Getting a grasp on the fundamentals of cryptocurrency tax regulations

Blur: NFT | Blur: NFT login | Blur: NFT connect | WalletConnect | Traders | What Is Blur Crypto

Blur: NFT | Blur: NFT login | Blur: NFT connect | WalletConnect | Traders | What Is Blur Crypto

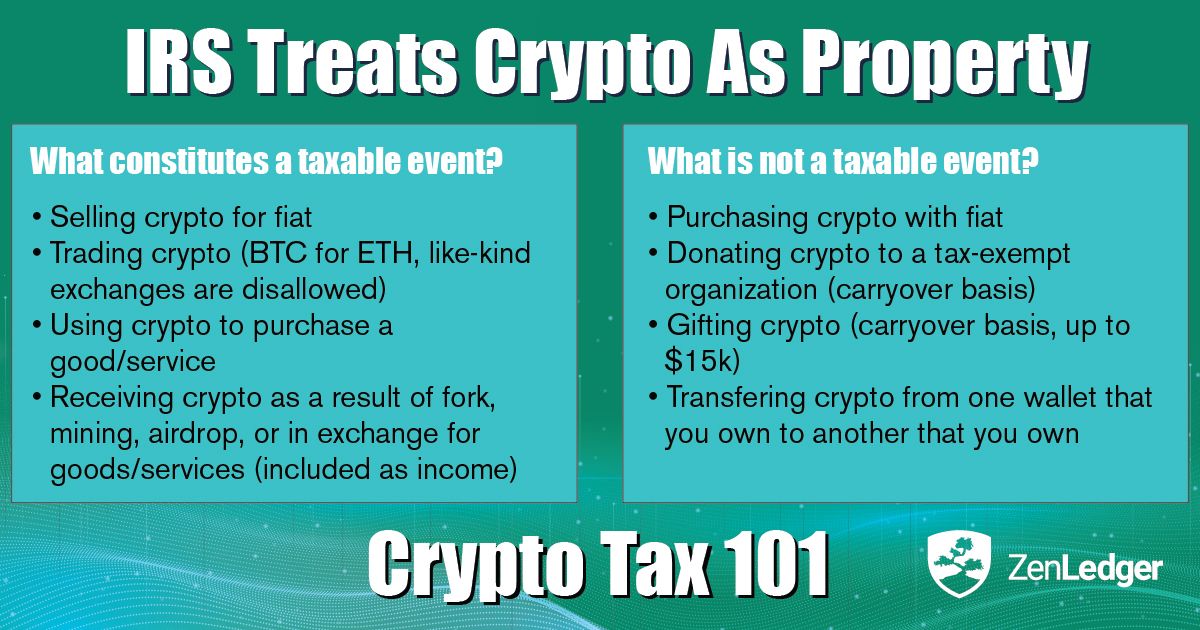

As more and more people are getting involved in cryptocurrency trading and investments, it's important to understand the tax implications of these transactions. Cryptocurrency is considered property by the Internal Revenue Service (IRS), which means that any gains or losses from cryptocurrency transactions are subject to taxation.

One of the key things to understand about cryptocurrency taxes is that they are not like traditional taxes. There are specific rules and regulations that apply to different types of cryptocurrency transactions, such as buying and selling, mining, and even receiving cryptocurrency as payment. It's crucial to stay updated on the latest tax laws and regulations surrounding cryptocurrency to ensure compliance.

The IRS requires individuals to report any cryptocurrency transactions on their tax returns, including calculating and reporting any gains or losses. This means that if you have made a profit from selling cryptocurrency or received cryptocurrency as payment, you are required to report and pay taxes on those gains. Failure to accurately report cryptocurrency transactions can result in penalties and fines from the IRS.

While cryptocurrency taxes can seem complex, there are tools and resources available to help individuals navigate the process. Hiring a certified tax professional with experience in cryptocurrency taxes can provide valuable guidance and ensure compliance with tax laws. Additionally, there are online platforms and software specifically designed for calculating and reporting cryptocurrency taxes, making the process more streamlined and efficient.

Understanding the basics of cryptocurrency taxes is crucial for anyone involved in cryptocurrency transactions. By staying informed and seeking professional advice, individuals can navigate the tax implications of cryptocurrency investments and mitigate the risk of non-compliance with tax laws. Keep in mind that cryptocurrency tax laws may vary by country, so it's important to research and understand the specific regulations that apply to your jurisdiction.

Understanding the taxation of cryptocurrencies

As cryptocurrencies continue to gain popularity and become more mainstream, it's important to understand the tax implications of such assets. In many jurisdictions, cryptocurrencies are treated as property for tax purposes, which means they are subject to capital gains and losses taxes.

When it comes to cryptocurrencies, the most common form of taxation is on the capital gains made from buying and selling digital assets. This means that if you sell your cryptocurrency for a profit, you will need to report that gain on your tax return. On the other hand, if you sell your cryptocurrency for a loss, you may be eligible for a tax deduction.

It's worth noting that the taxation of cryptocurrencies can vary from country to country. Some countries have specific regulations that govern the taxation of cryptocurrencies, while others may treat them as regular investment assets. It's important to consult with a tax professional or research the specific regulations in your jurisdiction to ensure compliance with the law.

In addition to capital gains taxes, there may also be other types of taxes associated with cryptocurrencies. For example, some countries may impose a tax on the mining of cryptocurrencies or require businesses that accept cryptocurrencies as payment to report and pay taxes on those transactions.

Keeping track of cryptocurrency transactions

One of the challenges of dealing with cryptocurrency taxes is keeping track of your transactions. Since cryptocurrencies are decentralized and can be traded on multiple platforms, it's important to keep detailed records of all your transactions, including the date, time, amount, and the value of the cryptocurrency at the time of the transaction.

Fortunately, there are now software tools and platforms available that can help individuals and businesses track their cryptocurrency transactions for tax purposes. These tools can automatically calculate capital gains and losses, generate tax reports, and even integrate with tax filing software.

Verbinden mit Blur.io: Entdecken Sie die Funktionen und Vorteile von Blur.io

By staying organized and keeping accurate records, individuals and businesses can ensure they are complying with their tax obligations and avoid any potential penalties or legal issues.

Seeking professional advice

Given the complex and evolving nature of cryptocurrency taxation, it's highly recommended to seek professional advice from a tax accountant or specialist who has experience in dealing with cryptocurrencies. They can provide guidance on how to report your cryptocurrency transactions, ensure compliance with tax laws, and help you take advantage of any available deductions or exemptions.

Overall, understanding the taxation of cryptocurrencies is essential for anyone who owns or trades digital assets. By staying informed and seeking professional advice, individuals and businesses can navigate the complexities of cryptocurrency taxation and ensure they are fulfilling their tax obligations.

What are cryptocurrency taxes?

Cryptocurrency taxes refer to the tax obligations and regulations that apply to individuals and businesses who engage in cryptocurrency transactions. As cryptocurrencies like Bitcoin, Ethereum, and others have gained popularity, governments around the world have been developing tax policies to ensure that they can effectively regulate and tax these digital assets.

The taxation of cryptocurrencies varies by jurisdiction, but in general, individuals and businesses may be subject to taxes on activities such as buying, selling, trading, mining, and receiving or spending cryptocurrencies.

For example, when a person sells or exchanges cryptocurrencies, it may trigger a capital gains or losses tax event, similar to the taxation of traditional investments like stocks or real estate. Similarly, if a business accepts cryptocurrencies as payment for goods or services, the value of those digital assets may need to be reported as income.

It's worth noting that tax regulations surrounding cryptocurrencies are still evolving, and the specific requirements may vary depending on your country or jurisdiction. It's important to consult with a tax professional or accountant who is familiar with cryptocurrency taxation to ensure compliance with applicable laws and regulations.

The Importance of Reporting Cryptocurrency Transactions

When it comes to cryptocurrency, it's important to understand the significance of reporting your transactions to the appropriate tax authorities. Whether you're buying or selling cryptocurrencies or participating in mining or staking activities, accurate reporting ensures compliance with tax laws and regulations.

Reporting cryptocurrency transactions not only demonstrates transparency but also helps to prevent potential legal issues and penalties. By voluntarily reporting your transactions, you can avoid any suspicion of tax evasion and contribute to maintaining the integrity of the cryptocurrency ecosystem.

Benefits of Reporting Cryptocurrency Transactions

1. Compliance: Reporting your cryptocurrency transactions allows you to meet your tax obligations according to your jurisdiction's regulations. This ensures that you're operating within legal boundaries and mitigates the risk of potential fines or audits.

2. Clear Record-Keeping: By reporting your transactions, you maintain a clear record of your cryptocurrency activities. This can be useful for future reference or in case of any dispute concerning your tax liability.

3. Avoiding Penalties: Failing to report your cryptocurrency transactions can result in penalties, fines, or even legal consequences. By accurately reporting your transactions, you minimize the risk of facing such penalties.

4. Supporting the Crypto Industry: Reporting your cryptocurrency transactions helps to legitimize the industry by demonstrating its adherence to financial regulations. This contributes to the wider acceptance of cryptocurrencies and provides a stronger foundation for its growth and adoption.

How to Report Cryptocurrency Transactions

Reporting cryptocurrency transactions typically involves providing detailed information about each transaction, including the date, type of transaction, amount, and any related fees. This information is typically included in your annual tax return or supplemented by additional forms specifically designed for cryptocurrency reporting.

While the process of reporting can vary depending on your jurisdiction, it's essential to familiarize yourself with the specific tax regulations applicable to cryptocurrency. Consultation with a tax professional experienced in cryptocurrency taxation can help ensure accurate reporting and compliance.

A platform for connecting with NFT (Non-Fungible Token) assets and exploring the world of digital art and collectibles.

Tax implications of buying and selling cryptocurrencies

When it comes to buying and selling cryptocurrencies, there are several tax implications that individuals need to be aware of. The tax treatment of cryptocurrencies can vary depending on the jurisdiction and the specific circumstances of each transaction. Here's what you need to know:

Capital gains tax

In many countries, buying and selling cryptocurrencies is treated as a taxable event, similar to buying or selling stocks or other investment assets. This means that any gains made from selling cryptocurrencies may be subject to capital gains tax. The amount of tax owed will depend on various factors, such as the holding period and the individual's tax bracket.

Reporting requirements

Most tax authorities require individuals to report their cryptocurrency transactions when filing their tax returns. This includes providing details of each transaction, such as the date of acquisition, the purchase price, and the sale price. Failure to report these transactions accurately and honestly can result in penalties or legal consequences.

It's important to note that not all cryptocurrency transactions are taxable. For example, if you are simply holding onto cryptocurrencies without selling them, you may not need to report anything until you sell or exchange them for other assets.

Exchange transactions

When buying or selling cryptocurrencies on exchanges, it's important to keep track of each transaction and the associated tax implications. Exchanges may provide transaction history and reports that can be used for tax purposes. It's recommended to keep detailed records of all cryptocurrency transactions, including the date, amount, and value in the local currency.

March 1, 2022

0.5 BTC

$10,000

$15,000

May 15, 2022

1 ETH

$2,000

$2,500

These records will be invaluable when calculating and reporting your capital gains or losses for tax purposes.

It's always a good idea to consult with a tax professional or accountant who is familiar with cryptocurrency tax regulations to ensure compliance and minimize any potential tax liabilities.

Understanding capital gains tax on cryptocurrencies

When dealing with cryptocurrencies, it is important to understand the concept of capital gains tax, as it applies to any profits made from buying, selling, or trading cryptocurrencies.

Capital gains tax is a type of tax that is levied on the profits made from the sale of assets, including cryptocurrencies. It is important to note that capital gains tax is only applicable when a cryptocurrency is sold or exchanged for another cryptocurrency or fiat currency.

Calculating capital gains tax

To calculate your capital gains tax on cryptocurrencies, you need to determine the cost basis and the fair market value of the cryptocurrency at the time of the transaction.

The cost basis is the original purchase price of the cryptocurrency, including any fees or commissions paid. The fair market value is the price at which the cryptocurrency is sold or exchanged for another currency.

To calculate your capital gains, subtract the cost basis from the fair market value. If the result is positive, it means you have made a profit, and you will need to pay capital gains tax on that amount. If the result is negative, it means you have made a loss, and you may be eligible for capital gains tax deductions.

Reporting capital gains tax

Once you have calculated your capital gains tax, you will need to report it on your tax return. In some countries, such as the United States, you may need to report your cryptocurrency transactions on a separate form, such as Form 8949.

It is important to keep detailed records of all your cryptocurrency transactions, including the date of each transaction, the amount of cryptocurrency involved, the cost basis, and the fair market value. This will help you accurately report your capital gains tax and avoid any potential audits or penalties.

It is advisable to consult with a tax professional or accountant who is familiar with the taxation of cryptocurrencies in your jurisdiction. They can provide guidance on how to accurately calculate and report your capital gains tax, and ensure compliance with local tax laws.

Tax obligations for mining and staking cryptocurrencies

When it comes to mining and staking cryptocurrencies, it's important to understand the tax implications and obligations that come with these activities. While the tax rules will vary depending on your country's specific regulations, here are some general considerations to keep in mind:

Income tax: In many countries, mining and staking cryptocurrencies are considered taxable activities, and any income generated from these activities may be subject to income tax. This means that you will need to report your mining and staking earnings as income on your tax return.

Self-employment tax: If you are mining or staking cryptocurrencies as a business or as a regular source of income, you may also be subject to self-employment tax. This tax is typically paid by individuals who are self-employed or operate as independent contractors.

Capital gains tax: In addition to income tax, you may also be liable for capital gains tax when you sell or exchange the cryptocurrencies you have mined or staked, depending on the price difference between when they were acquired and when they were sold. The tax rate for capital gains can vary, so it's important to check your local tax laws.

Record-keeping: To ensure compliance with tax regulations, it is crucial to keep detailed records of your mining and staking activities. This includes records of your mining or staking income, expenses related to mining or staking, and any transactions involving the cryptocurrencies you have earned.

Tax deductions: Depending on your country's tax laws, you may be eligible to claim certain deductions related to your mining or staking activities. For example, you may be able to deduct the cost of equipment or electricity used for mining or staking cryptocurrencies. Consult with a tax professional to determine which deductions you are eligible for.

Reporting obligations: Finally, it's important to understand and fulfill your reporting obligations. This may involve reporting your mining and staking income on your tax return, filing additional forms or schedules specific to cryptocurrency activities, and keeping up to date with any changes in tax regulations related to cryptocurrencies.

Overall, the tax obligations for mining and staking cryptocurrencies can be complex and vary from country to country. It's important to consult with a tax professional or accountant who specializes in cryptocurrency taxes to ensure that you are fully compliant with your tax obligations.

Tax treatment of receiving cryptocurrencies as payment

When you receive cryptocurrencies as payment for goods or services, you need to be aware of the tax implications involved. The tax treatment will depend on your jurisdiction and the specific rules governing cryptocurrency transactions.

In many countries, receiving cryptocurrencies as payment is treated similarly to receiving cash or other forms of payment. This means that you will need to report the value of the cryptocurrencies received as income on your tax return. The value can be determined using the fair market value of the cryptocurrencies at the time of receipt.

It's important to keep accurate records of all cryptocurrency transactions, including the date and value of each transaction. This information will be necessary for calculating your taxable income or capital gains. In some cases, you may also need to provide documentation to support the value of the cryptocurrencies received.

It's worth noting that if you receive cryptocurrencies as payment and hold onto them for some time before selling or exchanging them, you may also be subject to capital gains taxes. The tax rate for capital gains can vary depending on the length of time you held the cryptocurrencies and your overall income level.

Before accepting cryptocurrencies as payment, it's important to consult with a tax professional or accountant who can provide guidance specific to your situation. They can help you understand the tax implications and assist you in complying with the tax laws in your jurisdiction.

For more information on the tax treatment of receiving cryptocurrencies as payment, you may want to visit Blur.io の機能と利点を探る. This website provides valuable insights and resources on the topic to help you navigate the complexities of cryptocurrency taxes.

The tax implications of cryptocurrency airdrops and forks

When it comes to cryptocurrency taxes, it's important to understand the tax implications of airdrops and forks. These events can have an impact on your tax liability and require proper reporting to the relevant tax authorities.

An airdrop refers to the distribution of free cryptocurrency tokens or coins to holders of a particular cryptocurrency. This can be done by a project team to promote their coin or as a way of rewarding existing holders. From a tax perspective, airdrops are generally considered as taxable income. The value of the coins received through an airdrop is regarded as ordinary income, and you will need to report it on your tax return. It's important to keep track of the fair market value of the airdropped coins on the date of receipt for tax purposes.

A fork happens when a cryptocurrency splits into two separate chains, creating a new cryptocurrency. If you hold the original cryptocurrency at the time of the fork, you will receive an equal amount of the new cryptocurrency. From a tax perspective, forks can be considered as taxable events. The fair market value of the new cryptocurrency at the time of the fork should be treated as ordinary income, and you will need to report it on your tax return. Similar to airdrops, it's crucial to accurately track the fair market value of the new coins for tax purposes.

It's worth noting that not all airdrops and forks are taxable. The tax treatment can vary depending on the jurisdiction and the specific circumstances. Some countries may exempt certain small amounts or have different rules for specific types of airdrops or forks. It's crucial to consult with a tax professional or accountant who is knowledgeable in cryptocurrency taxes to ensure compliance with local tax laws.

Additionally, it's important to keep proper records of your airdrops and forks, including documentation of the transactions, the fair market value of the received coins, and any associated costs or fees. These records will be essential for accurate tax reporting and in case of any potential audits or inquiries from tax authorities.

In conclusion, understanding the tax implications of cryptocurrency airdrops and forks is crucial for crypto investors. Properly reporting these events and keeping thorough records will help ensure compliance with tax laws and minimize any potential tax liabilities or penalties.

How to Calculate Your Cryptocurrency Gains and Losses

Calculating your cryptocurrency gains and losses is an important step in staying compliant with tax regulations. Here are the steps you can follow to calculate your gains and losses:

1. Track Your Transactions

Start by keeping a detailed record of all your cryptocurrency transactions. This includes purchases, sales, exchanges, and any other type of transfer. You should list the date of each transaction, the amount of cryptocurrency involved, the value in your local currency at the time of the transaction, and any fees incurred.

2. Determine the Cost Basis

Next, you need to determine the cost basis of each cryptocurrency you buy. The cost basis is the original value of the cryptocurrency when you acquired it. If you purchased it, the cost basis is the amount you paid for it, including any fees. If you received it as a gift or through a mining process, you need to determine the fair market value at the time you acquired it.

3. Calculate the Gain or Loss

Once you have the cost basis for each cryptocurrency and the transaction history, you can calculate the gain or loss for each transaction. If the value of the cryptocurrency has appreciated since you acquired it, you will have a capital gain. If the value has decreased, you will have a capital loss. The gain or loss is calculated by subtracting the cost basis from the value at the time of the transaction.

4. Summarize Your Gains and Losses

After calculating the gain or loss for each transaction, you need to summarize your total gains and losses for the tax year. Add up all the gains and losses separately to determine the net capital gain or loss.

It's important to note that different tax regulations may apply depending on the jurisdiction you're in. Make sure to consult with a tax professional or use specialized cryptocurrency tax software to ensure accuracy and compliance with the applicable regulations.

By following these steps and maintaining accurate records, you can calculate your cryptocurrency gains and losses effectively, making the tax filing process smoother and easier.

The Significance of Tax Reporting Deadlines

When it comes to cryptocurrency taxes, one of the most important aspects to consider is the tax reporting deadlines. These deadlines indicate when taxpayers are required to file their tax returns and pay any taxes owed to the government.

Meeting the tax reporting deadlines is crucial for several reasons:

Avoid Penalties: Failing to file your tax return or pay the taxes owed by the deadline can result in penalties and interest charges. The penalties for late filing and late payment can be substantial, making it essential to file and pay on time.

Maintain Compliance: By meeting the tax reporting deadlines, you ensure that you are in compliance with the tax laws and regulations. This helps to avoid any legal issues or audits from tax authorities.

Plan Ahead: Knowing the tax reporting deadlines allows you to plan ahead and allocate the necessary resources for filing and paying your taxes. It gives you time to gather the required documentation, calculate your tax liability accurately, and avoid last-minute rush.

Claim Refunds: Filing your tax return early can be beneficial if you are eligible for a refund. By filing early, you can receive your refund sooner and put the money to use.

Peace of Mind: Meeting the tax reporting deadlines provides peace of mind, knowing that you have fulfilled your tax obligations and are not at risk of any penalties or legal consequences.

It's important to note that tax reporting deadlines may vary depending on your jurisdiction and the type of taxpayer you are. Therefore, it is recommended to stay informed about the specific deadlines applicable to you or seek professional advice to ensure compliance.

Tax Strategies for Minimizing Cryptocurrency Tax Liability

When it comes to cryptocurrency, taxes can be a complex and confusing topic. However, with careful planning and execution, individuals can minimize their cryptocurrency tax liability. Here are some tax strategies to consider:

1. Holding Period

One strategy for minimizing cryptocurrency tax liability is to hold onto your assets for a longer period of time. In many jurisdictions, the length of time you hold a cryptocurrency can impact the tax rate you are subject to. By holding onto your assets for at least a year, you may qualify for long-term capital gains rates, which are generally lower than short-term rates.

2. Tax-Loss Harvesting

Tax-loss harvesting involves selling cryptocurrency assets that have decreased in value to offset capital gains. By strategically selling losing assets, individuals can offset any taxable gains they have realized, thereby lowering their overall tax liability. However, it's important to consult with a tax professional to ensure compliance with tax regulations and avoid any unintended tax consequences.

These are just a few strategies individuals can use to minimize their cryptocurrency tax liability. It's important to consult with a tax professional or accountant who is knowledgeable in cryptocurrency taxation to ensure you are taking advantage of all available tax-saving opportunities and complying with tax laws.

Tax obligations for cryptocurrency traders

As cryptocurrency gains popularity and becomes more mainstream, it is important for traders to understand their tax obligations. While cryptocurrency is often seen as a decentralized and anonymous form of currency, the tax authorities still expect traders to report their gains and pay taxes on them.

Here are some key tax obligations that cryptocurrency traders need to be aware of:

Reporting cryptocurrency transactions: Traders are required to report all of their cryptocurrency transactions, including buying, selling, exchanging, and mining, when filing their tax returns. This applies to both fiat-to-cryptocurrency and cryptocurrency-to-cryptocurrency transactions.

Calculating capital gains and losses: Traders need to calculate their capital gains and losses from their cryptocurrency transactions. This involves tracking the cost basis of each cryptocurrency asset, determining the fair market value at the time of acquisition and sale, and calculating the difference.

Filing Form 8949: To report their capital gains and losses, traders need to file Form 8949 along with their tax returns. This form requires them to provide detailed information about each cryptocurrency transaction, including the date of acquisition, date of sale, cost basis, proceeds, and capital gain or loss.

Paying taxes on capital gains: Traders are required to pay taxes on their capital gains from cryptocurrency trading. The tax rate depends on various factors, including the holding period (short-term or long-term) and the individual's income tax bracket.

Keeping accurate records: It is crucial for traders to keep accurate records of all their cryptocurrency transactions, including receipts, invoices, and transaction history. These records are essential for accurately reporting their gains and losses and for satisfying any potential audits from the tax authorities.

It is important for cryptocurrency traders to consult with a tax professional or accountant who specializes in cryptocurrency taxation to ensure compliance with all tax obligations. Failing to properly report and pay taxes on cryptocurrency transactions can result in penalties, fines, and even legal consequences.

Reporting requirements for foreign cryptocurrency exchanges

When it comes to reporting taxes on cryptocurrency, it's important to understand the specific requirements for foreign cryptocurrency exchanges. If you have used a foreign exchange to buy, sell, or trade cryptocurrency, you may have additional reporting obligations.

Foreign Bank Account Reporting (FBAR)

If you have a financial interest in or signature authority over a foreign cryptocurrency exchange account, and the total value of all your foreign financial accounts exceeds $10,000 at any point during the year, you must report this information to the Financial Crimes Enforcement Network (FinCEN) by filing an FBAR. This requirement applies to both individuals and entities.

Failure to comply with FBAR reporting requirements can result in severe penalties, so it's important to understand if you meet the criteria and take the necessary steps to file an FBAR if required.

Foreign Account Tax Compliance Act (FATCA)

In addition to FBAR reporting, you may also have obligations under the Foreign Account Tax Compliance Act (FATCA). FATCA requires individuals and entities to report certain foreign financial assets if they meet certain thresholds.

If you have foreign cryptocurrency exchange accounts with a total value that exceeds certain thresholds, you may be required to report this information to the Internal Revenue Service (IRS) by filing Form 8938. The thresholds for Form 8938 reporting depend on your filing status and location.

For unmarried individuals living in the United States, the threshold is $50,000 on the last day of the year or $75,000 at any point during the year.

For married individuals filing jointly in the United States, the thresholds double to $100,000 on the last day of the year or $150,000 at any point during the year.

For individuals living abroad, the thresholds are higher, starting at $200,000 on the last day of the year or $300,000 at any point during the year.

It's important to consult with a knowledgeable tax professional or attorney to determine if you have FATCA reporting obligations based on the specific details of your foreign cryptocurrency exchange accounts.

Overall, reporting requirements for foreign cryptocurrency exchanges can be complex and may vary based on different factors. It's crucial to stay up to date with the latest regulations and seek professional advice to ensure compliance with tax obligations.

The role of tax professionals in cryptocurrency tax compliance

The world of cryptocurrency can be complex, especially when it comes to taxes. With constantly changing regulations and unique reporting requirements, navigating the tax implications of cryptocurrency transactions can be a challenging task. This is where tax professionals play a crucial role in ensuring individuals and businesses remain compliant with tax laws.

Expertise and Knowledge: Tax professionals have a deep understanding of tax laws and regulations. They stay updated with the latest changes and developments in the field of cryptocurrency taxation. Their expertise allows them to accurately assess the tax implications of cryptocurrency transactions, identify potential deductions, and maximize tax benefits for their clients. They can help individuals and businesses save money by ensuring they take advantage of all available deductions and credits.

Compliance and Reporting: Cryptocurrency transactions are subject to various reporting requirements, including the filing of income and capital gain/loss reports. Tax professionals are well-versed in these requirements and can assist individuals and businesses in properly reporting their cryptocurrency activities. They can ensure accurate calculations of gains and losses, determine the appropriate tax rates, and file the necessary forms and schedules on behalf of their clients. By partnering with tax professionals, individuals and businesses can minimize the risk of making errors in their tax filings and avoid potential penalties and audits.

Advocacy and Representation: In case of an audit or tax dispute related to cryptocurrency transactions, tax professionals can provide invaluable assistance. They can represent their clients before tax authorities, argue their case, and help resolve any issues or disputes. Tax professionals understand the complex nature of cryptocurrency transactions and can effectively communicate with tax authorities on behalf of their clients. Their expertise and professional representation can significantly reduce the stress and burden associated with tax disputes.

In conclusion, tax professionals play a crucial role in cryptocurrency tax compliance. Their expertise and knowledge enable individuals and businesses to navigate the complex world of cryptocurrency taxation, ensure compliance with tax laws, and maximize tax benefits. By engaging the services of tax professionals, individuals and businesses can have peace of mind knowing that their cryptocurrency tax matters are in capable hands.

Common cryptocurrency tax mistakes to avoid

When it comes to cryptocurrency taxes, there are several common mistakes that many people make. By avoiding these mistakes, you can ensure that you are accurately reporting and paying your cryptocurrency taxes.

1. Failure to report all cryptocurrency transactions

One of the most common mistakes is not reporting all cryptocurrency transactions. Every time you buy, sell, or exchange cryptocurrency, it is important to keep accurate records and report the transactions on your tax return. Failure to do so can result in penalties and audits.

2. Neglecting to calculate and report capital gains

Another common mistake is neglecting to calculate and report capital gains from cryptocurrency investments. When you sell a cryptocurrency for a profit, it is considered a capital gain and must be reported on your tax return. Failing to do so can result in fines and legal issues.

3. Underestimating the importance of proper record-keeping

Proper record-keeping is crucial when it comes to cryptocurrency taxes. You should keep detailed records of every transaction, including dates, amounts, and values. Without proper records, it can be difficult to accurately report your cryptocurrency transactions and calculate your tax liability.

4. Incorrectly categorizing cryptocurrency activities

It is essential to understand the different ways that cryptocurrencies can be classified for tax purposes. For example, cryptocurrencies held for investment purposes are treated differently than those used for personal transactions. Incorrectly categorizing your cryptocurrency activities can result in inaccurate tax reporting.

5. Failing to seek professional advice

Given the complexity of cryptocurrency taxes, it is always a good idea to seek professional advice. Tax laws regarding cryptocurrencies can be intricate and constantly changing, so consulting with a tax professional can help ensure that you are meeting your obligations and taking advantage of any available tax benefits.

By avoiding these common cryptocurrency tax mistakes, you can minimize your risk of penalties, fines, and legal issues while ensuring that you are accurately reporting and paying your cryptocurrency taxes.

The Future of Cryptocurrency Taxation

Cryptocurrency taxation has been a complex and ever-evolving topic since the inception of digital currencies. The increasing popularity and adoption of cryptocurrencies by individuals and businesses have brought the need for clearer and more streamlined tax regulations. As governments around the world grapple with this new form of currency, the future of cryptocurrency taxation remains uncertain.

Regulatory Developments

One key aspect shaping the future of cryptocurrency taxation is regulatory developments. Governments are becoming more aware of the potential revenue stream from cryptocurrencies and are taking steps to ensure compliance and reporting. Several countries have implemented or are considering legislation to regulate cryptocurrency transactions and tax obligations.

For example, the United States Internal Revenue Service (IRS) has issued guidelines on the taxation of cryptocurrencies. The IRS treats cryptocurrencies as property, subjecting them to capital gains tax. Similarly, countries like Germany, Australia, and Japan have established regulations to tax cryptocurrencies.

However, due to the decentralized and global nature of cryptocurrencies, harmonizing regulations internationally remains a challenge. Cryptocurrency tax laws vary widely from country to country, leading to discrepancies and potential confusion for taxpayers. As the industry continues to grow, it is likely that governments will collaborate to establish international standards for cryptocurrency taxation.

Technological Advancements

Another factor influencing the future of cryptocurrency taxation is technological advancements. Blockchain technology, which underlies most cryptocurrencies, can potentially simplify tax reporting and compliance. Blockchain's transparency and immutability can provide governments with a more accurate and efficient way to track cryptocurrency transactions.

Several companies and governments are exploring the use of blockchain for tax purposes. For instance, Estonia has implemented a blockchain-based e-residency program that enables digital entrepreneurs to manage and report their business activities, including cryptocurrency transactions. This technology can streamline tax processes and reduce the risk of fraud and data manipulation.

International Cooperation

The future of cryptocurrency taxation also depends on international cooperation. As cryptocurrencies transcend geographical borders, governments need to collaborate and share information to effectively enforce tax laws. Cryptocurrency exchanges play a crucial role in this cooperation, as they can provide data on users' trading activities.

Efforts are already underway to strengthen international cooperation for cryptocurrency taxation. Organizations like the Financial Action Task Force (FATF) are developing guidelines for governments and cryptocurrency exchanges to combat money laundering and terrorist financing. By working together, countries can create a more unified approach to taxing cryptocurrencies.

Increased tax revenue

Regulatory complexity and discrepancies

Streamlined tax reporting

Enforcement of tax laws in decentralized systems

Reduced risk of tax fraud

International coordination and cooperation

In conclusion, the future of cryptocurrency taxation hinges on regulatory developments, technological advancements, and international cooperation. As governments continue to adapt to the rise of digital currencies, it is vital for them to strike a balance between ensuring tax compliance and fostering innovation in the cryptocurrency space.

What are cryptocurrency taxes?

Cryptocurrency taxes refer to the taxes that individuals or businesses need to pay on any profits made from buying, selling, or holding cryptocurrencies.

Do I need to pay taxes on my cryptocurrency holdings?

Yes, in most countries, you are required to pay taxes on your cryptocurrency holdings. The specific rules and regulations vary from country to country.

How are cryptocurrency taxes calculated?

Cryptocurrency taxes are calculated based on the value of your cryptocurrency holdings at the time of buying, selling, or exchanging. The difference between the purchase price and the selling price is considered taxable income.

What happens if I don't pay my cryptocurrency taxes?

If you don't pay your cryptocurrency taxes, you could face penalties, fines, or even legal consequences depending on the law in your country. It's important to comply with tax laws to avoid any issues.

Are there any ways to minimize cryptocurrency taxes?

There are certain strategies you can use to potentially minimize your cryptocurrency taxes, such as utilizing tax benefits like capital gains exemptions, keeping proper records of your transactions, and seeking professional advice from a tax accountant.

What are cryptocurrency taxes?

Cryptocurrency taxes refer to the taxes that individuals or businesses are required to pay on their cryptocurrency transactions and holdings. These taxes are similar to traditional taxes, but they are specific to the digital currency market.

How are cryptocurrency taxes calculated?

Cryptocurrency taxes are calculated based on the capital gains or losses made from buying, selling, or trading cryptocurrencies. The tax rate varies depending on the holding period and the total amount of profit or loss. It's important to keep track of all cryptocurrency transactions and consult with a tax professional to ensure accurate calculations.

What is the difference between short-term and long-term capital gains in cryptocurrency taxes?

Short-term capital gains apply to cryptocurrency holding periods of one year or less, while long-term capital gains apply to holding periods over one year. The tax rates for these gains differ, with short-term gains usually taxed at a higher rate. It's important to understand the difference and plan accordingly for tax purposes.

Blur: NFT | Blur: NFT login | Blur: NFT connect | WalletConnect | Traders | What Is Blur Crypto

2022-2024 @ Understanding the basics of cryptocurrency taxes