By investing in companies with different market capitalizations, investors can reduce their exposure to the volatility of any single stock or sector.

Large-cap stocks, which are typically defined as companies with market capitalizations above $10 billion, can provide stability and steady returns. These companies are often well-established and have a track record of success. They tend to be less volatile than small-cap or mid-cap stocks, making them a popular choice for conservative investors.

On the other hand, small-cap stocks, with market capitalizations below $2 billion, can offer higher growth potential. These companies are often in the early stages of development and may be more innovative and agile. While small-cap stocks can be more volatile, they can also provide substantial returns for investors willing to take on additional risk.

Mid-cap stocks, which fall between large-cap and small-cap stocks with market capitalizations between $2 billion and $10 billion, can offer a balance of growth potential and stability. These companies have already demonstrated some success but still have room for expansion. Investing in mid-cap stocks can provide diversification benefits while still allowing for potential growth.

By diversifying their portfolios across market capitalizations, investors can potentially increase their chances of earning positive returns while reducing the overall risk. This strategy allows investors to have exposure to different sectors and types of companies, providing a balance of stability and growth potential.

Large-cap

Market capitalizations > $10 billion

Stability, steady returns

Mid-cap

Market capitalizations between $2 billion and $10 billion

Growth potential, some stability

Small-cap

Market capitalizations < $2 billion

Higher growth potential, volatility

Investors should consider their risk tolerance and investment goals when deciding how to allocate their portfolio across different market capitalizations. It's also important to regularly review and rebalance the portfolio to ensure it remains aligned with the investor's objectives.

Market Capitalization and Sector Allocation

Market capitalization is an important factor to consider when determining the value of a company and its potential for growth. It is the total market value of a company's outstanding shares of stock, calculated by multiplying the current market price per share by the total number of outstanding shares.

One way to assess the risk and potential of an investment is by analyzing the sector allocation within a market capitalization-weighted portfolio. Sector allocation refers to the distribution of investments across different sectors, such as technology, finance, healthcare, and energy.

By analyzing a portfolio's sector allocation, investors can gain insights into potential risks and opportunities. Different sectors often perform differently in various market conditions, so having a well-diversified portfolio across sectors can help reduce overall risk.

Technology

$1,000,000,000

25%

Finance

$800,000,000

20%

Healthcare

$600,000,000

15%

Energy

$400,000,000

10%

Other Sectors

$2,200,000,000

55%

In the example above, a portfolio with a market capitalization of $5,000,000,000 is allocated across different sectors. The technology sector has the highest market capitalization and represents 25% of the portfolio, followed by finance at 20%, healthcare at 15%, and energy at 10%. The remaining 55% is allocated to other sectors.

Different sectors may have different levels of volatility and growth potential. By carefully selecting and diversifying investments across sectors, investors can potentially minimize risk and maximize returns.

It is important for investors to regularly review and rebalance their portfolios to maintain the desired sector allocation. Changes in market conditions or sector performance may require adjustments to ensure the portfolio remains aligned with the investor's goals and risk tolerance.

Market Capitalization and Market Volatility

Market capitalization refers to the total market value of a company's outstanding shares. It is calculated by multiplying the current share price by the total number of shares outstanding. Market capitalization is an important metric used by investors to assess the size and value of a company. However, market capitalization alone does not provide a complete picture of a company's financial health.

Market volatility, on the other hand, refers to the frequency and magnitude of price changes in the market. It is a measure of how quickly and dramatically prices can fluctuate. High volatility can create both opportunities and risks for investors. It can provide opportunities for profit through price swings, but it also increases the risk of investment losses.

In relation to market capitalization, there is a correlation between market volatility and the size of a company. Generally, smaller companies with lower market capitalization tend to be more volatile compared to larger companies. This is because smaller companies are typically more sensitive to changes in market conditions and can be influenced by company-specific events.

Investors should be aware of the relationship between market capitalization and market volatility when making investment decisions. Large-cap stocks, which are shares of companies with higher market capitalization, typically have lower volatility compared to small-cap stocks. Investing in large-cap stocks can be less risky but may also have lower growth potential.

On the other hand, small-cap stocks, which are shares of companies with lower market capitalization, tend to have higher volatility. While investing in small-cap stocks can involve higher risk, it can also provide greater opportunities for higher returns. It is important for investors to carefully assess their risk tolerance and investment objectives when considering investments in small-cap stocks.

In summary, market capitalization and market volatility are interconnected. The size of a company, as indicated by its market capitalization, can influence its volatility. Understanding this relationship can help investors make more informed investment decisions and manage their portfolio according to their risk tolerance and investment goals.

Market Capitalization as a Long-Term Investment Strategy

When it comes to investing in the volatile market, having a long-term investment strategy is crucial for success. One such strategy that many experts recommend is market capitalization. Market capitalization, also known as market cap, is a measure of a company's size and value in the stock market.

Market capitalization is calculated by multiplying a company's share price by the total number of its outstanding shares. This metric is important because it provides investors with an idea of the company's worth and its position in the market.

As a long-term investment strategy, market capitalization can be used to identify companies that have the potential for growth. Generally, larger companies with a higher market cap are considered to be more stable and less risky investments. These companies often have a solid track record, established customer base, and a strong presence in their industry.

Investing in large-cap companies can be a smart move for long-term investors as they tend to be less volatile compared to small-cap or mid-cap companies. This stability can provide investors with a sense of security, especially during times of market uncertainty.

Additionally, large-cap companies are often well-established and have the resources to weather economic downturns. They may have a global presence, diversified revenue streams, and strong cash flow. This can make them more resistant to market fluctuations and increase their chances of long-term success.

Another advantage of investing in large-cap companies is the potential for dividend income. Many large-cap companies have a history of paying regular dividends to their shareholders, making them attractive to income-focused investors.

It is important to note that while market capitalization is a useful metric for long-term investors, it should not be the sole factor in making investment decisions. Other factors such as a company's financial health, management team, competitive advantage, and industry trends should also be considered.

In conclusion, market capitalization can serve as a valuable long-term investment strategy. Investing in large-cap companies can provide stability, potential for growth, and the possibility of dividend income. However, it is important for investors to conduct thorough research and consider other factors before making investment decisions.

Future Trends in Market Capitalization

The concept of market capitalization has always been a crucial factor in the investment market. As we move into the future, several trends are expected to influence market capitalization.

1. Technological Advancements: With the rapid advancement of technology, various industries are witnessing significant disruptions. Companies that adapt and innovate in line with these advancements are likely to experience growth in market capitalization.

2. Emerging Markets: As emerging markets continue to expand and attract investments, companies operating in these markets have the potential to experience substantial growth in market capitalization. These markets often offer untapped opportunities and high growth potential.

3. ESG Considerations: Environmental, Social, and Governance (ESG) factors are increasingly influencing investment decisions. Investors are focusing on companies that demonstrate strong ESG practices, which can positively impact market capitalization.

4. Industry Disruptions: Various industries face disruptions from new business models, technological advancements, and changing consumer preferences. Companies that can navigate these disruptions and adapt to the changing landscape are expected to see fluctuations in market capitalization.

5. Investor Sentiment: Investor sentiment plays a crucial role in market capitalization. Market trends, economic indicators, and geopolitical factors can influence investor behavior, which in turn impacts the market capitalization of companies.

6. Regulatory Changes: Changes in regulations and policies can have a significant impact on market capitalization. Companies that can effectively manage compliance with new regulations while minimizing disruption are likely to maintain or increase their market capitalization.

7. Global Economic Conditions: Global economic conditions, such as economic growth, inflation rates, and interest rates, can have a direct impact on market capitalization. A stable and growing economy often leads to increased market capitalization.

In conclusion, market capitalization in the investment market is influenced by various factors. As we move into the future, technological advancements, emerging markets, ESG considerations, industry disruptions, investor sentiment, regulatory changes, and global economic conditions will continue to shape and define market capitalization trends.

Why is market capitalization important in the volatile investment market?

Market capitalization is important in the volatile investment market because it helps investors understand the size and value of a company. This information can be crucial in assessing the potential risks and rewards associated with investing in a particular stock.

How can market capitalization affect investment decisions?

Market capitalization can affect investment decisions because it is often used as an indicator of a company's stability and growth potential. Investors may choose to invest in large-cap companies for their stability, while others may be interested in small-cap companies for their potential for rapid growth.

What is the relationship between market capitalization and volatility?

The relationship between market capitalization and volatility is complex. Generally, larger companies with higher market capitalizations tend to be more stable and less volatile. On the other hand, smaller companies with lower market capitalizations can be more vulnerable to market fluctuations and have the potential for higher volatility.

How can market capitalization be used to evaluate the risk of investing in a particular stock?

Market capitalization can be used to evaluate the risk of investing in a particular stock by providing insights into a company's size, liquidity, and stability. Larger companies with higher market capitalizations are often considered less risky investments compared to smaller companies with lower market capitalizations.

What are the different categories of market capitalization?

Market capitalization can be categorized into three main groups: large-cap, mid-cap, and small-cap. Large-cap refers to companies with a market capitalization of over $10 billion, mid-cap refers to companies with a market capitalization between $2 billion and $10 billion, and small-cap refers to companies with a market capitalization of less than $2 billion.

What is market capitalization?

Market capitalization refers to the total value of a company's outstanding shares of stock. It is calculated by multiplying the current market price of a share by the total number of shares outstanding. It is an important metric that allows investors to assess the size and financial strength of a company.

Why is market capitalization important in the volatile investment market?

Market capitalization is important in the volatile investment market because it helps investors understand the level of risk associated with a particular stock. Generally, larger companies with higher market capitalizations tend to be more stable and less volatile compared to smaller companies. Investors can use market capitalization as a tool to evaluate the potential returns and risks of different investment opportunities.

Blur: NFT | Blur: NFT login | Blur: NFT connect | WalletConnect | Traders | What Is Blur Crypto

2022-2024 @ The importance of market capitalization in the volatile investment market