Beginner's introduction to NFTs, Bitcoin fractions, and the digital collectibles industry

Blur: NFT | Blur: NFT login | Blur: NFT connect | WalletConnect | Traders | What Is Blur Crypto

Blur: NFT | Blur: NFT login | Blur: NFT connect | WalletConnect | Traders | What Is Blur Crypto

Welcome to the fascinating world of NFTs, Bitcoin, oracles, and digital collectibles! If you're new to the world of blockchain technology and decentralized finance, this beginner's guide will help you navigate through the complexities and understand the basics. Whether you're an artist looking to sell your digital artwork as an NFT or an investor interested in the potential of cryptocurrencies, this guide is for you.

NFTs, or non-fungible tokens, have exploded in popularity in recent years. But what exactly are NFTs? Unlike cryptocurrencies such as Bitcoin, which are fungible and can be exchanged on a one-to-one basis, NFTs are unique digital assets that represent ownership or proof of authenticity for a particular item or collectible. These items can range from digital art, music, videos, virtual real estate, and even virtual pets. NFTs are stored on blockchain networks, providing transparency, security, and immutability.

Bitcoin, the first and most well-known cryptocurrency, has also captured the attention of the world. It operates on a decentralized network known as blockchain, which allows for peer-to-peer transactions without the need for intermediaries like banks. Bitcoin is often referred to as digital gold due to its limited supply and store of value properties. As an investor, understanding the basics of Bitcoin is crucial for navigating the cryptocurrency market.

Oracles play a crucial role in the world of blockchain and smart contracts. These are external data sources that provide real-world information to the blockchain. Oracles ensure that smart contracts can interact with real-time data, making them more versatile and allowing for the creation of decentralized applications (DApps) and other innovative use cases. Understanding how oracles work is essential for building and using decentralized applications on the blockchain.

Lastly, we'll delve into the exciting world of digital collectibles. With the rise of NFTs, digital collectibles have gained immense popularity. From virtual trading cards to virtual real estate, digital collectibles offer unique ownership experiences in the digital realm. We'll explore the different types of digital collectibles and how they have disrupted traditional collectible markets.

Whether you're a cryptocurrency enthusiast, an artist exploring NFTs, or simply curious about blockchain technology, this guide will provide you with a solid foundation to navigate the fascinating world of NFTs, Bitcoin, oracles, and the world of digital collectibles. Get ready to dive into this exciting new frontier and unlock the potential of blockchain technology!

What Are NFTs?

NFTs, or Non-Fungible Tokens, have become one of the hottest trends in the world of digital collectibles and blockchain technology. But what exactly are NFTs and why have they gained so much popularity?

Unlike cryptocurrencies such as Bitcoin or Ethereum, which are fungible and can be exchanged on a one-to-one basis, NFTs are unique and cannot be exchanged on a like-for-like basis. Each NFT represents a one-of-a-kind asset or piece of digital content, whether it's an artwork, a music album, a video clip, or even virtual real estate.

One of the key aspects of NFTs is their ability to be stored and traded on a blockchain, usually on the Ethereum blockchain. This means that ownership and transaction history of an NFT can be easily verified, making it a secure and transparent way to buy, sell, and trade digital assets.

Another important feature of NFTs is their ability to provide royalties to artists or creators. When an NFT is sold or traded, the original creator can set a royalty percentage, earning a percentage of the subsequent sales. This can potentially bring new revenue streams to artists and incentivize the creation of unique digital content.

Additionally, NFTs have opened up new possibilities for collectors and enthusiasts. Owning an NFT can grant exclusive rights or access to special events, perks, or additional digital content associated with the asset. This can create a sense of exclusivity and scarcity, increasing the perceived value of the NFT.

However, it's important to note that NFTs have also faced criticism and controversy. Some argue that NFTs contribute to environmental issues due to the energy consumption of blockchain networks. Others question the long-term value and sustainability of the NFT market, as the hype around certain assets may fade over time.

In conclusion, NFTs are unique digital assets that can represent a wide range of digital content. They offer new opportunities for creators, collectors, and investors alike, but also raise important questions about sustainability and the future of digital ownership.

Understanding Bitcoin and Its Role in the Digital Collectibles Market

Bitcoin is a decentralized digital currency that was invented in 2008 by an unknown person or group of people using the name Satoshi Nakamoto. It was introduced as an open-source software in 2009. Bitcoin operates on a peer-to-peer network, meaning that transactions can be conducted directly between users without the need for intermediaries like banks or governments.

Bitcoin has gained significant popularity and has become a household name in recent years. It has been widely adopted as a form of digital and decentralized currency. One of the reasons for its popularity is its potential to revolutionize various industries, including the world of digital collectibles.

Bitcoin plays a crucial role in the digital collectibles market, particularly in the emergence of Non-Fungible Tokens (NFTs). NFTs are unique digital assets that are stored on a blockchain, the technology behind Bitcoin. They can represent ownership of various digital items, such as artwork, music, videos, and even virtual real estate.

With the help of Bitcoin and blockchain technology, NFTs have created a new paradigm in the world of collectibles. They provide artists, creators, and collectors with a decentralized and transparent platform to buy, sell, and trade digital assets. This has opened up a whole new market for digital art and collectibles, where the provenance and authenticity of the items can be easily verified.

Bitcoin's role in the digital collectibles market goes beyond just being a means of exchange. It also serves as a store of value and a medium for investment. Many collectors see Bitcoin as a hedge against inflation and a potentially profitable investment. In addition, the scarcity and limited supply of Bitcoin make it highly sought after, similar to rare collectible items.

In conclusion, Bitcoin has revolutionized the digital collectibles market through the emergence of NFTs. Its decentralized nature and the use of blockchain technology have provided artists, creators, and collectors with a secure and transparent platform to buy, sell, and trade digital assets. Bitcoin's role as both a means of exchange and a store of value has made it an integral part of the digital collectibles market.

For more information on buying and selling digital collectibles, you can log in to your BLUR.IO 계정에 로그인하는 방법 account and explore the wide range of options available.

Ordinals and Their Significance in the World of Digital Collectibles

When discussing the world of digital collectibles, one term that often comes up is "ordinals". In simple terms, ordinals refer to the order or ranking of a particular item within a collection or series of digital assets.

What are ordinals?

Ordinals are alphanumeric labels that indicate the position of a digital collectible within a set or series. These labels are typically assigned to each item during the creation process and can range from simple numerical digits (e.g., 1, 2, 3) to more complex combinations, including letters and symbols (e.g., A, B, C or !, @, #).

The significance of ordinals

Ordinals play a crucial role in the world of digital collectibles for several reasons:

1. Identifying uniqueness

By assigning ordinals to each digital collectible, creators can establish a unique identity for each item within a collection. This uniqueness adds value and rarity to the digital asset, as collectors can distinguish between various items based on their assigned ordinals.

2. Conveying scarcity

Collectibles with lower ordinals, such as "1" or "A," often hold a higher perceived value due to their association with being the first or original item in a series. These lower ordinals represent rarity and exclusivity, making them highly sought after by collectors.

For example, an NFT (non-fungible token) with the ordinal "001" may hold a higher market value compared to an NFT with the ordinal "100."

3. Establishing order

Ordinals help establish the order and arrangement of digital collectibles within a set or series. They allow collectors and enthusiasts to navigate through a collection easily and identify missing items or duplicates more efficiently.

Overall, ordinals are an essential aspect of digital collectibles as they provide a unique identity to each item, convey scarcity, and establish order within a collection. Understanding the significance of ordinals can enhance one's appreciation and engagement with the world of digital collectibles.

The Basics of Digital Collectibles

Digital collectibles have taken the world by storm in recent years, offering a new way to own and trade unique items in the digital realm. These collectibles, also known as non-fungible tokens (NFTs), have revolutionized the art, gaming, and entertainment industries. This guide will provide you with a basic understanding of what digital collectibles are and how they work.

What are Digital Collectibles?

Digital collectibles are unique items that exist in digital form and can be bought, sold, and traded using blockchain technology. Each digital collectible is represented by an NFT, which is a type of cryptographic token that verifies the authenticity and ownership of the item. Unlike cryptocurrencies like Bitcoin, NFTs are indivisible and cannot be exchanged on a one-to-one basis.

How do Digital Collectibles Work?

When an artist, game developer, or content creator wants to create a digital collectible, they mint it as an NFT on a blockchain platform. This process involves creating a digital asset and attaching it to a specific NFT, which is then stored on the blockchain. The blockchain acts as a decentralized ledger that records all transactions and ownership changes, ensuring the uniqueness and authenticity of each digital collectible.

Once minted, digital collectibles can be bought, sold, and traded on various NFT marketplaces. These marketplaces allow collectors to browse and purchase digital collectibles using cryptocurrency. The ownership of the NFT is transferred to the buyer, who now has full control and ownership rights over the digital asset. Some digital collectibles, such as virtual avatars or in-game items, can also have utility beyond being collectible items, adding further value to the owner.

One of the key features of digital collectibles is their scarcity. Unlike digital files that can easily be copied or replicated, NFTs have a unique digital signature that makes them one-of-a-kind. This scarcity, combined with the growing demand for digital collectibles, has driven up their value in the market, with some rare items selling for millions of dollars.

It's important to note that digital collectibles are still a relatively new and rapidly evolving market. As the technology and use cases for NFTs continue to develop, the world of digital collectibles is likely to expand even further, offering new and exciting opportunities for collectors and creators alike.

The History of NFTs and Digital Collectibles

NFTs, or non-fungible tokens, have gained widespread attention in recent years as a new way to buy, sell, and collect digital assets. But where did it all begin? Let's take a dive into the history of NFTs and digital collectibles.

The concept of digital collectibles dates back to the early 2010s when projects like CryptoPunks and Rare Pepe started gaining popularity. These projects introduced the idea of unique digital assets that could be bought, sold, and traded on the blockchain.

However, it wasn't until the launch of CryptoKitties in 2017 that NFTs truly exploded onto the scene. CryptoKitties, a blockchain game where users could breed and trade virtual cats, became a viral sensation and brought mainstream attention to the world of NFTs.

Since then, the NFT market has continued to grow rapidly, with artists, musicians, and celebrities joining the space and creating their own digital collectibles. With the rise of Ethereum as the most popular blockchain for NFTs, platforms like OpenSea and Rarible have emerged as marketplaces for buying and selling these unique digital assets.

One of the key features of NFTs is their ability to prove ownership and authenticity. Each NFT is minted on the blockchain, creating an immutable record of ownership that can be verified by anyone. This has revolutionized the world of digital art and collectibles, allowing creators to monetize their work and collectors to truly own a piece of digital history.

While some may question the value and longevity of NFTs, there's no denying that they have sparked a new wave of innovation and creativity in the digital landscape. As the technology continues to evolve, it will be fascinating to see how NFTs and digital collectibles shape the future of art, gaming, and more.

How to Create and Sell NFTs

Creating and selling NFTs is becoming increasingly popular in the world of digital collectibles. NFTs, or non-fungible tokens, are unique digital assets that can represent ownership of artwork, music, videos, and other digital items. If you're interested in getting started with creating and selling NFTs, here are the steps you need to follow:

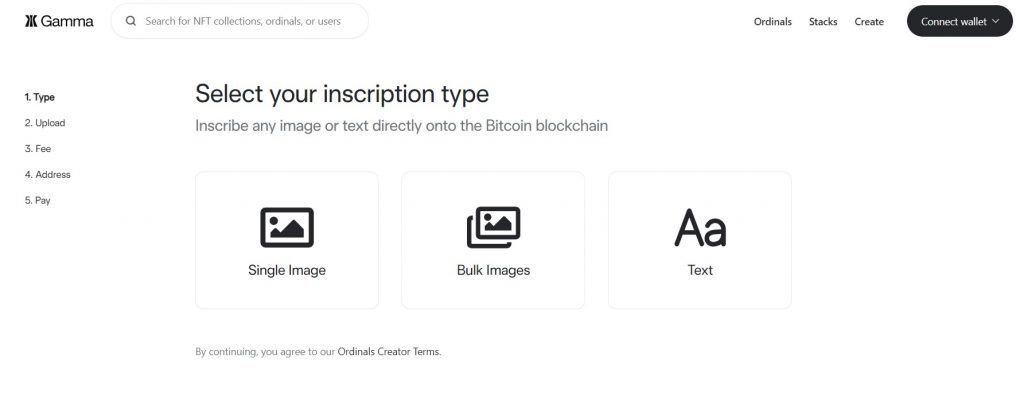

1. Choose an NFT Marketplace: The first step in creating and selling NFTs is to choose an NFT marketplace. Some popular NFT marketplaces include OpenSea, Rarible, and SuperRare. Each marketplace has its own requirements and fees, so it's important to do your research and find the one that best suits your needs.

2. Create a Wallet: In order to create and sell NFTs, you'll need a cryptocurrency wallet. Most NFT marketplaces are built on blockchain platforms like Ethereum, so you'll need an Ethereum wallet. Some popular options include MetaMask, Trust Wallet, and Coinbase Wallet.

3. Mint Your NFT: Once you have a wallet set up, you can begin the process of minting your NFT. Minting an NFT involves creating a digital asset and linking it to a unique token on the blockchain. This process typically involves uploading your digital file, providing a title and description, and setting a price for your NFT.

4. List Your NFT for Sale: After minting your NFT, you can list it for sale on the chosen marketplace. You'll need to set a price for your NFT and potentially pay a listing fee. Some marketplaces also allow you to auction your NFT or accept bids from potential buyers.

5. Promote Your NFT: Once your NFT is listed for sale, it's important to promote it to potential buyers. Share your NFT on social media platforms, join NFT communities and forums, and consider reaching out to influencers or collectors who may be interested in your work.

6. Complete the Sale: When a buyer is interested in purchasing your NFT, they will typically pay for it using cryptocurrency. Once the payment is received, you can transfer the ownership of the NFT to the buyer's wallet. Some marketplaces facilitate this process automatically, while others require you to manually transfer the NFT.

7. Engage with Your Community: After successfully selling your NFT, it's important to engage with your community and build relationships with collectors. Consider creating more NFTs, participating in collaborations, and exploring new opportunities within the NFT space.

By following these steps, you can start creating and selling NFTs and become a part of the exciting world of digital collectibles.

Exploring the Different Types of NFTs

NFTs (Non-Fungible Tokens) have gained significant attention in recent years, revolutionizing the world of digital collectibles and blockchain technology. NFTs represent unique digital assets that can be bought, sold, and owned, providing creators and collectors with new opportunities.

Let's take a closer look at some of the different types of NFTs:

1. Art NFTs: This is one of the most popular categories of NFTs, where digital artists showcase their work and sell them as unique tokens on various NFT marketplaces. These artworks can be anything from illustrations, paintings, sculptures, or even virtual reality experiences. Art NFTs allow artists to monetize their creations directly and connect with a global audience.

2. Gaming NFTs: Gaming NFTs have exploded in popularity, allowing gamers to own and trade in-game assets as unique tokens. These assets can be anything from rare weapons, skins, characters, or virtual real estate. By utilizing NFTs, gamers now have true ownership and can even make money by selling their valuable in-game items on secondary marketplaces.

3. Collectibles NFTs: Collectibles NFTs are digital versions of trading cards or collectible items, ranging from sports memorabilia to virtual pets to digital sneakers. These NFTs allow collectors to own and showcase unique items in their digital collections. The scarcity and uniqueness of these collectibles make them highly desirable among enthusiasts and collectors.

4. Virtual Real Estate NFTs: Virtual real estate NFTs provide users with the opportunity to own and trade virtual land or properties within virtual worlds. These NFTs have gained popularity in metaverse platforms, where users can build, explore, and monetize their virtual creations. Virtual real estate can hold significant value, especially in thriving virtual economies.

5. Domain Name NFTs: With the rise of decentralized websites and blockchain-based domain systems, domain name NFTs have become sought-after digital assets. These NFTs represent ownership of unique domain names on the blockchain, allowing users to sell, transfer, or utilize them to build decentralized websites or platforms.

These are just a few examples of the different types of NFTs available in the digital collectibles space. Whether you're an artist, gamer, collector, or someone interested in blockchain technology, NFTs offer a new world of possibilities and unique digital ownership.

Investing in NFTs and Bitcoin

Investing in NFTs (Non-Fungible Tokens) and Bitcoin can be an exciting and potentially profitable venture. However, it's important to understand the risks and challenges involved in these markets.

Before diving into NFTs or Bitcoin, it's essential to do thorough research and understand the fundamentals of these assets. NFTs are unique digital assets that can represent ownership of an item, artwork, or collectible in the digital world. On the other hand, Bitcoin is a decentralized digital currency that can be used as a store of value or for daily transactions.

Here are some key factors to consider before investing in NFTs and Bitcoin:

Educate Yourself: Start by learning about NFTs and Bitcoin, including their technology, potential use cases, and market trends. This will help you make informed investment decisions.

Diversify Your Portfolio: It's crucial to diversify your investments and not put all your eggs in one basket. Consider investing in different types of NFTs or cryptocurrencies to spread risk and maximize potential returns.

Understand Market Volatility: Both the NFT and Bitcoin markets can be highly volatile. Be prepared for price fluctuations and be aware that the value of your investments can go up or down significantly.

Choose a Reputable Marketplace: When buying NFTs, make sure to use a reputable marketplace that has a strong track record of secure transactions and reliable customer support. Similarly, when investing in Bitcoin, choose a reliable cryptocurrency exchange.

Keep Security in Mind: Protect your NFTs and Bitcoin investments by implementing strong security measures. Use hardware wallets and enable two-factor authentication to secure your assets.

Stay Updated: Stay informed about the latest news and developments in the NFT and Bitcoin space. This will help you make better investment decisions and adapt to changing market conditions.

Remember, investing in NFTs and Bitcoin carries risks, and it's important to only invest what you can afford to lose. Seek advice from financial professionals if needed and carefully consider your investment goals and risk tolerance before entering these markets.

The Future of NFTs and the Digital Collectibles Market

The world of NFTs and digital collectibles is constantly evolving and there is much excitement about what the future holds. Here are some key trends and developments to watch out for:

1. Mainstream Adoption:

NFTs have gained significant attention in recent years, with artists, celebrities, and even traditional institutions like museums and sports teams jumping on board. As more people become familiar with the concept of owning unique digital assets, we can expect to see wider adoption and integration into various industries.

2. Enhanced Interactivity:

The current state of digital collectibles mainly involves owning and trading items, but the future may bring more interactive experiences. This could include gamified elements, virtual reality integration, and augmented reality features, allowing collectors to engage with their assets in new and exciting ways.

3. Increased Utility:

Currently, NFTs are primarily used for collecting and investing purposes. However, there is growing potential for them to serve practical functions as well. For example, NFTs could be used for ticketing, digital identity verification, or even as access keys to exclusive events or content.

4. Sustainability and Environmental Impact:

As the popularity of NFTs grows, so does concern about their environmental impact. Many NFTs are built on blockchain networks that consume a significant amount of energy. In the future, we can expect to see more focus on developing sustainable solutions, such as using energy-efficient blockchains or finding alternative methods for verifying ownership and authenticity.

5. Emerging Marketplaces and Creative Possibilities:

The current NFT market is dominated by a few major platforms, but as the industry expands, we can expect to see new marketplaces and platforms emerge. This will provide greater opportunities for artists and creators to showcase their work and explore innovative ways of monetizing their digital assets.

In conclusion, the future of NFTs and the digital collectibles market is filled with endless possibilities. As the technology and market continue to evolve, we can expect to see more mainstream adoption, enhanced interactivity, increased utility, sustainability measures, and a flourishing ecosystem of marketplaces and creative possibilities.

Understanding the Risks and Challenges in the NFT Market

As the NFT (Non-Fungible Token) market continues to gain popularity, it is important to understand the risks and challenges associated with it. While digital collectibles and blockchain technology offer unique opportunities, there are also potential pitfalls that collectors and investors should be aware of.

One of the main risks in the NFT market is the possibility of fraud. Due to the decentralized nature of blockchain, it can be difficult to verify the authenticity of an NFT. Scammers can create fake NFTs and sell them to unsuspecting buyers. Therefore, it is crucial to exercise caution and conduct thorough research before purchasing any NFT.

Another challenge in the NFT market is the volatility of prices. Just like any other asset, the value of an NFT can fluctuate dramatically. Some NFTs may be highly sought after today but lose their value in the future. It is essential to consider the long-term potential and demand for an NFT before investing a significant amount of money.

Additionally, the NFT market is still relatively new and evolving. It is a rapidly changing industry and therefore carries inherent uncertainties. Regulations surrounding NFTs are still being developed, and there is a lack of standardized practices. This can make it difficult to navigate the market and protect one's interests.

Furthermore, the environmental impact of NFTs is a concern. The blockchain technology used in NFTs, such as Ethereum, consumes a significant amount of energy. Many artists and collectors are mindful of the carbon footprint associated with NFTs and are exploring more sustainable options.

To mitigate these risks and challenges, individuals should take certain precautions. They should only transact on reputable NFT marketplaces and platforms that have robust security measures in place. It is also advisable to consult with experts and stay informed about the latest developments in the NFT market.

In conclusion, while the NFT market offers exciting opportunities for collectors and artists, it is crucial to be aware of the risks and challenges involved. By conducting thorough research, exercising caution, and staying informed, individuals can navigate the NFT market more effectively and protect their investments. Wallet Connect, a popular crypto wallet solution, can be utilized to ensure secure transactions and enhance security in the NFT market. For more information, visit Wallet Connect.

Exploring the Legal and Copyright Aspects of NFTs

As the popularity of NFTs continues to grow, it's important to understand the legal and copyright implications that come with buying, selling, and owning these digital assets. While NFTs offer unique opportunities for creators and collectors alike, there are certain legal considerations that must be taken into account.

Ownership Rights

One of the key aspects of NFTs is the idea of ownership. When you buy an NFT, you're essentially buying a certificate of authenticity for a digital asset. However, it's important to note that owning an NFT does not automatically grant you ownership of the underlying content. The creator or copyright holder still retains their rights to the content itself.

For example, if you purchase an NFT that represents a digital artwork, you own the unique token associated with that artwork, but you do not own the copyright to the actual artwork. This means that you cannot reproduce or distribute the artwork without the permission of the copyright holder.

Copyright Infringement

When it comes to NFTs, copyright infringement is a significant concern. With the ease of creating and selling NFTs, there is a risk that someone may mint an NFT of a copyrighted work without proper authorization. This can lead to legal issues for both the creator of the NFT and the person who buys it.

Creators should be diligent in ensuring that the content they tokenize is their original work or that they have obtained the necessary permissions to use copyrighted materials. Buyers should also do their due diligence to ensure that the NFT they are purchasing does not infringe on any copyrights.

Smart Contracts and Licensing

Smart contracts play a crucial role in the NFT ecosystem. They define the terms and conditions of ownership and can include licensing agreements. These agreements can outline what owners are allowed to do with their NFTs, such as display them publicly or sell them on secondary markets.

It's important for creators and collectors to carefully review the terms of these smart contracts before buying or selling NFTs. By understanding the licensing agreements, both parties can ensure that they are acting within the legal boundaries set by the creator.

- Owning an NFT does not grant ownership of the underlying content

- Copyright infringement is a concern in the NFT space

- Smart contracts can include licensing agreements

The Environmental Impact of NFTs and Bitcoin Mining

NFTs have gained significant popularity in the digital art world, but their environmental impact has raised concerns. One major factor contributing to this impact is the energy consumption associated with Bitcoin mining, which is used to power the blockchain technology backing NFTs.

Bitcoin mining is a process that requires a significant amount of computational power and electricity. This process involves solving complex mathematical problems to validate transactions and add them to the blockchain. As more people participate in mining, the difficulty of these problems increases, leading to even higher energy consumption.

Estimates suggest that Bitcoin mining consumes a substantial amount of energy, with some sources comparing its energy consumption to that of entire countries. This high energy consumption results in a large carbon footprint, as a significant portion of the electricity used comes from non-renewable sources such as coal and natural gas.

Additionally, the process of creating NFTs, known as minting, also contributes to environmental concerns. Minting an NFT requires using blockchain technology, which relies on the same energy-intensive mining process mentioned above. Therefore, each NFT transaction has a carbon footprint associated with it.

To address these concerns and minimize the environmental impact, various initiatives and alternatives have emerged. Some artists and platforms are exploring environmentally friendly blockchain options that use less energy, such as Proof of Stake (PoS) instead of the traditional Proof of Work (PoW) model.

Another way to reduce the environmental impact is to offset the carbon emissions associated with NFTs and Bitcoin mining. Projects like Blur NFT Marketplace are taking steps to address this issue by partnering with organizations that promote renewable energy and carbon offset initiatives. They also provide tools for users to calculate and offset the carbon footprint of their NFT transactions.

By being conscious of the environmental impact of NFTs and Bitcoin mining, individuals and platforms can take steps to mitigate their carbon footprint and contribute to a more sustainable future for digital collectibles.

To learn more about the environmental impact of NFTs and Bitcoin mining, and to explore an eco-friendly NFT marketplace, visit Wallet Connect.

Exploring the Role of Social Media in the NFT Market

Social media platforms have played a significant role in the growth and popularity of the NFT market. These digital marketplaces and platforms have provided a space for artists, collectors, and enthusiasts to connect, showcase their digital collectibles, and discuss the latest trends in the NFT space.

One of the key ways social media enhances the NFT market is through the ability to generate hype and awareness. Artists and creators can leverage platforms like Twitter, Instagram, and TikTok to share sneak peeks of upcoming releases or to showcase their latest works. This creates anticipation and excitement among their followers and helps generate interest and demand for their NFTs.

Moreover, social media platforms serve as a digital gallery where artists can showcase their digital collectibles and gain exposure to a wider audience. Artists can use platforms like Instagram and Twitter to share images and videos of their NFTs, allowing potential buyers and collectors to discover their work and engage with the artist directly. This direct interaction strengthens the relationship between artists and collectors, fostering a community around the NFT market.

Additionally, social media platforms provide a platform for discussions and conversations around NFTs. Communities dedicated to the NFT market have flourished on platforms like Discord and Reddit, where collectors and enthusiasts can come together to share their knowledge, experiences, and opinions. These discussions provide valuable insights and information to newcomers in the NFT space and help foster a sense of camaraderie among community members.

Furthermore, social media platforms have been instrumental in facilitating the buying and selling of NFTs. Artists and collectors can use platforms like Twitter or Discord to announce the availability of their NFTs and provide links to the respective marketplaces where they can be purchased. This seamless integration between social media and NFT marketplaces makes it easier for users to navigate the space and participate in the market.

In conclusion, social media platforms have played a crucial role in the growth and development of the NFT market. They serve as a means to generate hype, showcase digital collectibles, foster community engagement, and facilitate transactions. As the NFT market continues to evolve, social media is likely to remain an integral part of the ecosystem, connecting artists, collectors, and enthusiasts worldwide.

NFTs and the Gaming Industry

NFTs, or Non-Fungible Tokens, have made a significant impact on the gaming industry. With the rise of blockchain technology, NFTs have revolutionized the way players can own and trade in-game assets.

Traditionally, gaming companies have held complete control over in-game items, making it impossible for players to truly own and transfer them. However, with the introduction of NFTs, players can now have true ownership of their digital assets, giving them the ability to sell, trade, or even borrow these assets.

One of the main advantages of NFTs in the gaming industry is the concept of rarity. Just like collecting physical items, players can now collect rare and unique digital assets that have value within the game and in the broader NFT market. This has led to the emergence of a whole new market for digital collectibles within the gaming community.

Additionally, NFTs can be used to create a more immersive gaming experience. Developers can create unique and limited edition items that players can earn or purchase, adding a sense of exclusivity to the game. This has also opened doors for collaboration between game developers and artists, as they can create and sell their own digital art within the game.

Moreover, NFTs have the potential to address the issue of item scalping. In traditional gaming economies, rare and valuable items are often bought up by scalpers and resold at inflated prices. With NFTs, each item can be tracked on the blockchain, making it easier to ensure fair distribution and prevent scalping.

Overall, NFTs have brought about a new level of ownership and value to the gaming industry. With the ability to truly own and trade digital assets, players can now have a more immersive and personalized gaming experience, while also participating in a thriving digital economy.

How NFTs Are Changing the Art World

Art has always been a cultural artifact, an expression of creativity, and a reflection of society. But with the rise of non-fungible tokens (NFTs), the art world is experiencing a transformation. NFTs are changing the way we create, sell, and collect art, and this digital revolution is challenging traditional notions of ownership and value.

One of the main ways NFTs are changing the art world is through the concept of authentic ownership. In the past, art collectors would buy physical artworks and prove their ownership with certificates or provenance records. With NFTs, however, ownership is verified and recorded on the blockchain, creating a transparent and immutable record of the artwork's provenance. This not only eliminates the need for physical certificates but also prevents fraud and ensures that artists receive proper recognition and compensation for their work.

The democratization of art

NFTs are also democratizing the art world by creating new opportunities for artists to showcase and sell their work. In the traditional art market, artists often have to rely on galleries or agents to promote and sell their artwork. This can limit their exposure and earning potential. With NFTs, artists can create, market, and sell their own digital artworks directly to a global audience without intermediaries. This opens up new avenues for emerging artists to gain recognition and monetize their creations.

The digital nature of NFTs also allows for greater accessibility and inclusivity in the art world. Physical artworks are often limited to a select few who can afford to purchase them, but digital art can be enjoyed by anyone with an internet connection. NFTs enable art to be shared and appreciated by a wider audience, regardless of their geographical location or financial status.

New possibilities for collectors

NFTs have revolutionized the concept of collecting by introducing digital scarcity and unique ownership. Collectors can now own one-of-a-kind digital artworks that cannot be replicated or destroyed. This adds value and prestige to their collections. Moreover, NFTs enable collectors to display and share their digital art collections with ease, breaking free from the limitations of physical space.

Collecting NFTs also offers new opportunities for interaction and engagement. Some NFTs come with additional benefits, such as access to exclusive events or experiences, which enhance the overall collecting experience. Additionally, the transparent nature of blockchain technology allows collectors to track the history and provenance of their NFTs, creating a sense of security and confidence in their investments.

NFTs are transforming the art world in exciting ways. They are challenging traditional notions of ownership, democratizing the art market, and opening up new possibilities for collectors. As the technology continues to evolve, it will be interesting to see how NFTs shape the future of art and culture.

What is an NFT?

An NFT, or non-fungible token, is a type of digital asset that represents ownership or proof of authenticity of a unique item or piece of content. Unlike cryptocurrencies like Bitcoin, which are fungible and can be exchanged for one another, NFTs are unique and cannot be exchanged on a like-for-like basis.

How do NFTs work?

NFTs are built on blockchain technology, typically using the Ethereum blockchain. Each NFT contains a unique identifier, known as a token ID, that distinguishes it from other NFTs. This token ID is stored on the blockchain, along with information about the item or content the NFT represents and its ownership. NFTs can be bought, sold, and traded on various online platforms.

What can be turned into an NFT?

Almost anything digital can be turned into an NFT. This includes digital artwork, music, videos, virtual real estate, collectibles, and more. The key is that the item or content being turned into an NFT must have some level of scarcity or uniqueness to make it desirable as a digital collectible.

Why are NFTs valuable?

NFTs can have value for a variety of reasons. They can represent ownership of rare or exclusive digital content, such as a one-of-a-kind artwork or a limited edition trading card. NFTs can also carry sentimental value to collectors, as they can support their favorite artists or creators directly. Additionally, NFTs can appreciate in value over time, similar to physical collectibles.

How do I buy or sell NFTs?

To buy or sell NFTs, you can use various online platforms that specialize in digital collectibles and NFT marketplaces. These platforms allow users to browse, buy, and sell NFTs using cryptocurrencies such as Bitcoin or Ethereum. It's important to do research and be cautious when transacting with NFTs, as the market is relatively new and can be volatile.

What are NFTs and how do they work?

NFTs, or non-fungible tokens, are digital assets that use blockchain technology to prove their ownership and authenticity. Unlike cryptocurrencies like Bitcoin, which are fungible and can be exchanged on a one-to-one basis, NFTs are unique and cannot be exchanged on a like-for-like basis. Each NFT has its own distinct value and properties, making it a one-of-a-kind item in the digital world.

Can you give an example of a popular NFT?

One popular example of an NFT is the digital artwork "Everydays: The First 5000 Days" by artist Beeple. It was sold at an auction for $69 million, making it one of the most expensive NFTs ever sold. The artwork is a collage of every image that Beeple created over the course of 5,000 days, making it a unique and valuable piece of digital art.

Blur: NFT | Blur: NFT login | Blur: NFT connect | WalletConnect | Traders | What Is Blur Crypto

2022-2024 @ A beginners guide to understanding nfts bitcoin ordinals and the world of digital collectibles